What is this in accounting?

According to PBU 9/99 “Income of the organization”, revenue is recognized as income from ordinary activities - revenue from the sale of goods or products, as well as receipts that are associated with the provision of services and performance of work.

In accounting, revenue does not mean any income from sales, but only income from the main type of activity, while the remaining income is recognized as other income (we talked in more detail about how revenue differs from income and other accounting concepts here). Reference! In organizations in which the main subject of activity is the provision of assets under a lease agreement for temporary use, revenue is rent receipts.

In accounting, revenue is recognized subject to the following conditions:

revenue can be determined in terms of value;- the organization has the right to receive this revenue;

- as a result of the operation, the economic benefits of the company will definitely increase;

- the property rights to the product (goods) have been transferred to the buyer or the work has been accepted by the customer (service has been provided);

- the costs of this operation can be determined.

That is, revenue is considered to be an increase in economic benefits that leads to an increase in the assets of a given organization. Often, revenue is recognized without actual cash receipts (accrual basis). But small businesses have the opportunity to record revenue using the cash method - when funds are received. Read this material about what to do when proceeds from a buyer are credited to your bank account or cash register.

To record revenue in accounting, account 90 “Sales” is used (we tell you more about which accounting account revenue is displayed on here). Sub-accounts are opened for account 90:

- subaccount 90.1 – records are kept of receipts considered revenue;

- subaccount 90.2 – records are kept of the cost of sales (read the difference between the concepts of “revenue” and “cost” here);

- subaccount 90.3 – records of VAT amounts are kept;

- subaccount 90.4 – records of excise tax amounts are kept;

- subaccount 90.9 – necessary to reflect the financial result of the organization’s sales for the reporting month.

Income recognition procedure

Note 1

Funds received as a result of any operation must be reflected in the accounting records of the enterprise. The recognition procedure depends directly on whether the appearance of these funds is related to the main activity of the company or not.

All organizations, except insurance and credit, which are legal entities, are required to consolidate information on income received in accordance with the rules outlined in PBU 9/99 “Income of the organization.”

PBU9/99 is also applied by non-profit organizations, but exclusively in relation to income received from business activities.

The income of an enterprise, according to the definition set out in paragraph 2 of PBU9/99, is considered to be an increase in the economic benefits of the enterprise from the receipt of assets or the repayment of liabilities, leading to an increase in the capital of this company.

However, not all funds and property received by the organization are income. In accordance with clause 3 of PBU9/99, the following receipts are not recognized as income of the enterprise:

Finished works on a similar topic

- Coursework Recognition of income 430 rub.

- Abstract Recognition of income 230 rub.

- Test work Recognition of income 210 rub.

Receive completed work or specialist advice on your educational project Find out the cost

- amounts of VAT, excise taxes, export duties and other similar mandatory payments;

- under commission, agency and similar agreements in favor of the principal, principal and the like;

- advance payment for goods, products, works or services;

- advances in payment for products, goods, works, services;

- deposit amount;

- funds as collateral;

- funds to repay a loan.

Basic definitions and industry terms

The most comprehensive definition of a service as a result of the activities of an economic entity is given in the Instructions for filling out the indicator “Volume of paid services to the population” in federal statistical observation forms. According to paragraph 3 of the Guidelines, services are understood as useful results of production activities that satisfy certain needs of citizens, but are not embodied in a material form that could be subject to property rights.

In search of a definition of tourism and hotel services, we had to turn to the Model Law on Tourism Activities. Although this legislative act is advisory, we suggest that you familiarize yourself with its wording. So, Art. 1 of this Law proposes that tourism services be understood as any actions carried out by subjects of the tourism industry at their own discretion or at the specific request of consumers for tourism purposes, including the formation and promotion of tourism products.

From this definition it is clearly seen that the formation and promotion of a tourism product is, although the main, but not the only tourism service provided by subjects of the tourism industry to consumers. The provision of tourism services by the Model Law on Tourism Activities is characterized as an orderly process of formation, production, promotion and marketing, distribution (booking, reservation), sale, delivery and execution of individual, complex tourism services and tourism products.

In the same article. 1 of the Model Law on Tourism Activities contains a definition of hotel services (accommodation services). Accommodation services are services of the hospitality industry, activities for the maintenance and ensuring the proper level of functioning of the accommodation facility in accordance with the standard and certificate of the assigned classification, promotion of accommodation services, actions (operations) for booking, accommodation and temporary accommodation of guests and tourists in collective, specialized and individual facilities accommodation, as well as other actions (operations) related to the accommodation and temporary residence of citizens and the provision of related services to them, including food and sale of goods, utilities and personal services.

