The gratuitous transfer of goods, works, and services in the context of the taxation of this operation with VAT causes an ambiguous interpretation. If we think about it, the gratuitous transfer of property does not bring any material benefit to the person who performed this action. It would seem that this operation should not be subject to VAT. But at the same time, the tax legislation of the Russian Federation equates the gratuitous transfer of goods, works, and services to sales. It follows that not only the sale of property on a reimbursable basis may be subject to VAT. In this article we will look at how VAT is determined when transferring goods, property, fixed assets, and inventories free of charge.

Restrictions on donation

The gratuitous transfer of valuables or property rights is essentially a donation (Clause 1, Article 572 of the Civil Code of the Russian Federation). The transferred objects can be:

- fixed assets;

- goods;

- in cash;

- finished products;

- intangible assets;

- materials;

- securities;

- property claims (rights), for example, this may be the right to use a land plot disinterestedly transferred by a commercial organization to a non-profit institution or a disinterested assignment by a commercial enterprise of the right to demand payment of the debt of its debtor to a non-profit organization.

For commercial enterprises, an acceptable limit for the value of gratuitously transferred valuables has been established - up to 3 thousand rubles. This restriction does not apply to transactions with individuals and public organizations, charitable and other foundations, budgetary institutions, consumer cooperatives, religious and other non-profit organizations. In addition, it is possible to transfer property free of charge to commercial organizations-founders, but provided that such operations are stipulated in the charter. Donation of valuables between commercial organizations in the amount of more than 3 thousand rubles. is considered a violation of the requirements of the law, and such a transaction may be declared invalid (clause 1 of Article 168, subclause 4 of clause 1 of Article 575 of the Civil Code of the Russian Federation).

When donating valuables worth over 3 thousand rubles. a citizen or non-profit organization should draw up a written gift agreement (Articles 574 and 575 of the Civil Code of the Russian Federation).

The transaction of gratuitous transfer of valuables is confirmed by a delivery note or an acceptance certificate.

About the form used to draw up the consignment note, read the article “Unified form TORG-12 - form and sample.”

If donation is prohibited, then why is it used?

Donation

A gift agreement between commercial companies exceeding 3,000 rubles is prohibited (Clause 4, Article 575 of the Civil Code of the Russian Federation). This requirement is logical. According to Art. 50 of the Civil Code of the Russian Federation, the purpose of conducting the activities of a commercial company is to make a profit. Does this mean that the court will recognize such a transaction as void? Yes. At the very least, we do not recommend drawing up an agreement with this name.

Let's consider several important conditions:

- The restriction described above does not apply to the case when the donor is a commercial company and the recipient is a non-profit organization or individual (see the appendix to the article for a sample agreement).

- If we are talking about charity, then a donation agreement is used.

- If the value of the gift is more than 3,000 rubles and one of the parties is a legal entity, a written form is required (clause 2 of Article 574 of the Civil Code of the Russian Federation).

Broadcast

Is an agreement for the gratuitous transfer of property different from a gift agreement? From the point of view of some lawyers, yes. If the organization is the founder of another legal entity, then it is vitally interested in the commercial success of the “daughter”. In the absence of explicit compensation in the form of money or counter services, implicit compensation follows from the very content of corporate relationships.

From this perspective, Art. 251 of the Tax Code of the Russian Federation, an agreement on the gratuitous transfer of property from the founder to a legal entity does not contradict civil law.

When is the gratuitous transfer of property subject to VAT?

In tax legislation, values or rights transferred to the recipient without issuing counter obligations are considered to be received free of charge (clause 2 of Article 248 of the Tax Code of the Russian Federation). The accrual and payment of a particular tax occurs only if there is a tax base. For the purposes of calculating and paying VAT, the gratuitous transfer of valuables is recognized as a sale (Clause 1, Article 39 of the Tax Code of the Russian Federation). This means that the party must also pay VAT on the value of the valuables transferred free of charge.

VAT is calculated for the gratuitous transfer of valuables at the time the transaction itself is performed (clause 1 of Article 167 of the Tax Code of the Russian Federation). The transfer date is considered to be the date of execution of the primary documents:

- in case of transfer of goods - the date of issue of the invoice;

- if services were provided free of charge (work performed) - the date of drawing up the acceptance certificate.

Read about the details that are a mandatory component of such an act in the material “Accounting - postings for services”.

The tax base is determined by the market price of the transferred property on the date of the transaction (clause 3 of Article 105.3 of the Tax Code of the Russian Federation, clause 2 of Article 154 of the Tax Code of the Russian Federation). As for the VAT rate, in case of gratuitous transfer, the rate provided for this type of product (work, service) is applied.

The cost of the property or other benefits transferred free of charge, as well as the amount of VAT calculated for payment to the budget, are reflected in the invoice. This document is registered in the sales book during the period of transfer of valuables (clauses 1, 3 of the rules for maintaining the sales book, approved by Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137).

