Chapter 23 of the Tax Code of the Russian Federation is devoted to income tax (NDFL). The provisions of this chapter establish the circle of valid personal income tax payers, as well as taxable objects and the procedure for determining the tax base when calculating the tax payable. Thus, according to Chap. 23 Tax Code of the Russian Federation:

- Personal income tax taxpayers are ordinary citizens (residents, non-residents of the Russian Federation) who have income.

- Income tax is imposed on all income received from sources in the Russian Federation and abroad.

- When calculating personal income tax, the tax base includes all income received by a citizen in kind or in monetary terms, as well as in the form of material benefits.

Meanwhile, some types of income are not subject to personal income tax. Their full list is presented in Art. 217 Tax Code of the Russian Federation. These include, for example, all types of compensation payments related to dismissal, free housing, and fuel. Unemployment benefits, maternity benefits, insurance pensions, compensation for unused vacation by the employee and other payments are also not subject to personal income tax.

Based on the listed norms, we can conclude that penalties and fines can be subject to personal income tax only if they are income, i.e., subject to inclusion in the tax base. All that remains is to find the answer to a simple question: are they recognized as an individual’s income or not.

What does a penalty (fine) mean and is it necessary to withhold personal income tax from it?

The definition of this concept is given in Art. 330 Civil Code of the Russian Federation. The article clearly states that a penalty (as well as a fine, penalties) is understood as the amount of money that the debtor must pay to the creditor in the event of failure to fulfill or improper fulfillment of its obligations. The amount of this amount is determined by law and agreement. It should be clearly understood that this is not compensation for damage, i.e. this payment is not compensatory in nature.

It should be noted that both the penalty and the fine can be collected pre-trial and through the court. In the first case, the payment is made by the debtor voluntarily, in the second - forcibly. For example, if the developer did not fulfill the terms of the equity participation agreement and did not deliver the house on time, then he must pay the shareholder a penalty, and in some cases a fine. He can do this voluntarily, at the written request of the second participant of the DDU, i.e., the shareholder. If he does not do this, then the shareholder has the right to file a lawsuit against him to collect a penalty. Then they talk about forced collection of the penalty by court order.

Regardless of how the forfeit (fine) is paid to the creditor, voluntarily or compulsorily, in both the first and second cases it is recognized as his income. And income, as established by the Tax Code of the Russian Federation, is subject to personal income tax. This position is confirmed by the relevant legislative norms (see table below).

| Art. 41 Tax Code of the Russian Federation | Art. 209 Tax Code of the Russian Federation | Art. 217 Tax Code of the Russian Federation | Art. 210 Tax Code of the Russian Federation | Art. 208 Code of Civil Procedure of the Russian Federation |

| What is recognized as income | Object of taxation | Non-taxable income | What is included in the tax base | Indexation of amounts collected by the court |

Thus, penalties (fines) collected through the court are monetary income of an individual, since they are recognized as economic benefits. And all income received by an individual in kind or in cash is included in the tax base. In addition, penalties and fines are not included in the list of income that is exempt from personal income tax.

It follows that penalties and fines collected by the court, as well as their indexed amounts, are always subject to personal income tax. This position is recognized by the Federal Tax Service and the Ministry of Finance of the Russian Federation, is confirmed by legal norms and is not subject to challenge at the moment. In particular, in the letter of the Ministry of Finance of the Russian Federation No. 03-04-05/19869 dated March 29, 2020, it is noted that all sanctions that are provided for by the current Federal Law of the Russian Federation No. 2300-1 dated February 7, 1992 (as amended on March 18, 2020) “On the Protection of Rights consumers” are exclusively punitive in nature. They are not considered compensation. Since they form a property benefit for consumers, they are included in the taxable income of an individual.

Are payments based on a court decision (forfeit, fine, moral damage, legal expenses) subject to tax?

Are payments made by the developer pursuant to a court decision (penalties, fines, moral damages, legal expenses) subject to tax?

You can find up-to-date (as of 2020) information on the issue of personal income tax taxation of the specified income HERE>>>

Consultation with a lawyer from the website “DOLSCHIK”

The Ministry of Finance of the Russian Federation has repeatedly spoken out on this issue in various letters, in particular in the Letter of the Ministry of Finance of the Russian Federation dated March 19, 2014 N 03-04-05/11930, the Letter of the Ministry of Finance of the Russian Federation dated June 10, 2010 N 03-04-06/10-21, Letter Ministry of Finance of Russia dated January 27, 2014 N 03-04-05/2931.

According to Article 41 of the Tax Code of the Russian Federation, income is recognized as an economic benefit in monetary or in-kind form, taken into account (if it is possible to assess it and to the extent that such benefit can be assessed) and determined in accordance with the chapters “Tax on personal income” and “ Corporate Income Tax” of this Code. At the same time, Article 208 of the Tax Code of the Russian Federation establishes a list of income subject to personal income tax.

In our opinion, payments awarded by a court decision to a developer organization cannot, by their nature, be considered as an economic benefit and, as a result, cannot be subject to taxation. However, the position of the Ministry of Finance of the Russian Federation on this matter is different.

