A payment order is an order issued by the account holder to the servicing bank for the purpose of making any payments. Despite the fact that the need to fill out this document appears quite often in enterprises, many specialists have problems filling out this form. One of the most common difficulties is filling out fields 106 and 107. Let's try to figure out how to fill out these fields correctly. Moreover, in the latest Letter dated April 26, 2018 No. KCH-3-8/2721, Federal Tax Service officials clarified this issue.

A detailed description of filling out the fields of payment documents is given in the “Regulations on the rules for transferring funds” (approved by the Bank of Russia on June 19, 2012 No. 383-P). Their correct execution eliminates disputes with control authorities. Errors made when filling out certain sections may result in additional taxes being assessed.

Why is field 106 necessary in a payment order?

The rules for filling out payment slips are enshrined in the Bank of Russia regulation “On the rules for transferring funds” dated June 19, 2012 No. 383-P.

The so-called basis for payment is entered in the field, or, in other words, the code of the reason for which the payment is made is indicated.

This field requires completion in the following cases:

IMPORTANT! When generating payments that do not relate to tax and customs duties, this field is set to 0.

Below is the location of field 106 in the payment order:

For details that fall into the remaining fields of the payment document, read the article “Basic details of a payment order.”

Required details

The same form number of the form is always indicated in the upper right corner - 0401060. Next, the serial number of the document is written. It is assigned by the bank and consists of 6 digits. Identification is carried out using the last three digits.

The date is entered in the format DD.MM.YYYY. If a document is sent via Internet banking, the system assigns the required format independently. If the document is drawn up on paper, then it is important not to confuse the first two indicators.

The type of payment is specified in the form of a code approved by the bank. The amount in words is indicated only in paper payments. The same information is duplicated separately in numbers. Rubles are separated from small change by a sign (“”). If the amount is indicated without kopecks, then you can put the “=” sign (7575=).

In the “Payer” field, the legal entity indicates its abbreviated name. If the payment is sent abroad, the address of the location is additionally indicated. Individual entrepreneurs and individuals indicate their full names. (in full) and legal status. In the case of an international payment, the address of residence is additionally indicated. Payment can be made without opening an account. In this case, the document contains the name of the bank and information about the payer: his full name, tax identification number, address. The payer's account must consist of 20 digits.

The document contains the name of the sender and recipient's bank, its address, BIC, correspondent account numbers, and the abbreviated name of the recipient. If the transfer is made through an account opened with another financial institution, then the client’s account number is additionally indicated.

In the “Type of transaction” field the payment code is entered, in the “Payment purpose” - what exactly the payment is for. If we are talking about budget payments, then the information from this field should complement the “Base of payment” (106). Penalties and fines are paid with a unique code, but goods and services are paid without it. After filling out all the fields, the stamp and signature of the bank’s responsible person is affixed.

These are standard details that must be present in any payment document. Now let's look at the additional fields that are filled in when transferring taxes.

https://youtu.be/rHmZl7SXySY

What are the requirements for filling out field 106 in a payment order in 2020?

Regulation No. 383-P stipulates that the entry in this field should not be longer than 2 characters representing capital letters of the Russian alphabet.

For tax payments

| Field 106 | Designation |

| TP | Payment of taxes for the current year |

| TR | Payment of debt based on the requirements of the Federal Tax Service |

| ZD | Payment of debt (without the requirement of the Federal Tax Service) |

| RS | Payment of taxes by installments |

| FROM | Payment of taxes with deferred payment |

| RT | Payment of taxes taking into account restructuring (according to schedule) |

| VU | Payment is deferred due to the introduction of external management |

| ETC | Payment of debts that cannot be collected |

| AP | Payment of taxes based on the act of the Federal Tax Service |

| AR | Payment of taxes based on court orders |

| TL | Payment by third parties for a creditor due to bankruptcy |

| IN | Payment of investment loan for taxes |

| RK | Payment of debt from the register of claims of debtors participating in bankruptcy proceedings |

| ST | Payment of current debt of a bankrupt creditor |

For foreign trade payments

| Field 106 | Designation |

| DE | Payment according to customs declaration |

| BY | Payment based on receipt order |

| ID | Payment based on an executive document |

| HF | Payment by receipt to pay the sanction |

| IP | Payment by collection |

| THAT | Payment based on requirement |

| CT | Payment taking into account changes in customs value |

| DB | Payment based on customs requirements |

| IN | Payment based on collection document |

| KP | Payment subject to an agreement on centralized payment of payments by large creditors |

It should be noted that the indicator in this column affects the value of the fields:

- 107 - tax period;

- 108 - date of the document on the basis of which payment is made.

