Information presentation formats

Tax reporting documentation can be submitted electronically or on paper. This depends both on the tax or fee for which the document is generated, and on the company itself. When choosing a format for presenting data, it is necessary to focus on what exactly is specified in the legislation for a particular situation. However, you need to understand that submitting reports on paper is associated with an impressive amount of labor and time, while filing electronically allows you to reduce them.

As for the reporting method, it could be:

- personal visit to the Federal Tax Service Inspectorate office by the head or other person authorized to transmit reports (based on a power of attorney);

- sending a registered letter by Russian Post with a list of the attachments;

- personal account on the Federal Tax Service website;

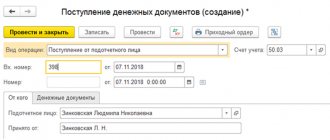

- sending via telecommunication channels (TCC).

Important! It is imperative to make sure that one or another transmission method can be used for a particular type of report. If you violate the reporting rules, it will not be accepted by the tax authorities.

Penalty for late submission of balance to statistics

This applies not only to those who deliberately did not submit the relevant documents, but also to enterprises that were late in submitting them.

The absence of an audit report is also punishable by fines. According to Article 19.7 of the Administrative Code of the Russian Federation for different categories of entrepreneurs, the amounts are as follows:

- citizens - 100-300 rubles;

- officials - 300-500 rubles;

- legal entities - 3000-5000 rubles.

The Federal Tax and Statistical Services require a lot of documents, and their number and variety confuses even experienced specialists. The audit report requires certain material costs, and statistical reporting is provided in different forms for different types of enterprises.

However, the fines for failure to provide these documents are significant, and a persistent violation can lead to your company being banned from operating.

Every entrepreneur, regardless of the form of doing business, must provide reporting to the tax service regarding the profit received. In addition to this organization, Rosstat collects information on income, where it is necessary to submit reports regarding the company’s activities.

The competence of the Federal State Statistics Service covers exclusively all types of entrepreneurs, from individual entrepreneurs to closed joint-stock companies, but at specific periods of time, data can only be collected from certain types. Let's figure out what the fine is for failure to submit statistical reports in 2020, and how to avoid such problems?

Important

If you have violated the standards for submitting reports to Rosstat, you should be prepared to pay a fine. And in this case, it is necessary to know what value it is established and when exactly such administrative responsibility begins for companies and individual entrepreneurs in the Russian Federation.

All entrepreneurs and legal entities know very well where they should submit reports on their activities. One of such authorities is Rosstat. Moreover, regulatory documents establish certain forms of reports, as well as deadlines for their submission, which should be strictly adhered to in order to avoid unnecessary problems.

Many people are wondering what the size of the fine is for late submission of reports, failure to provide them and submission of statistical forms that contain errors to Rosstat at the moment.

Attention

How to report Statistical reporting can be submitted:

- on paper directly to the territorial statistical office or sent by mail (by registered mail with a list of attachments);

- in electronic form using a specialized electronic reporting operator or on the website of Rosstat of the Russian Federation.

In addition, in accordance with Article 3 of the Law of the Russian Federation dated May 13, 1992 No. 2761-1 “On liability for violation of the procedure for submitting state statistical reporting,” a company or individual entrepreneur that provided reporting in violation of deadlines or inaccurate data, at the request of state authorities statistics compensates for damages incurred due to the need to correct the summary results for these reports. In practice, this rule does not work, since there are no clear criteria for calculating the damage caused by the respondent.

Important! Thanks to the Federal Law of December 30, 2015 No. 442-FZ “On Amendments to Article 13.19 of the Administrative Code”, which came into force on December 30, 2015, the liability of companies and individual entrepreneurs for failure to submit (late submission) of statistical information has been tightened. Failure to provide primary statistical data in the prescribed manner or untimely provision of this data will entail fines:

- for officials in the amount of 10 thousand to 20 thousand rubles;

- for legal entities - from 20 thousand to 70 thousand rubles.

Repeated violation is punishable by large fines:

- for officials in the amount of 30 thousand to 50 thousand rubles,

- for legal entities - from 100 thousand to 150 thousand.

Federal Law No. 402 of December 6, 2011) Form P-3 Submitted before the end of January (information about the financial situation of the enterprise) Form P-4 Submitted by the 15th day of the next month after the end of the reporting quarter (mandatory for all entrepreneurs) P-4 (NZ) Submitted before the 8th day of the month following the reporting quarter (about the movement of personnel) Form PM (result of activity) Submitted before the 29th day of the following month after the end of the quarter PM-industry (about the product that is produced) Rented by entrepreneurs who have 16 – 100 employees by the 4th of the next month after the end of the reporting period 1-IP (for example, for agricultural producers) Submitted once a year - before March 2 next year A Rosstat employee provides information about what reports should be prepared and when to submit. He also notifies you about the peculiarities of filling out forms.

