Regulations on the use of official means of communication

| REGULATIONS FOR THE USE OF OFFICE COMMUNICATION MEANS Approved by the Order of the Director of Novichok LLC dated January 16, 2009 These regulations determine the procedure for providing business mobile communications to Novichok LLC 1. GENERAL PROVISIONS 1.1. Business mobile communications is the provision of an employee with the opportunity to conduct official conversations on a mobile phone at the expense of the organization. 1.2. Providing employees with business mobile communications is carried out by issuing them telephones connected to the telecom operator's tariff. Employees are not allowed to use personal phones for business purposes. 1.3. The organization provides both permanent and temporary provision of employees with official mobile communications. 1.3.1. Employees of the following departments are provided with official mobile communications on an ongoing basis - expedition department - sales department 1.3.2. Advertising department employees are provided with business mobile communications on a temporary basis during business trips, as well as during exhibitions, presentations and seminars. 1.4. For each user of business mobile communications, a limit is set for business calls on mobile phones. 1.4.1. For employees who use business mobile communications on an ongoing basis, the limit is two thousand rubles per month. 1.4.2. For employees using business mobile communications on a temporary basis, the limit is five hundred rubles per day. 2. SERVICE PROCEDURES 2.1. All office mobile phones are connected to the Sotovik cellular operator. The selection of tariff plans, connection and replenishment of personal accounts of business mobile phones is carried out by the accounting department in agreement with the Deputy Director for General Issues. 2.4. Maintenance and repair of office telephones is carried out by the housekeeping department. 3. PROCEDURE FOR USING SERVICE COMMUNICATIONS 3.1. The time for carrying out official negotiations is not limited by the normal working day. If necessary, telephone conversations, as well as data transfer via business mobile communications, can be carried out on weekends and (or) outside of working hours. 3.2. Employees are prohibited from using company mobile communications for personal purposes. |

What is the document for, its role

Russian legislation does not indicate a ban on the use of mobile phones and other similar devices at work. However, the management of each organization has the right to establish such a requirement in the company’s internal regulations and issue an appropriate order.

All employees of the enterprise must be familiarized with these documents against signature, which means their mandatory execution in the future. In case of violation, the employer reserves the right to disciplinary punishment of the offender, ranging from a simple reprimand and even dismissal (in case of repeated disregard for the prohibition).

We register the use of cell phones by employees

If the fact of conducting personal conversations is discovered, the employee is deprived of the right to use official mobile communications and is obliged to hand over the telephone to the personnel department.

3.3. Employees are prohibited from refilling their company mobile phone account on their own. Funds contributed in violation of this requirement will not be reimbursed by the organization.

3.4. The employee must ensure the safety of his work mobile phone. If you lose your office phone number, you must immediately notify the HR department.

3.5. In cases of long-term absence (vacation, etc.), the user must hand over the company mobile phone to the HR department. 4. PROCEDURE FOR ISSUING OFFICE TELEPHONES

4.1. The HR department issues a company mobile phone to employees.

4.2. To be provided with permanent or temporary mobile communications, an employee must submit a corresponding application to the HR department.

4.3. The deadline for completing an application for the provision of business mobile communications is up to 10 working days.

4.4. The issue of a service mobile phone, as well as instructions for its operation, are recorded in the equipment receipt sheet. The telephone is issued only after the employee has read the instructions for using the telephone and these regulations, which is recorded and certified by the employee’s signature on the equipment receipt sheet.

4.5. The company mobile phone must be returned to the HR department in the following cases:

- expiration of the telephone use period if it was issued on a temporary basis;

- dismissal of an employee;

- transfer of an employee to another department;

- a change in the employee’s job responsibilities, as a result of which there is no need for official radio communications;

- violation by an employee of the rules for using official communications.

How to prohibit the use of phones in the workplace for personal purposes?

The procedure for providing access and use of Internet resources. According to the employer, this violation carries the risk of leakage of restricted information and a reputational risk.

The plaintiff wrote an explanatory note in which he confirmed the fact of accessing the named site on average 10 times a day, also indicating in the explanatory note that access to the site vkontakte.ru is related exclusively to official activities. Satisfying the claims for the illegality of the order and the cancellation of the latter, the courts noted that the site vkontakte.ru is not included in the list of sites prohibited by the above-mentioned Rules of Promsvyazbank OJSC on the fundamentals of information security; from this paragraph it follows that access to the Internet is provided to bank employees exclusively for work purposes, to perform job duties. Use of Internet access for non-business purposes is strictly prohibited.