Read about filling out other payment details in this section of our website.

Nuances

The procedure for filling out a payment order at the request of the Federal Tax Service in 2020 has its own peculiarities. This applies to fields that must be traditionally filled out. The main nuances are discussed below in the table.

| Filling out a payment based on the request from the Federal Tax Service | |

| Field | What to indicate |

| 106 “Basis of payment” | The value should be “TR”. That is, the debt is repaid on the basis of a request received from the tax authority. |

| 107 “Tax period indicator” | The payment deadline established in the request for payment of taxes, fees, and contributions received from the Federal Tax Service is given. The format for filling out this field should be strictly as follows: “DD.MM.YYYY” For example, if we are talking about a late advance tax payment for the 2nd quarter of 2017, then field 107 should be like this: KV.02.2017 |

| 108 “Document number” | Number of the request for payment of tax, insurance premium, fee (without intermediate signs). In other cases, this field is not filled in at all. |

| 109 “Document date” | The date of the tax authority's request for payment of tax, insurance premium, or fee is transferred to this field. It is located next to the request number. In other cases, when voluntarily deducting current payments, indicate the date of signing the tax reporting (declaration). |

In field 106 “Base of payment”, enter exactly “ZD” if you voluntarily pay off debts for expired tax periods, but there have been no demands from the Federal Tax Service for payment of tax (fee, insurance contribution).

Results

Correctly filling out the payment form, including field 106, helps to avoid unnecessary disputes with regulatory authorities. By incorrectly entering any details, the payer thereby creates problems, the solution of which requires additional measures, and this requires additional labor costs and can lead to penalties and fines.

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

The corresponding code in field 106 of the payment order is the basis for the payment made to the budget and will help it be correctly identified by the tax authority. We’ll figure out how to fill it out in 2020 further.

Why is field 106 necessary in a payment order?

This detail deciphers the basis for transferring the amount of funds according to the payment document. It is filled in when transferring:

- taxes, fees, insurance payments;

- funds as fulfillment of obligations in case of late payment of taxes, fees and insurance premiums (penalties, arrears, collection upon request, inspection report or writ of execution);

- funds to pay off debts in a bankruptcy case.

In other cases, “0” is entered in field 106. If the tax authority cannot accurately identify the payment, then the received funds are independently attributed to any of the grounds in accordance with tax legislation.

Payer status (101)

If the “Base of payment” detail (106), the explanation of which will be presented below, identifies the purpose of the funds, then the data in cell “101” determines who is making the transfer. There are 26 payer statuses in total. Let's look at the most popular ones (see table below).

| Legal face |

| Agent |

| Foreign trade participant – legal entity. face |

| Individual – participant of foreign trade activities |

| Individual entrepreneur – participant of foreign trade activities |

| Entrepreneur |

| Notary |

| Lawyer with his own office |

| Head of a farm |

| Other individual – bank account holder |

| The taxpayer making payments to individuals. persons |

| Organizations that transfer funds withheld from salaries |

| Taxpayer group member |

| An individual transfers money to pay insurance premiums |

It is also necessary to check whether the transfer matches the status of the sender.

| Payment | Status |

| Personal income tax and VAT are paid by the tax agent (organization, individual entrepreneur) | |

| Taxes are paid by the organization (IP) | 01 (09) |

| Insurance premiums are transferred by the enterprise, individual entrepreneur | |

| Individual entrepreneur transfers fixed contributions |

If an individual entrepreneur pays personal income tax on his income, then the transaction should be assigned the status “09”. If an entrepreneur pays personal income tax on the income of employees, then he acts as an agent. In this case, you need to indicate the status “02” on the payment.

