Fulfillment of the obligation to pay taxes, fees, insurance premiums (penalties, fines) upon liquidation of an organization is regulated by Art. 49 of the Tax Code of the Russian Federation, and during its reorganization - Art. 50 Tax Code of the Russian Federation.

The Tax Code does not contain special rules establishing deadlines for filing tax returns for the last reporting (tax or accounting) period of activity of a reorganized or liquidated organization, which in practice raises questions on the part of taxpayers.

What are the procedures and deadlines for filing tax returns during the liquidation and reorganization of a taxpayer? We'll tell you in this article.

Who fulfills the obligations to pay taxes during the liquidation (reorganization) of a taxpayer?

The obligation to pay taxes, fees, insurance premiums (penalties, fines) of the liquidated organization is fulfilled by the liquidation commission at the expense of the funds of the said organization, including those received from the sale of its property (Clause 1 of Article 49 of the Tax Code of the Russian Federation).

The obligation to pay taxes of a reorganized legal entity is fulfilled by its legal successor(s) in the manner established by Art. 50 Tax Code of the Russian Federation.

According to this article, the legal successor in terms of fulfilling the obligation to pay taxes is recognized as:

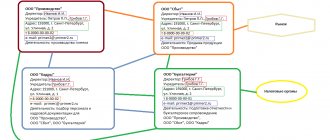

- in the case of a merger of several legal entities - the legal entity resulting from such merger (clause 4);

- when one legal entity is merged with another legal entity - the legal entity that merged it (clause 5);

- in case of division - legal entities arising as a result of such division (clause 6);

- when transforming one legal entity into another - a newly emerged legal entity (clause 9).

According to paragraphs 7 and 8 of Art. 50 of the Tax Code of the Russian Federation, if there are several legal successors, the share of participation of each of them in the performance of the duties of the reorganized legal entity to pay taxes is determined in the manner prescribed by civil law. When one or more legal entities are separated from a legal entity, succession in relation to the reorganized legal entity in terms of the performance of its obligations to pay taxes (penalties, fines) does not arise. In a number of cases provided for by these paragraphs, by a court decision, newly emerged (split-off) legal entities may jointly fulfill the obligation to pay taxes of the reorganized entity.

Taxes and Law

In the event of termination of the activities of an organization in connection with its liquidation or termination by an individual of activities as an individual entrepreneur before the end of the billing period, payers of insurance premiums are obliged to submit to the registration authority an application for state registration of a legal entity in connection with its liquidation or an application for state registration of termination an individual operating as an individual entrepreneur, accordingly, submit to the body monitoring the payment of insurance premiums a calculation of accrued and paid insurance premiums for the period from the beginning of the billing period to the day of submission of the specified calculation, inclusive.

The difference between the amount of insurance premiums payable in accordance with the specified calculation and the amount of insurance premiums paid by payers of insurance premiums from the beginning of the calculation period is subject to payment within 15 calendar days from the date of submission of such calculation or return to the payer of insurance premiums

In the event of reorganization of the payer of insurance premiums - an organization, the payment of insurance premiums, as well as the submission of calculations for accrued and paid insurance premiums are carried out by its legal successor (legal successors), regardless of whether the facts and (or) circumstances of non-fulfillment or improper fulfillment by the reorganized legal entity of obligations to pay insurance premiums. If there are several legal successors, the share of participation of each of them in the performance of the duties of the reorganized legal entity for the payment of insurance premiums is determined in the manner prescribed by the civil legislation of the Russian Federation. If the separation balance sheet does not allow determining the share of the legal successor of the reorganized legal entity or excludes the possibility of fulfillment in full of obligations to pay insurance premiums by any legal successor and such reorganization was aimed at non-fulfillment of obligations to pay insurance premiums, by a court decision the newly formed legal entities may jointly and severally fulfill obligation to pay insurance premiums of the reorganized entity.

These provisions regarding the reorganization and liquidation of the company are established in Article 15 “The procedure for calculating, the procedure and terms for paying insurance premiums by payers of insurance premiums making payments and other remuneration to individuals” of Federal Law 212-FZ.

Judicial practice regarding liquidation and reorganization of a company

- If the company is subject to receivership, insurance premiums are paid.

In the Resolution of the Federal Antimonopoly Service of the East Siberian District dated December 15, 2010 in case No. A69-1720/2010, the court came to the conclusion that since employees are paid during bankruptcy proceedings, the bankruptcy trustee must make deductions required by law.

In accordance with paragraphs 3 - 5 of Article 15 of the Federal Law of July 24, 2009 N 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund and territorial compulsory medical insurance funds” during the estimated period period, the policyholder pays insurance premiums in the form of monthly mandatory payments.

The monthly obligatory payment is due no later than the 15th day of the calendar month following the calendar month for which the monthly obligatory payment is calculated. If the specified deadline for payment of the monthly obligatory payment falls on a day recognized in accordance with the legislation of the Russian Federation as a weekend and (or) a non-working holiday, the expiration date of the deadline is considered to be the next working day following it.

