Key points when calculating sick leave in 2019-2020

There are 2 blocks of main points that you need to know before starting the calculation.

1st block - initial calculation parameters

1. Who pays for sick leave:

- for illness and injury (non-occupational):

- the first 3 days - by the employer;

- subsequent days - from the FSS budget;

- for the entire period - from the FSS budget.

2. Who is paid sick leave:

- employees under an employment contract;

- recipients of funds from which contributions to the Social Insurance Fund are paid.

IMPORTANT! Foreign citizens temporarily staying in Russia and working in Russian organizations are also entitled to sick pay if they have an employment contract and the employer (insurer) has paid contributions for the foreigner to the Social Insurance Fund for 6 months prior to the month in which the incapacity occurred (Article 2 of the law “ On compulsory social insurance in case of temporary disability and in connection with maternity" dated December 29, 2006 No. 255-FZ).

3. How sick leave is paid.

Calendar days of incapacity for work (indicated on the sick leave certificate) are paid. The exceptions (under Article 9 of the Law “On Mandatory Social Insurance...” dated December 29, 2006 No. 255-FZ) are the periods:

- downtime;

- suspension from work;

- other exemption from work with full or partial compensation, except for annual basic leave;

- the employee’s stay in custody or arrest;

- conducting forensic and medical examinations.

2nd block - indicators for calculation

1. Percentage of earnings depending on length of service. Payment of accrued benefits in 2019-2020 is made taking into account the following ratios:

| Working experience (during which insurance premiums were paid), in years | Percentage of average earnings limiting sick leave payment, in % |

| Up to 5 | 60 |

| From 5 to 8 | 80 |

| From 8 | 100 |

NOTE! If the incapacity for work occurs as a result of an occupational disease or an emergency at work, 100% of earnings are immediately taken into account. In this case, the maximum payment for sick leave is limited to 4 times the monthly insurance payment in the Social Insurance Fund (Article 9 of the Law “On Compulsory Social Insurance against Industrial Accidents and Occupational Diseases” dated July 24, 1998 No. 125-FZ).

Restrictions on payments based on length of service do not apply to sick pay for maternity leave.

Read about calculating sick leave for pregnancy and childbirth here.

2. Calculation period. It is 2 years before the year of sick leave. Includes all payments from which contributions to the Social Insurance Fund were calculated, including from other employers (Article 14 of Law No. 255-FZ).

3. Divider to obtain the average daily earnings. For sick leave, the figure of 730 is always used. An exception here would be calculations related to maternity benefits. For them, the formula (if we are not talking about determining the minimum or maximum benefit amount) takes the actual number of days in the calculation period, from which the duration of certain periods must be subtracted.

For more information about the features of recording the number of days in a period for sick leave for pregnancy and childbirth, see the material “When you give sick leave for pregnancy and childbirth .

Changes in filling out reports for the Social Insurance Fund in 2020

Since January 2020, new rules for filling out reports for the Social Insurance Fund have come into force. Enterprises that have employees are accustomed to being required to submit reports to this body several times a year or monthly. The most common format is the 4 FSS report. In 2020, the principles for submitting such a report will change noticeably, and this applies not only to the rules for designing individual sections of the form, but to the entire system of working with this document.

The changes are due to the fact that the legislation gave part of the powers to work with insurance contributions to the Federal Tax Service. The reason is that the Federal Tax Service processes tax data better and faster, and this gives hope that insurance and tax collections across the country will increase.

From the first quarter of the new year, you will need to prepare reports for the Social Insurance Fund and the Pension Fund of the Russian Federation according to the new rules. It is advisable to familiarize yourself with these rules and prepare your accounting before the end of the year, so that you do not subsequently experience difficulties in complying with the new requirements imposed by law.

Minimum amount of sick pay in 2019-2020

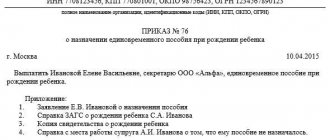

The amount of average earnings for the period of incapacity calculated according to the basic method must be compared to the minimum indicator. This is usually necessary in cases where the sick employee, for some reason, did not work for 2 years before the sick leave and the amount of the benefit calculated for the month may be less than the established minimum wage.

If the calculation based on average earnings turns out to be less than the calculation based on the minimum wage, it is necessary to calculate the sick leave payment based on the minimum wage. From 01/01/2019 the minimum wage is 11,280 rubles. From 01/01/2020 it will be equal to 12,130 rubles.

