Loan: differences from credit

A loan is a contractual relationship according to which one party (the lender) transfers money or other things defined by generic characteristics into the ownership of the other party (the borrower).

The borrower undertakes to return to the lender the same amount of money (loan amount) or an equal amount of other things received by him of the same kind and quality. If the lender under the agreement is an organization or an individual entrepreneur, such an agreement must be concluded in writing (subparagraph 1, paragraph 1, article 161, paragraph 1, article 808, paragraph 3, article 23, paragraph 2, paragraph 1, article 807 Civil Code of the Russian Federation).

https://www.youtube.com/watch?v=https:accounts.google.comServiceLogin

As follows from paragraph 1 of Art. 809 of the Civil Code of the Russian Federation, unless otherwise provided by law or the loan agreement, the lender has the right to receive interest from the borrower on the loan amount in the amount and in the manner specified in the agreement. In a situation where the amount is not established in the agreement, they are calculated based on the refinancing rate of the Bank of Russia, which is in effect at the location (place of residence) of the lender on the day the borrower pays the debt amount or part thereof.

If, under a loan agreement, it is not money, but things that are transferred, then such an agreement, as a rule, is interest-free. However, the parties to the agreement may stipulate in it a condition on the accrual of interest (clause 3 of Article 809 of the Civil Code of the Russian Federation).

A loan is a contractual relationship under which only funds can be transferred, and the creditor must be either a bank or another credit organization (clause 1 of Article 819 of the Civil Code of the Russian Federation).

Interest on the loan amount is accrued without fail, that is, a loan, unlike a loan, cannot be interest-free (Clause 1, Article 819 of the Civil Code of the Russian Federation). The loan agreement must be drawn up in writing (Articles 820, 822, 823, paragraph 1 of Article 822, paragraph 1 of Article 823 of the Civil Code of the Russian Federation).

If a loan (credit) is received in a foreign currency, the tax base is determined as the excess of the amount of interest on the loan (credit), calculated on the basis of 9% per annum, over the amount of interest calculated on the basis of the terms of the agreement (subclause 2, clause 2, article 212 of the Tax Code RF). Such income is taxed at a personal income tax rate of 35% (clause 2 of Article 224 of the Tax Code of the Russian Federation).

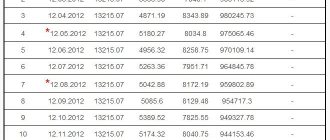

Tax base = Credit (loan) amount x (Interest based on 9% per annum – Interest under the terms of the agreement) x number of days of using the loan per month: 365 (366).

Tax = Tax base x 35% (30%).

The number of days of using the loan is calculated:

- in the month when the loan was issued - from the day following the day the loan was issued until the last day of the month;

- in the month when the loan is repaid - from the first day of the month until the day the loan is repaid;

- in other months - as the calendar number of days in a month.

The personal income tax rate on material benefits for loans is (Article 224 of the Tax Code of the Russian Federation):

- if the individual is a resident – 35%;

- if an individual is a non-resident - 30%.

Tax must be withheld from the nearest cash income paid to an individual.

To calculate personal income tax on material benefits from a loan, you can use the Calculator on our website.

Personal income tax withheld from any income paid to an individual (except for vacation pay and temporary disability benefits) is transferred to the budget no later than the next day after payment of income (clause 6 of Article 226 of the Tax Code of the Russian Federation).

A sample payment order for personal income tax payment is given here.

https://www.youtube.com/watch?v=ytaboutru

If an individual received an interest-free loan from another individual, then income in the form of material benefits from saving on interest does not arise. That is, no one needs to pay personal income tax on such a loan.

As amended by paragraphs. 3 p. 1 art. 223 of the Tax Code of the Russian Federation, in force until January 1, 2016, it was stated that the date of actual receipt of income when receiving income in the form of material benefits is defined as the day the taxpayer pays interest on the borrowed (credit) funds received. Thus, in 2020, if an organization issued interest-free loans (or at a low rate), then the actual date of receipt of income in the form of material benefits should be considered the corresponding date of repayment of borrowed funds.

In the commented letter, financiers noted: if in 2012, 2013, 2014 and 2020 there was no repayment of debt on an interest-free loan, income in the form of material benefits subject to personal income tax does not arise in these tax periods.

