What needs to be completed so that the director can sign documents for the chief accountant?

Transfer of signature rights to the general director from the chief accountant is a phenomenon that often arises in modern business conditions. This situation is typical for small businesses when the director combines his powers with the functions of the chief accountant.

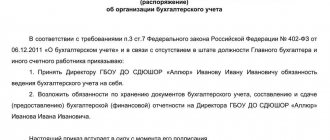

If the director, upon taking office, indicated in the order that he takes over the accounting, it is not necessary to issue orders or powers of attorney specifically for the right to sign for the chief accountant, since:

- the ability of the general director to act without a power of attorney on behalf of the company is enshrined in law (Article 69 of the Law “On Joint Stock Companies” dated December 26, 1995 No. 208-FZ, paragraph 3 of Article 40 of the Law “On Limited Liability Companies” dated February 8, 1998 No. 14 -FZ);

- Section 3 of Art. allows certain categories of businessmen to combine directorial functions with those of the “chief accountant”. 7 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ.

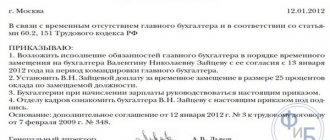

It is necessary to issue an order or power of attorney for the right to sign any documents, if the exact opposite situation arises - the chief accountant signs for the director (in his absence due to illness, vacation, business trip, etc.).

The articles posted on our website will tell you how to draw up an order or power of attorney to grant the right to sign documents:

Certificates for employees: is the signature of the chief accountant irreplaceable?

| Experts from the Legal Consulting Service GARANT Liliya Fedorova and Sergey Rodyushkin talk about signing certificates for employees (2-NDFL and others) by authorized persons. |

| In accordance with paragraph 3 of Art. 230 of the Tax Code of the Russian Federation, tax agents issue to individuals, upon their applications, certificates of income received by individuals and withheld amounts of personal income tax in the form 2-NDFL “Certificate of income of an individual for the year 20__”, approved by order of the Federal Tax Service of Russia dated November 17, 2010 N MMV-7- 3/ [email protected] (hereinafter referred to as certificate 2-NDFL). The recommendations for filling out the 2-NDFL form indicate that the completed 2-NDFL certificate is signed in the “Tax agent (signature)” field. In the field “Tax agent (position)” the position of the person who signed the certificate is indicated. In the field “Tax agent (full name)” the surname and initials of the specified person are indicated. The signature must not be sealed. Tax agents for personal income tax are, among other things, Russian organizations from which or as a result of relations with which the taxpayer (individual) received the income specified in clause 2 of Art. 226 of the Tax Code of the Russian Federation, and which are obliged to calculate, withhold from the taxpayer and pay the amount of personal income tax to the budget (clause 1 of Article 226 of the Tax Code of the Russian Federation). The rights and obligations of the LLC are exercised by the sole executive management body (general director, president, etc.), elected by the general meeting of company participants (Article 40 of the Federal Law of 02/08/1998 N 14-FZ “On Limited Liability Companies”, hereinafter referred to as the Law on LLC), which, based on the provisions of paragraph 3 of Art. 40 of the LLC Law, has the right to sign any documents as a person acting without a power of attorney on behalf of the company, and also has the right to issue a power of attorney to another person for the right to sign documents on behalf of the company. If the tax agent is an LLC, as a result of relations with which the individual received income indicated in the 2-NDFL certificate, then the company must sign this certificate. Since the sole executive body of the LLC is the head of the company, he must sign this certificate, or has the right to issue a power of attorney to another person to sign this certificate on behalf of the company. By virtue of clause 3 of part 2 of Art. 4.1 of the Federal Law of December 29, 2006 N 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity” (hereinafter referred to as Law N 255-FZ), the insurer is obliged to issue to the insured person on the day of termination of work (service, other activities) or upon a written application of the insured person after termination of work (service, other activity) for this policyholder no later than 3 working days from the date of filing this application, a certificate of the amount of earnings for 2 calendar years preceding the year of termination of work (service, other activity) or the year of application for a certificate of the amount of earnings, and the current calendar year for which insurance premiums were calculated. The form and procedure for issuing such a certificate are approved by order of the Ministry of Health and Social Development of Russia dated January 17, 2011 N 4n (hereinafter referred to as the Certificate). The certificate is signed by the head of the organization (separate division) (the position is filled by him) and the chief accountant, indicating their full name, i.e. when filling out the Certificate, the signatures of those persons who perform the duties of the head and chief accountant of the organization are affixed. You should also take into account information about the mandatory details of the primary accounting document given in Part 2 of Art. 9 of the Federal Law of December 6, 2011 N 402-FZ “On Accounting”. Also, according to clause 14 of the Regulations on Chief Accountants, approved by Resolution of the Council of Ministers of the USSR dated January 24, 1980 N 59 (hereinafter referred to as the Regulations), documents serving as the basis for the acceptance and issuance of funds and inventory, as well as credit and settlement obligations are signed by the head of the association, enterprises, organizations, institutions and the chief accountant or persons authorized by them. Granting the right to sign documents to these persons must be formalized by an order for the association, enterprise, organization, or institution. The above documents without the signature of the chief accountant or persons authorized by him are considered invalid and should not be accepted for execution by financially responsible persons and accounting employees of a given association, enterprise, organization, institution, as well as bank institutions. By virtue of clause 8 of the Regulations, during the absence of the chief accountant (business trip, vacation, illness, etc.), the rights and responsibilities of the chief accountant are transferred to his deputy, and in the absence of the latter - to another official, which is announced by order of the organization. So, although the recommendations for filling out these certificates do not directly say that they can be signed by other authorized persons, taking into account the above norms, we believe that in the absence of the chief accountant, as well as the manager, these documents can be signed by other persons authorized by order of the manager, and These certificates must bear the signatures of those persons who compiled the certificates and are responsible for the correctness of their execution. We believe that if documents are signed by another authorized person, in the column “chief accountant” (“manager”), it is necessary to indicate not only his signature and transcript of the signature, but also the name of the position of the person who signed these documents, details of the document (order), on the basis of which an authorized person has the right to sign documents. The texts of the documents mentioned in the experts’ response can be found in the GARANT legal reference system. |