Court expenses. According to the Ministry of Finance of the Russian Federation, if the court reimburses a citizen for the costs of paying for the services of a representative, these payments are subject to taxation.

According to the financial department, in paragraph 3 of Art. 217 of the Tax Code of the Russian Federation establishes an exhaustive list of payments that are not subject to personal income tax. Due to the fact that the amounts of compensation for legal expenses incurred by an individual are not included in the above list, the Ministry of Finance of the Russian Federation believes that such payments are subject to taxation in the generally established manner (see letter of the Ministry of Finance of Russia dated January 27, 2014 N 03-04-05/2931) .

In our opinion, this position cannot be considered justified due to the following. Money collected by the court as reimbursement of expenses for the services of a representative and other types of legal expenses cannot be considered income, due to the fact that they do not carry economic benefits for the citizen, but are aimed at reimbursing the costs incurred by the taxpayer in connection with restoration of violated rights in court.

The illegality of the position of the Ministry of Finance of the Russian Federation is confirmed by judicial practice. For example, in the Resolution of the Federal Antimonopoly Service of the Volga-Vyatka District dated August 2, 2010 in case No. A29-10481/2009, the court noted that when recovering legal expenses, the taxpayer does not receive income in kind and material benefits, since he actually compensates for his expenses in the amount indicated in the court decision. Consequently, compensation for legal expenses cannot be recognized as the employee’s income in accordance with Article 41 of the Tax Code of the Russian Federation.

In addition, the Federal Tax Service provided clarifications according to which the amounts of payments for the purpose of reimbursement of any documented expenses and expenses recognized by the court as necessary are exempt from taxation (letter of the Federal Tax Service of Russia dated September 8, 2010 No. ШС-07-3/238).

Penalty (interest for using someone else's money). The Ministry of Finance of the Russian Federation believes that the amounts received by the taxpayer in cash in the form of interest for the use of his funds meet the criteria of economic benefit, since an individual has the right to dispose of these funds. Therefore, these incomes are subject to personal income tax in the prescribed manner at a rate of 13 percent (letter of the Ministry of Finance of the Russian Federation dated September 27, 2012 No. 03-04-05/6-1130).

The position of the Ministry of Finance of the Russian Federation on this issue also seems to us to be unlawful and contrary to established judicial practice.

Thus, the Volgograd Regional Court in the Appeal ruling dated October 11, 2012 in case No. 33-10133/2012) noted that the amount of the penalty, as well as interest for the use of other people’s funds, collected in favor of the taxpayer, are not related to the income of an individual persons are a measure of liability for late fulfillment of obligations or for improper fulfillment of a monetary obligation, and the legislation on taxes and fees does not include these amounts as taxable income.

Thus, funds in the form of amounts paid by the developer to a citizen for late transfer of a shared construction project are not subject to personal income tax.

A fine collected from the developer in accordance with the Law of the Russian Federation “On the Protection of Consumer Rights”. The Ministry of Finance of the Russian Federation believes that the fine collected from the developer in accordance with clause 6 of Art. 13 of the Law of the Russian Federation “On the Protection of Consumer Rights” for failure to voluntarily satisfy consumer requirements, similar to the penalty in clause 3 of Art. 217 of the Tax Code is not provided for, and therefore, such payments are subject to taxation in the prescribed manner (letter of the Ministry of Finance of the Russian Federation dated May 28, 2013 No. 03-04-05/19242).

However, the courts quite rightly do not share the position of the financial department on this issue.

The Arkhangelsk District Court, resolving a dispute of this kind, was guided by the following norms of legislation. In accordance with paragraph 3 of Art. 43 of the Tax Code of the Russian Federation, interest is recognized as any previously declared (established) income, including in the form of a discount, received on a debt obligation of any type (regardless of the method of its execution). In this case, interest is recognized, in particular, as income received from cash deposits and debt obligations. Based on the systemic interpretation of this paragraph, amounts collected by court decision cannot be classified as income subject to taxation, since such income was not declared (not established) in advance and was not received under a debt obligation.

According to the court, payments established by a court decision and having the nature of compensation for damage caused by the developer, material and moral losses in accordance with the Law of the Russian Federation “On the Protection of Consumer Rights” are compensatory. In such circumstances, these payments are not considered income, and therefore they are not subject to inclusion in taxable income. The court also noted that the amount of the penalty, as well as interest for the use of other people’s funds, as well as the fine collected in favor of the consumer, are not related to the income of an individual, are a measure of the developer’s liability for delay in fulfilling obligations, and the legislation on taxes and fees does not include specified amounts to taxable income. Thus, the inclusion of these amounts in taxable income is unlawful.

Moral injury. On the issue of the need to impose personal income tax on compensation for moral damage awarded by the court, the position of the Ministry of Finance of the Russian Federation, in our opinion, is legal and justified and is confirmed by judicial practice (see Letter of the Ministry of Finance of the Russian Federation dated June 10, 2010 No. 03-04-06/10-21).

In accordance with paragraph 3 of Art. 217 of the Code are not subject to taxation on personal income tax of all types of compensation payments established by the current legislation of the Russian Federation, legislative acts of the constituent entities of the Russian Federation, decisions of representative bodies of local self-government (within the limits established in accordance with the legislation of the Russian Federation), related, in particular, with compensation for harm caused by injury or other damage to health.

