Carrying out currency transactions in Russia

Operations for the purchase and sale of currency occur in organizations if:

- Carrying out trading operations in foreign currency;

- Payment of travel expenses for overseas business trips;

- Placement of funds on foreign currency deposits;

- Repayment of foreign currency loans and borrowings and interest on them, etc.

Currency transactions between residents are prohibited on the territory of the Russian Federation, with the exception of several cases:

- Operations with loans and borrowings, accrual and payment of interest and penalties and fines;

- Bank deposits;

- Purchase and sale of currency for rubles by individuals;

- Operations with bills, etc.

Residents - individuals can use currency for:

- Donations and wills;

- Acquisitions for collecting purposes;

- Transfer of funds without opening a foreign currency account, etc.

For transactions between two non-residents on the territory of Russia, all transactions that do not violate the requirements of Russian antimonopoly legislation are permitted.

One of the conditions for foreign exchange control is that all foreign exchange transactions in the country are carried out through banks. To account for these transactions, account 52 “Currency accounts” is created.

Also, in transactions of purchase and sale of currency, accounts for accounting settlements by counterparties (62, 76) and cash accounts are used: 51 “Settlement accounts”, 57 “Transfers in transit”.

Purchase of foreign currency - transactions, standard correspondence

Get 267 video lessons on 1C for free:

The amount transferred to account 57 for the purchase of currency must exceed the amount at the Central Bank exchange rate. This stems from the fact that banks buy currency on the exchange - mainly at a higher rate.

When purchasing currency to pay for import operations, the amount of the bank commission is reflected by the posting:

| Dt | CT | Operation description |

| 08(07,10,15, etc.) | 51 | Commission of the bank |

That is, in these cases, the costs of paying commissions are included in the cost of the purchased goods.

Sale of foreign currency - transactions, standard correspondence

When selling currency in debit transactions from a foreign currency account, in addition to the transit account, account 76 can be used:

conclusions

Transactions on revaluation of currency balances are regulated by legal regulations. They are mandatory and are carried out as part of accounting and tax accounting. Business entities must keep financial records in ruble equivalent, as a result of which they have to recalculate the value of objects originally valued in foreign currency. Recalculation is carried out based on the date of the transaction and the end of the reporting period. Cash may be revalued on a daily basis.

https://youtu.be/61XWfJw1R1Q

Purchasing currency, example with transactions

purchases currency in the amount of $5,000 from the bank. For this purpose, 300,000 rubles were transferred to the bank. The dollar exchange rate approved by the Central Bank for this day is 58.50 rubles, the bank rate is 58.90 rubles. for a dollar. The bank commission is 1,500 rubles.

Marena's accountant makes an accounting entry when purchasing currency from a bank:

| Dt | CT | Operation description | Amount, rub. | Document |

| 57 | 51 | Transfer of funds to the bank | 300 000 | Payment order |

| 52 | 57 | Transfer of currency to a foreign currency account (5,000*58.9) | 294 500 | Bank statement |

| 91.2 | 57 | Reflection of bank commission | 1 500 | Bank statement |

| 91.2 | 57 | Negative exchange rate difference reflected ((58.9-58.5)*5,000)) | 2 000 | Accounting information |

| 51 | 57 | Reflection of the return of unspent funds (300,000 - 294,500 - 1,500) | 4 000 | Bank statement |

Selling currency, example with transactions

Development LLC instructed the bank to sell 7,000 euros from its foreign currency account. The Central Bank exchange rate for the euro on this day is 65.5 rubles. per euro. The bank rate is 65 rubles. per euro. The bank commission amounted to 2,500 rubles.

The accountant of LLC "Razvitie" creates a journal entry for the sale of currency:

| Dt | CT | Operation description | Amount, rub. | Document |

| 57 | 52 | Reflected the movement of DS from a foreign currency account (7,000 * 65.5) | 485 500 | Payment order, bank statement |

| 51 | 91.1 | Proceeds from the sale of currency were transferred (7,000*65) | 455 000 | Accounting information |

| 91.2 | 51 | Commission withheld by the bank | 2 500 | Accounting information |

| 91.2 | 57 | Reflection of negative exchange rate difference ((65.5 -65)*7,000) | 3 500 | Accounting information |

| 91.2 | 57 | The write-off of the currency value is reflected (7,000*65.5) | 485 500 | Accounting information |

The financial result of the operation can be reflected by posting:

| Dt | CT | Description of operations | Amount, rub. | Document |

| 99 | 91.9 | Loss on sale (455,000 - (485,000 + 2,500 + 3,500)) | 36 000 | Accounting information |

Add a comment Cancel reply

You must be logged in to post a comment.

