Salary advance: terms and definitions

The procedure for submitting 6-NDFL once again prompts financial specialists to think about the nuances of filling out this reporting puzzle.

Salary advance in 6-NDFL is one of many issues that require separate clarification.

An advance is considered to be part of an employee’s earnings given to him by the employer:

- without fail;

- the force of legal requirements;

- deadlines established by the company itself (taking into account the requirements of labor legislation).

NOTE! The need for advance payment arises from the requirements of labor legislation. Art. 136 of the Labor Code of the Russian Federation requires the employer to pay wages at least every half month, otherwise he faces fines (Article 5.27 of the Code of Administrative Offenses of the Russian Federation) and material losses in the form of interest for late wages (Article 236 of the Labor Code of the Russian Federation).

For more information about the advance, see the article “Salary Advance in 2020 under the Labor Code.”

Study salary nuances using the materials posted on our website:

- “Payroll taxes in 2019-2020 - table of changes”;

- “Payment for shift work”, etc.

Thus, an advance is an element of an employee’s income that is subject to personal income tax and, as a result, has every reason to be included in personal income tax reports, one of which is form 6-NDFL. You will find out whether the advance is reflected in 6-NDFL in the next section.

When is the advance payment due?

Labor legislation, namely Art. 136 of the Labor Code of the Russian Federation strictly regulates the payment of wages, the payment of which must be made every half month.

Taking into account the legislation, wages are paid as follows:

| Wage | Payment term |

| Salary for the first half of the month | From the 16th to the 30th (31st) day of the current month |

| Salary for the second half of the month | From the 1st to the 15th of the next month |

This is important to know: Letters from the Federal Tax Service on determining the location of water vessels.

A specific date for payment of wages must be established:

- internal labor regulations,

- collective agreement,

- employment contract

In which line of 6-NDFL is the salary advance reflected?

There is no point in looking for a separate advance line in the report. There is no space allocated for information about the salary advance issued to employees and the personal income tax corresponding to this payment.

This seemingly flaw in the report is actually based on tax legislation, since:

- the employer is obliged to calculate personal income tax on the date of actual receipt of income (this approach is dictated by clause 3 of Article 226 of the Tax Code of the Russian Federation);

- it is necessary to withhold tax from the employee’s salary upon its actual payment (clause 4 of article 226 of the Tax Code of the Russian Federation);

- the date of receipt of income in the form of wages (including advance payments) is the last day of the month for which salary accruals were made (clause 2 of Article 223 of the Tax Code of the Russian Federation, see also letters of the Ministry of Finance dated January 15, 2019 No. 03-04-06/1192, dated 07/13/2017 No. 03-04-05/44802).

Thus, at the time of payment of the advance, it is not yet recognized as income, and therefore there is no need to withhold personal income tax from it.

For more details, see: “Do I need to pay personal income tax on an advance and when?”

NOTE! Additional confirmation that information about the advance in 6-NDFL is not reflected in a separate line is the opinion on this matter of federal tax officials, expressed by them in letters dated January 15, 2016 No. BS-4-11/320, dated March 24, 2016 No. BS-4 -11/4999.

Despite all of the above, advance payments took place in the reporting quarter, and the question of how to reflect the advance in 6-personal income tax remains open.

Personal income tax from advance payment - how and when to withhold

In order to understand the taxation of salary advances, you need to rely on legislation. Thus, advance payment of wages is regulated by labor law:

- The fundamental rule of law governing the payment of advance payments is Article 136 of the Labor Code of the Russian Federation, which requires the employer to pay wages twice a month.

- If the employer does not comply with these requirements, he is obliged to charge interest on wages that are paid with delays and pay employees an increased amount for each day of delay. The article of the Labor Code in which this is established is numbered 236.

- Administrative liability has also been established for violating companies (see Article 5.27 of the Code of Administrative Offenses of the Russian Federation).

At the same time, specific dates for advance and final payments are established within the company by a separate order, most often - the Regulations on Remuneration. This fact often provokes an exception to the rules, which will be discussed separately.

It follows that the advance is a direct component of the employee’s income, which must be subject to income tax. Accordingly, these payments should be clearly included in personal income tax reporting.

But when this should be done in the calculation of 6-NDFL, you need to figure it out separately. This issue requires detailed consideration due to certain nuances and particulars. And everything depends on the deadlines and requirements established at the legislative level:

- Regarding the calculation of personal income tax - this issue is regulated by paragraph 3 of Article 226 of the Tax Code of the Russian Federation, which establishes that the agent must calculate the income tax on the day the individual actually receives income. face.

- The deadline for withholding income tax is established in paragraph 4 of Article 226 of the Tax Code of the Russian Federation, which determines that personal income tax must be withheld from the employee’s salary upon its actual payment.