At the same time, in Art. 15 of the Law of the Russian Federation dated 02/07/1992 N 2300-1 “On the Protection of Consumer Rights” establishes that moral damage caused to the consumer as a result of violation by the manufacturer (performer, seller, authorized organization or authorized individual entrepreneur, importer) of consumer rights provided for by laws and regulations Acts of the Russian Federation regulating relations in the field of consumer rights protection are subject to compensation by the causer of harm if he is at fault. The amount of compensation for moral damage is determined by the court and does not depend on the amount of compensation for property damage.

Compensation for moral damage is carried out regardless of compensation for property damage and losses incurred by the consumer.

Based on the above, the Ministry of Finance of the Russian Federation rightly comes to the conclusion that compensation for moral damage paid by court decision is a compensation payment provided for in paragraph 3 of Art. 217 of the Code, and is not subject to personal income tax.

Non-personal income tax amounts collected by court decision

So, taking into account the norms of the Tax Code of the Russian Federation, it is determined that penalties and fines paid to an individual by court decision are taxable amounts. At the same time, often the plaintiff, when going to court, demands not only the recovery of these amounts, but also compensation for moral damage (physical, moral suffering), expenses and losses incurred, and lost profits. Accordingly, the question arises whether it is necessary to pay personal income tax on these amounts, i.e. whether they are included in the taxable income of an individual.

As mentioned above, the main list of payments that are exempt from taxation is indicated in Art. 217 Tax Code of the Russian Federation. This implies:

- Compensation for moral, as well as actual, real damage is a compensation payment provided for by law. Therefore, personal income tax is not withheld from her.

- Lost profits are lost income that an individual could have received if his rights had not been violated (in relation to Article 15 of the Civil Code of the Russian Federation). Therefore, personal income tax must be calculated and paid from it.

Important! Legal costs and other related expenses (such as state fees, postage, etc.) that occurred during the consideration of a claim for the collection of a penalty or fine are not subject to personal income tax. Reason: clause 61 of Art. 217 NK.

The following standard situation can be given as an example. A citizen purchased a product that turned out to be defective and of poor quality. He spent his own money to eliminate them. In this situation, he has the right to demand compensation from the seller for damages and moral damages. If he refuses to compensate for the damage, the buyer can go to court.

Thus, through the court it is possible to obtain compensation for real damage (expenses that were spent on eliminating a defect, defect), as well as moral damage. In this case, the guilty person (seller) reimburses all compensation amounts, but the buyer (plaintiff) pays personal income tax on them.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Are they subject to personal income tax?

Personal income tax is charged on the amount of income received by an individual, including when executing a court decision. According to the Tax Code of the Russian Federation (Articles 41, 210), income is the economic benefit of its recipient. For the purposes of calculating personal income tax, all income received, both in cash and in kind, is taken into account, with the exception of those that the Tax Code directly excludes from the scope of tax collection rules. The list of such exceptions is given in Article 217 of the Tax Code of the Russian Federation.

Damages recovered

According to the position of the Ministry of Finance and tax authorities, the amount of losses (actual damage caused) returned to the citizen is not in the nature of economic benefit and, accordingly, does not require payment of personal income tax (letter of the Ministry of Finance of the Russian Federation dated July 6, 2020 No. 03-04-05/39501).

The purpose of compensation is to restore the rights of the injured party to their original state. No additional benefits or benefits are acquired.

Court expenses

As a general rule, the losing party reimburses the winner for legal expenses (Article 98 of the Code of Civil Procedure of the Russian Federation). Such payments include:

- National tax;

- lawyer's fees;

- postage costs;

- cost of forensic examination;

- expenses for travel and accommodation of participants in the case, travel allowances, etc.

If the winning party is an organization, it can also reimburse personal income tax from the amounts paid to the lawyer who represented its interests in court as part of the legal costs. This was indicated by the Supreme Court of the Russian Federation in the Determination of the Judicial Collegium for Economic Disputes dated August 9, 2020 No. 310-KG16-13086 in case No. A36-3766/2015.

Legal costs are indicated in the list of payments exempt from personal income tax in accordance with Article 217 of the Tax Code of the Russian Federation (clause 61). Therefore, there is no need to pay tax on them.

Penalties, penalties and fines

Amounts collected as liability for violation of obligations are subject to personal income tax. It is believed that these amounts meet the criteria of economic benefit, since they were received without any connection with the implementation of any expenses. This was indicated by the Supreme Court of the Russian Federation in its Review of the practice of courts considering cases related to the application of Chapter 23 of the Tax Code of the Russian Federation, approved on October 21, 2020.

Tax is charged on interest and penalties for the period in which they were actually received. The date of the court decision does not matter. It is important when the plaintiff received funds under the writ of execution. This follows from Art. 223 of the Tax Code of the Russian Federation, according to which the date of receipt of income is the day of its payment, including transfer to a bank account.

