| [organizational and legal form, name of organization, enterprise] | I approve [position, signature, full name of the manager or other official authorized to approve the job description] [day month Year] M.P. |

Job description of the chief accountant [name of organization, enterprise, etc.]

This job description has been developed in accordance with the provisions of the Labor Code of the Russian Federation, as well as other regulations governing labor relations in the Russian Federation.

II. Functions

The chief accountant is assigned the following functions:

2.1. Management of accounting and reporting at the enterprise.

2.2. Formation of accounting policies with the development of measures for its implementation.

2.3. Providing methodological assistance to employees of enterprise departments on accounting, control and reporting issues.

2.4. Ensuring the preparation of salary calculations, accruals and transfers of taxes and fees to budgets of various levels, payments to banking institutions.

2.5. Identification of on-farm reserves, implementation of measures to eliminate losses and unproductive costs.

2.6. Introduction of modern technical means and information technologies.

2.7. Monitoring the timely and correct execution of accounting documentation.

2.8. Ensuring healthy and safe working conditions for subordinate performers, monitoring their compliance with the requirements of legislative and regulatory legal acts on labor protection.

https://youtu.be/ORDZdo3_c64

What will the general provisions tell you?

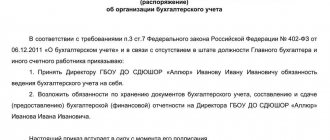

The instructions begin with the “General Provisions” section. It gives an idea of the principles of accounting at a particular enterprise, makes the necessary accents and comments, and points out the nuances in the work.

This paragraph includes a little from all sections, summarizing the information into single abstracts. This part of the document may indicate that the main function of the chief accountant is the timely maintenance of accounting records with control over the use of various types of resources for the smooth functioning of the enterprise. Accounting is designated as a separate division, which cannot be included in other departments. The chief accountant reports to the management of the organization. The manager has the right to appoint and dismiss an employee, based on the norms of the Labor Code and other regulations.

This section indicates wishes about the specialist’s level of education and work experience. A higher education is almost always required, but there are cases when its absence is compensated for by practice and experience in the field. If there is no chief accountant at the workplace, then his responsibilities should be delegated to his deputy or a person from the staff who can cope with the task. He must also be familiar with the instructions.

This paragraph regulates the procedure for receiving and transferring cases in the case when the chief accountant leaves his place temporarily or permanently. The conditions and deadlines for checking reporting data and the level of accounting are prescribed. Also here you can find information about the authority of a specialist in the field of managing funds, financial responsibility and the algorithm for disposing of goods and materials.

“General information” can also be supplemented with other subparagraphs if they reveal the principle of accounting and contribute to ideal accounting discipline.

Often this part is skipped and not given enough attention. This is fraught with errors and incidents, because it contains important aspects for successful accounting and analysis.

III. Job responsibilities

To perform the functions assigned to him, the chief accountant of the enterprise is obliged to:

3.1. Organize accounting of economic and financial activities and control over the economical use of material, labor and financial resources, and the safety of the enterprise’s property.

3.2. Formulate an accounting policy in accordance with accounting legislation, based on the structure and characteristics of the enterprise’s activities, the need to ensure its financial stability.

3.3. Organize accounting of property, liabilities and business transactions, incoming fixed assets, inventory and cash, execution of cost estimates, performance of work (services), results of financial and economic activities of the enterprise, as well as financial, settlement and credit transactions, timely reflection on accounting accounts of transactions related to their movement.

3.4. Monitor compliance with the procedure for preparing primary and accounting documents, settlements and payment obligations, spending the wage fund, conducting inventories of fixed assets, inventory and cash, checking the organization of accounting and reporting, as well as documentary audits in the divisions of the enterprise (branches ).

3.5. Take measures to prevent shortages, illegal spending of funds and inventory, violations of financial and economic legislation.

3.6. Ensure the legality, timeliness and correctness of the execution of documents, work (services) performed, payroll calculations, correct calculation and transfer of taxes and fees to the federal, regional and local budgets, insurance contributions to state extra-budgetary social funds, payments to banking institutions, funds for financing capital investments, repaying bank loan debts on time, as well as deductions for material incentives for enterprise employees.

3.7. Participate in the preparation of materials on shortages and thefts of funds and inventory items, control the transfer, if necessary, of these materials to investigative and judicial authorities.

3.8. Lead the work on the preparation and adoption of a working chart of accounts, forms of primary accounting documents used for registration of business transactions for which standard forms are not provided, development of forms of internal accounting documents, as well as ensuring the procedure for conducting inventories, monitoring the conduct of business transactions, compliance with technology processing of accounting information and document flow procedures.

3.9. Participate in conducting an economic analysis of the economic and financial activities of an enterprise based on accounting and reporting data in order to identify on-farm reserves, eliminate losses and unproductive costs.

3.10. Work to ensure strict compliance with staffing, financial and cash discipline, estimates of administrative, economic and other expenses, the legality of writing off shortages, accounts receivable and other losses from accounting accounts, the safety of accounting documents, their execution and delivery in the prescribed manner to the archive.

3.11. Take measures to accumulate financial resources to ensure the sustainability of the enterprise.

3.12. Ensure the rational organization of accounting and reporting at the enterprise on the basis of maximum centralization of accounting and computing work and the use of modern technical means and information technologies, progressive forms and methods of accounting and control, the formation and timely submission of complete and reliable accounting information about the activities of the enterprise, its property status , income and expenses, as well as the development and implementation of measures aimed at strengthening financial discipline.

