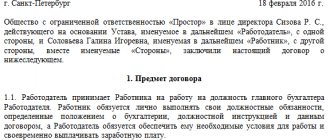

It is unlawful to enter into agreements on full financial liability with employees whose positions are not provided for in the List approved by Resolution of the Ministry of Labor of Russia dated December 31, 2002 No. 85. The courts take a similar position (see, for example, the appeal rulings of the Irkutsk Regional Court dated July 24, 2013 No. 33-5868/13 and the Supreme Court of the Republic of Khakassia dated July 24, 2013 No. 33-1736/2013). Attention: There is no need to conclude a separate agreement on full financial liability with the head of the organization, his deputies and the chief accountant (Articles 243, 277 of the Labor Code of the Russian Federation). Advice: In the employment contract with the employee who will service material assets, stipulate that he bears full financial responsibility on the basis of the relevant contract.

Is it possible to conclude an agreement on full financial liability with loaders?

Important

The employee holds the position specified in part 1 of the said resolution of the Ministry of Labor of the Russian Federation; 2. The employee performs the work specified in part 2 of the resolution. Accordingly, in order to make loaders financially responsible persons, it is necessary to include in the list of their job responsibilities (job description, employment contract, etc.), for example, a provision that the loader “performs work on the supply of services (goods, products), preparation them for sale" or "work on issuing material assets in a warehouse (base, etc.)."

After such adjustment of job responsibilities, you will have the legal right to conclude either individual agreements with the loaders on full financial responsibility, or include them in a team (team) bearing full collective financial responsibility. L. Frantsuzova, labor law specialist at Beta Press Personnel Holding LLC May 1, 2006

How is it prescribed?

The basis for bringing a materially responsible person to the appropriate type of liability is a certain document.

It was already stated earlier that this could be an employment contract or an additional agreement.

The first option is used if a full type of liability is established.

The conditions for its occurrence and the procedure for bringing to responsibility must be present in one of the clauses of the agreement.

In the event that incomplete swearing is established in relation to the employee. liability, the employer should conclude an additional agreement with the employee.

The document must contain all information related to this issue.

The direct appointment of a materially responsible person is formalized by an order of this type.

Read more about the procedure for assigning a MOL.

Material liability of loaders

Info

In this case, the court should have involved all members of the team in the case and considered the dispute. The court, without sufficient grounds, came to the conclusion that the employer did not provide adequate protection for inventory items. The court did not take into account that the warehouse is guarded around the clock by private security companies, therefore there is no basis for installing a security alarm.

Having checked the case materials within the framework of the arguments of the cassation appeal on the grounds of Article 347 Part 1 of the Civil Procedure Code of the Russian Federation, having discussed the arguments of the complaint, the judicial panel considers the cassation appeal not subject to satisfaction. As established by the court and follows from the case materials, in the position of LLC "TAURUS LTD" ... Kuznetsova M.N. worked, in the position of ... Eroshenko E.I. and Tishkevich A.V. 02.11.2009

Is criminal liability possible?

Persons bearing financial responsibility may also be subject to criminal charges. The specifics of MOL activities are based on interaction with material assets.

The most common cases of criminal liability are fraud - theft, theft of property belonging to the company.

In order to bring the MOL to criminal liability, the employer must prepare a document confirming the fact of fraud and submit it to the police.

In the future, the issue will be considered in court. If the employee's guilt is proven, he is given an appropriate sentence.

For a part-time worker

Labor legislation establishes that all employed citizens are subject to limited liability.

K completely swearing. The responsible person is recognized as employees whose positions are reflected in the Labor Code of the Russian Federation. There are no exceptions in this case.

From this we can conclude that employees who simultaneously work in several companies are held financially liable in the general manner.

Consequently, part-time workers can be financially responsible persons. The number of places of employment is not affected in any way by this factor.