The nuances of signing documents by the general director for the chief accountant

Problems may arise if the document form contains two signatures at the same time: the director and the chief accountant (for example, an invoice, a universal transfer document, etc.). Filling out both lines with the same signatures may raise additional questions from counterparties or regulatory authorities.

If the director has assigned the functions of accounting to himself by order, everyone who asks a question about the legality of this form of signing a document must be presented with this order.

If it turns out that the company has a chief accountant on staff and the document (in the line intended for his signature) contains his last name, the consequences may be as follows:

- counterparties will ask you to redo the document, since the signature and its transcript do not correspond to each other;

- regulatory authorities will have claims against a document drawn up with violations, and in some cases, for example, when confirming a VAT deduction, the legality of this form of signing documents will have to be proven in court. For example, in the paper version of the invoice, the signature of the chief accountant is required (clause 6 of Article 169 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated August 27, 2014 No. 03-07-09/42854).

To avoid misunderstandings and not waste time proving the legitimacy of the director’s signature for the chief accountant, this right can be delegated to another person (not the general director) by issuing a power of attorney or order.

For a variety of information about documents and the requirements for signing them, see the articles posted on our website:

the right to sign for the chief accountant if he has taken over the accounting. In other cases, it is better to assign this right to another person, confirming such powers with a power of attorney or order.

Signing the document: what, where and how

Each fact of the economic life of an organization is accompanied by a document: an invoice, a letter, an order or a payment order. But it is not always clear who signs such documents. Let's answer a few questions on this topic.

Has the chief accountant gone on maternity leave? Give the digital signature to the replacement employee

The chief accountant went on maternity leave. Instead, “Client-Bank” is now run by her deputy. Can he use the digital signature of the master? Do I need to redo the digital signature for a new person or can I “transfer” the digital signature by drawing up some document?

: The replacement employee can use the digital signature of the chief accountant. For this you need clause 1 of Art. 10 of the Law of 04/06/2011 No. 63-FZ (hereinafter referred to as Law No. 63-FZ):

- include a clause on the “transfer” of the digital signature in the order transferring powers to the deputy during the maternity leave of the chief accountant;

- issue a separate order to “transfer” the digital signature to the deputy chief accountant.

In this case, the responsibility for using the digital signature of the chief accountant will be borne by the deputy.

The director may delegate the right to sign powers of attorney to receive inventory items to another person

Our director is going on vacation. All documents for the purchase and sale of goods (invoices, invoices, powers of attorney for receiving inventory items) will be signed for him by other employees. Is it enough to indicate this in the order?

: Invoices are signed by the manager or persons authorized to do so by order or power of attorney and clause 6 of Art. 169 Tax Code of the Russian Federation. So if another employee signs the invoice for the director, then the right to sign can be transferred by power of attorney or by order of clause 6 of Art. 169 Tax Code of the Russian Federation.

In a standard invoice , both for the sale and purchase of goods and materials, the signature of the manager is not needed - it is signed by the materially responsible persons. But if your director nevertheless signed this initial document, then before the vacation it is enough for him to issue an order appointing persons responsible for the shipment and receipt of goods and clause 6, part 2, art. 9, part 1 art. 7 of the Law of December 6, 2011 No. 402-FZ (hereinafter referred to as Law No. 402-FZ); clause 14 of the Regulations, approved. By Order of the Ministry of Finance dated July 29, 1998 No. 34n.