For information about the specifics of issuing an invoice for services, read the article “Invoice for services - sample filling in 2018 - 2020.”

In the case of accrual and payment of VAT upon gratuitous transfer, input VAT paid to suppliers for the acquisition of gratuitously transferred property can be deducted (subclause 1, clause 2, article 171 of the Tax Code of the Russian Federation).

Transfer of winnings and prizes to competition winners

The transfer of winnings and prizes to individuals based on the results of contests, competitions and other events is also recognized as a gratuitous sale and is subject to VAT. In this sense, prizes are no different from gifts.

For profit tax purposes, expenses for the acquisition (production) of prizes awarded to the winners of drawings of such prizes during mass advertising campaigns are considered standard advertising expenses (Clause 4 of Article 264 of the Tax Code of the Russian Federation). Such expenses will be recognized in an amount not exceeding 1% of sales revenue, determined in accordance with Article 249 of the Tax Code of the Russian Federation.

If the holding of a contest or competition does not pursue advertising purposes, is not provided for by a collective agreement and is not included in the remuneration system, then the cost of winnings will not be included in expenses.

As for personal income tax, the cost of winnings and prizes received in competitions, competitions, games is taxed at the following rates (clauses 1, 2 of Article 224, clause 28 of Article 217 of the Tax Code of the Russian Federation):

- 35% - in terms of exceeding 4,000 rubles, if the event is held for the purpose of advertising goods, works and services;

- 13% and without applying a deduction of 4,000 rubles, if the event is held for other purposes (letter of the Ministry of Finance of Russia dated August 20, 2018 No. 03-04-05/58919);

- 13% - in terms of excess of 4,000 rubles, if the event is held according to decisions of the Government of the Russian Federation and representative authorities (letter of the Ministry of Finance of Russia dated November 14, 2018 No. 03-04-06/81966).

Let's look at how in "1C: Accounting 8" (rev. 3.0) you can reflect the transfer of prizes to the winners of a drawing held as part of an advertising campaign.

Example 2

| Modern Technologies LLC is participating in the exhibition in March 2020, where it is holding a prize draw among visitors for advertising purposes. A total of 10 prizes worth RUB 1,200.00 are being drawn. (including VAT 20% - RUB 200.00). The winners are determined by random sampling using a computer program. According to tax accounting data, the amount of expenses for holding prize draws does not exceed 1% of sales revenue for the current reporting period. |

It is also convenient to reflect the transfer of prizes using the Gratuitous Transfer document. The procedure for filling out the Products tab is similar to the procedure described in Example 1. Since prizes are given to an indefinite number of people, the Recipient field also does not need to be filled out.

On the Cost account tab in the Cost account field, you should independently set the required account (for example, account 44.01 “Distribution costs in organizations engaged in trading activities” with the expense type Advertising expenses (standardized)).

According to the Ministry of Finance of Russia and the Federal Tax Service of Russia, expenses in the form of VAT amounts paid by an organization when distributing advertising products free of charge cannot be taken into account when calculating income tax (letter of the Ministry of Finance of Russia dated March 11, 2010 No. 03-03-06/1/123, dated November 20, 2006 No. 02-1-07/92). This conclusion can be extended to the transfer of prizes to the winners of a drawing held as part of an advertising campaign. Therefore, in the VAT Account field, you should leave account 91.02, which is offered by the program by default (Fig. 3).

Rice. 3. Cost accounts for the transfer of prizes as part of an advertising campaign

After posting the Gratuitous Transfer document, the following accounting register entries are generated:

Debit 44.01 Credit 41.01 - for the cost of prizes (10,000 rubles). Debit 91.02 Credit 68.02 - for the amount of accrued VAT (2,000 rubles).

For tax accounting purposes for income tax, amounts are entered into special resources of the accounting register:

Amount Dt NU 44.01 and Amount Kt NU 41.01 - for the cost of prizes (10,000 rubles). Amount Dt PR 91.02 - for a constant difference (2,000 rubles).

In the month of transfer of prizes, after completion of the month-closing processing and completion of the regulatory operation Calculation of deferred tax according to PBU 18, a constant tax expense will be recognized:

Debit 99.02.3 Credit 68.04.2 - in the amount of 400 rubles. (RUB 2,000 x 20%).

The settlement certificate or summary invoice issued upon transfer of prizes will be recorded in the sales book with the transaction type code “10”. The cost of the prizes issued will be included in indirect expenses, which are reflected in the income tax return on line 040 of Appendix No. 2 to Sheet 02.