Before you enter into a contract

If the operator debits money from the account without any reason, he will be held responsible for it. But at the same time, the company can resort to cunning and do everything so that the user connects as many paid services as possible.

A standard contract for the provision of mobile communication services is usually large and drawn up on several sheets, so not everyone carefully studies the information, as a result of which important information is missed.

Rospotrebnadzor specialists recommend first of all paying attention to:

- mobile number;

- a minimum list of services that the operator will provide;

- tariffication of mobile communications;

- terms of payment for services;

- validity period of the tariff plan;

- payment form.

Already when studying the contract, many users may discover the first pitfall - cellular operators often impose additional services as basic ones, and they, of course, are always paid. Operators do not have the right to impose on a future client an answering machine, anti-caller ID and other services that are unnecessary for most people.

It is advisable to check how long the tariff plan will be valid, so that it does not turn out that the subscriber subscribed to a favorable tariff, and after two or three months the operator automatically changed it to another, more expensive one.

Written complaint

If you cannot resolve the issue with the operator, and money continues to be withdrawn from your account, you can make a written complaint, in which you need to describe the current situation in detail. The claim is drawn up in two copies and contains the following information:

- FULL NAME;

- address;

- information about the contract (date and place of signing);

- the amount that the operator debited from the account.

A written claim, along with details of the invoice and a copy of the contract, must be submitted to the operator, who is obliged to consider it within 2 months. After this, the company must send a written justification to the specified address. If the operator admits his mistake, he will recalculate, otherwise there will be no choice but to go to court.

Before submitting a written claim, you need to carefully study the contract again. If the connection of a paid service is provided for by the terms of the contract, the mobile operator will not perform recalculation.

How can I find out information about tariff changes?

Users of cellular communication services have the right to learn in a timely manner about all changes to their tariff plan or connection of additional services. As practice shows, operators usually notify via SMS. But not everyone receives messages and, of course, not everyone reads them.

In fact, operators are not required to notify subscribers by personal calls and SMS messages about changes in service fees. Rospotrebnadzor specialists say that this information should appear in the media and on the operator’s official website, and subscribers are required to independently monitor all changes. Information always appears no later than 10 days before the introduction of a new service.

To avoid overpaying for mobile communication services, do not forget:

1. Regularly check your balance and monitor what amounts are debited from your account.

2. Control what services are connected. The easiest way to do this is by calling the call center and asking for information about the tariff plan and additional services.

3. Monitor the emergence of new, more favorable tariffs - to do this, you need to study the information on the official website of the cellular operator. You can also call the call center and clarify information about the new favorable tariffs available for connection.

Appendix N ___ to the Order dated “___” _________ ___ N _____ I approve ___________________________________ (position of the head of the organization) ___________________________________ (full name of the head) “___” _____________ ____ Rules for the use of business mobile phones in “___________________________” (name organizations)

General provisions

1.1. The rules for the use of business mobile phones in “____________” (hereinafter referred to as the Rules) determine the procedure for the provision and use of business mobile communications in “____________”.

1.2. Providing employees with business mobile communications is carried out by providing them with business mobile phones connected to a corporate tariff.

1.3. Mobile service communications are provided to employees of the following structural divisions:

1.4. During exhibitions, seminars, presentations, and when sent on business trips, employees of the following departments are also provided with mobile communications: ____________________________________________________________.

1.5. A limit on expenses for the use of mobile telephone communications is established in the amount of _____________ (________________) rubles (or: no more than ____________ (_______) hours) for ___________________________________. (period)

Procedure for servicing business mobile communications

2.1. All office mobile phones are connected to the cellular operator “__________________”.

2.2. The selection of tariff plans, connection and replenishment of personal accounts of business mobile phones is carried out by the chief accountant in agreement with the head (deputy head) of the organization.

2.3. Employees using official mobile communications are prohibited from:

— connect or disconnect any services of a telecom operator without prior written approval from the head (deputy head) of the organization;

— top up your personal account on your business mobile phone; Funds contributed by the organization are not reimbursed.

2.4. Maintenance and repair of business mobile phones is carried out in the following order: __________________________________________________________.