A power of attorney from an organization can be issued only by its head or another person authorized by the constituent documents to act on behalf of the organization without a power of attorney, that is, by persons whose information is included in the Unified State Register of Legal Entities of the organization and paragraph. 3 p. 1 art. 53 Civil Code of the Russian Federation; Art. 27 Tax Code of the Russian Federation. Therefore, it is most convenient if the director signs in advance the necessary powers of attorney to receive inventory and materials for the period of his absence. Instructions, approved. Resolution of the State Statistics Committee dated October 30, 1997 No. 71a. Or he can entrust this right to someone by issuing a power of attorney for the right to sign powers of attorney to receive goods and materials, clause 3 of Art. 29 Tax Code of the Russian Federation; pp. 1, 3, 7 tbsp. 187 Civil Code of the Russian Federation.

The chief accountant can approve the advance report

Can the chief accountant sign the expense report instead of the manager?

: Yes maybe.

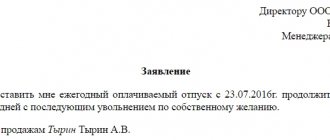

In the advance report, the manager puts his signature under the words “I approve the report in the amount. ", thereby confirming that the expenses on the advance report are, as they say, for the benefit of the organization. So if the director decided to entrust this mission to the chief accountant, then you need to formalize:

- order on delegation of authority to approve expense reports;

- power of attorney clause 4 art. 185.1 Civil Code of the Russian Federation.

Agreements signed with a qualified digital signature have legal force

Do contracts concluded on the Supplier Portal need to be printed and certified with the organization’s seal and the signatures of managers? Or is it enough that they are certified with digital signature?

You can find out how electronic contracts are signed: Supplier Portal → Supplier Portal User Instructions → Registration on the Supplier Portal

: It is not necessary to put “live” signatures and stamps on the contract concluded on the Supplier Portal. Such electronic contracts are signed with an enhanced qualified electronic digital signature. 1, 4 tbsp. 5 of Law No. 63-FZ. An agreement signed with a qualified digital signature is recognized as equivalent to an agreement on paper, signed with a “living” signature and certified by a seal.

The signatures of which officials should be certified with which seal?

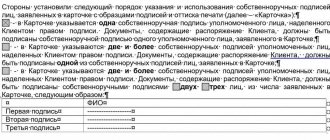

To do this, you need to have an order appointing a person responsible for signing. The main thing is that they contain information about to whom the right to sign is transferred, and sample signatures of these employees. Then let him sign for the chief accountant too... One of the first documents that needs to be completed by a newly opened company is the appointment of the chief accountant to the General Directorate.

And based on this, 2 signatures are placed. Does the head of the enterprise have the right to sign in the column for the chief accountant? Yes, if this is stipulated by the charter of the enterprise. How many people can simultaneously have the right to sign for the chief accountant? The general director has the right of first signature; his deputy can also have the right of first signature if the general director has been issued for him... more. Of course, maybe, if there is no chief accountant on staff and there is an order from the director that “I assign the responsibilities of the chief accountant to myself.

- Who has the right to sign important documentation, and can this right be delegated to others?

- How to place your signature in accordance with the rules of office work?

- What if several people must sign at once?

Necessity of signature The entire economic life of an organization is accompanied by written documentation. Charters, reports, declarations, contracts and other documents have legal force if they are made in writing, and evidence of writing is the presence on the documents of the signature of the parties or responsible persons having the necessary authority.

Important

During the absence of the chief accountant, the director may assume the responsibility of signing invoices for him by issuing an appropriate order. In this case, he will have every right to sign for the chief accountant. In practice, this is organized in different ways. The first option is for the director to sign the invoice in one place, that is, for himself.

We invite you to familiarize yourself with: Failure to liquidate a procurement participant sample

At the same time, the place for the chief accountant’s signature remained empty. However, the Federal Tax Service knows that the organization has a chief accountant, so inspectors may consider that the invoice was drawn up in violation. We will have to figure it out and prove that the director simply did not sign twice, because one of his signatures replaces both.

Moreover, such proceedings may take place already in the process of challenging the decision of the Federal Tax Service. Therefore, this option is quite risky.

It is mandatory to indicate:

- Date of issue;

- The place where it was issued;

- Her number;

- Text containing all information about the company, as well as information about the director and the person to whom it is issued;

- Signature of the head and seal of the organization.

If a power of attorney is issued by way of delegation, it must be certified by a notary. A power of attorney can be issued to any person, even one who is not an employee of the organization. Executing an order for the right to sign An order can only be issued to an employee of the company.

The head of the organization has the legal opportunity to transfer the right to sign primary documents solely by his own decision, without taking into account the opinions of shareholders, founders or the board of directors, if their presence is provided for by the form of organization of the company. An exception can only be a clause provided for in the constituent agreement or charter. Not only the director of the enterprise, but also the chief accountant can transfer his own power to sign accounting agreements and reporting.