In the statement of financial results, the cost of prizes is reflected in line 2210 “Business expenses”, and the amount of accrued VAT is reflected in line 2350 “Other expenses”.

| 1C:ITS For information on how to reflect the accrual of VAT for advertising distribution of goods, see the reference book “Accounting for Value Added Tax” in the “Accounting and Tax Accounting” section. |

Transfer of property is not a sale

Free transfer of fixed assets to state and municipal institutions, authorities and local self-government, as well as state unitary enterprises and municipal unitary enterprises is not considered a sale (subclause 5, clause 2, article 146 of the Tax Code of the Russian Federation). Therefore, the transferring party does not need to calculate VAT.

The gratuitous transfer of funds is also not regarded as a sale, therefore it is not subject to VAT on the transferring party (subclause 1, clause 3, article 39 of the Tax Code of the Russian Federation, subclause 1, clause 1, article 146 of the Tax Code of the Russian Federation).

The gratuitous transfer of valuables or other benefits for the implementation of the main activity specified in the charter of the enterprise and other than entrepreneurial activity to non-profit organizations will not be considered a sale (subclause 3, clause 3, article 39 of the Tax Code of the Russian Federation). In this situation, the basis for calculating and paying tax is not formed, which means there are no obligations to calculate and pay VAT.

- free transfer of socio-cultural objects to the treasury of a constituent entity of the Russian Federation or municipal entity;

- gratuitous transfer of real estate to the treasury of the Russian Federation;

- free transfer of property to Russia for scientific research in Antarctica.

Let's consider an example of a gratuitous transfer of valuables to an educational institution.

An educational institution can act both as a non-profit organization and as a commercial one. Legally, an educational institution can be a legal entity of any organizational and legal form, the main activity of which is educational activity, which must be noted in the organization’s charter and is based on passing accreditation in the established order. Individual entrepreneurs engaged in educational activities can also be classified as educational organizations. That is, when carrying out a transaction for the gratuitous transfer of valuables to an educational institution, enterprises may encounter both institutions belonging to non-profit structures and commercial organizations.

The gratuitous transfer of property to an educational institution belonging to a non-profit organization (for example, a state educational institution), aimed at carrying out the main activities reflected in the charter of this enterprise, will not be subject to VAT.

At the same time, it is important to indicate in the gift agreement the further use of gratuitously transferred material assets and other benefits in the main (registered in the charter) activities of the recipient enterprise, which is a non-profit organization.

Drawing up an invoice for the gratuitous transfer of valuables to non-profit organizations, if the benefits received are used only in the statutory activities of the enterprise other than business, is not required (clause 3 of Article 169 of the Tax Code of the Russian Federation).

The gratuitous transfer of property will be subject to VAT if the recipient of assistance turns out to be a commercial enterprise (for example, a private educational institution).

Issuing an invoice and registering it in the purchase book and sales book

According to paragraph 1 of Art. 168 of the Tax Code of the Russian Federation, when selling goods (work, services), transferring property rights, the taxpayer (tax agent specified in paragraphs 4 and 5 of Article 161 of the Tax Code of the Russian Federation) in addition to the price (tariff) of the sold goods (work, services) transferred property rights is obliged to present the corresponding amount of VAT for payment to the buyer of these goods (works, services), property rights.

Paragraph 2 of clause 16 of the Rules for maintaining logs of received and issued invoices, purchase books and sales books for VAT calculations, approved by Decree of the Government of the Russian Federation of December 2, 2000 N 914 (hereinafter referred to as the Rules), it is established that the sales book records issued and (or) issued invoices in all cases when the obligation to calculate VAT arises, including when receiving funds that increase the tax base.

Registration of invoices in the sales book is carried out in chronological order in the tax period in which the tax liability arises.

The purchase book does not record invoices received for the gratuitous transfer of goods (performance of work, provision of services), including fixed assets and intangible assets.

Buyers keep a log of original invoices received from sellers, in which they are stored, and sellers keep a log of invoices issued to buyers, in which their second copies are stored.

Thus, when transferring goods free of charge (performing work, providing services), the invoice is issued in two copies: the first is transferred to the receiving party, the second remains with the transferring party.

The receiving party that receives such an invoice does not have the right to deduct VAT, therefore the invoice is not registered in the purchase book. This position is confirmed in the Letter of the Ministry of Finance of Russia dated March 21, 2006 N 03-04-11/60.

When transferred free of charge to an individual, the invoice is issued in one copy.

When transferring property, there is a VAT benefit

It is possible not to pay tax in cases where the benefit under Art. 149 of the Tax Code of the Russian Federation, which exempts this operation from VAT.

Thus, the distribution of advertising magazines, booklets, leaflets and other things is exempt from VAT if no more than 100 rubles were spent on the creation or purchase of a copy of this assortment. including VAT (subclause 25, clause 3, article 149 of the Tax Code of the Russian Federation).

