How to correctly indicate OKTMO in a payment order (field 105)? What to do if you fill it in incorrectly?

January 8, 2020 Payment order

In certain documentation of a business entity, a code according to the OKTMO directory must be written down.

Taxpayers indicate this detail when processing various payment orders and preparing financial statements submitted to the relevant state authorities.

The OKTMO code clearly informs about the territorial affiliation of the payer (business entity) to a certain region, municipal entity, or populated area.

Didn't find the answer to your question in the article?

Get instructions on how to solve your specific problem. Call now:

+7 Moscow — CALL

+7 St. Petersburg — CALL

+8 ext.849 — Other regions — CALL

It's fast and free!

The reflection of the OKTMO code in field 105 when generating a payment order is strictly prescribed by Order number 107n, approved by the Ministry of Finance of the Russian Federation in 2013.

It should be noted that it is this regulatory act that regulates the proper filling of all lines/fields of a bank payment order.

So, if the payment document does not contain any mandatory information, including OKTMO, the servicing bank will not be able to accept the client’s order for execution, and the money, accordingly, will not be transferred to the addressee on time.

Thus, you should understand what OKTMO is, how it is indicated on the payment slip, where you can check this detail.

In addition, it is important to find out what actions the payer should take if the OKTMO code is incorrectly indicated in a document that has already been sent for execution.

NEW PAYMENT ORDER - PAYMENT in 2020

When paying taxes and insurance premiums to the budget, use standard payment order forms. The form and fields of the payment order, numbers and names of its fields are given in Appendix 3 to the regulation approved by the Bank of Russia dated June 19, 2012 No. 383-P.

What kind of estimate item should be filled out in the payment slip? The rules for filling out new payment orders in 2020 when transferring tax payments to the budget were approved by Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n. These rules apply to everyone who transfers payments to the budget system of the Russian Federation:

- payers of taxes, fees and insurance premiums;

- tax agents;

- payers of customs and other payments to the budget.

How many characters - meaning

The directory contains certain code values officially assigned to municipalities and regions (subjects) of the Russian Federation.

Consequently, business entities and other organizations located and operating within a certain territory must use the code of this territory when preparing bank statements and financial statements.

Thus, OKTMO is an ordered sequence of 8 (eight) or 11 (eleven) digital characters, the combination of which indicates a specific territory and contains the following information:

- A subject (region) of the Russian Federation is indicated by a combination of the first (I) and second (II) digits of this code.

- Each populated area located within the borders of a given subject of the Russian Federation is designated by a combination of the third (III), fourth (IV) and fifth (V) digits of OKTMO.

- Rural/urban settlements, as well as territories located between them, within a particular locality are indicated by a combination of the sixth (VI), seventh (VII) and eighth (VIII) digits.

- A settlement located within a specific municipal territory is designated by a combination of the ninth (IX), tenth (X) and eleventh (XI) digits.

Principles of application

The OKTMO directory was developed by the department of state statistics, since it is this structure that uses the corresponding codes in its activities.

The use of data contained in OKTMO is regulated by Order No. 159-st, approved by Rosstandart on June 14, 2013.

It should be noted that the current OKTMO classifier was developed and implemented from 01/01/2014 as a replacement for the OKATO directory, which was used previously (before 01/01/2014) for the same purposes.

The new directory provides for a more extensive coding of territories than the OKATO directory, which has already been taken out of service since 01/01/2014. Thus, OKTMO has in-depth detail of municipalities.

However, business entities do not need to delve into the existing procedure for compiling codes, since their meanings do not need to be generated independently. The finished code can be easily found in the reference book.

On what line of the payment slip is it written?

Order number 107n, approved by the Ministry of Finance of the Russian Federation, provides for updated rules for drawing up bank payments.

This regulatory act prescribes the replacement of the OKATO code with the OKTMO code when drawing up a document on non-cash transfer of money from a bank account.