He can entrust this to the employee whose authority includes accounting. What is the difference between a chief accountant and an ordinary employee? In the office there is a concept of the first and second signature. The right of first signature belongs to the head (director) of the enterprise.

He has permission for any organizational actions, he is also responsible for administrative and economic functioning. Who has the right to sign primary documents

- Risks of non-contractual delivery: if the contract and the invoice are not on friendly terms, No. 11

- 2016

- Document flow, No. 24

- Recovering lost documents, No. 20

- Accounting documents: prepare, fill out, sign, No. 20

- It is advisable to include a time stamp in the electronic signature, No. 15

- The Federal Tax Service can accept electronic documents only in approved formats, No. 13

- Correcting the primary accounting system, No. 10

- An electronic document is not just created on a computer, No. 5

- We issue an order assigning the duties of the chief accountant to the director, No. 4

- We transfer accounting to an outsourcer, No. 3

2015 All documents accompanying the execution of business transactions must be signed by the first persons. Without this, they are considered invalid.

Important

All members of the commission also sign the minutes of meetings of certification, competition and other commissions. If the protocol is signed by all members of the collegial (advisory) body, signatures are drawn up as follows [2]: Chairman Personal signature A.

Info

Article 23 of the Tax Code states that accounting information and other documents necessary for the calculation and payment of taxes must be saved for four years. Documents that certify a loss carried forward to a future period must be preserved until the taxable amount is reduced by the amount of the previously incurred loss (Article 283 of the Tax Code).

Attention

It is extremely difficult to clearly distinguish between accounting and tax documentation. Therefore, it is better to adhere to the longest retention period, that is, keep the documentation for at least five years.

For any document, the storage period begins on the first of January of the year following the year the document was created. Primary documents are the basis of the organization's documentary base.

It is important to know and follow the rules for its registration.

Supplier Portal → User Manual for the Supplier Portal → Registration on the Supplier Portal: It is not necessary to put “live” signatures and stamps on the contract concluded on the Supplier Portal. Such electronic contracts are signed with an enhanced qualified electronic digital signature.

1, 4 tbsp. 5 of Law No. 63-FZ. An agreement signed with a qualified digital signature is recognized as equivalent to an agreement on paper, signed with a “living” signature and certified by a seal.

Uyba Approximate sample of the Ministry of Health and Social Development of Russia Federal Medical and Biological Agency (FMBA of Russia) ORDER 01/16/2010 42 N Moscow On the distribution of responsibilities between managers In connection with personnel changes that have occurred in the management of the agency, I order: 1. Establish the following distribution of responsibilities between the heads of the agency.

I leave behind: general management; improving management and coordination of the agency’s divisions; interaction with authorities and management, judicial authorities; organization of the agency's work; coordination of the activities of agency divisions; distribution of financial resources;

personnel management issues. Deputy head for main activities - management of the departments of planning and labor organization, financial support, accounting. Zyulkova In the same way, but indicating the name of the organization, documents issued jointly by the heads of two organizations are signed (joint resolution, joint order), as well as agreements (civil legal and labor), additions to civil contracts, agreements on amendments (additions) to the employment contract, protocols in the contractual documentation system (protocol of disagreements, protocol of reconciliation of disagreements, etc.).

We suggest you familiarize yourself with: Income reduced by expenses tax rate

When drawing up a joint document, the first sheet is not drawn up on letterhead. When drawing up contracts, you should keep in mind that the contract is always signed by the person indicated in the preamble of the contract. The basis on which the person has the right to sign is also indicated there - the charter of the organization, power of attorney.

If heads of structural units are given the right to sign documents, both forms of structural units and forms of documents of the organization can be used to issue documents. The decision on the types of forms used in the organization is made by the head of the organization. The document can be signed by several officials, for example the head of the organization and the chief accountant.

Can the director sign for the chief accountant?

Perhaps this does not require a power of attorney or a special order. Clause 3 of Art. 40 of the Law “On LLC” dated 02/08/1998 No. 14-FZ assigns to the manager the status of the legal representative of the organization, and, consequently, the right to represent the interests of society and enter into transactions without a power of attorney.

However, this does not mean that the content of this article makes the presence of an accountant in companies where the director has decided to independently delve into the intricacies of accounting pointless. The execution of some documents is regulated separately by the Law “On Accounting” dated December 6, 2011 No. 402-FZ, PBU 4/99, the Tax Code and information messages of the Ministry of Finance, and therefore requires compliance with certain formalities - both on the papers themselves and in the constituent documents of the organization .

So, the legislation gives the general director greater rights than other employees, which is not surprising. However, along with authority, the manager bears responsibility for what happens in the organization. Therefore, the right of the director to sign for the chief accountant in most cases is a sign that the company’s chief executive has to be distracted from business development by auditing and processing documents.