- And the most important thing in this matter is that labor law standards recognize the date of receipt of profit in the form of wages (and this includes advance transfers) as the final day of the month for which wage payments were made. This is regulated by paragraph 2 of Article 223 of the Tax Code of the Russian Federation, comments regarding this are given in the explanations of the Ministry of Finance No. 03–04–05/44802 dated July 13, 2017.

From all that has been said, a certain conclusion follows: there is no need to withhold personal income tax at the time of advance payments, since at the time of transfer of the advance it is not actually recognized as income.

An exception to the general rules when withholding personal income tax from an advance payment - an example of filling out the form

All of the above can be refuted by one particular case (but that’s why they are exceptions, to confirm the rules). Let’s take the option when the company sets the days for payment of earnings with the following deadlines:

- On the 30th of the current month, an advance is transferred to employees;

- The 15th is the so-called ending.

We remember that the tax agent must transfer the amount of calculated and withheld personal income tax on the next day after the employee is paid a salary; this is the deadline (see paragraph 6 of Article 226 of the Tax Code of the Russian Federation). This standard is applied taking into account the requirements of Article 223 of the Code, which establishes specific dates of actual receipt for certain types of income. For salaries, this date is the final day of the month for which income is accrued. It is this standard that gives the right not to withhold income tax when paying remuneration for the first part of the month (advance).

But in our case, the salary advance will be accrued and paid (in certain months) exactly on the final day of the current billing month. That is, the date of actual receipt of remuneration for labor (clause 2 of Article 223 of the Tax Code of the Russian Federation) will coincide with the payment of income (clause 4 of Article 226 of the Tax Code of the Russian Federation). Consequently, the agent company will have to charge on this day the personal income tax fee for the current ending month, unless of course the month consists of thirty days and it is the last one.

As established in the clarifications of the Supreme Court of the Russian Federation No. 309-KG16–1804 dated May 11, 2016: if the advance payment is paid on the last day of the month, then personal income tax will need to be withheld. The tax fee will need to be paid to the state budget on the next working day. This means that in this variation, the answer to the question: is personal income tax withheld from the advance payment will depend on the number of days in a particular month. If, for example, in February (when payments will be transferred), April, June, September and November, payment of a salary advance on the 30th will lead to the need to calculate and withhold income tax, then in January, March, May, July, August, etc. - No.

The algorithm for filling out the calculation in the case of thirty-day months will look like this (take, for example, a report for the full year 2018). In it, November 30, 2020 will have to be recognized as both the date of receipt of the remuneration and the date of its payment, therefore, November 30, 2018 should be entered in section No. 2 of the calculation as follows:

- on line 100 - November 30, 2018;

- on line 110 - November 30, 2018;

- on line 120 - 12/03/2018 (as the final deadline for paying personal income tax to the state budget is the first working day after 11/30/2018).

A small example of filling out one of the blocks about advance payment on November 30, 2018, if the company has set the advance payment date for the 30th of the month

And in December 2020, the advance will be paid in the last month, since December 30, 2018 falls on a weekend. Therefore, the lines will be filled in by analogy.

The same will need to be done in February of each year if the advance payment in the company is set on the 28th. The main thing is not to miss such moments when submitting the report. Otherwise it will be considered an error. To be fair, we note that it is extremely rare for enterprises to set exactly such advance and completion dates. But what is important here is the approach to calculating personal income tax and recording it in the report.

How to show a salary advance in the 6-NDFL report: example

Advance payments are still reflected in 6-NDFL, but not in a separate line, but in cells designed to reflect the salary issued. In this case, the salary advance is the legally paid part of the earned income.

Let's show the algorithm for reflecting an advance in 6-NDFL using an example.

Example

Tekhspetsprom LLC began operating only in January 2020, and by the end of the 1st quarter, salary accruals amounted to 738,000 rubles. (personal income tax - 95,940 rubles), including:

- On January 22, 2020, a salary advance was issued (RUB 300,000);

- On 02/05/2020 the final payment for August was made (RUB 438,000).

To simplify the example, we will assume that there are no other accruals and payments during this period.

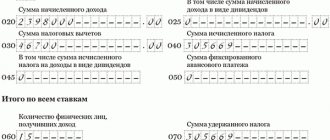

Filling out 6-NDFL:

The amount of a fixed advance payment in 6-NDFL: how not to make a mistake in terms

We’ve figured out how to show an advance on salary in 6-NDFL. But sometimes it also indicates an advance of a completely different nature, namely: a fixed advance payment (FAP), which is paid by foreigners working on the basis of a patent.

For him, the calculation has a separate line 050 and its own reflection rules, due to the offset between the personal income tax advance, which is transferred by the employee under the patent, and the tax that the employer has calculated and must transfer to the budget from the income paid to the employee.

