The single tax in “simplified taxation” is inextricably linked with the concept of “advance payment under the simplified tax system . In order to pay the state for a single tax, you need to calculate and pay advance payments of the simplified tax system and pay the final tax amount once, next year...

Get a free consultation from a specialist ►

| Read the new article about advance payments under the simplified tax system here. |

Negative balance at the end of the year

By default, if a negative balance arose at the end of the year, in accordance with clause 6 of Art. 346.18 Tax Code, an entrepreneur or organization must pay a minimum fee (1% of income). Moreover, among all the documents confirming the correctness of advance calculations, the main one is the Book of Income and Expenses.

Date of payment for organizations, according to Art. 346.21 Tax Code - no later than March 31 of the year following the reporting year, and April 30 - for individual entrepreneurs. If these days fall on weekends or holidays, then the deadline becomes the next working day.

Important! The minimum tax paid is not reflected either in the accounting books or in the simplified tax system database (Article 346.16 of the Tax Code), and all advance payments under the simplified tax system count towards the minimum fee (Article 78 of the Tax Code).

https://youtu.be/K44TsYDZVhE

Cancellation if payment deadlines are not met

At the present time, the personal income tax payment control system is fully automated, and for this reason, the lack of receipt of funds on a certain target date can lead to the fact that the foreigner’s work patent will be canceled in the database of the regulatory authorities.

It is for this reason that in a situation in which payment is made later than required, at least one day, the document is automatically subject to cancellation due to late payment for the labor patent.

See how to receive a social security pension for the loss of a survivor. Amounts of social pensions for disabled people of groups 1, 2 and 3. Find it at the link.

When advance payments are not made

We have already found out that if the activity of an entrepreneur or organization is unprofitable for the year, their payment will be only 1% of income (the minimum tax provided for by law). But do you need to pay it in advance? The correct answer is no, it is not necessary, since the tax base in this case is zero.

How are advance payments made if income is less than expenses?

- Quarterly balances are calculated (income minus expenses), and at the end of each subsequent reporting period (6, 9 and 12 months) the corresponding amounts are added up.

- The result is multiplied by the tax percentage (the rate cannot be less than 6%, but for 15%, in accordance with the provisions of Article 346.20 of the Tax Code, reducing factors may apply in some regions).

- The amount of tax to be transferred is determined as follows:

- 1 sq. – the entire amount;

- 6 months – total amount minus transfers in the 1st quarter;

- 9 months – the total amount minus transfers for the first 2 quarters;

- year – the total amount minus transfers for the first 3 quarters.

If the final result is negative, there is no need to make advance payments.

Let's consider an example of such calculations for a conditional enterprise operating under the simplified tax system (rate 15%, the amounts of income and costs are increasing).

- In the 1st quarter, revenues exceed expenses, and therefore the advance payment is equal to the estimated tax amount.

- In 6 months the amount of income (increasing) turned out to be less than costs - accordingly, there is no base for taxation, no tax, no advance, since the enterprise was at a loss.

- In 9 months the total amount of income exceeds the amount of expenses, however, the advance payment for the entire period should be only 1,500 rubles, and in the 1st quarter 3,000 rubles were already paid. Therefore, no new advance transfers are required.

Types of losses and their transfer to subsequent periods

The accounting documents show not one, but two types of losses.

- Accounting – taking into account all income and expenses.

- Tax – taking into account only the types of income and expenses that are subject to taxation according to the simplified tax system of the Tax Code.

Obviously, 6% people will pay tax under the simplified tax system in any case, since their expenses are not taken into account in the formula. But 15% of them may generate a loss.

We have already shown how tax payments occur in the first three quarters. Over the course of a year, the formula will be slightly different. Here (even if the enterprise is generally unprofitable), you will have to pay tax in any case - however, only in the amount of 1% of the amount of annual taxable income, excluding expenses. But even in such a situation, it will not be made in advance.

There is one more nuance regarding losses at the end of the year, and it is associated with the ability to carry forward such negative amounts to subsequent tax periods (maximum period - 10 years, if all supporting documents are available). However, the reduction in the annual tax base in this case does not affect interim advance payments in any way.

Payment of tax according to the simplified tax system with a loss for the year

Let's finish our table for a conditional enterprise - we will continue it until the end of the year and assume that this financial period has ended for the simplified tax system payer at a rate of 15% with a total loss.

