What can and cannot be adjusted

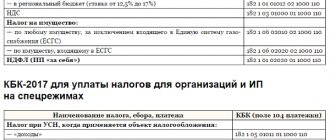

There are a number of errors that are considered non-critical in payment orders, i.e. subject to editing (for example, an incorrectly entered BCC - budget classification code, TIN, KPP, name of the organization, etc.) and they are the ones that are corrected by submitting the appropriate application to the tax office.

At the same time, there are inaccuracies that cannot be corrected in the manner described above:

- incorrectly specified name of the receiving bank;

- Invalid federal treasury account number.

In cases where the sender of the payment made errors in such details, the function of paying the contribution or tax will not be considered completed, which means the money will have to be transferred again (including late fees, if any).

How to change the purpose of an executed payment

There is no standard form for a letter to clarify the purpose of payment. Let's figure out how to draw up this document (a sample is provided below) to avoid or prevent adverse tax consequences.

1. A letter to clarify the purpose of payment is drawn up by the payer

If the payee discovers an error, he notifies the payer and asks to make changes. The recipient himself does not have the right to change the purpose of the money received to him. For example , he cannot offset the prepayment under the new contract against the debt on the old delivery.

If the payer indicated in the purpose of payment “Advance payment under the agreement. “, then the recipient is obliged to record this amount as an advance payment and charge VAT on it (paragraph 2, paragraph 1, article 154 of the Tax Code of the Russian Federation). Otherwise, the tax authorities will do it for him and charge additional penalties and fines.

2. The banks through which the payment was made must be notified of changes in the purpose of the payment.

The judges recommend the following course of action. The payer notifies his bank in writing of the need to change the purpose of the payment and asks to put an acceptance mark on his copy of the letter. The payer attaches this letter with the bank’s mark to the original payment document. The payer's bank sends the second copy of the letter through its channels to the recipient's bank. The payee receives this letter from his bank and attaches it to the payment slip.

If the bank refuses to accept a letter from the payer about changing the purpose of payment, you will have to send it by registered mail with a list of the attachments. Proof of sending and clarification of payment is the post office mark on the inventory.

3. It’s safer not to delay correcting the purpose of payment

It is advisable to correct an error in the purpose of payment as quickly as possible. If a significant period of time has passed since the date of payment, there is a risk that the tax authorities or the court will invalidate the new purpose of payment. That is, they will consider that the money was transferred precisely on the basis that was originally indicated. And the specified purpose of payment will not be taken into account.

It is not clear what period is considered reasonable for correcting an error in an executed payment. Each dispute is individual. There are examples where the court found it unreasonable to adjust the payment after the following deadlines have passed from the date of the banking transaction:

- two years (Resolutions of the Arbitration Court of the Volga District dated March 24, 2015 N F06-20843/2013, F06-21795/2013, FAS Moscow District dated October 24, 2005 N KG-A40/10239-05-P and the Second Arbitration Court of Appeal dated December 2. 2010 N A28-5541/2010-179/22);

- one year (Resolutions of the First Arbitration Court of Appeal dated 06/09/2015 N A11-9168/2014 and the Second Arbitration Court of Appeal dated 02/19/2013 N A82-8699/2012);

- nine months (Resolution of the Arbitration Court of the West Siberian District dated June 10, 2015 N F04-8740/2014);

- six months (Resolutions of the Federal Antimonopoly Service of the North-Western District dated December 12, 2012 N A66-6747/2011 and the Twelfth Arbitration Court of Appeal dated November 18, 2014 N A12-23638/2014);

- five months (Resolution of the Eighth Arbitration Court of Appeal dated February 16, 2010 N A46-19197/2009);

- two and a half months (Resolution of the Federal Antimonopoly Service of the Central District dated March 3, 2011 N A09-5609/2010).

Therefore, it is safer to adjust the purpose of the payment within one to two months from the date the money is written off from the current account.

4. The letter indicates the details of the corrected payment, the erroneous and correct purpose of the payment

This is interesting: Sample contract header with individual entrepreneur

It is advisable to attach a copy of the payment order to which changes are being made to the letter. Despite this, in the text of the letter it is better to repeat the original purpose of the payment and the main payment details:

- date and number of the adjusted payment order;

- payment amount (including in words);

- recipient's name and bank details. The absence of this information in the letter may negate all efforts to adjust the purpose of the payment. There is a risk that the court will not recognize the new payment purpose as valid. For example , if the letter does not indicate the number of the corrected payment order (Resolution of the Federal Antimonopoly Service of the East Siberian District dated June 27, 2003 N A19-10165/02-15-Ф02-1903/03-С1).

Next, the letter indicates the correct purpose of the payment. Completely, including a link to the details of the contract or invoice, the rate and amount of VAT (even if everything in these details was correct). It is very important not to make a mistake in the purpose of payment again.