Thus, the amount of the FAP in line 050 should not exceed the amount of tax from such employees included in line 040. When the personal income tax paid under a patent is less than the tax calculated on wages, the entire fixed advance is reflected in line 050. When more, only a part of it equal to the calculated personal income tax. If the foreigner continues to work and receive a salary, the difference is counted in subsequent periods.

Filling out the calculation in such a situation is discussed line by line in the article “Nuances of filling out 6-NDFL for “patent” foreigners.”

Fixed advance payment

A fixed advance payment is provided only for foreign citizens working in the Russian Federation under a patent. In practice, an employer who has formalized an employment relationship with a representative of another country can underestimate the amount of personal income tax on such payments.

However, before making a reduction in income tax, it is necessary to confirm this right with the tax service. The tax agent must apply to the Federal Tax Service with an application to exercise the right to reduce the amount of personal income tax on the income of a foreign employee. The application can also be submitted electronically. The composition of the appeal is presented for review in the Letter of the Federal Tax Service of the Russian Federation MMB-7-6 / [email protected] dated December 8, 2015.

A foreign employee must also submit a corresponding application to the Federal Tax Service and attach a package of necessary documents to it. The list of attached documentation must include a certificate confirming the transfer of fixed advance payments for personal income tax.

To reflect this payment in the 6-NDFL report in Section 1 “Generalized indicators” there is a special line 050 “Amount of fixed advance payment”. Data in this line is entered only if a citizen of another country works at the enterprise. Line 050 contains information about the amount of all fixed advances.

If foreign employees are not listed in the organization, “0” is entered in line 050.

Do I need to indicate an advance in 6-NDFL?

Yes, advance salary accruals are necessarily included in the 6-NDFL calculation lines.

The advance is a part of the salary, it is assigned according to Article 136 of the Labor Code of the Russian Federation for the first part of the month, and is paid in the time period from the 15th to the 30th or 31st of the month for which the advance amount is assigned.

An important point is that since the advance is part of the salary, it is subject to personal income tax. However, taxation is carried out not upon the assignment and payment of income, but together with wages for the second part.

Since taxation for wages for the first and second parts of the month is carried out according to the same rules, at the same time, the advance payment must be reflected in 6-NDFL in the same order as the second part of wages.

The following important dates are set for salary and advance payments:

- actual accrual - the last day of the month for which the accrual was made;

- tax calculation is similar;

- tax withholding - on the day established as the deadline for full payment of wages to employees (from the 1st to the 15th of the next month);

- tax transfer – corresponds to the withholding date or the day following it.

Based on these data, the quarterly calculation form is filled out.

The 6-NDFL calculation is presented in two sections, allowing tax authorities to show what amounts were accrued to workers in the current year, what tax was deducted from income and paid to the budget. The report shows a general picture of the entire staff of the enterprise; it does not contain personalized information on employees.

How to reflect the salary for the first half of the month in sections 1 and 2?

Advance amounts for wages are included in separate lines in both sections.

It is important to remember that the first part of the 6-NDFL report shows the results from the beginning of the year to the end of the period for which the calculation is being prepared. Indicators are calculated on an accrual basis. The second part of the report shows data from the last quarter, that is, three months.

The advance, acting as a salary for the first half of the month, must be included in the following lines of section 1:

- 020 - is included in the taxable income accrued before taxation for the months included in the reporting period (for example, the calculation for the 1st quarter of 2020 will include advances for January, February and March 2020). About filling out line 020 6-NDFL;

- 040 - the calculated tax on income from field 020 is shown - this line will also include personal income tax, which is calculated from the advance payment included in field 020 (for example, the calculation for the 1st quarter of 2020 will include the tax on advance amounts assigned for January , February and March 2020);

- 070 - personal income tax deducted from income is shown (the line differs from 040) - the line will include the tax deducted from those advances, the payment date of which fell on the months included in the reporting period (for example, 6-personal income tax for the 1st quarter of 2020 will include the withheld tax from advances for December 2020, January 2020 and February 2020 and the tax deducted from the advance amount for March 2020 will not be included).

The values of fields 040 and 070 may differ. The procedure for filling them out can be found in more detail in this article.

In section 2, the advance will be reflected as follows:

- 100 - the last day of the month in which money was issued to the staff;

- 110 - reflects the date when the remaining wages for the second part of the month were paid;

- 120 - the day when the tax was transferred to the tax authorities;

- 130 - the amount of income that was accrued on the date from line 100 (advance payment and salary for the 2nd part of the same month are shown together);

- 140 - the amount of tax that is collectively withheld from the advance payment and salary for the 2nd part of the same month.

