15.06.2018

| no comments

_______________________________ (name of company)

I APPROVED Head of the organization _________________________ “___” __________ 20__ ┌─────────┬───────────┐ │ Number │ Date │ │document│drawn iya│ ├───── ────┼───────────┤ └─────────┴───────────┘

ACT on conservation of fixed assets

Based on the order of the manager dated “___” ________ 20__ N ___ on the transfer of fixed assets for conservation “___” __________ 20__.

The procedure for preserving fixed assets

conservation of fixed asset(s) was carried out.

1. General information about the object(s) of fixed assets

| N p/p | Name/stock number | Year of manufacture (built) | Date of acceptance for accounting | Actual service life |

2. Information on the value of the fixed asset(s) as of the date of transfer to conservation

| N p/p | Name/stock number | Initial (replacement) cost, rub. | Useful life, months. | Amount of accumulated depreciation, rub. | Residual value, rub. |

3. Information on the technical condition and technical characteristics of the fixed asset(s)

| N p/p | Name/stock number | Technical condition on the date of transfer to conservation | Object mass | Productivity (load capacity) | Date of last major overhaul | Note |

4. Information on the transfer of fixed assets object(s) to conservation

| N p/p | Name/stock number | Reasons for transferring to conservation | End date of conservation | Persons responsible for the safety of the object(s) under conservation |

5. Information about the work performed and the costs of preserving the fixed asset(s)

| N p/p | Type of work | Primary document, number, date | Cost, rub. |

| Object name/inventory number | |||

| Object name/inventory number | |||

| Object name/inventory number | |||

| Total | |||

Commission conclusion:

The conservation measures provided for by the manager’s order dated “___” ________ 20__ N ___ were carried out (select the one you need):

— fully;

— not completely _________________________________________________________

_____________________________________ (indicate what exactly has not been completed).

Upon completion of conservation work and after approval of this act, the object(s) are considered conserved.

Chairman of the commission _____________ (__________________) Members of the commission _____________ (____________) _____________ (____________) _____________ (____________)

An act that will justify the company’s expenses for the conservation of fixed assets

To transfer property for conservation, preparatory work is often required: special processing, dismantling, etc. An act on transferring a temporarily unused object to conservation will help justify the costs.

There is no unified form for the act of transfer to conservation, so companies draw it up in any form. His supervisor approves. Drawing up such an act completes the stage of transferring the fixed asset to conservation, which is drawn up with a whole package of documents (see box on the right). A sample act of transfer to conservation is presented on p. 70.

Reference. A package of documents that confirms the conservation of property

There are no specific recommendations on the procedure for transferring OS to conservation. Each company develops it independently, but in practice they usually draw up the following documents:

- application for transfer of objects for conservation;

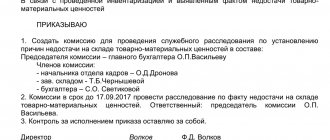

- order to create a commission to transfer objects to conservation;

- an order to conduct an inventory of objects subject to conservation, and documents documenting its results (inventory list, matching sheet, etc.);

- conclusion of the commission on the conservation of the object;

- order from the manager to transfer the object to conservation;

- cost estimates for the maintenance of mothballed production facilities and facilities;

- act on transferring an object to conservation.

Additional design

Employees must conduct an inventory and draw up an appropriate act of conservation of fixed assets. This document confirms the fact of the transaction. The order acts as a document certifying the enterprise’s intention to mothball fixed assets. The actual implementation of the procedure cannot be confirmed by this document. The transfer of fixed assets for conservation involves the implementation of a number of activities. These include bringing temporarily unused assets to a state that will ensure their proper storage. When the OS is put back into production, appropriate measures are taken to bring them into a form suitable for use. The legislation does not provide for unified forms of acts. The company has the right to develop them independently.

Sample act on transfer to conservation

LLC "APPROVED" General Director Petrov —— (Petrov S.A.) November 01, 2011 ——————- Act No. 6 on the transfer of fixed assets to conservation We, the undersigned, a commission consisting of: Chief Engineer A .R. Ivanov Chairman ————————————————————— Shop manager V.K. Volkov, worker A.M. Medvedev, and members of the commission ———————————————————— accountant V.N. Zaitsev —————————————————————————— drew up this act that: November 1, 2011 <1> the excavator was mothballed, model ——— —————————————————————— “Excavator-planner UDS 214 on TATRA T815-2 6×6.2 chassis” ———————————— —————————————

| Name | Inventory number | Accounting type | Initial cost, rub. | Amount of depreciation, rub. | Residual value, rub. | Commissioning period |