This site uses Akismet to reduce spam. Find out how your comment data is processed.

Legal regulation of transactions expressed in foreign monetary units

The rules for transactions expressed in foreign monetary units are regulated by Federal Law No. 173 of December 10, 2003.

Accounting for such transactions is regulated by PBU 3/2006, approved by Order of the Ministry of Finance No. 154n dated November 27, 2006.

The movement of funds expressed in foreign monetary units is reflected in account 52 “Currency accounts” with detail by open accounts and types of monetary units (Order of the Ministry of Finance No. 94n dated October 31, 2000). When reflecting the purchase and sale of currency, transit account 57 “Transfers in transit” is used.

Below we will consider which, depending on the direction, it is necessary to generate transactions for foreign exchange transactions; the example given by us reflects all the nuances of the situation under consideration.

The procedure for non-cash payments in foreign currency between residents

Residents can open foreign currency accounts in authorized banks of the Russian Federation without any restrictions. However, currency transactions between residents of paragraph 1 of Art. 9 of Law No. 173-FZ prohibits. But there are still a number of concessions regarding non-cash payments between them. These are the operations:

- on transfers of investment money and currency of the Russian Federation between residents’ accounts in banks located on the territory of the Russian Federation and abroad (subparagraphs “g” and “h”, paragraph 9, part 1, article 1 of Law No. 173-FZ);

- mandatory payments to budgets and settlements and transfers related to their execution;

- settlements and transfers of foreign currency for the purposes of carrying out the activities of diplomatic missions, consulates and other official representative offices of the Russian Federation, as well as those related to the maintenance of their employees;

- non-cash transfers between resident individuals from bank accounts outside the Russian Federation to Russian authorized banks;

- non-cash transfers between resident individuals who are also spouses or close relatives from bank accounts in the territory of the Russian Federation to banks outside its borders;

- settlements related to obtaining a commercial or bank loan from an authorized bank.

Purchasing currency: transactions with an example

If an organization needs foreign currency funds for settlements with foreign partners, or management has decided to place part of the available funds in foreign currency units, they must be purchased through the bank servicing this account. He will sell foreign banknotes at its domestic value. In accounting, all transactions are reflected in rubles. Moreover, transactions in foreign monetary units are converted into rubles at the Bank of Russia exchange rate. In this regard, the emergence of exchange rate differences is inevitable, which must be taken into account on the date of the operation:

- negative (if the Central Bank rate is lower than the servicing bank rate). They are taken into account in other expenses;

- positive (if the rate of the Central Bank of the Russian Federation is higher). They are included in other income.

Purchase of foreign currency, posting:

According to the application for the purchase of foreign currency, rubles were debited from the current account

50 000 × 72

Funds are credited to a foreign currency account

50 000 × 71,2450

Exchange rate difference reflected

50,000 × (72 – 71.2450) or 3,600,000 – 3,562,250

Currency revaluation for tax accounting (in accounting)

When calculating income tax, amounts in foreign currency are not converted into rubles. Income and expenses of a business entity generated due to exchange rate differences are taken into account when determining the tax base. Income from revaluation can increase it due to their inclusion in non-operating income, and decrease it if the fact of expenses is recorded.

The results of the revaluation settlement operation are taken into account not only when calculating taxes by enterprises on the general taxation system. Adjustment is also required from entities that are in special regimes, the amount of taxes in which is determined by the amount of income actually received. The financial result from exchange rate fluctuations is also taken into account in the calculations.

The revaluation of foreign currency accounts also affects VAT calculations. Recalculation into rubles for advances made and acquired tangible assets, works and services is performed once, on the date of the transaction. The amount obtained as a result of the calculations will be the basis for calculating VAT to be paid or deducted, provided that the transaction carried out is subject to it under Russian law.

Purchasing foreign currency: transactions

To account for the purchase of foreign currency, as a rule, intermediate account 57 “Transfers in transit” is used. The debit of this account includes ruble funds for the purchase of foreign currency, and the purchased foreign currency is written off from the credit. Since currency is purchased at the rate of a commercial bank, and is accounted for in accounting at the rate of the Central Bank of the Russian Federation, the resulting difference is attributed to other income (expenses) of the organization (clause 4.5 of PBU 3/2006, clause 7 of PBU 9/99, clause 11 PBU 10/99).