When filling out the second section, you need to pay attention to the following:

- for the month preceding the last quarter, the advance is accrued on the last day of this month, but the tax on it is withheld in the next month, so data on this income must be included in the calculation of 6-NDFL (for example, when generating a report for the 1st half of 2020, entries in the section 2 will begin with information about the advance payment and salary balances for March 2020);

- for the last month of the last quarter, the advance amount is accrued on its last day, but the tax on it will be withheld in the next quarter, therefore the calculation does not include data on the advance calculated for the last month of the reporting or tax period (for example, when compiling 6-NDFL for the 1st half of the year 2020 there is no need to reflect information about the advance payment and salary for June 2020).

Below is an example for clarity, which explains exactly how to reflect the advance in 6-NDFL.

Example of filling for 2020

6-NDFL is compiled for the first half of 2020. There is only one employee in the company. His salary consists of two parts: for the first half of the month the employee receives 25,000, for the second - 30,000). There are no deductions; apart from the salary, there were no other payments or accruals.

The task is to correctly reflect the advance in the amount of 25,000 in the sections of form 6-NDFL.

Section 1:

The remaining fields are filled in with zeros due to the lack of indicators to reflect

In this example, fields 040 and 070 coincided, but this does not always happen.

Section 2:

Since 6-NDFL is compiled for six months, this part of the calculation reflects data for the last three months.

Example of reflecting an advance:

Do I need to show the payment?

An advance is a mandatory payment that every employer must make monthly. Article 136 of the Labor Code of the Russian Federation requires the division of salaries into two parts, each of which is paid at least every half month.

In form 6-NDFL there are two sections, in the first the data is presented cumulatively from the beginning of the year, in the second - for the last quarter.

In the first section of form 6-NDFL it will be reflected in the lines:

- 020 – accrued income, will include all wages accrued from the beginning of the year to the end of the quarter, including the advance payment for the last month of the reporting or tax period;

- 040 – calculated personal income tax, including income tax on the advance for the entire period will be shown here;

- 070 – withheld personal income tax, the tax on the advance amount for the last month of the quarter will not be shown here, since the deduction is made only in the month following the billing month.

In the second section of 6-NDFL, the first part of the salary will be taken into account when filling out the lines:

- 100 – the date of actual receipt of income is indicated; for an advance, this is the last day of the month in which it was accrued;

- 110 – tax withholding day – date of payment of wages for the second half;

- 120 – the tax payment deadline is the day of deduction or the next day;

- 130 – the amount will include the advance payment from which personal income tax was withheld in the last quarter;

- 140 – withheld tax, personal income tax from the advance payment for the last month of the quarter will not be shown in this line.

This is interesting: Instructions for accepting goods into the warehouse

Thus, the salary advance affects the content of many fields of 6-NDFL; they must be filled out correctly. How exactly income tax should be reflected in the report is discussed below.

How to show it in the report?

Each employer sets the terms for paying wages at the enterprise:

- advance payment – in the period from 15 to 30 (31) of the estimated monthly period;

- balance – from 1st to 15th of the next day.

Line 020 of Section 1 of Form 6-NDFL will indicate the advance amount accrued for the entire reporting period , including the last month.

Field 040 reflects the amount of personal income tax that has been calculated. The moment of calculation falls on the date of actual receipt of income; for salaries for the first and second half, the date is the same - the last calendar day .

In field 070 the situation is different. Only the personal income tax that is withheld is shown here. Withholding from the salary for the first part is made upon actual payment of the balance of the salary - this day falls in the month following the reporting period. Therefore, personal income tax from the advance for the last month of the quarter is not shown in this line.

But 070 will include the withheld personal income tax from the advance amount paid for December last year, since the tax is withheld already in January of the next year, which is included in the reporting period for which the report is submitted.

Explanations for filling out these lines are given in the example below.

In field 100 of section 2 , the date of actual receipt of income is indicated; for an advance, this is the last day of the month in which it is accrued.

In field 110 - tax withholding date - the day set as the payment deadline for the remaining salary .

In field 120 – the date of transfer; the date may coincide with line 110 or be the next one.

130 and 140 do not reflect the advance payment and the tax on it for the last month of the quarter.

That is, when filling out section 2, the advance payment (as part of the total salary) for the month preceding the last quarter, as well as for the first two monthly terms of this quarter, is first indicated. For the last - the advance will be shown in the report for the next period.

Let us explain the features of reflecting the payment in question in 6-NDFL using the example below.

Filling example

Calculation of 6-NDFL is submitted for 9 months of 2018 .

Sample reflection in section 1:

- 020 – 25000 will be included in the total amount of this line;

- 040 – personal income tax from 25,000 will be calculated on September 30, 2018 and will also be included in this line;

- 070 – Personal income tax will be withheld at the beginning of October 2020 and will not be reflected in this field.

