Under certain conditions, Russian citizens can temporarily reduce their tax burden. To do this, they must apply for a tax deduction. It allows you to reduce the taxable amount of income of individuals by the amount of this deduction.

Several years ago, my husband and I purchased an apartment. And after that we had the right to receive a property deduction. To exercise your right, you must submit an application to the tax authorities with the required package of documents. And in this article I will tell you how to correctly draw up an application to receive this type of deduction.

Property deduction

Any citizen may have the right to receive it, provided that he has not previously used it in full. A property deduction can be obtained when purchasing real estate, its construction, as well as when spending money on reconstruction and carrying out some other construction work. All details and conditions can be studied in detail in the Tax Code. This is what Article 220 is dedicated to.

This regulatory legal act for 2020 sets a limit on the amount within which each person can take advantage of the property deduction. The limit is set as follows:

- no more than 13% of 2 million rubles of the cost of housing, which is 260 thousand;

- no more than 13% of 1 million rubles of mortgage interest overpaid to the bank, which is 130 thousand.

Thus, in the totality, a person has the right to receive 390 thousand rubles in the form of unpaid personal income tax. This right is valid for 3 years from the date of expenditure. A prerequisite is that the person must have taxable income from which the deduction amount can be compensated.

You can receive a deduction in 2 ways:

- return previously paid tax through the Federal Tax Service;

- not pay current taxes by providing notice to the employer of the existence of such a right.

Depending on the chosen method, the type of application submitted for property deduction will also depend. You can get more detailed information about the deduction itself by watching this video.

https://youtu.be/7l5F8zrnm5g

Documents attached to the application

The materials sought to be attached to the petition must clearly assert the right to privilege. Their package could be like this:

- Certificate of family increase (documentary confirmation of birth, guardianship, adoption).

- Certificates certifying a certain condition (disability, classes at an educational institution, cohabitation, maintenance, marriage status).

- Materials on divorce and the absence of alimony arrears.

- Certificate confirming the death of an ancestor.

- A request to renounce the preferential taxation of the second spouse with a warning about this to the management of the company.

A request to purchase benefits for a child does not have a unified template and is drawn up as an ordinary application, which requires the following to be displayed:

- Details of the addressee, to whom it is addressed (position, company name, full name of the boss).

- Data of the compiler, displaying the position, structural department, his full name. residential addresses, passport information, personnel number and TIN.

- The text of the request, which displays the desire of the petitioner.

- List of materials attached to the request.

- Signature of the author and date of sending the request.

Sample application for child tax deduction in 2020

Application for tax deduction when purchasing an apartment

In Art.

220 of the Tax Code of the Russian Federation regulates that persons of the Russian Federation have the right to send a request for a reduction in duty when purchasing residential premises. Order of the Federal Tax Service of the Russian Federation N ММВ-7-8/182 approved a standard declaration template. The request requires information about the duty payer, the essence of the request and a list of attached materials. If the purchase of housing was carried out with a mortgage, then it is necessary to indicate what benefit the applicant is applying for - from interest or from the cost of housing. However, Law No. 212-FZ stipulates that the house must be purchased no later than January 1, 2014. It turns out that you can purchase an interest benefit from one home, and a cost benefit from another. The request must indicate that the basis for transferring interest is a mortgage agreement.

Regulatory acts provide for property deductions for certain categories of persons:

- Minors.

- Able to work.

- For pensioners.

Pensioners have some restrictions on benefits. If a person has registered for a pension, then he is exempt from income tax, so his right to the privilege of buying a house expires after 3 years.

The following are not entitled to a tax refund:

- Unemployed persons whose only income is benefits.

- An individual entrepreneur who is exempt from the 13% duty rate.

Only persons receiving earnings taxed at the standard personal income tax rate can submit a request for a duty reduction.

The Tax Code of the Russian Federation regulates the procedure for reducing duties in accordance with clause 7 of Art. 220 of the Tax Code, which states that in order to acquire a privilege it is necessary to submit a declaration. The tax authority has been given time to verify the declaration for 3 months (clause 2 of Article 88 of the Tax Code of the Russian Federation).

If the document is filled out correctly, then, according to clause 6 of Art. 78 of the Tax Code of the Russian Federation, the benefit will be established for one month.

Refund amount is limited. There are 2 options for individuals:

- Purchase in the amount of up to 2 million rubles. Here you can use the sum for several objects.

- When mortgage interest is returned. It is allowed to use only one object in the amount of up to 3 million rubles.

Application for a standard tax deduction for a disabled child in 2020 (sample)

Standard duty privileges that reduce the personal income tax base are regulated by Art. 218 Tax Code of the Russian Federation.