Let's give an example of transactions for purchasing currency.

02/02/2017 The organization purchased foreign currency from its servicing bank in the amount of USD 100,000. The selling rate of a commercial bank on the date of purchase of currency by the organization is 60.89 rubles/US dollar, the rate of the Central Bank of the Russian Federation on the same date is 60.3099 rubles/US dollar.

| Content | Sum | Debit | Credit |

| 3 600 000 | 57 | 51 | |

| 3 562 250 | 52 | 57 | |

| 37 750 | 91 | 57 | |

| Content | Sum | Debit | Credit |

| 577 701 | 57 | 52 | |

| 560 000 | 51 | 52 | |

| 17 701 | 91 | 57 |

| Operation | Account debit | Account credit | Sum |

| Ruble funds were allocated for the purchase of foreign currency (USD 100,000 * RUB 60.89/USD) | 57 | 51 “Current accounts” | 6,089,000-00 rub. |

| Foreign currency was capitalized (USD 100,000 * RUB 60.3099/USD | 52 “Currency accounts” | 57 | RUB 6,030,990-00 US$100,000-00 |

| The difference that arose due to the deviation of the purchase rate of a commercial bank’s currency from the rate of the Central Bank of the Russian Federation was written off (USD 100,000 * (60.89 – 60.3099) RUR/USD) | 91 “Other income and expenses”, subaccount “Other expenses” | 57 | RUB 58,010-00 |

If the rate of a commercial bank is lower than the rate of the Central Bank of the Russian Federation, other income will arise:

Debit of account 57 – Credit of account 91, subaccount “Other income”

Selling currency to a bank: transactions

The sale of foreign currency is also reflected using account 57, while the amount of benefit (loss) from the sale of currency will be reflected in income (expenses) as the difference between the amount of funds in rubles received from the sale of foreign currency and the ruble valuation of this currency as of the date operations (Appendix to the letter of the Ministry of Finance of Russia dated December 28, 2016 No. 07-04-09/78875).

Let's continue the example and assume that on 02/03/2017 the organization sold the balance of currency in the amount of $25,000. The purchase rate of currency by a commercial bank on the date of sale of currency by an organization is 58.91 rubles/US dollar, the rate of the Central Bank of the Russian Federation on the same date is 59.9858 rubles/US dollar.

| Operation | Account debit | Account credit | Sum |

| A negative exchange rate difference is reflected on the foreign exchange account on the date of sale of the currency (USD 25,000 * (59.9858 - 60.3099) RUB/USD) | 91, subaccount “Other expenses” | 52 | 8 102-50 rub. |

| Cash allocated for sale was written off from a foreign currency account (USD 25,000 * RUB 59.9858/USD) | 57 | 52 | RUB 1,499,645-00 $25,000 |

| Funds from the sale of foreign currency were credited to the current account (USD 25,000 * RUB 58.91/USD) | 51 | 57 | RUB 1,472,750-00 |

| The difference that arose due to the deviation of the exchange rate for selling currency to a commercial bank from the rate of the Central Bank of the Russian Federation was written off (USD 25,000 * (58.91 – 59.9858) rub./USD) | 91, subaccount “Other expenses” | 57 | RUB 26,895-00 |

If, during a sale or purchase, the bank withholds an additional commission for performing exchange transactions, it is debited to account 91, subaccount “Other expenses”.

We learn to prepare accounting entries for exchange rate differences

If you are engaged in active foreign economic activity with foreign partners, then in addition to issues of customs clearance, payment of VAT and other “delights,” you will definitely encounter settlements in foreign currency.

Meanwhile, accounting records are kept in rubles. To comply with this rule, special accounting entries have been introduced for exchange rate differences, which help to correlate amounts estimated in rubles and foreign currency. The recalculation rules are quite simple, but they are often confused.

Therefore, in this article, using practical examples, we will study the occurrence and reflection of exchange rate differences in accounting. The main motto of the article is a minimum of theory, a maximum of examples.

Content

1. Accounting for currency transactions

2. How exchange rate differences are formed

3. Accounting entries for exchange rate differences

4. Exchange rate difference when purchasing currency

5. Exchange rate difference at the end of the month

6. Exchange rate difference when selling currency

7. Exchange rate difference in 1s 8.3 (using the example of currency sales)

8. Exchange difference on prepayment

9. Exchange differences on imports

10. How to take into account exchange rate differences

So, let's go in order. If you don't have time to read a long article, watch the short video below, from which you will learn all the most important things about the topic of the article.