This indicator should be reflected in field 105 of the payment slip - exactly where OKATO was previously registered.

It is noteworthy that OKTMO and OKATO agree with each other only in the first and second digits.

The remaining signs designating territorial (municipal) entities have completely changed.

When drawing up relevant documents, tables for converting canceled OKATO codes into existing OKTMO codes are often used.

Whose code should be indicated in field 105 – the payer or the recipient?

In the payment order, in field 105, you should enter the unique code of the particular municipality within which the non-cash payment is made or the payer (business entity) operates.

If the organization has separate divisions, the required documentation should reflect the code of exactly the territorial area in which the corresponding division is located.

What should I set for taxes?

If a tax payment is transferred on the basis of a tax declaration, the OKTMO corresponding to this declaration should be specified in the payment order issued.

Thus, in the payment slip in field 105 you need to enter the code of the territorial area within whose borders the mobilization of tax payment funds is carried out.

It is important to remember that this code is a requisite that clearly provides a clear identification of the payment being made.

When filling out a payment order to pay taxes, the payer should indicate the code of the recipient of this payment - the municipality/region.

Use in details and tax returns

OKATO was used in documents until the end of 2013. Now, throughout the Russian Federation, OKTMO is indicated in all declarations.

The most popular types of declarations:

- For tax on income received.

- For personal income tax.

- According to a single tax on imputed income.

- For value added tax.

- For land ownership tax.

- For transport tax.

- For tax purposes based on the Income Certificate.

- For the tax on received income of individuals, filled out by citizens themselves, as well as on income that is planned to be received in the current year.

- According to a simplified taxation system.

In the details of the enterprise, for example, on contracts or letterheads, it is possible to indicate OKATO, but not necessarily.

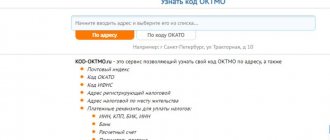

Where and how you can find out OKATO:

- In the Federal Tax Service according to OKTMO or TIN. To do this, you need to personally contact the employees of the tax department in whose department you are located at your place of registration.

- On the official website of the Federal Tax Service. Go to the “Electronic Services” section. Select “Find out OKTMO”. Select your region from the proposed list. Below write the name of the municipality and click “Find”. Your OKATO number will be indicated above the search lines.

- You can download the “Legal Taxpayer” program on the official website of the Main Scientific Research Computing Center of the Federal Tax Service. On the official website, on the left, click on the “Free Software” menu. Then, from the proposed options, select “Software for legal entities and individuals.” A list of programs available for download will open. Select the desired program by clicking on the hyperlink. Next, click “Details”. Select “Instructions for downloading” and “Installation kit”. In the window that pops up, click the “Save file” button. Save it to a convenient place on your computer. All you have to do is unzip the file and install the program. In the running program, select your address and find out the necessary information.

- At the address on the website www.okato-kod.ru. Visit this site. There is a search bar at the top. In it, enter the name of your locality and click the “Find” button. The search result will display all options for geographical objects in our country with the entered name. All options are designed as hyperlinks. Choose yours and click on it. Your code will be indicated on the open page.

What to do if it is indicated incorrectly?

What should the payer do if he makes a mistake in filling out field 105 of the payment order?

If the code according to the OKTMO reference book is reflected incorrectly in the payment for the Federal Tax Service, this error will not affect the crediting of tax payments to the budget.

If such an error is detected, the payer should make a request to clarify the details to the tax service. The decision is made by the tax department within a ten-day period, counted from the date of acceptance of the relevant application.

In case of such errors and incorrect KBK in field 105, a reconciliation of calculations between the payer and the tax service is often carried out, based on the results of which a corresponding act is drawn up.

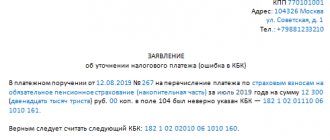

Sample letter of clarification to the tax service

Although such a statement is drawn up arbitrarily, it must contain the following data:

- date of payment made;

- the amount transferred under the payment order;

- purpose of the completed payment;

- specific details in which the error was made;

- correct value of the attribute.

