Minimum wage for the quarter of the year for the Sverdlovsk region

The minimum wage (minimum wage) is used to regulate wages and determine the amount of benefits for temporary disability, pregnancy and childbirth, as well as for other purposes of compulsory social insurance.

The size of the minimum wage is prescribed in Federal Law No. 82-FZ of June 19, 2000 and is subject to annual indexation. The right of an employee to receive a salary not lower than the minimum wage is guaranteed by the Labor Code of the Russian Federation. In accordance with Art. 133 of the Labor Code of the Russian Federation, the approved minimum wage is valid throughout the country and cannot be less than the subsistence level of the working population.

The minimum wage in a constituent entity of the Russian Federation cannot be lower than the minimum wage established by federal law.

https://youtu.be/iIEMmXHMy9A

What else is worth knowing

Wages, or rather the minimum wage in the Sverdlovsk region, are established as the lower limit of wages that each employee receives on a monthly basis. This is typical for all regions of the Russian Federation. At the same time, it is stipulated that the employee must necessarily fulfill the monthly labor standard.

At its core, this amount represents a guaranteed minimum, with the help of which all the needs of a citizen of the Russian Federation can be met in the following aspects:

- purchasing a basic set of food products;

- acquisition of material goods;

- payment for services, including utilities.

In 2020, the minimum wage in the cities of the Sverdlovsk region does not allow us to talk about exactly what needs can be fully satisfied. That is why the Government of the Russian Federation annually takes concrete measures to increase the minimum wage throughout the country.

The increase in the minimum wage from July 1, 2020 in all federal subjects indicates not only a change in the minimum wage threshold for residents of the region. In accordance with legislative changes, it will be possible to increase the amount of some social benefits and compensation payments.

First of all, this can be attributed to the following payments:

- for temporary disability;

- for pregnancy and childbirth;

- on maternity leave, until the newborn child reaches the age of 1.5 years.

As for the calculation of benefits for sick leave, the new level of wages in the region under consideration will be used in the following cases:

- an employee of any organization did not receive wages during the billing period;

- the salary is below the minimum wage in the region;

- work experience is less than 6 months;

- the employee violated the regime established by the medical institution.

In this case, the calculation process takes into account the minimum payment amount established for the whole of Russia.

Liability and fines

It is worth remembering that the monthly salary may be less than the minimum wage if an employee of an enterprise or private organization operates on a part-time basis. In accordance with the norms of Article No. 129 of the Labor Code of the Russian Federation, wages include the basic salary, compensation, additional allowances and incentive payments.

Taking into account all allowances to the basic amount, the employee must necessarily receive an amount equal to or greater than the minimum wage in the region. If the salary is less than the minimum value, then the employer is obliged to establish additional payments up to the minimum wage.

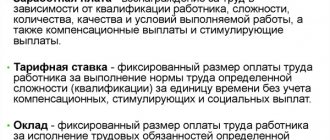

Article 129 of the Labor Code of the Russian Federation. Basic concepts and definitions

Every employer should be aware that it may face problems if its employees receive low wages. Based on the results of inspection activities, the authorized labor inspectorate may impose objective penalties.

In accordance with Article No. 5.27 of the Code of Administrative Offenses, this violation entails the imposition of a financial fine on officials in the amount of up to 20,000 rubles. As for legal entities, for them this amount increases to 50,000 rubles.

For repeated violations, fines of up to 30,000 and 100,000 rubles are imposed, respectively. Among other things, disqualification is possible for up to 3 years. During this period, entrepreneurs will not be able to carry out their activities legally.

Pernicious offenders may face up to 1 year in prison in accordance with Article No. 145 of the Criminal Code of the Russian Federation.

The minimum wage in the Sverdlovsk region from July 1, 2020

Previously, based on the minimum wage, the amount of insurance premiums for individual entrepreneurs for compulsory health insurance and compulsory medical insurance was determined; now the contributions are fixed and do not depend on the minimum wage. Here is a table with the main provisions of the legislative acts on minimum wages and minimum wages: Link to the normative document What is regulated by Art. 133 of the Labor Code of the Russian Federation Financial support for expenses related to the establishment of wages for employees not lower than the minimum wage Art.