The head of a company that has outsourced its accounting department to 1C-WiseAdvice specialists for comprehensive services will not have to take time off from strategic issues to figure out whether someone else should sign the financial statements or invoice. Indeed, by the way, even regulations contain conflicting requirements for filling out these documents, and therefore organizations often have to go to court, for example, to prove the legality of applying the deduction.

How to fill out documents that require two signatures?

Since mid-2020, an appendix to the Order of the Ministry of Finance of Russia dated April 6, 2015 No. 57n, the signature of the chief accountant was excluded from a number of documents, including from:

- balance sheet;

- financial results report;

- statement of changes in capital;

- statement of cash flows and intended use of funds;

- simplified forms of balance sheet.

Completion of one of the key accounting documents - accounting (financial) statements is regulated by Article 13 of Law No. 402-FZ. Thus, the reporting is considered completed after it has been signed by the head of the organization. The law does not provide for any other requirements for its approval.

This provision is confirmed by the Resolution of the Arbitration Court of the Far Eastern District dated 02/05/2019 No. F03-6116/2018 in case No. A73-8993/2018. In it, the court, referring to the above-mentioned article, confirmed that the reporting is considered drawn up after the general director has put his signature on it.

At the same time, clause 17 of PBU 4/99 and clause 38 of the Regulations on accounting and financial reporting in the Russian Federation insist that this document is signed by both the director and the accountant.

The contradictory content of the mentioned standards was explained by the Ministry of Finance in the information message dated May 19, 2015 No. IS-accounting-2. It states that “the authority to sign accounting (financial) statements is established, as a rule, by the constituent documents of an economic entity, or by decisions of the relevant management bodies of the economic entity.”

Expert outsourced accounting services will save any company from all the delights of studying numerous and sometimes contradictory requirements for filling out reports, as well as from errors and financial risks.

Invoice, in accordance with clause 6 of Art. 169 of the Tax Code of the Russian Federation, in addition to the manager, must be signed by the chief accountant or another person authorized to do so through a special order. In the case of an individual entrepreneur, the document is endorsed either by the entrepreneur himself or by his authorized representative acting under a power of attorney.

What should the head of an organization do if there is no accountant on staff, and the invoice is the basis for deducting the tax amounts presented to the buyer by the seller? Sign both for yourself and for the chief accountant.

Blog

Question: Does the general director have the right to sign an invoice if the chief accountant is temporarily absent from the organization? Based on what document? Are there any risks that the tax authority will refuse to deduct VAT on such an invoice?

Answer:

The General Director has the right to sign an invoice both for himself and for the chief accountant. The absence of a chief accountant in the organization can be confirmed by a certified copy of the order (instruction) assigning accounting responsibilities to the manager. In our opinion, when an invoice is signed by a manager and there is an order assigning the responsibility for accounting to the manager, the tax authority has no grounds for refusing to deduct VAT on such an invoice.

Justification: In accordance with paragraph 2 of Art. 169 of the Tax Code of the Russian Federation, invoices are the basis for accepting tax amounts presented to the buyer by the seller for deduction when the requirements established by clauses 5, 5.1 and 6 of this article are met.

Paragraph 6 of the above article establishes that the invoice is signed by the head and chief accountant of the organization or other persons authorized to do so by an order (other administrative document) for the organization or a power of attorney on behalf of the organization.

According to para. 2 p. 2 art. 169 of the Tax Code of the Russian Federation, errors in invoices that do not prevent tax authorities from identifying the seller, buyer of goods (work, services), property rights, the name of goods (work, services), property rights, their value, as well as the tax rate and the amount of tax presented to the buyer is not a basis for refusing to accept tax amounts for deduction.

The form and rules for filling out an invoice used in calculations for value added tax are established by Decree of the Government of the Russian Federation of December 26, 2011 N 1137 “On the forms and rules for filling out (maintaining) documents used in calculations for value added tax.” In Appendix No. 1 to the above

The resolution establishes the form of the invoice, which provides the following details: “Head of the organization or other authorized person”, “Chief accountant or other authorized person”.

In its Letter No. 03-07-09/42854 dated August 27, 2014, the Russian Ministry of Finance indicated the need for the signature of the chief accountant on invoices.

At the same time, the right to sign may be assigned to another person authorized by order or power of attorney on behalf of the organization (clause 6 of Article 169 of the Tax Code of the Russian Federation).

The norms of the Tax Code of the Russian Federation and the Decree of the Government of the Russian Federation N 1137 do not establish a ban on signing an invoice by one person authorized to sign on the basis of a power of attorney, both for the manager and for the chief accountant (Letter of the Ministry of Finance of Russia dated October 21, 2014 N 03-07-09 /53005). A similar conclusion is contained in Letter of the Ministry of Finance of Russia dated July 2, 2013 N 03-07-09/25296.

