We are opening a separate division: how and where to submit 6-NDFL

The company's obligation to register and submit 6-NDFL for separate divisions (OP) arises if income is paid:

- employees performing labor duties at stationary workplaces geographically remote from the head office (created for a period of more than 1 month);

- to individuals under civil contracts concluded by authorized persons on behalf of the OP.

If income is paid to at least 1 such individual, the accounting service may have a question: how to fill out and submit 6-NDFL for a separate division?

Each OP is required to submit 6-NDFL at the place of its tax registration, regardless of:

- on the number of OPs registered by the company;

- the number of individuals receiving income from the OP;

- other conditions of the OP’s activities.

Tax agents - the largest taxpayers (CT) have the right to choose the address for filing 6-NDFL at the place of registration:

- companies as CN;

- or their OPs.

From 01/01/2020, it is possible to switch to centralized submission of 6-NDFL for OPs that are located in the same municipality. 6-NDFL on them can be submitted to the tax office at the location of one of these divisions, or to the Federal Tax Service of the parent organization, if the head office is located in the same municipality as the OP (even if the OP is the only one (see letter from the Federal Tax Service dated November 15, 2019 No. BS-4-11/23247).

To select the responsible department, you need to submit the following notification to the Federal Tax Service. The deadline is defined as the first working day of the corresponding year, but notifications for 2020 will be accepted until 01/31/2020 inclusive.

The notification only needs to be submitted to one inspection - the one that takes into account the responsible OP, the rest of the Federal Tax Service will be notified automatically.

How to open an OP and organize accounting in it - see this article .

The algorithm for filling out sections 1 and the 6-NDFL report for separate divisions is no different from a similar report for the parent company.

NOTE! The requirements for filling out 6-NDFL are contained in the order of the Federal Tax Service of Russia dated October 14, 2015 No. MMB-7-11/ [email protected] (as amended on January 17, 2018).

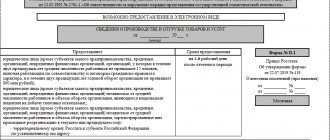

Close attention will require filling out the title page of the 6-NDFL report, or rather the cells intended for the codes of the tax authority to which it is submitted, as well as the checkpoint and OKTMO department.

On the title page of 6-NDFL, it is necessary to reflect the checkpoint and OKTMO of the OP that paid income to individuals, and with centralized reporting from 2020 - the checkpoint of the responsible OP.

Sample of filling out 6 personal income tax for a closed separate division, submission period

The delivery location also depends on this:

- if reports are submitted before closure and deregistration, then to the Federal Tax Service at the place of registration of the OP;

- if the 6NFLD report is submitted after the closure of a separate division and deregistration from taxation, then at the place of registration of the parent enterprise.

There are other nuances that are worth considering:

- Checkpoint. The checkpoint of the liquidated OP is always indicated;

- OKTMO code is always indicated at the location of the enterprise that is subject to liquidation;

- The Federal Tax Service code is assigned depending on when the documents are submitted - before or after the company is officially closed.

On a note! The report itself must be completed correctly. Otherwise, it will not be accepted by the Federal Tax Service, and this threatens with tax consequences in the form of a fine.

Tax agents - CNs - are again given the opportunity to choose: submit the latest 6-NDFL report for the liquidated OP to the inspectorate with which the company is registered as a CN, or at the place of registration of the liquidated OP. What to do if it was not possible to report to the place of registration of the OP before its closure, see “

Where, in what time frame, and how to fill out personal income tax reporting for a closed division?” The results of 6-NDFL for separate divisions are submitted to the tax office at the place of their registration.

The same rule applies when submitting the last 6-NDFL report in case of closure of a unit. The largest taxpayers have a choice: to report for the division in Form 6-NDFL to the inspectorate for the largest taxpayers or at the place of registration of the division.

Online magazine for accountants

Personal income tax A separate division is closing: where to submit 6-NDFL upon closing Results We are opening a separate division: how and where to submit 6-NDFL The company’s obligation to register and submit 6-NDFL for separate divisions (OP) arises if income is paid:

- employees performing labor duties at stationary workplaces geographically remote from the head office (created for a period of more than 1 month);

- to individuals under civil contracts concluded by authorized persons on behalf of the OP.

If income is paid to at least 1 such individual, the accounting service may have a question: how to submit 6-NDFL for a separate division? The algorithm for filling out sections 1 and 2 of the 6-NDFL report for separate divisions is no different from a similar report for the parent company. Cm.