In accordance with paragraphs 13 and the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated June 22, 2006 N 25 “On some issues related to the qualification and establishment of requirements for mandatory payments, as well as sanctions for public offenses in bankruptcy cases,” requirements for payment of mandatory payments that arose after opening of bankruptcy proceedings are subject to satisfaction in accordance with paragraph 4 of Article 142 of the Bankruptcy Law after satisfying the claims of creditors included in the register of creditors' claims.

When applying paragraph 4 of Article 142 of the Bankruptcy Law, courts must take into account that this norm is not subject to application to claims for payment of insurance contributions for compulsory pension insurance due to the presence of a special norm establishing the obligation of the bankruptcy trustee to make payments assigned to the employer in accordance with federal law when paying labor of workers carrying out labor activities during bankruptcy proceedings (clause 5 of Article 134 of the Law).

The effect of paragraph 5 of Article 134 of the Federal Law of October 26, 2002 N 127-FZ “On Insolvency (Bankruptcy)” also applies to the procedure for paying insurance premiums for compulsory health insurance.

The same conclusion was made in the Resolution of the Federal Antimonopoly Service of the West Siberian District dated September 2, 2011 in case No. A27-526/2011. The court found that if, in accordance with a judicial act that has entered into legal force, a company is declared bankrupt and bankruptcy proceedings are opened against it, then the company must pay insurance premiums in any case. The courts of first and appellate instances, refusing to satisfy the claims made by the Company, proceeded from the mandatory nature of insurance payments and their legal nature; obligations to pay insurance premiums are current; the requirements of the bodies of the Pension Fund of the Russian Federation in relation to insurance contributions for compulsory pension insurance, the obligation to pay which arose after the opening of bankruptcy proceedings, are subject to execution by the debtor in the manner established by Article 855 of the Civil Code of the Russian Federation; By virtue of the direct instructions of the Federal Law of October 26, 2002 N 127-FZ “On Insolvency (Bankruptcy)”, the bankruptcy trustee is obliged to make payments assigned to the employer in accordance with federal law when paying for the labor of employees engaged in labor activities during bankruptcy proceedings.

- The legal successor must pay insurance premiums within the deadlines established by law.

If the deadlines for payment of insurance premiums are met, the application of penalties is not legal - Resolution of the Seventeenth Arbitration Court of Appeal dated 01.08.2011 No. 17AP-5403/2011-AK in case No. A60-3543/2011.

According to Art. 10 of Law N 212-FZ, the calculation period for insurance premiums is understood to be a calendar year. Reporting periods are the first quarter, half a year, nine months of a calendar year, and a calendar year.

Based on Part 4 of Art. 57 of the Civil Code of the Russian Federation, when a legal entity is reorganized in the form of the merger of another legal entity, the first of them is considered reorganized from the moment an entry is made in the Unified State Register of Legal Entities about the termination of the activities of the merged legal entity.

Part 2 of Art. 58 of the Civil Code of the Russian Federation determines that when a legal entity is merged with another legal entity, the rights and obligations of the merged legal entity are transferred to the latter in accordance with the transfer deed.

The court established and confirmed by the case materials that, on the basis of the Resolution of the Government of the Sverdlovsk Region, the Sverdlovsk regional state health care institution “Anti-tuberculosis dispensary” is subject to reorganization by merging with it the state health care institution of the Sverdlovsk region “Anti-tuberculosis dispensary No. 2”. However

The Pension Fund Administration did not prove the circumstances of the offense committed either by the State Healthcare Institution SO "Anti-tuberculosis dispensary No. 2", of which the defendant is the legal successor, or by the defendant.

3. When a company is reorganized, its unfulfilled obligations for insurance premiums are transferred to the legal successor(s). Moreover, regardless of whether the latter was aware of the unpaid contributions before the completion of the reorganization.

According to Part 16 of Article 14 of Federal Law N 212-FZ, in the event of reorganization of the payer of insurance premiums - an organization, payment of insurance premiums is carried out by its legal successor, regardless of whether the facts and (or) circumstances of non-fulfillment or improper fulfillment by the reorganized legal entity were known to the legal successor before the completion of the reorganization obligations to pay insurance premiums.

If an organization was liquidated or reorganized before the end of the calendar year, the last billing period for it is the period from the beginning of this calendar year until the day the liquidation or reorganization was completed (Part 4 of Article 10 of Federal Law N 212-FZ).

This conclusion was made in the Resolution of the Twelfth Arbitration Court of Appeal dated July 1, 2011 in case No. A06-7538/2010 in the case of collection of arrears and penalties for insurance premiums.

Refund of overpaid contributions

The amount of overpaid insurance premiums is subject to offset against the upcoming payments of the payer of insurance premiums for insurance premiums, repayment of debts on penalties and fines for offenses

The offset or refund of the amount of overpaid insurance premiums is carried out by the body monitoring the payment of insurance premiums at the place of registration of the payer of insurance premiums

The body for control over the payment of insurance premiums is obliged to inform the payer of insurance premiums about each fact of excessive payment of insurance premiums and the amount of overpaid insurance premiums that has become known to the body for control over the payment of insurance premiums within 10 days from the date of discovery of such a fact.

