Supporting documents

Let's start with the documents. In the last issue, we examined in detail the issue of documentary evidence of a business trip. Let us remind you that when sending an employee on a business trip, the employer needs:

1. Issue an order (decision, order) to send the employee on a business trip.

2. The employee’s business trip days should be noted on the working time sheet (unified forms No. T-12, T-13, approved by Decree of the State Statistics Committee of Russia dated January 5, 2004 No. 1, or an independently developed form).

In connection with the publication of Decree of the Government of the Russian Federation dated July 29, 2015 No. 771, starting from August 8, 2020, the employer is not required to keep records of employees going on business trips, as well as those arriving to him in connection with a business trip. Therefore, the employer himself decides whether or not to keep a log of employees leaving a business trip and arriving on a business trip. Such a decision should be reflected in the organization’s Accounting Policy and (or) other local regulations, for example, in the Regulations on Business Travel.

Upon returning from a business trip, the employee submits the following documents to the employer:

1. An advance report of the posted employee on the amounts spent, approved by the head of the organization, in form No. AO-1, approved. Resolution of the State Statistics Committee of Russia dated August 1, 2001 No. 55, or an independently developed form.

2. Supporting documents attached to the advance report on the rental of living quarters, actual travel expenses (including payment for services for issuing travel documents) and other expenses associated with the business trip.

The main difference between a business trip abroad and a business trip in Russia will be supporting documents confirming travel expenses, which are drawn up in a foreign language. Such documents must be translated into Russian.

If the air ticket is issued in a foreign language, to confirm travel expenses you need to translate some of the ticket details into Russian: Full name. passenger, direction, flight number, departure date, ticket price. You can also get a certificate from an air transportation sales agency in Russian, which contains all the above information. Then you won’t have to translate the ticket details yourself (letters from the Ministry of Finance of Russia dated March 24, 2010 No. 03-03-07/6, dated March 22, 2010 No. 03-03-06/1/168, dated September 14, 2009 No. 03-03-05/ 170).

Previously, representatives of the financial department noted that there is no need to translate an electronic air ticket into Russian (letter of the Federal Tax Service of Russia dated April 26, 2010 No. ШС-37-3/656).

However, in letter dated December 9, 2015 No. 03-07-14/71801, the Russian Ministry of Finance indicated that primary accounting documents drawn up in foreign languages must have a line-by-line translation into Russian in accordance with clause 9 of the Regulations on Accounting and Financial Reporting in the Russian Federation, approved. by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n (hereinafter referred to as Regulation No. 34n).

Such a translation can be made either by a professional translator or by specialists of the organization itself, who are entrusted with such a responsibility as part of the performance of their official duties. In this case, the transfer is provided by the taxpayer organization.

Thus, taking into account the later position of the financial department, it is better to have a translation of the document confirming business trip expenses into Russian. Let us emphasize once again that the translation can be made by any employee of the company who has such a responsibility enshrined in their official authority.

Risk of employee not being allowed to go abroad

According to paragraph 1 of Art. 67 of the Federal Law of 02.10.2007 No. 229-FZ “On Enforcement Proceedings” (hereinafter referred to as the Federal Law “On Enforcement Proceedings”) in case of failure by a debtor-citizen or a debtor who is an individual entrepreneur to fulfill the requirements contained in the deadline established for voluntary execution without good reason in a writ of execution, the amount of debt for which exceeds ten thousand rubles, or a writ of execution of a non-property nature, issued on the basis of a judicial act or being a judicial act, the bailiff has the right, at the request of the claimant or on his own initiative, to issue a resolution on a temporary restriction on the debtor’s departure from the Russian Federation .

However, in practice, the debtor himself often simply does not know about this... until he passes through passport control at the border. On the one hand, the employee did not know and in many cases could not know about the existence of this restriction. For example, many amounts of fines for traffic violations are currently recorded by automatic surveillance and recording cameras, and all documentation is sent to the place of registration/place of residence of the violator (who is automatically recognized as the owner of the car). In Moscow there are a lot of cars that are registered to non-resident citizens. Accordingly, a citizen who permanently works and lives in Moscow, but is registered in another city, in fact very often does not know that he has fines, and, accordingly, does not pay them. If the amount of debt is exceeded (including fines for traffic violations), the bailiff quite reasonably applies the measure provided for in paragraph 1 of Art. 67 Federal Law “On Enforcement Proceedings”.

After the occurrence of an event in the form of an employee’s failure to go abroad, which entails such negative consequences as the employee’s failure to complete an official assignment, disruption of the employer’s plans (even threatening consequences), the employer usually has a question about the possibility and methods of recovery from the employee sent on a business trip abroad, but so and who has not crossed the border, expenses already incurred by the employer: daily allowance, paid tickets, cost of hotel reservation, etc.

In most cases, in such a situation, it will not be possible to recover from the employee the expenses incurred by the employer for his business trip that never took place.