Complete swearing. responsibility

From Part 1 of Art. 244 of the Labor Code of the Russian Federation, it follows that written agreements on full individual financial responsibility (Clause 2, Part 1, Article 243 of the Labor Code of the Russian Federation) can be concluded with employees who have reached the age of 18 and directly service or use monetary, commodity valuables or other property. As a rule, such work is associated with the storage, release and sale of goods, with the escort and delivery of goods, etc. The list of such positions and work is contained in Resolution of the Ministry of Labor of Russia dated December 31, 2002 No. 85. In the letter of Rostrud dated October 19, 2006 No. 1746-6-1 provides an explanation that written agreements on full financial liability can be concluded only with those employees and for the performance of those types of work that are provided for in the List. This List is exhaustive and is not subject to broad interpretation. This position is confirmed by judicial practice (see.

Part-time and combination

Internal part-time work is possible if the same employer has vacancies;

Previously, internal part-time work was allowed only in another profession, specialty or position. Now there are no such restrictions. The norm of Article 60.1 of the Labor Code of the Russian Federation gives an employee the right to enter into employment contracts to perform other regular paid work in his free time from his main job, without specifying that this work should be in a different profession, specialty or position.

Does the loader have financial liability?

Why are only the regulations of the Ministry of Labor given here??? There is such an article 245 of the Labor Code of the Russian Federation and it is written in black and white that when workers jointly perform certain types of work related... to the transportation... of the values transferred to them... So - based on this article, we now have team responsibility for storekeepers and transporters and drivers. But we simply do not have such a concept as a loader - they are all transporters, because loading is automated.

And even if he is just a loader, he is still associated with the process of transporting material assets from the warehouse premises to a vehicle (container, wagon, tank)... I think that the loader also falls under the transportation of valuables, with a stretch, of course... Well, or take another approach - other use of material assets.

Maybe this is just a different use...

Rules for imposing financial liability on an employee

The employee is subject to a presumption of innocence - the employer must prove the fact of causing damage. Thus, he must prove that direct damage occurred as a result of illegal actions or inaction of the employee (he did not fulfill his duties, and because of this property was damaged), and identify the causal relationship between the employee’s actions and the damage caused. All this can be revealed by an inspection initiated by the employer upon the fact of a violation - in the conclusion drawn up based on the results of its work, individual facts should form a complete picture proving the employee’s guilt.

The damage itself must be recorded in the inventory during the inspection, on the basis of which a report will then be drawn up. Its size is determined by the losses incurred. They are calculated taking into account market prices (currently in a given area) and the degree of depreciation of the property.

“subsidies mortgage agency of Ugra payments 2012”

The question relates to the city of Kurgan. The loader, by definition, is not present. mat. answer. face. If he (the loader) stole something, for example, then he bears civil liability according to the Civil Code. The financially responsible person may be the employee to whom the mate is assigned. valuables, usually a seller, a cashier, a railway manager, but not a loader, whose duties are to take in one place and put in another. Then the profession of a loader is not included in the list of professions in the performance of duties for which agreements on full financial liability must be concluded. Password is someone else's computer Forgot your password? © 1997 - 2020 PPT.RUFull or partial copying of materials is prohibited; with agreed copying, a link to the resource is required. Your personal data is processed on the site for the purpose of its functioning within the framework of the Policy regarding the processing of personal data.

Who can be a MOL in an organization - list of positions

Only certain categories of working citizens can bear financial responsibility.

List of employees:

- employees who, in the course of their professional activities, manipulate securities;

- citizens participating in purchase and sale transactions and other similar ones;

- specialists conducting warehouse activities;

- persons whose work involves interacting with jewelry;

- employees of closed organizations.

A clear list of persons who are required to bear the previously mentioned type of responsibility is established by the Labor Code of the Russian Federation and the Resolution of the Ministry of Labor.

This list includes a sufficient number of positions.

List of positions according to the Labor Code and Resolution:

- accountant (including chief accountant);

- driver;

- storekeeper;

- director;

- cashiers;

- company directors and their deputies;

- salesman;

- serviceman;

- cashier;

- pharmacists, etc.