We invite you to familiarize yourself with: The lease agreement is subject to state registration in the event

A similar explanation is presented in Letter of the Ministry of Finance of the Russian Federation dated February 24, 2016 No. 03-04-05/10113: if before 2020 there was no repayment of debt on an interest-free loan, income in the form of material benefits subject to personal income tax in tax periods, preceding the 2020 tax period does not arise.

Thus, taking into account all the provisions of the legislation, both in force in 2020 and in force in 2020, as well as explanations from employees of the financial department, we can draw the following conclusion: if the borrowed funds were issued by the tax agent organization in 2020, and repayment will be made in the next tax period for personal income tax, then the taxpayer does not receive a material benefit in 2020, it arises only at the time of repayment, that is, in the next tax period (for example, in 2020 - on the date of loan repayment).

As for the period of 2020, the tax agent for this loan must calculate and withhold tax on the material benefit of an individual received from savings on interest on a monthly basis until its repayment. At the time of repayment of the loan, the tax agent must calculate and withhold personal income tax on the material benefit received by the individual taxpayer in 2020.

Between legal entities

If an interest-free loan agreement is concluded between legal entities, then the borrowing organization does not pay tax, since it does not have a material benefit.

This comes out of ch. 25 of the Tax Code of the Russian Federation, which indicates all types of income subject to taxation, among which there is no material benefit when concluding an interest-free or preferential loan agreement. Therefore, the borrower does not need to pay interest.

When a legal entity is a UTII, its taxation is determined by local authorities, which can tax certain areas of activity. But even in this case, the material benefit from the loan cannot be subject to taxation.

The lending organization, according to the law, is not subject to VAT when issuing a loan, as specified in Art. 149 of the Tax Code of the Russian Federation. All funds given or received from the loan account are not taken into account as expenses or income of the lender, and therefore are not subject to tax.

The interest that the borrower pays for using the loan is considered non-operating income of the organization. Each loan must be accounted for separately, and the interest on it is included in the list of monthly income.

If the debt is repaid ahead of schedule or upon expiration of the contract, income is taken into account on the date of repayment.

When the loan is returned to the company's cash desk, interest income is accrued immediately.

Personal income tax and material benefits when borrowing from an individual

According to paragraph 4 of Art. 226 of the Tax Code of the Russian Federation, the withholding of tax on material benefits occurs from any income of the taxpayer paid to him by a tax agent in cash.

If it is impossible to withhold the calculated amount of tax from the taxpayer during the tax period, the tax agent is obliged, no later than March 1 of the year following the expired tax period in which the relevant circumstances arose, to notify the taxpayer and the tax authority at the place of his registration in writing about the impossibility of withholding the tax, the amounts of income from which tax was not withheld, and the amount of tax not withheld (clause 5 of Article 226 of the Tax Code of the Russian Federation).

As noted, the tax base is defined as the excess of the amount of interest on a loan (credit), calculated based on 2/3 of the current refinancing rate of the Bank of Russia, over the amount of interest calculated based on the terms of the agreement (subclause 1, clause 2, article 212 of the Tax Code of the Russian Federation ).

The tax rate is 35% for tax residents, 30% for tax non-residents (clauses 2, 3 of Article 224 of the Tax Code of the Russian Federation).

Tax base = Credit (loan) amount x (Interest based on 2/3 of the refinancing rate - Interest under the terms of the agreement) x number of days of using the loan per month: 365 (366).

We invite you to read: Compensation for moral damage in case of an accident in 2020: compensation for moral damage from the culprit of the accident

As a general rule, the date of receipt of income is the date on which income is recognized as actually received for the purpose of including it in the personal income tax base. The specified date is determined in accordance with Art. 223 of the Tax Code of the Russian Federation, depending on the type of income received.

From January 1, 2020, when receiving income in the form of material benefits from savings on interest for the use of borrowed (credit) funds, the date of actual receipt of income is recognized as the last day of each month during the period for which the borrowed (credit) funds were provided.

Let us recall that before January 1, 2020, the date of receipt of income was considered the date of payment of interest on the loan (credit) (subclause 1, clause 2, article 212, subclause 3, clause 1, article 223 of the Tax Code of the Russian Federation of previous editions), and for interest-free For borrowings, this date was considered the date of repayment of borrowed funds (letter of the Ministry of Finance of Russia dated October 28, 2014 No. 03-04-06/54626, dated July 15.

