The minimum wage is one of the most important indicators. The minimum wage, benefits and a number of other payments depend on it.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 110-43-85 (Moscow)

+7 (812) 317-60-09 (Saint Petersburg)

8 (800) 222-69-48 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

The minimum wage in the Irkutsk region has changed several times, but employers must always focus on the current value when calculating the corresponding payments. At the same time, they also need to take into account a number of features of the region.

What it is

On the territory of Russia, according to the bill, an act dated June 19, 2000 was recorded that the minimum wage for citizens should not be lower than the norm.

Thus, there is a setting of a certain salary for work, where workers are not allowed to pay less than a fixed amount.

In practice, this is not the first time such an innovation has occurred. In 1991, an attempt was made to compare the general minimum wage and the subsistence level.

At that time, the amount was equal to 170 rubles. Subsequently, by 2016, the minimum wage in the Russian Federation was fixed at 6,300 rubles.

But, unfortunately, the cost of living is growing much faster. For this reason, Russians still welcomed 2020 with 9,000 rubles or more.

In the capitals of the country, the amount is much higher - 13,000 rubles. Today, the government is trying to equalize the minimum wage and the subsistence level, as this is an excellent component for the country’s economy.

By 2020, the difference in indicators became smaller. According to legislation No. 82, the minimum wage is applied when: it is necessary to establish the amount of income for the working class, combining it with a variety of payments - sick leave, vacation pay, etc.

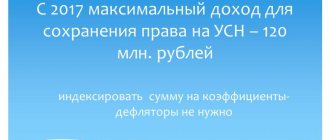

Fixed contributions for individual entrepreneurs from 07/01/2016

Well, this will not affect us, entrepreneurs, in any way. The calculation of insurance premiums for entrepreneurs remains at the old level.

For 2020 we will pay fixed rates. (by following the link you will see the calculations that I carried out for 2020, that is, for all 12 months)

THERE WILL BE NO CHANGES IN THE CALCULATION OF FIXED CONTRIBUTIONS IN 2020 AND THE OLD MINIMUM WAGE OF RUB 6,204 WILL BE USED IN THE CALCULATIONS.

Currently, many entrepreneurs use this Internet accounting to calculate taxes, contributions and submit reports online, try it for free. The service helped me save on accountant services and saved me from going to the tax office.

The procedure for state registration of an individual entrepreneur or LLC has now become even simpler. If you have not yet registered your business, prepare documents for registration completely free of charge without leaving your home through the online service I have tested: Registration of an individual entrepreneur or LLC for free in 15 minutes. All documents comply with the current legislation of the Russian Federation.

Legal grounds

According to the law, the salary may in fact be lower than the minimum wage, since the salary also includes compensation payments - bonuses, allowances, etc. (Article 129 of the Labor Code of the Russian Federation).

It follows that when an employee, with all the allowances, has an income greater than or at the level established in the region the minimum wage, in this case there will be no problems.

Important! After the delay in personal income tax, the management of the organization faces no threat from the income that the worker receives below the minimum wage.

If a worker’s income is less than the norm, then management is obliged to pay an additional amount. According to the law, from January 1, 2018, the minimum wage is 9,400 rubles. Art. 3 Federal Law dated December 28, 2017 No. 421-FZ.

It follows that if a salary is received below the norm, combined with all additional payments, then such an employee should be paid extra.

Important! The minimum wage from July 1, 2018 increases by 11,100 rubles, data according to Federal legislation dated March 7, 2018 No. 41-FZ.

The Labor Code of the Russian Federation fixes the minimum wage value not lower than the subsistence level for the working population according to Article 133 of the Labor Code of the Russian Federation.

Of course, this can be perplexing to production managers, since the cost of living is usually higher than the minimum wage. That is why it is recommended to rely on minimum wage standards in order to be right.

Minimum wages by region

With changes and additions from 07/01/2016

| Region of the Russian Federation | Minimum wage in 2020 |

| Central Federal District | |

| Belgorod region | 8694 |

| Bryansk region | 6500 |

| Vladimir region | 6204 7000 |

| Voronezh region | 6204 (for budgetary organizations) 8787 (for extra-budgetary organizations) |

| Ivanovo region | 8645 |

| Kaluga region | |

| Kostroma region | 7500 (for public sector organizations) at the subsistence level (for non-budgetary organizations) |

| Kursk region | 7500 (for public sector organizations) at the subsistence level (for non-budgetary organizations) |

| Lipetsk region | 6000 (for budgetary organizations) (for extra-budgetary organizations) |