To formalize an employment relationship with an employee whose position is included in the specified list, the employer must take care of some nuances.

If a limited type of liability is established for an employee, an additional agreement should be concluded with him. When establishing full liability, the terms relating to this topic should be reflected in the main agreement.

Can a loader in a warehouse be a MOL?

Not everyone attaches due importance to the profession of a loader. The activities of such employees are related to lifting and other types of transportation of various goods.

These may include items that are highly fragile and valuable. This raises the question: is the loader a person bearing financial responsibility?

To get an answer, it is necessary to analyze the list of positions in relation to which a full checkmate must be established. responsibility. Loaders are not included in this list.

It is important to remember that limited financial liability is automatically assigned to all employees of the enterprise.

The loader cannot be a completely financially responsible person.

In case of damage to the employer, employees pay him compensation, the amount of which cannot exceed the average monthly salary of the worker.

Is the head of the enterprise a MOL?

According to the information reflected in Article 243 of the Labor Code of the Russian Federation, the head of the company is the financially responsible person.

It is possible to bring him to the appropriate type of responsibility only if certain conditions are met.

These are the following factors:

- causing damage as a result of premeditated actions (presence of intent);

- performance of official duties in an improper manner or complete inaction of the employee;

- dissemination of information not subject to disclosure;

- committing an offense in a state of any type of intoxication;

- identifying shortages of material assets.

The head of the company bears full financial responsibility. To complete it, you do not need to draw up an additional contract. The conditions for its occurrence must be present in the main agreement.

Responsibilities and functions

Persons who are charged with financial responsibility are required to comply with established rules, which are the same for all employees of this nature.

The responsibilities of the MOL include:

- careful treatment of the property entrusted to the financially responsible person, its careful use, as well as ensuring its safety and value;

- immediately notifying the manager of a danger that could cause damage to the company’s property (if such circumstances arise);

- keeping records of material assets, monitoring their quantity and volume, conducting regular appropriate inspections;

- carrying out inventories;

- taking part in the procedure for accepting new material assets.

Each position may have other, more specific responsibilities.

Their essence should be reflected in the employment or additional agreement.

The MOL functions are defined in a similar way. Information about their explanation must be present in the documentation of the previously specified type.

The main function of employees bearing financial responsibility is to perform their job duties properly and ensure the safety of the property entrusted to them.

Can a loader be a financially responsible person?

In addition, the condition for the employee’s full financial responsibility is provided for in the employment contract concluded with him. From the answer “How to conclude an agreement on full financial responsibility” 2. Answer: Is it possible to conclude an agreement on full financial responsibility as part of a combination. The position that the employee will hold involves servicing inventory items. Read more about additional payment for financial responsibility here. If the position (profession) that the employee will hold involves direct servicing or use of money, goods, as well as other property of the employer, then additionally enter into an agreement with the employee on full financial liability (Articles 241–243 of the Labor Code of the Russian Federation).

Financial liability of a part-time employee

As a general rule, he bears financial responsibility within the limits of his average monthly earnings. Full financial responsibility (the obligation to compensate for damage in full) is assigned to the employee only in cases established by the Labor Code of the Russian Federation and other federal laws.

Thus, financial liability in the full amount of damage caused is assigned to the employee in the event of a shortage of valuables entrusted to him on the basis of a special written agreement or received by him under a one-time document, intentional infliction of damage, damage caused while under the influence of alcohol or drugs.

In all cases of illegal deprivation of an employee’s opportunity to work (for example, illegal removal of an employee from work) (Art.

The loader may be the financially responsible person

The Labor Code of the Russian Federation follows that written agreements on full individual financial responsibility (clause 2, part 1, article. Material liability of loaders The loader must know: 1.4.1. Organization of loading and unloading operations, safety rules for their implementation; 1.4.2.