It will be impossible to recover from an employee the average salary (preserved for the days of his business trip in accordance with Article 167 of the Labor Code of the Russian Federation) for days of aimless travel in the form of deduction from wages, since the Labor Code of the Russian Federation in Art. 137 does not contain such cases of deduction from wages.

Daily allowances paid to an employee are not subject to reverse recovery (withholding from wages), since they are not remuneration for work, do not relate to wages, but are of a compensatory nature. The payment of daily allowances is not made in any way dependent on the employee’s actual performance of the labor function; the employee should be paid daily allowances for all days he is on a business trip (see the explanations of Rostrud in letter No. 1024-6 dated April 30, 2008).

The cost of unused tickets and the cost of hotel reservations can be recovered as material damage to the employer if proven

— the presence of direct actual damage, the amount of damage caused, the absence of circumstances excluding the employee’s financial liability, as well as (which is important!) the illegality of the behavior (action or inaction) of the harm-cauter, the employee’s guilt in causing the damage and the causal connection between the employee’s behavior and the damage that occurred. The last two factors in the situation under consideration will be very difficult to prove. After all, you will have to prove the fact that the employee knew about the travel restrictions, but did not inform the employer about it.

In addition, in case of claims for compensation of losses in full, and not in the amount of the employee’s average earnings, the employer will have to prove compliance with the rules for concluding an agreement on full financial liability (see the relevant explanations in paragraph 4 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated November 16, 2006 No. 52 “On the application by courts of legislation regulating the financial liability of employees for damage caused to the employer” (hereinafter referred to as Resolution of the Plenum of the Supreme Court of the Russian Federation No. 52) or the presence of another case of full financial liability provided for in Article 243 of the Labor Code of the Russian Federation.

As for travel expenses to the place of departure abroad, the employer must reimburse the employee in any case (paragraph 2, part 1, article 168 of the Labor Code of the Russian Federation, paragraph 1, paragraph 11, paragraphs 12, 22 of the Regulations on the specifics sending employees on business trips, approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749), that is, even if the foreign business trip did not take place due to the employee’s failure to leave the country at the airport/port.

Conclusion: when sending an employee on a business trip abroad, the employer may not achieve the goal of fulfilling the official assignment due to the employee’s failure to leave the Russian Federation due to the imposed restriction. At the same time, it is practically impossible to recover from an employee expenses already incurred by the employer as losses, although it is theoretically possible to recover some expenses.

Accounting

In accordance with clauses 5, 7 of PBU 10/99, the organization’s expenses for business trips of employees, including in the form of daily allowances, are taken into account as part of expenses for ordinary activities.

From clause 11 of PBU 10/99 it follows that the organization’s costs associated with paying for bank services (including the bank’s commission for withdrawing cash from an ATM) are other expenses.

According to clause 16 of PBU 10/99, until the advance report is approved, amounts written off from the bank account (including bank commission) are recognized as the employee’s receivables (as amounts issued on account).

Accounting entries for the organization's foreign currency accounts, as well as for transactions in foreign currency, are made in rubles in amounts determined by converting foreign currency at the Bank of Russia exchange rate effective on the date of the transaction.

At the same time, these entries are made in the currency of settlements and payments (clause 24 of Regulation No. 34n, clause 20 of the Accounting Regulations “Accounting for assets and liabilities, the value of which is expressed in foreign currency” PBU 3/2006, approved by order of the Ministry of Finance of Russia dated November 27. 2006 No. 154n).

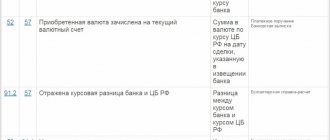

When reflecting in accounting transactions related to the issuance of currency for a business trip, there are the following nuances.

The currency received from the bank is reflected in the debit of account 50 “Cash”; accordingly, when cash is issued to an employee for reporting, the currency is debited from account 50 “Cash” and reflected in the debit of account 71 “Settlements with accountable persons”. In this case, it is more convenient to open an additional sub-account “Settlements in foreign currency”. In this case, the amount in accounting is reflected in ruble equivalent at the Bank of Russia exchange rate at the time of issue (clause 9 of PBU 3/2006).

Upon the employee’s return from a business trip and submission of an advance report with supporting documents attached, the corresponding amounts of expenses are reflected in expense accounts (20, 26, 44, etc.) in correspondence with account 71 “Settlements with accountable persons” subaccount “Settlements in foreign currency”.

It is worth noting that, in essence, accountable amounts issued to an employee are an advance, which means that for this employee’s receivables, exchange rate differences do not arise in accounting (clause 10, paragraph 4, clause 3 of PBU 3/2006). On the date of approval of advance reports of posted workers, the employee’s receivables are repaid.

If the employee has unspent currency, it must be returned. This amount can no longer be regarded as an advance, and therefore, if the exchange rate changes during the period of a business trip, the exchange rate difference from the amount of returned currency is written off to account 91 “Other income and expenses.”