The status indicated when transferring land tax or income tax depends on the BCC. The table of details is presented in the letter of the Ministry of Finance No. 10/800. Before filling out the document, you should check the data with the table to avoid errors. If the BCC is indicated incorrectly, a tax arrears will arise.

Payments with different statuses are recorded in different personal accounts. If this detail is specified incorrectly, in the internal accounting of the Federal Tax Service the amount will be credited to the debt, which the individual entrepreneur may not have. The tax for which the payment was sent will remain unpaid, even if the details “Base of payment” (106) are registered. The fine and penalty will be charged on the amount of the resulting arrears. Most often, such situations arise in organizations that are both payers and agents.

Basic codes for filling out field 106

According to Appendix No. 2, transfer of funds for payments accounted for by the tax office, field 106 can have the following meanings:

| Code | Decoding |

| TP | Current year payments (current payments) |

| ZD | Repayment of debts incurred during previous tax periods on a voluntary basis |

| BF | Current payment paid from the account of an individual - the owner of this account |

| TR | Repayment of debt made on the basis of a demand for payment issued by the tax authority |

| RS | Repayment of debt by installments |

| FROM | Deferred debt repayment |

| RT | Debt repayment under a debt restructuring scheme |

| PB | Paying off debt when bankruptcy proceedings are applied |

| TL | Repayment by the owner of the debtor's property (founder, participant) of a unitary enterprise or a third party of debts in the event of opening a bankruptcy case |

| ST | Payment of current debt in a bankruptcy case |

| ETC | Repayment of debt that has been suspended for collection |

| AP | Funds are transferred to pay off the debt specified in the tax authority’s audit report |

| AR | Repayment of debt collected during enforcement procedures |

| IN | Investment tax credit payment |

Appendix No. 3 contains field 106 codes for customs and other payments:

| Code | Decoding |

| DE | Declaration for goods, excluding declarations for goods for which payers pay customs duties, guided by Articles 114, 115 and 116 of Law No. 311-FZ of November 27, 2010, through electronic or payment terminals, ATMs. |

| PD | Passenger customs declaration |

| BY | Customs receipt order (except for orders for which payments are made in accordance with Articles 114, 115 and 116 of Law 311-FZ through electronic or payment terminals, ATMs) |

| CT | Adjustment of the declaration for goods (except for adjustments for goods for which payments are made in accordance with Articles 114, 115 and 116 of Law 311-FZ through electronic or payment terminals, ATMs) |

| THAT | Requirement for payment of customs duties (except for those for which payments are made in accordance with Articles 114, 115 and 116 of Law 311-FZ through electronic or payment terminals, ATMs) |

| ID | Executive document |

| DB | Documents related to the activities of customs authorities |

| IP | Collection order |

| IN | Collection document |

| KP | Agreement on interaction in relation to large payers of payments in the order of centralization |

| DK | Declaration for goods for which payments are made by payers on the basis of Art. 114, 115, 116 of Law 311-FZ through electronic or payment terminals, ATMs |

| PC | Customs receipt order, when payments are made by payers on the basis of Art. 114, 115, 116 of Law 311-FZ through electronic or payment terminals, ATMs |

| QC | Adjustment of the goods declaration, for which payments are made by payers on the basis of Art. 114, 115, 116 of Law 311-FZ through electronic or payment terminals, ATMs |

| TK | The requirement to pay customs duties, for which payments are made by payers on the basis of Art. 114, 115, 116 of Law 311-FZ through electronic or payment terminals, ATMs |

| HF | International mail recipient's receipt |

| 00 | Code for other cases |

The indicator entered in field 106 affects the completion of the following parameters of the payment order:

- field 107 – indicates the tax period for which payment is made;

- field 108 – the date is entered in accordance with the document - the basis for payment.