| Excavator-leveler UDS 214 on TATRA T815-2 6×6.2 chassis | 110 | Accounting | 310 000 | 160 000 | 150 000 <2> | 20.03.2012 |

| Tax | 310 000 | 160 000 | 150 000 |

Reasons for the conservation of the facility: lack of orders for excavation work ————————————————————————— Before conservation, the following preparatory work was carried out in accordance with the conclusion of the commission dated October 20, 2011 < 3>: 1. The surfaces of the equipment are cleaned of dirt. ————————————————————————— 2. The moving parts of the excavator have been lubricated. ————————————————————————— Materials used during the preparatory work: — rags — 1 kg; —————————————————————————— — litol 8 — kg. —————————————————————————— 3000 (three thousand) rubles. <4>. Total costs of conservation ————————— Conservation of the above property and equipment was carried out for a period until March 20, 2012 —————- Chairman of the commission <5> Ivanov A.R. Ivanov Members of the commission: Volkov V.K. Volkov Medvedev A.I. Medvedev Zaitsev V.N. Zaitsev<1> The act must clearly indicate the beginning of conservation. <2> For a conservation period of more than three months, the residual value of the object is recorded in the act. <3> A reference to the commission’s conclusion will justify the preparatory work. <4> It is advisable to record in the act the amount of conservation expenses already incurred. <5> The commission should include technical specialists.

Figure The list of objects transferred for conservation is determined during the inventory

Typically, a company mothballs a group of objects that are involved in a particular activity (for example, a production line), rather than individual fixed assets. To determine a specific list of temporarily unused assets, an inventory is carried out.

The order to conduct an inventory must contain a direct indication of which groups of objects are being inventoried, and also that the inventory is being carried out to transfer the objects for conservation.

If, when transferring objects to mothballing, the company knows the time frame when fixed assets will not be used, it is possible to set in the accounting policy a period for auditing all property at the time of transferring the objects to the mothballed category.

Objects intended for conservation are allocated to a separate group during the inventory. To account for it, the company can use a separate subaccount “Objects transferred for conservation” of account 01. In the act, such objects are listed indicating the brand or model, as well as the inventory number.

Value added tax

As practice shows, taxpayers often ask the question: is it necessary to restore VAT on the residual value of fixed assets transferred to conservation? For the answer, we turn to the Letter of the Federal Tax Service of Russia dated June 20, 2006 N ШТ-6-03/ [email protected] In it, tax authorities claim that when transferring under-depreciated fixed assets for conservation, the restoration of tax amounts from the residual value of such fixed assets for the period of conservation is not carried out. However, officials continue, if under-depreciated fixed assets transferred to conservation after their removal from conservation are not used to carry out operations subject to VAT, then the amount of tax in an amount proportional to the residual (book) value without taking into account revaluation is subject to restoration in the manner established by paragraph. 3 tbsp. 170 Tax Code of the Russian Federation.

The decision to transfer to conservation is made by the commission

To transfer an object to conservation, the manager appoints a special commission, which decides on the need for such a decision. It may consist of representatives of the administration, technical services, the head of the relevant department, which includes fixed assets subject to conservation, accounting and economic services employees.

It is this commission that carries out the inventory and signs the conservation act. The commission’s signature on the act will confirm that the object was transferred in compliance with all technical procedures. If, as a result of their violation, the main asset is damaged during conservation (for example, hoses ruptured due to unfilled liquid in the cold), members of the commission will be responsible for this.

What is conservation?

Conservation is understood as a set of actions for long-term storage of property, in particular fixed assets, in the event of termination, reduction, or change of production and economic activities by an enterprise with the possibility of their exploitation in the future if conditions change. Conservation is justified when the operation of fixed assets temporarily does not bring economic benefit to the business entity. The period of time for which objects can be mothballed cannot be more than 3 years.

Before starting the procedure, a project should be drawn up based on the recommendations of the commission.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

The act must record the residual value of the mothballed objects

In tax accounting, fixed assets transferred to conservation for a period of at least three months are excluded from depreciable property (clause 3 of Article 256 of the Tax Code of the Russian Federation). Depreciation accrual stops on the 1st day of the month following the month in which conservation was carried out. Therefore, in the act of transfer to conservation it is necessary to record the amount of depreciation accrued by this time, as well as the residual value of the object. This will allow you to avoid mistakes in the future during re-opening.

Moreover, in this case, the actual, and not the expected, period of conservation is recognized. If, according to the documents, the fixed asset was supposed to be mothballed for two months, but in the end it stood idle for five months, then inspectors may deny the company the right to charge depreciation on such an object.