5. It’s safer to agree on a new payment purpose with the recipient

A new payment purpose can be agreed upon with the recipient in one of the following ways:

- by exchanging letters. First, the payer notifies the recipient of the error in the purpose of the payment and suggests the correct wording. The recipient, in response to this notification, sends the payer a letter confirming his consent to change the purpose of the payment;

- a separate agreement between the payer and the recipient.

It is advisable to attach the relevant document - a response letter from the payee or an agreement between the parties - to the letter that the payer sends to the bank.

6. The letter about changing the purpose of payment is endorsed by the same officials who signed the payment

This applies to cases where the payment order being corrected was drawn up on paper.

If an organization makes payments through the Internet - Bank or Client - Bank system, the letter is signed by persons who have the right to sign on bank documents. That is, those persons who are indicated on the card with sample signatures and seal imprints (clause 2.3 of the Regulations on the rules for the transfer of funds, approved by the Bank of Russia on June 19, 2012 N 383-P). Only they have the right to manage money in the organization’s current account. This means that only they have the authority to change the purpose of the executed payment.

A stamp on the payment clarification letter is required if it is affixed to the card with sample signatures and seal imprints. If a stamp is not provided on the card, it may not be stamped on the letter.

Features of drawing up an application

An application for clarification of payment to the tax service today does not have a unified uniform form, so employees of organizations and enterprises have the opportunity to write it in any form or, if the company has a developed and approved document template, based on its sample. The main thing is that office work standards are observed in terms of the structure of the document, and some mandatory information is also entered.

In the header you need to indicate:

- addressee: name and number of the tax service department to which the application is sent, its location, position, last name, first name and patronymic of the head of the territorial inspection;

- similarly, information about the applicant company is entered into the form;

- then in the middle of the line the name of the document is written, and just below it is assigned an outgoing number and the date of preparation is indicated.

In the main part of the application you should write:

- what kind of mistake was made, indicating a link to the payment order (its number and date);

- Next, you need to enter the correct information. If we are talking about some amounts, it is better to write them in numbers and words;

- Below it is advisable to provide a link to a provision of law that allows for the inclusion of updated data in previously submitted documents;

- if any additional papers are attached to the application, this must be reflected in the form as a separate item.

Who draws up the document

The application for clarification of payment to the tax service does not have a unified form, so it can be drawn up in any form. It is only necessary to pay attention to the correctness of its preparation and to comply with the norms of office work in terms of the structure of the document, and some mandatory information was also entered.

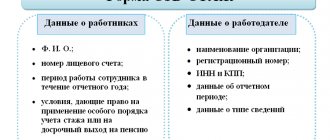

| Field | What needs to be indicated |

| Statement header | · Name of the tax authority where the application will be sent; location; position, surname, name, and patronymic of the head of the tax service; · The name of the organization from which the application is received, its location address, as well as the last name, first name and patronymic of the head of the company · Document's name; · Outgoing number and date of application. |

| a common part | This part of the document describes the current situation; you must refer to the document that was sent earlier, after which you must ask for clarification of the payment and enter the correct details. It is also advisable to include a link to the legal provision, according to which you have the right to make adjustments to a previously sent payment where errors were made. If additional documents are attached to the application, this must be reflected in an additional paragraph. |

| Conclusion | Attachment: copies of documents with incorrect details Signature of the head of the organization. |

The obligation of current account owners to indicate the purpose of payment when issuing a payment document is regulated by the Regulations of the Bank of Russia.

This procedure is associated with disclosing the essence of transactions, making it more transparent and understandable for regulatory authorities and counterparties.

A letter to clarify the purpose of the payment is drawn up after an employee of the enterprise has discovered an error in a previously sent payment document.

The inaccuracy may also be detected by the recipient of the funds. He cannot correct it on his own; to correct the document, he must contact the counterparty.

Sometimes the recipient corrects the error using his own capabilities and then notifies the recipient of his actions. But as a result of such manipulations, controversial issues may arise; the truth will always be on the sender’s side; it is better to exclude this method from practice.

Only the payer sends a letter to the bank to change the purpose of the payment.

Before sending an application to a credit institution, the sender sends a request to the recipient for approval of the changes.

A simple notification will not be enough; written consent from the recipient is required.

There is no unified form for such a letter; faced with the need to draw up a document, many employees of business entities find it difficult to draw it up.

The message is written in free form, in the upper right corner the details of the party issuing the request are written (name, address, tax identification number, checkpoint).

A heading is recorded in the center of the sheet: “message about a change in the payment order in the purpose of payment.” The following is the text part, which indicates:

- name of the sender of funds;

- date, number, amount of the payment order, with an incorrect indication of the purpose;

- erroneous payment purpose text (as stated in the document);

- corrected, correct text part;

- request to the recipient to confirm consent to amend the payment order.

