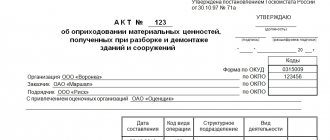

act of acceptance and transfer of material assets

The acceptance certificate of inventory items (TMT) is written in a free form, in which all goods are scrupulously noted, displaying the quantity, valuation, parameters and defects.

Today, existing legislation offers a unified template for the acceptance certificate of goods and materials. It is regulated by Resolution No. 66 of the State Statistics Committee of the Russian Federation dated August 9, 1999, which approved the MX-1 form. At the same time, each type of economic activity is documented in a primary accounting document, which is reflected in Article 9 of Law No. 402-FZ “On Accounting”. The provisions of the Law give institutions the right to draw up templates for primary accounting acts themselves.

In the life of enterprises, circumstances often arise when it is necessary to organize the transfer of products due to various reasons, for example, vacation, illness, business trip, dismissal of a financially responsible employee. This action must be documented in an acceptance certificate.

Why do you need an acceptance certificate for the transfer of goods and materials?

Let's consider under what circumstances an acceptance certificate is drawn up:

- Discrepancy in numbers and inventory parameters.

- Arrival of goods and materials without documents.

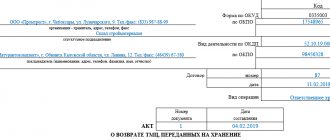

- Transfer of inventory items for safekeeping.

- Transfer of assets by agreement of the commission.

- Transfer of inventory items within an institution between departments or financially responsible employees.

- Transfer of inventory items into temporary storage.

The example document below can be used together with the acceptance certificate for storage (form MX-1).

Receipt of products against an invoice implies the possibility that the goods delivered do not correspond to the quantity displayed on the invoice. However, there are circumstances when the actual quantity of products does not coincide with the declared quantity. To make a claim to the seller, it is necessary to reflect this circumstance in the acceptance certificate with recording of the identified discrepancies.

Acceptance of some types of goods and materials (for example, equipment) is carried out according to an act, since this is required by the procedure for its acceptance: inspection, determination of serviceability, etc. When sending inventory items for safekeeping, documents are drawn up describing the condition of inventory items, determining the conditions for their placement and appointing a materially responsible employee.

When signing an agreement for the supply of goods, the parties can write into the agreement a clause on the need to draw up an act of acceptance of the products upon transfer to the buyer.

Instructions for drawing up a document

The order is drawn up in the generally accepted form, but there are some differences from other documents for the enterprise .

Form

The legislation has not developed a special form for such a document, which means freestyle. Like any other, such an order is printed with the company details and address at the top of the sheet.

Below in the center is the name - the order, on the next line on the left indicate the point where the change of chief accountant takes place and the company is located, and on the right - the date.

On the left, a short column describes the topic of the document, in this case it looks like this: “Concerns the transfer of affairs by the chief accountant.” Below, with a paragraph, the text part of the document begins.

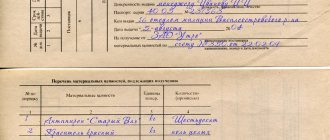

How to draw up an acceptance certificate of goods and materials

The acceptance certificate of goods and materials is usually attached to the supply contract and is considered an integral part of the agreement. The standard document structure includes the following information:

- Title of the document.

- Date and place of completion.

- Information about the parties to the contract displaying details, addresses and contacts.

- Full names of responsible employees, details of their passports, powers of the represented parties.

- The contract number and the date of its signing, according to which the delivery is ensured.

- List of transferred goods and materials with display of quantity and price.

- Qualitative parameters of goods and materials.

- Final estimated amount.

- Presence/absence of product defects.

- List of identified discrepancies.

- Claims based on acceptance results.

By agreement of the parties, other requirements may be displayed in the form, for example:

- Terms of payment for shipped groups of goods (advance payment - full or partial, payment after acceptance of goods and materials).

- Deadlines for final payment, display of the number and date of payment orders for advance payments.

- Inclusion of certain groups of inventory items or named items in special acts.

Who needs a simple sample act of acceptance of the transfer of material assets

The acceptance certificate, which states the fact of delivery of goods with violations, with quality claims, is the basis for filing a claim with the supplier with an offer to replace the product or provide monetary compensation for losses. The return of rejected goods to the supplier is carried out on the basis of a return certificate (form TORG-2) with a display of the reason for the return and a detailed display of the identified deficiencies. If the cargo is lost or damaged during transportation, compensation for costs is carried out on the basis of an agreement, if such cases are provided for. Therefore, both parties need an act of acceptance and transfer of goods and materials.