2014 No. 03-04-06/34520, dated 03/26/2013 No. 03-04-05/4-282, dated 02/27/2012 No. 03-04-05/9-223, dated 07/25/2011 No. 03-04-05 /6-531, dated December 25, 2012 No. 03-04-06/3-366, Federal Tax Service of Russia for Moscow dated May 4, 2009 No. 20-15/3/ [email protected] , resolutions of the Federal Antimonopoly Service of the West Siberian District dated July 30 .2013 in case No. A03-9886/2012, East Siberian District dated March 27.

2013 in case No. A58-4544/12, Ural District dated December 4, 2012 No. F09-11970/12 in case No. A60-7752/2012). Therefore, if interest was not paid during the tax period, there was no income subject to personal income tax (letters of the Ministry of Finance of Russia dated 06/08/2012 No. 03-04-06/4-163, dated 02/01/2010 No. 03-04-08/6-18, Resolution of the Federal Antimonopoly Service of the Volga Region dated July 19.

If the loan (credit) agreement provided that interest was not paid by the borrower, but was included in the amount of the principal debt, the material benefit arose on the date the interest was added to the amount of debt (letter dated October 8, 2010 No. 03-04-06/6-247).

Based on the above, according to the old rules, personal income tax from the employee’s income (in example 1) was subject to withholding only as of February 29, 2016 in the amount of 2033.70 rubles.

Law No. 113-FZ does not provide for any transitional provisions for debt obligations arising before 2020. This means that under loan agreements issued before 2020, including interest-free loans, an individual’s income in the form of material benefits will be determined as of January 31, 2020, February 29, 2020, etc.

https://www.youtube.com/watch?v=ytcopyrightru

Thus, if in example 1 the loan is repaid before January 31, 2020, the grounds for paying tax on income in the form of material benefits received from saving on interest for the entire period of using borrowed funds under such a loan agreement have not been established. That is, in the event of termination of a debt obligation (by execution, debt forgiveness and other means) not on the last day of the month, the calculation of the tax base for income in the form of material benefits for the period from the last day of the past month to the date of termination of the obligation is not provided.

Debt forgiveness

An organization can forgive the amount of debt an employee has by signing a gift agreement or a debt forgiveness agreement with him. Then the employee will not have any material benefit, but will have income that is taxed at a rate of 13% (letters of the Ministry of Finance of the Russian Federation dated July 15, 2014 No. 03-04-06/34520, dated January 22, 2010 No. 03-04-06/6-3 ).

https://youtu.be/XnrF3U_1jSk

In addition, the Ministry of Health and Social Development of the Russian Federation believes that the employer has an obligation to charge insurance premiums for the amount of the forgiven loan (letters from the Ministry of Health and Social Development of the Russian Federation dated May 21, 2010 No. 1283-19 and dated May 17, 2010 No. 1212-19. However, judicial practice indicates the opposite (FAS Resolution Directive dated 24.03.

In what cases does material benefit arise?

In accordance with paragraphs. 1 clause 1 art. 212 of the Tax Code of the Russian Federation, an organization is obliged to calculate personal income tax on the material benefits received from savings on interest when providing a loan (including interest-free) to an individual:

- if the rate on a loan, the amount of which is determined in rubles, is less than 2/3 of the refinancing rate (key rate) of the Central Bank of the Russian Federation (clause 1, clause 2, article 212 of the Tax Code of the Russian Federation);

- if the rate on a loan, the amount of which is determined in foreign currency, is less than 9% (clause 2, clause 2, article 212 of the Tax Code of the Russian Federation).

What is it and when does it occur

Material benefit under a loan agreement is the amount generated when signing an agreement on an interest-free or preferential loan, calculated as the borrower saving money on interest payments. Of this, 35% is paid as personal income tax, which has been approved since the beginning of the 90s.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 110-43-85 (Moscow)

+7 (812) 317-60-09 (Saint Petersburg)

8 (800) 222-69-48 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

The reason for introducing such a norm into legislation was the policy of some companies to evade paying taxes: processing salaries in the form of interest-free loans, signing loan agreements for relatives, etc.