The list of such privileges includes the return of duty for a disabled child.

Duty privileges for a disabled child in 2020 are regulated by paragraph 4 of paragraph 1 of Article 218 of the Tax Code of the Russian Federation and are displayed in the table below:

| Who is privileged? | Allocation period | Who gets the privilege? | |

| Ancestors, adoptive parents supporting a disabled person | Guardians, adoptive ancestors, trustees, spouses of an adopted ancestor supporting a disabled person | ||

| Disabled kid | Before turning 18 years old | 12 thousand rubles | 6 thousand rubles |

Tax refund through the tax office

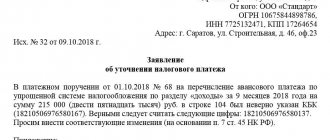

If you decide to return previously paid tax, then you can do this only for the last 3 years from the date of expenses incurred. The required list of documents includes filing an application for a tax refund. This document is drawn up in a special form developed by tax legislation, according to KND 1150058.

Before filling out I recommend:

- ;

- View a sample application for personal income tax refund.

After this, you can begin filling out the saved blank application form. It will consist of 3 pages. Before starting registration, take a 2-NDFL certificate received from your employer for the period for which you will be refunding the tax. We will need to take some information from it.

Let's start filling out the application in order from the first page:

- At the top we indicate “TIN”. We are looking for these 11 numbers at the top of the 2-NDFL certificate, where information about you as a taxpayer is indicated.

- If you have never submitted such a document this year, then the “Application Number” will be “ 1 ”.

- “Tax authority code” can be found on the Federal Tax Service website. But you can also simply rewrite the first 4 digits from the TIN, since they are the code of the tax authority where you are registered.

- Below we write down our full name .

- You have the right to refund the tax paid on the basis of Article 78 of the Tax Code , so we write down this number.

- We also put “1 ” in the lower squares, which implies a refund of overpaid tax.

- When filling out the 3-NDFL declaration, you will definitely calculate the amount of deduction that you are entitled to return. Therefore, in the “Amount of tax” we enter the previously calculated amount.

- Next, you need to indicate for which “billing period” this calculation was made. We write the year for which it is calculated.

- Further in the 2-NDFL certificate we find “OKTMO Code” , it is set individually for each tax authority.

- the “budget classification code” , since it is determined by the tax authorities 182101102030011000110 .

- This type of application consists of 3 pages. Therefore, in the line “Number of pages” we put “ 3 ”.

- When you have prepared the entire package of required documents, you will know their total number. You must enter it in the line “Number of applications” .

- As a standard, at the end of each application we put our signature, transcript, and date .

Let's move on to the next page:

- We indicate your “TIN” again .

- In the line “ Last name ” we write it in full, and in the lines “ first name”, “patronymic” we write only the initials.

- After this, we must write the details of our card or bank account, where the tax authorities will have to transfer the funds. If you have a card, you can view its details through your personal account, or request it at any bank branch. You can only indicate your own account. First we write “ bank name” .

- “Account name” will always be current.

- Then fill in the order “BIK”, “Correspondent account”, “account number” .

- In the “Account number” , select the number “1”, it will mean that these are your details as a taxpayer, and not another person.

- The full name must match those indicated in the account details.

- Next, we must indicate the document with which you will confirm your identity when submitting documents to the tax authorities. Usually a passport is used for this. If for some reason it is missing, then you can use another document established by Russian legislation. Therefore, in the “Passport data” we rewrite the document details.

- And in the line “Document type code” we indicate the code corresponding to this document. The passport has code 21 .

After this, we go to the last page, where we enter the full name in the same way as the previous sheet. address here , where, if necessary, correspondence should be sent.

You also need to know that each spouse has the right to receive such a deduction if the property was acquired during marriage. For example, my husband and I filed tax refund documents together to get back the full amount of tax due to us. Although according to documents I am not the owner. To do this, you need to fill out an additional application for the distribution of deductions between spouses. You can see the procedure for completing it here.

Application for property deduction: registration procedure

According to the law, an application for a tax refund in connection with receiving a deduction for the purchase of an apartment (room, house) can be drawn up in any form. The Tax Service does not have the right to approve its form. However, often, recommended forms for such statements are posted on information stands in tax offices. You have the right to draw up an application in the form recommended by the inspectorate or draw up an application for a tax refund the way you want. The tax service does not have the right to refuse you a tax refund only on the grounds that your form does not correspond to the sample. But it is better, in order to avoid unnecessary disputes, to do this in an official form.