Since the acceptance certificate is a mutual document, it must be signed by representatives of both parties (sender and recipient of the goods). Before starting the procedure for acceptance of goods and materials, it is required to check that there are representatives from each party with the appropriate authority to endorse the acceptance certificate.

Supporting documents of authority may be:

- Availability of a power of attorney signed by the management of the institution.

- Order to appoint a person with authority on behalf of the company

- A notarized document for an individual, on the contract side.

To document the fact of acceptance of goods under a contract, you must:

- acceptance certificate and edit it so that it complies with the terms of the contract, namely, remove unnecessary clauses and add fields shown in the agreement.

- Acceptance of inventory items is mostly carried out during warehouse visits, so the edited form must be printed in 2 copies to be filled out manually.

- Carry out measures for external inspection, counting, reweighing, reconciling items, etc., depending on the type of product and the conditions of the acceptance and transfer procedure.

- Identify defects together with the seller’s representative and write down comments in the report.

- File a claim, if any, and if there are no comments, confirm in writing that there are no claims.

- Check the contents of the act with the supplier’s representative and check that all information is correct.

- Attach the document with the signatures of the parties and seals.

Act of acceptance and transfer of material assets

Related publications

Material assets are the main and important asset of the company. It is very important to organize clear control over inventory items in the company: this is ensured primarily by the preparation of documents. For example, an act of acceptance of the transfer of material assets is drawn up. Let's take a closer look at who, when and under what circumstances should draw up the act, whether there is a unified form of the act, and what the employer faces in its absence.

Where can I document the transfer of documents when changing the director?

You can download a completed sample act of acceptance and transfer of documents when changing the head of an organization on our website.

This sample is designed for certification of both copies of the act by the former and new general director and chief accountant of the organization. If necessary, a notary can put his details on it.

You can get acquainted with other useful nuances of interaction between a private organization and a notary in the article “The Federal Tax Service clarified when it is not necessary to have a decision to increase the authorized capital certified by a notary.”

Form of the act of acceptance and transfer of material assets

The unified form of the form is not approved by law. Therefore, the company will have to develop the form itself. Do not forget that the law establishes mandatory details that must be included in the primary document. Thus, the form for the act of acceptance and transfer of material assets (and other documents), according to federal law, must contain the following details:

- document's name;

- the date the form was completed;

- the name of the company that compiled this document;

- content, the essence of a fact of economic life;

- the amount in which a fact of economic life is measured in physical or monetary terms (be sure to indicate the unit of measurement);

- the act of accepting the transfer of material assets must contain an indication of the positions of the persons between whom the transaction was made, the citizen who is responsible for its registration, or the name of the position of a citizen or several citizens responsible only for the registration of the accomplished event;

- personal signatures of all responsible persons with a transcript (indicating their surnames and initials or other details that allow the identification of these persons).

Additional procedures when submitting cases

The main form for transferring cases is the act of accepting the transfer of documents upon dismissal, sample. At the same time, the resigning and new employee usually prepare:

- Order for the upcoming delivery of cases

- List of documents for transfer

- Order to carry out inventory

- Order for approval of the transfer commission

- Accounting records and certificates

Additional forms may vary. Their compilation most often serves the following purposes:

- Unify the accounting system used

- Fix the existing document flow option

- Confirm the presence of financial flow control

- Inform about the rules for accepting and registering money

- Confirm the level of control of values

- Check the timely submission of reports to tax authorities

PLEASE ATTENTION: the act of accepting the transfer of affairs upon dismissal is intended not just to transfer papers to the new official, but to make all the company’s operating regulations clear to him, taking into account the level of control and timeliness of the procedures.

Complete procedure for submitting cases

The entire transfer process begins with the preparation of an order that regulates who, when and to whom transfers valuables and documents. The basis for drawing up the document may be:

- Employee resignation letter

- Order to dismiss an employee by decision of the manager

- Identification of shortages due to the fault of a financially responsible specialist

- Transfer of a responsible employee to another position

- Company expansion

- Reduction in numbers

In some cases, transferring cases from an employee to a new official is impossible. For example, a specialist died or was hospitalized and will not recover soon. Then the act of accepting the transfer of affairs upon dismissal is drawn up by his authorized representative and/or deputy, and in the absence of one, it is filled out unilaterally by the person newly appointed to the position.

Act of acceptance of transfer of material assets upon dismissal

Financially responsible persons in a company may change or be absent for various reasons. It must be remembered that the very concept of “material liability of an employee to the employer” means his obligation to compensate the employer for the actual damage caused. Of course, an employee can be held liable, but, as a rule, employees bear limited liability (within the limits of average monthly earnings).