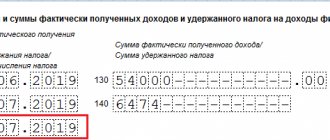

Sample reflection in section 2:

Advance payment for September in form 6-NDFL when filled out 9 months in advance. will not be shown, it will be included in the calculation for 2020 and will be reflected first in the list.

- 100 – 30.09.2018;

- 110 – 05.10.2018;

- 120 – 06.10.2018;

- 130 – will be shown as part of the total salary;

- 140 – personal income tax withheld from the total salary will be indicated.

Sample of filling out section 2 6-NDFL for 2018:

Personal income tax and advance: dates and deadlines

The employer must calculate personal income tax on the date of actual receipt of income (clause 3 of Article 226 of the Tax Code of the Russian Federation) and withhold tax from the employee’s wages upon actual payment (clause 4 of Article 226 of the Tax Code of the Russian Federation). For wages (including advance payments), the date of receipt of income is the last day of the month for which the wages were accrued (clause 2 of Article 223 of the Tax Code of the Russian Federation).

When paying an advance on salary, do not withhold personal income tax. Calculate personal income tax based on the results of the month for which income was accrued (clause 3 of Article 226 of the Tax Code). Withhold the tax when you pay your salary for the month (clause 4 of Article 226 of the Tax Code). The date of receipt of income in the form of salary is recognized as:

- the last day of the month for which it was accrued;

- the last day of work of an employee in the organization if he is dismissed before the end of the month.

Online magazine for accountants

Personal income tax on them. The absence of lines, as a rule, is based on tax legislation, since: Get 267 video lessons on 1C for free:

- Free video tutorial on 1C Accounting 8.3 and 8.2;

- Tutorial on the new version of 1C ZUP 3.0;

- Good course on 1C Trade Management 11.

- the employer should calculate personal income tax on the date of actual receipt of income by the employee, based on clause 3 of Article 226 of the Tax Code of the Russian Federation;

- tax is withheld from the employee’s salary upon actual payment, based on clause 4 of Article 226 of the Tax Code of the Russian Federation;

- The actual date of receipt of income in the form of salary and advance payments is considered to be the last day of the month for which income is accrued, based on clause 2 of Article 223 of the Tax Code of the Russian Federation.

Consequently, on the date of payment, the advance is not recognized as income, and therefore personal income tax is not withheld from the advance amount.

Example of filling out 6-NDFL: advances

The amount of the advance paid is not shown separately in Form 6-NDFL. The advance will be reflected in the salary for which it was issued.

Example 1

The LLC has been operating since February 2020. Until the end of the first quarter of 2020, salary accruals amounted to RUB 738,000. (personal income tax - 95,940 rubles), including:

- On February 22, 2019, a salary advance was issued (RUB 300,000);

- On 03/05/2019 the final payment for February was made (RUB 438,000).

Example of filling out 6-NDFL:

Example 2

For May 2020, the employee was paid a salary of 63,218 rubles. Personal income tax at a rate of 13% is 8,218 rubles. On 05/20/2019, the employee was paid an advance in the amount of 25,000 rubles, the final payment was made on 06/03/2019 in the amount of 30,000 rubles. To simplify, let’s assume that the employee had no other income for the six months.

Then, as part of 6-NDFL:

- on line 100 “Date of actual receipt of income” - 05/31/2019;

- on line 110 “Tax withholding date” - 06/03/2019;

- on line 120 “Tax payment deadline” - 06/04/2019;

- on line 130 “Amount of income actually received” - 63,218;

- on line 140 “Amount of tax withheld” - 8,218.

Example 3

Let’s say a company gave an employee an advance on June 18, 2020 in the amount of 25,000 rubles. The accountant does not withhold personal income tax from this amount. The employee received the remaining second part on July 3.

The monthly salary amounted to 50,000 rubles. The accountant withheld personal income tax from the entire amount at once - 6,500 rubles. I transferred the tax on July 4th. In the second section of the 6-NDFL calculation it will be like this:

Deadline for submitting 6-NDFL for the 1st quarter of 2020

Line 140 of Section 2 also shows the amount of tax withheld, broken down by the timing of its transfer to the budget. The condition that line 070 is equal to the sum of lines 140 was previously indicated by the Ministry of Finance in a letter on control ratios dated January 20, 2016 No. BS-4-11 / [email protected] But in the light of new clarifications from the Federal Tax Service, this equality cannot be observed (letters from the Federal Tax Service of Russia dated February 12 .2016 No. BS-3-11/ [email protected] , dated 02/18/2016 No. BS-3-11/ [email protected] ):

- Since line 070 is filled with a cumulative total, and the sum of the lines is 140 sec. 2 reflects the tax withheld for a certain quarter.