All amounts of the minimum daily benefit depending on the insurance period are given in the Ready-made solution from ConsultantPlus.

Read about the taxation of sick leave with personal income tax in the article “Is sick leave (sick leave) subject to personal income tax?” .

How to correctly submit reports to the Social Insurance Fund and Pension Fund in 2020

In order to send reports on time using the DAM form to the Pension Fund and using the Social Insurance Fund form to the social fund, you need to know how to fill out the relevant sections and what data needs to be entered. If the company has its own accountant, then he solves these problems; if there is no accountant (this applies mainly to small enterprises), the manager deals with such issues.

Experience shows that it can be problematic for a company owner to control data, keep records and fill out reports for all funds and structures. In this situation, it is useful to seek the services of remote accounting. Using such accounting does not require constantly making deductions for employees, much less paying them for vacation and sick leave. There is no need to hire an employee, which is important for individual entrepreneurs without employees. The necessary data will be collected and the necessary reports sent within the deadlines established for this. The use of such services relieves the work time of the head of the company, because he does not need to fill out documents for regulatory authorities or think about this topic.

Maximum amount of sick leave payment in 2019-2020

The maximum payment for sick leave in 2019-2020, as before, is made dependent on the maximum base for calculating insurance contributions to the Social Insurance Fund. The value is established annually (indexed) by resolutions of the Government of the Russian Federation and characterizes the maximum amount with which contributions to the Social Insurance Fund can be paid for the year. Thus, the FSS cannot pay benefits in an amount above this limit (it does not receive contributions for this).

At the same time, the organization, at its discretion, can increase the amount of benefits to the actual average earnings of the employee. This additional payment to the sick leave benefit is made at the expense of the organization’s own funds. Everything about accounting and taxation of such additional payments is set out in the Ready-made solution from ConsultantPlus.

In practice, this looks like a second example of the result of the original calculation of average earnings, but now to the maximum amount of sick leave that the Social Insurance Fund compensates.

The maximum base for calculating contributions was:

- in 2020 - 718,000 rubles;

- in 2020 - 755,000 rubles;

- in 2020 - 815,000 rubles;

- in 2020 - 865,000 rubles;

- for 2020 - 912,000 rubles.

This means that in 2020 the average daily earnings for calculating the maximum sick leave payment will be no more than:

(865,000 + 815,000) / 730 = 2,301.37 rubles.

And for 2020 it should not exceed:

(755,000 + 815,000) / 730 = 2,150.68 rubles.

All amounts of maximum daily benefit values depending on the insurance period are given in the Ready-made solution from ConsultantPlus.

Deadlines for filing FSS reports in 2020

For most companies, it remains necessary to submit monthly reports to the Social Insurance Fund. The exception is for companies without employees and with specific benefits in this area.

The deadline for submitting a report on social payments made for employees must be sent to the Social Insurance Fund no later than the 10th day of the month following the reporting month. Violation of deadlines results in fines of 500 rubles for each individual offense. The legislator considers information about each employee to be a separate offense; for this reason, it is especially important for an enterprise with a large number of employees to strictly adhere to deadlines.

Today it is possible to send such data to the websites of relevant departments in a semi-automatic mode. Using a specialized accountant calendar, such a specialist will receive a reminder of the deadlines when reports to the pension fund should be ready to be sent, and the programs will help make the correct calculation and fill out the form themselves. For an accountant, the most important point here is keeping records of data for the enterprise. If the data is in order, then compliance with legal requirements will not be difficult.

Maximum sick leave period

Speaking about the maximum sick leave payment in 2019-2020, one cannot help but recall the 2nd part of the final calculation formula - the duration of the period of illness in calendar days. Sick leave is issued according to strictly regulated rules for a period established by law.

The most common maximum terms are:

- For outpatient treatment - 15 days inclusive.

- Inpatient treatment - the period of stay in a hospital plus up to 10 days inclusive after hospitalization on an outpatient basis.

- Continuation of treatment in sanatorium-type institutions - 24 days inclusive.

NOTE! If the illness (injury) is related to the professional activity of the sick person, the travel time to the medical institution and back is included in the sanatorium sick leave.

- For pregnancy and childbirth - 140–196 days (depending on the situation).

- Caring for a sick child:

- up to 7 years - for the entire period of illness;

- from 7 to 15 years - for 15 days inclusive;

- over 15 years of age for outpatient treatment - for 3 days.

IMPORTANT! Standard treatment periods can be extended, but only by decision of a special medical commission.

Read about the rules for filling out sick leave brought by an employee in the material “An example of filling out a sick leave by an employer .