Example 1

Employee A.A. According to the order, Tumanov was sent on a business trip from September 5 to September 9, 2020 for five days to Greece. He was given 60,000 rubles on account to pay for travel expenses. and 820 euros, of which:

— 53,300 rub. — to pay for air travel to the place of business trip and back;

— 700 rub. — to pay for Aeroexpress services;

— 5300 rub. - for obtaining a visa;

— 600 euros — to pay for accommodation at the place of business trip;

— 220 euros and 700 rubles. - daily allowance.

Upon returning from a business trip, the employee submitted an advance report and documents confirming expenses, according to which:

— cost of air travel — 50,000 rubles;

— cost of Aeroexpress services — 700 rubles;

— visa cost — 5,000 rubles;

— the cost of hotel services is 550 euros.

The advance report is approved by the manager in full; the employee returns the unspent funds to the organization's cash desk.

The euro exchange rate set by the Bank of Russia was (conditionally):

— on the date of issue of cash foreign currency for reporting — 72 rubles/euro;

— on the date of approval of the advance report and return of unspent funds by the employee — 69 rubles/euro.

The organization's accounting records must reflect the following entries:

On the date of issue of funds to the employee for a business trip:

Debit 71 “Settlements with accountable persons”, sub-account “Settlements in rubles”, Credit 50 “Cash”, sub-account “Cash of the organization in rubles”

— 60,000 rub. — funds were issued in rubles for travel expenses;

Debit 71 “Settlements with accountable persons”, sub-account “Settlements in foreign currency”, Credit 50 “Cash”, sub-account “Cash of the organization in euros”

— 59,040 rub. (820 euros × 72 rubles/euro) - funds were issued in euros for travel expenses;

As of the advance report date:

Debit 44 “Sales expenses” Credit 71 “Settlements with accountable persons”, subaccount “Settlements in rubles”

— 56,400 rub. (50,000 rub. + 700 rub. + 5,000 rub. + 700 rub.) - travel expenses are reflected in rubles;

Debit 44 “Sales expenses” Credit 71 “Settlements with accountable persons”, subaccount “Settlements in euros”

— 55,440 rub. (550 euros × 72 rubles/euro + 220 euros × 72 rubles/euro) - travel expenses are reflected in euros;

Debit 50 “Cash”, sub-account “Cash of the organization in rubles”, Credit 71 “Settlements with accountable persons”, sub-account “Settlements in rubles”

— 3600 rub. (60,000 rubles – 56,400 rubles) - unused funds in rubles were returned;

Debit 50 “Cash”, sub-account “Cash of the organization in euros”, Credit 71 “Settlements with accountable persons”, sub-account “Settlements in euros”

— 3450 rub. [(820 euros – 500 euros – 220 euros) × 69 rubles/euro] - unused funds in euros were returned;

Debit 91 “Other income and expenses”, subaccount “Other expenses”, Credit 71 “Settlements with accountable persons”, subaccount “Settlements in euros”

— 150 rub. [(820 euros – 500 euros – 220 euros) × (72 rubles/euro – – 69 rubles/euro)] - reflects the exchange rate difference in settlements with the accountable person.

However, not all organizations, even when sending an employee on a business trip abroad, issue foreign currency for reporting purposes. Often, to pay for travel expenses, an employee is given rubles, which are exchanged for the required currency by the employee himself.

In this case, the organization will not have transactions in foreign currency: the employee is given rubles, and in the event of a balance of unspent funds, he also returns rubles.

In fact, the employee will independently carry out exchange transactions, but this will not be reflected in any way in the organization’s accounting records. Since the employee will make expenses in foreign currency (accordingly, the documents confirming the expenses will be in foreign currency), then in order to account for such expenses, the employee should be asked to obtain certificates from the bank confirming the exchange rate between rubles and foreign currency.

In other words, expenses in accounting will be recognized on the date of approval of the advance report at the exchange rate, confirmed by a bank receipt (certificate) (clauses 5, 7, 9, 16 and 18 of PBU 10/99).

If the employee has not provided a certificate (receipt) on the exchange rate, expenses incurred from previously issued funds for the report are taken into account on the date of approval of the advance report at the rate of the Central Bank of the Russian Federation on the date of issue of funds for the report. But if an employee has overexpenditure (he will spend his own funds), in this case expenses will be recognized at the rate as of the date of approval of the advance report (Appendix to PBU 3/2006).

It should be noted that the costs of currency conversion, which are reimbursed by the employer, can be taken into account as part of other expenses.

Let's look at what has been said with an example.

Example 2

Employee A.A. Tumanov was sent on a business trip to Germany from September 12 to September 16, 2020.

On September 9, 2020, the employee received 105,000 rubles from the organization’s cash desk, including a daily allowance of 9,500 rubles.