The payment code basis, column 106, is intended to indicate cash payments when fulfilling taxpayers’ obligations to the budget of the Russian Federation and is not used in other cases. In what order are these details filled out? Is it possible to enter a zero value? Let's understand the regulatory requirements.

Legal settlement

If the basis of payment (106) “TP” means voluntary repayment of overdue debt, then the following codes are used if the Federal Tax Service has sent a request to repay the debt.

| Reason for payment (106) | Period (107) | Number (108) | Date (109) | |

| TR | Payment of debt at the request of the Federal Tax Service | The deadline established in the document | Number and date of the claim, decisions on installments, deferment, restructuring | |

| RS | Payment of overdue debt | Date established by the installment schedule | ||

| FROM | Payment of deferred debt | Deferred repayment date | ||

| RT | Repayment of restructured debt | Date set by the restructuring schedule | ||

If the debt repayment case has been sent to court, how to fill out the payment order (field “106”)? The basis for payment will depend on at what stage of the legal investigation the debt is repaid.

| Reason for payment (106) | Period (107) | |

| PB | Payment of debt during bankruptcy proceedings | Procedure completion date |

| ETC | Payment of debt suspended for collection | Suspension end date |

| AP | Payment of debt under the act | |

| AR | Payment of debt under a writ of execution | |

This is what a correctly executed payment order should look like (field “106”: “Base of payment”). The document must also indicate the material number and the date of the relevant court decision.

How else can a payment order be filled out (“Basis of payment”, 106)? A sample filling can be found in the table below.

| Payment code | |

| TL | Repayment by the owner of the property of a debtor-enterprise of debt during bankruptcy proceedings |

| ST | Payment of current debt during bankruptcy proceedings |

If the “Base of payment” field (106) is not filled in, Sberbank or another credit institution through which the payment passes assigns code “0”. This means that the payment cannot be identified.

Why do you need field 106 in the payment slip?

One of the main instruments for non-cash payments is a payment order, the standard form of which was approved by the Bank of the Russian Federation in Resolution No. 383-P dated June 19, 2012. The same act regulates the procedure for filling out details, including field 106. According to clause 4 of Appendix No. 1 to the Resolution, the indicator “basis of tax payment” is indicated only when transferring funds to the state budget.

This regulation applies to both legal entities and entrepreneurs, as well as individuals. Payment information is identified by types of deductions, that is, taxes, fees, contributions; by the method of debt repayment - voluntary or forced; time of occurrence of obligations - payments of past periods, current year, etc. In order to correctly fill out the payment order and field 106 in 2017, you should be guided by the current list in clause 7 of Appendix No. 2 to Order of the Ministry of Finance No. 107n dated November 12, 2013.

Payment Identifier (UPI)

Also, special attention should be paid to field 22 - “Unique payment identifier” (UPI). This consists of 20 or 25 characters. As a general rule, the UIP should be reflected in the payment only if it is set by the recipient of the funds. In addition, the latter must communicate its value to the payer (clause 1.1 of the instruction of the Central Bank of the Russian Federation dated July 15, 2013 No. 3025-U).

When transferring amounts of current taxes, fees, and insurance premiums calculated by the payer independently, additional identification of such payments is not required. In this case, the identifiers are KBK, INN, KPP and other details of payment orders. In field 22 “Code” it is enough to indicate “0”. In this case, the bank:

- cannot refuse to execute such an order;

- does not have the right to require filling out the “Code” field if the payer’s TIN is indicated (letter of the Federal Tax Service dated 04/08/2016 No. ZN-4-1/6133).

At the same time, filling out a payment order at the request of the Federal Tax Service for 2020 obliges to transfer to the payment the UIP value, which must be indicated in the submitted request.

Otherwise, filling out the fields of a payment order at the request of the Federal Tax Service does not have any fundamental features.

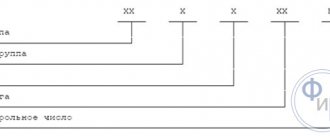

Reason for payment field 106 – decryption

Let's look at the decoding of the basis for payment in a payment order, and how data is entered into this detail. The indicator value always consists of two capital printed letters and is filled in in the “XX” format. It is not allowed to leave a blank payment basis in the payment slip: you must either enter an official symbol or enter “0”.