The letter is signed by the head of the enterprise and the chief accountant.

Situations arise when the buyer mistakenly highlighted VAT in the purpose of payment. Tax inspectors can detect the allocation of tax much earlier than their on-site audit by conducting a desk audit of declarations for the period in which the erroneous payment was made.

Having discovered a payment with VAT, the supervisory authorities will make the assumption that the buyer will be issued an invoice with the allocated tax that had to be paid to the budget.

Thus, the occurrence of a typo can cause a lot of trouble for the seller. To avoid unpleasant moments and attract the attention of buyers, it is necessary to write “Without VAT” in large font on the invoices issued for payment.

Typically, the responsibility for filing an application to clarify the payment to the tax office lies with the employee of the accounting department who made the payment, or with the chief accountant. In this case, the application itself must be signed not only by the employee who compiled it, but also by the head of the company.

What to pay attention to when filling out the form

Just like the text of the application, there are no special requirements for its execution, so it can be formed on a simple sheet of any convenient format (usually A4) or on the organization’s letterhead.

You can write the application by hand or type it on a computer.

The main thing is that the document contains a “living” signature of the head of the applicant company or a person authorized to act on his behalf (in this case, the use of facsimile autographs, i.e. printed by any method, is prohibited).

There is no strict need to certify the form with a seal - this should be done only if the use of stamp products is enshrined in the regulatory legal acts of the enterprise.

The application should be made in two copies , one of which is transferred to the tax office, and the second remains in the hands of the representative of the organization, but only after the tax specialist puts a mark on it accepting the document.

Payment clarification letter: sample

A letter to clarify the purpose of payment, a sample of which is given below, is drawn up in any form. With this letter, the payer agrees with the recipient on the change in the purpose of the payment. The payer indicates the correct name of the payment purpose and asks the counterparty to give written consent to the change in the payment order. If an agreement with a counterparty, for example, provides for the payer’s right to change the purpose of payment by sending a notification to the recipient without the need to obtain consent, there will be no need to wait for a response from the counterparty.

This is interesting: Furniture supply agreement sample

After the change in the purpose of the payment has been agreed upon with the recipient of the money, the payer sends to his bank a notice of the change in the payment order, to which he attaches the written consent of the counterparty, as well as a copy of the original payment order. The notification to the bank must be signed by the same persons who signed the corrected payment order.

For a letter about clarification of payment to a counterparty, we provide a sample of how to fill it out.

How to submit an application

The application can be submitted in different ways:

- The simplest, fastest and most accessible way is to come to the tax office in person and hand over the form to the inspector.

- Transfer with the help of a representative is also acceptable, but only if he has a notarized power of attorney.

- It is also possible to send the application via regular mail by registered mail with acknowledgment of receipt.

- In recent years, another method has become widespread: sending various types of documentation to government accounting and control services via electronic means of communication (but in this case, the sender must have an officially registered electronic digital signature).

How to change the purpose of payment in an executed payment order

The error may be detected by the payee. Since he cannot independently correct the purpose of the payment, he must make this request to the payer. There are cases when the recipient independently corrects the error and notifies the payer about it. However, in case of disputes, the truth will not be on the recipient’s side, so it is better not to do this.

It is the payer who can send a letter about changing the purpose of payment (we will provide a sample at the end of the article) to the bank. Thus, if the payer himself discovered an error in the payment, he must proceed as follows: agree on a change in the purpose of the payment with the recipient; consent must be asked to be given in writing. Simply notifying that you want to change the purpose of the payment will not be enough in this case. After receiving the recipient's consent, send a message to your bank about changing the purpose of the payment.

Causes and common types of errors

Payment orders are usually drawn up by an employee of the accounting or financial department. When filling out a document manually, errors are inevitable. Most often, employees make mistakes in the contract number or its date, incorrectly indicate the name of the paid goods or services, and when transferring tax, they make mistakes in the BCC and payment period. In 2020, due to the change in the VAT rate from 18% to 20%, cases of errors in indicating the tax rate and amount have become more frequent. We will tell you how and in what cases to write a sample letter about an error in the purpose of payment.

Some details must be corrected, but in some cases this is not necessary. A clarifying letter must be drawn up if the translation cannot be clearly identified, that is, it cannot be determined for what and on what basis the payment was made. If the error is not critical, a clarification notice need not be drawn up.

How long should you store

When erroneously allocated details are identified, and there is reason to believe that the order was drawn up incorrectly, a letter is sent to clarify the details, including the correct allocation of VAT.

When a letter is sent, it is recorded in the journal of outgoing documents, and one of the copies must be attached to the current primary documents. It is stored for the period established for such forms in accordance with company regulations and laws, but not less than three years.

When a document loses its relevance and the mandatory storage period expires, the letter can be redirected to the archive, or it can be disposed of in accordance with the procedures reflected in the laws.