Tax period code

In 3-NDFL, the tax period (code) is the period of time for which you are reporting. Each time period is indicated by a digital value, depending on the period for which the declaration is submitted and indicated on the title page.

| 21 | First quarter |

| 31 | Half year |

| 33 | Nine month |

| 34 | Year |

https://youtu.be/mN6xxajC2D8

Taxpayer category code in the 3-NDFL declaration

On the title page of the form you will also find the payer category code for 3-NDFL. The categories are listed in Appendix No. 1 to the procedure for filling out reports. For ordinary citizens, the appropriate 3-NDFL taxpayer category code is “760,” and the 3-NDFL taxpayer category code “720” is allocated for individual entrepreneurs.

| 720 | An individual registered as an individual entrepreneur |

| 730 | Notary engaged in private practice and other persons engaged in private practice |

| 740 | Lawyer who established a law office |

| 750 | Arbitration manager |

| 760 | Another individual declaring income in accordance with Articles 227.1 and 228 of the Tax Code, as well as for the purpose of obtaining tax deductions in accordance with Articles 218-221 or for another purpose |

| 770 | Individual entrepreneur - head of a peasant (farm) enterprise |

Other features of filling out the title page

The document has the right to be drawn up not only by the applicant for a tax deduction, but also by his representative. To display this fact in the part of the title page signed as “accuracy and completeness of information,” you need to indicate the number 1 or 2, thereby indicating the status of the individual confirming the correctness of the above information. If it is the taxpayer himself, it is necessary to write one, and if his representative - two.

In addition, we recommend that persons who enter information on the first sheet of the tax return pay attention to the following aspects:

- The top of the sheet. At the top of the title page there are twelve empty cells in which an individual must enter the digits of the identification code, and below them three more, intended for affixing the sheet number. In this case it is the first page. To number it correctly, you need to enter zeros in the first two cells, and the number one in the third.

- Number of pages of this 3-NDFL form. When checking a declaration, it is convenient for the tax inspector to immediately see how many pages the received form consists of. Therefore, after the field in which an individual must indicate his contact phone number, there is a line intended to indicate the number of sheets. If the tax return includes seven pages, then such information is displayed as follows: “007”.

- Empty fields. Sometimes some cells, for example, district, locality or taxpayer address outside the Russian Federation, do not need to be filled out. In order to make it clear to the tax inspector that these fields were left empty and not forgotten, a dash must be placed in each cell.

- Date of. There is a rule regarding entering the date in the declaration, as well as in some other documents, which implies compliance with a certain sequence - first you must write the date, then the month and then the year (everything is indicated using numbers). If the serial number of the day or month is less than ten, then zero is written first, and then the number itself.

- Address. In addition to writing by an individual the name of the city, street and other coordinates of the address, he must indicate whether we are talking about the address of his stay (code 2) or residence (code 3).

This is important to know: Purchase and sale agreement: taxation

It should be noted that if, along with the declaration form, an individual sends some other documents to the tax service, then he needs to count the total number of pages of these papers and note the result obtained on the title page (next to the number of pages of the 3-NDFL form).

Document type code in the 3-NDFL declaration

On the title page of the declaration, in the section about the identity document, indicate its code value. The full list is contained in Appendix No. 2 to the procedure for filling out 3-NDFL and in the following table.

| 21 | Russian citizen passport |

| 03 | Birth certificate |

| 07 | Military ID |

| 08 | Temporary certificate issued in lieu of a military ID |

| 10 | Foreign citizen's passport |

| 11 | Certificate of consideration of an application for recognition of a person as a refugee on the territory of Russia on the merits |

| 12 | Residence permit in the Russian Federation |

| 13 | Refugee ID |

| 14 | Temporary identity card of a Russian citizen |

| 15 | Temporary residence permit in the Russian Federation |

| 18 | Certificate of temporary asylum on the territory of the Russian Federation |

| 23 | Birth certificate issued in another state |

| 24 | Identity card of a Russian military personnel, military ID of a reserve officer |

| 91 | Other documents |

Filling out 3 personal income taxes for 2020 when purchasing an apartment

A citizen can reimburse expenses for purchasing an apartment as part of a property deduction.

