Is an invoice considered a contract?

Contractual relationships between partners arise when an invoice for products or services is paid. It does not matter whether the agreement is in writing. The relevant provisions are specified in Articles 433, 434, 438 of the Civil Code of the Russian Federation. Will an invoice be considered a contract? Everything is determined by the method of drawing up the agreement.

In what cases will an invoice be an agreement?

In a number of situations, to form a contractual relationship, you only need an invoice for payment. There is no need to draw up an agreement at all. The transaction is accompanied by an invoice executed in the form of an offer. A legally significant offer is an invoice with all the necessary essential conditions.

How to determine whether an invoice will be considered a contract? It is necessary to establish whether there are significant provisions in it. Consider these essential conditions:

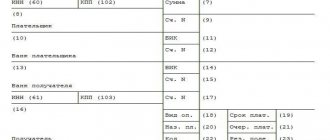

- Name of the product being sold.

- Product volume.

- Unit of measurement.

- VAT.

- The names of both parties, their details.

- VAT rate.

- The time frame within which payment for the goods must be made.

- Signatures and their decoding.

It is recommended to put the organization's stamp on the account. This will give the document additional legal weight, which will become an argument in legal proceedings. An invoice, submitted in the form of an offer and paid, is a substitute for an agreement.

In what cases will an invoice not constitute an agreement?

In some cases, an invoice cannot be considered a contract even if it contains essential terms. This is relevant for the following forms of transactions:

- Sale of real estate (Article 550 of the Civil Code of the Russian Federation).

- Sale of an enterprise (Article 560 of the Civil Code of the Russian Federation).

- Lease of buildings (Article 651 of the Civil Code of the Russian Federation).

All these transactions are always related to the execution of an agreement. This is partly due to the fact that these are transactions involving large amounts of money. The larger the amount, the more important documentary evidence is.

Why does the bank need to receive confirmation of payment?

Protecting the client from unauthorized debits is one of the tasks, within which bank employees can stop the payment and additionally ask to confirm the transaction.

Practice shows that if money disappears from a card account at Sberbank, employees will conduct an investigation, the conclusion of which will be information that the client incorrectly stored secret information and is in fact himself to blame for the disappearance of funds. In such cases, for some reason, there are no requests to confirm the debiting of funds. Under the guise of protecting funds, Sberbank collects information about the origin of savings and recipients of funds.

Ordinary transactions may be subject to additional confirmation:

- transfer to a card to another individual;

- payment for housing and communal services, when the client enters the organization details independently;

- purchasing goods on the Internet;

- calculations in social networks.

Sberbank employees will definitely not process a payment without calling the client in three cases:

- if the daily limit for the transfer operation is exceeded;

- if the transfer is made to a client’s card abroad;

- when replenishing the balance of a foreign phone number.

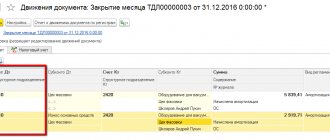

For normal cash flow, the payment goes through several statuses:

- "Entered";

- "Awaiting confirmation";

- "Waiting to be processed";

- "Processing";

- "Completed."

Under normal circumstances, all payment statuses are processed instantly; time may be spent waiting for an SMS with a password to confirm the operation. Information about the execution of the transfer appears in the Sberbank Online system, after which in the “History” menu you can view the transaction receipt with the bank’s mark.

READ The procedure for making payments using a barcode via phone in Sberbank Online

When a payment, after confirmation by SMS code, does not go into the “Completed” state for a long time, you should look at its status.

If the information says “Partially filled”, you need to check additional fields and check the recipient’s details for a possible error. If the status of the document is “Waiting for confirmation at the contact center”, you must contact the bank at 900. When the payment cannot be made, the bank assigns the operation the status “Refused”, in which case brief information about the reasons can be viewed by hovering the cursor over the status, behind Please contact your bank for details.

The client can independently cancel the operation at any stage, before the document is executed.

Important! Sberbank never asks for passwords or additional steps to cancel a payment. If the program prompts you to enter a code to cancel the transfer, you must immediately exit the service and contact the bank to prevent fraudulent activities.

Invoicing without agreement

Is it possible to issue an invoice without drawing up an agreement? It is possible under two circumstances:

- Presence of essential conditions in the receipt (sales volume, product name).

- The transaction is not included in the list of transactions for which the existence of an agreement is mandatory.

Payment for goods by the buyer means agreement with the terms proposed by the seller. In court, such transactions are recognized as a one-time transaction. That is, the rights and obligations of participants relate to only one transaction.

Useful tips

The procedure associated with additional confirmation of transfers is not approved by Sberbank clients. In fact, the owners of the funds must spend additional time talking on the phone and answering questions that the bank does not have the right to ask (According to the Regulation of the Central Bank of the Russian Federation No. 383-P, clause 1.25, the bank should not interfere in the contractual relations of clients). The economic situation in Russia shows that banking secrecy ceases to be such, and credit organizations indicate the direction of cash flow.

To avoid unnecessary communication with bank employees and preserve the remaining confidential information, you should be careful about the limits for transactions through Sberbank Online. The bank often changes the amounts available for transfers, so clients should check the terms of transfers and familiarize themselves with payment restrictions before making a transaction.