The minimum wage in a constituent entity of the Russian Federation cannot be lower than the minimum wage established by federal law.

If the minimum wage is not established in a constituent entity of the Russian Federation, then the minimum wage is applied. Minimum wage from May 1, 2020 in Russia The minimum wage (minimum wage) is the legally established minimum wage per month. The minimum wage is used to regulate wages and determine the amount of benefits for temporary disability, pregnancy and childbirth, as well as for other purposes of compulsory social insurance (Article 3 of the Federal Law of June 19, 2000 N 82-FZ).

From May 1, 2020, the minimum wage in the Russian Federation is 11,163 rubles. (Article 1 of the Federal Law of June 19, 2000 N 82-FZ).

Minimum wage and cost of living in the Sverdlovsk region for 2020

The minimum wage (minimum wage) from January 1, 2020 in the Sverdlovsk region is the same as at the federal level - 11,280 rubles. To calculate wages, the Ural regional coefficients are also added to this indicator. The cost of living in the Sverdlovsk region for the 3rd quarter of 2020 per capita is 10,656 rubles. There are no data for the 4th quarter yet.

We will tell you how the values of the minimum wage and the subsistence minimum relate to each other, what is the size of the minimum and average wages in the region.

What is the minimum wage and why is it needed?

The minimum wage is the lowest salary that an employer has the right to pay to an employee who has worked a full month. You cannot pay below the minimum wage - this is a serious violation of labor legislation, for which high administrative fines are provided in accordance with paragraphs 6, 7 of Art. 5.27 Code of Administrative Offenses of the Russian Federation.

The minimum wage is used when calculating benefits for persons who have gone on parental leave to care for children under 1.5 years old, “maternity leave” (for working women), to calculate the amount of benefits for the unemployed and for temporary disability, and pension payments.

The parameters of the minimum wage in the Russian Federation are established by law at the federal level. Article 1 of the Federal Law of the Russian Federation dated October 19, 2000 No. 82-FZ implements the norms of Article 133 of the Labor Code of the Russian Federation. The minimum wage should now not fall below the subsistence level for workers for the 2nd quarter of last year. From January 1, 2020, this value should not be lower than 12,130 rubles (Order of the Ministry of Labor of Russia dated 08/09/2019 N561н). But constituent entities of the Russian Federation can establish in their local acts that the lowest salary for persons working in the region is higher than in the country as a whole (Article 133.1 of the Labor Code of the Russian Federation).

Living wage and minimum wage in the Chelyabinsk region from 01/01/2020 with the Ural coefficient

Minimum wage in the Russian Federation and in Yekaterinburg

The regulatory legal act on the basis of which the value of the “minimum wage” is established is Federal Law No. 82-FZ of June 19, 2000, its article No. 1. The basic value of the minimum wage is applied by all organizations: both budgetary and commercial.

The minimum wage in the Sverdlovsk region in 2020, from January 1, was 11,280 rubles per month. Let us remind you that the Government of the Russian Federation has decided to increase the minimum wage, which is now 100% equal to the subsistence level. The “minimum wage” in Russia corresponds to the monthly minimum wage for the 2nd quarter of 2020 and, most likely, will not change until the end of 2020.

Due to the need to raise the minimum wage to the federal level, the budget of the Sverdlovsk region for 2020 was adjusted, and the planned budget for 2020-2020 with additions was approved by the Legislative Assembly of the region on March 20, 2018. Additional budget expenses amounted to 1.5 billion rubles. Of this, 1.364 billion rubles will be used to increase the minimum wage level for public sector employees to the subsistence level.

Features of the Ural “minimum wage”

It must be borne in mind that in the Sverdlovsk region the minimum wage is applied with a regional coefficient. The fact is that in the region there are areas with special climatic conditions. In this regard, wages for such areas are set with amendments. Adjustments are made by applying regional coefficients.

Such regional bonuses are required to make wages higher than the established minimum wage. This norm was clarified by the Resolution of the Constitutional Court dated 12/07/17 # 38-P.