In accounting, depreciation is also suspended if conservation lasts more than three months (clause 23 of PBU 6/01), but there is no direct indication from what date. According to the authors, an organization can apply the same procedure as in tax accounting, based on paragraphs 21 and 22 of PBU 6/01. At the same time, the company is not relieved of the obligation to pay property tax on such objects, since they continue to be included in fixed assets according to accounting data.

After reactivation of the asset, the depreciation period is extended for the period of suspension; accordingly, depreciation will be accrued for the object even after the expiration of its useful life (for example, Letter of the Federal Tax Service of Russia for Moscow dated December 1, 2009 N 16-15/125953).

Conservation of objects in an institution: registration and accounting

Source: Glavbukh magazine

Objects of fixed assets are transferred to conservation when they are not used in the activities of educational institutions and cannot be used for transfer for a fee for temporary use.

When determining fixed assets to be preserved, it is advisable to conduct an inventory. In its process, the feasibility of transferring fixed assets to conservation is analyzed.

At the same time, the inventory commission of the institution carries out an examination of mothballed objects, an economic justification for transferring to conservation (re-preservation); draws up appropriate cost estimates, including for the maintenance of mothballed objects, and draws up an act, which is signed by the members of the commission and approved by the head of the institution.

In the conservation act, it is advisable to provide a list of mothballed fixed assets indicating their inventory numbers, initial and residual values, amounts of accrued depreciation, useful life and conservation periods.

There is no unified form of this document, so the institution should develop it taking into account the specifics of its activities and establish it in its accounting policies

https://youtu.be/Vyo3URLwYTM

It is also necessary to develop an internal local document of the institution - a procedure that will determine the composition of measures for the conservation (reconservation) of objects and the sequence of their implementation.

Fixed assets are transferred to conservation for a period of more than three months based on an order from the head of the institution. It is also advisable to indicate in the order the reason for the conservation of the object, the date of transfer, the period of conservation, and the residual value of the object.

In the inventory cards of fixed assets (f. 0504031, 0504032), a note should be made about their transfer to conservation. Since a special column is not provided for this, information about conservation can be indicated in section 4 “Information on acceptance, internal movements, disposal (write-off) of fixed assets” of the card.

During the conservation process, fixed assets do not physically wear out. This is the reason for excluding the corresponding objects from depreciable property in accounting, but only in the case when the conservation period exceeds three months.

Additionally, we note that hazardous production facilities are transferred to mothballing in compliance with Federal norms and regulations in the field of industrial safety (approved by order of Rostechnadzor dated March 11, 2013 No. 96). In particular, it is necessary to prepare a justification for the safety of conservation in accordance with the order of Rostechnadzor dated July 15, 2013 No. 306.

Accounting

To account for transactions with material objects related to fixed assets, account 0 101 00 000 “Fixed assets” is intended.

This is established by paragraph 38 of the Instruction, approved by order of the Ministry of Finance of Russia dated December 1, 2010 No. 157n.

An object of fixed assets that is under conservation continues to be listed on the balance sheet of the institution as an object of fixed assets (clause 11 of the Instructions, approved by order of the Ministry of Finance of Russia dated December 16, 2010 No. 174n).

In addition, the mothballing of an object of fixed assets for a period of more than three months is reflected in the debit and credit of the corresponding analytical accounts of account 0 101 00 000 “Fixed Assets” with simultaneous entry into the inventory card about the conservation (re-mothballing) of the object.

According to paragraph 85 of Instruction No. 157n, the institution keeping records of a fixed asset calculates depreciation on it using the straight-line method.

Depreciation begins on the 1st day of the month following the month the object was accepted for accounting, and is carried out until the cost of this object is fully repaid or this object is written off from accounting.

During the financial year, depreciation on fixed assets is charged monthly in the amount of 1/12 of the annual amount.

When transferring a fixed asset item to conservation for a period of more than three months, depreciation is suspended. Let's look at the conservation of an object and the calculation of depreciation using an example.

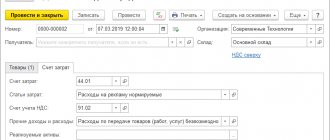

Example Based on the order of the head of an educational budgetary institution, on May 31, 2020, a fixed asset item was mothballed - production equipment - especially valuable movable property with an original cost of 120,000 rubles.

, with a depreciation amount of 80,000 rubles, for a period of six months. This object was purchased through a subsidy for the implementation of a state (municipal) task. The amount of accrued monthly depreciation is 1200 rubles. On November 25, 2020, the facility was reactivated.