(if the video is not clear, there is a gear at the bottom of the video, click it and select 720p Quality)

We will discuss the topic further in the article in more detail than in the video.

Accounting for currency transactions

In accounting, all business transactions, regardless of the currency in which they were actually carried out, in rubles or foreign, are reflected exclusively in rubles.

Accounting for currency transactions is carried out in the manner prescribed by PBU 3/2006, approved by Order of the Ministry of Finance dated November 27, 2006 No. 154n, and in accordance with the principles established by federal legislation.

To convert currency amounts into rubles, the official Central Bank exchange rate for a specific date . And this date will vary depending on the situation (PBU 3/2006):

- As of the date of the business transaction: the cost of fixed assets accepted for accounting, intangible and other non-current assets, the cost of inventories, and cash flows are reflected.

- As of the reporting date: cash and non-cash currency in accounts and in cash, accounts payable are assessed.

- On the payment date: to recognize foreign exchange income, receive an advance payment, pay an advance payment.

- Date of approval of the advance report: for travel expenses.

How are exchange rate differences formed?

How are exchange rate differences formed? The fact is that the exchange rate changes on different dates. For example, a company purchased imported materials, capitalized them at the rate in effect on the date of acceptance for accounting, and paid the supplier on a different date, with a different exchange rate.

The difference in rubles that arises when recalculating the currency value of assets and liabilities on different dates is called exchange rate.

Please note that until 2020, the Tax Code had the concept of “total difference”. They arise if the debt itself is expressed in foreign currency or cu, and payment is made in rubles. But since 2015, this concept has been excluded and such differences are also considered exchange rate differences.

Accounting entries for exchange rate differences

Now that you know the basic rules for valuing assets and liabilities in currency, let's move on to the accounting rules, and then look at several examples in detail.

The accounting entries for exchange rate differences depend on where the differences arise. Accounts 50, 52, 55, 57, 60, 62, 66, 67, 76 may be involved. But in any case, account 91 will be involved in the postings:

- — 91-2 “Other expenses”, if there is a negative exchange rate difference ;

- — 91-1 “Other expenses”, if there is a positive exchange rate difference .

Debit 52, 55, 50, 57, 60, 62, 66, 67, 76 – Credit 91-1 – positive exchange rate difference;

Debit 91-2 – Credit 52, 55, 50, 57, 60, 62, 66, 67, 76 – negative exchange rate difference.

The difference at the end of the reporting period relates to the financial result of the company, with the exception of the difference that is calculated on constituent contributions.

In the latter case, the difference in rubles arises during the time interval between the founders’ decision to make a contribution in foreign currency and the very moment the founder pays the contribution. Such exchange rate differences do not affect the company’s financial results, but change the amount of additional capital.

Exchange rate difference when purchasing currency

Let's start our study of exchange rate differences with transactions of buying and selling currencies, and then move on to more complex examples. Is there any exchange rate difference when purchasing foreign currency? Let's check.

On September 13, Belochka LLC sent an order to the bank to purchase Brazil nuts from a foreign supplier for the purchase of $10,000. On the same day, the bank wrote off 670,000 rubles from the organization’s ruble current account. to purchase currency.

The currency was purchased on September 14 at the rate of 66.52 rubles/dollar. (conditionally). The excess amount written off was returned to the ruble account on the same day.

The commission for purchasing currency was 0.3% of the amount of the order to purchase currency. The bank wrote off this amount from the organization's ruble account on the day of purchase of foreign currency.

The exchange rate of the Central Bank of the Russian Federation as of September 14 was 64.81 rubles/dollar. (conditionally).

We will prepare accounting entries

September 13:

Debit 57 subaccount “Purchase of currency for rubles” - Credit 51 - in the amount of 670,000 rubles. – funds are reserved for the purchase of currency

Instead of account 57, account 76 sub-account “Settlements with the bank for transactions for the purchase of foreign currency” can be used.