An application for a tax refund in connection with payment of expenses for the purchase of an apartment or other residential real estate must be drawn up in the form that is approved by Order of the Federal Tax Service of Russia dated February 14, 2017 No. ММВ-7-8/ [email protected] This form is mandatory for everyone (!) tax inspectorates of Russia.

On our website there is:

- A sample of a completed application form for a tax refund in connection with receiving a property deduction. The lines that you must complete are filled in in red font.

- Template of the current tax refund application form in Excel and PDF format (see attached files). You can download it, fill it out based on our sample and indicate your own data.

To find out within what time frame the inspectorate is obliged to return the tax, see the link. Now let's talk about how to fill out the application.

General rules

The application consists of three sheets. You definitely need to fill out the first two - the title and your bank details. The third one (it contains your passport details) is needed if you have not indicated your TIN. If it is included in the first and second sheets, then the third sheet can be left blank. The title page contains your details and other information about the tax being refunded (in your case, this is personal income tax). On the second sheet enter your bank details to which the money will be returned. The third sheet is devoted to individual information about you: passport details and place of registration (registration).

The application can be filled out by hand in block letters, or on a computer. But the signature on the application must be “live” (that is, written by hand). It is placed only on the title page.

You can apply several years in advance. For example, for 2018, 2020 and 2020. In this case, you need to make not one, but three statements. One for each year. When purchasing real estate, you can claim a tax refund both on the cost of the apartment (room, house) itself, and on the cost of paying interest on a mortgage loan. The application must indicate the total amount to be refunded without breaking it down into taxes on the cost of the apartment and on mortgage expenses. That is, there is no need to separate them in the application. The application must indicate the amount of tax to be refunded. It will be entered in your income tax return (form 3-NDFL) on line 050 of Section 1 and line 160 of Section 2.

Return application cover page

1. Enter your Taxpayer Identification Number . If you don’t know it, then you can find it out through our “Find out your TIN” service. There is no need to fill out the checkpoint line. It is intended exclusively for organizations. Let us remind you that if you indicated your TIN, the third page of the application (passport data) does not need to be filled out.

2. Enter the number of the first page - “001”.

3. Enter the application number in the format “1 — — — — — “. If you submit a second application in the same year, then its number will be “2 - - - - -”, etc. Several applications will be required, for example, if: - you are returning tax for several years at once. You need to make your own application for each year; - you made a mistake in the first application and are submitting the corrected document again.

4. Write the code of the tax office to which you are submitting the application. You can find out the code of your tax office on the tax service website here.

5. Indicate your last name, first name and patronymic in block letters on each line of the application.

The completed application lines will look like this:

6. In the “Payer status” , enter “1”.

7. Next, indicate the article of the Tax Code , on the basis of which you are required to return the money. This is Article 78 of the Tax Code

8. Then enter the overpayment reason code . If you paid (or were deducted from you) an excess - 1, if the amount was forcibly collected from you (for example, bailiffs) - 2, indicator - 3 applies only to organizations. When returning tax for an apartment, it will be “1”.

9. Next, indicate the payment code you are returning. If the tax is 1, if the fee is 2, if the insurance premium is 3, if the penalty is 4, if the fine is 5. You will have “1” here.

10. In the next line, enter the amount that you are required to return . The number should be pressed to the right side of the line (see example below).

Attention!

The amount of tax to be refunded must match the same figure specified in the tax return (Form 3-NDFL). The amount to be refunded upon application must match the numbers entered in line 050 “Amount of tax to be refunded from the budget” of Section 1 and line 160 “Amount of tax to be refunded from the budget” of Section 2. If several lines 050 are filled out in Section 1 and several statements.

11. Next, indicate the tax period code : two letters, two numbers and the year for which the tax is being returned. You are returning personal income tax. It's annual. That's why they write "GD" here. The annual payment has code “00”. Next, indicate the year for which you are returning the overpayment. For example, you bought real estate in 2020 and are returning the overpayment of income taxes for 2020. Then this line will be filled in like this: “GD.00.2019”

12. Indicate the OKTMO code (all-Russian classifier of municipal territories). OKTMO is the code of the region in which income tax was withheld. You can take it from the Income Certificate (form 2-NDFL) at your place of work. By the way, the same code must be indicated in your declaration on line 030 of Section 1.

13. The next line of the KBK is the code for the budget classification of budget income, which consists of 20 digits. Each tax has its own BCC. You can find out this code if you have a receipt for the tax that you plan to return, previously received from the tax office (this code is on the receipt). If there is no receipt, look for it on the Internet. Example of a request “KBK for personal income tax”. Now the BCC for income tax is 182 1 0100 110. This is what needs to be entered. But it changes regularly.