- If there are carryover amounts of tax withheld in one reporting period, but due to the transfer period falling within the next one.

For example, when withholding personal income tax from vacation pay in December, the deadline for its payment is 1 day after the weekend - January 9 (since December 31 is usually a day off), and the amount of tax withheld will be entered in cell 140 for the 1st quarter. But this personal income tax will not be included in the amount of line 070 6-personal income tax for the 1st quarter, since it is already reflected in the amount of line 070 in the reporting for the previous year. The same will happen with disability benefits accrued and issued in December.

Or, let’s say, in March 2020, personal income tax was withheld when income was issued, and the last day to pay the tax was April 1, since March 31 is Sunday. Then these values will not appear in cell 140 for the 1st quarter, but will appear in line 070.

According to the control ratios, approved. by letter of the Ministry of Finance dated March 10, 2016 No. BS-4-11/ [email protected] , comparison of indicators pp. 070 and 040 is excluded. Why is line 040 of section 1 not equal to line 070 of the same section?

Line 040 shows personal income tax, calculated on an accrual basis from the beginning of the year. But the month of accrual of income and tax on this income is rarely equal to the month of withholding personal income tax, since payment of income and withholding of tax for the last month of the quarter falls on the first month of the next quarter. Therefore, calculated personal income tax is shown in line 040 from January to the end of the quarter, for example March, and withheld personal income tax is shown in line 070 from January to the 2nd month of the quarter, for example February.

Matching tax amounts on line 040 and line 070 when filling out 6-NDFL for the 1st quarter of 2020 are possible if the income was paid in the last month of the quarter and the deadline for paying income tax withheld in March (June, September or December) falls on the last working day day of this month.

Title page

Let's look at an example of how an advance is reflected in the 6-NDFL form.

Let’s assume that a company employee received a salary of 40,000 rubles for February 2020. On February 15, 2020, the employee was paid an advance of 15,000 rubles. The salary was paid in full on March 3, 2020 in the amount of 19,800 rubles.

A personal income tax rate of 13% is withheld from the entire amount of accrued wages, and not separately from the advance or from the remaining amount of wages.

Let's do the calculation:

- Personal income tax: 40,000 * 13% = 5,200 rubles;

- Salary: 40,000 – 15,000 – 5,200 = 19,800 rubles.

In the 6-NDFL calculation, the advance payment and the balance of wages are not reflected separately, but rather the full amount of accrued wages for the month is shown. Therefore, the advance in 6-NDFL will be reflected in the following form:

- In the example under consideration, the salary is 40,000 rubles, and is reflected in line 130.

- Personal income tax is 5,200 rubles. and is reflected in line 140.

- The date of actual receipt by the employee of salary for February 2017 for calculating 6 personal income tax is the last day of the month, that is, 02/28/2017;

- The day of final payment of wages for February is 03/03/2017, and is reflected in line 110;

- Transfer 5,200 rubles to the budget. tax is required until the end of the next working day, that is, 03/04/2017:

For form 6-NDFL for 2020, 1st quarter, we will consider an example of filling out later in the article, and we will also tell you in simple language about the rules for filling out the report.

Only tax agents with up to 25 people submit reports on paper. If this rule is not followed, liability is established in Art. 119.1 Tax Code of the Russian Federation. The violator is fined 200 rubles.

Look at the table and check how you should report your personal income tax.

Criteria for determining the format for transmitting the 6-NDFL report

| The number of individuals who received taxable income from the policyholder in the 1st quarter of 2020 (under employment contracts, contract agreements, etc.) | How to submit Form 6-NDFL for the 1st quarter of 2020 |

| From 1 to 25 | In any form (on paper or electronically) |

| 26 or more | Only with an enhanced qualified digital signature via telecommunication channels |

However, in order to avoid misunderstandings and blocking of the account, it is recommended to submit a free-form letter to the tax office about the absence of accruals for wages, contract agreements, etc. in the 1st quarter of 2020.

The procedure for filling out the reporting form indicates that a separate 6-NDFL form is issued for different OKTMO (clause 1.10 of the Procedure). Accordingly, separate forms are filled out for the parent organization and its separate divisions located in different municipalities.

- Fill out the title page, reporting period code – 21.

- In section 1, reflect the total amounts of accruals for the first quarter of 2019. This should include accruals for wages (including vacation pay, bonuses, etc.) for January, February, March 2019, payments under GPC agreements, dividends and other amounts from which personal income tax is calculated. Please note that line 080 (amount of unwithheld tax) includes only amounts that, in principle, cannot be withheld.

- In section 2, enter the amounts of actual tax transfers and withholdings. This group of lines includes those incomes for which the tax payment deadline falls in the 1st quarter of 2020. This could be a salary for December 2020 or for January-February 2019, vacation pay for the first 3 months of the reporting year, dividends and other things.