There is no need to pay VAT when transferring valuables free of charge for charitable purposes (subclause 12, clause 3, article 149 of the Tax Code of the Russian Federation). The exception is the transfer of excisable goods.

Charity in the legislation is considered as an activity for the disinterested (free) transfer of material assets or other benefits to legal entities or individuals on a voluntary basis (Article 1 of the Law “On Charitable Activities...” dated August 11, 1995 No. 135-FZ. But this benefit is possible only if compliance with the following conditions:

- the assistance provided must strictly correspond to the charitable purposes specified in the list of paragraph 1 of Art. 2 Law No. 135-FZ;

- recipients of material assets, as well as gratuitous assistance in the form of other benefits, can only be non-profit organizations or individuals;

- the gratuitous transfer of valuables must be documented (letter from the Ministry of Finance of Russia dated October 26, 2011 No. 03-07-07/66, Federal Tax Service of the Russian Federation for Moscow dated December 2, 2009 No. 16-15/126825):

- an agreement on the agreement of the parties to transfer free of charge;

- copies of documents confirming the acceptance of valuables for registration by the recipient of gratuitous assistance;

- acts or other documents confirming the intended use of the transferred values.

When a charitable transfer of material assets occurs, the transaction is considered taxable, but exempt from tax. The obligation to draw up an invoice for transactions exempt from VAT has been canceled since January 1, 2014 (subparagraph “a”, paragraph 3, article 3 of the Law “On Amendments...” dated December 28, 2013 No. 420-FZ). Therefore, when transferring valuables in the form of charitable assistance, an invoice need not be drawn up.

On the application of Art. 149 of the Tax Code of the Russian Federation, read more in this section of our website.

Repaying an employee loan

Our company provides assistance in preparing 3-NDFL tax returns on personal income. Our managers will be happy to help you resolve your issues!

Repayment of obligations under a loan agreement can be carried out both in cash and non-cash forms. As a rule, repayment of an intra-company loan based on an employee’s application is carried out through deductions from his salary.

Let's consider the procedure for taxation of transactions related to the repayment of a loan issued to an employee of the organization.

Income tax

The amount of the loan issued to the employee and the amount received from him to repay such borrowing are not taken into account when determining income and expenses for profit tax purposes (clause 10, clause 1, article 251, clause 12, article 270 of the Tax Code of the Russian Federation).

If the employee was issued an interest-bearing loan, then for the purpose of calculating income tax, interest on the loans provided is classified as non-operating income (clause 6 of Article 250 of the Tax Code of the Russian Federation). Their accounting depends on the method of recognition of income and expenses for calculating the taxable base.

Value added tax

Operations for the provision of loans in cash and the provision of financial services for the provision of loans in cash are not subject to VAT (clause 15, clause 3, article 149 of the Tax Code of the Russian Federation). At the same time, when an employer issues an interest-bearing loan to an employee, the enterprise needs to keep separate VAT records on the basis of clause 4 of Article 149 and clause 4 of Article 170 of the Tax Code of the Russian Federation.

Personal income tax

Loans for employees are issued by organizations, as a rule, at reduced interest rates. Preferential use of borrowed funds is considered in this case as the borrower’s income in the form of material benefits received from savings on interest in accordance with paragraph 1 of paragraph 1 of Article 212 of the Tax Code of the Russian Federation. Thus, the borrower becomes a personal income tax payer on this basis.

The tax base for calculating personal income tax is defined as the excess of the amount of interest calculated on the basis of three-quarters of the current refinancing rate established by the Central Bank of the Russian Federation on the date of receipt of the loan over the amount of interest under the terms of the agreement. In accordance with paragraph 2 of Article 224 of the Tax Code of the Russian Federation, this income is subject to personal income tax at a rate of 35%.

Based on paragraph 3 of paragraph 1 of Article 223 of the Tax Code of the Russian Federation, the date of receipt of income is the date of payment by the taxpayer of interest on borrowed (credit) funds received. According to the Ministry of Finance of Russia, when issuing an interest-free loan, the actual date of receipt of income in the form of material benefits should be considered the corresponding dates of repayment of borrowed funds (letters dated 04/23/2008 N 03-04-06-01/103, dated 04/11/2008 N 03-04- 06-01/83, dated 04.02.2008 N 03-04-07-01/21).

We note that from January 1, 2008, the date of actual receipt of income is recognized as the day the employee paid interest for the use of borrowed funds (clause 3, clause 1, Article 223 of the Tax Code of the Russian Federation), and material benefits received from savings on interest for use are excluded from the list of income borrowed (credit) funds for new construction or acquisition on the territory of the Russian Federation of a residential building, apartment, room or share(s) in them if the taxpayer (borrower) has the right to receive a property tax deduction in accordance with paragraph 2 of paragraph 1 Article 220 of the Tax Code of the Russian Federation.