The table shows that, despite a generally unprofitable year and working under the simplified tax system with a tax rate of 15%, the accounting department will still have to pay an additional 700 rubles to the tax office. Where did this amount come from, and do I have to pay it in advance?

The answer to the second question is negative; the amount will not be paid in advance. According to the regulatory provisions of the Tax Code of the Russian Federation, it must be paid no later than March 31 of the year following the reporting year, or no later than April 30 for individual entrepreneurs.

In order for the advance payment to be taken into account in the minimum tax of 1% (provided that the enterprise or individual entrepreneur ended the year with a loss), you will need to enter this data into the “simplified” declaration.

Receipt and return of prepayment to counterparties

What the advance payment will be in a particular reporting period and whether there is a loss in it is also influenced by another type of income - not related to sales (most often prepayment).

In the cash book, it is taken into account as income, which, of course, affects the size of the advance payment under the simplified tax system. But, for a number of reasons, amounts received on prepayment are sometimes returned, including in subsequent tax periods.

How to document this type of transaction so that the return of the prepayment goes through the accounting department as an expense and, as a result, affects the likelihood of a loss in the reporting period as a whole?

To do this, you need to have a number of documents, namely:

- payment order for the return of the prepayment;

- bank statement;

- documentary evidence, which is the basis for the return of the advance.

Date of payment of advance personal income tax payments for a patent in 2020

Payment of the fixed payment this year should occur in advance - approximately 3-5 days before the date reflected in the first check for payment of the labor patent.

For example, if the first advance payment was made on September 10, then the next time payment should be made no later than October 10. Payment should be made a little earlier, so that subsequently, by October 10, the payment amount will be in the personal account.

Let's give a simple example.

As a result, the quarter ended with a loss, and the tax authorities lost the advance payment, but the company or entrepreneur did not make any artificial, let alone illegal, attempts to “reduce taxation.”

Finally, the advance payment can be received or returned not in money, but in property.

In the first case, no problems will arise, but in the second, the accountant will not have the right to adjust income or expenses (since Article 346.17 of the Tax Code does not provide for property return). The solution is to market valuation of such property and “translate” it into monetary terms. Moreover, this must be done in strict accordance with the requirements of Art. 105.3 of the Tax Code.

Advance payments and tax according to the simplified tax system in 2019

For a detailed step-by-step calculation of advance payments and simplified tax system, you can use this free online calculator directly on this website.

This is interesting: Question about working hours

To correctly calculate the tax, you need to know that on the simplified tax system:

- The tax

period is considered to be a calendar year; - reporting

periods are 1st quarter, half a year and 9 months; - the tax is calculated on an accrual basis

from the beginning of the year (for example, income (expense) for 9 months will include income (expense) for half a year and the first quarter).

To pay the simplified tax system in full you need:

- during

the year (no reporting required); - next

year pay tax according to the simplified tax system minus previously paid advance payments (submit a declaration according to the simplified tax system).

It is worth noting that many individual entrepreneurs and organizations that do not want to independently calculate the simplified tax system use special programs.

Punishment for failure to pay advance payments on time

According to the Tax Code of the Russian Federation, if advance payments were not accrued on time and sent to the state budget, penalties are charged on them.

The amount of the penalty is equal to 1/3 of the refinancing rate of the Central Bank of the Russian Federation for each day of delay.

However, with regard to individual entrepreneurs who neglect to pay advance payments, legislators limited themselves to only charging penalties - no other fines or punishments are provided here.

But if an individual entrepreneur does not submit a tax return according to the simplified tax system on time, then in this case he will be required to pay a fine. The amount of the fine is individual in each case, since it is equal to 5% of the unpaid amount for each month.

However, there are also restrictions on the amount of the fine - it should not be higher than 30% of the amount of unpaid tax, and at the same time it cannot be lower than 1 thousand rubles.

Deadlines for paying the simplified tax system in 2019

At the end of each reporting period (1st quarter, half a year and 9 months), individual entrepreneurs and LLCs using the simplified tax system must make advance payments. In total, you need to make 3 payments per calendar year, and at the end of the year, calculate and pay the final tax.

The table below shows the deadlines for paying the simplified tax system in 2019:

| Tax payment period | Tax payment deadline |

| 1st quarter | until April 25, 2020 |

| Half year | until July 25, 2020 |

| 9 months | until October 25, 2020 |

| Calendar year (for 2018) | For individual entrepreneurs – April 30, 2020 |

| For organizations – April 1, 2020 | |

| Calendar year (for 2019) | For individual entrepreneurs – April 30, 2020 |

| For organizations – March 31, 2020 |

Note

: if the deadline for paying the simplified tax system falls on a weekend or holiday, then the deadline for payment is postponed to the next working day.

