Pros and cons of hiring a chief accountant without signing authority

The advantages of hiring an accounting manager who will not sign any documents are few, but they exist. This:

- possibility of salary reduction;

- saving work space (the chief accountant without the right to sign can work remotely).

However, company executives often take such a step, bearing in mind that the previous chief accountant fundamentally did not sign, for example, documents for a bank loan. Let us note that it is precisely for this case that the chief accountant does not have the right to sign – plus is dubious. Banks are more willing to give loans if there are two signatures - in order to be able to bring the chief accountant to subsidiary liability.

In another situation with banks, for example, for cash settlement services it is better to have one signature:

- banks have long considered, by default, all the client’s employees who are listed on the card of sample signatures and seal imprints to be of equal importance;

- the first, second, third signature is just a number, and each of them is enough for the payment order to be processed;

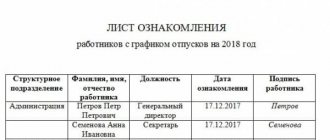

- In order to ensure that a payment order does not go into payment without the signature of the head of the company, it is necessary, as a rule, to fill out a separate statement at the bank on the interdependence of the signatures (see Fig. 1).

Learn more about this issue

Rice. 1

It is the equivalence of signatures, when an accountant can send a payment only under his own signature, that is the reason for theft even in those companies where the general (financial) director does not trust his electronic signature to the accounting department.

In addition, the head of the company will be responsible for reporting that he did not actually prepare, including its late submission. However, administrative fines are usually always issued to managers, even if the chief accountant has the right to sign.

Having considered the issue, we came to the following conclusion:

2-NDFL certificates can be signed by both the head of the organization and any authorized representative of the organization acting on the basis of a power of attorney. Such an authorized representative may be, in particular, the chief accountant.

Rationale for the conclusion:

Information on form 2-NDFL “Certificate of Income of an Individual” (hereinafter referred to as the Certificate) was approved by Order of the Federal Tax Service of Russia dated October 30, 2015 N ММВ-7-11/ [email protected] The same document approved the Procedure for filling out the Certificate.

The certificate is submitted annually (no later than April 1 of the year following the expired tax period) by tax agents (in particular, organizations) to the tax authority at the place of their registration (clause 2 of Article 230 of the Tax Code of the Russian Federation).

In addition, tax agents issue Certificates to individuals upon their written applications (clause 3 of Article 230 of the Tax Code of the Russian Federation, Article 62 of the Labor Code of the Russian Federation).

According to Section I of the Procedure for filling out the Certificate, the completed Certificate form is signed on each page in the “Tax Agent” field. At the same time, analysis of the “Tax Agent” field of the Certificate form shows that this field can be signed by both the tax agent and his authorized representative.

Information about the document confirming the authority of the tax agent representative is reflected in the corresponding field of the Certificate.

By virtue of clause 2 of Art. 24 of the Tax Code of the Russian Federation, in general, tax agents have the same rights as taxpayers. Accordingly (clause 1 of article 26, clause 1 of article 27 of the Tax Code of the Russian Federation), they have the right to participate in relations regulated by the legislation on taxes and fees through a legal or authorized representative (unless otherwise provided by the Tax Code of the Russian Federation).

An authorized representative of a taxpayer (tax agent) - organization exercises his powers on the basis of a power of attorney issued in the manner established by the civil legislation of the Russian Federation, unless otherwise provided by the Tax Code of the Russian Federation (clause 4 of Article 26, clause 3 of Article 29 of the Tax Code of the Russian Federation, clause 4 Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 N 57). According to paragraph 4 of Art. 185.1 of the Civil Code of the Russian Federation, a power of attorney on behalf of a legal entity is issued signed by its head or another person authorized to do so in accordance with the law and constituent documents. See additionally letters of the Ministry of Finance of Russia dated 04/25/2017 N 03-02-08/24718, dated 04/08/2016 N 03-02-08/20028.