As you can see, accommodation and temporary accommodation of guests is the main, but not the only service in the hospitality industry. The provision of hotel services involves the provision of accommodation services to the consumer (by order of the latter). To the essential terms of the contract for the provision of hotel services Model Law on Tourism Activities (Clause 7 of Art.

Currently there are two definition options:

- By accrual.

- Upon receipt of funds.

The second method of revenue recognition can only be used by small enterprises that are considered such in accordance with paragraph 1 of Art. 4 of the Federal Law of July 24, 2007 No. 209-FZ. In accordance with paragraph 4 of Art. 6 of Federal Law No. 402-FZ of December 6, 2011, they have the right to conduct simplified accounting and not apply a number of existing Accounting Regulations (Information of the Ministry of Finance PZ-3/2015). All others must use the accrual method.

Features of accounting and tax accounting

Based on the name, the main difference between accounting and tax accounting is their regulatory system. Accounting is regulated by Federal Law No. 402-FZ dated December 6, 2011 “On Accounting” and other legislation in the field of accounting, which is a four-level system. Tax accounting, accordingly, is based on tax legislation and, first of all, the Tax Code of the Russian Federation.

Accounting and tax legislation, as a rule, in relation to individual objects or operations presents variability in their accounting. This necessitates the organization choosing a specific option, which is enshrined in the Accounting Policy. For example, choosing a depreciation calculation method for accounting and tax purposes.

For these purposes, the organization develops and approves Accounting Policies for accounting purposes and Accounting Policies for tax purposes.

It must be borne in mind that in accordance with the Tax Code of the Russian Federation, tax accounting is a system for summarizing information to determine the tax base for income tax (Article 313 of the Tax Code of the Russian Federation). However, in a broader sense, tax accounting is a system for determining taxable indicators for all taxes, not just income tax.

In what documents is this amount reflected?

To reflect revenue from the sale of products (performance of work or provision of services) in accounting, it is necessary to have documents that confirm the transfer of property rights to these products to the buyer. Sources of information about the company’s revenue are the following documents:

- Source documents:

- contracts with clients for the sale of products, services and works;

- waybills;

invoices;

- invoices for delivery of finished products;

- requirements for product release;

- warehouse cards;

- log of received and issued invoices;

- sales book;

- invoices for the sale of finished products, bills of lading, cargo customs declarations;

- turnover sheets, quantitative and total cards;

- certificates of services rendered or work performed.

- Analytical and synthetic accounting registers:

- main book;

- order magazines No. 10, No. 11 and No. 15;

- statement No. 16.

General provisions on revenue recognition in accounting

— the organization has the right to receive revenue arising from a specific agreement;

— the amount of revenue can be determined;

— there is confidence that as a result of a specific transaction there will be an increase in the economic benefits of the organization (the organization received an asset in payment or there is no uncertainty regarding the receipt of the asset);

— the service is provided;

— the expenses that have been incurred or will be incurred in connection with this operation can be determined.

If at least one of the above conditions is not met, then the organization’s accounting records recognize accounts payable, not revenue.

We invite you to read the speech of the lawyer in the debate when admitting guilt

Of the conditions listed above, we will pay special attention to the provision of services. Obviously, for each specific service it is possible to select individual signs indicating its provision.

— on the procedure for recognizing revenue;

— on the method for determining the readiness of services, revenue from the provision of which is recognized as readiness.

So, an alternative procedure for recognizing revenue (as services are ready) is fixed in the accounting policy for accounting purposes, as well as approaches to determining the degree of readiness of services. Most often, construction organizations enjoy the right to recognize revenue “as they are ready,” however, other business entities are not deprived of the opportunity to choose this option for recognizing income from their core activities.

Thus, we have identified two key questions that need to be answered in order to correctly and timely reflect revenue from the provision of services (tourism and hotel services): when is the service provided and (or) when is it ready?

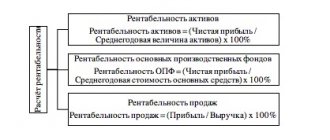

Accounting info

The financial result of the economic activity of an enterprise is determined by the profit or loss indicator formed during the calendar (business) year.The financial result is the difference between the amounts of income and expenses of the enterprise. The excess of income over expenses means an increase in the property of the enterprise - profit, and the excess of expenses over income - a loss. The financial result obtained by the enterprise for the reporting year in the form of profit or loss, respectively, leads to an increase or decrease in the enterprise's equity capital.