How to fill out 6-NDFL: 12 tips from the Federal Tax Service

This is explained in the letter of the Federal Tax Service of Russia dated August 1, 2016 No. BS-4-11 / [email protected] (question No. 7).

- 6-NDFL reporting data is submitted to the tax office both at the registration address of the main company and at the location (registration) address of the branches.

- For companies that are large taxpayers, the exact opposite rule applies. In particular, based on the norms of Part 4, Clause 2, Art. 230 of the Tax Code of the Russian Federation, such companies are entitled to choose which tax authority they should submit 6-NDFL reporting indicators to - at the address of registration as the largest taxpayer or in the region of registration of one of the separated structures. Moreover, the legislator does not provide for the simultaneous submission of the document in question at the place of registration of both the main company and its branches, that is, it actually prohibits this (letter of the Federal Tax Service of Russia dated 01.02.2016 No. BS-4-11 / [email protected] ). You can download the current 6-NDFL form here.

6-personal income tax for separate divisions

Then it will be assigned a separate reason code, which is an important detail when filling out reports. Then, upon liquidation of such an enterprise, all 6-NDFL reports for a separate division will be submitted to the inspectorate at the place of registration.

Tax payment can be made using a single payment document. If OPs are located in different municipalities, then reports for each liquidated enterprise are submitted to the Federal Tax Service to which it is “attached”.

Personal income tax for separate divisions is one of the types of tax reporting for income tax. We will consider the main points regarding the reporting documentation of 6-NDFL branches in our article.

6- Personal income tax when opening remote units Where to submit 6-personal income tax for a separate unit? Where to submit 6-NDFL and 2-NDFL when closing a branch? 6-NDFL when opening remote divisions Due to the fact that remote structures of the enterprise are not independent in their powers, the main burden of submitting reports to regulatory authorities lies with the head legal entity. face. At the same time, some reports are submitted with the participation of remote branches of the company, and Form 6-NDFL also applies to such reporting documentation.

Subscribe to our channel in Yandex.Zen! Subscribe to the channel Read about the differences between branches and representative offices here.

Tax payment is also made in separate payments. When registering the OP and the parent company with the same tax office, such problems should not arise.

Important

Submitting reports if employees do not quit but are transferred to the head office. In this case, you need to do the following:

- draw up all personnel documentation on the transfer of an employee from the OP to the head office;

- until the transfer by order, report 6 personal income tax is submitted to the location of the branch;

- After transfer to the head office, information about taxpayers is filled out and submitted to its location.

The amount of tax payable must be calculated in proportion to the time worked by a particular employee, first in a separate division, and then in the head office. Employees resigning during the liquidation of an EP will receive a 2NDFL certificate from the liquidated separate division being closed.

Where to submit 6-NDFL and 2-NDFL when closing a branch? When liquidating a branch, it is necessary to report on 6-NDFL for a separate division and submit certificates in form 2-NDFL. This can be done in the following ways:

- No later than the day the remote division is deregistered, submit reports and certificates to the same tax office where reports and certificates were submitted before the branch was closed, that is, at the registration address. At the same time, the reporting documents indicate all the data of the liquidated branch (KPP, OKTMO, code of the tax authority with which the branch is registered). In this case, it is not necessary to submit 2-NDFL certificates a second time at the end of the year in which the branch’s activities are terminated (letter of the Federal Tax Service of Russia dated March 28, 2011 No. KE-4-3/4817).

- After deregistration of the branch, submit 6-NDFL reporting indicators for the separate division and 2-NDFL certificates to the tax service at the place of registration of the main company.

Source: https://kodeks-alania.ru/obrazets-zapolneniya-6-ndfl-po-zakrytomu-obosoblennomu-podrazdeleniyu-period-predstavleniya/

https://youtu.be/-m0RgjUzafI

A separate division is closing: where to submit 6-NDFL upon closure

If a division closes, how to submit 6-NDFL? A similar question may arise at any time after a decision is made to liquidate one or more OP of the company.

In this case, employees of this OP may be:

- Transferred to another OP or head office. From the moment of such a transfer, the income paid to them will go to another 6-NDFL - the division to which they were transferred.

For information on how to fill out a report when an employee moves between departments, read the material “How to fill out 6-NDFL if the employee “roams” between departments (examples).”

- Fired. If the company as a whole is liquidated along with all OPs, the final 6-NDFL report drawn up under this OP will be the last report that will reflect the amounts of income and personal income tax, as well as the corresponding dates (receipt of income, withholding of tax and its transfer) for dismissed employees .