The Letter of the Federal Tax Service of Russia dated June 18, 2009 N 3-1-11/ [email protected] “On the procedure for signing invoices” states that the Tax Code of the Russian Federation does not establish a ban on signing an invoice by a single authorized person. Arbitration courts also recognize the legal deduction of VAT in cases where there is no signature of the chief accountant due to the fact that the responsibility for maintaining accounting records at the time of issuing the invoice was assigned to the head of the supplier, and his signature is present in the invoice (Resolutions of the FAS East Siberian District dated 04/12/2011 in case No. A19-11133/08, FAS Moscow District dated 01/16/2009 No. KA-A40/11421-08 in case No. A40-14778/08-118-60).

Thus, the general director has the right to sign an invoice both for himself and for the accountant in the absence of the position of chief accountant. The absence of a chief accountant in the organization can be confirmed by a certified copy of the order (instruction) assigning accounting responsibilities to the manager.

In our opinion, when an invoice is signed by a manager and there is an order assigning the responsibility for accounting to the manager, the tax authority has no grounds for refusing to deduct VAT on such an invoice.

S.N. Shalyaev Advisor to the State Civil Service of the Russian Federation, 1st class 10/28/2016

Invoice without the signature of the chief accountant: is the deduction legal?

In the resolution of the Federal Antimonopoly Service of the North-Western District dated November 17, 2006 in case No. A56-35103/2005, the court indicated that the identity of the signatures of the general director and chief accountant in the disputed invoices does not deprive the organization of the right to claim a refund of the VAT paid to the supplier on the basis of this document. But this is provided that it contains all the necessary details and information required by tax legislation.

“The presence in invoices of transcripts of the signatures of the manager and chief accountant is not provided for by the provisions of paragraph 6 of Article 169 of the Tax Code of the Russian Federation and the requirements for the preparation of primary accounting documents given in Article 9 of the Federal Law of November 21, 1996 No. 129-FZ,” the resolution states.

A similar conclusion is contained in other resolutions. For example, in the resolution of the Federal Antimonopoly Service of the North Caucasus District dated October 29, 2008 No. F08-6533/2008 in case No. A53-2656/2008-C5-14, the court recognized the deduction on an invoice signed by the manager as legitimate. And all because, according to the order, he reserved the right to sign accounting and financial documents for the chief accountant.

A similar decision, motivated by the fact that the general director of the company simultaneously performs the duties of the chief accountant, was announced by the court in the decision of the Federal Antimonopoly Service of the North Caucasus District dated 06/03/2009 in case No. A53-17547/2008-C5-23.

That is, detailed planning of the business organization - in the charter and other constituent documents - plays an important role in the ability to defend the legitimacy of the absence of the signature of the company's chief accountant on the invoice.

The risk-based approach of 1C-WiseAdvice specialists to the management of processes that are strategically important for business - accounting and tax accounting, document flow, including personnel, etc. - will free the company from the need to make changes to the constituent documents or issue orders retroactively.

Managers of companies that have outsourced their accounting to 1C-WiseAdvice spend their time on business development rather than its day-to-day maintenance.

What needs to be completed so that the director can sign documents for the chief accountant?

Transfer of signature rights to the general director from the chief accountant is a phenomenon that often arises in modern business conditions. This situation is typical for small businesses when the director combines his powers with the functions of the chief accountant.

If the director, upon taking office, indicated in the order that he takes over the accounting, it is not necessary to issue orders or powers of attorney specifically for the right to sign for the chief accountant, since:

- the ability of the general director to act without a power of attorney on behalf of the company is enshrined in law (Article 69 of the Law “On Joint Stock Companies” dated December 26, 1995 No. 208-FZ, paragraph 3 of Article 40 of the Law “On Limited Liability Companies” dated February 8, 1998 No. 14 -FZ);

- Section 3 of Art. allows certain categories of businessmen to combine directorial functions with those of the “chief accountant”. 7 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ.

It is necessary to issue an order or power of attorney for the right to sign any documents, if the exact opposite situation arises - the chief accountant signs for the director (in his absence due to illness, vacation, business trip, etc.).

The articles posted on our website will tell you how to draw up an order or power of attorney to grant the right to sign documents:

Rules for preparing a power of attorney for the right to sign contracts for a director

If the manager has not given the right to sign documents to the chief accountant, then there will be no need to transfer this right to anyone in the absence of the chief accountant.

If the right of the second signature is granted to the chief accountant and secured by an order or power of attorney, the chief accountant’s departure on vacation or sick leave, going on a business trip or the presence of other grounds for his absence require additional actions from the manager - it is necessary to issue an order or issue a power of attorney for the right of the second signature to another person.

While, for example, on vacation, the chief accountant, who has the right of second signature on the payroll, does not have the right to sign this document. If the authority to sign has not been delegated to anyone, the chief accountant must be formally recalled from vacation to sign this document.