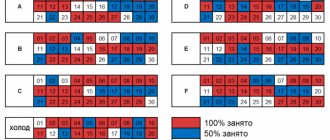

Therefore, the transfer of goods and materials when changing the MOL (materially responsible person) is necessarily accompanied by an inventory - that is, determining the real condition and quantity of material assets transferred under the responsibility of another employee. This happens both in the event of dismissal of the responsible employee and in the event of his going on vacation. The transfer of goods and materials to the financially responsible person during inventory takes place with the participation of the “old” responsible employee and the “new” one - the one who will replace him.

The obligation to carry out an inventory in such cases does not depend on the taxation system applied. If you do not correctly formalize the acceptance and transfer of inventory items, the employee’s liability statement (you will find a sample at the end of the article), the employer will have difficulty identifying the person at fault in the event of damage to property or its loss. Yes, the agreement on full financial responsibility is also valid during the employee’s vacation; responsibility for the valuables continues to remain with him. The transfer of fixed assets from one MOL to another must be formalized correctly, and this is not only in the interests of the employer, but also in the interests of the employee: if something happens during the employee’s vacation, he will be able to prove his absence and non-involvement in the loss. In this case, it will be very difficult for the employer to find and prove the involvement of the truly guilty person.

The employer must remember that in order to conclude an agreement with an employee on full financial responsibility, the employee’s position must be included in a special closed list approved by a special resolution of the Ministry of Labor dated December 31, 2002 No. 85. If the employee’s position is not indicated in the list, then it is impossible to conclude an agreement with him on full financial responsibility.

An act of financial responsibility (form), which will formalize the transfer of valuables from one employee to another employee, can be issued directly between financially responsible persons. To develop such a document, you can take, for example, the unified form No. OP-18 as a basis.

Inventory assets can also be transferred from one responsible person to another with the help of another party - directly the employing company, which in this case acts as an intermediary: the company takes the values back from the “old” responsible person and then gives them to the “new” one under responsibility. In this case, the act that formalizes the transfer of material assets is drawn up in at least two copies (one for the employer and one for the employee) and will confirm the transfer of property to the company and the absence of property claims against the employee who is resigning from the employing company. After this, in order to transfer the property to the “management” of the new MOL, 2 copies of the act for the transfer of valuables to the new financially responsible person are drawn up.

Transfer of documents under the act: nuances

We are talking about the following nuances:

1. Since the resigning general director has the status of a financially responsible person (Article 277 of the Labor Code of the Russian Federation), before transferring documents he needs to conduct an inventory of property and papers certifying the property rights of the organization (clause 22 of the Methodological Instructions by order of the Ministry of Finance of the Russian Federation dated December 28, 2001 No. 119n), for example securities, bills.

2. Simultaneously with the inventory of property, it is useful to initiate a similar procedure in relation to all transferred documents. If some documents are missing, information about this can be reflected in the act or in a separate appendix to it (in fact, the results of the inventory of documents can be recorded in it).

3. Confirmation of the authenticity and completeness of the transferred documents can be carried out with the involvement of third parties, for example, the chief accountant, financial director. At the same time, they can carry out these actions as members of a special commission (the procedure for convening it may also be regulated by local regulations). The commission may also include other specialists - for example, a document specialist, an accountant.

It happens that the competencies of the new general director are not enough to determine the authenticity or completeness of a particular financial document - in this case, it is impossible to do without the involvement of company specialists (sometimes independent experts).

In turn, the signature on the act of the new general director (deputy), certifying the fact that he received documents from the former, as well as the signature of the chief accountant, can be certified by a notary present.

Cases of transfer of responsibility when changing employees' positions

The employer requires the transfer of material assets from one employee to another, if this is provided for by their positions. Positions that may be held by employees from whom this procedure is required :

- Director.

- Chief Accountant.

- HR department employee.

- Department head.

- An employee who bears financial responsibility (for example, chief cashier, warehouse manager).

The reason for changing the financially responsible person may be:

- Dismissal.

- Long-term sick leave care.

- Going on a business trip or going on vacation.

- The previous employee failed in his duties.

Purpose of registration of the act

The act of transfer of cases is a document that confirms the fact of transfer of documentation. The transfer procedure is carried out upon dismissal:

- company director;

- chief accountant;

- cashier;

- accountant;

- other employees whose activities are directly related to documentation.

Not only cases, but also all documents are subject to transfer. For example, a new cashier needs to transfer all the cash in the cash register.

The purpose of drawing up the act is to track the movement of documents, as well as other property from the former employee to the new employee.