September 14:

Debit 52 – Credit 57 (76) – in the amount of 648,100 rubles. ($10,000* 64.81 RUB/USD) – the purchased currency is credited to the account (we evaluate it at the Central Bank exchange rate)

Debit 51 – Credit 57 (76) – in the amount of 4800 rubles. (RUB 670,000 – USD 10,000 * 66.52 RUB/USD) – the unspent balance of rubles written off for the purchase of foreign currency was returned

Debit 91-2 – Credit 57 (76) – in the amount of 17,100 rubles. ($10,000 * (66.52 – 64.81)) – reflects the expense of purchasing foreign currency at a rate higher than the Central Bank rate

Debit 91-2 – Credit 51 – in the amount of 1995.60 rubles. ($10,000 * 0.3% * 66.52 rubles/dollars) – the bank commission for the purchase of currency is written off.

As you can see from the example, we have some difference - 17,100 rubles. But it is not a course work, because is not related to changes in exchange rates on different dates. There are no exchange rate differences when purchasing foreign currency! The exchange rate in our example is for the same date, it’s just that the rates are different - the official Central Bank rate and the bank rate. As a result, the resulting difference is the financial result as a result of the deviation of the bank’s exchange rate from the Central Bank exchange rate.

The negative difference in the form of deviation of the purchase rate from the Central Bank exchange rate and the bank commission for the purchase of currency are other expenses in accounting and non-operating expenses in tax accounting. On the simplified tax system with the “income-expenses” object, they can also be taken into account.

Exchange rate difference at the end of the month

Let’s assume that Belochka LLC changed its mind about paying the supplier for now and decided to postpone the purchase of nuts. The currency remains with the organization and lies safely in account 52. September has ended, and this means that the exchange rate difference at the end of the month must be calculated. And here we already have two dates with different rates - on the date of purchase of the currency and the last day of the month.

Let’s assume that the exchange rate increased during this time and amounted to 66.12 rubles/dollar. as of September 30 at the Central Bank exchange rate. Since the Central Bank exchange rate has increased, the ruble equivalent of foreign currency has also increased. The organization recognizes other income in accounting and non-operating income in taxation.

The exchange rate difference at the end of the month on September 30 will be reflected by the posting:

Debit 52 – Credit 91-1 – in the amount of 13,100 rubles. ($10,000 * (66.12 – 64.81 rub/dollar)) – positive exchange rate difference from currency revaluation.

Positive exchange rate differences are other income in accounting and non-operating in tax accounting.

If cash currency was kept in the cash register, then the revaluation procedure would be the same, only instead of account 52 there would be 50. If the exchange rate had decreased, the posting would be reversed.

Exchange rate difference when selling currency

Let us continue that Belochka LLC decided to purchase less nuts than originally planned and sell part of the currency - $5,000. The amount in foreign currency must be converted into rubles on the date of sale at the Central Bank exchange rate.

On October 18, Belochka LLC instructs the bank to sell currency in the amount of $5,000, the currency was purchased by the bank at a price of 63.62 rubles/dollar. On the same day, the bank transferred the proceeds from the sale of currency to the organization’s current account. To simplify the example, let's assume that the bank does not charge a fee.

The official exchange rate of the Central Bank on October 18 was 65.44 rubles. (conditionally). Let me remind you that on September 30, the Central Bank exchange rate was 66.12 rubles/dollar.

Debit 57 (76) – Credit 52 – in the amount of 327,200 rubles. ($5,000 * 65.44 rubles/dollars) – the currency being sold is debited from the foreign currency account

Debit 91-2 – Credit 52 – in the amount of 3,400 rubles. ($5,000 * (66.12 – 65.44 rub/dollar)) – negative exchange rate difference

Let's check the accuracy of the calculations. As of September 30, we valued $5,000 at 5,000 * 66.12 rubles/dollar. = 330,600 rubles, this is exactly the figure that gives a total of 327,200 + 3,400 rubles, which means everything is correct.

If the exchange rate had increased compared to September 30, there would have been a positive exchange rate difference.

What about the difference in the Central Bank rate and the bank rate? This is also a difference, only not in the exchange rate (since the date is the same), but in the financial result from the sale of currency.

Debit 51 – Credit 57 (76) – in the amount of 318,100 rubles. (5000 dollars * 63.62 rubles/dollar) - the rubles received for the sold currency are credited to the current account.

Debit 91-2 – Credit 57 (76) – in the amount of 9100 rubles. ($5000 * (65.44 – 63.62 rubles/dollars) – reflects the financial result from the sale of currency.

Exchange rate difference in 1s 8.3 (using the example of currency sales)

For those who keep records in the 1C: Accounting program - see what accounting entries for exchange rate differences are formed in 1C: Accounting 8th ed. 3.0 when selling currency.