The advance report was submitted by the employee on September 19, 2020, with the following documents attached:

— receipt dated September 11, 2020 for the purchase of 200 euros at an exchange office in Moscow at the rate of 76 rubles. per euro, totaling 15,200 rubles;

— air ticket Moscow — Munich — Moscow in the amount of 45,000 rubles. At the Moscow airport on September 12, 2016, the employee changed another 400 euros at the exchange rate of 79 rubles. for euros in the amount of 31,600 rubles, but forgot to take the exchange receipt.

— an invoice from a hotel in Munich in the amount of 600 euros.

The advance report was approved by the director on September 19, 2020.

The euro exchange rate (conditionally) was:

- on the date of issue of the advance (09.09.2016) - 75 rubles. per euro,

— as of the date of submission of the advance report (09.19.2016) — 80 rubles. per euro.

The organization's accounting records will reflect the following entries:

As of the date of issue of funds for the report (09.09.2016):

Debit 71 “Settlements with accountable persons”, sub-account “Settlements in rubles”, Credit 50 “Cash”, sub-account “Cash of the organization in rubles”

— 105,000 rub. — funds were issued in rubles for travel expenses.

As of the date of approval of the advance report (09/19/2016):

Debit 44 “Sales expenses” Credit 71 “Settlements with accountable persons”, subaccount “Settlements in rubles”

— 54,500 rub. (9,500 rubles + 45,000 rubles) - daily allowance and air ticket expenses are reflected;

Debit 44 “Sales expenses” Credit 71 “Settlements with accountable persons”, subaccount “Settlements in rubles”

— 45,200 rub. (200 euros × 76 rubles/euro + 400 euros × 75 rubles/euro) - travel expenses for hotel payments are reflected;

Debit 50 “Cash”, sub-account “Cash of the organization in rubles”, Credit 71 “Settlements with accountable persons”, sub-account “Settlements with accountable persons in rubles”

— 4000 rub. (105,000 rubles - 54,200 rubles - 200 euros × 76 rubles - 400 euros × 79 rubles) - unused funds in rubles were returned;

Debit 91-2 “Other expenses”, Credit 71 “Settlements with accountable persons”, subaccount “Settlements in rubles”

— 1300 rub. – (105,000 rubles – 54,500 rubles – 45,200 rubles – 4,000 rubles) - the employee did not provide a receipt for the exchange of 400 euros at the rate of 79 rubles. per euro.

Example 3

Employee A.A. Tumanov was sent on a business trip to Germany from September 12 to 16, 2020.

On September 9, 2020, the employee was given 100,000 rubles on account. of which 9,500 rubles are travel allowances.

The advance report was provided by the employee on September 19, 2020, with the following documents attached:

— air ticket Moscow — Berlin — Moscow — 45,000 rubles;

— receipt from the bank for currency exchange — 650 euros at the rate of 70 rubles/euro;

— hotel bill — 650 euros;

- ticket to the exhibition, visiting which was the purpose of the business trip - 50 euros.

The employee did not provide any other documents.

Thus, the employee has an overexpenditure of 50 euros, which the organization must reimburse him.

The advance report was approved by the director on September 19, 2020.

The euro exchange rate (conditionally) was:

— 09.09.2016 — 69 rub. for euro;

— 09.19.2016 — 75 rub. per euro.

The organization's accounting records should reflect:

As of the date of issue of funds for the report (09.09.2016):

Debit 71 “Settlements with accountable persons”, sub-account “Settlements in rubles”, Credit 50 “Cash”, sub-account “Cash of the organization in rubles”

— 100,000 rub. — funds were issued in rubles for travel expenses.

As of the date of approval of the advance report (09/19/2016):

Debit 44 “Sales expenses” Credit 71 “Settlements with accountable persons”, subaccount “Settlements in rubles”

— 54,500 rub. (9,500 rubles + 45,000 rubles) - daily allowance and air ticket expenses are reflected;

Debit 44 “Sales expenses” Credit 71 “Settlements with accountable persons”, subaccount “Settlements in rubles”

— 45,500 rub. (650 euros x 70 rubles) - travel expenses for paying for a hotel are reflected;

Debit 44 “Sales expenses” Credit 71 “Settlements with accountable persons”, subaccount “Settlements in rubles”

— 3750 rub. (50 euros x 75 rubles) - expenses for a ticket to the exhibition are reflected at the exchange rate on the date of approval of the advance report;

Debit 71 “Settlements with accountable persons”, sub-account “Settlements in rubles” Credit 50 “Cash”, sub-account “Cash of the organization in rubles”

— 3750 rub. — employee expenses are reimbursed.

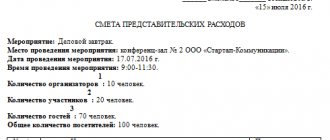

We prepare an advance report

Upon returning from a business trip, the employee must, within 3 working days, under your strict guidance, fill out an advance report (Form N AO-1) about the money spent on the business trip . Before submitting the expense report to the manager (other authorized person) for approval, you need to:

— check the report for correct completion, as well as arithmetic errors;

— make sure that the supporting documents indicated in the report are actually attached to it and that they are all drawn up properly.

