Increasing balance currency

It happens that the balance sheet currency may change positively (increase) or negatively (decrease). There are several reasons that cause an increase in the balance sheet currency. In particular, these may be:

- increase in overall production volumes at the enterprise,

- increase in terms of settlements with debtors,

- obtaining a loan from a bank,

- revaluation of fixed assets of the enterprise, etc.

In some cases, an increase in the currency (figure) balance can provoke inflationary mechanisms.

“In addition, the opposite process is possible - a decrease in the balance sheet currency, usually caused by a decrease in business activity and, in fact, being a decrease in the solvency of the company.”

conclusions

To find the balance sheet currency for assets, you need to sum up lines 1100 and 1200 and then add them up. To find the balance sheet currency for liabilities, you need to calculate the values on lines 1300, 1400, 1500 and sum the resulting results. It is important to remember that the totals of assets and liabilities on the balance sheet must be equal.

What is the balance sheet of an enterprise, what is its content and structure, we described in ours. And in a separate article they gave an example of filling out the balance sheet as of December 31, 2017 using conventional digital data. What is the balance sheet currency in the balance sheet?

Balance currency: formula

- The increase in the balance sheet currency of the enterprise is carried out according to the following formula:

| A + SI = P + SII. Where A is the assets of the balance sheet, SI is the amount of change in funds, P is the liabilities of the balance sheet, SII is the amount of the change in the sources of finance coming into the accounts. |

- In turn, the decrease in the balance sheet currency is calculated using the formula:

| A – SI = P – SII. The notation will be the same as in the formula for increasing the balance sheet currency. |

It is important to remember that an increase or decrease implies a simultaneous (and, very important, equal) increase/decrease in assets and liabilities.

The balance sheet currency is...

The balance sheet reporting template is approved by the Ministry of Finance. The current version of the document is given in the Order dated 07/02/2010 under No. 66n. The normative act stipulates the rules and features of filling out the form, and provides key indicators that must be deciphered. It is important for an accountant to correctly enter all the data from the accounting registers and maintain equality of balance sheet currency. The balance sheet currency is the final indicator for the two parts of the report.

Balance Sheet Currency Purpose

The balance sheet form is divided into two blocks of indicators - assets and liabilities. For each of them the total is summed up. The data obtained must be identical. If these key values do not match, the balance will be considered incorrect and the report will be invalid. What is the balance sheet currency in the balance sheet - these are the results obtained for all sections of the asset, and the total value of the values of the sections from the liability.

The equality of balance sheet currencies is ensured by the principle of double entry. The key to correctly filling out the report are:

- completeness of recording of business transactions;

- use of standard correspondence when filling out the transaction log for the reporting period;

- compliance with the principle of double entry;

- no arithmetic errors;

- using accounting registers as a basis when filling out a report.

The balance sheet currency – line in the balance sheet 1600 and 1700 helps to check the correctness of the report. In the process of self-checking, it is necessary to focus on the identity of the total lines. Problems solved using this indicator:

- checking that the form is filled out correctly;

- balance sheet analysis (study of its results using vertical and horizontal analysis methods);

- determining the company's performance by calculating a number of financial ratios.

Foreign currency balance

A legal entity may have financial reserves in the currencies of other countries on its own balance sheet. In particular, these include:

- cash in the form of currency at the cash desk ("Cashier" account, sub-account),

- money placed in foreign currency accounts with authorized credit institutions (account “Currency accounts”),

- foreign currency funds placed on deposit accounts, letters of credit and other financial instruments (account “Special accounts in banks”, sub-account).

In addition, the balance sheet of the enterprise takes into account such foreign currency finances that were collected or deposited into bank accounts for settlements with creditors, but were not posted at the time of the accounting date (the “Transfers in transit” account, sub-account).

Transactions affecting the value of the balance sheet currency

The term BALANCE is of Latin origin. Literally: bis - twice, lanz - scales, i.e. double scales as a symbol of balance.

This is interesting: Payment payment payment payment

The balance sheet reflects the assets of the enterprise in two aspects: on the one hand, according to their composition and functional role, on the other hand, according to the sources of formation and intended purpose.

All property is grouped and summarized in the balance sheet in a single monetary measure. In order to show the state of assets, the balance sheet is compiled at a certain point, usually on the first day of the month (quarter). Since the balance sheet only shows the state of assets, the balance sheet does not characterize the movement and use of funds.