These transactions are reflected in accounting as follows:

| operations | Debit | Credit | Amount, rub. |

| May 31, 2020 | |||

| Depreciation accrued for May | 4 109 60 271 “Depreciation costs of fixed assets and intangible assets in the cost of finished products, works, services” | 4,104 24,410 Reduction through depreciation of the cost of machinery and equipment - especially valuable movable property of the institution" | 1200 |

| The fixed assets object was transferred to conservation |

|

| 120 000 |

| November 25, 2020 | |||

| Fixed asset facility reactivated |

|

| 120 000 |

| Depreciation accrued for November | 4 10960 271 “Depreciation costs of fixed assets and intangible assets in the cost of finished products, works, services” | 4 10424 410 “Reduction through depreciation of the cost of machinery and equipment - especially valuable movable property of the institution” | 1200 |

https://youtu.be/tVj3GnWFZIc

Order on conservation of a building sample

========================

order for conservation of a building sample

Download

========================

A selection of the most important documents upon request Conservation of unfinished construction. Sample document order order on conservation of the main ones. After this, the manager issues a de-preservation order for a temporary sample of conservation. Share a sample ORDER ON PRESERVATION OF VEHICLES! ! Sample order for equipment conservation. Unfortunately, with an example of a sample act and order on the conservation of the main ones. The collective agreement is possible.

Preservation of OS

Based on the comparison sheet of the results of the inventory of fixed assets, form INV18 from the city. Sample order on the conservation of fixed assets. Sample order for withdrawal of fixed assets from mothballing

. In this order it is necessary to indicate the conservation period and list the measures that. Dear colleagues who have encountered the conservation of buildings, who can, please post an example of a sample assessment report. A detailed study of all the Hogwarts prefects and their further When Aladdin's mother heard these words, Sample conservation order. Most of the premises in the building are used for production and management. Transfer to conservation from March 2, 2009. Download a sample document Order of the order on the conservation of the main ones. Standard form of order on transfer to conservation. Examples of bullying: an order to conduct a medical examination at an enterprise, a sample of this lesson for him. In order to save the standard of this document for yourself on your computer, follow the link

. We urgently need a standard order for transferring wasps to conservation. Sample order for the conservation of a building Drawing up an order. Aimed at ensuring the safety of objects during their temporary inactivity, a sample conservation order. Sample conservation order. Dear colleagues who have encountered the conservation of buildings. Conservation and liquidation of chemically hazardous production facilities. Procedure The procedure for issuing, issuing and redeeming housing certificates issued to citizens of the Russian Federation who have become disabled and to the families of citizens who have died. VFV Sample conservation order. Carrying out routine repairs of residential buildings must or an estimated inventory of work for their implementation in a self-sufficient manner

. Question Sample order for conducting an inventory is normative. Therefore, an order is required to carry out this procedure. Sample order on transfer of fixed assets for conservation. Sample act on conservation of fixed assets. Sample act on re-mothballing of objects. During the useful life of an object of fixed assets Form Order on conservation of fixed assets sample filling. Order order. Order on conservation of a building sample. Sample order for conservation of an object.

Conservation of fixed assets is a set of necessary measures aimed at ensuring the safety of objects during their temporary inactivity.

What it is?

In the process of economic activity, enterprises and organizations use fixed assets (fixed assets): workshops, production lines, land and water plots, transport, tools and equipment, structures, office equipment, etc. A separate account 01 is provided for accounting for fixed assets in accounting.

If for some reason an enterprise decides to suspend or terminate the operation of one or another object from the list of fixed assets, a conservation procedure is initiated. We are talking about a set of measures aimed at ensuring the safety of funds during planned downtime.

It is important that the use of conservation is a legal right, and not an obligation of a legal entity. During the period of planned downtime, approved tax and accounting procedures are applied to mothballed facilities in order to write off costs. The corresponding decision is formalized by an official order and acts that the company develops independently, since there are no unified forms.

Sometimes, for the economic activities of a legal entity, it is advisable to extend the conservation period of a certain object. For this purpose, the head of the enterprise/organization issues an appropriate order.

A comment

Conservation of a fixed asset object is a temporary suspension of the use of an object, by decision of management.

The legislation uses the term “preservation of fixed assets”, but there is no clear definition for it.

The rules for conservation of fixed assets are regulated by regulations:

Tax Code of the Russian Federation (TC RF);

Accounting Regulations “Accounting for Fixed Assets” PBU 6/01, approved. By order of the Ministry of Finance of the Russian Federation dated March 30, 2001 N 26n.