Sample of filling out 3 personal income tax for 2020 when purchasing an apartment (without a mortgage)

In addition to the main deduction for the costs of purchasing real estate and its decoration, you can get a deduction for paid bank interest if the housing was purchased on credit.

https://www.youtube.com/watch{q}v=upload

Sample of filling out 3 personal income tax for 2020 when purchasing an apartment (with a mortgage)

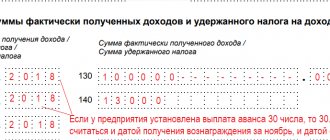

Please note that the declaration must indicate the amount of interest actually paid in the reporting period.

The amount of deduction for the purchase of real estate in 2020 is:

- 2,000,000 rub. – for purchase costs (even if the apartment was purchased on credit, the entire amount of costs is deductible);

- 3,000,000 rub. – on the cost of repaying credit interest. However, if the mortgage for the apartment was issued before 2014, the limit is 3 million rubles. does not apply to interest expenses.

Deduction amount x 13%

Let's say Litvinova A.S. in 2020, I bought a one-room apartment with a mortgage for RUB 1,984,000. For the year she paid 125,600 rubles on the loan. in the form of interest. For expenses for 2020, Litvinova can receive a deduction in the total amount of RUB 2,109,600:

- RUB 1,984,000 – deduction for basic expenses for the purchase of housing;

- RUB 125,600 – deduction for paid credit interest.

In total, the maximum amount of costs that Litvinova can reimburse will be 274,248 rubles: 257,920 rubles. (1,984,000 x 13%) – main deduction and 16,328 rubles. (125,600 x 13%) - by percentage.

- The property deduction, unlike the social deduction, does not expire after 3 years, but it can only be claimed in the reporting period for the previous 3 years. Thus, in 2020 you can receive a refund for the years 2016-2014;

- Pensioners, both working and not, can carry forward the balance of the deduction back 3 years;

- A deduction for land that was acquired under individual housing construction can be obtained only after the construction of a residential building on it and registration of ownership of it;

- The main deduction can also include finishing costs, but the need for them must be documented;

- Spouses are currently entitled to receive a benefit in the amount of 2 million rubles. for each, and it does not matter which of them the property is registered in and who directly paid for its purchase.

- This type of deduction can be obtained only once in a lifetime; it cannot be provided again (the only exception is if a citizen received a deduction before 2001, when the right to deduction was regulated not by the Tax Code of the Russian Federation, but by the Law on Personal Income Tax);

- The interest deduction can be obtained separately from the main one, but the balance cannot be transferred to the next housing purchased on credit (for example, if the limit of 3 million rubles on mortgage interest was not selected for one apartment, the balance cannot be transferred to the next mortgaged housing will not be possible);

- The declaration can be submitted at any time, without any time limit;

Region code of the Russian Federation

In the “Address and telephone” section on the title page, you must indicate the code designation of the Russian region. Find the region (code) for 3-NDFL in Appendix No. 3 to the filling procedure, or in the following table:

| 01 | Republic of Adygea |

| 02 | Republic of Bashkortostan |

| 03 | The Republic of Buryatia |

| 04 | Altai Republic |

| 05 | The Republic of Dagestan |

| 06 | The Republic of Ingushetia |

| 07 | Kabardino-Balkarian Republic |

| 08 | Republic of Kalmykia |

| 09 | Karachay-Cherkess Republic |

| 10 | Republic of Karelia |

| 11 | Komi Republic |

| 12 | Mari El Republic |

| 13 | The Republic of Mordovia |

| 14 | The Republic of Sakha (Yakutia) |

| 15 | Republic of North Ossetia-Alania |

| 16 | Republic of Tatarstan (Tatarstan) |

| 17 | Tyva Republic |

| 18 | Udmurt republic |

| 19 | The Republic of Khakassia |

| 20 | Chechen Republic |

| 21 | Chuvash Republic - Chuvashia |

| 22 | Altai region |

| 23 | Krasnodar region |

| 24 | Krasnoyarsk region |

| 25 | Primorsky Krai |

| 26 | Stavropol region |

| 27 | Khabarovsk region |

| 28 | Amur region |

| 29 | Arhangelsk region |

| 30 | Astrakhan region |

| 31 | Belgorod region |

| 32 | Bryansk region |

| 33 | Vladimir region |

| 34 | Volgograd region |

| 35 | Vologda Region |

| 36 | Voronezh region |

| 37 | Ivanovo region |

| 38 | Irkutsk region |

| 39 | Kaliningrad region |

| 40 | Kaluga region |

| 41 | Kamchatka Krai |

| 42 | Kemerovo region |

| 43 | Kirov region |

| 44 | Kostroma region |

| 45 | Kurgan region |

| 46 | Kursk region |

| 47 | Leningrad region |

| 48 | Lipetsk region |

| 49 | Magadan Region |

| 50 | Moscow region |

| 51 | Murmansk region |

| 52 | Nizhny Novgorod Region |

| 53 | Novgorod region |

| 54 | Novosibirsk region |

| 55 | Omsk region |

| 56 | Orenburg region |

| 57 | Oryol Region |

| 58 | Penza region |

| 59 | Perm region |

| 60 | Pskov region |

| 61 | Rostov region |

| 62 | Ryazan Oblast |

| 63 | Samara Region |

| 64 | Saratov region |

| 65 | Sakhalin region |

| 66 | Sverdlovsk region |

| 67 | Smolensk region |

| 68 | Tambov Region |

| 69 | Tver region |

| 70 | Tomsk region |

| 71 | Tula region |

| 72 | Tyumen region |

| 73 | Ulyanovsk region |

| 74 | Chelyabinsk region |

| 75 | Transbaikal region |

| 76 | Yaroslavl region |

| 77 | Moscow |

| 78 | Saint Petersburg |

| 79 | Jewish Autonomous Region |

| 83 | Nenets Autonomous Okrug |

| 86 | Khanty-Mansiysk Autonomous Okrug - Ugra |

| 87 | Chukotka Autonomous Okrug |

| 89 | Yamalo-Nenets Autonomous Okrug |

| 91 | Republic of Crimea |

| 92 | Sevastopol |

| 99 | Other areas, including the city and Baikonur Cosmodrome |

Income type code in 3-NDFL

The type of income code (020) in the 3-NDFL declaration is filled out on Sheet A “Income from sources in the Russian Federation”. The list of designations is given in Appendix No. 4 to the procedure for completing the declaration.

For example, when selling a car, the income code in 3-NDFL is “02”. For other cases, see the table:

| 01 | Income from the sale of real estate and shares in it, determined based on the price of the object specified in the agreement on the alienation of property |

| 02 | Income from the sale of other property (including a car) |

| 03 | Income from transactions with securities |

| 04 | Income from renting out an apartment (other property) |

| 05 | Cash and in-kind income received as a gift |

| 06 | Income received on the basis of an employment (civil) contract, the tax from which is withheld by the tax agent |

| 07 | Income received on the basis of an employment (civil) contract, the tax from which is not withheld by the tax agent (even partially) |

| 08 | Income from equity participation in the activities of organizations in the form of dividends |

| 09 | Income from the sale of real estate and shares in property, determined based on the cadastral value of this property, multiplied by a reduction factor of 0.7 |

| 10 | Other income |

Results

Appendix 7 in 3-NDFL is formed in cases where the personal income tax payer has the right to a tax deduction as a result of transactions to improve housing conditions. The rules for filling out the sheet are established by the Federal Tax Service order No. MMV-7-11/ [email protected] 3, 2018, as amended by the Federal Tax Service order No. MMV-7-11/ [email protected] There are nuances to filling out Appendix 7 in cases , when a tax deduction declaration is submitted for the first time or is submitted again, for the balance of the confirmed deduction for previous periods (years).

Learn more about the nuances of forming 3-NDFL from the article “Sample of filling out a 3-NDFL tax return.”

Read more about the specifics of registering a deduction when purchasing real estate in the article “Procedure for compensation (return) of personal income tax when purchasing an apartment.”