This letter should be accompanied by a bank statement certifying the fact of the transfer, and a copy of the order containing the erroneous value of the details in field 105.

letters about clarification of OKTMO - word.

Where to get?

If a business entity wants to clarify its code in the directory, it can easily do this at its registration address and its own TIN code, using one of the following sources:

- Tax Service website. Through the OKTMO online clarification service. Information about the region of the Russian Federation/municipality in which this taxpayer is registered is entered.

- Website of the statistical agency. Through the online version of the directory. The search is carried out using data on the region of the Russian Federation / municipality in which the taxpayer is registered.

- State Services website. The search is performed manually, which makes this procedure more labor intensive.

- Websites of a commercial nature. Often, the search is carried out using the TIN of a business entity or, alternatively, its registered address.

Where to find

To understand which OKTMO code to indicate in a payment order, you need to know that all the values of the codes in question are listed in the All-Russian Classifier of Municipal Territories - abbreviated OKTMO, which was approved on June 14, 2013 by order of Rosstandart No. 159-st. This reference book was adopted to replace OKATO - the classifier of administrative-territorial divisions. Thus, the question in itself disappears - what to indicate - the OKATO or OKTMO code in the payment order.

Please note that since the beginning of 2014, in tax returns and in payment slips, the value in field 105 has been entered in accordance with the OKTMO classifier. It represents the code of the municipality in which the organization operates or makes payments.

If an organization has separate divisions, which OKTMO should be indicated in payment orders when deducting contributions and taxes? Payments and declarations indicate the OKTMO code of the area where the “isolation” is located.

If the tax is transferred on the basis of a declaration, then the OKTMO code in the payment order is indicated in accordance with such a declaration.

The code in question consists of 8 or 11 digits. In accordance with the Classifier, the last 3 digits - from 9th to 11th - indicate a specific small settlement.

Any payer can find out his or the required OKTMO using a special service on the website of the Federal Tax Service of Russia www.nalog.ru. It allows you to determine the code using a directory through the name of the municipality.

Also see “Electronic services for accountants on the Federal Tax Service website: use wisely.”

There is a feature whose OKTMO is indicated in the payment order in relation to payments at customs. It is necessary to take the code of the territory that accumulates the corresponding payment.

Also see “Field 107 of the payment order: customs authority code”.

What is OKATO in details?

The ability to correctly decipher the proposed code will help you fully understand the meaning of OKATO.

To do this, first of all, you need to understand that the code has a multi-level structure, that is, it should be deciphered gradually. To fully understand the code, you should give each level a letter designation: XX YYY ZZZ KCH

.

Let's take a closer look at each of the levels:

- The first and second numbers ( XX

) indicate the first level of classification. These are the largest facilities that are of federal importance. These may include territories, republics, autonomous okrugs, etc. - From the third to the fifth number ( YYY

) – the second level of classification. It encrypts smaller territorial objects. Among these are specific districts within large (krais, regions, etc.) territorial entities, as well as large urban-type settlements or cities at the republican or regional levels. - The sixth to eighth ( ZZZ

) numbers are the third level of classification. They describe the smallest geographical features within a country. These can be villages, hamlets, regional cities, etc. - The ninth to tenth ( CN

) numbers are an abbreviation for the control number.

Knowing the definitions of all these designations using specialized literature or the Internet, you can easily decipher the OKATO code.

What to do if it is specified incorrectly

If the OKTMO code in the payment order is indicated incorrectly, this will not affect the receipt of tax to the budget. When an error is discovered in this detail, in accordance with clause 7 of Art. 45 of the Tax Code of the Russian Federation, an organization should contact the Federal Tax Service with an application to clarify the details. Such a petition is written in free form. In this case, the document must indicate:

- date of payment, transferred amount, purpose of payment;

- details that are specified incorrectly;

- the correct value of this attribute.