Tax accounting

Income tax

According to sub. 5 paragraph 7 art. 272 of the Tax Code of the Russian Federation, the date of non-operating and other expenses is recognized, unless otherwise established by Art. 261, 262, 266 and 267 of the Tax Code of the Russian Federation, in particular, the date of approval of the advance report - for expenses, business trips, maintenance of official transport, entertainment expenses, and other similar expenses.

According to Art. 10 tbsp. 272 of the Tax Code of the Russian Federation, expenses expressed in foreign currency are recalculated for tax purposes into rubles at the official rate established by the Bank of Russia on the date of recognition of the corresponding expense.

Based on the above, expenses are recognized on the date of approval of the advance report.

In a letter from the Ministry of Finance of Russia dated September 3, 2015 No. 03-03-07/50836, the financial department explained that the organization’s expenses for travel expenses in this case should be determined based on the amount spent according to the primary documents for the purchase of currency. The exchange rate is determined by a certificate of purchase of foreign currency by a business traveler. At the same time, by virtue of sub. 5 paragraph 7 art. 272 of the Tax Code of the Russian Federation, the date of travel expenses is the date of approval of the advance report.

If a seconded employee cannot confirm the conversion rate of rubles into foreign currency due to the absence of a primary exchange document, the Russian Ministry of Finance believes that the amount of expenses in foreign currency can be compared with the accountable amount in rubles issued in advance at the official rate established by the Bank Russia on the date of issue.

Considering that in accordance with paragraph 10 of Art. 272 of the Tax Code of the Russian Federation, in the case of transfer of an advance, a deposit for payment of expenses in foreign currency, such expenses are recalculated at the official rate established by the Bank of Russia on the date of transfer of the advance, deposit (in the part attributable to the advance, deposit), then in a situation where the employee cannot confirm conversion rate of rubles into foreign currency due to the absence of a primary exchange document, the amount in foreign currency is recalculated at the official rate established by the Bank of Russia on the date of issuance of accountable amounts.

The Ministry of Finance of Russia in letter dated January 21, 2016 No. 03-03-06/1/2059, based on paragraph 1 of Art. 252, sub. 5 clause 7, clause 10 art. 272, Tax Code of the Russian Federation, Art. 168 of the Labor Code of the Russian Federation, indicated that the date of approval of the advance report, according to subparagraph. 5 paragraph 7 art. 272 of the Tax Code of the Russian Federation, serves, first of all, to determine the date of expenses, that is, the date when they are recognized for tax purposes, and not to determine their size. The actual amount of expenses should be determined based on the relevant primary documents.

The organization's expenses for travel expenses in foreign currency should be determined based on the amount spent according to the primary documents for the purchase of currency. The exchange rate is determined by a certificate of purchase of foreign currency by a business traveler. In this case, the date of travel expenses is the date of approval of the advance report.

If a seconded employee cannot confirm the conversion rate of rubles into foreign currency due to the lack of a primary exchange document, in the opinion of the Russian Ministry of Finance, the amount of expenses in foreign currency can be compared with the accountable amount in rubles issued in advance at the official rate established by the Central Bank of the Russian Federation on the date of issue of accountable amounts.

In the letter of the Ministry of Finance of Russia dated July 10, 2015 No. 03-03-06/39749, the financial department indicated the following regarding payment of expenses by non-cash means. When payment of expenses at the place of business trip (in particular, payment for hotel accommodation) is made from a bank card denominated in rubles, and the payment is made in foreign currency, the organization’s expenses for travel expenses should be determined based on the amount of currency spent according to the primary documents at the exchange rate valid at the time of payment. The exchange rate can be confirmed by a certificate of cash flow in the account certified by the bank.

So, if an employee has presented a document confirming the exchange rate (a certificate from the bank about the amount actually written off in rubles), then the organization has the right to take into account the expenses based on such an exchange rate (at the exchange rate in effect at the time of the payment).

If the employee does not provide a certificate:

- expenses are incurred at the expense of previously issued funds for the report: expenses will be taken into account on the date of approval of the advance report at the rate of the Central Bank of the Russian Federation on the date of issue of funds for the report (on the date of receipt of funds on the employee’s card - when he actually received the funds from the organization).

— expenses are incurred at the expense of own funds: expenses must be recognized on the date of approval of the advance report at the exchange rate of the Central Bank of the Russian Federation on the date of approval of the advance report.

If an employee has overspending, then expenses incurred in foreign currency (not reimbursed in advance) are recalculated into rubles at the rate (currency of expenses) of the Central Bank of the Russian Federation on the date of approval of the advance report (subclause 5, clause 7, article 272 of the Tax Code of the Russian Federation).

Example 4

Let's use the conditions of example 1.

Advances issued are not recognized as expenses for tax accounting.

As of the date of approval of the advance report (09/19/2016):

Expenses for air travel, Aeroexpress, visa and daily allowance for the day of departure on a business trip are 56,400 rubles. reflected in travel expenses.