Below we will describe these points in more detail.

Special questions arise when filling out section 1 of the report.

Fill in lines 010 to 050 separately for each tax rate. All accruals made in the first quarter of 2019 are reflected (but the salary for December 2020 does not fall into these lines, even if it was paid in January 2020).

And the group of lines 060 – 090 is filled in in total for all personal income tax rates.

With section 2 there are fewer difficulties. The amounts for which the personal income tax payment deadline fell in the 1st quarter of 2019 are indicated here.

We will consider examples of filling out 6-NDFL for the 1st quarter of 2020 for individual cases in the following sections of this publication.

Usually, when filling out the cover page of a personal income tax report, accountants do not encounter any particular difficulties. The requirements for the design of this report page are standard and do not differ from the requirements for most other reporting forms.

Below is a sample of filling out the 6-NDFL title page for the 1st quarter of 2020.

Let's consider filling out section 1 of form 6-NDFL for an organization based on the following data:

- Wages for January 2020 were accrued on January 31 (and paid on February 5) in the amount of RUB 300,000. Tax deductions were provided to several employees in the amount of RUB 11,200. Personal income tax was assessed in the amount of 37,544 rubles.

- Payment was accrued and paid under the contract in the amount of 18,000 rubles. January 25, 2020. Personal income tax amounted to 2,340 rubles.

- Wages for February 2020 were accrued on February 28 (and paid on March 5) in the amount of 300,000 rubles. Tax deductions were provided to several employees in the amount of RUB 11,200. Personal income tax was assessed in the amount of 37,544 rubles.

- Vacation pay for March 2020 was paid on March 11 in the amount of 14,000 rubles. Personal income tax was withheld in the amount of 1,820 rubles.

- Dividends for 2020 in the amount of RUB 25,000,000 were accrued and paid on March 18, 2020. Personal income tax is withheld from them in the amount of 3,250,000 rubles.

- Wages for March 2020 were accrued on March 31 (and paid on April 5) in the amount of RUB 285,000. Tax deductions were provided to several employees in the amount of RUB 11,200. Personal income tax was assessed in the amount of 35,594 rubles.

See how the first section of form 6-NDFL is filled out based on this data. Please note that the amount of personal income tax withheld from wages for March 2020 was not included in line 070. It must be reflected in the report for the half year 2020.

Look at section 2, completed based on these data.

- vacation starts on April 1, 2020, but payment was made in March 2020, since labor legislation obliges the employer to transfer vacation pay 3 days before the start of the rest period.

What happens in this case?

Fortunately, in the 1st quarter of 2020 this situation will not cause difficulties. The deadline for transferring personal income tax on vacation pay falls on the last day of the month, but in this case, March 31 is a day off, which means vacation pay will be reflected in both sections of Form 6-NDFL only when reporting for the first half of 2020. But we’ll talk about the December salary, which also often refers to carryover payments, in the next section.

Features of filling out line 070 in 6-NDFL for the 1st quarter of 2020 for the December salary. The reflection of the December salary in personal income tax reporting depends on the date of its actual transfer. It is possible that all wages for December 2020 have already been included in last year’s reporting. This could happen if it was paid before December 28 inclusive. If the payment happened later, then in form 6-NDFL for the 1st quarter of 2020 the following will happen:

- In any case, the amount of the salary itself and the tax calculated on it are already reflected in lines 020 and 040, respectively, in the report for 2018.

- When wages for December are transferred in January of the following year, then tax is withheld in January. Accordingly, in such a situation, the amount of personal income tax on paid income is reflected in line 070 of the report for the 1st quarter of 2020.

- The lines of the second section for December salaries are filled in in the quarter in which the deadline for transferring withheld personal income tax occurs (for personal income tax on income paid on December 29, 2020, this is January 9, 2020).

And for salaries, this date is the last day of the month. It turns out that the advance included in the salary is recognized as actually received income at the end of the month, and at the moment when it is actually paid, tax is not withheld and transferred.

It is also worth recalling that the date of transfer of tax to the treasury must be no later than the day following the payment of wages. For sick leave, this number shifts during the month in which it is paid.

| Person who has violated the law | Amount of administrative fine (RUB) |

| The offense was detected for the first time | |

| Executive | 1 000 – 5 000 |

| Official (accounting violation) | 5 000 – 10 000 |

| Individual entrepreneur | 1 000 – 5 000 |

| Entity | 30 000 – 50 000 |

| The offense was detected again | |

| Executive | 10,000 – 20,000 or disqualification for 1-3 years |

| Official (accounting violation) | 10,000 – 20,000 or disqualification for 1-2 years |

| Individual entrepreneur | 10 000 – 20 000 |

| Entity | 50 000 – 70 000 |

Example 1

Personal income tax and advance payment – dates and deadlines

Form 6-NDFL

6 Personal income tax – a form developed and imposed on legal entities and private entrepreneurs from 2020. Due to this, as well as the lack of established practice, accountants still have questions when filling it out.