The accounting provisions “Income of the organization” (PBU 9/99) and “Expenses of the organization” (PBU 10/99), approved by Orders of the Ministry of Finance of Russia dated May 6, 1999 No. 32n and No. 33n, respectively (with amendments and additions), recognize an increase in , and expenses - a decrease in economic benefits as a result of the receipt or disposal of assets, as well as the repayment or occurrence of liabilities, leading to corresponding changes in the capital of the enterprise. These regulations provide a grouping of income and expenses to reflect them in accounting and reporting, provide their definition and the procedure for recognition in accounting.

According to PBU 10/99 (clause 16), expenses are recognized in accounting if the following conditions are met:

• expenses are made in accordance with a specific agreement, the requirements of legislative and regulatory acts, and business customs;

• the amount of expenditure can be determined;

• there is confidence that as a result of a particular transaction there will be a decrease in the economic benefits of the organization. There is certainty that a particular transaction will result in a reduction in the entity's economic benefits when the entity has transferred an asset or there is no uncertainty about the transfer of the asset.

If at least one of the above conditions is not met in relation to any expenses incurred by the organization, then receivables are recognized in the organization’s accounting records.

Depreciation is recognized as an expense based on the amount of depreciation charges, determined on the basis of the cost of depreciable assets, useful life and the methods of depreciation adopted by the organization.

Expenses are subject to recognition in accounting, regardless of the intention to receive revenue, operating or other income and the form of the expense (monetary, in-kind and other).

Expenses are recognized in the reporting period in which they occurred, regardless of the time of actual payment of funds and other form of implementation (assuming the temporary certainty of the facts of economic activity).

Expenses are recognized in the income statement:

• taking into account the relationship between expenses incurred and revenues (correspondence between income and expenses);

• by their reasonable distribution between reporting periods, when expenses determine the receipt of income over several reporting periods and when the relationship between income and expenses cannot be clearly defined or is determined indirectly;

• for expenses recognized in the reporting period when the non-receipt of economic benefits (income) or receipt of assets becomes determined;

• regardless of how they are accepted for the purposes of calculating the tax base;

• when liabilities arise that are not caused by the recognition of the corresponding assets.

According to PBU 9/99, expenses from ordinary activities are revenue from the sale of products and goods, receipts associated with the performance of work, provision of services (hereinafter referred to as revenue).

Revenue is recognized in accounting if the following conditions are met (clause 12 of PBU 9/99):

a) the organization has the right to receive this revenue arising from a specific agreement or confirmed in another appropriate manner;

b) the amount of revenue can be determined;

c) there is confidence that as a result of a particular transaction there will be an increase in the economic benefits of the organization. Confidence that a particular transaction will result in an increase in the economic benefits of the organization exists when the organization received an asset in payment or there is no uncertainty regarding the receipt of the asset;

d) the right of ownership (possession, use and disposal) of the product (goods) has passed from the organization to the buyer or the work has been accepted by the customer (service provided);

e) the expenses to be incurred or to be incurred in connection with this operation can be determined.

If at least one of the above conditions is not met in relation to cash and other assets received by the organization as payment, then the organization’s accounting records recognize accounts payable, not revenue.

An organization may recognize in its accounting revenues from the performance of work, provision of services, sale of products with a long production cycle as the work, service, product is ready or upon completion of the work, provision of service, or production of products in general.

Revenue from performing specific work, providing a specific service, or selling a specific product is recognized in accounting as it is ready, if it is possible to determine the readiness of the work, service, or product.

In relation to different nature and conditions of work, provision of services, manufacturing of products, an organization may simultaneously apply in one reporting period different methods of revenue recognition, provided for in clause 13 of PBU 9/99.

If the amount of revenue from the sale of products, performance of work, provision of services cannot be determined, then it is accepted for accounting in the amount of expenses recognized in accounting for the manufacture of these products, performance of this work, provision of this service, which will subsequently be reimbursed to the organization.

The financial result of an enterprise’s economic activity is formed from two of its components, the main of which is the result obtained from the sale of products, goods, works and services, as well as from business transactions that constitute the subject of the enterprise’s activities, such as the rental of fixed assets for a fee, the transfer for paid use of intellectual property and investment in the authorized capital of other enterprises.

The second part, in the form of income and expenses not directly related to the formation of the main operating financial result (financial result from sales), forms other financial result, which includes operating and non-operating income and expenses. If during the reporting period an enterprise made a profit from the sale of products, goods, works, services and other operations that constitute the subject of its activities, then its entire financial result will be equal to the profit from sales plus other income minus other expenses. If an organization receives a loss on sales, its total financial result will be equal to the amount of the loss on sales plus other expenses minus other income.