Exchange rate difference on prepayment

Pay attention to the situation when an organization transfers an advance to the supplier, against which goods are subsequently shipped, work is performed, and services are provided. Or vice versa, the organization receives an advance from the buyer against upcoming deliveries.

The amounts of advances received and issued are taken into account at the exchange rate on the date of receipt or transfer of funds, respectively, and are not subsequently revalued (clause 7, clause 9 of PBU 3/2006). In the case of purchasing, for example, materials on account of a previously issued advance, the materials are charged at the rate on the date of transfer of the advance.

In this case, there is no exchange rate difference on prepayment! Let's look at an example of how this happens.

On October 20, Belochka LLC transferred a 100% advance to a foreign supplier for the upcoming delivery of a batch of nuts in the amount of $5,000. The Central Bank exchange rate as of October 20 was 65.82 rubles/dollar.

Debit 60 – Credit 52 – in the amount of 329,100 rubles. ($5,000* 65.82 RUR/USD) – advance payment to the supplier

Debit 91-2 – Credit 52 – in the amount of 1500 rubles. ($5,000 * (66.12 – 65.82 rubles/dollar)) – negative exchange rate difference (reflects the change in the exchange rate since the date of the last currency revaluation on September 30, when the rate was 66.12 rubles/dollar)

On October 28, the ownership of the purchased goods was transferred to the buyer:

Debit 41 – Credit 60 – in the amount of 329,100 rubles. – goods have been capitalized.

As can be seen from the example, incoming goods are reflected in the amount that was transferred in the form of an advance; no recalculation is made; exchange rate differences do not arise when making an advance payment.

Exchange differences on imports

But if the shipment of goods or the provision of services is carried out before payment, or there was an advance, but only partial, which does not fully cover the delivery or cost of the service, then in such a situation exchange rate differences already appear.

Let's change the conditions of the previous example and assume that on October 20, Belochka LLC transferred an advance payment for the supply of nuts in the amount of $2,000. The rest, $3,000, was transferred by the organization on November 16.

The posting for the advance payment will be as follows:

Debit 60 – Credit 52 – in the amount of 131,640 rubles. ($2000* 65.82 rub/dollar) – advance payment to the supplier

Debit 91-2 – Credit 52 – in the amount of 600 rubles. ($2000 * (66.12 – 65.82 rub./dollar)) – negative exchange rate difference

On October 28, ownership of the purchased goods was transferred to the buyer. The cost of goods will consist of two components:

- — the part paid in advance will not be revalued;

- — the unpaid portion will be valued at the Central Bank exchange rate on the date of transfer of ownership.

We assume that the Central Bank exchange rate on October 28 was 66.40 rubles/dollar.

Debit 41 – Credit 60 – in the amount of 330,840 rubles. (RUB 131,640 + USD 3,000 * RUB 66.40/USD) – goods have been capitalized.

After acceptance for accounting, the cost of purchased goods (work, services) is not recalculated. And your accounts payable to the seller, reflected on account 60, must be recalculated at the exchange rate. e. or currency established:

- on the last day of each month until the month when you pay off your debt to the seller;

- on the date of repayment of the debt to the seller.

These dates are called restatement dates.

Payment of the remaining balance to the supplier

The remaining payment in our example will be transferred in November. The end of October is coming, and that means we need to re-evaluate:

- — foreign currency account balance – $3,000 (the last time this amount was assessed was as of September 30)

- — accounts payable to the supplier – $3,000 (the last time this amount was estimated was on October 28)

Let the Central Bank exchange rate on October 31 be 66.32 rubles/dollar. We will have 2 accounting entries for exchange rate differences:

Debit 52 – Credit 91-1 – in the amount of 600 rubles. (3000 dollars * (66.32 - 66.12 rubles / dollar) - positive exchange rate difference as a result of an increase in the exchange rate, and, consequently, the balance of the foreign exchange account in rubles

Debit 60 – Credit 91-1 – in the amount of 240 rubles. ($3,000 * (66.40 – 66.32 rubles/$) – positive exchange rate difference as a result of a depreciation of the currency and a reduction in debt to the supplier in ruble terms.

On November 16, Belochka LLC transfers the balance to the supplier. The Central Bank exchange rate on this date is 66.80 rubles/dollars.

Debit 60 – Credit 52 – in the amount of 200,400 rubles. ($3000 * 66.80 rubles/dollars) – the debt to the supplier is repaid

Debit 91-2 – Credit 60 – in the amount of 1440 rubles. ($3000 * (66.80 – 66.32 rubles/dollar) – negative exchange rate difference.