This position is confirmed by numerous letters from the Ministry of Finance of the Russian Federation - see, for example, letter dated July 5, 2020 No. 03-04-05/49727. According to it, the amounts of penalties and fines for violation of the contract represent the economic benefit (income) of the recipient.

Personal income tax is also paid on the amount of the penalty that is awarded for failure to comply with a judicial act. The court can award it based on the principles of fairness, proportionality and the inadmissibility of benefiting from unlawful behavior on the basis of Art. 1 Civil Code of the Russian Federation.

According to the letter of the Ministry of Finance of the Russian Federation dated June 14, 2020 No. 03-04-05/43684, the amount of the penalty for failure to comply with a judicial act meets the criteria of income, and is therefore subject to personal income tax.

Indexation of monetary payments in court

Based on Art. 208 of the Civil Code of the Russian Federation, the court may establish in a decision that the awarded amount is subject to indexation on the day of execution of the court decision. This mechanism is intended to compensate for losses due to inflation and ensure that the position of the affected party is restored in full.

Expert opinion

Lawyer Alexander Vasiliev comments

According to the Determination of the Constitutional Court of the Russian Federation of December 24, 2013 No. 1990-O, indexation is not a measure of civil liability. Its purpose is to compensate the claimant for losses caused by untimely execution of a judicial act.

On this basis, personal income tax is not paid on indexation amounts.

Compensation for moral damage

The Civil Code allows in some cases to recover compensation from the defendant for the moral or physical suffering caused to him. This amount of compensation for moral damage is not subject to personal income tax when collected in court.

As the Ministry of Finance of Russia indicated in Letter No. 03-04-05/49727 dated July 5, 2020, compensation for moral damage collected in court is not subject to personal income tax.

Calculation and payment of personal income tax on penalties and fines based on a court decision: rates, formula, payment procedure

Calculation and payment of personal income tax on penalties and fines collected by court decision is carried out according to the generally established procedure. This means that in order to calculate personal income tax, you need to determine the total amount of taxable income, as well as know the tax rate. In this case, one should be guided by the norms prescribed in Art. 224 of the Tax Code of the Russian Federation (rates) and Art. 225 of the Tax Code of the Russian Federation (general procedure for calculating personal income tax).

That is, the actual amount of the penalty or fine is the income from which the tax must be calculated. As for the rate, for residents of the Russian Federation it is set at 13%, and for non-residents - 30%. For calculation purposes, we can distinguish a certain general formula, which is quite simple: taxable income * percentage tax rate.

No other calculation features for personal income tax have been established. In general, tax must be calculated on the date of actual receipt of income. Tax agents calculate and pay income for an individual in accordance with Art. 226 Tax Code of the Russian Federation. Citizens who pay personal income tax on their own are required to submit a declaration. For them, the procedure for calculation and payment is determined by Art. 227 Tax Code of the Russian Federation.

Penalty: concept, types, collection rules

By concluding a business agreement on cooperation, each partner expects that its counterparty will fulfill its obligations efficiently and on time. Unfortunately, this does not always happen. The legislation of the Russian Federation provides for several ways to ensure the implementation of business agreements (Article 329 of the Civil Code of the Russian Federation). One of them is a penalty (Article 330 of the Civil Code of the Russian Federation), which can be in the form of:

- A fine is a fixed amount collected for non-compliance with the terms of the business agreement by one of the partners. However, the duration of the violation is not important here. The fine can be set not only as a fixed amount, but also as a percentage.

- Penalty accrued continuously until the breached obligations are fulfilled. In order to ensure this continuity, it is necessary to fix the period for which the penalty is calculated. Otherwise, it will not be difficult to later re-qualify it as a one-time fine, which can be extremely disadvantageous for the creditor.

Read about the relationship between the concepts of “fine” and “forfeit” in the article “ Fine and forfeit - what is the difference?” .

This publication will tell you what grounds there are for reducing the penalty.

A penalty can be applied to non-compliance with a variety of terms of a business agreement: late payment or delivery, low-quality goods, etc. Moreover, it is possible to simultaneously prescribe both sanction measures in the contract: a fine and penalties (determination of the Supreme Arbitration Court of the Russian Federation dated February 15, 2013 No. VAS-800/ 13).

IMPORTANT! The agreement on penalties must be drawn up in writing, regardless of the form in which the violated business agreement was concluded. Otherwise, it will be impossible to collect it (Article 331 of the Civil Code of the Russian Federation). In this case, it is possible to draw up both an additional agreement and introduce provisions on penalties into the main agreement. In the agreement, indicate for which violation it is provided (Resolution of the Federal Antimonopoly Service of the Volga-Vyatka District dated September 4, 2012 No. A31-11425/2011).

See a sample of such an agreement here.

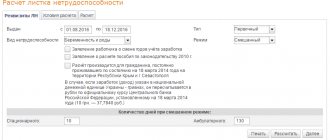

Example 1. Withholding personal income tax from a penalty collected by court

Moskvich, Belsky N.N. entered into an equity participation agreement (DPA) with the developer in January 2020 for the construction of a two-room apartment. According to the terms of this agreement, the shareholder paid the required cost of the apartment according to the DDU within the established time frame. However, the developer delayed the delivery of the house. As a result, Belsky I.N. went to court, demanding to collect a penalty from him for delay.