The overall financial result obtained in this way is adjusted to the amount of losses, expenses and income due to extraordinary circumstances of the enterprise’s economic activity.

The realized financial result is determined at the end of each reporting period. If the financial result is profit, then it is reflected in the credit of account 99 “Profits and losses” in correspondence with the debit of account 90 “Sales”. If the result of the enterprise’s activities is a loss, then it is reflected in the debit of account 99 “Profits and losses” in correspondence with the credit of account 90 “Sales”.

Other income and expenses included in the overall financial result of the organization are reflected in accounting separately from the financial result from sales on account 91 “Other income and expenses” by “expanded” reflection of individual items of income and expenses during the reporting period.

In financial statements of profit and loss, income may be shown less related expenses related to these income in cases where this is required or not prohibited by accounting rules or if individual items of income and related similar items of expenses are not significant to the characteristics financial position of the organization.

Other income is reflected in the credit of account 91 “Other income and expenses” in correspondence with the debit of cash accounts, settlements, inventory and other relevant accounts.

Analytical accounting for account 91 “Other income and expenses” is carried out for each type of other income and expenses. At the same time, the construction of analytical accounting for other income and expenses related to the same financial or business transaction should ensure the ability to identify the financial result for each operation.

It should be borne in mind that entries in accounts 90 and 91 are made cumulatively from the beginning of the reporting year so as to ensure the formation of the necessary information for drawing up a profit and loss statement (form No. 2).

The balanced result of account 91 “Other income and expenses” in the form of profit and loss is written off monthly, as well as the balance of account 90 “Sales”, to the final savings account of financial results 99 “Profits and losses”: the balance in the form of profit is to the credit of account 99 c debit account 91, the balance in the form of losses - to the debit of account 99 from the credit of account 91.

Extraordinary income and expenses are reflected directly on account 91 “Other income and expenses”[7]: income - on credit, expenses - on debit in correspondence with the corresponding accounts for cash, inventory, settlements, etc.

On account 99, at the end of the first quarter, the interim financial result for the first quarter is revealed, at the end of the second quarter - for the first half of the year, at the end of the third quarter - for 9 months of the year and at the end of the fourth quarter - the final financial result for the entire reporting period.

The information structure of account 99 “Profits and losses” for the formation of the final financial result must ensure the receipt of:

1) systemically reliable information about accounting profit - an indicator necessary to determine the taxable base for income tax through appropriate tax adjustment of accounting profit;

2) information on the formation of the final indicator of net retained earnings, which comes to the disposal of the founders (participants) of the enterprise for distribution at the end of the economic and financial year and transferred in December of the reporting year to account 84 “Retained earnings (uncovered loss)”.

The system of accounts reflecting the financial results of the enterprise for the reporting year must contain all the necessary information about the indicators contained in the financial statements of profit and loss (form No. 2).

Analytical data for all accounts of this group participate as turnovers and balances in the formation of profit and loss statement indicators for the reporting year.

At the end of the calendar year, based on the amount of actual accounting profit received by the enterprise for the reporting year, the final calculation of the amount of income tax due to the budget at the established tax rate is made as a matter of priority. In this case, the amount of taxable profit differs from the accounting profit of the enterprise by the amount of those positive and negative adjustments that are established by the Tax Code of the Russian Federation on profit taxation.

A complete list of all adjustments to reported profit to the taxable level is provided in the form of a certificate attached to the tax return for calculating tax on actual profit.

Due to the fact that the profit indicator in the current quarterly reporting does not represent the final financial result, current income tax payments, calculated quarterly, as well as intra-quarter payments, are of an advance nature. This current (essentially, advance) distribution of profit is now reflected during the year in the debit of account 99 “Profits and losses” in correspondence with the credit of account 68 “Calculations for taxes and fees”.

The amount remaining after deducting the tax accrued from profit is called net profit, which does not correspond to international accounting practice. In foreign literature, this term has a different meaning; it means the balanced result of comparing all income and expenses of an enterprise, i.e. the entire financial result.

As Russian accounting practices converge with international accounting and reporting standards, the concept of net profit as remaining at the disposal of the enterprise has practically ceased to exist. Its place was taken by a new concept - “retained earnings of the reporting year.” This part of the profit is now managed by the enterprise after completion of the process of its formation. From the net profit, the enterprise (both before and now) reimburses payments under the sanctions of the relevant authorities for non-compliance with tax rules and payment of similar mandatory payments to social state extra-budgetary funds (pension fund, social and health insurance funds).