Valid types of the “payment basis” indicator in field 106:

| Letter encoding | Explanation of values according to clause 7 of Appendix No. 2 of Order No. 107n |

| TP | The basis for the TP payment is the designation of all transfers of the current calendar year |

| ZD | Used for voluntary transfer of amounts of obligations for past periods, and there is no requirement of the Federal Tax Service |

| BF | Current transfers of an individual from his own current account |

| TR | Used for forced repayment (according to the requirements of the Federal Tax Service) of obligations |

| RS | Indicated upon fulfillment of obligations on overdue debts |

| FROM | Indicated when fulfilling obligations on deferred debts |

| RT | Indicated upon fulfillment of obligations under restructured debts |

| PB | Applicable when fulfilling obligations by a debtor company during bankruptcy |

| ETC | Indicated when fulfilling obligations on debts suspended for collection |

| AP | Indicates the fulfillment of obligations based on the results of inspection reports |

| AR | Indicated upon fulfillment of obligations based on the results of the writ of execution |

| IN | Used when paying amounts within the framework of an investment loan from the Federal Tax Service |

| TL | Indicates the transfer of debts by third parties for a debtor company in bankruptcy |

| ST | Applicable when paying current debts by a bankrupt debtor |

Note! The basis for payment is a penalty, as such in clause 7 of Appendix No. 2. To indicate what kind of debt is being repaid - tax, penalties or fines, you should select a separate BCC and indicate the code “ZD” in field 106 - in case of voluntary repayment of obligations; “TR” - when repaying at the request of the territorial division of the Federal Tax Service or "AP" - when making payments according to the inspection report.

Taxable period

Let us separately consider how the “107” detail is filled in when making payments. In all of the above transactions, the tax period is reflected as follows:

- transfer of insurance premiums – “0”;

- tax transfer – 10-digit code of the Federal Tax Service in the format “SS.UU.YYYY”.

The first characters of the code will decipher the payment period:

- "MS" - month.

- "KV" - quarter.

- "PL" - half a year.

- "GD" - year.

The fourth and fifth characters after the dot indicate the period number. If the tax is paid for January, “01” is entered, if for the second quarter – “02”. The last four signs indicate the year. These three groups are separated by dots. This scheme allows you to quickly decrypt payments. For example, VAT is transferred for February 2020, then in detail “107” you need to enter “MS.01.2015”. If there are several deadlines for the annual fee, and separate payment dates are set for each, then these dates are indicated in the period.

If funds are transferred not for the full reporting period, but only for several days, then the first two characters will look like “D1” (2,3). Depending on what figure is indicated, the tax is transferred for the 1st, 2nd or 3rd decade. If payment is made at the request of the Federal Tax Service, then a clear date of the act must be indicated. The specific period must also be indicated in the payment document if an error was discovered in a previously submitted declaration, and the taxpayer tries to independently charge additional fees for the expired period. In this case, in the fourth and fifth digits you need to indicate for what specific period the additional fee is charged.

When a zero indicator of the basis of payment is allowed 106

Due to the fact that the basis for payment is, first of all, the amount of obligations to the budget, taxpayers ask themselves: what will happen if this field is filled out incorrectly? As mentioned above, it is not allowed to leave an empty gr. 106, but putting “0” or indicating an incorrect value is not considered sufficient grounds for refusing to credit the payment.

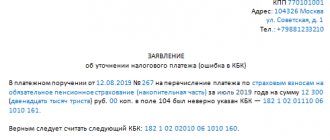

If for any reason the payer has entered “0” or an incorrect letter code, tax officials independently assign the required value, focusing on general legal requirements (clause 7 of Appendix No. 2 of Order No. 107n). Received funds are not subject to classification as unidentified income and are credited to the taxpayer’s account. To clarify the payment, you may need to provide written explanations in the form of a statement in any form.