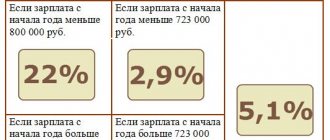

STS "Income"

To calculate the tax (advance payment) on a given taxable object, you need to multiply the amount of income for a certain period by the rate 6%

. Then the resulting result can be made significantly smaller, since on the simplified tax system “Income”:

- Individual entrepreneurs without employees

can reduce

100%

of the tax (advance payment) by the amount of fixed payments paid (for themselves). - Individual entrepreneurs and organizations with employees

can reduce up to

50%

of the tax (advance payment) by the amount of insurance premiums paid for employees, as well as by the amount of fixed payments paid for themselves (if they are included in

50%

). It is worth noting that if an individual entrepreneur worked alone (that is, he could reduce the tax or advance payment by 100%), and then hired an employee (even temporarily), then the individual entrepreneur loses the right to reduce the advance payment by the entire amount of insurance premiums paid for himself until the end of the year, regardless of the period for which the employee was hired and whether he worked until the end of the year. That is, if an employee was hired, for example, on January 1 and fired on March 1, then advances will have to be reduced by no more than 50% of the amount payable by the end of the year. An individual entrepreneur loses the right to reduce the amount of calculated tax (advance tax payments) by the entire amount of insurance premiums paid for himself, starting from the tax (reporting) period from which he hired employees.

Please note that in order to reduce advance payments for the corresponding quarters, fixed payments for pension and health insurance must be paid in the same quarter for which the advance is calculated, namely no later than

:

- January 1 to March 31 – for the 1st quarter

; - April 1 to June 30 for the half-year - for the half-year (2nd quarter)

; - July 1 to September 30 for 9 months - for 9 months (3rd quarter)

; - October 1 to December 31 – per year

.

Thus, to calculate the advance payment (tax) according to the simplified tax system “Income”, you can create a formula:

Advance payment

(

Tax

) =

Tax base

(cumulative amount of income) *

6%

–

Insurance premiums

(only for yourself or for other employees) –

Previous advance payments

(applied except for calculating the advance payment for the first quarter).

The most common example for calculating advance payments and tax on the simplified tax system “Income”

Let’s assume that an individual entrepreneur without employees has the following indicators:

Advance payment for the first quarter:

- We multiply the tax base for the first quarter by 6%

(

540,000

*

6%

), i.e.

32,400

. - We determine the amount of the deduction (fixed payments paid for the first quarter), i.e. 9 059,5

. - The tax turned out to be more than the deduction, so you will have to pay the tax office for the first quarter ( 32,400

-

9,059.5

), i.e.

23,340

. If the tax for the first quarter was less than the deduction, then there would be no need to pay anything to the tax office.

Advance payment for the second quarter:

- We multiply the tax base for the six months (i.e., cumulatively, including income for the first and second quarters) by 6%

(

1,160,000

*

6%

), i.e.

69,600

. - We determine the amount of the deduction (on an accrual basis, including fixed payments for the first and second quarters, as well as the advance payment paid for the first quarter): ( 18,119

+

23,340

), i.e.

41,459

. - The tax again turned out to be more than the deduction, so you will need to pay the tax authority for the six months ( 69,600

-

41,459

), i.e.

28 141

. If the tax for six months were less than the deduction, then there would be no need to pay anything to the tax authority.

The advance payment for 9 months, as well as the simplified tax system for the year, are calculated in the same way. You just need to remember to calculate advance payments (tax) on an accrual basis and, when necessary, subtract payments already paid.

How to reflect in reporting a decrease in personal income tax for fixed payments

Calculation of 6-NDFL

Personal income tax on the income of a foreigner working under a patent is reflected in the 6-NDFL calculation in the following order (clauses 3.1, 3.3, 4.1 - 4.2 of the Procedure for filling out the 6-NDFL calculation, Letter of the Federal Tax Service of Russia dated May 17, 2016 N BS-4-11 / [email protected] ):

- information about the income of a foreigner is reflected in section. 1 calculation at a rate of 13%. Wherein:

— the amount of income accrued to a foreigner is included in the calculation of line 020 along with the income amounts of other employees;

— the amount of the fixed advance payment by which the personal income tax was reduced is reflected on line 050;

- in Sect. 2 of calculation 6-NDFL, the amount of tax withheld (line 140) is reflected minus fixed advance payments.