This conclusion follows from the general definition of rest time and “vacation” nuances:

- rest time is the time during which the employee is free from performing work duties and which he can use at his own discretion (Article 106 of the Labor Code of the Russian Federation);

- the vacation period is not considered working time (Article 107 of the Labor Code of the Russian Federation), the employee only retains his workplace during the vacation and the average salary;

- affixing a signature on documents is the performance of a labor function that is subject to payment in accordance with the employment contract.

We invite you to read: Responsibility for violation of children’s rights in an educational institution

Thus, in the absence of a chief accountant, the right of second signature on certain documents, secured by internal company regulations, must be delegated to another employee (financial director, senior accountant, etc.).

The validity period of the power of attorney must be specified in its text. The document can be issued to fulfill a one-time order or for a certain period (for example, three years). If a specific time period is not fixed, the validity of the document is limited to one year.

The nuances of signing documents by the general director for the chief accountant

Problems may arise if the document form contains two signatures at the same time: the director and the chief accountant (for example, an invoice, a universal transfer document, etc.). Filling out both lines with the same signatures may raise additional questions from counterparties or regulatory authorities.

If the director has assigned the functions of accounting to himself by order, everyone who asks a question about the legality of this form of signing a document must be presented with this order.

If it turns out that the company has a chief accountant on staff and the document (in the line intended for his signature) contains his last name, the consequences may be as follows:

- counterparties will ask you to redo the document, since the signature and its transcript do not correspond to each other;

- regulatory authorities will have claims against a document drawn up with violations, and in some cases, for example, when confirming a VAT deduction, the legality of this form of signing documents will have to be proven in court. For example, in the paper version of the invoice, the signature of the chief accountant is required (clause 6 of Article 169 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated August 27, 2014 No. 03-07-09/42854).

To avoid misunderstandings and not waste time proving the legitimacy of the director’s signature for the chief accountant, this right can be delegated to another person (not the general director) by issuing a power of attorney or order.

For a variety of information about documents and the requirements for signing them, see the articles posted on our website:

Signature right for the chief accountant

may be from the general director, if he has taken over the accounting. In other cases, it is better to assign this right to another person, confirming such powers with a power of attorney or order.

Powers of the chief accountant

The chief accountant has the right of second signature on the invoice and TORG-12. The chief accountant has the right to sign other documents only on the basis of a power of attorney issued by the head of the legal entity. For the procedure for issuing a power of attorney, see the recommendations.

"No not always. Completed tax reporting forms must be signed by representatives of the organization (). The chief accountant is *. Therefore, he can sign reports only if he has a power of attorney for the right to sign (Tax Code of the Russian Federation).

If there is no position of chief accountant in the organization, if there are powers of attorney from the taxpayer organization, the accuracy and completeness of the information specified in the reporting can be confirmed* by:

- full-time accountant of the organization;

- head of a specialized organization (centralized accounting) responsible for accounting;

- an employee of a specialized organization responsible for maintaining records (if a power of attorney for the right to sign reports was issued to the head of a specialized organization with the right to delegate it to other persons);

- a specialist accountant who keeps records on a contractual basis.

Such clarifications are contained in letters from the Russian Ministry of Finance and.

If the head of the organization personally conducts accounting, then he signs the reports as a legal representative.

For the manager's signature, appropriate fields are provided in the reporting forms.

A professional help system for lawyers in which you will find the answer to any, even the most complex, question.

How to draw up a power of attorney for the chief accountant?

A power of attorney for the chief accountant to the tax office (a sample is given below) is drawn up as follows:

- The name of the document must be indicated at the top (for example, “Power of Attorney”);

- In the “header” you must indicate the name of the place of issue, the date of drawing up the power of attorney;

- After this, indicate the full name of the organization and its details: OGRN, INN, KPP, full name. leader.

- Then you need to indicate information about the authorized person: full name, number and series of the passport, who issued it and when, address of the place of registration. Usually this information is indicated after the phrase: “This power of attorney authorizes...”.

- After this, it is necessary to list the actions that the authorized person has the right to perform.

- Below you need to indicate the validity period of the document and make a note about whether the trustee has the right of subrogation.

- Next, signatures and full name must be present. the authorized representative and the general director, as well as the seal of the organization (if available).

The principal has the right to revoke the power of attorney at any time. When dismissing an employee, it is recommended to revoke all powers of attorney issued to him.

Sample power of attorney for the chief accountant

The right of the second signature of the chief accountant on documents

the right of the second signature belonged to the chief accountant - this was the wording contained in clause.

7.6 of the Bank of Russia Instruction No. 28-I dated September 14, 2006, devoted to the procedure for opening and closing bank accounts.

No one questioned the status of the second signature of the chief accountant if an order was issued for his appointment to the position.