Consequences of repeated violations

Violations of tax legislation are regulated by the Code of Administrative Offenses of the Russian Federation and are subject to administrative penalties in the form of fines. The imposed penalty obligations do not relieve the taxpayer from fulfilling them - only the court can decide to remove the penalty from the person. Therefore, payment of fines is a necessary measure.

Note! The Code of Administrative Offenses establishes a list of offenses for which they can be fined under the relevant article.

In Art. 15.3-10 of the code lists the main reasons for applying fines:

- Late registration of a business entity or conducting illegal activities without registration. Fine 500-3000 rubles*.

- Delay in providing information on opening/closing a bank account, etc. Fine from 1000 to 2000 rubles*.

- The declaration was not submitted to the territorial tax authorities on time. Fine from 300 to 500 rubles*.

- Failure to provide data that must be submitted to control the economic activities of the organization. Fine 100-1000 rubles*.

- Violations related to opening a bank account. Fine 1000-3000 rubles*.

- Late calculation and deduction of taxes. Fine from 4000 to 5000 rubles*.

- Violations of the deadline for making customs payments. Fine from 500 to 300,000 rubles*.

Detected violations are recorded in the protocol, then a decision (resolution) is made to apply sanctions or release them. The resolution acquires legal force 10 days after its adoption.

Repeated offenses in the field of taxation are aggravated by administrative punishment (Article 112, paragraph 2 of the Tax Code of the Russian Federation). Paragraph 3 of this article states that if a person has been subject to penalties, they are valid for one year after the court decision enters into force. If during this period the violator commits a tax crime again, the amount of the fine will be increased by 100% (Article 114 of the Tax Code of the Russian Federation).

Conditions for repeated offenses:

- New violation after the entry into force of the decision in the previous case.

- The interval between violations is less than a year.

- The statute of limitations for imposing administrative punishment has not expired.

Article 129.1 of the Tax Code of the Russian Federation provides for punishment for failure to provide the Federal Tax Service with information that must be submitted in the manner established by law. Such a violation, if repeated, entails a 4-fold increase in the fine. However, one should keep in mind mitigating circumstances that reduce the amount of sanctions in the manner prescribed by Article 114 of the Tax Code of the Russian Federation, 3 paragraphs.

Features of paying fines

A payment order or payment order is a document used to make non-cash payments. It is a form in which information is entered in encoded form. The document was approved by the Regulations on the rules for conducting transfers of funds in domestic currency on the territory of the Russian Federation. The specifics of filling out this paper are dictated by the conditions of document flow, since all information is processed automatically.

Important! When paying fines, you must indicate a specific department of the Federal Tax Service and its details as the recipient.

The basis for the payment in the form is a fine, so it is issued at the request of the tax service. To fill out the order, the UIN may be useful. Persons receive it along with a notification of a fine.

The payment order for the payment of fines is drawn up in the same form as for the payment of current tax obligations. The document contains fields with codes. In column “106” indicate the basis for payment when paying a fine to the tax office by court decision and enter TR (on request). To pay current obligations, such as taxes, fees, and insurance premiums, a ZD is entered on the form.

The UIN should be entered in field cell 22, but if it is not there, then the person indicates “0”. This rule also applies to other details - if they are not known to the payer for some reason, then zero must be entered instead. As a rule, this situation arises if the Federal Tax Service does not send a notification to the payer.

In the case where an economic entity has received a demand for repayment of a fine, field “107” indicates the payment period that is established for paying the debt. In addition to this data, it is necessary to correctly fill in the lines for the OKTMO and KBK codes:

- OKTMO is the territorial identifier of the municipality where the person is registered. Its value coincides with that indicated when paying taxes. The code length is 8 characters.

- KBK - budget classification code. It is important to take into account several nuances: the BCC refers to the year the fine was paid, not its actual accrual; The meaning of the code for debt obligations, fines and penalties varies.

How to fill out a payment order to the Federal Tax Service

Features of the formation of “payments” for insurance premiums

There are also some features of the formation of payment slips for penalties on contributions:

- KBK

The information is reflected in field 104. For penalties on insurance premiums, your own BCC is used, in which categories 14-16 differ from the BCC for basic contributions or fines. Due to the division of the KBK from 2020, there is no need to fill out field 110, which reflects the type of payment. Previously, it indicated the code “PE”, which is currently not used, since penalties can be judged by the KBK.