Expenses for hotel accommodation and daily allowances for which funds were issued in euros are taken into account in tax accounting at the exchange rate on the date of issue of funds, that is, in the amount of 55,440 rubles. (550 euros × 72 rubles/euro + 220 euros × 72 rubles/euro).

The returned funds in euros were recalculated at the exchange rate on the date of approval of the advance report and an exchange rate difference was formed, which is taken into account as part of non-operating expenses - 150 rubles. (820 euros – 550 euros – 220 euros) × (72 rubles/euro – – 69 rubles/euro).

Example 5

Let's use the conditions of example 2. Advances issued are not recognized as expenses for tax accounting.

As of the date of approval of the advance report (09/19/2016):

Expenses for daily allowance and air ticket in the amount of 54,500 rubles. (excluding VAT) are reflected in travel expenses.

Hotel expenses are included in travel expenses in the amount of RUB 45,200. (200 euros × 76 rubles/euro + 400 euros × 75 rubles/euro).

The employee did not provide a receipt for the exchange of 400 euros at the exchange rate of 79 rubles. for euros and could not confirm my expense when exchanging currency in the amount of 1300 rubles. Such expenses are not taken into account for profit taxation in accordance with paragraph 1 of Art. 252 of the Tax Code of the Russian Federation.

Confusion with daily allowance calculations when visiting several countries during a business trip

The procedure and amount of reimbursement of expenses associated with business trips to employees of commercial organizations and private enterprises are determined by a collective agreement or a local regulatory act, unless otherwise established by the Labor Code of the Russian Federation, other federal laws and other regulatory legal acts of the Russian Federation (Part 4 of Article 168 of the Labor Code of the Russian Federation ). And only in relation to employees who have entered into an employment contract to work in federal government bodies, employees of state extra-budgetary funds of the Russian Federation, federal government institutions, the amounts of these expenses are determined by regulatory legal acts of the Government of the Russian Federation; and in relation to employees who have entered into an employment contract to work in government bodies of the constituent entities of the Russian Federation, employees of state institutions of the constituent entities of the Russian Federation, persons working in local government bodies, employees of municipal institutions - by regulatory legal acts of state authorities of the constituent entities of the Russian Federation, regulatory legal acts of local government bodies ( Parts 2 and 3 of Article 168 of the Labor Code of the Russian Federation).

According to Part 1 of Art. 168 of the Labor Code of the Russian Federation, in the event of being sent on a business trip, the employer is obliged to compensate the employee for:

— travel expenses;

- expenses for renting residential premises;

— additional expenses associated with living outside the place of permanent residence (per diem);

- other expenses incurred by the employee with the permission or knowledge of the employer.

Other expenses when sending an employee outside the Russian Federation, reimbursed by the employer to the employee in accordance with Art. 168 of the Labor Code of the Russian Federation, the costs of obtaining a foreign passport, visa and other travel documents, mandatory consular fees, costs of obtaining compulsory medical insurance, fuel surcharge for air travel, fees for the right of entry or transit of motor transport (when traveling by motor transport), etc. may be included. mandatory payments and fees, as well as employee expenses associated with the exchange of Russian rubles for foreign currency (in the case of an advance payment for a business trip by the employer exclusively in rubles).

However, confusion in the vast majority of cases occurs regarding the calculation of daily allowances.

In relation to foreign business trips, the amount of daily subsistence allowance is differentiated depending on the country of visit. With complex business trip routes, errors in calculating daily allowances are very common.

The following rules will help you calculate them correctly:

1) When an employee travels from the territory of the Russian Federation, the date of crossing the state border of the Russian Federation is included in the days for which daily allowances are paid in foreign currency, and when traveling to the territory of the Russian Federation, the date of crossing the state border of the Russian Federation is included in the days for which daily allowances are paid in rubles (clause 18 “Regulations on the specifics of sending employees on business trips”, approved by Decree of the Government of the Russian Federation dated October 13, 2008 No. 749 “On the specifics of sending employees on business trips” (hereinafter referred to as the Regulations).

2) The dates of crossing the state border of the Russian Federation when traveling from the territory of the Russian Federation and to the territory of the Russian Federation are determined by the marks of the border authorities in the passport.

3) If an employee was in several foreign countries during a business trip, then from the day of departure from one country to another (determined by the mark in the passport), daily allowances are paid according to the rate established for payment in the country to which he is sent (see Letter from the Ministry of Labor of the Russian Federation , Ministry of Finance of the Russian Federation dated May 17, 1996 No. 1037-IH “On the procedure for paying daily allowances to employees sent on short-term business trips abroad”).

Example of daily allowance calculation.