Attention

Conditions for transportation and storage of goods; 1.4.3. Forms of documents for acceptance and dispatch of goods; 1.4.4. Location of warehouses and places of loading and unloading of goods; 1.4.5. The procedure for accepting and delivering cargo; 1.4.6. Permissible dimensions when loading goods onto open railway rolling stock and vehicles when loading goods from railway cars and stacking them; 1.4.7.

Material liability of employees Lost income (lost profits) cannot be recovered from the employee.

Is it possible to enter into an agreement on full financial liability with a loader? After all, the list of positions and works does not include the position of a loader. At the same time, I know that in many organizations these agreements are concluded. Which is correct? Resolution of the Ministry of Labor of the Russian Federation of December 31, 2002

N 85 to some extent limited the arbitrariness of introducing full financial liability for workers. Indeed, many employers tend to consider all employees financially responsible. This is wrong. All employees without exception bear limited financial liability. But the full one is only for financially responsible persons, i.e. those employees whose work activity is related to the storage, processing, sale (vacation), transportation or use of material assets in the production process. Thus, agreements on full liability can be concluded in two cases: 1.

In what cases does financial liability arise?

Employee's responsibility

It arises only if the employee’s guilt is proven. Damage means deterioration (decrease) or complete loss of valuable property. If force majeure or self-defense occurred, the employee cannot be punished. Damage will not be recovered if there was a so-called production and economic risk (for example, new technical equipment was tested and some of them were damaged).

The employer is obliged to create conditions for normal work, ensure labor safety and preservation of employees’ property while they perform their duties. Financial liability arises if the property of employees is damaged, as well as if the employer violates the employee’s right to fulfill his duties: does not pay him wages on time, or somehow causes him moral suffering.

The loader is the financially responsible person

Determination of the Altai Regional Court dated March 30, 2011 No. 33−2491/2011 at the end of the answer). Read more about the agreement on financial liability here: In addition, in paragraph 3.7 of the Order of the USSR MINTORGA of August 19, 1982 No. 169, Instructions on the procedure for applying in state trade the legislation regulating the financial liability of workers and employees for damage caused to an enterprise, institution, organization ( applies to the extent that does not contradict the Labor Code of the Russian Federation) it is directly stated that teams with collective financial responsibility cannot include: junior service personnel, loaders, auxiliary (transport) workers, watchmen. The inclusion of additional duties in the job description of loaders will entail a change in the labor function of employees (which is possible only by agreement of the parties, Part 1 of Art.

What laws?

There are several legislative acts that in one way or another affect the issue of financial liability:

- Article 21 of the Labor Code of the Russian Federation. It obliges workers to take care of the property of their employers.

- Articles 22,212 and 239 of the Labor Code of the Russian Federation. They oblige the employer to create a safe environment for workers and provide them with tools and information on how to carry out work correctly.

- Article 232 of the Labor Code of the Russian Federation. It specifies the mandatory nature of compensation for damage caused. The article places this responsibility on both the employee and the employer. The article also specifies that the reimbursement process must take place in accordance with the law.

Labor Code of the Russian Federation, Article 232. Obligation of a party to an employment contract to compensate for damage caused by it to the other party to this contractThe party to the employment contract (employer or employee) who caused damage to the other party shall compensate for it in accordance with this Code and other federal laws.

- An employment contract or written agreements attached to it may specify the financial liability of the parties to this contract. At the same time, the contractual liability of the employer to the employee cannot be lower, and the employee to the employer – higher, than is provided for by this Code or other federal laws.

- Termination of an employment contract after damage has been caused does not entail the release of the party to this contract from financial liability provided for by this Code or other federal laws.

Mentions of financial liability are also found in other legislative acts of the Russian Federation, but those listed above are considered the main ones.

Go to Age at which criminal liability applies

It is impossible to single out the most important one among them, because in order to resolve the situation with the damage caused, one must be guided by each of the legislative acts.

General provisions on part-time work

Concluding employment contracts for part-time work is permitted with an unlimited number of employers, unless otherwise provided by federal law.

