Officially employed citizens with minor children may qualify for government support, which is expressed in a standard personal income tax deduction.

It implies a reduction in the tax rate that the employer withholds monthly from employees' salaries for transfer to the tax authorities. The amount of money established at the legislative level is returned to the employees’ account.

You can download sample applications for double deductions for personal income tax for a single parent, if the second parent refuses, for free at the bottom of the article in word .

Double standard personal income tax benefit

Parents and guardians of children under 18 years of age have the right to claim a tax deduction. Some categories of citizens are entitled to a double standard deduction. This is possible if it is received by:

- single mother or father (sole parent or guardian);

- one of the parents, provided that the other refused the deduction. This right applies only to blood and adoptive parents; it does not apply to guardians.

The current legislation of the Russian Federation determines that only working citizens can apply for a tax benefit of this type, from whose salaries 13% is withheld monthly.

It is important to note that if the child’s only parent, regardless of whether it is the mother or the father, gets married, the right to receive a double deduction disappears.

If such circumstances occur, the natural parent and stepmother/stepfather have the right to claim a standard deduction for personal income tax. It is assumed that both spouses will be involved in raising the child, so each of them can count on financial support.

The tax benefit is not doubled if one of the guardians is deprived of parental rights and does not participate in the life of the child. If one of the parents is not employed, the other parent also does not have the right to claim a double standard deduction.

A certain maximum wage is established for the application of personal income tax benefits.

Employed citizens can count on receiving benefits until their earnings reach the established level. For 2020 this is 350,000 rubles.

To whom can this deduction be made?

Article 218 of the Tax Code of the Russian Federation prescribes the procedure for assigning and calculating tax benefits, including “children’s” deductions. According to the law, the child tax deduction is an amount of money designated in regulations, from which the 13% personal income tax (income tax) will not be charged.

Each has the right to make this deduction :

- the child's natural parents;

- adoptive parents;

- guardians;

- trustees.

The right to receive this tax benefit is recognized if there are one or more offspring under the age of 18 or older (up to 24 years), if the eldest child is a full-time student as:

FOR YOUR INFORMATION! Full-time education is allowed not only in an educational institution in the Russian Federation, but also abroad. Studying a master's degree as a first higher education will not be an obstacle to assigning a tax deduction (naturally, if the child meets the age criterion).

Regardless of age, a separate tax deduction will be accrued for disabled children.

Application deadlines

To receive a standard deduction, an employee must prepare a special application, which is subsequently submitted to the employer. There are 2 options for submitting it:

- during the employment process. Along with the application, the citizen must provide a document reflecting his income received since the beginning of the year. This is necessary if, before employment, the employee carried out his professional activities in another organization;

- when the right to double deduction for personal income tax arises. This circumstance implies the refusal of one of the parents from benefits, the birth of a child to a single mother, etc.

Do I need to write every year?

An application of this type is drawn up only once - upon hiring, or at the time of acquiring the right to receive double benefits. Annual renewal of documentation is an optional procedure.

The exception is situations in which there have been changes in the employee’s life regarding the procedure for providing benefits.

These include:

- the birth of a second child;

- marriage;

- death of a spouse.

What documents need to be attached?

To receive this type of financial assistance, an employee must provide not only an application, but also a package of supporting documentation. The list of papers depends on the specific situation.

To obtain the right to a benefit, a citizen must collect the following papers:

- birth certificate of the child for whom he receives the deduction.

A prerequisite for a single parent is the presence of a dash in the column with information about the second parent;

- certificate of form No. 25. It is received at the registry office in cases where the baby’s father is indicated according to his mother;

- certificate confirming the death of the second parent;

- a court decision serving as confirmation that one of the parents is deprived of parental rights;

- copies of some pages of the passport (those that contain information about marital status);

- papers establishing the right of guardianship;

- certificate 2-NDFL received from the place of previous employment.