14. Next, indicate the number of pages in the application - “003” and the number of sheets of documents that you are attaching to this application. If one sheet is “001”, if two - “002”, if three - “003”, etc.

15. Enter the number of sheets of the documents attached to the application. If you receive a tax deduction for an apartment, then all the necessary documents are attached not to the application, but to the income tax return. Therefore, in the application in the line “... with supporting documents or their copies attached” there will be dashes.

When returning income tax for 2020, the completed lines will look like this:

16. If you are submitting the application in person, in the last block of the title page “Accuracy and completeness of the information specified ...”, indicate the number “1”.

17. Next, enter your phone number without spaces in the form “89160650634”.

18. Enter the current date in the application and put a “living” signature.

There is no need to write anything in the “To be completed by a tax authority employee” section.

If you are submitting an application on your own (without a representative), this block can be filled out like this:

Second page of the return application - bank details

On this sheet, indicate your Taxpayer Identification Number, last name and initials. Next, enter all the bank details for which the tax must be refunded. Get bank details for depositing money from the bank where you have your card or account. At your request, you will be given a printout where all the details will be indicated. You can also take them from the personal account of the bank in which the account is opened (if you have obtained access to your personal account). In Sberbank Online, you need to go to the details of your card or account by clicking on it, go to the “Deposit Information” tab and click the link “Transfer details to the deposit account”.

Fill out the second sheet as follows.

1. Re-enter your TIN and indicate the page number “002”. The TIN must be exactly the same as on the title page. If you do not have a TIN, then this line does not need to be filled out. But then you are required to fill out the third sheet of the application.

2. Write down your last name (in capital letters) and initials .

All subsequent lines are bank details for crediting tax to your account.

Attention!

If you enter the bank details of another person (for example, a wife or husband) into the application, then the money will not be transferred to you under such an application. Also, you will not be able to receive money if you make a mistake in the details (it is enough to miss or write one number incorrectly). Of course, in all these situations there is nothing terrible. The money will be returned to you in any case. But this will require a new application with the correct data. As a result, the return process will be delayed.

3. Indicate the name of the bank in which the account is opened. This must be done in strict accordance with the data received from the bank.

4. Enter the number “02” if the money will be credited to a card or current account (on demand) or “07” if it is a deposit.

The necessary data can be entered in the return application like this:

5. Specify the bank's BIC . This is a 9 digit bank identification account. It will be in the account details that you will receive at the bank or download from your personal account.

6. If you are returning income tax in connection with the purchase of an apartment, indicate the number “1”.

7. Write down your bank account number . This is 20 digits. It is important not to make a mistake here. Because if there is an error in even one digit, the tax authorities will not be able to credit you with money. Do not confuse your account number with the bank's correspondent account number. These are different accounts. The correspondent account number also consists of 20 digits and will be indicated on a separate line in the bank details. You don't need it!

8. In the “Recipient” , enter the number “2”.

9. Write down your last name, first name, patronymic in full. In capital letters.

You do not need to fill out anything else on this sheet. All of the above data can be filled in like this:

The third sheet of the return application - personal data

This is the simplest sheet. Here you need to enter your personal data: full name and details of your identity document.

Attention!

If your TIN is indicated on the first sheet of the application, then the third sheet does not need to be filled out.

We fill out this sheet like this:

1. Write the sheet number “003”.

2. Enter the surname and initials .

3. We indicate the code of the document that proves your identity. Each document has its own code. In particular:

— 21 — passport; — 03 — birth certificate; — 07 — military ID; — 10 — passport of a foreign citizen.

A complete list of documents with codes is in Appendix 2 to the Order of the Federal Tax Service of Russia dated October 3, 2018 No. ММВ-7-11/ [email protected]

4. We provide the series and document number separated by a space.

5. We enter the organization that issued it (in strict accordance with this document).

6. We provide the date of issue of the document in the format “DD.MM.YYYY”

The required data can be filled in like this:

Deduction through employer

If you plan to take advantage of the right to deduct through your employer, you must first request notification from the tax authorities that you have such a right. And then you need to write an application to your employer so that he gives you the opportunity to use it. Thus, we will need to fill out 2 applications.

Application for notification

This document is free form. But I recommend filling it out in a ready-made sample, since we will only have to change information about ourselves. Therefore, first, let's save ourselves a sample using this link . But if you wish, you can fill it out on a blank sheet of paper.

The procedure will be as follows:

- First, we write down the full name of the Federal Tax Service where we are registered. This is where we should submit our documents. You can check the name on the official website of the Federal Tax Service. This information is also written in the TIN certificate.