The employee works in two positions, both positions (both the main one and an internal part-time job) are provided for by the List of positions and work replaced or performed by employees with whom the employer can enter into written agreements on full individual financial responsibility for the shortage of entrusted property, approved by the resolution of the Ministry of Labor of the Russian Federation dated 12/31/2002 N 85. It is expected to conclude an agreement on full individual financial responsibility with the employee for both positions. Is it possible?

Having considered the issue, we came to the following conclusion:

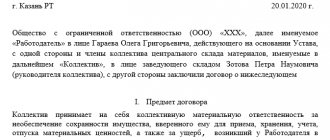

An agreement on full individual financial responsibility must be concluded separately for each position filled by an employee (both primary and internal part-time).

Rationale for the conclusion:

According to part one of Art. 244 of the Labor Code of the Russian Federation, written agreements on full individual or collective (team) financial liability can be concluded with employees who have reached the age of 18 and directly service or use monetary, commodity valuables or other property. In accordance with part two of Art. 244 of the Labor Code of the Russian Federation, by Decree of the Ministry of Labor of the Russian Federation dated December 31, 2002 N 85, approved the List of positions and work replaced or performed by employees with whom the employer can enter into written agreements on full individual financial liability for shortages of entrusted property (hereinafter referred to as the List). This List is exhaustive and is not subject to broad interpretation (see letter of Rostrud dated October 19, 2006 N 1746-6-1). Thus, the basis for concluding an agreement on full financial liability is the performance of certain types of work or the filling of certain positions related to the direct service or use by the specified person of monetary, commodity valuables or other property. The legislation does not contain any restrictions on the number of contracts on full individual liability that can be concluded with one employee. This is due to the fact that, as a general rule, bringing an employee to financial liability is possible only in the event of damage caused to the employer as a result of the culpable unlawful behavior (actions or inaction) of the employee within the framework of a specific labor function (Article 233 of the Labor Code of the Russian Federation). In other words, if, for example, an agreement on full individual financial responsibility for the main position is concluded with an employee, then in accordance with this agreement it is impossible to oblige the employee to compensate in full for damage caused while performing a job function under an internal part-time agreement. The List provides a standard form of an agreement on full individual liability. This agreement specifies the name of the employee's position. Accordingly, since the employee is hired internally for another position, another (second) agreement on full individual financial responsibility must be concluded. Thus, since the question states that both positions are provided for in the List, an agreement on full individual financial responsibility must be concluded separately for each position filled by the employee (both the main and part-time positions).

Answer prepared by: Expert of the Legal Consulting Service GARANT Troshina Tatyana

Response quality control: Reviewer of the Legal Consulting Service GARANT Mikhailov Ivan

The material was prepared on the basis of individual written consultation provided as part of the Legal Consulting service.

- Anya Sysoeva:

Does the part-time partner sign a liability agreement? If the employee’s position is included in the list of positions approved by Resolution of the Ministry of Labor of the Russian Federation of December 31, 2002 85, then the agreement on financial liability is concluded in any case, regardless of whether the employee is a part-time worker or... The agreement on financial liability has nothing to do with the position. Any person who deals with material assets can and should sign such an agreement. Moreover, it may not work in this company at all, but for example...

Read completely

- Anna Lazareva:

Contract agreement instead of an employment contract. What's the catch? An employment contract is concluded between an employee and an employer, a civil contract is concluded between a customer and a performer (contractor). Here are the MAIN DIFFERENCES between TD and GPA Employment contract/Civil contract 1. An employee must work according to... Because rights and social guarantees do not apply to you provided for by the Labor Code. the difference is that the contract has nothing to do with labor relations. no vacation allowed, sick leave not paid, salary every...

Read completely

- Vladislav Markov:

Does an enterprise (LLC) need a cashier position? What legal documents can I read? In accordance with clause 3 of the Procedure for conducting cash transactions in the Russian Federation (approved by the Decision of the Board of Directors of the Central Bank of Russia dated September 22, 1993 N 40), any organizations (regardless of organizational and legal forms and scope of activity) carrying out ...