How to fill out section 2, if personal income tax turned out to be less than advance payments

In this case, Sec. 2 must be filled out as follows (Letter of the Federal Tax Service of Russia dated May 17, 2016 N BS-4-11/ [email protected] ):

- line 100 indicates the date of actual receipt of income reflected in line 130;

- zeros are entered on lines 110, 120 and 140, since there will be no tax to withhold and transfer;

- on line 130 - the amount of income actually received (without subtracting the amount of withheld tax) on the date indicated on line 100.

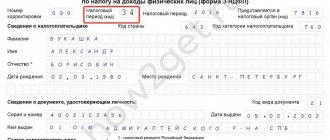

Help 2-NDFL

The amount of fixed advance payments by which you reduced the personal income tax of a foreigner working under a patent must be reflected in section. 5 certificate 2-NDFL in the field “Amount of fixed advance payments”.

In the “Notification confirming the right to reduce tax on fixed advance payments” field, indicate the number and date of the tax notice, as well as the code of the tax authority that issued it.

This is indicated in Sect. VII Procedure for filling out the 2-NDFL certificate.

USN “Income minus expenses”

To calculate the advance payment (tax) for the simplified tax system “Income reduced by the amount of expenses” you must:

- all

insurance premiums

for oneself and for employees

are recognized as expenses, among others ). - When calculating tax for the year, you can include in expenses the amount of losses from previous years (when expenses exceeded income) and the difference between the minimum tax paid and the amount of tax calculated in the general manner for the previous year. For example, in 2020, the organization received a loss of 500,000 rubles. (income was 500,000 rubles, expenses were 1,000,000 rubles, respectively, the loss was 500,000 rubles). Despite the loss, the organization paid a minimum tax of 5,000 rubles at the end of the year. (1% of RUB 500,000). When calculating the tax for 2020, she will be able to take into account the loss received in 2020 in the amount of 500,000 rubles. and the difference between the minimum tax paid and the tax calculated in the general manner (when calculated in the general manner, the tax was 0 rubles, since there was no tax base) in the amount of 5,000 rubles. (5,000 – 0). At the same time, please note that the loss and difference can only be taken into account when calculating tax for the year, and not for the quarter. For example, when calculating the advance for the 1st quarter of 2020, it will not be possible to take into account the loss received in 2020 and the difference between the minimum tax and the tax calculated in the general manner.

- Multiply the result by a rate of 15%

(in some regions a preferential rate is set from 5% to 15%). - Subtract advance payments already paid for the current year.

Thus, to calculate the advance payment according to the simplified tax system “Income minus expenses”, you can derive the formula:

Advance payment

(

Tax

) = (

Tax base

(cumulative amount of income minus cumulative total of expenses) x

15%

(depending on the region)) –

Previous advance payments

(applied except for calculating the advance payment for the first quarter).

This is interesting: Requirements for a massage room

We calculate the tax at the end of the year taking into account the loss of the previous year (years) and the difference between the minimum tax and the tax calculated in the general manner:

Tax

= (

Tax base

(cumulative amount of income minus cumulative total of expenses) –

Loss and the difference between the minimum tax paid and the amount of tax calculated in the general manner

(for one year, if it was within the previous 10 years)) *

15%

(depends from the region) –

advance payments for the 1st quarter, half a year and 9 months

.

The most common example for calculating advance payments and tax on the simplified tax system “Income minus expenses”

Let’s assume that an individual entrepreneur without employees has the following indicators:

Advance payment for the first quarter:

- We multiply the tax base for the first quarter by 15%

(

260,000

*

15%

), i.e.

39,000

.

Advance payment for the second quarter:

- We multiply the tax base for the half-year (i.e. on a cumulative basis, including the first and second quarters) by 15%

(

570,000

*

15%

), i.e.

85,500

. - We subtract the advance payment for the first quarter ( 85,500

–

39,000

), i.e.

for the first half of the year the advance payment is 46,500

.

The advance payment for 9 months, as well as the simplified tax system for the year, are calculated in the same way. You just need to remember to calculate advance payments (tax) on an accrual basis and, when necessary, subtract payments already paid.

Frequently asked questions about advance payments

Below are answers to some questions asked about advance payments:

Is it necessary to pay an advance payment for the 1st quarter if the organization (IP) opened in the 2nd quarter?