- Then we write down all the information about ourselves. This includes: full name, tax identification number, date of birth.

- Be sure to indicate your passport information so that you are not confused with your namesake.

- We immediately write down the registration address and telephone number . The tax authorities will contact you through these contacts if necessary.

- Be sure to enter the title of the document in the center of the sheet. We write that this is not just a statement, but we decipher its essence, that you need confirmation of the right to a property deduction.

- In the body of the application we write why you have this right, what amount of deduction and for what period you expect to receive it. We indicate the amount without kopecks in the form of numbers and write it in words.

- Next, we write down information about the employer from whom you plan to receive income. Here you need to indicate its legal name, INN, KPP. And also the official address.

- Mandatory documents confirming this right will be attached to the application, so we write down the entire list of documents .

- At the end we put the date, signature, transcript .

Once all papers have been submitted, tax officials must review them within 30 days and provide written notice. Further, on the basis of it, we will demand the money due to us from the employer.

Application to the employer

It is also filled out in a free format, but many companies have their own form of internal documents. As a rule, they already have ready-made lines where you need to enter certain data.

The procedure for compiling this document will be as follows:

- We indicate the position and full name of the manager . Who needs to submit such an application should check with your company.

- We write your position and full name , if the staff is large, I recommend also writing your passport details and telephone number for contact.

- the name of the document in the center of the application.

- The title goes to the heart of the document . Here you must refer to the fact that you have the right to a property deduction, which is enshrined in Article 220 of the Tax Code in the amount of a specific amount (equal to expenses incurred, up to 2 million rubles), as well as in the amount of interest overpaid on the mortgage loan (up to 1 million rubles) in connection with your purchase of real estate in a particular year.

- Below we rewrite the details of the notification from the tax authorities, which confirms this right.

- We indicate from which month you want to receive this deduction (from the current or next).

- The list of documents will consist only of the original of this notice. We indicate that it is attached.

- We finish with the date, signature and transcript.

After receiving the notification application, the employer’s accounting department must independently calculate the due deduction and pay you your wages in full without deducting taxes.

Ways to return tax

You can get your tax refund in the following ways:

- In the year the right to a deduction arises, submit to the Federal Tax Service at your place of permanent residence the entire package of documents relating to it, and receive from the tax office a notification of the right to a deduction for its application at the place of work. If this year the deduction amount is not used in full, then next year you must again contact the Federal Tax Service for notification of the remaining deduction. And so on every year until the full amount is selected.

The procedure for providing a deduction for the purchase of housing at work is described in detail at ConsultantPlus. Get trial access to the system and proceed to the material.

- After the end of the year in which the right to deduction arises, submit to the Federal Tax Service a 3-NDFL declaration for the past year, drawn up taking into account the amount of deduction possible for the year. The amount of the deduction cannot be greater than the amount of annual income. The declaration must be accompanied by 2-NDFL certificates confirming the amount of income and the amount of tax withheld from it, a set of documents giving the right to deduction, and an application for a personal income tax refund for the past year. If there is a need to return the balance of the deduction in the following years, the taxpayer can choose one of 2 ways: receiving an annual notification for the current year for the employer or annually submitting a declaration for the past year to the Federal Tax Service. When choosing the first route, an application for a personal income tax refund to the employer is submitted together with a notification of the right to deduction received from the INFS. If you do not use the deduction at work, you will be able to submit the declaration again to the Federal Tax Service at the end of the year.

A sample application to the INFS to receive a notification confirming the right to a property tax deduction can be found in the article “Application for a property tax deduction.”

Resubmission of the set of documents entitling the right to deduction will not be required with any of the applications relating to the balance of the deduction in subsequent years.

Return of personal income tax through the Federal Tax Service is possible only if a declaration is submitted for the tax period (clause 7 of Article 220 of the Tax Code of the Russian Federation), i.e. at the end of the year. The Federal Tax Service will check the submitted declaration within 3 months (clause 2 of Article 88 of the Tax Code of the Russian Federation) and after another 1 month (clause 6 of Article 78 of the Tax Code of the Russian Federation) will return the tax to the bank account that the taxpayer will indicate in the application.

Read about the declaration form used for the 2019 report in the article “3 Personal Income Tax: New Form”.

Sample application to an employer for a property deduction

An example of filling out an application to an employer for a property deduction. The application is submitted to the employer's accounting department along with a notice confirming the deduction received from the tax office. Microsoft Word version 2003 or higher (or similar program) is required to open.

Note: There is no single standard application form established by law, therefore some organizations have introduced their own application form. In this case, you may be asked to rewrite it according to the internal form.