The minimum wage in the Volgograd region in 2020 from January 1 is a question that interests many. Efficient citizens of the region do not always have the necessary information to objectively assess their prospects. In addition, there may be some difficulties with the interpretation of the concepts of federal and regional minimum wage. This article is intended to explain the main features of the calculation and methods of calculating the territorial minimum wage in relation to the Volgograd region.

As of January 1, 2020, the amount of the minimum wage for Volgograd residents will not change. Local authorities, with the assistance of the Federation of Trade Unions and the Union of Employers of the region, have developed a program according to which this figure will increase synchronously with the federal figure. Thus, the next rise is expected on July 1, 2020. This is the period when the amendments introduced by the President of the Russian Federation to the Federal Law “On the Minimum Wage” will come into force. Let us remind you that this implies an increase in the minimum wage in the country by 4% or 300 rubles in monetary terms.

Features of regional calculations for the Volgograd region

But this figure is not final. According to a tripartite agreement between the above-mentioned persons, reached at the local level, to withdraw the “minimum wage” to citizens from the budgetary and extra-budgetary spheres, a special coefficient is applied, which is equal to 1.2. By multiplying the official cost of living, which is 9,898 rubles, by this figure, we get the actual minimum wage for the region. At the moment it is 877 rubles and 60 kopecks.

Accordingly, with the next increase in the cost of living, salaries can again be indexed. However, any forecasts can be given after the end of the second quarter of 2019.

We also note that the lowest salaries in the region today are observed among non-budgetary organizations, while employees of government agencies have some privileges. And this case can be called special, since in most regions of the Russian Federation the situation is the opposite.

Equation to the subsistence level

In December 2020, Law No. 421-FZ was adopted, according to which it is planned to increase the minimum wage to the subsistence level. The implementation of this event will take place in two stages.

The first one took place on January 1, 2020, then the figure was increased to 9,489 rubles. As for the second stage, it was initially established that it would be implemented only at the beginning of 2020.

However, the Government of the Russian Federation took other actions. As a result, already on May 1, 2020, the minimum wage was 11,163 rubles, which made it equal to the subsistence level for the second quarter of 2017.

The subsistence minimum is the cost of a conditional consumer basket, which includes a list of food products, non-food products and services necessary to maintain the life of an average person. Additionally, mandatory payments and fees are taken into account - taxes, payment for housing and communal services and other amounts.

The minimum is set at the end of the next quarter based on statistical data and the current inflation rate. Both federal and regional PM are distinguished. Accordingly, the constituent entities of the Russian Federation have the right to independently determine the minimum wage. However, changes are allowed only in the direction of increase.

It is worth understanding that the minimum wage cannot correspond to the current PM, since the data is published by Rosstat only at the end of the reporting period. Moreover, after receiving this information, the Government needs time to develop adequate measures, which, again, is not done instantly.

Therefore, it is normal for changes to lag behind the actual situation by several months. Unfortunately, it is almost impossible to correct this situation without significant losses.

General concepts

To bring even greater clarity to what is happening at the state and regional level, let’s look at what the minimum wage is formed from and what factors influence its value. Thus, when calculating federal significance, the average figures obtained by statistical and control bodies in various territories of the country are taken as a basis. As a result, the end result is quite inaccurate and may not apply to all areas.

Regional minimum wage is a more subjective and individual concept that was introduced relatively recently. The main tools here are:

- Living wage (in this case, Volgograd region).

- Cost of the consumer basket.

- Cost of household and social services.

- Prices on the domestic market, etc.

By bringing together all these parameters, local governments form the very coefficient by which the federal value is multiplied. As a result, we have the amount announced above.

The size of the minimum salary taking into account the coefficient

Before moving directly to determining wages taking into account the coefficient, it is worth clarifying one point regarding the possibility of setting a rate lower than the federal minimum wage. In particular, this applies to persons who are employed part-time or part-time. In such situations, payment is calculated based on the time actually worked.

So, according to the provisions of Art. 129 of the Labor Code of the Russian Federation, the minimum remuneration for work under the relevant agreement is formed taking into account the following parameters:

- employee qualifications;

- complexity and volume of activities;

- working conditions;

- compensation (additional payments, allowances, as well as payment for performing assigned functions in conditions different from standard ones, during radiation and in difficult climatic zones);

- stimulating (be it a bonus or other encouragement);

- allowances of a different nature.

At the same time, regional coefficients do not take part in the calculations of the minimum wage - they are taken into account above the minimum. In the Omsk region, this parameter corresponds to a value of 1.15.

If the minimum wage includes all bonuses and remunerations included in the wage system, then regional coefficients and bonuses are calculated in excess of the minimum wage.