Input data: the employee is sent on a business trip with a complex route. From Saratov on February 12, 2020, he goes by train to Moscow. Departure for a foreign business trip is made from the airport in Moscow at 8.20 am on 02/13/2016, arriving in Berlin (Germany) at 9.05 am on the same day. From February 13 to February 14, 2020, the employee performs a work assignment in Germany in different cities. On 02/14/2016 from the airport in Munich (Germany) at 9.20 a.m. the employee goes to Rome (Italy), arriving at 10.55 a.m. Having completed the task, the employee on the same day, Sunday, 02.14.2016 leaves Rome at 20.20 p.m. to Sweden, landing on the same date in Stockholm at 23.30. Having been on a business trip in Sweden from 02/14/2016 to 02/19/2016, an employee from Stockholm flies at 12.50 to Moscow, where he lands at 16.55. By train at 18.00. On the same day of 02/19/2016, the employee is sent to the location of the employing enterprise in Saratov, where he arrives on 02/20/2016. The employer’s local act provides for the following daily allowance rates: in Russia - 1000 rubles per day, in Germany - 90 euros, Italy - 100 euros, Sweden - 120 euros.

Calculation example:

In total, the employee was on a business trip for 9 days.

For February 12, 19, 20, daily allowance will be paid at the rate of 1000 rubles. per day, as if on a business trip across the territory of the Russian Federation.

For February 13, daily allowance is paid in the amount of 90 euros, for 02/14/16 to 02/18/16 (5 days) - daily allowance in the amount of 120 euros per day. In this case, the daily allowance for February 14 is paid in the country in which the employee ultimately arrived (Sweden), despite the fact that on the specified day he was also in Italy.

Total for the entire business trip the employee must be paid (1000 rubles x 3 days) = 3000 rubles. and 690 euros ((120 x 5) +90).

Conclusion: a rule will help you correctly calculate daily allowances for complex routes of business trips abroad - daily allowances are calculated according to the norm established for payment in the country to which the employee is sent.

Foreign VAT

According to paragraph 2 of Art. 171 of the Tax Code of the Russian Federation, VAT amounts presented to the taxpayer upon acquisition of goods (work, services), as well as property rights in the territory of the Russian Federation, are subject to deduction. Thus, the application of VAT deduction in relation to goods (works, services) purchased on the territory of a foreign state, according to the norms of Chapter. 21 of the Tax Code of the Russian Federation is not provided for.

According to the opinion of the Ministry of Finance of Russia, expressed in 2011-2010, foreign taxes cannot be taken into account in income tax expenses (letters of the Ministry of Finance of Russia dated 04/08/2011 No. 03-03-06/1/226, dated 02/28/2011 No. 03-03 -06/1/112, dated 06/11/2010 No. 03-03-06/1/407).

After this, the officials' opinion changed. Currently they believe that Art. 270 of the Tax Code of the Russian Federation contains a closed list of expenses that cannot be taken into account when calculating the tax base. The amounts of taxes (fees) paid on the territory of a foreign state are not indicated. Therefore, such expenses can be accepted on the basis of sub-clause. 49 clause 1 art. 264 Tax Code of the Russian Federation. This position was reflected in letters of the Ministry of Finance of Russia dated 04/07/2014 No. 03-03-06/1/15337, dated 10/04/2013 No. 03-03-06/2/41278, dated 08/12/2013 No. 03-03-10/32521 , Federal Tax Service of Russia dated 09/03/2013 No. ED-4-3/ [email protected] It is necessary to remember that taxes for which the Tax Code of the Russian Federation or an international treaty provide for the procedure for eliminating double taxation by offsetting the tax paid on the territory of a foreign state when paying the corresponding tax in the Russian Federation, are not subject to accounting as expenses when calculating corporate income tax.

And regarding expenses for accommodation in foreign hotels, the financial department has previously noted that the VAT amounts allocated in invoices for accommodation can be taken into account when calculating income tax either as an independent expense (subclause 49, paragraph 1, article 264 of the Tax Code of the Russian Federation), or as part of travel expenses (subclause 12, clause 1, article 264 of the Tax Code of the Russian Federation) (letters from the Ministry of Finance of Russia dated 02/14/2008 No. 03-03-06/4/8, dated 02/09/2007 No. 03-03-06/1/74 ).

Thus, today organizations have the right to take into account foreign VAT in expenses for tax accounting purposes as other expenses associated with production and sales or as part of travel expenses, depending on the conditions of the company’s Accounting Policy.

What should be attached to the expense report

Here are the documents that must be attached to the advance report (Clause 26 of the Regulations):

- travel certificate in form N T-10 (for business trips to CIS countries with which there are agreements that border marks are not made in the international passport) (Clause 15 of the Regulations) or copies of pages of the employee’s international passport with marks on border crossing;

— documents confirming travel expenses . Moreover, if an electronic air or railway ticket was purchased, then the supporting documents may be a printout of the itinerary receipt (ticket) and boarding pass, as well as documents confirming payment for the ticket (cash register receipt or payment terminal receipts, bank statement);

— documents confirming living expenses (invoices, payment receipts);

- documents confirming other expenses (if any): for visas and medical insurance, for paying for bed linen on the train, excess baggage, entertainment services, postage, communication services, etc.