For reference! Calculation 6 of personal income tax was approved by order of the Federal Tax Service of Russia No. ММВ-7-11 / [email protected] dated October 14, 2020.

It must be submitted quarterly, the due date is before the end of the month following the last quarter. More precisely, the document is sent to the inspection on the dates:

- April 30 – for the first quarter;

- July 31 – for the second;

- October 31 – for the third;

- March 1 – for the year.

Important information! 6 personal income taxes are not submitted for a quarter if no tax was collected on employee income for the period in question. Zero reporting is not practiced.

For example, in the period March-July the company did not work. Therefore, there is no need to report to the Federal Tax Service for the second quarter. Another example is that a company began operating in November of the year, which means it only submits annual accounts.

A special feature of the form is the difference in filling out the first and second sections. So, in the first block the values are indicated for the entire time from the beginning of the year, and in the second - for the last 3 months. The form must report state income and taxes on it. This is where the questions begin, since different payments are taken into account according to the instructions of the Federal Tax Service, and not according to a single rule. How is the advance reflected in the form?

Note! According to Article 136 of the Tax Code of the Russian Federation, the employer is obliged to pay advances to staff. Salaries must be paid 2 times a month - every 15 days. Failure to comply with the provisions of the article entails the collection of fines from the organization.

Advance and fixed advance payment in 6 personal income taxes - what is the difference

An advance is a payment included in the salary; accordingly, the same standards apply to it as for earnings for a full month.

For example, an employee is approved for a salary of 20,000 rubles. per month. The employer, observing Article 136 of the Labor Code of the Russian Federation, pays him 8,000 rubles. on the 10th of the month and the remaining 12,000 on the 25th.

A fixed advance payment is a completely different concept that applies to individual entrepreneurs working on OSNO. As income tax payers, they pay it based on the approximate annual income of the previous year 3 personal income tax. These payments are prepayments.

Further, when the year ends, the individual entrepreneur calculates the base based on real, rather than approximate income, deducts advance payments from the annual tax and pays the balance to the Federal Treasury.

If he had the right to a professional deduction, he uses it and reduces the basis even more, so that it can become zero, and then he will have an amount overpaid to the treasury, which can be returned or left for the future to offset new accruals. The opposite situation is also possible - the need to pay extra to the state treasury due to an increase in real income compared to the approximate one.

Important! 6 personal income tax reflects salary advances, and fixed advance payments have no relation to this form, since they relate not to employees, but to the individual entrepreneur himself.

The entrepreneur will record fixed advances in his 3 personal income tax declaration, which must be submitted to the inspectorate at the end of each year.

In which line 6 of personal income tax is the salary advance reflected?

In calculation 6 of personal income tax, it is necessary to reflect the salary advance in the second section, in line 130 - “Amount of income actually received.”

Note! In Form 6 Personal Income Tax there is no special column for advances; they relate to total income accrued as of a certain date.

In each block of the second section, all income accrued on the date indicated opposite, in column 100, is recorded. Moreover, there is no division by employee; payments for all employees are included here. And for personalized accounting, another form is provided - 2 personal income taxes.

In simpler terms, line 130 will show advances and other amounts received by the state during the calendar month and reported as paid on the last day of the base payment month. Next I will talk about accounting for advances in calculations in more detail and give examples.

How to reflect an advance in 6 personal income taxes

According to Article 226 of the Tax Code of the Russian Federation, income tax is calculated on the date of actual issue of income. And according to Article 223 of the Tax Code of the Russian Federation, the date of payment of income in the form of wages or salary advance is the last day of the month.

Attention! No tax is charged on the advance payment, as stated in the letter of the Federal Tax Service of Russia No. BS-4-11/4999 dated March 24, 2020, but 13% of the full salary is withheld when paying the second part of the month’s earnings.

For example, an employee receives a salary of 30,000 rubles. Of these, 15,000 - for the first half of the month, 15,000 rubles. - for the second. When paying the advance, the employee will receive 15,000 in full, and upon final payment - 11,100. Why: 30,000 - 13% = 26,100. The tax is withheld from the main calculation, and the advance is paid in full.

Next, the tax is transferred to the treasury on the day of deduction or on the next business day. Based on these theses, the advance is not reflected as a separate date in 6 personal income tax, since it is not considered full-fledged income on the day of issue (therefore, income tax is not levied on it).

Important! The advance payment in the calculation of 6 personal income tax is added to the basic salary and is considered part of the salary.

Using examples, the rules for reflecting advance payments will become clearer.