In this material you can familiarize yourself in detail with all the BCCs related to insurance premiums;

- basis of payment

The information is reflected in field 106. For basic insurance premiums, the coding “TP” is entered - current payments. The following options are available for penalties:

— code “ZD”, if penalties are calculated and paid by the organization independently. In other words, this is a voluntary transfer of debt for past periods when the tax office has not yet issued a demand for payment;

— code “TR”, if the company pays penalties at the request of the tax inspectorate;

— code “AP”, if the company pays penalties based on the inspection report;

- taxable period

The information is entered in field 107. The formation of this column depends on the basis of the payment:

- if the base code is “ZD”, then 0 is entered, since such transfers do not have a frequency. When paying a penalty for a certain period, for example, a quarter or a month, you can display it: MS.07.2018 - penalties for July 2020;

- if the base is code “TR”, then the period reflected in the request of the tax inspectorate is indicated;

- if the base code is “AP”, then 0 is indicated.

Payment algorithm

Payment of a fine based on the decision of the Federal Tax Service in 2020 is as follows:

- A person receives a demand from the tax office.

- The offender draws up a payment order to a banking organization to transfer funds to the Federal Tax Service account.

From 2020, third parties can pay fines. To do this, the document must indicate the payer status, INN and KPP of the person for whom the payment is being made. Individuals can pay fines through an online account on the website of the Russian Tax Service.

WIN

“Unique accrual identifier” includes 23 characters. This field is as important as “Basis for tax payment” (106). The UIN is entered in field “22” and in the “Purpose of payment”. Example: “UIN13246587091324658709/// Payment of fine...”.

There are situations when the UIN is missing. For example, when transferring taxes calculated by legal entities and individual entrepreneurs independently on the basis of declarations, the payment identifier is KBK, which is indicated in detail “104”. According to the new rules, a UIN is not formed in such cases.

Individuals who pay taxes upon notification from the Federal Tax Service receive a notification in the form of “PD”. The document is filled out automatically by the Federal Tax Service using software. A UIN is immediately formed in it. This code must be indicated in the payment order.

If the payer wishes to transfer tax to the budget without notifying the Federal Tax Service and filling out the notice, then he generates the document independently. This can be done through the electronic service on the Federal Tax Service website. The UIN will be assigned automatically on the receipt.

Taxes can be paid through a bank cash desk. In this case, the “PD4sb” notice is filled out. If the operation is carried out through Sberbank, then the UIN is not indicated. In this case, the document must include the full name. payer and his place of residence.

Sample order

Let's look at how to fill out a payment order to pay an administrative fine using a specific example. In IP "Zvezdin I.L." An audit was carried out, as a result of which the tax inspectorate determined that the company did not pay additional VAT. Based on these violations, the authorities sent demand No. 14-44/34124 dated January 28, 2018 for the payment of arrears, penalties and fines. Document UIN 42214533211348892011. Payer details:

- KBK - 18210301000013000110 (fines, interest, VAT fines for legal entities and individual entrepreneurs on the territory of the Russian Federation);

- OKTMO - 46704000 (Balashikha, Moscow region);

- TIN - 1243422344;

- Checkpoint - 411222444;

- The fine amount is 2000 rubles.

How is the fine paid to the Federal Tax Service? A sample payment order for 2020 is presented below.

Sample payment order

Criminal penalty

Note! Criminal liability in case of non-payment of taxes is regulated by Articles of the Criminal Code of the Russian Federation 198, 199 and 199.1.

This punishment also comes into force by decision of the Federal Tax Service, since the authorities send information to the investigative committee within 10 days after discovering violations of the law.

Article 198 of the Criminal Code of the Russian Federation threatens only individuals. The basis for its use may be failure to provide the necessary documentation to the Federal Tax Service or entering false information into the report. To be imprisoned, the amount of untransferred taxes must exceed 900 thousand rubles over 3 years. According to Art. 198 of the Criminal Code of the Russian Federation, a person pays a fine in the amount of 100,000 to 500,000 rubles*, which can be replaced by imprisonment for up to 3 years.