By the way, we studied the issues of customs clearance of goods and import accounting in this article.

How to take into account exchange rate differences

So let's recap. Exchange differences in accounting are reflected as follows:

- - other income - positive exchange rate differences

- - other expenses - negative exchange rate differences

In tax accounting, exchange rate differences must be taken into account in the following order (clause 11 of Article 250, clause 5 of clause 1 of Article 265 of the Tax Code):

- - positive exchange rate differences - non-operating income;

- - negative exchange rate differences - non-operating expenses.

What problematic issues did you encounter when calculating exchange rate differences? Ask them in the comments and together we will find the answer!

We learn to prepare accounting entries for exchange rate differences

Accounting for the purchase of foreign currency - postings, exchange rate differences, example

Organizations often practice the acquisition of foreign currency. Typically, the purchase of foreign monetary units can be carried out both by business entities related to foreign economic activity, and by organizations not directly related to the export or import of any goods.

Accordingly, the company’s purposes for acquiring foreign currency may vary. Foreign currency can be purchased both for subsequent payment of import supplies, and for other purposes other than financing imports.

The article describes typical situations. To solve your problem , write to our consultant or call for free:

+7 (499) 490-27-62 — Moscow — CALL

+7 — St. Petersburg — CALL

+8 ext.849 — Other regions — CALL

It's fast and free!

Accounting for the purchase and subsequent use of foreign currency is of great importance in the work of an economic entity.

A separate aspect is the correct recording of exchange rate differences in accounting.

How the purchase of foreign currency is carried out, how this operation is formalized and accounted for - all these points require detailed consideration.

Procedure for acquiring foreign money

In the Russian Federation, foreign currency is purchased by organizations according to the following rules:

- Purchase transactions are carefully regulated by official authorities (the Government of the Russian Federation, the Central Bank of the Russian Federation).

- There are no restrictions on the monetary amounts of foreign exchange transactions carried out between entities.

- Transactions in foreign currency are not carried out between Russian residents (certain exceptions to this rule are provided for by separate norms of current legislation - 173-FZ, Article 9, paragraph 1, subparagraphs 1-24).

- The purchase of foreign currency money can be carried out exclusively through authorized financial institutions (banks).

- Opening foreign currency accounts in relevant banks is a mandatory condition for residents wishing to both buy and sell currency. There are no restrictions on opening such accounts for most residents.

- Information on opening and closing a bank account in a foreign currency, as well as changes in its details, must be submitted by residents to the tax service within a month.

- Bank foreign currency accounts are opened without restrictions by non-residents in Russian financial institutions.

- In relation to the organization's foreign currency assets, the necessary revaluation is carried out on the date of preparation of the financial statements, on the date of the currency transaction, as well as in cases where the exchange rate of the relevant currency changes.

The difference in exchange rates identified during revaluation is adequately recorded in accounting (relates to other income/costs).

The general algorithm for purchasing foreign currency looks like this:

- To purchase the required amount of foreign currency, the corresponding amount of money (in rubles) is transferred to the bank from the organization’s current bank account.

- The transferred funds are temporarily recorded in accounting records in a special transit account.

- When the financial institution does execute the client’s order (after some time), the purchased currency is credited to the legal entity’s foreign currency account while simultaneously closing the transit account.

- Using the money transferred from the client’s current bank account, the financial institution purchases the required amount of foreign currency for the business entity, crediting it to the organization’s account in foreign currency. In accounting, currency funds are always recorded in rubles; the corresponding conversion is carried out at the current exchange rate of the Central Bank of the Russian Federation.

- Accounting for the receipt of purchased currency with conversion into domestic rubles at the current exchange rate of the Central Bank of the Russian Federation and proper reflection of positive and negative exchange rate differences.

- The funds that remained in the transit (temporary) account after purchasing the required amount of foreign currency are returned back, that is, they are again credited to his bank account.

- When purchasing a specific amount of foreign currency based on a client’s application, the servicing bank, as a rule, charges (withholds) the appropriate commission from the applicant. Such a commission is often paid by transfer from the current bank account of the business entity.

All of the above actions are properly recorded in the organization’s accounting records. If previously there was a mandatory sale of a certain part of the available purchased currency, now such a requirement is no longer in effect.