3.13. Interact with banks on the placement of available funds on bank deposits (certificates) and the acquisition of highly liquid government securities, control over accounting transactions with deposit and loan agreements, securities.

3.14. Participate in the development and implementation of rational planning and accounting documentation, progressive forms and methods of accounting based on the use of modern computer technology.

3.15. Ensure the preparation of balance sheets and operational summary reports on income and expenses of funds, the use of the budget, other accounting and statistical reporting, and their submission in the prescribed manner to the relevant authorities.

3.16. Provide methodological assistance to employees of enterprise departments on accounting, control, and reporting issues.

3.17. Manage employees of the company's accounting department.

Who is an accountant?

An accountant is a person involved in financial accounting, documentation and preparation of reports to the proper authorities. This profession is quite difficult. The functions of an accountant are very complex. However, all the complexity of the work is compensated by a decent salary and the opportunity for career growth.

Today, work related to accounting is quite in demand in the labor market. After all, almost any company or firm requires a specialist who would be involved in maintaining documentation and financial accounting. In fact, the company’s activities depend on the accountant: the enterprise’s budget, employee salaries, payment for product deliveries, etc. If the company is small, then only one chief accountant will be enough. At the same time, the functions of the chief accountant are always much broader and more extensive than the usual ones. If the company is large, then a whole accounting department will be needed.

IV. Rights

The chief accountant has the right:

4.1. Represent the interests of the enterprise in relations with other structural divisions of the enterprise and other organizations on financial, economic and other issues.

4.2. Establish job responsibilities for employees subordinate to him, so that each employee knows the range of his duties and is responsible for their implementation. Employees of other departments involved in accounting report to the chief accountant on all issues of organization and maintenance of accounting and reporting.

4.3. Submit proposals for improving economic and financial activities for consideration by the management of the enterprise.

4.4. Sign and endorse documents within your competence.

4.5. Receive in a timely manner from the heads of the enterprise departments (specialists) information and documents (orders, instructions, contracts, estimates, reports, standards, etc.) necessary to perform their job duties. (For untimely, poor-quality execution and preparation of these documents, delay in transferring them for reflection in accounting and reporting, for the unreliability of the data contained in the documents, as well as for the preparation of documents reflecting illegal transactions, the officials who compiled and signed these documents are responsible ).

4.6. Submit for consideration by the director of the enterprise proposals on the appointment, relocation, dismissal of accounting employees, proposals for their encouragement or the imposition of penalties on them.

4.7. Involve specialists from departments of the enterprise in solving the tasks assigned to it (if this is provided for by the regulations on departments, if not, with the permission of the manager).

4.8. Require the director of the enterprise to provide assistance in the performance of his official duties and rights.

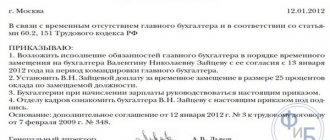

What should an employee know?

Each manager sets requirements for the level of knowledge of an employee individually. It all depends on personal wishes, the specifics of work, remuneration and other important factors.

There is a standard list of knowledge that a chief accountant must have:

- knowledge of legislation that regulates accounting, tax, personnel, statistical, and management accounting;

- legal awareness (at least the basics of law);

- keep abreast of the development, completion and submission of reports, regulatory and methodological documentation to regulatory authorities;

- know the rules and principles of accounting;

- have knowledge of accounting ethics, business cooperation and psychology;

- knowledge about the specifics, strategy, plans of the enterprise;

- have information about accounting records, terminology, methods, starting from business transactions and ending with the calculation of financial results;

- know what an audit is and ideally be able to conduct such an audit;

- knowledge of tax transactions, fees, deadlines for their payment and penalties;

- have a wealth of knowledge about inventory, audit, settlements with debtors and creditors;

- computer and office equipment skills;

- Perfect knowledge of accounting and tax programs;

- keep abreast of the latest changes in legislation, accounting and programs that are used in this sector;

- have at least minimal information security skills;

- know the rules for storing documentation, archiving and eliminating it (if necessary);

- possess data on international accounting, especially if we are talking about an international company;

- know labor safety standards and personnel accounting principles.

To know whether management is demanding too much from the chief accountant, you need to familiarize yourself with the legislation, the Charter of the enterprise, internal regulations, and orders within the organization.

V. Responsibility

The chief accountant is responsible for:

5.1. For failure to perform (improper performance) of one’s job duties as provided for in this job description, within the limits determined by the labor legislation of the Russian Federation.

5.2. For offenses committed in the course of carrying out their activities - within the limits determined by the administrative, criminal and civil legislation of the Russian Federation.

5.3. For causing material damage - within the limits determined by labor, criminal and civil legislation of the Russian Federation.

conclusions

The job description of the chief accountant is one of the basic documents that fully covers his activities, conditions, principles and prospects of work. Having studied the information, we can draw a conclusion about what measures of reward and punishment the employee may expect, what powers he has and the degree of influence on others.

Correctly developed instructions will avoid misunderstandings and conflict situations. It is not mandatory, like the Charter of an enterprise or a Collective Agreement, for example, but with the help of this document many working issues can be clarified.

Another advantage of a job description is that it can be adjusted during the operation of the enterprise. The introduction of new items will improve the quality of the chief accountant’s work and open up new dimensions of activity.

https://youtu.be/Cn_9FxS_Ztc