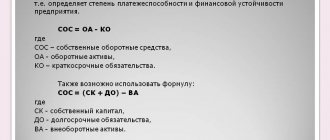

Own capital: balance sheet currency

In addition, accounting uses the concept of equity. It refers to the section of the enterprise’s balance sheet, which represents the sum of the authorized, reserve, and additional capital. In addition, the legal entity’s equity includes targeted financing and retained earnings.

Changes in equity capital (regardless of whether it is an increase or decrease) in most cases lead to an automatic change in the balance sheet currency of the enterprise.

Does the balance sheet currency depend on the type of activity of the enterprise?

To understand whether the balance sheet currency depends on the type of activity of the enterprise, and how much it depends, you should look at today's enterprises and compare different areas. For example, the difference is clearly visible between the manufacturing sector and the service sector. In the first case, a large number of non-current assets - real estate, transport, machinery and raw materials - creates a higher balance sheet currency, while in the service sector there are practically no non-current assets. No need to maintain a fleet of machines or purchase large quantities of industrial raw materials significantly reduces the average balance sheet currency.

Doubtful debts

In the BB it is also necessary to note a reserve for doubtful debts. Such obligations face any enterprise.

The provision for doubtful debts is reflected in the document accordingly. However, in order to correctly display such a reserve, it is necessary to understand what is meant by doubtful debts. The doubtful debts that this reserve includes include debts owed to the company, the repayment of which is unlikely to occur.

Signals for doubtful debts are as follows:

- violation of deadlines for paying off debts;

- availability of information about the presence of financial problems;

- lack of additional guarantees (for example, collateral), etc.

It is worth noting that the allowance for doubtful debts may include debt that is shown as a debit on various accounting accounts.

The debt that is included in the reserve for doubtful debts is calculated based on the results of the inventory carried out at the enterprise. To correctly display such debt, a reserve for doubtful debts is created. It serves as an estimate in financial statements.

Balance currency in asset

It is customary to include all components of the balance sheet in the assets section of the balance sheet currency section, indicating their value at the time of drawing up such a balance sheet. This may include tangible assets (enterprise property), fixed assets and inventories, organization accounts, finished goods and work in progress. Also taken into account are cash and monetary securities that currently belong to the organization and have some value. This also includes receivables to the organization from other organizations. The asset summarizes the so-called “fair” value of the farm.

Mandatory audit for companies depending on balance sheet currency in 2020

Currently, companies with a balance sheet value of more than 60 million rubles are audited. (Clause 1, Article 5 of the Federal Law of December 30, 2008 No. 307-FZ). But according to the plans, organizations with a balance sheet currency of 200, and then 400 million rubles will undergo a mandatory audit. The audit will be carried out only by audit organizations; individual auditors will not be allowed to do this.

The State Duma adopted the corresponding bill in the first reading. The second reading was postponed. The editors of the UNP newspaper are monitoring the changes and will tell you when the law is adopted.

Balance sheet currency for statutory audit

| During the period | amount, million rubles |

| 2018 | 60 |

| 2019 | 200* |

| 2020 onwards | 400* |

If your company requires an accounting audit, you will need to create a statement of integrity. Without this document, the auditor will refuse to audit (clause 20 of International Standard on Auditing 580).

The application will be requested from the manager. He is considered to have sufficient knowledge of the company's reporting to make a claim of good faith. Otherwise, the auditor will recommend that the director consult with employees who are competent in the accounting and affairs of the company. For example, with the chief accountant or lawyer. Then in the application it is necessary to add that the director made all the requests before responding to the auditor. In this case, written explanations from employees are not required. For a ready-made example of such a statement, see the link.

Balance sheet currency in liabilities

The list of positions by balance sheet currency in liabilities includes various sources of income that currently affect the final profit of the farm or enterprise. Typically this includes accounts payable (to partners, customers, suppliers), profits received in the past, authorized capital and borrowed funds. Accounts payable, among other things, include debt to the state in the form of unpaid taxes. In fact, in the list of balance sheet currency in liabilities, the total cost of items is equal to the balance sheet currency in assets; only the method of calculating the total cost of the economy changes.

Currency of assets and liabilities of the balance sheet: features

The balance sheet asset reflects the value of its balance sheet items at the time of publication of the statements. These are company property (tangible assets), finished goods, fixed inventories, financial accounts and enterprises, work in progress, etc. The securities and funds belonging to the legal entity that have a certain value on the date of summing up the total amount are also taken into account. Additionally, receivables from partners are taken into account. In general, an asset indicates the value of a company's economy, which is also called "fair value."

Liability includes the company's sources of income that affect its profit at the end of the reporting period. This includes the following items: borrowed funds, past profits, authorized capital, accounts payable to partners in the form of unpaid funds and the state in the form of unpaid taxes.