The list of documents is different in each case. Its composition depends on whether the beneficiary has a certain paper.

If a child has reached the age of 18 but is studying full-time, his parent can also claim a double deduction.

To do this, you must provide a document from the educational institution. It acts as confirmation that the child is actually studying there.

If there is a disability, an ITU document is prepared.

If in a complete family one guardian refuses the deduction, and the second wants to receive a double one, the first must draw up an application. It must reflect the fact of his refusal of the benefit. It is also necessary to prepare a 2-NDFL certificate.

Documents for child tax deduction

If the child’s parents are officially employed, then their employer himself submits the necessary papers to the relevant tax authority. Citizens will simply receive wages in accordance with all taxes withheld and deductions made. The necessary documents are provided by employees to the human resources department or accounting department at their place of work.

For a standard “children’s” tax deduction you will need:

- birth or adoption certificates (for all children);

- an application in which the employee requests a standard tax deduction for the child(ren);

- certificate 2-NDFL for the previous year (if the place of work was changed);

- for children who are already 18 years old - a certificate stating that they are actually studying full-time at a particular educational institution (this certificate must be updated annually).

ADDITIONALLY! If the parents are divorced or their marriage has not been registered, then the second parent can receive a deduction if he documents that he is involved in providing for his offspring: for this he needs to provide an agreement on the payment of alimony or a certificate of registration at the same place of residence as the child. A court decision on determining the person with whom the child remains in the event of a parental divorce is also valid.

For a “double” deduction, the following is added to these documents:

- application for a double tax deduction;

- written refusal of the other parent or adoptive parent;

- Certificate 2-NDFL of the parent who wrote the refusal (for each month for which the deduction is made).

How to apply correctly?

The technology for drawing up an application to some extent depends on the circumstances in connection with the occurrence of which the right to a benefit arose. In the writing process, you need to be guided by this very condition.

The statement includes several sections: introductory part, main text and final part.

- Opening. The header of the application, which reflects information about the employer and company details.

- Basic. Includes the essence of the statement. It must set out the data on the basis of which the citizen is entitled to a double benefit.

- Final. Here is a list of documentation attached to the application.

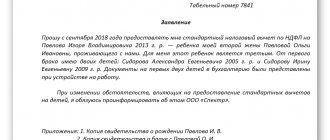

Single parent sample

The basis for receiving benefits in this case is a document confirming the fact that the parent is recognized as a single parent.

The application that he must submit for double deduction must include the following information:

- addressee's name;

- document's name;

- information about the applicant;

- a direct description of the request;

- amount of deduction;

- information about the child who is entitled to the deduction;

- reference to the Tax Code of the Russian Federation, in particular to Article 218;

- list of documents attached to the application;

- date of writing;

- signature and initials of the employee.

.

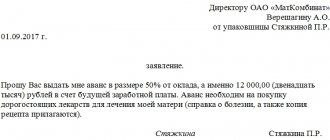

If the second spouse refuses

The situation in which one of the parents refuses this type of benefit is complicated by the fact that it is necessary to confirm the fact of their refusal every month.

The application written by the other parent must include the following information:

- standard header - company name, full name of the applicant;

- full name of the paper;

- appeal text. It indicates the request for a deduction, the amount of the benefit, the full name and date of birth of the child;

- appendices - list of additional documentation;

- date of compilation, full name, position and signature of the employee.

.

Nuances

Sample application for tax deduction for a child in 2020.

It's also worth remembering:

- if a parent has a child, then he has the right to receive a tax amount, thereby reducing personal income tax for payment;

- for the first and second child 1,400 rubles, for subsequent children 3,000 rubles. This is the tax base from which 13% is calculated;

- The refund must be provided by the applicant's employer. To do this, you must write an application in the accounting department in the established form and attach a package of documents confirming the right to return;

- Both parents are entitled to receive a refund. The single parent receives a double refund;

- If a citizen was employed, but did not make a refund, then he has the right to apply to the tax authority to demand a refund of funds for the period of the past three years.