3. Procedure for issuing a business mobile phone

3.1. The issuance of a business mobile phone is carried out by ___________________________________________________________________________ (specify the official/structural unit) upon the application of the employee, endorsed by his immediate supervisor.

3.2. The issuance of a service mobile phone and instructions for its operation is carried out after the employee has familiarized himself with these Rules and is recorded in the statement (book/log book) for the issuance of service mobile phones.

3.3 The work mobile phone must be returned by the employee in the following cases:

— dismissals;

— changes in job responsibilities, as a result of which the need for official mobile communications disappears;

— violations of these Rules.

Procedure for using business mobile communications

4.1. Employees use business mobile communications to conduct telephone conversations and send/receive messages. In case of business necessity, telephone conversations, as well as sending/receiving messages via business mobile communications, can be carried out on weekends and/or outside established working hours.

4.2. Employees are prohibited from using company mobile communications for personal purposes. If such a fact is discovered, the employee is deprived of the right to use official mobile communications and is obliged to hand over the official mobile phone ____________ ___________________________________________.

Accounting

The institution entered into an agreement with a communication service provider

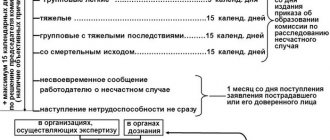

In order for a company to confirm expenses for cellular communications, it is necessary:

- manager's order;

- an agreement with an operator for the provision of communication services;

- detailed telecom operator accounts.

An order approving the list of officials who have the right to use cellular communication services must contain the maximum amount of expenses per month for each employee in accordance with their position (Letter of the Federal Tax Service of Russia for Moscow dated October 5, 2010 No. 16-15/ [email protected] ). If the maximum amount of expenses is specified in employment contracts, then the order must contain a reference to the employment contracts.

When detailing the total payment amount in the invoice issued by the operator, it indicates the numbers of all telephone numbers of subscribers with whom negotiations were carried out from this telephone, city (country) codes, date and time of negotiations, duration and cost of each conversation. Each telephone call must be detailed, documented and economically justified, otherwise disputes will inevitably arise regarding the calculation of income tax. Therefore, it is good if the enterprise practices drawing up official assignments for making calls, and subsequently writing reports on the work done on them.

This is interesting: A Chechen teenager tearfully apologized on television for almost an hour for criticizing Kadyrov

The specified list of positions can be enshrined in a separate order or specified in the Regulations on providing employees with cellular communications.

In some cases, the following is also required:

- invoice – for VAT taxpayers for the purpose of deducting “input” VAT (clause 1 of Article 172 of the Tax Code of the Russian Federation);

- a document confirming payment for the services of a cellular operator - for organizations using the simplified tax system (clause 2 of article 346.17 of the Tax Code of the Russian Federation).

In addition to the listed documents, tax inspectors often request additional documents confirming the economic justification of expenses for cellular communication services:

- job descriptions of employees who use cellular communications, as confirmation that the use of cellular communications is necessary to perform their job duties;

- employment contracts (collective agreement) with employees, which stipulate the conditions for providing cellular communications or provide a link to the relevant local act (Regulations on providing employees with cellular communications);

- details of bills for communication services, which indicate the telephone numbers of all subscribers with whom negotiations were conducted, as confirmation that the negotiations were of a work and not personal nature.

Their size will remain the same regardless of the duration of telephone conversations.

- Setting limits. This is necessary in order to reduce the number of unnecessary calls.

The size of the limits is established in the order of the head or in the relevant Regulations.

Having limits allows you to discipline employees. Calls over the limit are considered economically unjustified and therefore are not taken into account for tax purposes.

How do limits work? Let's look at an example.

500 rubles will have to be paid to the employee himself.

FOR YOUR INFORMATION! It is important to set limits that correspond to actual costs. If the limit is too low, it will degrade economic efficiency. If the established limit is constantly violated, it makes sense to increase it.

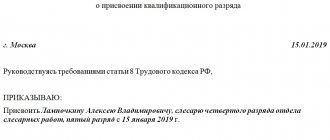

Order on expenses for cellular communications (Option)

Name of organization ORDER ________________ N _______________ Place of publication About expenses for cellular communications

In order to comply with tax accounting rules, streamline and optimize expenses for payment for cellular communication services and in connection with the conclusion of agreement No. _____ dated __ _____ 20__ with the mobile operator “________” for the provision of services

I ORDER:

1. Introduce a limit on mobile communications expenses to _____________________ (hereinafter referred to as the Organization).