So, what regional coefficients apply in the Sverdlovsk region:

- 1.2 - for Garinsky, Taborinsky districts, the cities of Ivdel, Severouralsk, Karpinsk, Krasnoturinsk and territories under their control. In these municipal units the minimum wage will be 13,536 rubles;

- 1, 15 - for Yekaterinburg itself and a number of other areas. Here the minimum wage, taking into account the coefficient, will be 12,972 rubles;

An even higher minimum wage could be set at the local level. It is developed and proposed by the “Sverdlovsk Regional Union of Industrialists and Entrepreneurs”, and approved by the regional authorities.

Previously, the agreement of the Regional Association of Employers No. 151 of 08/30/17 was in force in the region. In accordance with its provisions, the minimum wage in 2020 (since October) in the region was 9,217 rubles, which exceeded the federal figure. However, from January 1, 2020, the federal minimum wage exceeds the value established by agreement # 151. Therefore, the state “minimum” is in effect. A new regional agreement was not concluded.

Territories and tariffs applied to them

| Territory covered by the increased tariff | Tariff amount | Minimum wage of the Sverdlovsk region from January 1, 2020 with the Ural coefficient without deduction of personal income tax |

| Cities of Karpinsk, Ivdel, Severouralsk, Krasnoturinsk | 1,2 | 11,280 x 1.2 = 13,536 rubles |

| Areas under the administrative control of local authorities: Ivdelsky, Karpinsky, Severouralsky, Krasnoturinsky districts | 1,2 | 13,356 rubles |

| Taborinsky and Garinsky district | 1,2 | 13,356 rubles |

| Dobrinsky, Nosovsky, Firulevsky, Aleksandrovsky, Kuznetsovsky, Overinsky, Chernovsky, Palminsky and Ozersky districts | 1,2 | 13,356 rubles |

| Ekaterinburg and other territories of the Sverdlovsk region | 1,15 | 11,280 x 1.15 = 12,972 rubles |

The regional coefficient refers to an incentive bonus for employees and is required to be paid by employers (Articles 316, 146 of the Labor Code of the Russian Federation). Registration of a person working at a rate lower than the indicators indicated in the table is prohibited by the Labor Code of the Russian Federation. It is also prohibited to separate the payment of the “minimum wage” and payments according to the coefficient.

Employers should take into account that the regional coefficient is also calculated for employees who are temporarily employed, work part-time or have seasonal jobs.

If the requirements of the law are violated, the employer will be brought to administrative, and in some cases, criminal liability (Article 5.27 of the Code of Administrative Offenses of the Russian Federation).

Living wage in the Russian Federation and Yekaterinburg

The Federal Law “On the subsistence level in the Russian Federation” dated October 24, 1997 # 134-FZ establishes the following concepts:

The cost of the consumer basket and the cost of living calculated on its basis justify the minimum wage adopted at the federal level. The minimum indicator established for the 2nd quarter of the previous year is taken into account.

Local regulations apply in the region:

- Law # 15-OZ “On the living wage in the Sverdlovsk region” 0t 04.01. 1995;

- Law #47-OZ “On the consumer basket in the Sverdlovsk region for 2013-2020” dated May 24. 2013.

Note! The composition of the consumer basket in the region, as throughout the country, is frozen and unchanged from 2012 to 2020.

The cost of living in the Sverdlovsk region in 2020 was:

The cost of living in the Sverdlovsk region for 2020 has not yet been established - data for the 4th quarter of 2020 has not yet been published, the corresponding order should be expected in February.

The practical role of the minimum is that benefits are calculated on its basis. For example, when assigning a child benefit for the first child or when receiving a monthly payment from maternity capital, the amount of the family’s average per capita income is calculated. When it is below one and a half times the minimum monthly wage established for the 2nd quarter of the previous year, the right to benefits arises.

Is the Sverdlovsk region a region of the Far North

The northern regions are characterized by difficult climatic and working conditions. For these reasons, benefits and preferences are available to workers in the Far North on an ongoing basis. In addition, industrial enterprises with unhealthy working conditions are required to provide employees with additional vacation days and salary increases.