Article 199 of the Criminal Code of the Russian Federation applies to officials - managers and accountants of organizations that prepare financial statements. Sometimes employees who participate in fraudulent actions against the Federal Tax Service can be recognized as assistants. Grounds: non-payment of taxes in the amount of over 15,000,000 rubles for three years. Punishment is a fine of up to 500,000 rubles* or imprisonment for up to 6 years.

Article 199.1 of the Criminal Code of the Russian Federation applies to persons who deliberately did not transfer personal income tax. The punishment algorithm is similar to Art. 199 of the Criminal Code of the Russian Federation. The crime is committed from the moment of failure to pay the tax on time.

Criminal liability for tax offenses

When filling out a payment order, you must follow the recommendations described above. The document must be filled out correctly, otherwise it will not be possible to submit it to the bank. If errors are made in the details, the payment will not go through, which is why it will be classified as unclear or there will be a delay. It is better to clarify all the necessary information in advance at the territorial branch of the Federal Tax Service.

Refund

To avoid situations where tax arrears arise, you need to submit an application to the Federal Tax Service to clarify the payment. A copy of the payment slip must be attached to the document. If the status is indicated incorrectly, the funds will still go to the budget and to the correct current account. But for the Federal Tax Service, this amount will reflect the repayment of another tax. Only on the basis of an application can it be transferred to pay off real debt.

Before redistributing funds, the Federal Tax Service will reconcile the calculations of enterprises with the budget. If a positive decision is made, the inspectorate will cancel the accrued penalties. The taxpayer will be informed about the decision within 5 days. You can do it differently:

- remit the tax using the correct details in the payment slip;

- then refund the overpaid tax.

In this case, the company will only avoid the accrual of fines. The penalty will still have to be paid. Let's look at a sample application.

STATEMENT

about a mistake made

Irkutsk 07/16/2016

In accordance with paragraph 7 of Art. 45 NC OJSC "Organization" asks to clarify the payment. In detail “101” of receipt No. 416 dated July 16, 2020 for the transfer of VAT (specify KBK) in the amount of 6,000 (six thousand) rubles, the status “01” was incorrectly indicated. The correct status is “02”. This error resulted in non-transfer of tax to the budget of the Russian Federation to the treasury account. Please clarify the payment and recalculate the penalties.

Instructions for filling out a receipt for payment of a patent

- Go to the Federal Tax Service website www.nalog.ru.

- On the main page, in the top menu, select the “Electronic Services” section.

- Next, select “Fill out a payment order.”

- In the window that appears, select your territorial Tax Service. If you leave the field blank and click “Next”, the code will automatically be determined based on the address you entered.

- Select your Municipality, you can select from the drop-down list at the end of the input line. If you leave the field empty and click “Next”, the OKATO code will be automatically determined by the address you entered.

- Select the type of payment document: “Payment document”.

- Select the type of payment: “0 – Payment of tax, fee, payment, duty, contribution, advance (prepayment), tax sanctions, fines.”

- Enter KBK. If you do not know the BCC, leave the field blank and click “Next”, the corresponding code will appear automatically in the next step.

- Select the tax to be paid: “Tax levied in connection with the use of the patent taxation system, credited to the budgets of municipal districts (18210504020021000110).” Since the drop-down list contains a fairly long list of tax payments, you can write the word “patent” in the input field, then only lines containing the specified word will be reflected in the list.

- Select the status of the person who issued the payment document: “09 – taxpayer (payer of fees) – individual entrepreneur.”

- Enter the payment basis: “TP – payments for the current year.”

- Specify the tax period: “Specific date” and enter the date of payment of the corresponding amount.

- Provide identifying details: TIN, full name, address and payment amount (the amount is indicated in the patent issued by the tax authority).

- Select payment method: “Cash”.

- Click the “Generate payment document” button.

- Print out the receipt form and pay at Sberbank.