Saving money when applying for a loan in national currency can occur when:

- interest-free loan;

- a loan with interest less than 2/3 of the bank refinancing rate in a given territory.

When borrowing in foreign currency, profit arises during an interest-free agreement and an agreement with a rate of less than 9% per annum.

Material benefits can only arise from monetary loans. In the case of a property loan, it is not determined.

To ensure that the provision of a service such as an interest-free or preferential loan does not cost the borrower more than a loan with regular interest, you need to know how the material benefit and the tax on it are calculated.

What personal income tax rate applies to material benefits?

Article 224 of the Tax Code of the Russian Federation establishes personal income tax rates. This article says:

- if the borrower is a tax resident of the Russian Federation - at a rate of 35% (clause 2 of Article 224 of the Tax Code of the Russian Federation);

- if the borrower is not a tax resident of the Russian Federation - at a rate of 30% (clause 3 of Article 224 of the Tax Code of the Russian Federation).

MB – material benefit received from savings on interest;

SZ – loan amount;

% Central Bank of the Russian Federation – refinancing rate of the Central Bank of the Russian Federation in effect on the last day of the month;

% – interest rate on the loan;

365 (366) – number of days in a year;

days – number of days of loan use per month.

MB – material benefit from savings on interest;

SZ – loan amount;

365 (366) – number of days in a year;

For clarity, we will give an example of calculating the material benefit of an individual received from savings on interest, personal income tax on it, indicating specific dates for receiving income.

How to pay?

An employee of the company will repay the interest-free loan one time or in installments. The repayment schedule is usually specified in the loan agreement. Early repayment is also not prohibited.

The borrower can make payments in the following ways:

- depositing cash into the company's cash desk (if such an option is provided by the company);

- to the current account of the enterprise through the cash desk of any bank;

- from a bank card to the current network of the enterprise;

withholding from wages (at the client’s request or if this clause is specified in the loan agreement).

With each loan payment, it is necessary to calculate the material benefit.

Do you want to know under what conditions long-term loans are issued to pensioners using a Maestro card? Detailed information is presented here. Where to get a loan for the unemployed on a card without refusal, read the link provided.

You can find out how to get a loan into a bank account without checking your credit history from our article.

When is it necessary to transfer personal income tax to the budget?

According to paragraphs 4 and 6 of Art. 226 of the Tax Code of the Russian Federation, the organization must withhold personal income tax from material benefits upon the next payment of money to the borrower. As for the tax, it must be transferred to the budget no later than the day following the day the money is paid.

According to Part 3 of Art. 7 of Federal Law No. 212-FZ[1] do not apply to the object of taxation of insurance premiums, payments and other remuneration made, in particular, within the framework of civil contracts, the subject of which is the transfer of ownership or other proprietary rights to property (property rights) .

These clarifications are presented in Letter of the Ministry of Labor of the Russian Federation dated February 17, 2014 No. 17-4/B-54.

[1] Federal Law of July 24, 2009 No. 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund.”

Loan issued for the purchase of housing

Withhold personal income tax on material benefits for loans issued to residents for the purchase (construction) of housing or land in a special manner.

If borrowing costs are not included in the property tax deduction that an employee receives when purchasing (constructing) housing or land, the material benefit is subject to personal income tax for residents at a rate of 35, and for non-residents at a rate of 30 percent. If an employee who is a resident has the right to receive a property tax deduction related to the purchase (purchase) of housing (land), the material benefit is not recognized as income subject to personal income tax. Even if at the time of the material benefit the property tax deduction has already been spent (or has not yet been used). Since a prerequisite for exemption from personal income tax is the citizen’s right to a deduction in relation to housing (land), for the construction or acquisition of which a loan was allocated.

This procedure follows from the provisions of subparagraph 1 of paragraph 1 of Article 212 and paragraph 2 of Article 224 of the Tax Code of the Russian Federation, as well as letter of the Ministry of Finance of Russia dated September 4, 2009 No. 03-04-05-01/671.

A loan provided to an employee to repay a mortgage loan for the purchase of housing is not a targeted loan. If an organization issues such a loan to an employee, the latter receives a material benefit from savings on interest, subject to personal income tax at a rate of 35 or 30 percent (letter of the Ministry of Finance of Russia dated October 7, 2009 No. 03-04-05-01/727).