For information on the procedure for dismissing employees during a company reorganization, see the article . ”

When registering 6-NDFL for OPs that are planned to be liquidated, you must adhere to the following rules:

- reporting period for 6-NDFL - from the beginning of the year (or from the moment of registration of the enterprise, if it is created and liquidated during the calendar year) until the date of deregistration (completion of the liquidation process);

- The latest 6-NDFL report must be submitted at the location of the OP being closed.

About the features of reflecting payments upon dismissal in 6-NDFL, read the material “How to correctly reflect payments upon dismissal in 6-NDFL?”

Tax agents - CNs - are again given the opportunity to choose: submit the latest 6-NDFL report for the liquidated OP to the inspectorate with which the company is registered as a CN, or at the place of registration of the liquidated OP.

What to do if it was not possible to report to the place of registration of the OP before its closure, see here .

Sample of filling out 6-personal income tax for separate divisions - legal advice

On the title page of 6-NDFL it is necessary to reflect the checkpoint and OKTMO of the OP that paid income to individuals. See “How to apply for 6-NDFL for a branch?”

A separate division is closing: where to submit 6-NDFL upon closing? If the division is closed, how to submit 6-NDFL? A similar question may arise at any time after a decision is made to liquidate one or more OP of the company. In this case, employees of this OP may be:

- Transferred to another OP or head office. From the moment of such a transfer, the income paid to them will go to another 6-NDFL - the division to which they were transferred.

For information on how to fill out a report when an employee moves between departments, read the material “How to fill out 6-NDFL if the employee “roams” between departments (examples).”

About the new option for filling out the 6-NDFL form and errors when filling it out

Zobova E. P., magazine editor

For the tax period 2020, Form 6-NDFL is presented in an updated version. Read about what has changed in this personal income tax reporting form, as well as about errors encountered when filling it out.

Effective date of the updated form 6‑NDFL

[email protected] was signed . The document makes changes to form 6‑NDFL[2], which has been in effect in its original form since 2020.

Tax agents must report on the updated Form 6-NDFL for the 2020 tax period. This must be done no later than April 2, 2020 (clause 2 of Article 230 of the Tax Code of the Russian Federation).

Changes to Form 6‑NDFL

Changes have been made to the title page, the procedure for filling out and submitting, as well as the presentation format of form 6‑NDFL. Sections 1 “Generalized indicators” and 2 “Dates and amounts of actual income received and withheld personal income tax” remained unchanged.

Title page

The title page of form 6‑NDFL was not just adjusted, but replaced with a new version. Compared to the current edition of form 6‑NDFL, the following changes have been made to the title page:

- barcode 15201027 replaced by barcode 15202024;

- for organizations that are the largest taxpayers, the TIN and KPP at the location of the organization are indicated according to the certificate of registration of the Russian organization with the tax authority at the location (5th and 6th categories of KPP - 01);

- details have been entered for the reorganization or liquidation of the organization;

- other clarifying amendments have been made.

Regarding the reorganization or liquidation of an organization, the following fields are entered:

- “Form of reorganization (liquidation) (code)”;

- “TIN/KPP of the reorganized organization.”

The successor organization submits to the tax authority at its location (at the place of registration as the largest taxpayer) Form 6-NDFL for the last submission period and updated payments for the reorganized organization (in the form of merger with another legal entity, merger of several legal entities, division of a legal entity). persons, transformation of one legal entity into another) indicating in the title page (page 001) by the details “at the location (accounting) (code)” code 215 or 216, and in the upper part - the TIN and KPP of the successor organization. The “tax agent” line reflects the name of the reorganized organization or a separate division of the reorganized organization.

The line “TIN/KPP of the reorganized organization” records the TIN and KPP that were assigned to the organization before the reorganization by the tax authority at its location (at the place of registration as the largest taxpayer) or at the location of separate divisions of the reorganized organization.

Codes of forms of reorganization and liquidation of an organization (separate division) are given in Appendix 4 to the Procedure for filling out form 6-NDFL.

If the payment submitted to the tax authority is not a payment for a reorganized organization, dashes are indicated in the line “TIN/KPP of the reorganized organization.”

We note that according to clause 3.5 of Art.

55 of the Tax Code of the Russian Federation, upon termination of an organization through liquidation or reorganization (termination by an individual of activities as an individual entrepreneur), the last tax (settlement) period for such an organization (such an individual entrepreneur) is the period of time from the beginning of the calendar year until the day of state registration of the termination of the organization as a result of liquidation or reorganization (loss of validity of state registration of an individual as an individual entrepreneur).