After Law No. 129-FZ and Instruction No. 28-I were replaced by a pair of updated regulatory documents of the same name (Law No. 402-FZ and Bank of Russia Instruction No. 153-I dated May 30, 2014), on the legislatively established powers of the chief accountant in affixing a signature There is no need to talk about documents for the following reasons:

- the mention of the second signature of the chief accountant disappeared from the text of instruction No. 153-I;

- Law No. 402-FZ does not have a separate article dedicated to the chief accountant and a phrase prohibiting the acceptance for execution of documents without his signature.

Legal Russia

Based on a power of attorney from. .20 09 to provide the right to sign the manager and chief accountant when preparing the following documents on behalf and at the expense of the LLC, invoices, invoices, certificates of work performed for communication services. The right of first signature is assigned to the person indicated in the Charter, other employees only by proxy they can act on behalf of the legal entity. faces. The performance of duties can be entrusted to the accountant, but in this case, by decision of the general meeting that the accountant has the right to perform the duties of the General Manager and in the presence of an appropriate order. That’s right!

I personally always put my signature - I don’t trust accountants.

Does the director have the right to grant the right of first signature on financial and payment documents to the chief accountant of the organization, and the right of second signature to the accountant?

In accordance with clause 7.1 of the Instructions, the card is drawn up on form N 0401026 according to OKUD (Appendix 1 to the Instructions) and is presented by the client to the bank in the cases provided for in the Instructions, along with other documents necessary for opening a bank account.

According to clause 7.5 of the Instructions, the right of first signature belongs to the head of the client - a legal entity (sole executive body), as well as other persons (except for the persons specified in clause.

Power of attorney to the bank

This document is quite in demand, since the manager does not always have the opportunity to be personally present at the bank to carry out financial and business transactions. Both legal entities and individual entrepreneurs can draw up such a power of attorney.

A power of attorney to the bank for the chief accountant, a sample of which is presented below, must include: information about the principal and the authorized person, the name of the bank, a list of actions that the authorized person has the right to carry out.

It is important to remember that a power of attorney issued by an individual entrepreneur must be certified by a notary.

The same applies to drawing up a power of attorney for the chief accountant at the tax office. The document must clearly indicate the powers of the trustee. If accounting is outsourced, the document is issued to a specific specialist or to the head of the outsourcing company.

Read also: Power of attorney in the FSS

Signing the document: what, where and how

In a standard invoice, both for the sale and purchase of goods and materials, the signature of the manager is not needed - it is signed by the materially responsible persons.

But if your director nevertheless signed this initial document, then before the vacation it is enough for him to issue an order appointing persons responsible for the shipment and receipt of goods (hereinafter referred to as Law No. 402-FZ); .

A power of attorney from an organization can be issued only by its head or another person authorized by the constituent documents to act on behalf of the organization without a power of attorney, that is, by persons whose information is included in the organization’s Unified State Register of Legal Entities; . Therefore, it is most convenient if the director signs in advance the necessary powers of attorney to receive inventory items for the period of his absence. Or he can entrust this right to someone by writing out a power of attorney for the right to sign powers of attorney to receive goods and materials; , .

M.I. Solntseva, Sochi Can the chief accountant sign the expense report instead of the manager?

How to issue a power of attorney for a bank?

By default, the bank gives the right to sign payment documents to the first person of the organization - its head in accordance with the charter. In order for it to appear to the chief accountant, a power of attorney is drawn up. As a rule, it is drawn up on company letterhead or according to a template provided by a credit institution. It states:

- date and place of compilation;

- complete information about the company;

- Full name and position of the manager giving authority to the accountant;

- similar information about the authorized person, his passport data;

- list of transferred powers (for example: “to sign accounting and financial documents on behalf of the Company”, “to represent the interests of the Company when interacting with the bank”, etc.);

- validity period of the document;

- signature and seal.

A power of attorney for the right to sign to the bank is issued in simple written form; notarization is not required. It is transferred to the credit institution at the time of opening an account or when adding the chief accountant to the number of persons entitled to endorse payment documents.

A similar sample document is used when interacting with counterparties. For example, he authorizes the accountant to sign reconciliation reports with clients and suppliers.

The right of the General Director to sign for the Chief Accountant

The articles posted on our website will tell you how to draw up an order or power of attorney to grant the right to sign documents:

Problems may arise if the document form contains two signatures at the same time: the director and the chief accountant (for example, an invoice, a universal transfer document, etc.). Filling out both lines with the same signatures may raise additional questions from counterparties or regulatory authorities.

If the director has assigned the functions of accounting to himself by order, everyone who asks a question about the legality of this form of signing a document must be presented with this order. If it turns out that the company has a chief accountant on staff and the document (in the line intended for his signature) contains his last name, the consequences may be as follows:

- counterparties will ask you to redo the document, since the signature and its decoding