In fact, the equivalent value of both sections of the balance sheet currency indicates the use of two different methods for calculating the total value of the farm.

Changing the balance currency

Any change in the balance sheet currency, whether negative or positive, is always the result of the enterprise’s activities. In case of a positive change, we can talk about expanding the enterprise, obtaining new assets, and revaluing fixed assets. Other reasons include an increase in the period for payment or repayment of debts, inflation. That is, everything that concerns the increase in total assets in the farm is recorded here. The change can also be negative, and then we can talk about a reduction in demand or opportunities for purchasing raw materials. The decrease is often associated with the inclusion of new subsidiaries into the general economy.

Reflection of work results

The result of the activity of any enterprise will be finished products. Any production provides it. In the BB, finished products are reflected as assets and are entered in the “inventories” section. In this case, a small or large format enterprise must have account No. 43 with the name “Finished Products”.

Finished goods reflect production and are posted through postings. In this case, postings are made as production produces products. Descriptions are performed every month, even if there is a small indicator.

What does the balance currency provide?

You can find out what the balance sheet currency provides by comparing the assets and liabilities of the farm, including over a long distance. Calculating the balance sheet currency allows you to conduct an accurate analysis of profits and losses, see the income items that best expand the assets of the farm without negative consequences. It is the comparison of liability and asset items on the balance sheet that often gives an accurate picture of development dynamics. Based on the analysis of these articles, you can not only determine the unprofitability or profitability of the enterprise as a whole, but also find strategies for development in the coming months or years.

How to calculate the balance sheet currency (what is it, currency calculation) – Accounting

The balance sheet currency is the sum of the assets or liabilities of the balance sheet. This indicator demonstrates a kind of budget of the enterprise, that is, the amount of money invested in it.

Based on this figure, we can partially talk about the financial condition of the organization. The indicator has the same meaning for both liabilities and assets.

If an accountant has drawn up Form No. 1 of an enterprise, and his assets equal his liabilities, it means that the form has been drawn up correctly, and vice versa.

Example

The Zarya enterprise has the following performance indicators. The current assets section consists of: cash register - 100 rubles, current account balance - 1000 rubles, accounts receivable - 1000 rubles, balance of goods - 10,000 rubles.

https://youtu.be/YEv2li8ErSo

Section of non-current assets: real estate - 100,000 rubles, equipment - 100,000 rubles. The balance sheet currency, the formula of which in our case will look like current assets (100 + 1000 + 1000 + 10,000) plus non-current assets (100,000 + 100,000), will have a value of 212,100 rubles.

This is exactly the amount that should appear in the liability after it has been calculated.

What does the balance currency provide?

- Using it, you can calculate many ratios that indicate the liquidity of the enterprise, its solvency, turnover, etc.

- The dynamics with which the indicator changes shows the development trend of the organization as a whole. So, for example, if over several periods we see a positive increase in the dynamics of the balance sheet currency, this indicates that the company is developing positively (working or non-current assets are increasing, etc.).

- This indicator is a kind of financial “photograph” of an organization at a certain point in time, the task of which is to show its “face”.

Source:

Balance currency

The balance sheet currency in the balance sheet is the total values of its liability and asset items. The peculiarity of currency (digits) is the equality of these values.

Thus, the number obtained for a certain period indicates the amount of funds owned by the organization.

An important point: the value is considered indicative, since the value of assets on the organization’s balance sheet will differ from their market value.

Changes in balance figures

During the course of the company's activities, the value of the total amount may change towards decrease or increase. Reasons that cause an increase in the balance sheet currency:

- total production volumes increased;

- received a new bank loan;

- a revaluation of the company's assets and liabilities took place;

- the terms of settlement transactions with debtors have increased, etc.

This can also be facilitated by economic factors independent of the direct activities of the enterprise, for example, a decrease or increase in inflation and others. Positive changes indicate a revaluation of existing or the emergence of new assets, an increase in capital and expansion of the company as a whole.

A decrease in balance sheet currency is a negative process, which indicates that the company’s solvency has decreased due to a decrease in business activity, a reduction in market demand, a lack of opportunities to purchase raw materials, etc. Sometimes a decrease is caused by the inclusion of subsidiaries in the balance sheet.