In what case and for what can a company (individual entrepreneur) be fined for failure to provide or provision of false information to statistics? In addition to accounting (financial) and tax reporting, organizations and individual entrepreneurs must also submit statistical reporting.

Info

Federal Law “On official statistical accounting and the system of state statistics in the Russian Federation” (hereinafter referred to as Law No. 282-FZ). Rosstat of the Russian Federation, within the framework of its powers, approves the forms of federal statistical observation and instructions for filling them out (clause 5.5 of the Regulations on the Federal State Statistics Service, approved.

Decree of the Government of the Russian Federation dated June 2, 2008 No. 420).

Important! Lists of companies or individual entrepreneurs that must submit a particular statistical report are posted on regional statistics websites in the section: “Reporting” - “Statistical reporting” - “Lists of reporting business entities”. Here's an example in the Chelyabinsk region.

Statistical information must be provided to statistics according to approved forms of federal statistical observation on paper (at the location of the respondent) or electronically in the established format using an electronic signature, no later than the submission deadlines indicated on the forms.

Amount of fines Punishment for failure to provide primary statistical data or provision of unreliable statistical information is an administrative offense and entails the imposition of an administrative fine under Art. 13.19 of the Code of Administrative Offenses of the Russian Federation. And such codes will help the tax service monitor the work of enterprises. They are also needed when opening accounts at a banking institution.

Legal regulation The need to maintain statistical documents is stated in Federal Law No. 282, which was adopted by the government of the Russian Federation on November 29, 2007. The procedure for maintaining such documentation and its submission is discussed in Government Resolution No. 620.

It is also worth relying on the Law on Accounting. Previously, penalties for late reporting were small. Since 2018 it has been significantly increased. Authorized structures check all submitted information, and if it is discovered that a person is submitting incorrect data, then they will also have to bear responsibility. Established deadlines The following reports are mandatory: Data in Form 1 Provided before April 1 (clause 2 of Art.

- home

- Legal Resources

- Collections of materials

- Responsibility for failure to provide statistical reporting

A selection of the most important documents upon request Responsibility for failure to provide statistical reporting (regulatory acts, forms, articles, expert consultations and much more). Regulatory acts: Responsibility for failure to provide statistical reporting “Code of the Russian Federation on Administrative Offenses” dated December 30, 2001 N 195-FZ (ed.

dated 10/11/2018 (as amended and supplemented, entered into force on 10/29/2018) Article 13.19. Failure to provide primary statistical data Law of the Russian Federation of May 13, 1992 N 2761-1 (ed. Where can I see the obligation to submit statistical reports? Sample statistical observations are carried out by Rosstat of the Russian Federation in the form (clause 1 of the rules for conducting sample statistical observations of the activities of small and medium-sized businesses, approved . Decree of the Government of the Russian Federation dated February 16, 2008 No. 79, hereinafter referred to as Rules No. 79):

- monthly and (or) quarterly surveys of small and medium-sized enterprises (except for micro-enterprises);

- annual surveys of micro-enterprise activities.

And if sample observation is carried out, then only those small enterprises that are included in the sampling percentage of Rosstat of the Russian Federation should submit statistical reports (clause 2 of Rules No. 79).

The Tax Code does not indicate that organizations that did not function during the reporting period are exempt from submitting reports. Therefore, zero reporting should also be submitted to regulatory authorities. Annual zero reports should be sent to the Federal Tax Service by March 31, 2020. If an entrepreneur does not submit a declaration on time, he will have to pay a fine for failure to submit financial statements for 2020 to the Federal Tax Service in the amount of 1,000 rubles.

For providing an incomplete package of documents, administrative sanctions are applied to violators. Submitting SZV-M for the founding director: the Pension Fund has made its decision The Pension Fund has finally put an end to the debate about the need to submit the SZV-M form in relation to the director-sole founder. So, for such persons you need to take both SZV-M and SZV-STAZH!

Below you will find a sample payment slip for payment of a personal income tax fine.

We will tell you in what cases fines are still provided for an accountant in 2020. Some employers enter into agreements with chief accountants on full financial liability (Article 243 of the Labor Code of the Russian Federation). In this case, management may require the chief accountant to reimburse the organization for all listed fines to the budget in full.

Fines for failure to submit reports

If tax reporting is not received on time, tax authorities will issue fines to the company in accordance with Art. 119 Tax Code of the Russian Federation:

- if the tax is transferred in full, but the declaration for it is not submitted, a fine of 1,000 rubles is provided;

- If the tax is not paid in full or at all, a fine of 5% of the amount owed is issued for each month of delay. In this case, the fine cannot be more than 30% of this amount and must not be less than 1,000 rubles;

- if the taxpayer has not submitted a zero return, the fine is 1,000 rubles.