According to the clarifications of the Ministry of Finance in letter dated 04/16/2008 N 03-04-06-01/93, before the taxpayer confirms the right to receive a property tax deduction, income in the form of material benefits received from savings on interest for the use of borrowed (credit) funds is taxed according to rate 35%. Subsequently, after confirmation of this right in the manner prescribed by clause 3 of Article 220 of the Tax Code of the Russian Federation, the previously paid tax amount is recalculated. In a letter dated April 14, 2008 N 03-04-06-01/85, the Ministry of Finance of Russia indicated that when the taxpayer confirms the right to a property tax deduction, income in the form of material benefits received from savings on interest for the use of borrowed (credit) funds is exempt from taxation in full, including when the amount of the loan received exceeds the maximum amount of property tax deduction (excluding interest) provided for in paragraph 2 of paragraph 1 of Article 220 of the Tax Code of the Russian Federation.

To exclude material benefits from an employee’s taxable income, the following documents are required:

- loan agreement, the intended purpose of which is new construction or purchase of housing;

- notification confirming the taxpayer's right to a tax deduction issued by the tax authority

Since the beginning of 2008, the responsibility for determining the tax base when an individual receives income in the form of material benefits from savings on interest, calculation, withholding and transfer of tax has been assigned to the tax agent (clause 2 of Article 212 of the Tax Code of the Russian Federation). The lending company must enter this income into the tax card for accounting income and personal income tax in Form 1-NDFL and reflect it in the individual’s income certificate in Form 2-NDFL.

Results

The obligation to charge and pay VAT upon gratuitous transfer of property arises in cases where:

- the recipient of the valuables is a commercial organization (the transferring party will have to calculate VAT and pay it to the budget);

- a charitable transfer of valuables to a non-profit organization or individual is carried out; however, based on the benefits under sub. 12 clause 3 art. 149 of the Tax Code of the Russian Federation, tax may not be paid when registering a transaction, taking into account all established requirements.

The gratuitous transfer of property will not be subject to VAT if:

- funds are transferred (subclause 1, clause 3, article 39, subclause 1, clause 1, article 146 of the Tax Code of the Russian Federation);

- the receiving party is a non-profit organization (for example, a state educational institution) and the values received as a gift are aimed at carrying out the main activities reflected in the charter of this institution (subclause 3, clause 3, article 39 of the Tax Code of the Russian Federation);

- gratuitous transactions are not recognized as sales for the purposes of calculating VAT (clause 2 of article 146 of the Tax Code of the Russian Federation).

MINISTRY OF FINANCE OF THE RUSSIAN FEDERATION

LETTER dated April 25, 2014 N 03-07-11/19393

In connection with the letter on the issue of applying value added tax when transferring premises for free use, the Department of Tax and Customs Tariff Policy reports. According to paragraphs. 1 clause 1 art. 146 of the Tax Code of the Russian Federation (hereinafter referred to as the Code), the object of taxation with value added tax is transactions involving the sale of goods (work, services) on the territory of the Russian Federation, as well as the transfer of property rights. At the same time, the sale of goods (work, services) for the purposes of value added tax also recognizes the transfer of ownership of goods, the results of work performed, and the provision of services free of charge. In accordance with paragraph 1 of Art. 689 of the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code), under an agreement for gratuitous use, one party undertakes to transfer or transfers an item for gratuitous temporary use to the other party, and the latter undertakes to return the same item in the condition in which it received it, taking into account normal wear and tear or in a condition stipulated by the contract. At the same time, paragraph 2 of this article of the Civil Code stipulates that the rules provided for by the Civil Code in relation to the lease agreement are applied to the agreement for gratuitous use. Taking into account the above, the gratuitous transfer of premises for use is recognized as an object of taxation by value added tax. At the same time, we consider it necessary to note that clause 2 of Art. 146 of the Code establishes a list of transactions that are not recognized as subject to taxation by value added tax. This list includes operations for the provision of services for the transfer of fixed assets for free use to government and local government bodies, as well as state and municipal institutions, state and municipal unitary enterprises. This letter does not contain legal norms or general rules specifying regulatory requirements, and is not a regulatory legal act. In accordance with Letter of the Ministry of Finance of Russia dated 08/07/2007 N 03-02-07/2-138, the opinion provided is of an informational and explanatory nature on the application of the legislation of the Russian Federation on taxes and fees and does not interfere with following the norms of the legislation on taxes and fees in the understanding different from the interpretation set out in this letter.

Deputy Director of the Department of Tax and Customs Tariff Policy O. F. TSIBIZOVA

Transfer of gifts to individuals

So, donation between a commercial organization and an individual who is not an individual entrepreneur is not prohibited by current legislation (clause 4, clause 1, article 575 of the Civil Code of the Russian Federation). Transfer of a gift worth up to 3,000 rubles. can be committed orally (clause 1 of article 574 of the Civil Code of the Russian Federation).