Read completely

- Agata Kovaleva: about the work book

about the work book No. Change university. if the book is lost, you need to make a duplicate at your last job, the employer has the right to refuse... without a document!!! No, I don’t remember exactly, but about two years ago, a decree was issued allowing enterprises to issue duplicates...

Read completely

- Bogdan Pavlov:

Question!!! Just don't judge strictly!!! A friend was in such a situation, gave birth and has no regrets, but she is financially independent! I'm happy that there are people like you :) now you will take the choice of a man much more seriously and you will definitely meet a wonderful father to your baby, you'll see!!! The situation is not mine, but my sister’s is almost exactly the same...

Read completely

- Liana Osipova:

Can the founder of an LLC be its accountant and director at the same time? Naturally, it can. I don’t even know who could write that hiring is mandatory) an order is issued: “If there is no position of chief accountant on the staff, I assign the duties of one to myself.” Signature General Director Of course he can! In accordance with Article 6 of the Federal Law of the Russian Federation 129-FZ of November 21, 1996 On...

Read completely

- Tolik Evseev:

I want to work while on maternity leave Maternity leave is a woman’s right, therefore it is granted upon her application (Article 255 of the Labor Code). Payment of maternity benefits to an insured woman is also made after the woman contacts the employer. If... You can draw up a civil contract with your employer to perform certain work for a certain period of time (until the last day of your vacation). Nobody will commit such a violation. This is a great responsibility. Can…

Read completely

- Leonid Filippov:

In the kindergarten they handed out questionnaires for parents... I’m a little shocked by the questions... what is your opinion? looks like a test….if you are very confused by the questions, don’t answer…. What kind of kindergarten is this?! I wouldn’t even answer such questions. and now I had a masseuse...she said that they were also given such a questionnaire! I would answer the first two and sixth “yes”, the rest “no”. And there’s nothing wrong with that...

Read completely

- Vsevolod Gerasimov:

Hello. I would like to know about the job responsibilities of external part-time teachers (Teachers). 1. the financially responsible person must be the deputy director for administrative and administrative work (The list of works and categories of workers with whom agreements on financial responsibility can be concluded is approved by the Resolution of the Ministry of Labor and Social Development...

Read completely

- Inga Gordeeva:

Work under a civil contract, contract + mat. responsibility https://www.delo-press.ru/questions.php?n=10907, Internet to help if this is work for a position - DHPC this cannot be (The contract provides for the performance of a specific amount of work at the contractor’s own peril and risk) ). take her part-time... although... MOL - part-time is a profanation... Well...

Read completely

- Albert Novikov: vacation for part-time workers

leave for part-time workers A part-time worker is no different from a regular employee in terms of the timing of payment of vacation pay, but the leave itself must be provided to him along with leave at his main place of work. Article 124. Extension or transfer of annual paid... According to Art. 5.27 of the Code of Administrative Offenses of the Russian Federation, violation of labor legislation entails the imposition of an administrative fine on officials in the amount of one thousand to five thousand rubles; for persons carrying out business activities without...

Read completely

- Nadezhda Dmitrieva:

Is it possible to entrust this to an accountant? O. cashier for the period of cashier's incapacity for work or it is necessary to temporarily transfer. It is possible to work part-time, but in this case the part-time worker must receive 50% of the official salary of the person being replaced. There is a way out: the part-time worker must receive monthly 50% of the rate of the person being replaced + 50% monthly bonus in the amount of 50...

Read completely

- Vsevolod Gerasimov:

Dear HR officers and accountants, I have a question for you: what exactly is the problem? About trade secrets please! And about financial responsibility with his consent.

Read completely

- Misha Lavrentiev:

How to formalize a legally correct contract with sellers of another company? your company must enter into an outstaffing agreement (personnel rental) with that company. other options will be illegal. Catherine is wrong about one thing: part-time workers need to be paid salaries. the outstaffing agreement specifies the responsibilities of employees for... not necessarily outstaffing, hire them as external part-time workers and enter into an agreement on the cashier’s full individual financial responsibility.

