Only citizens of the Russian Federation who pay personal income tax (NDFL) at a rate of 13% can claim a tax deduction. To receive a deduction, you need to submit a declaration in form 3-NDFL. This can be done in several ways.

1. In your Personal Account on the tax website.

2. Through the “Declaration” program. You need to download and install it on your computer. Instructions for installing the program are also available on the tax website, and instructions for filling out are even available in video format.

3. On paper. The form with the declaration form can be downloaded from the tax website and filled out by hand in capital block letters. Examples of filling out are also available on the website. The completed declaration must be brought to the Federal Tax Service office at your place of residence or stay or to the MFC. But keep in mind that from March 30 to April 30, 2020, all branches of the Federal Tax Service will be closed.

We will analyze in detail the first method: filing a declaration through your Personal Account on the Federal Tax Service website.

Read on topic: Instructions: what is a tax deduction and how to get it

How to submit a declaration through the public service portal

In the same way as with the taxpayer’s personal account portal, you will need to have a valid government service portal account.

In the case when you already have a password and login, enter them and type “Filing a tax return” into the search engine field and then follow the steps:

- Download the special program “Legal Taxpayer”. You can find it in advance on the official FSN portal.

- In the program we fill out the tax report form. We save the file on our computer.

- Next, you will need the tax authority code. These are the details of the FSN department where you live. They can be found directly at the branch itself. Or use the special service “Determining the details of the Federal Tax Service”.

- On the government services website, we create an application to send our pre-filled declaration, attach the file, and click “send.”

- A number will be generated for the created and submitted application. We write it down somewhere for ourselves so as not to lose it; the need for it will become apparent when you contact the tax office for signature.

- When the application is submitted, its status will be displayed in your personal account, where you can monitor the process.

- We print out the submitted declaration, sign it and take it to the tax office.

Advice. Don't leave everything to the deadline. Employees of the public services website will first check the application, and only then forward it to the Federal Tax Service.

Program "Taxpayer of Legal Entities"

We wrote a little higher that in order to send a tax return using the government services service, you will need to download the “Legal Taxpayer” program from the tax resource and generate a declaration report in it.

In fact, this software allows you to create more than just one type of document. And, despite the fact that the tool is mainly intended for the generation of reporting documentation by legal entities, physicists can also use it. For example, fill out a declaration form for yourself and then use it to send reports to the tax office.

This tool is completely free, and all updates that come out due to changes in the official content of declaration forms will also not charge you a single ruble.

Form to fill out

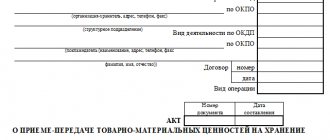

Representatives of tax authorities are required to store documents received by them, carry out verification and keep records.

There is no standardized form for compiling the inventory: the register can be filled out on a regular A4 sheet. In the upper right corner, information about the recipient - the head of the Federal Tax Service is entered, and in the main part of the document the names of the documents are listed.

Next to each document you should indicate:

- number of sheets and copies;

- copy or original;

- presence of a seal.

The inventory is completed by the taxpayer’s signature

It is advisable to ask for a receipt certified by the signature of the employee who received the documents.

We prepare documents

If you received a request electronically and want to send documents via TKS, you need to accept it and send an acceptance receipt. It will be loaded into the IFTS system and will serve as a notification that the request has been received. Check out the list of required documents. Some of them may have been compiled on paper - they will need to be scanned, some - in electronic form. In the latter case, pay attention to the format in which the documents were compiled. If in xml formats approved by the Federal Tax Service, then they can be attached to the inventory immediately. Otherwise, the documents will have to be printed, certified and scanned again, or converted into the required tif or jpg formats using appropriate software. Please note that, according to the inventory format, a limited list of documents can currently be submitted using the TKS, which is indicated in the Appendix to the Order of the Federal Tax Service of Russia dated June 29, 2012 No. ММВ-7-6/ [ email protected] All other documents will have to be sent by mail.

If the request was initially sent on paper, then it will not be possible to submit documents under the TKS due to the impossibility of creating an inventory of documents. The fact is that the xml format of the inventory presupposes the presence of a so-called identifier of the document file for which the inventory is generated (i.e., requirements). This identifier is not on the paper request, and without it the inventory will not be loaded into the inspection system.

The “Declaration” program on the FSN website. How to use

This is a program that can be downloaded from the official website of the federal tax service. It is constantly updated as amendments to the declaration form are released. Rules for its use and completion can also be found on the website.

The main purpose is to fill out forms 3-NDFL and 4-NDFL. The program is not difficult to use. And the main thing is that she herself corrects mistakes that the filler may make. But if you filled out the paper version manually, you would have to fill it out again every time.

BUT! The program is intended only for filling out the form. It will be impossible to send it. You will need to print it out and take it to the FSN office in person.

To find the program, you need to go to the resource of the regional branch of the Federal Tax Service, go to the “Software” item, then to “Software for individuals” and click on “Declaration”.

Let us denote the sequence of actions of the applicant.

- Go to the website of the Federal Tax Service of Russia www.nalog.ru, tab “Electronic services - “Submission of documents for state registration of legal entities and individual entrepreneurs.”

- Go to the “Program for generating documents used for state registration” tab.

To generate a statement (notification, message), you can use specialized free software.

- Using the downloaded and installed program for preparing documents for state registration (PPDGR), we fill out the appropriate application form (for example, P13001).

The “PPDGR” program is designed for automated preparation of documents used for state registration, as well as the formation of a container for filing an application for state registration in electronic form.

- We scan the necessary documents in separate files (application into one file, constituent documents into a second file, etc.).

- Using the program “Preparation of a package of electronic documents for state registration” (PPEDGR), we attach scanned documents and sign.

The PPEDGR program is intended for generating a package of documents in electronic form (for preparing the so-called transport container), sent by individual entrepreneurs or organizations to the registration authority for the purpose of state registration.

- After sending documents electronically, a message containing a unique number confirming the delivery of electronic documents is sent to the applicant in real time, as well as to the email address specified when sending electronic documents to the tax authority.

Important!

No later than the working day following the day the tax authority receives electronic documents, a transport container containing a file with a receipt for receipt of electronic documents, a file with an electronic signature of the tax authority is sent to the applicant by email.

Documents prepared by the tax authority in connection with making an entry in the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs (record sheets, registration certificates), or a decision to refuse state registration, generated electronically and signed with the electronic signature of the tax authority, are sent to the applicant by email address in the transport container.

The applicant can receive documents on paper using the delivery method specified in the application (in person or by mail).

TAX CONSULTATION

That is, in order to avoid going to the tax office, you need to purchase an electronic signature and download a program for creating a so-called transport container. Then a shipping container is created with the necessary documents and the documents are sent to the tax office. You can get ready-made documents in your personal account on the website of the Federal Tax Service of the Russian Federation.

To send an application for registration of a company or individual entrepreneur, you can use the service https://service.nalog.ru/gosreg/. But in this case, the rest of the package of documents must be prepared on paper and personally taken to the tax office.

ELECTRONIC FORMAT FOR GIVING EXPLANATIONS ON VAT