Thus, it turns out that the minimum wage that a resident of Omsk can count on is the minimum wage multiplied by 1.15, which equals 12,837.45 rubles.

That is, if an employer pays its employee less than this amount (without grounds approved by law), then he is held administratively liable.

Features of a tripartite agreement

When signing these agreements, the process involves 3 parties representing the interests of each class - workers, government and trade unions. However, despite the rather objective composition, there are a large number of employers who disagree with the decision, who cannot or simply do not want to pay their employees a salary in accordance with the regional minimum wage.

Even taking into account the fact that the document is official, it is rather advisory in nature, and after signing, all enterprises and individuals carrying out professional activities in the region are required to send out notifications of changes. And from this moment, within 30 days, each employer has the right to refuse the proposed conditions.

To carry out this procedure, you must follow a simple procedure:

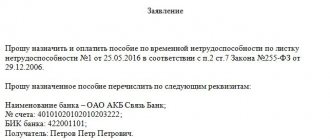

- Write a reasoned refusal in the application form.

- Indicate the reasons why the employer refuses to comply with the minimum wage conditions.

- Send an application to the Labor Committee.

In fact, there are a great many reasons, and it is not always possible to verify their validity. The most common ones are the lack of sufficient funds on the balance sheet, a crisis in the country, the risk of closing an enterprise or reducing the number of jobs.

Salaries, pensions and benefits will increase: changes in 2020

Journalists from “Evening Volgograd” have prepared a traditional review of key innovations in various spheres of life.

The minimum wage will be equal to the subsistence level.

From January 1, 2020, the minimum wage for the working population at the federal level will increase by 850 rubles and amount to 12,130 rubles.

Regions set their own minimum wage, the only condition being that it cannot be less than the national figure. The minimum wage is indexed annually based on the cost of living for a working person for the second quarter of the previous year and the regional coefficient.

In the Volgograd region, the minimum wage is determined by the agreement of the regional administration with trade unions and the association of employers (No. RS-71/19 dated June 26, 2020).

“For the non-budgetary sector of the economy, the minimum wage is set at 1.3 times the subsistence level of the working-age population of the Volgograd region for the second quarter of the previous year,” the document says.

Taking into account the fact that the cost of living for the working population for the second quarter of 2020 in the region is 10,794 rubles, multiplying this indicator by a factor of 1.3 will result in a minimum wage equal to 14,032 rubles 20 kopecks.

As for state and municipal institutions, budgetary, non-profit organizations, associations of disabled people and all other institutions, they will be guided by the new all-Russian indicator (12,130 rubles), without taking into account the coefficient.

All these organizations are obliged to raise wages to the minimum wage established for them.

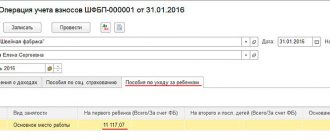

In addition, the minimum wage directly affects the calculation of sick leave, vacation pay, maternity leave, business trips, and the amount of some social benefits and compensation.

– For example, if the minimum wage in 2020 is equal to 12,130 rubles, the average daily amount of sick leave benefits should not be less than 398.79 rubles. (RUB 12,130 x 24 months / 730), the social insurance fund clarifies. – The amount of the minimum benefit is calculated by multiplying the number of days of sick leave by the average daily amount obtained from the current minimum wage. When calculated from average daily earnings, 398.79 rubles. The following minimums will apply in 2020:

RUB 55,830.60 – for 140-day sick leave (398.79 x 140);

62,211.24 – for 156 days (398.79 x 156);

77,365.26 – for 194 days (398.79 x 194).

The amount of benefits for the first and second child will increase

From January, changes to the law on payments for the first and second children will come into force, which will expand the circle of recipients several times.

Let us remind you that the payments are approximately the same - they depend on the cost of living in each region and amount to about 10 thousand rubles. But the sources of payments are different. If the benefit for the firstborn is paid by the state budget, then the money for the second child comes from maternity capital funds - if the parents submit the appropriate application. The main amendment, which comes into force on January 1, 2020, is that benefits will be paid not up to one and a half years, as today, but up to three. Another change concerns the rules for determining need.

“Families with an average per capita income not exceeding two times the subsistence level will have the right to this payment, and not one and a half times, as at present,” explains Tatyana Nikitina, a representative of the Social Protection Committee.

In the Volgograd region in 2020, the payment is 9,569 rubles, in 2020 it will increase to 10,123 rubles.

To receive payments from maternity capital, parents must submit an application to the Pension Fund, and the social security service handles benefits for the firstborn. A package of necessary documents can be submitted to the MFC.

If the firstborn is already one and a half years old, then after January you need to apply for benefits again. If you turn one and a half years old already in 2020, monthly payments will be automatically extended.