Fine for failure to provide financial statements in 2020

The subjects of liability for this offense may be officials and persons equivalent to them, whose official duties include the provision of statistical information.

4. The subjective side of the offense is characterized by intent and negligence.

5. Protocols on offenses are drawn up by officials of bodies authorized to consider cases of this category (Part 1 of Article 28.3 of the Code of Administrative Offenses of the Russian Federation).

6. Consideration of cases of administrative offenses under the commented article is carried out by officials of state statistical accounting bodies (Article 23.53 of the Code of Administrative Offenses of the Russian Federation).

Another comment on Article 13.19 of the Code of Administrative Offenses of the Russian Federation

Penalty for incorrect reporting format

If tax reporting is submitted in an incorrect format, liability is provided for this in accordance with Art. 119.1 Tax Code of the Russian Federation. The fine is 200 rubles. for each case of non-transfer of reporting.

At the same time, there is a possibility that the reporting will not be accepted even if the company complies with all the rules for its presentation. The fact is that due to technical failures in telecommunication data transmission systems, reporting may also not reach the tax office. If declarations are submitted at the very last moment, there is a risk that the company will be fined for being late.

You can challenge such a decision of the tax inspectorate through the court. However, this may take a long time. In addition, it will be necessary to provide evidence that the taxpayer did not submit reports precisely because of a technical failure in the system.

Composition and timing of the report

In 2020, organizations that maintain accounting, regardless of legal status and taxation system, are required to send financial statements to government agencies based on the results of their activities for 2018. It includes the following documents:

- balance sheet;

- income statement;

- attachments to these documents.

For enterprises required to conduct an annual audit of their financial statements (the list is determined by Article 5 of Law No. 3-FZ07 of December 30, 2008), an additional audit report is required.

A package of documents is submitted to the tax authorities and Rosstat. For the final instance, in 2020, reports are submitted for the last time, since from 2020 such an obligation is canceled in accordance with Law No. 444-FZ of November 28, 2018.

It is necessary to report on the activities of business entities no later than 3 months after the end of the reporting annual period. According to the Tax Code of the Russian Federation, if the deadline falls on a non-working holiday or weekend, the deadline is shifted to the next working day.

On a note! The deadline for submitting documents to the tax office for the past year was set until April 1, 2020 (since March 31 fell on a Sunday). But the rule of rescheduling does not apply to statistical bodies, because such an obligation is enshrined in the Accounting Law, and not in the Tax Code.

Don't miss: How to legalize construction at a dacha in 2020: latest news

How to pay the fine?

The taxpayer may pay the fine upon notification sent by the tax office. He can also calculate and pay the fine himself. To do this you need:

- generate and submit reports;

- pay tax;

- determine the amount of the fine;

- pay a fine according to the details of the Federal Tax Service for a specific KBK for fines for this tax;

- carry out a reconciliation with the Federal Tax Service.

Important! The Federal Tax Service can hold a taxpayer accountable only within 3 years from the date of violation of reporting rules. This period does not depend on the tax system, specific tax or type of declaration.

The Federal Tax Service may reduce the fine if there are any mitigating circumstances. The taxpayer should submit an application indicating that tax reporting was not submitted on time for valid reasons. Supporting documents must be attached to the application.

Arguments as mitigating circumstances may include the following:

- the tax is transferred on time without delay;

- a reporting violation was committed for the first time;

- the taxpayer has no debts on other taxes;

If the tax office refuses to reduce the fine, the company may go to court to challenge this decision. When considering the case, it is necessary to submit supporting documents that will confirm the plaintiff’s stated claim.

Penalties

Both the enterprise (legal entity) itself and individual officials can be fined for failure to submit a report.

On a note! Responsible officials are determined by internal order of the company. As a rule, the responsibility lies with the chief accountant or the head of the financial service (for large structures).

Fines for failure to provide financial statements are established by the provisions of the Tax Code and the Code of Administrative Offenses of the Russian Federation. The following tariffs apply in 2020:

- 200 rub. for each copy not submitted to the Federal Tax Service within the established time frame (Article 126 of the Tax Code of the Russian Federation). For example, if only the balance sheet is not submitted, the fine will be 200 rubles; if the balance sheet and report and financial results are not submitted, the amount will increase to 400 rubles. At the same time, Article 108 of the Tax Code of the Russian Federation establishes that for each offense a repeated punishment is not imposed, but at the same time, material punishment for an enterprise is not a reason to exempt officials from a fine.

- 300-500 rub. for violations related to failure to provide reports to the Federal Tax Service (Article 15.6 of the Code of Administrative Offenses of the Russian Federation).

- 100-300, 300-500, 3000-5000 rub. for individuals, responsible officials and legal entities, respectively, in connection with failure to submit a report to the Statistics Department (Article 19.7 of the Code of Administrative Offenses of the Russian Federation).

Don't miss: Public sector employees' salaries in 2020: will there be an increase?