The main part of the application contains a request to the employer to provide a standard tax deduction. In the text, it is imperative to refer to subparagraph 4, paragraph 1, article 218 of the Tax Code of Russia.

Another point in the document is a listing of all minors for whom benefits are required. The following lists the Komi documentation that is attached to the written application.

Registration is carried out in the accounting department of the enterprise. The tax authority at your place of residence is responsible for refunds for previous periods.

Sizes in 2020

The amount of tax deduction depends on several factors. For example, on the number of children. In accordance with this, parents are entitled to standard benefits in the usual amount:

- for 1 and 2 children - 1400 rubles each;

- for 3 and subsequent children - 3000 rubles;

- for a child with a disability - 12,000 rubles;

- for an adult full-time student with a disability of groups 1-2 - 12,000 rubles. Guardians can claim a deduction of 6,000 rubles.

In the presence of the circumstances mentioned earlier, the transferred amounts are doubled.

Child tax deduction in 2018

The legislation regulates certain types of income of citizens, which are deducted from the total amount for taxation. Tax deductions are not subject to the usual personal income tax rate of 13% if they are standard.

Amounts deducted for children are standard tax deductions. This means that this form of reducing the tax burden will be in effect continuously as long as the original status of the taxpayer is maintained (in this case, receiving taxable income and the presence of one or more future heirs).

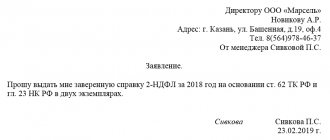

Application for a deduction

It is best if the enterprise has ready-made application forms in which you only need to enter individual data, and the necessary deductions will be required, then none of them will be forgotten.

However, a free form of application is also allowed, because there are no strictly established samples in this regard.

Sample application for the standard child tax credit

To the director of Domostroy LLC from storekeeper R.L. Rozanova.

STATEMENT

When determining the tax base, I ask you to provide me with monthly standard tax deductions for personal income taxes for my children A.D. Rozanov. (21 years old, full-time student), Rozanova O.D. (10 years).

I am attaching to the application:

- a copy of O.D. Rozanov’s birth certificate;

- a copy of A.D. Rozanova’s passport;

- certificate stating that Rozanova A.D. actually studying full-time at Moscow State University (Faculty of Economics).

01/14/2015 R.L. Rozanova

Example of an application for a double tax deduction

STATEMENT

Please provide me with a standard tax deduction for personal income tax for my children Zelentsova M.P. (04/13/2005), Zelentsov E.P. (07/06/2008), Zelentsov A.P. (10/18/2012) in double the amount (based on clause 4, clause 1, article 218 of the Tax Code of the Russian Federation) due to the fact that my husband Zelentsov P.I. died on November 23, 2016.

I am attaching the following documents to the application:

- copies of birth certificates of children – Zelentsova M.P., Zelentsova E.P., Zelentsova A.P.;

- a copy of the death certificate of the spouse Zelentsov P.I.

Final deadlines for deductions

If a child turns 18 this year and is not in full-time education, the standard tax deduction will be due until the end of that calendar year (month of birth does not matter).

This is important to know: The taxation system in the form of a single tax on imputed income for certain types of activities: what taxes it replaces, conditions for providing benefits

A full-time student under 24 years of age will give the right to a deduction to his parents for the following period:

- until he graduates from educational institution (even if he is not yet 24 years old);

- until the year of your 24th birthday (even if training is not completed).

NOTE! In the tragic event of the death of a child, the reduced tax rate remains with the parents until the end of the calendar year.

Application for deduction for a child

Related publications

To reduce the tax base for personal income tax due to “children’s” deductions, the taxpayer must provide documents confirming his right to the deduction and write an application. A correctly drawn up application will allow the employer to apply the required deductions on time and correctly withhold personal income tax. We’ll look at how to write such a statement in our article.