Request for documents outside the scope of verification: to submit or not?

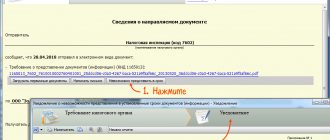

Recently, taxpayers are increasingly faced with a problem when the tax authority sends to them a requirement to provide documents and information outside the framework of a tax audit , referring to Art. 93.1 Tax Code of the Russian Federation.

The question arises: “What is this?”

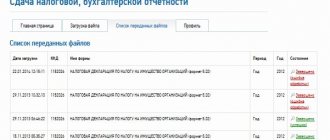

There are desk tax audits. Everything seems clear. In this case, documents may be requested.

There are on-site tax audits. Here they can demand even more.

What kind of form is this “outside the scope of a tax audit?”

How to respond to such a requirement? To submit documents and information or not?

Looking ahead, I will say that requesting documents outside the framework of a tax audit is actually a pre-audit analysis of the company’s activities, when tax officials are just collecting documents about the company and have not yet decided to conduct an audit (on-site or desk) against the company.

So to submit or not to submit documents and information?