Sources:

- Tax Code of the Russian Federation

- Order of the Federal Tax Service of Russia dated October 7, 2019 N ММВ-7-11/ [email protected]

- Order of the Federal Tax Service of Russia dated October 3, 2018 N ММВ-7-11/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Object name code in 3-NDFL

The object name code (010) in 3-NDFL is filled out in Sheet D1 “Calculation of property tax deductions for expenses on new construction or acquisition of real estate.” Indicate the numerical designation of the purchased property.

| 1 | House |

| 2 | Apartment |

| 3 | Room |

| 4 | Share in a residential building, apartment, room, land plot |

| 5 | Land plot for individual housing construction |

| 6 | Plot of land with purchased residential building |

| 7 | Residential building with land |

Filling out 3 personal income taxes for 2020 for social deductions

As part of the social deduction, you can reimburse expenses for:

- Education (your own, children, brothers and sisters);

Sample of filling out 3 personal income tax for 2020 for training

- Treatment and purchase of medicines (your own, your other spouse’s, children and parents)

Sample of filling out 3 NFDL for 2020 for treatment

- Charity;

- Pension insurance and security, as well as life insurance;

- The funded part of the pension.

The benefit amount has not changed in 2020 and is:

- 120,000 rub. – for all social payments (except for education of children and expensive treatment);

- 50,000 rub. – expenses for education of one child;

- Unlimited – in terms of costs for expensive treatment.

Deduction amount x 13%

Let's say Smirnov V.S. paid for my university education at a cost of 162,300 rubles. and daughter’s tuition in the amount of 49,000 rubles. In 2020, he has the right to claim a deduction for training expenses for 2020 in the total amount of 169,000 rubles:

- 120,000 rub. - for your studies at the university. Since the actual amount of costs exceeds the established limit, expenses will be accepted in the amount of 120,000 rubles;

- 49,000 rub. - since the expenses for his daughter’s education did not exceed the maximum limit of 50,000 rubles, Sergeev can claim all of them for deduction.

The amount that Smirnov will directly receive in his hands will be 21,970 rubles 0) x 13%.

Please note that in 2020, social tax can only be claimed for expenses incurred in 2016-2014. Tax will not be refunded for expenses incurred in earlier periods.

- The medical institution must have a license for the relevant activities;

- To receive compensation for expensive treatment, the certificate of medical services must indicate code “2”;

- Documents must be issued to the person who claims the deduction and pays for the treatment (with the exception of spouses);

- The deduction can be obtained both from the tax office and from the employer;

- Costs are reimbursed only for treatment in Russia;

- The medical services provided and medications purchased must be indicated in a special list approved by the Decree of the Government of the Russian Federation,

- The educational institution must have an educational license (except for individual entrepreneurs carrying out this activity without the involvement of teachers);

- The benefit can be claimed for studying not only at Russian universities, but also at foreign educational institutions;

- One spouse cannot claim benefits for the other.

- Unused balance does not carry over to the next year

- You can submit documents to receive this type of deduction at any time throughout 2020.

Taxpayer identification in 3-NDFL

In Sheet D1, you must also select the taxpayer attribute (030).

| 01 | The owner of the property in respect of which a property deduction for personal income tax is claimed |

| 02 | Property owner's spouse |

| 03 | Parent of a minor child - owner of the property |

| 13 | A payer claiming a property deduction for expenses related to the purchase of housing in the common shared ownership of himself and his minor child (children) |

| 23 | A payer claiming a property deduction for personal income tax for expenses related to the purchase of housing in the common shared ownership of the spouse and his minor child (children) |

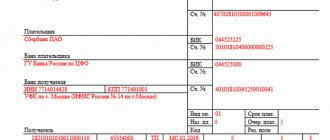

Budget classification code 3-NDFL

In field “020” of Section 1 “Information on the amounts of tax subject to payment (surcharge) to the budget/refund from the budget”, mark the budget classification code (BCC) of tax revenues, which is used to group items of the state budget. Find out the appropriate BCC for your case on the website of the Federal Tax Service.

In addition, you can use a service that will help you determine not only the BCC, but also the numbers of your inspection of the Federal Tax Service and the All-Russian Classifier of Municipal Territories (OKTMO).