How to reflect dismissal in 6-NDFL?

Order to transfer materials to the employer

The order is issued by the head of the organization. The standard form of the document is not established at the legislative level, therefore there is no mandatory unified sample of this document. Its structure, composition and style must comply with the norms of administrative documentation.

Data the document contains:

- Name of company.

- Number and date of compilation.

- Full name and position of the parties to the procedure.

- Reason for transfer of values. For example, due to the dismissal of a previous specialist.

- The date when the procedure will take place.

- List of values that will be transferred.

- Data of workers who will witness the process. If this is an audit company, this must be indicated.

- Full name of the person responsible.

- order on the acceptance and transfer of material assets in connection with dismissal

- order on the acceptance and transfer of material assets in connection with dismissal

Additional documents required for drawing up the act

Since the procedure for transferring cases is not specified by law, the director of the organization himself approves the list of accompanying reports. Documents are prepared by performing the following procedures:

- registration of the order issued for the transfer of cases;

- a complete inventory of liabilities, assets and strict reporting forms;

- record keeping checks;

- performing the direct transfer of cases;

- drawing up and signing the act.

If the procedure for transferring cases is not reflected in the organization’s documents, then an order is issued for each individual case.

We transfer cases

The handover process involves not only a report on the status of work, but also verbal recommendations on how to perform job responsibilities. The order is created to convey the boundaries of responsibility and job responsibilities as accurately as possible. It is compiled by the head of the company in any form.

Information contained in the order:

- Information about the organization.

- Number and date of compilation.

- Full name and position of the receiving and transferring parties.

- The reason and timing of the acceptance and transfer.

- List of cases that will be transferred.

- Composition of the commission and information about its chairman.

- Effective date.

- Additional instructions: conduct an inventory, audit, etc.

- The person responsible for the procedure.

- order on the acceptance and transfer of cases in connection with dismissal

- order on the acceptance and transfer of cases in connection with dismissal

The order to accept cases in connection with dismissal is signed by the general director. The persons mentioned in the order must also sign.

Mandatory notifications of management changes

If the chief accountant, manager with signatory authority or director of the enterprise has left their position, certain structures must be notified within three days. First of all, this is:

- The Federal Tax Service.

- The bank through which all financial transactions take place.

The Tax Service makes changes to the Unified State Register of Legal Entities. After this, the new manager or temporarily appointed person is sent an extract from the register stating that the changes have been made.

The authorized employee must submit this extract and the protocol on the appointment of a new manager to the bank. In some cases, for example, when issuing a personal bank card is mandatory, the new director must submit his passport information.

Notification of other organizations, such as funds or services, does not imply the collection of special documents. It is allowed to notify them by email.

Certificate of acceptance of documents by the employee

The act of acceptance and transfer of affairs allows you to remove the responsibility of the new employee for the actions of his predecessor. The head of the organization must organize the inspection and create conditions for its conduct. The procedure takes place after the order is issued. The act is drawn up by its parties. The procedure and form of the act are not regulated by law. The document is drawn up in any form on an A4 sheet. Usually it takes the form of an accounting inventory of documents.

Data indicated in the document:

- Date and place of compilation.

- Details of the order on the basis of which cases are transferred.

- Name of company.

- Full name and position of the parties to the procedure.

- List of transferred cases.

- Detected errors in accounting and reporting.

- Information about trial witnesses.

- act of acceptance and transfer of cases upon dismissal

- act of acceptance and transfer of cases upon dismissal

The act of acceptance and transfer of cases is signed by the parties to the transfer and members of the commission. Then he is approved by the head of the company.

Why is the process initiated?

The transfer of affairs upon dismissal of an employee is carried out only when he held a position that had several features, for example, he supervised something or was associated with the turnover sheet. Technologically difficult conditions, for example, managing an automated production line, also sometimes impose corresponding obligations on the departing specialist.

The reasons why cases need to be referred to the official level are:

- Involvement of a new employee without losing the speed of production or workflow.

- Determining the boundaries of responsibility and competence of the new person.

- Checking the activities and resource management of the departing person.

Persons holding positions involving responsibility for material wealth must be additionally checked by a special independent commission.

For example, when the chief accountant leaves, it will consist of his immediate superior - the director of the institution and several independent colleagues.

If during this meeting facts of inconsistency in the reporting documents are revealed, the departing specialist may be brought to criminal liability. Employees who held positions related to warehouse management must report to the accounting department and personally to the chief accountant before leaving. He checks the compliance of receipts and expenditures and makes the final decision on a specific case. If any inconsistencies or damage are detected, the resigning employee will have to correct and compensate everything before leaving.