The court found the claims of the plaintiff (Belsky N.N.) justified. By a court ruling dated June 26, 2020, a penalty in the amount of RUR 200,000 was collected from the developer in favor of the shareholder. rub. This amount is recognized as the income of citizen N.N. Belsky and is subject to personal income tax. Since he is a resident of the Russian Federation, when calculating income tax payable, a rate of 13% is used.

The total is: 200,000 RUR. rub. * 13% = RUR 26,000 rub. This is the amount of personal income tax that will need to be paid.

Composition of payments

The amount paid by the losing party under a court decision may include:

- compensation for losses caused by non-fulfillment or improper fulfillment of an obligation (clause 1 of Article 393 of the Civil Code of the Russian Federation);

- penalties (fines, penalties) (Clause 1, Article 330 of the Civil Code of the Russian Federation);

- compensation for legal expenses incurred by the party that won the dispute (clause 1 of Article 98 of the Code of Civil Procedure of the Russian Federation);

- interest for the use of other people's funds (clause 1 of Article 395 of the Civil Code of the Russian Federation);

- compensation for moral damage (Article 151 of the Civil Code of the Russian Federation).

Let's take a closer look at these payments.

Losses

The debtor is obliged to compensate the creditor for losses caused by non-fulfillment or improper fulfillment of the obligation (clause 1 of Article 393 of the Civil Code of the Russian Federation). According to paragraph 2 of Art. 15 of the Civil Code of the Russian Federation, losses caused are divided into real damage and lost profits.

Real damage refers to the expenses that a person whose right has been violated has made or will have to make to restore the violated right, as well as loss or damage to his property (Clause 2 of Article 15 of the Civil Code of the Russian Federation).

Lost profits are considered lost income that a person would have received under normal conditions of civil transactions if his right had not been violated (Clause 2 of Article 15 of the Civil Code of the Russian Federation). Since lost profits are lost income, the calculation of its size is always approximate and probabilistic. But the courts do not have the right to refuse to recover lost profits only because it is impossible to establish its reliable amount (clause 14 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated June 23, 2015 No. 25 “On the application by courts of certain provisions of Section I of Part One of the Civil Code of the Russian Federation ").

Penalty (fines, penalties)

A penalty (fine, penalty) is an amount of money that the debtor is obliged to pay to the creditor in the event of non-fulfillment or improper fulfillment of an obligation, in particular in case of delay in fulfillment. Its size is determined by law or agreement (clause 1 of Article 330 of the Civil Code of the Russian Federation).

A penalty, by its legal nature, is a sanction (a measure of liability) for improper fulfillment of an obligation (Resolution of the Supreme Court of the Russian Federation dated December 10, 2014 No. 307-AD14-1846).

Compensation for legal expenses

The obligation to compensate the winning party for the legal costs incurred by it is established in paragraph 1 of Art. 98 Code of Civil Procedure of the Russian Federation. Legal expenses consist of state fees and costs associated with the consideration of the case (Clause 1, Article 88 of the Code of Civil Procedure of the Russian Federation, Article 101 of the Arbitration Procedure Code of the Russian Federation).

Legal costs, in particular, include amounts of money to be paid to experts, specialists, witnesses, translators, expenses for the services of lawyers and other persons providing legal assistance (representatives), and other expenses incurred by persons during the trial (Art. 94 Code of Civil Procedure of the Russian Federation, Article 106 of the Code of Arbitration Procedure of the Russian Federation).

When compensating for legal expenses, a lot of controversy arises over the inclusion of the so-called “success fee”, which is paid to lawyers upon successful consideration of a case in court. The Supreme Arbitration Court of the Russian Federation did not object to the inclusion of the “success fee” in the collection of legal costs. This is evidenced by paragraph 6 of the information letter dated December 5, 2007 No. 121 “Review of judicial practice on issues related to the distribution of legal costs between the parties for the services of lawyers and other persons acting as representatives in arbitration courts” and the resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 02/04/2014 No. 16291/10.

But the Supreme Court of the Russian Federation is categorically against the inclusion of “success fees” as part of legal expenses. In Determination No. 309-ES14-3167 dated February 26, 2015, he noted that the amounts paid to lawyers for a positive outcome of the case are not conditional on the provision of any new services by them. Essentially, such amounts are a kind of bonus for lawyers. In this case, the amount of this premium depends on the agreement reached by the parties to the contract for the provision of legal services. And the result of such an agreement between the client and the representative cannot be recovered as legal costs from the client’s procedural opponent, who is not a party to the said agreement.

Thus, the “success fee” is not included in the legal costs awarded to the winner by the losing party.

Interest on the use of other people's funds

The obligation to pay interest for the use of other people's funds is established in paragraph 1 of Art. 395 of the Civil Code of the Russian Federation. Using someone else's money is their unlawful retention and evasion of return, delay in payment, or unjustified receipt or saving of money at the expense of another person.

Note that interest on the use of other people's funds is a measure of liability for failure to fulfill a monetary obligation. That is, such interest is paid only if the violated obligation is monetary (for example, failure to pay for goods delivered on time).