The list of regions of the Far North is established by the legislation of the Russian Federation, and the Sverdlovsk region is not included in this list. However, employers pay employees the minimum wage in the Sverdlovsk region in 2019 with the Ural coefficient, since this type of additional payment is in effect in the region.

Average salary in the Sverdlovsk region in 2020 according to Rosstat

According to the latest data, Rosstat has published information for the first 10 months of 2020. Information about the beginning of 2020 will appear approximately after March. Average salaries in the Sverdlovsk region in 2020 were by month, in rubles:

- in January - 33,809;

- in February - 34,438;

- in March - 35,337;

- in April - 35,911;

- in May - 38,730;

- in June - 40,338;

- in July - 37,805;

- in August - 36,471;

- in September - 36,787;

- in October - 36,222.

This is information for all organizations. The average monthly salaries for employees of organizations by type of activity were calculated as of November 2020. The difference in salaries between the beginning of the year (36,729 rubles) and the 11th month (37,604 rubles) showed a slight increase of 875 rubles.

Statistics prove that:

- The cheapest paid labor is in hotels and catering establishments, where the average salary was 19,982 rubles. The level of salaries decreased: at the beginning of the year the average value was 20,141 rubles.

- It is profitable to work in the financial and insurance sectors, where average salaries reached 60,930 rubles by November.

- The most profitable earnings turned out to be scientific research and development - the payment for them is 62,976 rubles.

Therefore, it can be argued that changes in the minimum wage or subsistence level from January 1, 2020 in the Sverdlovsk region will not significantly affect salaries in private business.

Level by year according to Rosstat

In 2020, the average salary in the Sverdlovsk region was 38,000 rubles, in Yekaterinburg – 52,000 rubles. According to the latest official data from Rosstat, in January 2019, an increase in wages was recorded at 5.2% compared to the same reporting period last year.

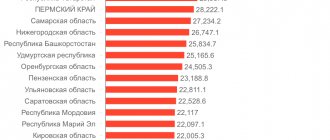

According to an independent rating of Russian regions based on the average level of wages of officially employed segments of the population, the Sverdlovsk region ranks 27th out of 82 possible, which can be considered a very good indicator. For the Ural Federal District, this value is considered very low. Ekaterinburg is ahead only of the Chelyabinsk and Kurgan regions.

The Sverdlovsk region is one of the large industrial regions, the economic development of which is ensured by the extraction of precious metals and other minerals: gold, platinum, asbestos, bauxite, iron, nickel, chromium, manganese and copper ore in particular. In addition to the mining industry, the following areas are well developed:

- ferrous and non-ferrous metallurgy;

- enrichment of uranium and iron ore;

- mechanical engineering – finished products are widely used in the military-industrial complex;

- production of modern high-precision industrial equipment;

- production of cars and trucks;

- electrical and electronic products;

- aircraft production.

All local food industry companies produce:

- high quality beer;

- non-alcoholic products;

- oil and fat products;

- confectionery products for consumer consumption.

Local agriculture specializes in cattle breeding and growing fodder crops. Beekeeping and poultry farming are well developed in the region.

Nominally accrued official wages consist of several parts:

- the basic salary, which is fixed by the signed employment contract and internal local regulations of the employer’s company;

- bonuses;

- other financial accruals;

- income tax, which is subject to transfer by the employer to the country's budget.

| Reporting calendar period | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 |

| Average salary level, thousand rubles. | 20 | 22 | 25 | 28 | 30 | 31 | 33 | 35 | 38 |

In 2020, the cost of living in the Sverdlovsk region, in particular in Yekaterinburg, is about 10,200 rubles

At the same time, the minimum wage, taking into account the established Ural coefficient, can vary between 13,000 - 14,000 rubles

According to an independent rating agency, the Sverdlovsk region ranks 25th in the compiled list of Russian regions in terms of wages, which is relevant for officially employed citizens.

About 3% of the working population receive a monthly stable income that exceeds 100,000 rubles, while:

- 20% of local residents expect wages of less than 15,000 rubles;

- Almost half of local residents receive an average salary of 17,000 to 40,000 rubles, not taking into account the subsequent deduction of income tax.