Earnings calculation

The above percentages apply to average earnings. It is clear that only official income , from which the employer withheld personal income tax, and also calculated and paid insurance premiums. In this case, the average earnings are calculated for the two years preceding the year in which the employee went on sick leave.

For example, if disability benefits are accrued in 2018, then earnings for 2016-2017 are taken into account. All income is included in the calculation - wages, bonuses, other allowances and bonuses. The resulting value is divided by 730 - exactly the number of days in the indicated years. The result is the amount of average earnings per day.

the length of service coefficient is applied to this amount (see above). That is, for an employee whose insurance period is 6 years, the amount of average earnings will be multiplied by 0.8, since for each day of sick leave he is entitled to 80% of the average earnings.

The resulting value should be multiplied by the number of days of sick leave. Moreover, both weekends and holidays are taken into account, that is, the calculation is carried out on calendar days.

Important! There is a certain maximum accrual for one day of sick leave. In 2020 it is 2017.81 rubles . When the calculated average daily earnings are greater than this threshold, sick leave is accrued based on the specified maximum.

But what about those insured persons who did not work in the previous two years or did not work for the entire period? For such cases, there is a lower limit on earnings. It is calculated based on the minimum wage , which currently amounts to 11,163.00 rubles.

Results

The maximum amount of sick leave in 2019-2020 is limited:

- a limited indicator of average daily earnings according to the maximum base value established for contributions to the Social Insurance Fund: for 2019 - 2,150.68 rubles / day, for 2020 - 2,301.37 rubles / day;

- limited duration of sick leave in days (for a standard case of staying at home due to an ordinary illness - no more than 15).

That is, in a normal situation, the maximum payment for sick leave in 2020 cannot be more: 15 × 2,150.68 = 32,260.20 rubles, and in 2020 - 15 × 2,301.37 = 34,520.55 rubles .

Sources:

- Federal Law of December 29, 2006 No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity”

- Federal Law of July 24, 1998 No. 125-FZ “On compulsory social insurance against industrial accidents and occupational diseases”

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

How to fill out the FSS report in 2020

Accounting workers should pay attention to how the report for the Social Insurance Fund has changed.

The title page and section 2, in which insurance payments are calculated, are retained. Section 1 has been completely eliminated from the report, because the company will be required to send the information contained in it to the Federal Tax Service. It wouldn’t hurt to look at the Federal Tax Service’s website in advance for examples of filling out reports according to the new rules and download the forms necessary for this.

In section 2, the enterprise accountant provides brief data on what payments were made to employees in connection with injuries during work, child care and other situations provided for by law. This report is sent to the FSS. But physically the money should be sent to the Federal Tax Service, because it is now the one that deals with such issues.

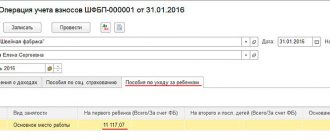

How is sick leave paid?

There are only 2 dates when employees are credited with money - advance and salary.

According to the payment rules, sick leave benefits are accrued on the earliest date.

If your employer violated payment deadlines or you were not paid for sick leave, you can go to court by presenting the following evidence:

- A copy of the sick leave certificate.

- A copy of the employment contract.

- An extract from the bank card account where funds for wages are received.

- A payslip with the accrued amount.

Payment for electronic sick leave depends on the region of residence and can be paid directly by the Social Insurance Fund or the employer.

back to menu ↑

Electronic certificate of incapacity for work: filling out procedure

For accountants, electronic documents are the easiest to use because they cannot be lost.

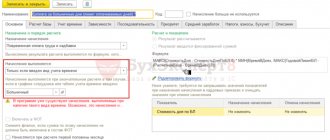

Filling procedure:

- Organization and position. It is necessary to enter the above data in the cells.

- Form of organization. You must check the box next to the type of work - part-time or permanent.

- Registration number and organization code.

- An identification number. If you take sick leave due to pregnancy or you do not have a tax identification number. In other cases, we skip the point.

- SNILS number.

- Periods of insurance and its absence. It is necessary to enter data on the period of contributions to the Social Insurance Fund.

- Average earnings.

- Benefit amount.

- The amount given by the employer in person.

- Accrual conditions.

Sick leave payment terms

After the employee provides documentation of disability, the employer has 10 days to calculate benefits.

The benefit is issued on the nearest date of payment of salary or advance payment.

If a pilot project is launched in the region, the number of days increases. The minimum waiting period is 15 days.

back to menu ↑