Advance payments are paid only from the period when the taxpayer began to apply the simplified tax system. If an organization or individual entrepreneur is registered, say, in the 2nd quarter, the advance is not calculated or paid for the 1st quarter.

How to reduce the advance payment (tax) on insurance premiums if an individual entrepreneur hired workers in the middle of the reporting (tax) period?

An individual entrepreneur loses the right to reduce the amount of calculated tax (advance tax payments) by the entire amount of insurance premiums paid for himself, starting from the tax (reporting) period from which he hired employees.

Thus, if an individual entrepreneur hired workers, say, in the second quarter, then he reduces the advance for the first quarter by the entire amount of fixed contributions paid for himself, and for the second only by an amount of no more than 50% of the advance payable.

It should be noted that the individual entrepreneur loses the right to reduce the advance payment by the entire amount of insurance premiums paid for himself until the end of the year, regardless of the period for which the employee was hired and whether he worked until the end of the year. That is, if an employee was hired, for example, on January 1 and fired on March 1, then advances will have to be reduced by no more than 50% of the amount payable by the end of the year

Common Mistakes

Amount of penalties payable to the budget = 25,000 x 1/300 x 7.25% x 15 days = 90.63 rubles

How right. According to the clarifications of the Federal Tax Service of Russia dated December 28, 2009, penalties are calculated starting from the day following the last day of payment and ending on the day when the arrears are paid to the budget. Therefore, the number of days of delay in July will be 6 days, and in August 10 days, the total number of days overdue will be 16, and the amount of penalties will be:

Amount of penalties = 25,000 x 1/300 x 7.25% x 16 = 96.67 rubles

And the total amount payable to the budget will be 25,000 + 96.67 = 25,096.67 rubles.

Important! The BCC that will need to be indicated in payment orders for the advance and for penalties will be different.

https://youtu.be/9tprjMQC3GA

Is it necessary to pay an advance payment under the simplified tax system if a loss is incurred?

“Simplified”, 2013, N 3

If you calculate the “simplified” tax on the difference between income and expenses, you may face a loss. This is when your expenses exceed your income or these indicators are equal. If a similar situation arises at the end of the year, you must pay the minimum tax. Let us remember that it is calculated as 1% of the income received.

What to do when there is a loss at the end of the reporting period? Should we also count 1% of income and pay the received amount as an advance payment? No. This procedure is not provided for by law. Remember: there cannot be advance payments for the minimum tax. Advance payments are calculated only for a single tax and only based on the tax base, in which income is higher than expenses. And if there is a loss, the tax base is zero. This means that you do not count the “simplified” tax, or rather, the advance payment for it. It will also be equal to zero.

Note! The minimum tax is calculated only at the end of the year. There are no advance payments for the minimum tax.

Accordingly, you can calculate the advance payment for the reporting period (quarter, half-year, 9 months) only if income for the reporting period is higher than expenses. To do this, take the following steps.

1. Determine the difference between income and expenses taken for the reporting period. Please note: indicators must be taken on a cumulative basis from the beginning of the year. So, for 6 months, take data cumulatively for the first and second quarters, and for 9 months - for all three quarters.

2. Multiply the resulting difference by your applicable tax rate. Let us remind you that the maximum bet is 15%. But a reduced tariff may be introduced in your region (clause 2 of Article 346.20 of the Tax Code of the Russian Federation).

At this point, the calculation of the advance payment can be considered complete. However, do not rush to pay the resulting amount. We still need to decide on the size of the payment. And it depends on what reporting period you made the calculation for.

If the reporting period is the first quarter, then the entire calculated amount of the advance payment will be due to you. But for 6 months you no longer transfer the entire amount, but minus the advance payment that was paid for the first quarter. Accordingly, you transfer the advance for 9 months minus the amounts for the first quarter and 6 months.

Please note that if as a result of such calculations you get a negative result (that is, based on the results of previous reporting periods, you have already paid more than you accrued for the current reporting period), it means that the advance payment payable for the current reporting period is zero - transfer nothing no need. You are already overpaid on advance payments.

Example. Payment of advance payments for “simplified” tax when receiving a loss in the middle of the year

Igra LLC applies the simplified tax system with the object of taxation “income minus expenses”. For 9 months of 2012, the company has the following indicators (given on an accrual basis from the beginning of the year):

- for the first quarter, income amounted to 150,000 rubles, expenses - 100,000 rubles;

- for 6 months, income amounted to 180,000 rubles, expenses - 200,000 rubles;

- for 9 months, income amounted to 260,000 rubles, expenses - 220,000 rubles.