These expenses are reflected in accounting as they accrue by recording:

Debit account 99 “Profits and losses”

Credit to account 68 “Calculations for taxes and fees”,

Credit to account 69 “Calculations for social insurance and security”.

From the accounting profit, the enterprise, as a matter of priority, reimburses the costs of paying current payments for income tax, current payments for taxes to the local budget paid from net profit, as well as fines and penalties covered by net profit for non-compliance with tax rules and violation of the procedure for settlements with government agencies. off-budget social funds, payments to which are equivalent to tax ones.

The amount of accounting profit obtained after deducting the listed current expenses is undistributed, i.e. net profit coming to the disposal of the founders of the enterprise for its use after approval of the results of production and financial activities for the past reporting year. In accordance with clause 83 of the Regulations on accounting and financial reporting in the Russian Federation, the financial result of the reporting period is reflected in the balance sheet as retained earnings (uncovered loss), i.e. the final financial result identified for the reporting period, minus taxes and other similar mandatory payments due from profits established in accordance with the legislation of the Russian Federation, including sanctions for non-compliance with tax rules.

In the current financial statements, the financial result is defined as the balance of account 99 “Profits and losses”. In the annual financial statements, this indicator is reflected after the balance sheet reformation carried out in December according to the balance of account 84 “Retained earnings (uncovered loss)”, subaccount 1 “Retained earnings (loss) of the reporting year”, while the corresponding balance on account 99 in the form profit or loss is transferred to account 84, subaccount 1 “Retained profit (loss) of the reporting year.” Retained earnings are credited to subaccount 84-1, and uncovered losses are credited to the debit of the same subaccount.

Comments:

- In contact with

Download SocComments v1.3

| Next > |

Postings

In an organization's accounting, revenue is reflected at the time of its recognition - that is, at the time of transfer or shipment of products. The exception is transactions under contracts where the specifics of the transfer of property rights are specified. When selling products to wholesale customers, the following transactions are recorded:

- D 62 K 90.1 - revenue from sales of goods or provision of services was reflected;

- D 90.2 K 41 - the cost of goods sold or services provided is written off;

- D 90.3 K 68 - VAT is charged on the cost of goods sold or services provided;

- D 51/52 K 62 - payment received from the buyer to a current/currency account.

Posting to retail revenue at the cash register can be done directly with account 90 “Sales”, since there is no need to keep records of settlements with retail customers on account 62 “Settlements with buyers and customers”, since payment and shipment are made simultaneously: D 50 K 90.1 - revenue from retail sales was taken into account.

According to the Instructions for using the Chart of Accounts, to reflect cash transferred for collection, posting to account 57 “Transfers in transit” is used:

- D 57 K 50 - cash was issued to the bank's collection service (you can learn about the procedure for accounting entries when depositing proceeds with the bank here).

- D 51 K 57 - cash was credited to the company's current account.

The procedure for reflecting other income in accounting

According to the Chart of Accounts for accounting financial and economic activities of organizations and the Instructions for its application, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n (hereinafter referred to as the Chart of Accounts), to record information on other income and expenses of the reporting period, it is necessary to use the account 91 “Other income and expenses.”

91-1 “Other income”;

91-2 “Other expenses”;

91-9 “Balance of other income and expenses.”

Receipts of other income are reflected in the credit of subaccount 91-1 “Other income”.

When reflecting revenue in accounting, the following entry is used: D 62 K 90.1 - revenue from the sale of finished products is reflected, the products are shipped to the buyer (work is performed or services are provided).

Simultaneously with this operation, the cost of production is written off. If an organization accounts for finished products at actual cost, then the write-off is reflected by the following entries: D 90.2 K 43 - products written off at actual cost.

If an organization keeps records of finished products at planned (standard) cost, then the write-off is reflected in accounting in the following way:

- D 43 K 40 - finished products are accepted for accounting at planned cost.

- D 90.2 K 43 - finished products are written off at planned cost.

- D 40 K 20 - actual cost is reflected (at the end of the month).

- D 90.2 K 40 - deviations of actual and standard costs are written off (overexpenditure).

- D 90.2 K 40 - reversal: deviations of actual and standard costs are written off (savings).

Important! The cost of services provided or work performed is not reflected in account 43 “Finished products”, and the actual costs for them are written off to account 90 “Sales” from the production cost accounts. - D 90.2 K 20 - costs for services/work are written off.

What is accounting?

The definition of accounting is given in the main accounting regulatory document - in paragraph 2 of Art. 1 of Law No. 402-FZ on “On Accounting”. According to this norm, accounting consists of the systematic formation of documented information about the economic activities of entities and the preparation of financial statements based on this information.