Electronic work books will be created for employees

On January 1, a package of laws on electronic labor comes into force in Russia. The digital book will provide employees with constant and convenient access to information about their work activities, and will open up new opportunities for personnel records for employers. In particular, information will begin to be transmitted to the Pension Fund online.

“An electronic work record book will allow us to minimize erroneous, inaccurate and unreliable information about work activities arising due to the human factor,” says Olga Vedeshina, deputy manager of the Pension Fund of Russia branch for the Volgograd region. – This also opens up additional opportunities for remote employment. The costs of employers for purchasing, maintaining and storing paper work books will be reduced, and information support will create a high level of security and integrity of data.

The transition to electronic work books is voluntary. An employee can keep a paper record book for as long as necessary. To switch to the new system, a citizen must submit a written application. Those who do not have time to decide in what format to conduct their work activities in 2020 will automatically switch to the electronic format. And people who officially started working after January 1, 2021 will no longer be able to obtain a paper work book.

Mothers and people over 50 will be able to undergo vocational training

Since January, the list of persons who will be able to undergo free retraining or improve their qualifications as pre-retirees has been expanded. Now absolutely all citizens who have reached the age of 50 will be able to do this, regardless of when they are granted a pension.

Let us remind you that this year only those who had five years left before receiving a pension were allowed to study. Such citizens can either independently contact the employment center at their place of residence, or at the initiative of the employer, who will subsequently be fully compensated for all costs.

For the duration of classes, unemployed retraining participants are assigned an allowance in the amount of the minimum wage established in the territory of the Russian Federation. In 2020, not only will the category of recipients expand, but the amount of funding for the program will also increase.

– This year, more than 2,000 people were sent for vocational training in the Volgograd region. The changes, which will come into force on January 1, will significantly expand the circle of people who will be able to take advantage of the program, says Dmitry Loktionov, chairman of the regional committee for labor and employment. – This is a good help for this age category to be more in demand in the labor market. We really hope that this event will help our pre-retirees and that they will continue to cooperate with us. So do employers.

The vocational training program for mothers will also expand. If today women who are on maternity leave, that is, in an employment relationship, can receive free training, then from the new year all mothers will attend preschool, regardless of whether they have a job or not. And if in 2020 more than 60 women received free vocational training, then next year they plan to cover 550! Students receive a stipend for the duration of their studies.

The size of the insurance pension will increase

From January 1, 2020, the insurance pension for non-working pensioners will increase by 6.6%. This will happen due to changes in two parameters that directly affect its size - the fixed payment (in the coming year it will be equal to 5,686 rubles 25 kopecks) and the pension coefficient (now it will cost 93 rubles). For working pensioners, indexation will traditionally be carried out in August, when recalculating their work experience.

The age threshold for retirement for men and women in 2020 will be determined as follows. In the first half of 2020, women born in the second half of 1964 and men born in the second half of 1959 will retire.

All of these changes are related to the pension reform to increase the retirement age.

Irina Marchenko, Margarita Babanova, Yulia Kazanjan, Olga Bagrova. Photo by Kirill Braga.

Consequences

Now there is a very clear trend. If an organization initially refused to legally comply with the requirements of the regional minimum wage, it is treated loyally and is not interfered with in its work. If for some reason the company previously fulfilled its obligations and then expressed a desire to move to the federal level, the Labor Committee, the Federal Tax Service and other structures may have questions, as a result of which inspections are initiated, the motivation is clarified, and quite often suspicions arise about “gray” salaries.

The conclusion suggests itself: if it is possible to pay wages by regional standards, it is better to do so in order not to have to deal with unnecessary proceedings and paperwork.

Minimum wage in the Omsk region

The activities of TSK in the Omsk region are regulated by the Law approved by the Governor, No. 452-OZ dated 06/11/03. According to it, 9 representatives of each side take part in the Commission. The agreement is considered accepted if all three parties vote “for” (i.e., the majority of representatives from each of them).

Note to the table: updated minimum wage values for a specific date are highlighted in bold. The values in the Omsk region for 2014, 2020, 2020, 2020, 2020, 2020 are given. These minimum wage values are applied in the cities of Omsk, Tara, Isilkul, Kalachinsk and other settlements of the Omsk region.

We recommend reading: Who Rents RSV1 in 2020

New minimum wage from January 1, 2020: table for all regions

Regional agreement between the government of the Bryansk region, the public organization "Federation of Trade Unions of the Bryansk Region" and associations of employers of the Bryansk region on the minimum wage in the Bryansk region for 2020

Keep in mind: do not include bonuses for work in the Far North and the regional coefficient in the amount of the salary that you compare with the minimum wage. Accrue these payments on top of your salary. That is, the salary should be no less than the regional or sectoral minimum wage, without the regional coefficient and the “northern bonus.”