As follows from the letters of the Federal Tax Service of Russia dated June 26, 2013 N ED-4-3/ [email protected] , the Ministry of Finance of Russia dated September 25, 2012 N 03-02-07/1-227, if it is impossible for the director to sign documents, participation in tax relations is possible only on the basis of a power of attorney (an order is not enough for this).

With regard to the Certificates, similar conclusions are contained in the letter of the Ministry of Finance of Russia dated July 25, 2008 N 03-04-06-01/230*(1), which states that if documents are signed by an authorized representative of the organization, a copy of a duly executed power of attorney must be attached to them, according to which the representative is authorized to sign relevant documents on behalf of the represented one. In this case, in the corresponding lines of the document “for signature”, instead of indicating the person being represented, the data of the authorized representative is indicated, the document is signed by the representative and certified by his seal.

Thus, the Certificate can be signed by both the head of the organization and any authorized representative of the organization acting on the basis of a power of attorney (including the chief accountant).

According to paragraph 1 of Art. 185.1 of the Civil Code of the Russian Federation, notarization requires a power of attorney:

— to carry out transactions requiring a notarial form;

— to submit applications for state registration of rights or transactions;

- to dispose of rights registered in state registers, except for cases provided for by law.

In all other cases*(2), including the situation under consideration, a simple power of attorney is sufficient.

Prepared answer:

Expert of the Legal Consulting Service GARANT

auditor Ovchinnikova Svetlana

Information legal support GARANT

https://www.garant.ru

Multiline phone

─────────────────────────────────────────────────────────────────────────

*(1) This letter can be viewed on the Internet.

*(2) Unless otherwise expressly provided by law.

What responsibility does an accountant without signatory authority have?

In practice, the chief accountant without the right to sign bears virtually the same responsibility as the chief accountant with a signature, but not a signatory:

- agreement of financial liability for company property;

- documents for external creditors.

As already mentioned, the prevailing practice is that the head of the company is brought to administrative liability, and also to criminal liability. Moreover, both the first and second responsibilities are, first of all, material costs. In the first case it is:

- administrative penalty;

- mandatory repayment of additional accruals (if necessary).

In the second case, we are always talking about active repentance in the form of repayment of arrears (debt). Often such expenses arise not because the head of the company:

- submitted false documents for accounting (failed to ensure receipt of all primary documents);

- prevented the timely payment of taxes.

Unfortunately, the reason is often accounting errors. And even if the accountant recognizes them, the company itself or its director (founder) still pays. Read more about this here >>>

Rights of employees of the organization and third parties

The reasons for delegating a signature come from office practice. The head of the company, who by default has the right to sign, may be absent from the workplace at the moment when this signature is needed. The reasons may be different:

- illness, vacation, business trip of the manager;

- 24-hour working hours or work of the company seven days a week;

- significant volumes of document flow.

There are several options for resolving the situation:

- Another manager signs for the manager; this possibility is prescribed in advance in the statutory documents.

- Instead of a signature, a facsimile is placed if this option does not contradict the law.

- The person authorized to sign documents is issued a power of attorney confirming this right.

- An order (instruction) is issued indicating the person(s) authorized to sign for other persons.

Let us say right away that the right to sign for a manager is rarely prescribed in the Charter, only if the second responsible person is guaranteed not to leave his post in a short time. Otherwise, there will be a need to amend the Charter.

A signature in facsimile form is also rarely used - it is invalid on most primary documents (invoices, personnel, cash documents, etc.). Facsimile can be used, for example, in document flow under contracts, if such a possibility is specified in the contract, and it is executed with a “regular” signature; on commercial offers, regular invoices issued for settlements between counterparties.

Let's consider cases of registration of the right to sign by power of attorney and order. A power of attorney for the right to sign documents can be issued not only to an employee of an organization, but also to a person who does not have labor or civil relations with it. The general rules for issuing powers of attorney for the right to sign are described by the Civil Code of the Russian Federation in Art. 185, 185.1. In this way, you can entrust the right to sign, for example, to an authorized private person, another company (represented by its director), to conclude an agreement; chief accountant for exchanging documents with the Federal Tax Service. The term of the power of attorney can be any. It is counted from the date of issue.