Thus, the main goal of accounting is the formation of reporting sources that reflect the financial condition of an economic entity (organization or individual entrepreneur) and allow internal and external users to judge the results of its activities.

It is on the basis of accounting records that the lender decides whether to provide a loan or loan to a potential borrower. Satisfactory accounting data will allow the organization to take part in an auction or competition, and investors, based on it, will be able to assess whether it makes sense to invest in the company.

The information recorded in the accounting records is no less interesting for internal users: on its basis, the founders and management make informed management decisions.

Now let's see who should do the accounting - Art. will tell you about this. 6 of Law 402-FZ. In this case, an exception is made only for two categories of entities: individual entrepreneurs (as well as private individuals) and foreign representative offices, if they keep records of taxable items in accordance with the established legislative procedure. In addition, it is possible to maintain accounting in a simplified version for some entities:

- small businesses,

- non-profit organizations,

- participants of the Skolkovo project.

All other persons are required to conduct accounting in a general manner, guided by special rules enshrined in the chart of accounts and accounting regulations (PBU), the norms of which regulate certain areas of accounting activities. As of 2020, there are 24 PBUs in operation.

How do the provisions of Russian and international financial accounting differ? Read the article “What are the main differences between PBU and IFRS?”

There is one more feature of accounting - it is almost always carried out only on the accrual basis (clause 5 of PBU 1/2008): business transactions are reflected in the period in which they were carried out, regardless of the period in which cash settlements were made for them. An exception is made only for representatives of small businesses (clause 5 of the information of the Ministry of Finance of the Russian Federation No. PZ-3/2012), who are allowed to conduct accounting on a cash basis. However, in practice, the cash method in accounting can only be used in the case of “manual” accounting: none of the professional accounting programs implements this feature.

And one more nuance. In accounting, the features that determine the differences in its management by enterprises of different industries and forms of ownership are very clearly visible. So, for example, the chart of accounts for commercial organizations was approved by Order of the Ministry of Finance dated October 31, 2004 No. 94n, and the chart of accounts for public sector employees was approved by Order of the Ministry of Finance dated December 1, 2010 No. 157n.

The article “Drawing up a chart of accounts for budget accounting - sample 2018” will help you create a chart of accounts for budget accounting.

Revenue in travel agent accounting

First, let us indicate that travel agency activity is, first of all, an activity for the promotion and sale of tourism products (Article 1 of the Law on the Fundamentals of Tourism Activities). In turn, according to Art. 9 of this Law, the promotion and sale of tourism products is carried out by a travel agent on the basis of an agreement concluded between him and the tour operator.

In this case, the travel agent acts on behalf of and on behalf of the tour operator, and in cases provided for in the agreement concluded between the tour operator and the travel agent, on his own behalf. This indicates the intermediary nature of the relationship between the tour operator and travel agent. In Art. 1 of the Model Law on Tourism Activities, travel agency activities are defined specifically as intermediary ones.

Meanwhile, in practice, various forms of travel agents providing travel services to consumers are used. This includes the conclusion of intermediary agreements between travel agents and the tourists themselves, and the use of mixed agreements, implying that the travel agent, in relation to the provision of one part of the services to the tourist, performs an exclusively intermediary function, and in relation to the other, is a direct performer.

It is not possible to consider in one article the entire palette of relationships between travel agents and other participants in the provision or consumption of tourist services; later in the article we will tell you how and when a travel agent recognizes revenue in the form of intermediary remuneration received from the tour operator for the performance of duties under an agency agreement (classic scheme promotion and sale of tourism products).

Under an agency agreement, the travel agent (agent) assumes obligations to promote and sell tourism products of the tour operator (principal). At the same time, according to Art. 1008 of the Civil Code of the Russian Federation, during the execution of this agreement, the agent is obliged to submit reports to the principal. The procedure and timing for their submission should be fixed in the contract.

In the absence of such reports, reports are submitted by the agent as he fulfills the contract or upon termination of the contract. What is meant by execution of a contract (orders under a contract) in this case? We believe that this is the sale of a tourism product to the end consumer, that is, the conclusion of an appropriate agreement with a tourist.

Thus, unless the agency agreement establishes a different procedure, the travel agent must draw up a report for the tour operator upon the sale of the tourism product. However, usually the parties to an agency agreement still agree on monthly reporting. Clause 3 of Art. 1008 of the Civil Code of the Russian Federation states that a principal who has objections to an agent’s report must inform the agent about this within 30 days from the date of receipt of the report (unless a different period is established by agreement of the parties).