Read completely

- Ariana Polyakova: dismissal

Dismissal We are not talking about working off, but about the fact that you must notify the employer of your desire to terminate the employment contract with him. But by agreement of the parties, you can receive everything in one day: both labor and settlement. If so... Of course, when working part-time, termination of an employment contract at the initiative of the employee is carried out on a general basis. But in practice, with part-time workers, everything is usually resolved easier and faster. The main reason for this is the lack...

Read completely

- Dmitry Afanasyev: Work as a salesperson-cashier.

Work as a salesperson-cashier. I work as a sales cashier. The work is really not easy. You begin to quietly hate people, they are rude to you, but you have to smile politely. Regarding shortages - if you work at the cash register and you have a shortage, then this is entirely your fault, and...

Read completely

- Lyubov Kiseleva: Need help

Ksyusha needs help, and you are definitely a chap. boom? It’s really a pioneering question, prepare an order for internal combination of positions in the amount of _____% of the rate, voila, you have a documentary basis to receive money for work already performed. But I don’t... The chief accountant does not have the right to take on a part-time job as a cashier. Dina is right, but there is a way out of this situation, remove the position of cashier from the staffing table and, by order of the director (general director), appoint any accountant responsible for maintaining the cash register...

Read completely

- Nika Dmitrieva: Seller for individual entrepreneurs

Seller for an individual entrepreneur You don’t want to register your employment record or pay taxes on his salary? If it’s a job, it’s part-time, but on one condition: the person must have a main place of work. If taxes - look at it this way...

Read completely

- Dmitry Matveev:

What is the difference between an employment contract and related civil law contracts? Employment contract / Civil contract The employee must work in a specific position in accordance with the staffing table, in a specific profession, specialty and carry out all instructions from management as they arrive (Article... this is about the difference between a privatized apartment and a non-privatized one. I’ll add to the wonderful answer of the Red Director .In labor relations between the parties there is a principle of subordination, in civil industrial relations there is equality of the parties.

Read completely

- Peter Timofeev:

Gentlemen entrepreneurs! Chief Accountant!... Attention! don't drive the horses! 1. The law provides for a MINIMUM wage of 2300 at the present time! - this is the limit - and no one can point out against the law - it is generally accepted that if there has now been a SQUEAL and an order from the president about shadow... I haven’t seen anything like that.... open the consultant.... in general about 22,100 there was no talk there... Go to the Glavbukh website, where this issue was recently discussed on the forum. Don’t pay attention, you won’t attach a call to business when there is an official letter...

Read completely

- Kamil Morozov:

How does the Labor Code differ from the Labor Code? Read the Labor Code, of course, it is somewhat different from the Labor Code due to objective changes in the economy, however, there is no “grace for employers” in it. It is no coincidence that the Russian Union of Industrialists and Entrepreneurs proposed to hold it in 2012...

Read completely

- Lev Alexandrov:

If you conclude a fixed-term employment contract with an employee, do you need to formalize it? Draw up a fixed-term employment contract and an agreement on individual financial responsibility. If you don’t need to carry it out, don’t make an entry in your labor report. Thais So it’s better for everyone in the event of a trial, a fixed-term contract is already a kind of official registration. It is definitely necessary to draw up. Read articles 56-59, 64-68 of the Labor Code of the Russian Federation. yeah...and eat the fish and...ahem...

Read completely

- Natalya Markova:

I’m quitting my job... and the question is: when should I receive a full payment? On the last working day or... According to Art. 140 of the Labor Code of the Russian Federation upon dismissal, payment of all amounts due to the employee from the employer is made on the day of dismissal of the employee. If the employee did not work on the day of dismissal, then the corresponding amounts must be paid no later than... What is there to think about for a long time? Here is an answer based on the law: According to Article 140 of the Labor Code of the Russian Federation, upon termination of an employment contract, payment of all amounts due to the employee from the employer is made on the day of the employee’s dismissal...