An order for the transfer of powers is used if it is necessary to assign them to employees of the company. The Ministry of Finance, in particular, insists on the need to determine the circle of persons authorized to sign (doc. No. PZ-10/2012 dated 04/12/12).

An order can grant the right to sign to either one person or a group of persons; give it to those employees who previously did not have such a right, and extend existing powers for a new term. The order is most often issued for a period of one year.

Whatever form of document is used, the following must be clearly stated:

- personal data of the substitute;

- a list of documents and situations in which a given person can sign documents.

The sample signature of the employee(s) must be personally certified by the manager. This is done either in the document itself or in the appendix to the order, if the list is extensive.

On a note! When an authorized person puts his signature on a document, mark it with the letters I.O. (“acting”), “for” (meaning “for the leader”) is not necessary.

How to reduce the cost of the chief accountant’s mistakes without a signature

If you decide to hire an accountant without a signature, this means that in the accounting policy it will not be possible to assign accounting to him.

This option is available to medium and small businesses if their manager has chosen one of two available options:

- assigned accounting to himself;

- entered into an agreement for the provision of accounting services.

It is for this reason that clients who have hired full-time (freelance) accountants come to us for service, but their ceiling is a chief accountant without the right to sign. The reason for contacting us at 1C-WiseAdvice is not only the professionalism of our accountants, but also the fact that we have insured our professional liability.

Let's assume it's hypothetical, but still a probability. For example, if our specialists make a mistake (incorrect calculation of taxes, errors in reporting, primary reporting) - we will compensate for:

- tax penalties;

- other additional charges and so on.

Moreover, the coverage of a professional liability insurance policy is by no means a rigid constant:

- Indexation occurs annually;

- Taking into account the latest increase, our coverage is 70 million rubles.

An important advantage is that the policy includes an expanded list of insured events that other outsourcing companies do not insure against. In addition, we guarantee financial compensation from the company’s personal funds in a number of cases that are not insurance, in particular:

- errors in payments and statistical reporting;

- violation of deadlines for submitting documents on currency control.

We are the only company in the Russian Federation that considers all insurance claims within three years after the submission of the last report. Even if we are talking about a former client. Read more here >>>

What documents are required to obtain an accounting digital signature?

The receipt scheme in this case is not very different from the one used by the head of the company. The only difference is the document on the basis of which the right to use the electronic signature is established. If, in the case of a director, an appointment order is sufficient, the chief accountant must confirm that he has such authority. If the company's management has decided that the accounting department needs to use a separate digital signature, this is confirmed by the relevant document. It must be submitted to the certification center.

Accordingly, the following documents will be required from the chief accountant to submit an application:

- an extract from the Unified State Register of Legal Entities containing information about the organization;

- civil passport (copy of pages with photo and registration);

- SNILS (copy);

- a document signed by the manager, which reflects the fact that the employee has been given the authority to use a separate electronic signature.

The list may vary slightly depending on the specific certification authority. In particular, additional information about the organization may be required.

How to register a chief accountant without the right to sign?

If the company applies professional standards, then it will not be possible to register an employee without the right to sign for the position of chief accountant. The same goes for registering such an employee simply as an accountant. The fact is that the chief accountant is assigned the following labor functions, and at least the first of them requires a signature:

If the company does not apply professional standards, then such an employment contract can be concluded.

Results

The right of the second signature of the chief accountant is secured in the order or power of attorney. The same documents are used if, in the absence of the chief accountant, the right of the second signature must be delegated to another employee.

Sources:

- Law “On Accounting” dated December 6, 2011 No. 402-FZ

- Labor Code of the Russian Federation

- Instruction of the Bank of Russia dated May 30, 2014 No. 153-I

- Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.