The cost of gifts received by an individual from organizations or individual entrepreneurs does not exceed 4,000 rubles. per year, not subject to personal income tax (clause 28, article 217 of the Tax Code of the Russian Federation). For a certain category of citizens (for example, for veterans and disabled people of the Great Patriotic War), the cost of gifts, which is not subject to personal income tax, is 10,000 rubles. per year (clause 33 of article 217 of the Tax Code of the Russian Federation).

To receive a tax deduction provided for in paragraphs 28 and 33 of Article 2020 of the Tax Code of the Russian Federation, the transfer of a gift must be confirmed with documents (letter of the Ministry of Finance of Russia dated August 12, 2014 No. 03-04-06/40051). In this case, for personal income tax purposes it does not matter:

- whether the gift is money, a gift certificate or other property;

- whether the recipient is an employee of the organization or not.

It’s a different matter if the gift is an employee’s incentive for conscientious performance of job duties. In this case, the gift is an incentive payment (bonus), which is part of the remuneration (Part 1 of Article 129, Article 131, Article 191 of the Labor Code of the Russian Federation).

A gift within the framework of an employment relationship is subject to personal income tax in full without applying a deduction as income in cash or in kind (clause 6, clause 1, article 208 of the Tax Code of the Russian Federation, clauses 1, 3, 4 of article 210 of the Tax Code of the Russian Federation, p. 2 Article 211 of the Tax Code of the Russian Federation).

An organization does not have an object for taxation of insurance premiums if gifts to employees are transferred under a gift agreement in writing, the value of the gift does not matter (clause 4 of Article 420 of the Tax Code of the Russian Federation, letter of the Ministry of Labor of Russia dated September 22, 2015 No. 17-3/B -473, letter of the Ministry of Finance of Russia dated January 20, 2017 No. 03-15-06/2437).

If the transfer of gifts is carried out within the framework of labor relations, is part of the remuneration system (remuneration for specific labor results) and is of an incentive nature, then the cost of gifts to employees of the organization is subject to insurance contributions (Definitions of the Supreme Court of the Russian Federation dated March 6, 2017 No. 307-KG17-54 in case No. A44-1285/2016, dated 08/27/2014 in case No. 307-ES14-377, A44-3041/2013).

Let's look at how 1C: Accounting 8 (rev. 3.0) reflects the transfer of gifts to individuals.

Example 1

| Modern Technologies LLC applies OSNO, the provisions of PBU 18/02, and pays VAT. In March 2020, the management of Modern Technologies LLC decided to present gifts to its employees and employees of the partner organization (10 gifts in total) at an official event in honor of International Women’s Day. The decision was formalized by order of the head. The cost of each gift is RUB 1,200.00. (including VAT 20% - RUB 200.00). |

The receipt of goods (materials), which are subsequently used to be transferred to individuals as gifts, is reflected in the standard accounting system document Receipt (act, invoice) with the transaction type Goods (invoice) (Purchases section). Let's say an organization purchased 50 ready-made gift sets. After posting the document, the following entries are entered into the accounting register:

Debit 41.01 Credit 60.01 - for the amount of purchased gifts (50,000 rubles). Debit 19.03 Credit 60.01 - for the amount of VAT (10,000 rubles).

For those accounts where tax accounting is supported (in this case, these are accounts 41 and 60; tax accounting is not supported for account 19), the corresponding amounts are entered into special resources of the accounting register for tax accounting purposes (Amount Dt NU and Amount Kt NU).

To register an invoice received from a supplier, fill in the Invoice No. and from fields, then click on the Register button. In this case, the document Invoice received is automatically created, and a hyperlink to the created invoice appears in the form of the basis document. In the form of the document Invoice received by default, the flag Reflect VAT deduction in the purchase book by the date of receipt is selected, which allows you to include the tax amount in VAT tax deductions immediately after gifts are accepted for accounting. If the flag is not set, then the deduction is reflected in the regulatory document Formation of purchase ledger entries.

Starting from version 3.0.65 in 1C:Accounting 8, you can reflect the gratuitous transfer of goods (materials, products) using the Gratuitous Transfer document (Sales section), which allows you to:

- indicate either a specific recipient (for example, when transferring a bonus product to a buyer) or not indicate it at all (for example, when distributing materials for advertising purposes to an indefinite number of people);

- automatically reflect the cost of the transferred property in expenses. The cost account and VAT account are indicated by default as 91.02 “Other expenses” with the analytics Expenses for the transfer of goods (work, services) free of charge and for one’s own needs (profits not accepted for tax purposes);

- charge VAT, which goes into the sales book and into the VAT return. If an organization maintains separate VAT accounting and enters a rate Without VAT, then the data can be reflected in Section 7 of the VAT return;

- reflect the reversal of paid expenses in the book of income and expenses of organizations and individual entrepreneurs using the simplified tax system (KUDiR);

- print documents (Demand-waybill (M-11), Invoice, Consignment note (TORG-12), Universal transfer document (UDD)).