Experts' opinion

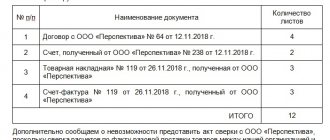

Let's look at an example. The company only has an invoice for the provision of services. It contains these provisions: name, quantity sold, cost, availability of payment order. Can this invoice serve as confirmation of the execution of a supply agreement? Yes, if the following conditions are met:

- The document is addressed to a specific person.

- From the invoice you can understand who exactly issued it.

If all these conditions are met, then the check is analogous to the execution of a supply agreement in a simple form. How is this conclusion justified? Let's look at it in detail. There are two definitions of a contract from a legal point of view:

- A contract is a transaction that fixes the will of several people or firms (Article 153-154 of the Civil Code of the Russian Federation).

- An agreement is a document fixing the conditions for the occurrence of obligations.

Paragraph 1 of Article 161 of the Civil Code of the Russian Federation states that transactions are carried out in writing. But drawing up an agreement is not the only method of completing a transaction. An agreement, on the basis of paragraph 2 of Article 432 of the Civil Code of the Russian Federation, can be concluded through the submission of an offer. An offer is a proposal to conclude an agreement. One participant makes an offer, and the other accepts this offer. Paragraph 2 of Article 434 of the Civil Code of the Russian Federation also states that an agreement can be concluded through an exchange of papers. Another way to conclude an agreement is to fulfill the terms of the transaction (clause 3 of Article 434, clause 3 of Article 438 of the Civil Code of the Russian Federation). For example, this could be the shipment of goods, the execution of services.

The considered methods of concluding an agreement are used if the law does not have specific requirements for the transaction being made (Article 434, 550 of the Civil Code of the Russian Federation). For example, if it is not a real estate transaction. That is, if the offer contains all the essential conditions, it replaces the contract. Payment by check is an acceptance, implying the conclusion of a contract. In this case, there is no document signed by the buyer and seller. But it does not matter. This conclusion is confirmed by these regulations:

- Government Decree VAS No. 981/98 of October 6, 1998.

- Resolution of the Federal Antimonopoly Service of the North-Western District No. A44-80/2008 dated May 4, 2009.

- By FAS Resolution No. Ф09-1968/09-С5 of April 13, 2009.

Why even raise the question of whether a check can be a contract? This becomes relevant when conflict situations arise. This is especially important in the context of litigation. Let's look at an example. The company began to cooperate with the supplier. She orders products from the latter for a certain amount. There was a need to return the product due to the fact that a defect was discovered. It is the receipt that is the basis for the return. In addition, it serves as confirmation of the transaction.

When you don't need an invoice

If an invoice can replace a contract, is the reverse true? This is also a fundamental question. If errors are made in the accounting department, a fine may be imposed on the company. Therefore, it is important to study which documents are interchangeable.

Do I need to issue an invoice for payment if there is an agreement? An invoice may not be issued if the agreement contains this information:

- Rates.

- Price.

- Availability of VAT.

- Excise tax.

- Payment period.

That is, all essential terms must be known from the contract. An example is an invoice agreement, which can replace a regular contract. This document indicates the list of products sold, their cost, and the total amount of delivery.

However, there are cases when an invoice for payment is required. For example, it is relevant if there is a general agreement. This could be an agreement for the provision of housing and communal services, cellular services. In such agreements, information about the transaction is usually not specified. They do not contain information about the cost of the service/product. Therefore, a check is needed to specify a certain operation.

FOR YOUR INFORMATION! To summarize: an invoice and a contract are different documents. However, sometimes they can replace each other. But this is not relevant for all situations.

Methods for confirming payments to Sberbank Online

All transactions made through Sberbank Online require confirmation, with the exception of payments saved in the template and frequently made transactions. For payments that the credit institution deems suspicious, you will need to confirm the payment again.

Confirmation via SMS

You can check the correctness of the entered data and send the transaction for processing using a one-time password. The secret code can be obtained from an ATM - the command is called “Get a check with one-time passwords”.

If the client uses the Mobile Bank service, you can receive confirmation of payment via SMS. The text message contains information about a specific transaction and a one-time password, which must be entered into a special field in the Sberbank Online program. The same procedure is provided for payments through Internet sites.

Before entering a one-time password, you must check the details specified in the message and the actual data entered into the program.

After entering the secret code, click “Confirm”; if the numbers are entered correctly, the operation will move to the next status.

READ Procedure for paying an invoice through Sberbank Business Online

Confirmation via contact center

A call to the call center should be made when the transaction confirmed by SMS code is not reflected as “Executed”. The Sberbank operator can independently call the phone number specified in the application form for receiving a card, inquire about the payment details and identify the client.

The procedure is important, and if a bank employee suspects that it is not the account owner speaking on the line, he will cancel the operation, temporarily block the card, and the client will have to visit the Sberbank office for further investigation.

If the phone number specified in the application form and the number to which the Mobile Bank is connected are different, a bank employee will make a call to both numbers. Each call must be answered by the account holder, otherwise the transaction will be cancelled. It is better not to transfer SIM cards to third parties, the numbers of which appear in financial documents.

You can call the contact center yourself. The number for calls from mobile devices is 900. You should call from the phone number specified in the application for the card, or from the number connected to the Mobile Bank. When a client contacts the bank from another phone, the operator will take a long time to find out the reasons why a call from the number registered in the system is impossible, after which he will fully identify the client.

Usually the conversation takes 5-10 minutes; during communication, the operator will clarify the payment details and client data: full name, card number, passport details and code word. The payment will be executed if the bank employee is satisfied with the information received.