According to the latest data, in the near future the average wage will remain at the same level. This is largely due to the protracted financial crisis throughout Russia, which is directly related to sanctions from the European Union and America in particular. When exactly we can hope for an improvement in the current situation, one can only guess.

The minimum wage was equalized to the subsistence level earlier than planned

By Decree of the Government of the Russian Federation of September 19, 2017 # 1119, the cost of living for the working population is 11,163 rubles. Thus, one could expect that the minimum wage of 11,163 rubles would be established from January 1, 2020. However, the situation changed dramatically after V.V.’s statement. Putin. During a working trip to the Tver region, Vladimir Putin promised: the minimum wage in Russia will be equal to the subsistence level from May 1, 2020.

Thus, bringing the minimum wage to the subsistence level of the working-age population occurred earlier than planned - from May 1, 2018.

The subsistence minimum is the cost of a conditional consumer basket, which includes a minimum set of food products, non-food products and services that are necessary to ensure human life. The cost of living also includes mandatory payments and fees.

The cost of living is approved at the end of each quarter, using numerous statistical data, including the inflation rate, to determine it. The federal subsistence minimum is set by the Government of Russia, and regional minimums are set by regional governments.

How the minimum wage is set from 01/01/2020 in Russia

From 01/01/2020 onwards every year from January 1 of the corresponding year, the minimum wage is established by federal law in the amount of the subsistence level of the working-age population as a whole in the Russian Federation for the second quarter of the previous year (Article 1 of the Federal Law of June 19, 2000 # 82-FZ).

Please note that if the cost of living for the second quarter of the previous year decreases compared to the cost of living in the year preceding the previous year, the minimum wage will not be reduced. Its value will be maintained at the previous approved value.

Will there be an increase in the minimum wage in 2020?

Taking into account the above procedure for approving the minimum wage, we can answer the question of what the minimum wage will be in 2020.

To do this, you need to know what the minimum subsistence level for the working-age population in the Russian Federation as a whole was approved for the second quarter of 2020. This value is 11,280 rubles (Order of the Ministry of Labor dated August 24, 2018 # 550n).

Consequently, the new minimum wage from January 1, 2020 will increase by only 117 rubles and will also amount to 11,280 rubles . The federal law that will approve the new minimum wage starting from 01/01/2020 will provide for exactly this amount.

Regional minimum wage from 2020 in Russia

Let us recall that in the constituent entities of the Russian Federation, a regional agreement on the minimum wage can establish the amount of the minimum wage in the corresponding constituent entity of the Russian Federation (Part 1 of Article 133.1 of the Labor Code of the Russian Federation). This minimum wage is established for those working in the territory of the relevant subject, with the exception of employees of organizations financed from the federal budget (Part 2 of Article 133.1 of the Labor Code of the Russian Federation).

The size of the regional minimum wage is established taking into account socio-economic conditions and the subsistence level of the working population in the relevant constituent entity of the Russian Federation (Part 3 of Article 133.1 of the Labor Code of the Russian Federation). In this case, it is necessary to take into account an important condition: the size of the minimum wage in a constituent entity of the Russian Federation cannot be lower than the federal minimum wage (Part 4 of Article 133.1 of the Labor Code of the Russian Federation).

Considering the increase in the minimum wage from January 2020, the regional minimum wage established for 2020, but which turned out to be less than 11,280 rubles, will not be applied.

Taking into account that in most subjects of the Russian Federation the regional minimum wage is set at the level of the federal minimum wage, in most subjects the regional minimum wage, like the federal one, will be 11,280 rubles .

Additional Information:

Is it possible to avoid the obligation to pay a regional salary?

Many employers are interested in the possibility of evading regional requirements. And although the difference between the federal and territorial salaries is no more than 1,000 rubles, even this can play a role in large enterprises with a large staff.

Indeed, there is a legal mechanism for circumventing the requirements. To be released from such obligations, it is necessary to provide a reasoned refusal with detailed explanations of the reasons. If the Labor Committee grants the request, the enterprise will return to state standards and will pay the federal minimum wage.