| Moscow region | 12500 |

| Oryol Region | 9778 |

| Ryazan Oblast | 6350 (for budgetary organizations) 7500 (for non-budgetary organizations) |

| Smolensk region | 6200 |

| Tambov Region | 6240 (for budgetary organizations) 7500 (for extra-budgetary organizations) |

| Tver region | 7500 (for budgetary organizations) 7280 (for non-budgetary organizations) |

| Tula region | 11000 (from 01.08.2016) (for budgetary organizations) 13000 (from 01.08.2016) (for non-budgetary organizations) |

| Yaroslavl region | 6000 (for budgetary organizations) 8021 (for extra-budgetary organizations) |

| Moscow | 17300 |

| Northwestern Federal District | |

| Republic of Karelia | 7213 (for public sector organizations in the northern regions: Belomorsky district, Kalevalsky district, Kemsky district, Loukhsky district, Kostomuksha) 5796 (for public sector organizations in other districts) at the subsistence level (for non-budgetary organizations) |

| Komi Republic | 6500 |

| Arhangelsk region | 7500 |

| Vologda Region | 7500 |

| Kaliningrad region | 10000 |

| Leningrad region | 7800 |

| Murmansk region | 13650 |

| Novgorod region | 6204 (for public sector organizations) at the subsistence level (for non-budgetary organizations) |

| Pskov region | 7500 |

| Saint Petersburg | 11700 |

| Nenets Autonomous Okrug | 6204 |

| Southern Federal District | |

| Republic of Adygea | 7500 |

| Republic of Kalmykia | 7500 |

| Krasnodar region | 7500 (for public sector organizations) at the subsistence level (for non-budgetary organizations) |

| Astrakhan region | 7500 (for budgetary organizations) 7350 (for non-budgetary organizations) |

| Volgograd region | 7500 (for public sector organizations) not less than 1.2 subsistence minimum (for non-budgetary organizations) |

| Rostov region | 7500 |

| North Caucasus Federal District | |

| The Republic of Dagestan | 7500 |

| The Republic of Ingushetia | 7500 |

| Kabardino-Balkarian Republic | 7500 (for public sector organizations) at the subsistence level (for non-budgetary organizations) |

| Karachay-Cherkess Republic | 7500 |

| Republic of North Ossetia-Alania | 7500 |

| Chechen Republic | 8252 |

| Stavropol region | 8588 |

| Volga Federal District | |

| Republic of Bashkortostan | 7500 (for budgetary organizations) 8900 (for non-budgetary organizations) |

| Mari El Republic | 9251 |

| The Republic of Mordovia | 7500 |

| Republic of Tatarstan | 6204 (for budgetary organizations) 7309 (for extra-budgetary organizations) |

| Udmurt republic | 7500 |

| Chuvash Republic | 7500 (for budgetary organizations) 6988 (for non-budgetary organizations) |

| Perm region | |

| Kirov region | 7500 |

| Nizhny Novgorod Region | 7500 (for budgetary organizations) 9000 (for non-budgetary organizations) |

| Orenburg region | 7500 |

| Penza region | 7500 |

| Samara Region | 7500 |

| Saratov region | 7500 (for budgetary organizations) 7900 (for non-budgetary organizations) |

| Ulyanovsk region | 6500 (for budgetary organizations) 10000 (for non-budgetary organizations) |

| Ural federal district | |

| Kurgan region | 7500 (for budgetary organizations) 7620 (for extra-budgetary organizations) |

| Sverdlovsk region | 8862 |

| Tyumen region | 7700 (for budgetary organizations) 9300 (for non-budgetary organizations) |

| Chelyabinsk region | 6100 (for budgetary organizations) 8300 (for extra-budgetary organizations) |

| Khanty-Mansiysk Autonomous Okrug - Yugra | Minimum wage, taking into account the regional coefficient and percentage increase in wages |

| Yamalo-Nenets Autonomous Okrug | 12431 |

| Siberian Federal District | |

| Altai Republic | 7500 (for budgetary organizations) 8751 (for non-budgetary organizations) |

| The Republic of Buryatia | 7500 |

| Tyva Republic | 7500 (for budgetary organizations) not less than 6300 (for non-budgetary organizations) |

| The Republic of Khakassia | 7500 |

| Altai region | 7500 (for budgetary organizations) 9400 (for non-budgetary organizations) |

| Transbaikal region | 6044 (for budgetary organizations) 8095 (for extra-budgetary organizations) |

| Krasnoyarsk region | 6204 (for budgetary organizations) 9544 (for extra-budgetary organizations) |