2. Establish a list of employees who can use communication services to perform their job tasks and promptly resolve issues related to ensuring the production activities of the Organization (Appendix).

3. Set a limit on calls using cellular communications during a calendar month for one employee in the amount of _______.

4. Employees must use cellular communication services exclusively for business purposes.

5. Appoint a chief accountant (hereinafter referred to as the Responsible Person) as the person responsible for relations with the cellular operator.

After receiving invoices for mobile communications, the Responsible Person checks whether the expenses are related to production activities, as well as whether the actual expenses comply with the established limits. If actual expenses exceed the established limit, the Responsible Person informs the manager of the name of the employee who exceeded the limit and the amount of the excess.

Reimbursement of mobile communications costs

Enterprises widely use employee mobile phones for business purposes. Calls are paid for from their personal funds, but it is possible to compensate the employee for the cost of mobile operator services.

Employee Cellular Compensation Law

The right to reimbursement of personal expenses incurred by a citizen in the performance of work duties is determined by the content of Article 188 of the Labor Code

: This is the use of property and property of the employee and depreciation of property.

Issues regarding the return of a citizen’s personal expenses for communications during the performance of official duties include:

- independent calculation of the amounts spent;

- determining the procedure for accrual and payment of funds;

- listing the conditions for payment;

- approval of a list of expense accounting documentation confirming the fact of spending a citizen’s personal funds.

IMPORTANT!

Only those conversations that were used in the performance of work duties are refundable: during working hours, during a business trip, etc.

How to determine the amount of compensation

There are two ways to determine the amount of compensation:

- introducing provisions on the amount of payment and accrual conditions into his employment agreement or issuing an addition to it - for a specific employee;

- adoption of a local regulatory act - in this case, the amount of accrual and the conditions for receipt are the same for all employees of the company, including management positions.

IMPORTANT!

By establishing rules for the refund of cellular expenses, the employer can set a limit for these expenses, which will limit the maximum amount of accrual.

An option with a fixed amount of compensation is also possible, regardless of the amount of money spent.

Documents to confirm expenses for mobile communications

The main document reflecting the amount of employee expenses is the detailing of accounts. It is ordered from the operator and confirms the actual amount of money spent.

In addition, the detail shows the time the calls were made, i.e. the employer can determine the date, time and duration of the telephone conversation, the cost of which is subject to reimbursement, thereby excluding expenses for personal conversations.

When using unlimited plans, it is easier to confirm expenses. In this case, the basis for calculating the payment will be a check, receipt or account statement confirming the fact of payment of the tariff.

Payment order

The procedure for reimbursement of expenses is standard:

- The employee provides receipts or the manager requests call details from the operator.

- The responsible official issues an order to return the money to the citizen.

- The approved amount is transferred to the employee.

The employee receives the due amount on the next payday or advance payment.

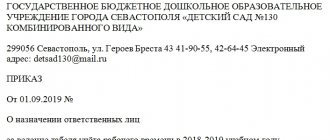

Sample order for reimbursement of expenses for cellular communications

The order is drawn up in free form or on the organization’s internal letterhead indicating the following information:

- Title of the document;

- link to article

188 Labor Code of the Russian Federation ; - amount of payment (different amounts are allowed for certain positions);

- sizes of correction factors (if necessary);

- document publication date and validity period;

- deadline for accrual;

- an order to familiarize employees with the contents of the order;

- appointment of a person responsible for monitoring the execution of the order;

- Full name of the person who drew up the order;

- signatures of the originator and persons who have read the order;

- serial registration number of the order and the date of its preparation.

Typical sample:

Is compensation subject to tax and insurance premiums?

Income tax is not calculated from these funds, and contributions to compulsory medical insurance, the Pension Fund and the Social Insurance Fund are not transferred. Exceptions are situations when the total accrual includes expenses incurred by the employee during non-working hours for personal purposes. In this case, the payment is equal to the income of an individual and is subject to personal income tax.

Other conditions apply when concluding an agreement for the rental of personal mobile phones at an enterprise.

Then a portion of the compensation payment, equal to the fee for the temporary use of the device as a work phone, will be subject to income tax.

That is, if a rental agreement with a monthly payment of 1,000 rubles was concluded with an employee, and a total of 3,000 rubles was accrued, then personal income tax will be withheld only from the amount of 1,000 rubles.

Source