Questions that arise

A number of questions remain open. Difficulties arise in relation to advance payments most often when receiving losses and determining income when calculating tax. What clarifications on this matter are there in legislative acts?

Do I need to pay an advance payment if a loss is incurred?

Is it necessary to calculate the advance amount and pay it to the budget if the period turns out to be unprofitable?

According to Art. 346.18 Tax Code, payers who work on the simplified tax system “Income minus expenses” transfer the minimum tax if the amount of the single tax is less than the minimum.

Video: advance payments of the simplified tax system

https://youtu.be/ohzaNwUKRmg

That is, the company must pay a minimum tax if losses are incurred during the tax period.

If you have not paid advance amounts, you do not have to worry, since such an obligation will not arise. Some companies still transfer funds in order to pay less at the end of the year.

If a company operates under the simplified tax system “Income” and a loss is recorded, it is still necessary to pay 6%. The results are calculated quarterly on an accrual basis at the beginning of the tax period.

Is an advance considered income?

There is no consensus on whether advance payments are taxable. There is no mention of this in the Tax Code, and therefore the following point of view arises: the advance payment does not need to be included in profit under the simplified tax system, which means that it is not worth paying tax on it.

If a company operates under the simplified tax system, income is considered to be:

- profit from the sale of products/services and property rights;

- non-operating profit.

Advance amounts are not considered profit from sales. In accordance with Art. 249 of the Tax Code, sales revenue is determined based on all receipts that are associated with determining the amounts for goods sold or rights to property.

According to Art. 39 Tax Code sale of products is a paid transfer of ownership rights to products, works or services. Upon receipt of an advance, there is no transfer of ownership.

Advance payments and non-operating profit are not considered. In accordance with the provisions of Art. 41, profit is a benefit of an economic nature, expressed in cash or in kind, subject to evaluation.

If a taxpayer applying a simplified tax regime receives an advance, then there is no benefit. This is explained by the fact that the company will be liable to the enterprise that transferred the advance amount.

Provided that the goods are not provided to the buyer, the advance payment must be transferred back. This means that in this case, advances are not considered profit. Accordingly, taxes on them do not need to be calculated and paid.

Inspectors have a different point of view. If the company operates on the simplified tax system “Income”, the calculation takes into account the profit from the sale, as well as non-operating income.

The date of receipt of profit is the day when funds arrive at the cash desk, property, work, services are received, and debt is repaid. Let's consider the provisions of Ch. 25 of the Tax Code of the Russian Federation.

Property objects, works, services that were received from a person in advance of payment for products/services/work by payers who determine profits and costs using the accrual method cannot be taken into account as profit.

In accordance with Art. 39 of the Tax Code, the date of actual sale of goods can be determined in accordance with Art. 346.17 clause 1 of the Tax Code of the Russian Federation.

This is the rationale for the fact that advances received against shipments from the taxpayer are considered a taxable item in the period in which they are received.

Is it necessary to keep a log of received and issued invoices under the simplified tax system? Read here.

Whether personal income tax is taken into account in expenses under the simplified tax system, see here.

The Tax Service is of the opinion that the advance payment should be included in income. The problem of determining the tax base also arises when repaying an advance.

This is important to know: An example of an accounting policy for an LLC on the simplified tax system and UTII for 2020: sample

According to the rules prescribed in Art. 346.15 clause 1 of the Tax Code of the Russian Federation, when determining the objects of taxation, profit from Art. 251 Tax Code is not taken into account.

The amount of the advance payment that is returned to the company is not mentioned in this regulatory act.

This means that if advance payments transferred to the seller were taken into account in the list of costs when calculating the tax base, then the returned amount should be reflected in income.

If the amounts of advances were not reflected in expenses, then the returned amounts are not indicated in the profit of the taxpayer.

If you have switched to the simplified tax system, then sooner or later questions about making advance payments will arise.

In order not to get into trouble in the form of penalties and problems with submitting reports at the end of the year, it’s worth looking into this.

After all, if the advance payment is not paid in full or the payment is completely overdue, you will have to bear responsibility for it. And this is fraught with additional costs for the company.