Moral injury

From the provisions of Art. 151 of the Civil Code of the Russian Federation it follows that moral harm is understood as physical or moral suffering caused to a citizen by actions that violate his personal non-property rights or encroach on intangible benefits belonging to the citizen. Thus, the obligation to compensate for moral damage can arise only in a legal dispute with an individual. For example, in case of violation of consumer rights (Article 15 of the Law of the Russian Federation dated 02/07/92 No. 2300-1 “On the Protection of Consumer Rights), in case of failure to comply with the terms of the agreement on the sale of a tourist product by a tour operator or travel agent (Article 6 of the Federal Law dated November 24, 1996 No. 132-FZ “On the fundamentals of tourism activities in the Russian Federation”).

Common mistakes when withholding personal income tax from penalties and fines by court decision

Error 1. It is necessary to correctly understand who, when, should calculate and pay personal income tax on penalties based on a court decision.

So, the organization that pays income to an individual is a tax agent. This is evidenced by paragraph 1 of Art. 226 Tax Code of the Russian Federation. Consequently, it is she who must withhold and transfer personal income tax from the income of an individual.

This rule fully applies to income paid in the form of penalties and fines, but with some reservations. It should be noted that here we are talking about a situation where the organization does not make other payments to an individual. If the court that made the decision indicated in its ruling a specific amount of the penalty and the amount of tax to be paid, then the debtor (organization), upon actual payment, will have to withhold and transfer personal income tax for the individual.

If there is no such division (in terms of the amount of the penalty and personal income tax), then the organization essentially does not have the opportunity to withhold and deduct tax. Then she must inform the individual and the Federal Tax Service in writing:

- about the inability to pay personal income tax;

- the amount of income (in the form of a penalty, a fine) from which tax must be withheld;

- the amount of unwithheld personal income tax.

This must be done within the deadline immediately after the last tax period. After this, payment of the tax falls entirely on the shoulders of the individual.

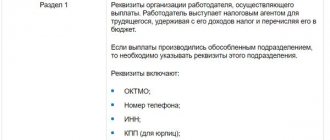

Payments for which personal income tax withholding depends on the content of the court decision

As a general rule, amounts awarded by a court decision in a labor dispute are subject to personal income tax in accordance with the provisions of clause 3 of Art. 217 of the Tax Code of the Russian Federation, because In this case, the former employer is recognized as a tax agent, and he is assigned responsibilities for calculating, withholding and paying the amount of personal income tax in cases where tax withholding is possible.

On the one hand, according to Article 226 of the Tax Code of the Russian Federation, the organization that is the source of payment of income to an individual is obliged to withhold personal income tax. On the other hand, if the payment is made on the basis of a court decision, and court decisions are binding on all organizations, therefore the organization must pay the individual exactly the amount specified in the court decision (clause 2 of Article 13 of the Code of Civil Procedure of the Russian Federation; clauses 1, 2 of Article 16, Articles 119, 332 of the Arbitration Procedure Code of the Russian Federation, part 1 of Article 105 of the Federal Law of October 2, 2007 No. 229-FZ “On Enforcement Proceedings”).

In the court decision itself regarding the amounts awarded, there are two possible wording options:

- with the allocation of the personal income tax amount (for example, “... to collect 100 rubles, including personal income tax in the amount of 13 rubles.”);

- without allocating the amount of personal income tax (for example, “... collect 100 rubles.”).

According to the official position of the Ministry of Finance of Russia (Letter of the Ministry of Finance of Russia dated September 3, 2015 N 03-04-06/50689), the Supreme Arbitration Court of the Russian Federation (Determination of the Supreme Arbitration Court of the Russian Federation dated July 27, 2012 No. VAS-6709/12 in case No. A47-4210/2011) and tax authorities, if the court did not allocate the amount of personal income tax when making a decision, the tax agent cannot withhold the tax. In this case, the organization must inform the Federal Tax Service about the impossibility of withholding tax no later than January 31 of the year (clause 5, article 6.1 of the Tax Code of the Russian Federation) in the 2-NDFL message form (clause 5.7 of the 2-NDFL form), if such an organization does not have the opportunity to withhold Personal income tax from other income of the taxpayer - individual.

Note : Previously, the position of the Russian Ministry of Finance was that the organization that is the source of the payment is obliged to withhold personal income tax if the payment is made by court decision.

Is it possible to recover the personal income tax paid for a representative from the losing party as part of legal costs?

The Ruling of the Supreme Court of the Russian Federation dated 08/09/2018 No. 310 KG16-13086 answers the question of whether the personal income tax paid for a representative - an individual can be recovered from the losing party among legal costs?

The court examined a situation in which an organization entered into an agreement for representation in court with an individual and paid personal income tax on the individual’s remuneration under the concluded agreement.