Types of currency accounts

There is no separate group for foreign currencies, and banks can open any accounts in rubles, dollars, and euros. The main types of foreign currency accounts are current (for individuals), settlement, budget, correspondent, deposit - for individual organizations, special. There are also trust management accounts, separate ones for courts, notaries, bailiffs, and law enforcement agencies.

Accounts for deposits are opened for storing and accounting for funds placed in the bank for the purpose of accumulating and generating income.

https://youtu.be/WVPualWSICM

Accounting

Transactions on the purchase of foreign currency are recorded in accounting according to the following main accounts:

- Account 52. Name – Currency accounts. This account reflects the current amount of foreign currency, calculated in domestic rubles at the current exchange rate of the Central Bank of the Russian Federation. Generalized information about the availability/movement of currency funds is reflected here. On debit – receipt of funds. On the loan - write-off of funds. Erroneous amounts are recorded on account 76. Accounting for all foreign exchange transactions is carried out using appropriate settlement documents and regular bank statements. There are subaccount 52-1 (accounts in foreign currency within the country) and subaccount 52-2 (accounts in foreign currency abroad).

- Account 57. Name – Transfers on the way. This account is transit (temporary), it reflects the intermediate movement of money between the bank accounts of the enterprise. It is active (by debit - depositing funds for subsequent crediting as intended, by credit - writing off with crediting as intended).

How are exchange rate differences reflected?

For accounting purposes, the purchased currency is reflected in rubles at the current exchange rate of the Central Bank of the Russian Federation.

However, the servicing bank often purchases it at a different rate. Accordingly, there is a need to properly take into account the difference that arises between the purchase rate and the Central Bank rate.

If the purchase rate turns out to be higher than the Central Bank rate, the negative difference is recorded as other expenses. If the acquisition rate is less than the Central Bank rate, the positive difference is reflected as other income. Other income and expenses are reflected in account 91.

Postings

When an organization purchases foreign currency, the following entries are reflected in its accounting records:

| Operation (action) | Debit | Credit |

| The amount of money required to purchase a specific amount of currency is debited from the organization’s current bank account (in rubles) | 57(76) | 51 |

| The servicing financial institution fulfills the client’s request - purchases foreign currency in the required quantity and credits it to the business entity’s account for foreign currency funds | 52 | 57(76) |

| The positive difference identified between the real acquisition rate and the current Central Bank rate is recorded | 57(76) | 91.1 |

| The negative difference identified between the real acquisition rate and the current Central Bank rate is recorded. | 91.2 | 57(76) |

| Unused ruble funds are returned to the organization's account in the bank | 51 | 57 |

| Bank commission is charged for purchasing currency | 91.2 | 76 |

| Bank commission is transferred to the servicing financial institution | 76 | 51 |

Example

The organization needs to purchase 1000 USD for subsequent payment to the foreign supplier.

On October 17, 2020, the company transferred 65,000 (sixty-five thousand) rubles to the servicing bank from its personal account to purchase 1,000 USD at an exchange rate not exceeding 65 rubles per 1 USD.

Already on October 18, 2020, the bank purchased the required amount of American dollars at the real price of 63 rubles per 1 USD, actually spending 63,000 rubles on this (1000 USD at 63 rubles).

The current exchange rate of the Central Bank is 64 rubles.

The bank commission for such a transaction is 500 rubles. The corresponding accounting entries are shown in the table.

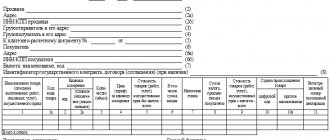

| Operation (action) | Date of operation | Transaction amount | Debit | Credit |

| The amount of money required to purchase 1000 USD is debited from the company's current bank account (in rubles) | 17.10 | 1000 USD * 65= 65,000 | 57 | 51 |

| The servicing bank fulfills the client’s request - purchases 1000 USD and transfers this amount to the organization’s account for foreign currency funds (fixed at the current Central Bank exchange rate) | 18.10 | 1000 USD * 64 = 64,000 | 52 | 57 |

| The positive difference identified between the current Central Bank exchange rate and the real purchase price is recorded | 18.10 | 1000 USD * (64-63) = 1000 | 57 | 91.1 |

| Unused ruble funds are returned to the organization’s bank account | 18.10 | 65 000 – 63 000 = 2000 | 51 | 57 |

| Bank commission is charged for the transaction of purchasing dollars | 18.10 | 500 | 91.2 | 76 |

| Bank commission is transferred to the servicing bank | 18.10 | 500 | 76 | 51 |