We invite you to familiarize yourself with the Orders, features of drafting and execution

Otherwise, the report is considered accepted by the principal. Acceptance of the report by the principal means that the agent has fulfilled his instructions and has the right to receive the intermediary remuneration provided for in the contract, that is, he has the right to recognize revenue in the appropriate amount in accounting, since all the conditions of clause 12 of PBU 9/99 “Income of the Organization” are met.

Here it is necessary to pay attention to one aspect. The tour operator accepts the agent's report (approves it), guided by his own judgment regarding the date of occurrence in his accounting of revenue from the sale of the tourism product. We mentioned above what the preferences of tour operators are in this regard: the dates of the start of the trip, the end of the trip, the conclusion of an agreement on the sale of tourism products.

That is, it is logical for the tour operator to approve the agent’s report (accept his service) at the moment when there is confidence in increasing its own economic benefits and revenue from the sale of the tourism product is recognized. This approach is quite understandable - the reluctance to incur expenses in the form of payment of agency fees for the sale of tourism products, which the tourist still has the right to refuse, reimbursing the contractor for the actual expenses incurred.

In principle, nothing prevents the tour operator from acting in this way (attention!), securing this approach to the approval of reports in the agency agreement. In this case, revenue (in the appropriate amount) will be recognized in the accounts of the travel agent and tour operator simultaneously (as the most reasonable option, on the start date of the trip).

However, if the agency agreement does not specify the procedure for approving the report, the general procedure enshrined in clause 3 of Art. 1008 of the Civil Code of the Russian Federation: a travel agent waits for objections to the report submitted to the tour operator for 30 days, and then legally considers the report accepted and has the right to recognize revenue in the form of remuneration and demand its payment.

In connection with all of the above, we recommend that the travel agent carefully study all agency agreements concluded with tour operators for their own rights in terms of receiving agency fees and recognizing revenue in accounting, depending on the established procedure for accepting and approving the agent’s reports.

- 20 with a total cost of 500,000 rubles. Travel start date: November 22, 2010, end date: November 29, 2010;

- 15 with a total cost of 300,000 rubles. Travel start date: 11/26/2010, end date: 12/02/2010;

- 10 with a total cost of 200,000 rubles. Travel start date - 12/06/2010, end date - 12/19/2010;

— 25 with a total cost of 1,000,000 rubles. The start date of the trip is 12/30/2010, the end date is 01/05/2011.

a) their monthly submission to the tour operator is provided no later than the 10th day of the month following the reporting month. Five calendar days are allotted for approval of reports from the date of their submission;

b) monthly submission is provided no later than the 10th day of the month following the reporting month. Reports only regarding the sale of tourism products for which the travel start date has arrived are subject to approval (within five calendar days from the date of submission);

c) there is no submission procedure provided.

Option "a". As of November 30, 2010, the travel agent will draw up a report indicating the total quantity and characteristics of tourism products sold in November - 70 items. of different durations and with different travel start dates, with a total cost of 2,000,000 rubles. Calculate and withhold agency fees in the amount of RUB 200,000.

| Contents of operation | Debit | Credit | Amount, rub. |

| In November 2010 | |||

| Payment for tourist products received from tourists | 50 | 62 | 2 000 000 |

| Funds have been deposited into the current account | 51 | 50 | 2 000 000 |

| Funds were transferred to the tour operator | 76-TO | 51 | 1 800 000 |

| The sales of the tour operator's tourism products are reflected according to the agent's report for November 2010. | 62 | 76-TO | 2 000 000 |

| Revenue in the form of agency fees was recognized according to the approved agent report for November 2010. | 76-TO | 90-1 | 200 000 |

Option "b". As of November 30, 2010, the travel agent will submit a report indicating the total quantity and characteristics of tourism products sold in November, with the start date of the trip falling in November - 35 items. with a total cost of 800,000 rubles. Calculate and withhold agency fees in the amount of RUB 80,000.