Read completely

- Zlata Komarova: tell me if you have a part-time job, is there additional leave or not?

Hello, please answer the question:... no it does not, but they can stipulate the following in the employment contract: The employee undertakes to: Ensure the safety of the property of the enterprise entrusted to him in his service or to which he has access (technical equipment, material assets, etc... Read completely

- Lena Rozhkova:

Why has the law on the responsibility of PRIVATE MEDICINE to patients been collecting dust in the State Duma for 10 years? It’s high time to understand that the “constitutional majority” in the State Duma cares only about its own pocket! Do you think state medicine is responsible? but in Russia we generally have the concept of responsibility - the responsibility of the government and the president to the people - everyone forgot about it, and the officials generally let their guard down - it’s just...

Read completely

- Savva Egorov:

I work in a government agency as a programmer! Am I obliged to take charge of all computers and other things? The programmer is not obliged to carry a weight heavier than a pen or pencil, is not obliged to answer stupid questions while working, the programmer must and is obliged to work so that the result of his work automates the work of the organization and in... NO not obliged, there is a list of people who answer swear words. But they forced me too, and I scored... no!!! Were you given all the office equipment according to the acceptance certificate? Min. Decree labor and social Development of the Russian Federation dated December 31, 2002 85, read the list...

Read completely

- Artemy Fedorov:

Financial liability and unpaid wages I am afraid that you must pay everything in full, and then prove and demand compensation for material damage in court (233 Labor Code). Can he evade responsibility by writing it off as a normal economic risk (239 Labor Code) - the question is... Chapter 39 of the Labor Code of the Russian Federation - financial responsibility of the employee. What you want to do is illegal. It is necessary to follow the entire procedure related to the mat. responsibility, and for this it is also necessary that the employer himself is interested in this. No

Does the Labor Code exist today??? from February 1, 2002 only in blessed memory. No, there is this Russian Encyclopedia on Labor Safety LABOR CODE OF THE RUSSIAN FEDERATION, the main systematized legislative act regulating labor relations in the Russian Federation. Signed by the President of the Russian Federation on December 30, 2001 (197-FZ), from 1...

Read completely

The concept of “object” or “subject” of liability

The concept of “object of liability” includes property that must be constantly monitored by a responsible person.

The assignment of the object is made to one of the employees of the enterprise, whose financial responsibility is confirmed by its registration in accounting records. If this object was damaged, then the person who was responsible for it is obliged to reimburse its cost or pay for the purchase of a new object with his own money.

Also, the subject of material liability is a person who has committed illegal actions in relation to a property object and is now obliged to compensate for losses.

A person can be subject to this type of liability only if the following rules are met:

- majority;

- The position at work is financially responsible.

The responsibilities of the subject of liability include the following:

- it is required to treat property transferred to a person for safekeeping with caution;

- you must immediately notify your boss of any situations that even indirectly threaten the safety of the object of financial responsibility;

- It is imperative to keep records of the condition of the object and its inventory.

If the property was damaged in some way, then the person responsible for it, before paying the penalty, must familiarize himself with the requirements for the manager who entrusted him with control over the object.

The manager has the following responsibilities:

- the superior must create optimal conditions for the safety of the object transferred under the responsibility of the subordinate;

- it is imperative to familiarize the employee with the regulations that present all the rules for storing the object transferred under responsibility;

- It is imperative to periodically take inventory of property.

The calculation of the funds that the employee is obliged to reimburse is equal to the market prices on the day when the object entrusted to the protection was damaged. The amount of damage caused cannot be lower than the value of the object to which the damage was caused. The amount of the penalty is also calculated taking into account exactly how damaged the object entrusted to the protection is.

Read more about who a financially responsible person is, about his rights and responsibilities, in this article, and you will learn about who is financially responsible before conducting an inventory here.