| Regions of the Far North of the Krasnoyarsk Territory | 16130 (Norilsk, Taimyr Dolgano-Nenets municipal district) 14269 (North Yenisei district) 19009 (Evenkiy municipal district) 15313 (Turukhansky district) 15200 (Yeniseisk) |

| Irkutsk region | 7774 (for budgetary organizations) 9717 (for extra-budgetary organizations) |

| Kemerovo region | 13617 |

| Novosibirsk region | 9030 (for budgetary organizations) 9390 (for extra-budgetary organizations) |

| Omsk region | 6204 (for budgetary organizations) 7135 (for extra-budgetary organizations) |

| Tomsk region | 7500 (for budgetary organizations) 8581 (for extra-budgetary organizations) |

| Far Eastern Federal District | |

| The Republic of Sakha (Yakutia) | 15390 |

| Kamchatka Krai | 16910-19510 |

| Primorsky Krai | 7500 |

| Khabarovsk region | 11414-15510 |

| Amur region | 7500 |

| Magadan Region | 18750 (for budgetary organizations) 20250 (for non-budgetary organizations) |

| Sakhalin region | 16838 |

| Jewish Autonomous Region | 7500 |

| Chukotka Autonomous Okrug | 6204 |

| Crimea | |

| Republic of Crimea | 6204 (for budgetary organizations) 7042 (for extra-budgetary organizations) |

| Sevastopol | 6204 (for budgetary organizations) 7343 (for extra-budgetary organizations) |

Archive:

Table of changes in values in the region

The current law states that the minimum wage in the Irkutsk region from July 1, 2018, based on adopted regulations, is 11,100 rubles for the base value and 12,000 rubles for remote areas.

Table of changes in values in the region:

Minimum salary in Moscow for benefits for low-income people

- Declarative principle. To receive a need-based benefit, the child’s parents (guardians) must submit an application and the necessary documents to the relevant authority themselves, confirming their need for additional support.

- Targeting and need. It is planned to abandon the principle of categoricality. Many payments will now be awarded exclusively to low-income families (especially at the regional level).

We recommend reading: Receive Compensation for Dairy Kitchen in Krasnodar

The cost of living for the 4th quarter of 2020 was established by Decree of the Moscow Government No. 176-PP dated March 13, 2020: The cost of living for the first quarter of 2020 is expected in June 2020. How is the cost of living determined in Moscow?

Responsibility for paying wages below the minimum wage (table)

Sometimes, despite the law, the management of a particular company fixes an employee’s salary below the minimum wage.

But according to the law, according to Article 133 of the Labor Code of the Russian Federation, monthly income for work performed should not be lower than the minimum wage.

The employee's salary consists of:

- salary;

- bonuses;

- incentive payments;

- compensation payments.

When a worker does not work full time for a month, then the law of the Russian Federation, according to Article 93 of the Labor Code, establishes the possibility of paying wages below the fixed norm.

In this situation, the head of the company must stipulate the following in the employment contract:

- work and rest hours;

- duration of the working day;

- a period that records the inadequacy of time worked;

- break time at work;

- the time when a worker starts and finishes an activity.

When an employee works less than the required time in accordance with the employment contract, the employer has the right to calculate wages based on the amount of work performed.

Provided they work part-time, workers are not provided with restrictions on the duration of annual leave, accrual of length of service and other labor rights.

Based on the Federal Law of December 19, 2016 No. 460-FZ “On Amendments to Article 1 of the Federal Law on Minimum Wages,” the payment is fixed from July 1, 2017 in the amount of 7,800 rubles. monthly. Therefore, the employee's income cannot be less than the amount.

Let's give an example. At the guard Osokin A.V. salary for December 2020:

| Salary | 2400 rub. |

| Compensatory | 720 rub. |

| Stimulating | 1200 rub. |

As a result - 4320 rubles. the total amount, where the boss must pay up to the established amount of 7800 rubles, which means an addition to the salary of 3480 rubles.

When an employer pays employees wages not in accordance with the legislation of the Russian Federation, then if labor inspectors establish a violation, the head of the organization faces a fine under the law, Part 6, Article 5.27 of the Code of Administrative Offenses of the Russian Federation:

| When the employer is a legal entity | Then a fine is imposed in the amount of 30,000 to 50,000 rubles for a company, from 10,000 to 20,000 rubles for officials |

| When the boss is an individual entrepreneur | Then a fine is imposed in the amount of 1,000 to 5,000 rubles |

In addition, the heads of companies that pay wages below the level are especially interested in representatives of the tax service, due to the payment of money “in an envelope”. As a result, hidden taxable income and non-payment of personal income tax.