As of December 31, 2010, the travel agent will indicate in the report the total quantity and characteristics of tourism products sold in November, with the start date of the trip falling in December - 35 items. total cost 1,200,000 rubles. Calculate and withhold agency fees in the amount of RUB 120,000.

| Contents of operation | Debit | Credit | Amount, rub. |

| In November 2010 | |||

| Payment for tourist products received from tourists | 50 | 62 | 2 000 000 |

| Funds have been deposited into the current account | 51 | 50 | 2 000 000 |

| Funds were transferred to the tour operator | 76-TO | 51 | 1 800 000 |

| The sales of the tour operator's tourism products are reflected according to the agent's report for November 2010. | 62 | 76-TO | 800 000 |

| Revenue in the form of agency fees was recognized according to the approved agent report for November 2010. | 76-TO | 90-1 | 80 000 |

| In December 2010 | |||

| The sales of the tour operator's tourism products are reflected according to the agent's report for December 2010. | 62 | 76-TO | 1 200 000 |

| Revenue in the form of agency fees was recognized according to the approved agent report for December 2010. | 76-TO | 90-1 | 120 000 |

Option "c". As of November 30, 2010, the travel agent will indicate in the report the total quantity and characteristics of tourism products sold in November - 70 items. of different durations and with different travel start dates, with a total cost of 2,000,000 rubles. Calculate and withhold agency fees in the amount of RUB 200,000.

| Contents of operation | Debit | Credit | Amount, rub. |

| In November 2010 | |||

| Payment for tourist products received from tourists | 50 | 62 | 2 000 000 |

| Funds have been deposited into the current account | 51 | 50 | 2 000 000 |

| Funds were transferred to the tour operator | 76-TO | 51 | 1 800 000 |

| In December 2010 | |||

| The sales of the tour operator's tourism products are reflected according to the agent's report for November 2010. | 62 | 76-TO | 2 000 000 |

| Revenue in the form of agency fees was recognized according to the agent's report for November 2010. | 76-TO | 90-1 | 200 000 |

Let us outline the main recommendations for travel agents formulated in the article regarding the recognition of revenue from the provision of tourism services in the form of promotion and sale of tourism products. If a travel agent has entered into an agency agreement with a tour operator for the promotion and sale of the latter’s tourism products, the travel agent’s revenue is the remuneration paid to him under this agreement.

The service provided by a travel agent to a tour operator under such an agreement should be considered provided upon the conclusion of the corresponding agreement with the tourist. The moment of recognition of revenue in the travel agent's accounting is determined in accordance with the terms of the intermediary agreement regarding the provision and approval of the agent's reports. In general, the basis for recording revenue arises on the date the tour operator approves the travel agent’s report.

Taxation

Operations for the sale of products (services or works) on the territory of the Russian Federation are objects of taxation, which means that the organization (if it is a VAT payer) is obliged to charge VAT on the sales amount, according to Art. 146 of the Tax Code of the Russian Federation (we talk about what is considered revenue from sales in a separate material). The moment of accounting for the tax base is the earliest of the following dates (Article 167 of the Tax Code of the Russian Federation):

- day of transfer/shipment of goods (provision of services or performance of work);

- the day of payment or prepayment for future deliveries of goods (provision of services or performance of work).

We invite you to familiarize yourself with Migration registration of foreign citizens in the Russian Federation

If the moment of determination of the tax base is set on the day of payment or prepayment for future supplies of goods (provision of services or performance of work) or on the day of transfer of ownership rights, then the moment of determination of the tax base arises on this day (Clause 14 of Article 167 Tax Code of the Russian Federation).

In some cases, the determination of the VAT tax base may not correspond at all to the moment the proceeds from the sale are accrued.

If the contract provides for the transfer of property rights at the time of transfer of goods, proceeds from the sale are recognized at the time of shipment, therefore, the moment the VAT tax base is determined is recognized on the same day.

Reference! The amount of VAT receivable from the buyer (client) is recorded in subaccount 90.3 “VAT”.

To reflect the tax on the day of shipment, the following entry is made in accounting: D 90.3 K 20 - VAT is charged on the proceeds from the sale.

If the contract stipulates that the transfer of property rights occurs at the time of transfer of goods, and the goods are shipped on an advance payment basis, then revenue is accounted for at the time of shipment. In this case, the moment of determining the tax base for VAT is the moment of prepayment against future supplies of goods.

In this situation, the moment of determining the VAT tax base has already arrived, but revenue has not yet been recognized in accounting.

At the time of shipment, revenue is recognized and the tax base is determined again. VAT will be reflected on the day of shipment. And now VAT on the amount of payment or prepayment received on account of future supplies of goods (services or work) is subject to deduction.

Revenue is the most important element demonstrating the effectiveness of the company's financial results. The importance of revenue is proven by the fact that the amount of taxes paid by the enterprise depends on the accuracy of its reflection in accounting - starting with VAT and ending with income tax.

In the event of an accounting error, the company expects incorrect readings in the annual financial statements and problems in interaction with the tax authorities. In this regard, it is necessary to pay a lot of attention to keeping records of revenue and avoid making mistakes.

We talked about how accounting records revenue with and without VAT in a separate article.