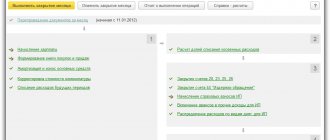

Impact of business transactions on the balance sheet

Performed business transactions change the quantitative values in the articles reflecting the funds of the enterprise and their sources. All operations are combined into 4 groups:

- Operations of the first type - a change in values in property items, only the asset is affected and the final value does not change (equality with the liability is maintained);

- Operations of the second type - a change in values in the sources that form the company’s property, only the liability is affected (equality with the asset is maintained);

- Operations of the third type - increase the values of liabilities and assets of the balance sheet, indicating the attraction of cash and other funds to the enterprise (equality between sections is maintained);

- Operations of the fourth type - reduce the values of liabilities and assets, indicating the withdrawal of funds from the company (equality between sections is maintained).

Display of foreign currency in the balance sheet

Balance sheet data is displayed in the currency of the country in which the enterprise is a resident, but some financial reserves may be displayed in the currencies of other countries. These data are:

- foreign currency at the organization's cash desk in cash;

- foreign currency placed on letters of credit, deposits, etc.;

- funds placed in foreign currency accounts of credit institutions.

This includes displaying currency deposited into bank accounts for settlements with creditors or collected, but not transferred to the balance sheet at the time of the accounting date.

What is equity?

Own capital is the section of the balance sheet, which is the sum of the enterprise's capital - authorized, additional and reserve. The figure also includes undistributed profits and targeted financing. Any changes in the amount of equity capital cause an automatic change in the balance sheet figure.

How does the activity of an enterprise affect the balance sheet figure?

The type of activity of the company directly affects the balance sheet currency. Thus, the balance sheet of a manufacturing company will display non-current assets - equipment, vehicles, raw materials, real estate, etc.

– which will ensure a high value of the final figure.

https://youtu.be/9h0OUfXBAJg

At the same time, enterprises operating in the service sector will not be burdened with non-current assets (purchases of raw materials or a significant fleet of machinery are not required), which helps to reduce the average value of the currency.

Currency of assets and liabilities of the balance sheet: features

The balance sheet asset reflects the value of its balance sheet items at the time of publication of the statements. These are company property (tangible assets), finished goods, fixed inventories, financial accounts and enterprises, work in progress, etc.

The securities and funds belonging to the legal entity that have a certain value on the date of summing up the total amount are also taken into account. Additionally, receivables from partners are taken into account.

In general, an asset indicates the value of a company's economy, which is also called "fair value."

In fact, the equivalent value of both sections of the balance sheet currency indicates the use of two different methods for calculating the total value of the farm.

What is the balance currency used for?

The balance sheet figure allows you to compare the balance sheet items of assets and liabilities of an enterprise to conduct a detailed analysis of its activities.

Which income items bring the greatest profit and contribute to the expansion of the company's assets, and which vice versa.

This helps to see the dynamics of the company's development in order to determine its level of profitability or unprofitability, as well as help in developing development strategies for future planning periods.

Source:

Balance sheet currency in the balance sheet

A special reporting document that any organization must maintain is called a balance sheet. The information reflected in it is sent in the form of an annual report to the tax office.

Also, the document itself has a certain form in which you cannot delete anything, but if necessary, you can add something new. In addition, each line is assigned a specific code, supported by a corresponding order (for example, accounts receivable has code 1230, and so on).

The balance sheet is divided into two forms in the form of Asset and Liability. The first section “Asset” includes the property of the enterprise as a whole (the cost of real estate, securities, available money, etc.).

It also records information about funds involved on an ongoing basis in the life of the company (daily), including non-current assets that can generate income in more than a year.

Balance sheet currency in the balance sheet, what is it?

That is, the balance sheet currency in the balance sheet for the “Asset” part includes summary information about current (tangible assets) and non-current assets (financial investments, etc.) of the entire enterprise. “Passive” records information about where this or that receipt of property came from.

The balance sheet currency is the sum of own and borrowed funds at the disposal of the organization.

Balance sheet currency in the balance sheet, how to calculate

To calculate the balance sheet currency, information from sections 1 and 2, responsible for “Asset”, and sections 1 to 3, responsible for “Liability” are used. In this case, the amount for each section is calculated separately, after which the final result is entered in the “Total”. And first, the “Total” is added up from 1 and 2 of the second sections, and then in the same way from 1 to 3.

It is worth noting a very important point: the amount received from the “Asset” must be equal to the “Liability”. If this does not work, then the first thing you need to do is double-check the correctness of the indicators.

Also, a company can incur both losses and make good profits. Accordingly, this will be reflected in “Asset” or “Liability”, which affects the formation of the balance sheet currency in the balance sheet by its shift in a positive or negative direction.

In order to see a clearer picture, reporting is completed at the beginning and end of the year. That is why it is so important to indicate all information on the operations of the enterprise, because they have a direct impact on changes in indicators in a positive or negative direction.