Situation: how to calculate personal income tax on material benefits for an interest-free loan issued for the purchase of housing (land)? The loan amount exceeds the maximum amount of property deduction (RUB 2 million).

The amount of material benefit from an interest-free loan issued to an employee for the purchase (construction) of housing or land is not subject to personal income tax. This rule applies only to those employees who are entitled to receive a property tax deduction. Moreover, even if the loan amount exceeds the maximum amount of property tax deduction (2 million rubles), income in the form of material benefits is not subject to personal income tax in full. The legislation does not provide for such a condition for the exemption of material benefits from personal income tax as the maximum amount of property deduction. This follows from the provisions of subparagraph 1 of paragraph 1 of Article 212 and subparagraph 3 of paragraph 1 of Article 220 of the Tax Code of the Russian Federation.

Calculate the material benefit from an interest-free loan in the manner prescribed by paragraph 2 of Article 212 of the Tax Code of the Russian Federation.

A similar point of view is expressed in letters of the Ministry of Finance of Russia dated April 14, 2008 No. 03-04-06-01/85 and dated January 25, 2008 No. 03-04-06-01/20.

Personal income tax reporting

Information about the income received by an individual will need to be reflected in the calculation of the amounts of personal income tax calculated and withheld by the tax agent, as well as in a certificate in form 2-NDFL - for 2020 (approved by order of the Federal Tax Service of Russia dated November 17, 2010 No. MMV- 7-3/ [email protected] ) (clause 2 of Article 230 of the Tax Code of the Russian Federation) and 6-NDFL - since 2016 (approved by order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/ [email protected] ).

In addition, if there is no payment of funds in 2020, the tax agent should inform the taxpayer and the tax authority about the calculated but not withheld amount of tax on material benefits no later than March 1, 2020 (Clause 5 of Article 226 of the Tax Code of the Russian Federation , letter of the Federal Tax Service of Russia dated October 19, 2015 No. BS-4-11/18217).

https://www.youtube.com/watch?v=ytdevru

If the tax agent does not report the impossibility of withholding personal income tax, a fine of 200 rubles may follow. for each document not submitted (clause 1 of Article 126 of the Tax Code of the Russian Federation).

Personal income tax withholding periods

The calculated amount of tax on income in the form of material benefits for using an interest-free loan must be withheld from the first next cash payment to an individual (clause 4 of Article 226 of the Tax Code of the Russian Federation). The employing organization can do this when paying wages: the tax agent will withhold the accrued amount of income tax in the form of a material benefit upon actual payment of wages, but in an amount not exceeding 50% of the payment amount.

Note!

If the employee fails to repay the loan after the expiration of the statute of limitations and the said debt is written off from the organization’s balance sheet as bad, the employee will have income in the amount of the written off debt (subclause 5, clause 1, article 223 of the Tax Code of the Russian Federation).

Property deduction for housing

An employee can confirm the right to exemption from personal income tax for material benefits received from savings on interest for the use of borrowed funds with the following documents from the tax office:

- notification, the form of which was approved by order of the Federal Tax Service of Russia dated January 14, 2020 No. ММВ-7-11/3;

- a certificate, the form of which is recommended by the letter of the Federal Tax Service of Russia dated July 27, 2009 No. ШС-22-3/594.

To receive a notification (certificate), the employee must contact the tax office at his place of residence with a set of supporting documents required when receiving a property deduction (documents confirming ownership of housing or acquisition of rights to housing under construction, as well as payment of expenses for the purchase (construction) of housing, land plot). It is enough for the employee to receive a supporting document (notification, certificate) and submit it to the organization once. If an organization has issued a long-term loan and the material benefit from interest savings occurs in different tax periods, then there is no need to annually require the employee to provide a new supporting document from the tax office.

This follows from the provisions of subparagraph 1 of paragraph 1 of Article 212, paragraph 3 of Article 220 of the Tax Code of the Russian Federation and clarifications of the Ministry of Finance of Russia in letters dated September 17, 2010 No. 03-04-05/6-559, dated September 14, 2010 No. 03- 04-06/6-211.