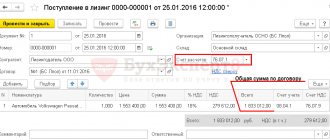

Let's create a document Gratuitous transfer according to the conditions of Example 1 (Fig. 1).

Rice. 1. Document “Free transfer”, tab “Products”

Despite the fact that gifts are transferred to certain individuals specified in the manager’s order, the Recipient field is not required to be filled in. When selling goods free of charge to individuals, there is no need to issue invoices to each of them, since individuals do not deduct VAT.

To reflect accrued VAT in the sales book, it is enough to draw up an accounting statement or a consolidated invoice (letter of the Ministry of Finance of Russia dated 02/08/2016 No. 03-07-09/6171).

On the Products tab, you should specify information about the products transferred for advertising purposes. As the market value of goods in the program, the sales price for the last document is automatically filled in. If the sale price is not determined, then the purchase price is filled in. In Example 1, this is 1,000 rubles.

Since the cost of gifts and the amount of accrued VAT are not taken into account in income tax expenses, on the Cost Account tab you should leave the cost account and VAT account set by default by the program in the appropriate fields (Fig. 2).

Rice. 2. Accounts for expenses when transferring gifts

After posting the Gratuitous Transfer document, the following accounting entries are generated:

Debit 91.02 Credit 41.01 - for the cost of gifts (10,000 rubles). Debit 91.02 Credit 68.02 - for the amount of accrued VAT (2,000 rubles).

For tax accounting purposes for income tax, amounts are entered into special resources of the accounting register:

The amount of Kt NU 41.01 is for the cost of gifts (10,000 rubles). Amount Dt PR 91.02 - for the amounts of permanent differences (10,000 rubles and 2,000 rubles).

If the organization decides to issue a consolidated invoice, then simply click on the Issue invoice button. In the automatically created invoice, dashes are placed in the lines “Consignee and his address”, “Buyer”, “Address”, “TIN/KPP of the buyer” in accordance with the recommendations of the Ministry of Finance of Russia set out in letter dated 02/08/2016 No. 03-07- 09/6171.

A consolidated invoice issued for the gratuitous transfer of goods will be registered in the sales book with the transaction type code “10”, which corresponds to the value “Shipment (transfer) of goods (performance of work, provision of services), property rights on a gratuitous basis” according to the Appendix to Order of the Federal Tax Service of Russia dated March 14, 2016 No. ММВ-7-3/ [email protected]

In the month of transfer of gifts, after processing the Closing of the month and performing the regulatory operation Calculation of deferred tax according to PBU 18, a constant tax expense will be recognized:

Debit 99.02.3 Credit 68.04.2 - in the amount of 2,400 rubles. (RUB 12,000 x 20%).

In the income statement, the cost of the gift transferred and the amount of accrued VAT will be automatically reflected in line 2350 “Other expenses”.

| 1C:ITS For information on how to reflect an individual’s income in the amount of the cost of a gift in 1C solutions, see the reference book “Personnel records and settlements with personnel in 1C programs” in the “Personnel and remuneration” section. |

How is it carried out?

If we are talking about a transferring organization, then the disposed property is registered in the general manner, and therefore does not differ in any way from any other type of registration. As for confirmation of disposal of property, it is confirmed by the following documents

:

Donation is considered a procedure performed free of charge

. Thanks to this, it is registered in the sales account. That is why accounting entries made due to the fact that real estate is deregistered are not much different from those entries made when the principal is sold.

There is only one difference here - this is a zero price for the sale of such an object

, as a result of which the donating company experiences a pre-planned loss. Such a loss can consist of two indicators - the cost of the property that has been removed from the register, and the expenses incurred due to the fact that it has been retired. For example, this may include dismantling, transportation and other expenses associated with gratuitous transfer.

As for the total number of transactions

, which are related to the fact that the property has been deregistered, they are presented below:

| Operation | Wiring | |

| Debit | Credit | |

| Write-off of the initial cost of the transferred object | 01-2 | 01-1 |

| Write-off of depreciation of the transferred object accrued at the time of donation | 02 | 01-2 |

| Write-off of the residual value of the transferred object | 91-2 | 01-2 |

| Write-off of costs for gratuitous transfer | 91-2 | 76 |

| VAT calculation | 91-2 | 68-2 |

| Revealed financial result | 99 | 91-9 |

If we talk about accounting carried out from the receiving side, then it also has its own characteristics

.