In making a positive decision on this issue, the Supreme Court of the Russian Federation justified its position with the following arguments:

- the person claiming the recovery of legal costs must prove the fact of their incurrence, as well as the connection between the costs incurred by the specified person and the case being considered in court with his participation. Failure to prove these circumstances is grounds for refusal to reimburse legal costs (paragraphs 10 – 13 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated January 21, 2016 No. 1 “On some issues of application of the legislation on reimbursement of costs associated with the consideration of the case”);

- The customer organization under an agreement for the provision of paid services concluded with an individual, being a tax agent, is obliged to calculate, withhold and pay to the budget the amount of personal income tax in relation to the remuneration (income) paid to the attracted representative under this agreement. Thus, payment of remuneration (income) to the representative is impossible without making mandatory contributions to the budget. At the same time, the mandatory contributions to the budget made by the applicant as a tax agent of the performer do not change the legal nature of the personal income tax amount as part of the cost of the performer’s services;

- The contract for the provision of legal services stipulates that the client (organization) acts as a tax agent in relation to the performer and transfers the amount of personal income tax to the tax authority at the place of registration of the latter. This condition of the contract allows us to conclude that the organization, along with paying remuneration directly to the contractor for the services provided by him, is obliged to withhold and transfer personal income tax for the contractor to the budget from the amount of remuneration. This is the rationale for classifying the disputed amount as legal costs. In addition, the fact that the organization fulfilled its duty as a tax agent was established by the courts when considering the dispute and was not disputed by the tax authority.

Thus, the costs of the organization in the amount of personal income tax transferred to the budget are directly related to the consideration of the dispute in the arbitration court and relate to the legal costs listed in Art. 106 of the Arbitration Procedure Code of the Russian Federation, and are subject to compensation in accordance with Art. 110 Arbitration Procedure Code of the Russian Federation. This means that the organization has the right to recover personal income tax paid for the representative - an individual, from the losing party among legal costs.

The article was written and posted on September 29, 2020. Added - 11/12/2015, 05/31/2016, 03/05/2017, 09/26/2018, 10/26/2018, 12/07/2018

ATTENTION!

Copying the article without providing a direct link is prohibited. Changes to the article are possible only with the permission of the author.

Author: lawyer and tax consultant Alexander Shmelev © 2001 — 2020

Answers to frequently asked questions

Question No. 1: Is it possible to apply any of the deductions when withholding personal income tax from a penalty?

An individual, when receiving income in the form of a penalty or a fine, can only claim a standard deduction for himself in the amount of 500 or 3000 rubles. rub. (for your child – from 1,400 to 12,000 Russian rubles). The law does not prohibit the use of a standard deduction.

It should be borne in mind that this deduction will be possible only if there are certain grounds and if the specific conditions provided for in Art. 218 Tax Code of the Russian Federation. Key point: the standard deduction is provided only to residents of the Russian Federation (i.e., those citizens whose income is subject to personal income tax at a rate of 13%).

Compensation for moral damage

The authors of the letter remind you that when determining the tax base for personal income tax, all income of the taxpayer received both in cash and in kind is taken into account (clause 1 of Article 210 of the Tax Code of the Russian Federation).

And income is recognized as economic benefit in cash or in kind (Article of the Tax Code of the Russian Federation). The list of non-taxable income is given in Article 217 of the Tax Code of the Russian Federation. Paragraph 3 of this article mentions legally established compensation payments related to compensation for harm caused by injury or other damage to health. Article 15 of the Law of the Russian Federation dated 02/07/92 No. 2300-1 “On the Protection of Consumer Rights” obliges compensation for moral damage caused to the consumer as a result of violation of consumer rights by the manufacturer (performer, seller, authorized organization or authorized individual entrepreneur, importer). The amount of compensation for moral damage is determined by the court.

Thus, the amount of compensation for moral damage caused by an organization to an individual is a compensation payment and is not subject to personal income tax.

Blog nefi

Question: Individual consumers receive from defendants in court decisions, settlement agreements and in the pre-trial settlement of disputes the following types of payments in cases of consumer rights protection:

— return of the cost of goods, work, services (including prepayment for goods, work, services);

— return of amounts of illegal commissions under loan agreements (for maintaining a loan account, issuing a loan, servicing a loan, etc.);

— compensation for losses (for example, interest on a loan upon termination of a sales contract, if the loan was taken out to purchase goods);

— compensation for moral damage;

— penalty for violation of deadlines for meeting consumer requirements;

- interest on the use of other people's funds under Art. 395 Civil Code of the Russian Federation;

— fine for failure to comply with the voluntary procedure for satisfying consumer requirements under Part 6 of Art. 13 Law of the Russian Federation dated 02/07/1992 N 2300-1 “On the protection of consumer rights” (according to the Resolution of the Plenum of the Supreme Court of the Russian Federation dated 06/28/2012 N 17, such fines are collected in favor of the consumer);

— reimbursement of legal expenses (for paying for the services of a representative, for conducting a forensic examination, for issuing a notarized power of attorney, etc.);

— return of part of the insurance premium for accident insurance upon early repayment of the loan agreement.

Are the specified payment amounts subject to personal income tax? If yes, then based on what legislation?

Is an individual obliged to pay personal income tax on the specified income independently or is it withheld and paid by the defendant (legal entity, individual entrepreneur) as a tax agent?