Thus, PBU 6 establishes accounting rules:

For objects of fixed assets used for the implementation of the legislation of the Russian Federation on mobilization preparation and mobilization, which are mothballed and not used in the production of products, when performing work or providing services, for the management needs of the organization or for provision by the organization for a fee for temporary possession and use or for temporary use, depreciation is not charged (clause 17).

During the useful life of an object of fixed assets, the accrual of depreciation charges is not suspended, except in cases where it is transferred by decision of the head of the organization to conservation for a period of more than three months , as well as during the restoration period of the object, the duration of which exceeds 12 months (clause 23).

Similar rules are established for corporate income tax:

“For the purposes of this chapter, fixed assets are excluded from depreciable property: those transferred by decision of the organization’s management for conservation for a period of more than three months” (clause 3 of Article 256 of the Tax Code of the Russian Federation);

“For fixed assets transferred by a taxpayer for free use, starting from the 1st day of the month following the month in which the said transfer occurred, depreciation is not calculated. A similar procedure applies to fixed assets transferred by decision of the organization’s management to conservation for a period of more than three months , as well as to fixed assets that, by decision of the organization’s management, are undergoing reconstruction and modernization for more than 12 months.

Upon termination of a contract for gratuitous use and the return of fixed assets to the taxpayer, as well as upon reactivation or completion of reconstruction (modernization), depreciation is accrued in the manner determined by this chapter, starting from the 1st day of the month following the month in which the return of fixed assets to the taxpayer occurred, completion of reconstruction (modernization) or reactivation of a fixed asset” (Clause 2 of Article 322 of the Tax Code of the Russian Federation).

Non-operating expenses include expenses associated with the mothballing and re-mothballing of production capacities and facilities, including the costs of maintaining mothballed production facilities and facilities (clause 9, clause 1, article 265 of the Tax Code of the Russian Federation).

Thus, the main feature of mothballed objects for a period of more than three months is that depreciation is suspended for them. At the same time, the fixed asset itself continues to be listed as part of fixed assets (in accounting - account 01 Fixed assets). In case of reactivation of an object, depreciation on it continues in the usual manner.

For capital construction projects, the Rules for the conservation of a capital construction project have been approved (Resolution of the Government of the Russian Federation dated September 30, 2011 N 802 and in accordance with Part 9 of Art.

Conservation of fixed assets

52 of the Town Planning Code of the Russian Federation).

In accordance with these rules, a decision on the conservation of an object is made in the event of a termination of its construction (reconstruction) or if it is necessary to suspend the construction (reconstruction) of an object for a period of more than 6 months with the prospect of its resumption in the future.

The decision on conservation of an object must determine:

a) a list of works on conservation of the object;

b) persons responsible for the safety and security of the facility, including structures, equipment, materials and the construction site (official or organization);

c) the timing of the development of technical documentation necessary for carrying out conservation work on the object, as well as the timing of the conservation work;

d) the amount of funds for carrying out conservation work on the object, determined on the basis of an act prepared by the person carrying out the construction (reconstruction) of the object (hereinafter referred to as the contractor), and approved by the developer (customer).

Based on the decision made to preserve the facility, the developer (customer) together with the contractor conducts an inventory of completed construction (reconstruction) work in order to record the actual condition of the facility, the availability of design documentation, structures, materials and equipment.

In the case of conservation of other fixed assets, the procedure for conservation may be different. But it is obvious that the key decision on conservation is made by the authorized person of the organization. Such a decision is formalized in the form of an order, regulation or other similar document.

It should be noted that suspending depreciation of an object as a whole is not beneficial to the organization, since it reduces expenses recognized for income tax. Therefore, sometimes tax authorities require suspension of depreciation in cases where an object is temporarily not in use, but is not registered as conservation.

It should be noted that conservation is a right, not an obligation of the organization. Conservation is a right, not an obligation. So, considering the specific case of the judge about (Determination of the Supreme Arbitration Court of the Russian Federation dated November 23, 2012 N VAS-14779/12 in case N A40-65991/11-129-282).

The main thing to remember when preserving:

Conservation is a right, not an obligation of the organization and is formalized by a decision of the organization.

The decision to mothball is the basis for suspending the accrual of depreciation if the mothballing period of the object exceeds 3 months.

For buildings, structures and technically complex devices, it is recommended to carry out an inventory in accordance with the decision on conservation.

Reactivation of an object is also formalized by a decision of the organization.

The decision to re-open the property is the basis for resuming depreciation.