For convenience, you can take several sheets of blank paper, title each by type of expense (for example, “Transportation expenses,” “Hotel expenses,” “Other expenses”) and stick the corresponding expense documents on them.

But it doesn’t matter what the employee spent his daily allowance on. There is no need to confirm this with any checks, receipts or other similar documents.

Attach to the advance report an official assignment form for sending on a business trip (Form N T-10a) with completed section. 12 “A brief report on the completion of the task” (Clause 26 of the Regulations) is not necessary, since the tax authorities believe that the official task together with the report on its completion are not the documents necessary to confirm expenses.

Standards for overseas business trips

Legislative acts regulating foreign travel are mainly represented by Government Resolution No. 812, the norms of which determine the amount of daily allowance for each state.

These limits are mandatory when sending employees employed in public sector sectors on business trips. Per diem rates are set per day and are expressed in US currency.

The following rules can be identified that apply to common areas of business travel.

| Foreign country - point of business trip | Daily allowance rate calculated in US currency (dollars) |

| Great Britain | 69,0 |

| Germany | 65,0 |

| China | 67,0 |

| Türkiye | 64,0 |

| USA | 72,0 |

This document provides for the existence of allowances for daily allowances for foreign business trips, which are payable to certain categories of employees.

Organizations in the commercial sector can use these standards, or they can create their own limits based on them.

Daily payment standards

The organization has the right to determine the amount of daily allowance when traveling abroad (Article 168 of the Labor Code of the Russian Federation). Such amounts must be fixed in a collective agreement or in an internal regulatory document.

Read more about drawing up an internal document regulating the rules related to business trips in our material.

However, for tax purposes it will be necessary to apply standards - upper limits on the amount of daily payments. Within these limits, amounts are not subject to personal income tax and insurance contributions (paragraph 12, paragraph 3, article 217 of the Tax Code of the Russian Federation, paragraph 2, article 422 of the Tax Code of the Russian Federation). For business trips abroad, such a limit is set at 2,500 rubles. If, for example, an enterprise has set the daily allowance at 5,000 rubles, then from the remaining 2,500 rubles. it will be necessary to withhold and transfer personal income tax and contributions.

Daily allowances for business trips - changes in legislation for 2020

First, you need to understand what daily expenses are on a business trip. Under Article 168

The Labor Code of the Russian Federation defines these payments as an opportunity to compensate an employee for expenses in connection with his residence outside his permanent place of residence.

Until recently, such payments were not subject to tax upon settlement. Since the beginning of 2020, the Government Decree prescribes certain limits, which are still not subject to tax and insurance contributions:

- 700 rubles for trips within Russia;

- 2500 rubles for business trips abroad.

The limit for these payments is not limited as before. However, amounts in excess of the specified limit are now subject to contributions in the standard manner.

Daily allowance for a business trip in Russia

The minimum daily allowance for a business trip for 2020 in Russia, as well as abroad, is not provided for by law. That is, in practice, accrual is carried out at the discretion of the employer in accordance with the local standards of the organization.

However, the rules for sending on a business trip

prescribe that the employee should not find himself in worse conditions than the current ones. Therefore, in order to avoid labor disputes when making calculations, it is recommended to adhere to the following minimum framework:

- when prescribed within the same region - 200-300 rubles;

- for another region - from 500 rubles.

The legislation provides that the daily allowance rate must be specified in the local regulations on business trips

. It may also be specified in the regulations under which the employee is sent on a trip.

Business trip abroad - daily allowance in 2020

Separately, it is necessary to consider travel expenses when sent abroad. In this situation, it is recommended to be guided by Government Resolution No. 812

. This legislation prescribes certain expenditure levels for each country.

This requirement applies to employees of budgetary organizations. Therefore, for extra-budgetary companies they are rather advisory in nature. In this matter, it is also necessary to take into account the established threshold of 2,500 rubles. All funds that exceed this value are subject to taxation.

The manager has the right to independently decide in what currency he pays the traveler money. The calculation is made in accordance with the current exchange rate of the Central Bank of the Russian Federation.

Daily allowances for business trips in budgetary institutions

Government Resolution No. 729

regulates the accrual of all travel allowances. It also prescribes a fixed amount of charges for expenses per day for trips within Russia. For 2020, for employees of budgetary institutions, the daily allowance is 100 rubles.

To calculate payments per day when traveling abroad, you must refer to Government Resolution No. 812. The appendix to this document regulates payments according to the calculation for each country separately.

Start and end days of the business trip

When calculating daily allowances for trips abroad, special attention should be paid to the number of business days. In 2020, this depends on the days the employee actually spent outside Russia.

According to paragraphs. 17 and 18 of the Regulations, approved by Decree of the Government of the Russian Federation dated October 13, 2008 No. 749, the day of crossing the border when going on a business trip is considered according to the foreign tariff, and the day of arrival - according to the domestic tariff.