In connection with the above, before the completion of liquidation (reorganization), the organization submits to the tax authority at the place of its registration a calculation in Form 6-NDFL for the period of time from the beginning of the year until the day the liquidation (reorganization) of the organization is completed.

The submission by the legal successor of the payment in form 6‑NDFL for the reorganized organization is not provided for by the current edition of the Tax Code of the Russian Federation (Letter of the Federal Tax Service for Moscow dated January 10, 2018 No. 13‑11/ [email protected] ).

Source:

6 Personal income tax upon closure of a separate division

The founders decided to close the branch. What actions should an accountant take?

Rules for submitting reports

In Art. 226 of the Tax Code of the Russian Federation states that tax agents for personal income tax must submit reports:

- in the Federal Tax Service, with which he is registered for tax purposes;

- at the place of registration of such a company;

- at the place of residence of the entrepreneur.

A tax agent is a legal entity that has separate divisions that submit to the Federal Tax Service at the location of these divisions reporting in Form 6-NDFL:

- for employees who work in an EP on the basis of an employment contract;

- with persons who received remuneration after working in an OP on the basis of a civil contract.

How to submit 6NDFL for separate divisions? What rules and regulations must be followed?

The same rules must be followed when submitting reports in Form 6-NFDL when closing a separate division. The exception is the largest taxpayers. They have the right to independently choose the Federal Tax Service:

- or at the place of registration of the head enterprise;

- or at the place of registration of each detachment.

You also need to take into account the following provisions:

- reporting period – from the beginning of the calendar year. If the separate entity was created in the same calendar year in which it is liquidated, then the reporting period for reporting income will be the entire period of activity of the OP;

- the last report is submitted at the location of the branch being closed.

Actions when closing an OP

The decision to close has already been made. Where to submit 6NDFL for separate divisions, and what deadlines must be adhered to?

You can submit reports in Form 6-NDFL for a closed, separate division both before and after it is deregistered with the Federal Tax Service. The delivery location also depends on this:

- if reports are submitted before closure and deregistration, then to the Federal Tax Service at the place of registration of the OP;

- if the 6NFLD report is submitted after the closure of a separate division and deregistration from taxation, then at the place of registration of the parent enterprise.

There are other nuances that are worth considering:

- Checkpoint. The checkpoint of the liquidated OP is always indicated;

- OKTMO code is always indicated at the location of the enterprise that is subject to liquidation;

- The Federal Tax Service code is assigned depending on when the documents are submitted - before or after the company is officially closed.

Results

6-NDFL for separate divisions is submitted to the tax office at the place of their registration. The same rule applies when submitting the last 6-NDFL report in case of closure of a unit.

The largest taxpayers have a choice: to report for the division in Form 6-NDFL to the inspectorate for the largest taxpayers or at the place of registration of the division.

From 01/01/2020, in some cases, it is possible to submit a single 6-NDFL in several separate sections.

Sources:

- Tax Code of the Russian Federation

- Order of the Federal Tax Service of Russia dated October 14, 2015 No. MMB-7-11/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Submission of reports if employees do not quit but are transferred to the head office

In this case, you need to do the following:

- draw up all personnel documentation on the transfer of an employee from the OP to the head office;

- until the transfer by order, report 6 personal income tax is submitted to the location of the branch;

- After transfer to the head office, information about taxpayers is filled out and submitted to its location.

The amount of tax payable must be calculated in proportion to the time worked by a particular employee, first in a separate division, and then in the head office.

Employees resigning during the liquidation of an EP will receive a 2NDFL certificate from the liquidated separate division being closed. This document represents the calculation in the line of accrued and paid income tax.

Closing a separate division, the procedure for submitting reports

They have the right to independently choose the Federal Tax Service:

- or at the place of registration of the head enterprise;

- or at the place of registration of each detachment.

You also need to take into account the following provisions:

- reporting period - from the beginning of the calendar year. If the separate entity was created in the same calendar year in which it is liquidated, then the reporting period for reporting income will be the entire period of activity of the OP;

- the last report is submitted at the location of the branch being closed.

Actions when closing an OP The decision to close has already been made.

Where to submit 6NDFL for separate divisions, and what deadlines must be adhered to? You can submit reports in Form 6-NDFL for a closed, separate division both before and after it is deregistered with the Federal Tax Service.

Separate units

Sometimes organizations that have separate divisions and operate within the same municipality submit one calculation in form 6-NDFL .

It is not right. The calculation in Form 6-NDFL is filled out by the tax agent separately for each separate division registered, including those cases where separate divisions are located in the same municipality.