If a fact is discovered indicating a possible excessive payment of insurance premiums, at the proposal of the body monitoring the payment of insurance premiums or the payer of insurance premiums, a joint reconciliation of calculations for insurance premiums can be carried out. The results of such reconciliation are documented in an act signed by the body monitoring the payment of insurance premiums and the payer of insurance premiums.

The decision to offset the amount of overpaid insurance premiums against the upcoming payments of the payer of insurance premiums is made by the body monitoring the payment of insurance premiums within 10 days from the date of discovery of the fact of excessive payment of insurance premiums, or from the date of receipt of the application of the payer of insurance premiums, or from the date of signing by the body control over the payment of insurance premiums and by this payer of insurance premiums an act of joint reconciliation of the insurance premiums paid by him, if such a joint reconciliation was carried out.

An application for offset or refund of the amount of overpaid insurance premiums may be submitted within three years from the date of payment of the specified amount.

The body monitoring the payment of insurance premiums is obliged to inform the payer of insurance premiums in writing about the decision made to offset (return) the amounts of overpaid insurance premiums or to refuse to offset (return) within five days from the date of adoption of the corresponding decision.

Judicial practice related to the return of insurance premiums

1. An application for offset or refund of the amount of overpaid insurance premiums may be submitted within three years from the date of payment of the specified amount. However, the court may recognize that the three-year period for the payer of insurance premiums to apply to the Pension Fund for compulsory pension insurance with an application for offset or return of overpaid insurance premiums shall be calculated from the moment the payer became aware of the excessive payment of contributions.

An example of such a decision is the Resolution of the Federal Antimonopoly Service of the Far Eastern District dated 06/01/2011 N F03-1832/2011 in case N A73-11822/2010.

In accordance with paragraph 3 of part 1 of Article 28 of the Law of July 24, 2009 N 212-FZ, it is provided that payers of insurance premiums have the right to timely offset or return of amounts of overpaid or overcharged insurance premiums, penalties and fines.

By virtue of paragraph 5 of part 3 of Article 29 of this Law, the bodies monitoring the payment of insurance premiums are obliged to make decisions on the return to the payer of insurance premiums of the amounts of overpaid or excessively collected insurance premiums, penalties and fines, to send instructions issued on the basis of these decisions to the relevant territorial bodies of the Federal Treasury for execution and offset the amounts of overpaid or overcollected insurance premiums, penalties and fines in the manner prescribed by this Federal Law.

An application for offset or refund of the amount of overpaid insurance premiums may be submitted within three years from the date of payment of the specified amount. The decision to return the amount of overpaid insurance premiums is made by the body for control over the payment of insurance premiums within 10 days from the date of receipt of the application of the payer of insurance premiums for the return of the amount of overpaid insurance premiums or from the date of signing by the body for control over the payment of insurance premiums and this payer of insurance premiums a joint act reconciliation of insurance premiums paid by him, if such a joint reconciliation was carried out. (Part 13, 14 of Article 26 of Law No. 212-FZ).

At the same time, the deadlines and the procedure for returning in court overpaid insurance premiums are not prescribed by Law No. 212-FZ.

The circumstances of the case, established by the court, indicate that there was no dispute about the amount of overpaid insurance contributions for compulsory pension insurance between the persons participating in the case, while the management motivated its objections by the company missing the deadline established by Part 13 of Article 26 of Law No. 212- Federal Law, for the return of insurance premiums.

Based on the circumstances examined by the courts of both instances based on the case materials, it was established that the fact of excessive payment of insurance premiums became known to the company on January 15, 2010 upon receipt of the on-site tax audit report dated December 31, 2009 N 653, which reflected the fact that the company did not is the insurer of foreign citizens temporarily arriving in the territory of the Russian Federation, and therefore insurance contributions were not subject to payment to the pension fund.

Thus, the moment from which it is necessary to calculate the three-year period established by Article 196 of the Civil Code of the Russian Federation for going to court for protection of a violated right is the date when the payer of contributions became aware of the excessive payment of insurance premiums for compulsory pension insurance.

A similar conclusion was made in the Resolution of the Federal Antimonopoly Service of the Far Eastern District dated May 31, 2011 N F03-1756/2011 in case N A73-12585/2010, the court concluded that the deadline for filing an application for offset or return of overpaid contributions to the mandatory pension insurance is subject to calculation from the moment when the payer becomes aware of the excessive payment of contributions.

How can taxpayers determine their most recent tax period?

The concept of a tax period, the definitions of the first and last tax periods are given in Art. 55 Tax Code of the Russian Federation.

According to paragraph 1 of this article, a tax period is understood as a calendar year or another period of time in relation to individual taxes, at the end of which the tax base is determined and the amount of tax payable is calculated. A tax period may consist of one or more reporting periods, taking into account the features established by this article.