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

What you need to know about advance payments under the simplified tax system

- Advance payments according to the simplified tax system You need to calculate and pay regularly, observing payment deadlines. Reporting periods are quarterly, half-yearly and 9 months. Payment must be made by the 25th day of the month following the reporting period. If the 25th falls on a weekend or holiday, you can pay on the next business day after the 25th. Thus, for payment of advance payments according to the simplified tax system The following deadlines are established (including weekends and holidays):

Reporting periodPayment deadline 1st quarter no later than April 25 6 months no later than July 25 9 months no later than October 25 - To transfer an advance, the following BCC must be indicated in the payment order: 182 1 0500 110 - on the “income minus expenses” system, 182 1 0500 110 - on the “income” system.

- The calculation is on an accrual basis. You cannot follow the “quarterly” calculation - this leads to distortions in the final declaration.

- Payments can be reduced by the amount of insurance premiums paid in the reporting period or taken into account as expenses when determining the tax base.

- For non-payment, liability is provided in the form of a penalty. For each day of delay, the state will charge a penalty in the amount of 1/300 of the refinancing rate of the Central Bank of the Russian Federation. The refinancing rate is now 10%. Moreover, now for organizations the penalty for late payment from the 31st day will be 1/150 of the refinancing rate. There are no penalties for non-payment or late payment of the AP.

What is this tax system?

The simplified tax system is a tax system with simplified accounting and tax accounting.

When working with this regime, companies may not pay property tax, VAT and contributions on profits. Only insurance premiums with a single tax are paid. Organizations and individual entrepreneurs can switch to the simplified tax system at the beginning of the tax period after sending a notification to the tax authority.

To pay a single tax, the payer selects an object of taxation. These include:

- Company income. To calculate the payment, income is used, the rate is 6%.

- Income minus expenses. The rate is 15%. Payment is made once a year, and advance payments are calculated in an incremental period for the first quarter, 6 and 9 months. If the correct calculations are made by the end of the year, the contribution amount will correspond to the amounts paid.

Calculation of an advance payment on the simplified tax system “Income”

INCOME is the amount of income received since the beginning of the year. In the Book of Accounting for Income and Expenses, this indicator is reflected in column 4 of section 1. In simplified terms, income includes income from sales and non-operating income specified in Articles 249 and 250 of the Tax Code of the Russian Federation,

The tax rate for the simplified tax system for income is 6%. However, by decision of regional authorities it can be lowered. 33 regions have already done this. So, for example, in the Bryansk region for certain types of activities the rate is set at 3%, in the Saratov region - 1%, and in Chukotka - the maximum rate is 4%.

DEDUCTION is the amount of employer funds paid during the reporting period to insurance funds, as well as used to pay sick leave to employees.

The single tax (INCOME * RATE) can be reduced: by a maximum of 50% for organizations and individual entrepreneurs with employees, and by 100% for individual entrepreneurs without employees.

We will calculate the advance payment according to the simplified tax system for Income for Raduga LLC.

- INCOME = 300000 + 60000 = 360000

- RATE = 6%

- Single tax = 160000 * 6% = 21600

- DEDUCTION = 10000 + 4000 = 14000

- Raduga LLC has the right to reduce the single tax by a maximum of 50%, that is, 21,600: 2 = 10,800 rubles.

The amount of a fixed advance payment in 6-NDFL: how not to make a mistake in terms

We’ve figured out how to show an advance on salary in 6-NDFL. But sometimes it also indicates an advance of a completely different nature, namely: a fixed advance payment (FAP), which is paid by foreigners working on the basis of a patent.

For him, the calculation has a separate line 050 and its own reflection rules, due to the offset between the personal income tax advance, which is transferred by the employee under the patent, and the tax that the employer has calculated and must transfer to the budget from the income paid to the employee.

Thus, the amount of the FAP in line 050 should not exceed the amount of tax from such employees included in line 040. When the personal income tax paid under a patent is less than the tax calculated on wages, the entire fixed advance is reflected in line 050. When more, only a part of it equal to the calculated personal income tax. If the foreigner continues to work and receive a salary, the difference is counted in subsequent periods.

Filling out the calculation in such a situation is discussed line by line in the article “Nuances of filling out 6-NDFL for “patent” foreigners .

Calculation of advance payments for individual entrepreneurs without employees

An individual entrepreneur without employees has the right to reduce the advance payment by the entire amount of insurance premiums paid during the reporting period. That is, unlike the above example, there is no need to compare the DEDUCTION with 50% of the calculated tax.

- Until April 25, IP Fedorov pays AP1 = 100,000 x 6% - 2000 rubles. = 4000 rub.