Answer:

MINISTRY OF FINANCE OF THE RUSSIAN FEDERATION

LETTER

dated May 24, 2013 N 03-04-06/18724

The Department of Tax and Customs Tariff Policy reviewed the letter on the issue of paying personal income tax when making payments in connection with violation of consumer rights and in accordance with Art. 34.2 of the Tax Code of the Russian Federation (hereinafter referred to as the Code) explains the following.

Clause 1 of Art. 210 of the Code establishes that when determining the tax base, all income of the taxpayer received by him, both in cash and in kind, is taken into account.

According to Art. 41 of the Code, income is recognized as economic benefit in cash or in kind, taken into account if it is possible to evaluate it and to the extent that such benefit can be assessed, and determined for individuals in accordance with Chapter. 23 “Income tax for individuals” of the Code.

Amounts returned to the taxpayer for the cost of goods (work, services), including prepayment amounts, as well as commissions on loan agreements, the collection of which was declared illegal by the court, do not form an economic benefit for the taxpayer and, accordingly, are not subject to personal income tax.

Clause 3 of Art. 217 of the Code provides that all types of compensation payments established by the legislation of the Russian Federation (within the limits established in accordance with the legislation of the Russian Federation), related, in particular, to compensation for harm caused by injury or other damage to health, are not subject to taxation on personal income. .

In accordance with Art. 15 of the Law of the Russian Federation dated 02/07/1992 N 2300-1 “On the Protection of Consumer Rights” (hereinafter referred to as the Law) moral damage caused to the consumer as a result of violation by the manufacturer (performer, seller, authorized organization or authorized individual entrepreneur, importer) of consumer rights provided for by law and legal acts of the Russian Federation regulating relations in the field of consumer rights protection, is subject to compensation by the causer of harm if he is at fault. The amount of compensation for moral damage is determined by the court.

Thus, the amount of money paid on the basis of a court decision in compensation for moral damage caused by an organization to an individual is a compensation payment provided for in paragraph 3 of Art. 217 of the Code, and on this basis is not subject to personal income tax.

Clause 1 of Art. 16 of the Law provides that the terms of the contract that infringe on the rights of the consumer in comparison with the rules established by laws or other legal acts of the Russian Federation in the field of consumer protection are declared invalid.

If, as a result of the execution of a contract that infringes the rights of the consumer, he incurs losses, they are subject to compensation by the manufacturer (performer, seller) in full.

Taking into account the above, amounts of actual damage reimbursed in accordance with the Law to the consumer by the manufacturer (performer, seller) are exempt from taxation if they arose as a result of the execution of a contract that infringes on the rights of the consumer.

The amount of compensation by the organization for fines for failure to voluntarily satisfy consumer requirements in accordance with the Law, penalties in paragraph 3 of Art. 217 of the Code are not provided for and, therefore, such payments are subject to personal income tax in the prescribed manner.

With regard to legal expenses, it should be assumed that if the party reimbursing the taxpayer for legal expenses related to the performance of legally significant actions against the taxpayer and on his initiative or the provision of legal services by a representative is an organization or an individual entrepreneur, then the corresponding amounts of compensation are recognized as income of the taxpayer in kind, subject to personal income tax in the prescribed manner.

If the party reimbursing these expenses are individuals, income in kind, subject to personal income tax, does not arise.

In cases of early termination of voluntary life insurance contracts upon early termination of a loan agreement (except for cases of early termination of voluntary life insurance contracts for reasons beyond the control of the parties) and the return to individuals of the monetary (redemption) amount due in accordance with the insurance rules and conditions of these contracts, upon early termination of such contracts, the income received minus the amounts of insurance contributions paid by the taxpayer is subject to taxation.

Clause 1 of Art. 226 of the Code provides that Russian organizations from which or as a result of relations with which the taxpayer received the income specified in paragraph 2 of Art. 226 of the Code are recognized as tax agents in relation to such income paid to an individual, and are obliged to calculate, withhold from the taxpayer and pay the amount of tax calculated in accordance with Art. 224 of the Code.

In accordance with paragraph 4 of Art. 226 of the Code, tax agents are required to withhold the accrued amount of tax directly from the taxpayer’s income upon actual payment.

The tax agent withholds the accrued amount of tax from the taxpayer at the expense of any funds paid by the tax agent to the taxpayer upon actual payment of these funds to the taxpayer or on his behalf to third parties.

The Code does not establish the specifics of how a tax agent fulfills his duties when paying income to a taxpayer based on a court decision.

The debtor organization, in accordance with civil procedural legislation, is given the right, at the stage of consideration of a civil case, to draw the court’s attention to the need to determine the debt subject to collection, taking into account the requirements of the legislation on taxes and fees.

If, when making a decision, the court does not separate the amounts due to an individual and subject to withholding from the individual, the tax agent organization does not have the opportunity to withhold personal income tax from the taxpayer. In this case, the tax agent is obliged in accordance with paragraph 5 of Art. 226 of the Code, no later than one month from the end of the tax period in which the relevant circumstances arose, notify the taxpayer and the tax authority at the place of registration in writing about the impossibility of withholding the tax and the amount of the tax.

Deputy Director

Tax Department

and customs tariff policy

S.V.RAZGULIN

24.05.2013