This party must carry out accounting in a general manner

. Therefore, the procedures will be similar in some sense. As for the documents, they will also be similar to those available to the transferring party.

The initial value of those funds received through the donation procedure is determined as the market price at the time the transfer was received. Also taken into account are the costs that were incurred due to the delivery and procedures that keep the property in a serviceable condition.

In this case, the transactions made through the donation procedure on the part of the recipient will look like this:

| Operation | Wiring | |

| Debit | Credit | |

| Cost of the received object | 08 | 98 |

| Costs of bringing the property to a usable condition | 08 | 23, 26, 60, 76 |

| VAT on received property | 19 | 60, 76 |

| Acceptance of an object for registration | 01 | 08 |

| Depreciation on received objects | 20, 23, 25 | 02 |

| Income in the amount of depreciation charges | 98 | 91-1 |

Despite the fact that at first glance, keeping records on the part of the transmitted and received parties seems very simple, in fact it is not so. Thus, the donation procedure in tax accounting can lead to very problematic ambiguous situations, which, by the way, are interpreted differently by the fiscal authorities and the tax inspectorate.

Agreement for free use or loan

This is one of the most popular forms of property transfer. According to the agreement, one party transfers property to the other party for temporary use free of charge, the second party undertakes to return the property in the same condition or in the form specified in the agreement. At the same time, the contract takes into account the factors of normal wear and tear of the property or its “aging”. At the same time, the transfer of property is not the basis for the application or termination of the rights of third parties to it.

The loan term may not be defined in the contract and may continue until the death of an individual or the liquidation of a legal entity. In this case, ownership rights to the property are not transferred to the loan recipient. By law, only things can be transferred and only for a certain period of time, but in practice, services or the result of any work can be transferred.

Gift agreements with the participation of individual entrepreneurs

Transactions whose subject is the transfer of property free of charge in favor of individual entrepreneurs are quite specific. The peculiarity of the corresponding type of legal relationship is that an individual entrepreneur, on the one hand, is not a legal entity. Accordingly, the rule according to which the organization’s property received as a gift must be included in non-operating income may be considered irrelevant for entrepreneurs. On the other hand, for an individual entrepreneur, surprisingly, it might be more profitable to formalize the relevant transaction precisely as a subject of commercial legal relations. Why?

From the point of view of the Tax Code of the Russian Federation, individual entrepreneurs must pay the state, in general, the same types of taxes as a legal entity. That is, it could be an income tax (under the general fee regime) or a transfer of funds within the framework of a “simplified tax regime”. In many cases, the amount of the corresponding fees is lower than the personal income tax, which is 13%. This is exactly the tax rate if an individual receives something as a gift from non-relatives. Obviously, if an individual entrepreneur accepts property free of charge, then it is probably more profitable for him to do this as a subject of commercial legal relations, provided that he and the donor are not relatives.

Some common cases

Despite the ban on gifts between commercial organizations, gratuitous transactions are ubiquitous in real life. Below are the most common ones.

Rented premises

There is often a case where the tenant, with the consent of the landlord, repaired the rented premises and made inseparable improvements, for example, installing suspended ceilings. After the lease expires, the property returns to the owner , and the question arises: should he pay for these improvements?

VAT is levied on goods, works and services sold for profit. The tenant made the necessary improvements (performed the work) and transferred them to the landlord after the end of the lease. If the lessor did not compensate for the work and did not deduct expenses from the rent payments, then from a legal point of view it is considered that there has been a transfer of ownership of the result of the work performed or the provision of services free of charge. Such transactions are subject to VAT.

But the landlord is not required to pay income tax. Since 2005, income in the form of capital investments in inseparable improvements to the leased property that were made by the lessee is not taken into account.

Debt forgiveness

The Tax Code does not define the concept of “debt forgiveness”, and therefore they are taken into account in the same way as the transfer of property and property rights. When determining the tax base for an organization's profit, expenses in the form of the value of gratuitously transferred property and expenses associated with such transfer are not taken into account. When the debt is forgiven (if it is a debt for goods supplied), the amount of expenses for writing off these goods is restored.

Money received under a loan agreement and remaining with the lender is considered received free of charge. However, if the debt is forgiven to a subsidiary or parent company in which the participation is more than 50%, then this money is not subject to taxation.

Free rental

Russian law provides for such a phenomenon as the transfer of property for free use. In another way, this type of legal relationship is called a loan. Free transfer of property for rent is a common type of transaction in business. At the very beginning of the article, we noted that the law provides for a limit of 3 thousand rubles on the value of transferred assets in favor of commercial organizations. As an alternative, businesses use a marked transaction type. The main advantage of such legal relations is that neither the owner of the property nor its user, as part of a free acquisition for rent, has any obligations to calculate taxes.

Actually, the aspect reflecting how taxes are calculated is also interesting. Let's consider it.