- Until July 25 (for six months), the entrepreneur pays AP2 = (100,000 + 120,000) x 6% - (2000 + 5000) - AP1 = 2200 rubles.

- Until October 25 (for 9 months) advance payment AP3 = (100,000 + 120,000 + 130,000) x 6% - (2000 + 5000 + 1000) - AP1 - AP2 = 6800 rubles.

Calculation of an advance payment using the simplified tax system “Income minus Expenses”

INCOME is the amount of income received since the beginning of the year. In the Book of Accounting for Income and Expenses, this indicator is reflected in column 4 of section 1. In simplified terms, income includes income from sales and non-operating income specified in Articles 249 and 250 of the Tax Code of the Russian Federation,

EXPENSE is the amount of expenses incurred since the beginning of the year. Only those costs specified in clause 1 of Art. are taken into account. 346.16 Tax Code of the Russian Federation. They must be economically justified, actually paid and supported by documents. In the Book of Income and Expenses, this indicator is reflected in column 5 of section 1.

The tax rate for the simplified tax system “Income minus Expenses” is 15%. Regional authorities may lower the rate. In the Russian Federation, preferential rates apply in 71 regions. For example, in Dagestan for all types of activities the rate is set at 10%, in Karelia - depending on the type of activity the rate is 5, 10 or 12.5%.

It is impossible to reduce the single tax by the amount of tax deductions in this regime, but paid insurance premiums and paid sick leave can be taken into account in expenses.

Let's calculate the advance payment according to the simplified tax system for Raduga LLC using the formula:

- INCOME = 300000 + 60000 = 360000

- CONSUMPTION = 80000 + 20000 = 100000

- The tax base for the quarter will be 360,000 – 100,000 = 260,000

- A tax rate of 15% must be applied to this amount.

- As a result, the advance payment under the simplified tax system Income minus AP Expenses = 260,000 x 15% = 39,000 rubles.

Certificate 2-NDFL (patent) – we issue a certificate to a foreign employee

When drawing up a certificate to be issued to an employee, the employer uses the template presented in Appendix 5 to Order No. ММВ-7-11 / [email protected] Information that the recipient of the income is a foreigner is entered in section 2. This is reflected in the status codes taxpayer, citizenship and identification document. In sections 3 and 4, information on income accruals and deductions for children is entered in the usual manner.

The amount of fixed payments for a patent is indicated only in section 5. It is reflected in a separate line, and the calculated personal income tax is reduced by its amount. The details of the notification received by the employer from the Federal Tax Service for income tax adjustments do not need to be indicated in the employee’s certificate.

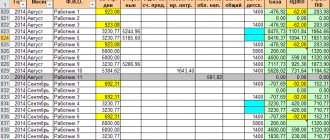

Calculation of advance payments according to the simplified tax system for 9 months

Advance payments under the simplified tax system are considered an accrual total. Let's give an example of a calculation.

- For the 1st quarter, AP1 = 400,000 x 6% - 12,000 = 12,000. The company was able to reduce the single tax (24,000 rubles) by the entire amount of contributions paid, since the DEDUCTION does not exceed 50% of the calculated tax amount.

- For half a year, AP2 = 750,000 x 6% - 22,000 - AP1 = 11,000 rubles. Here, the DEDUCTION for the six months (22,000) turned out to be less than 50% of the calculated tax amount (45,000: 2 = 22,500). Therefore, we can again reduce the tax by the entire amount of contributions paid. In addition, we deduct the advance payment already paid for the 1st quarter.

- For 9 months, contributions amounting to 40,000 were paid. At the same time, the single tax is 1,0000,000 x 6% = 60,000. Since the DEDUCTION is more than 50% of the single tax amount, it is impossible to deduct the entire amount of contributions. The maximum that can be deducted is 30,000. Therefore, the calculation for 9 months is AP3 = 1,000,000 x 6% - 30,000 - AP1 - AP2 = 7,000 rubles.

| Period | Revenue for the quarter | Income for the reporting period on an accrual basis | Contributions per quarter | Contributions for the reporting period on an accrual basis | AP for the quarter | AP for the reporting period on a cumulative basis |

| 1st quarter | 400 000 | 400 000 | 12000 | 12000 | 12000 | 12000 |

| 2nd quarter | 350 000 | 750 000 | 10000 | 22000 | 11000 | 23000 |

| 3rd quarter | 250 000 | 1 000 000 | 18000 | 40000 | 7000 | 30000 |