Along with the application you must submit:

- A copy of the erroneously completed payment slip.

- Statement of transfer of the amount.

In the event of an error in OKTMO in a payment order, the tax office may invite the organization to reconcile the calculations. The Federal Tax Service must make a decision no later than 10 working days from the date of receipt of the application from the organization, taking into account the execution of a settlement reconciliation report. The tax office is obliged to notify the payer of its decision.

Also see “Request for a reconciliation report with the tax office: changes from 2020.”

If the OKTMO code is entered incorrectly on the payment slip when paying insurance premiums in 2020, clarification of the payment is not required, since the Treasury does not take its value into account when distributing insurance premiums between budgets. This payment does not fall into the unknown, but will be taken into account in a special payment card with the budget, which indicates the OKTMO code at the place of activity of the organization.

Occasionally, OKTMO in a payment slip at the Pension Fund may have a zero value. This issue is regulated by clause 4 of Appendix No. 4 of Order No. 107n of the Ministry of Finance dated November 12, 2013.

If you find an error, please select a piece of text and press Ctrl+Enter.

How to find your OKTMO

When filling out a payment slip, it may be difficult to determine the OKTMO code. The values of these codes are indicated in the All-Russian Classifier of Municipal Territories (OKTMO), approved by order of Rosstandart No. 159-st dated June 14, 2013. This classifier has replaced the Classifier of Administrative Territorial Divisions (OKATO), that is, if OKATO was previously indicated in the payment order, now the code OKTMO should be indicated. In the payment order, OKTMO is indicated in field 105.

Important! The company issues a payment order for taxes and duties, or to the address of its counterparty. Such a document must be drawn up correctly, without errors. Otherwise, the recipient of the funds simply will not receive them.

The OKTMO code consists of 8 or 11 digits. The last three digits of the eleven-digit code represent the designation of a specific small settlement. If a taxpayer has difficulties determining his OKTMO, then you can find out your code on the Federal Tax Service website (www.nalog.ru). The service presented on the tax website allows you to find out your code using the directory by entering the municipality. If OKTMO must be indicated in the payment slip for payments at customs, then the code must be taken from the territory that accumulates this payment (

What is the difference between OKTMO and OKATO?

First of all, it should be noted that OKTMO is rather an addition to the first code. The replacement performs related, but slightly different functions from OKATO. At first glance, the difference between the codes is invisible, because OKTMO is externally similar to its predecessor. Only the OKTMO system reflects the local government system in more detail. It makes it possible, more precisely, to monitor payment transactions, track statistics and control so that fewer payments are lost. Nowadays, a payment cannot go far if any of the numbers are entered incorrectly, and all this is thanks to the thoughtful structuring of the code.

OKTMO is a much more advanced tool for identifying an object, since the code contains several check digits that prevent errors when entering it into automatically processed databases.

If you are asked if OKTMO and OKATO are the same thing or not, answer with confidence, no, because the classifiers have differences in structure: OKATO includes from 3 to 8 characters , and OKTMO contains only 11 values . The new code reflects all levels of territorial local government, and makes it possible to collect and then analyze data separately for each municipal structure in all economic areas. The structure of the OKTMO code is based on a hierarchical principle:

- two initial digits – code of the subject of the country;

- three subsequent values – municipal structure code, district, city;

- the next three digits are the settlement code;

- the remaining three – code of a settlement that is part of a municipality.

OKTMO code structure

Penalty for incorrectly specified OKTMO in a payment order

Organizations and entrepreneurs quite often make mistakes in the tax payment details, so the Federal Tax Service requires the development of a bill introducing a fine for incorrectly indicated OKTMO. Today, tax payments must be made even if the OKTMO is incorrectly specified, however, if the bill is approved, then you will have to pay for errors.

A bill has been submitted to the State Duma, according to which it is proposed to punish taxpayers for errors in indicating OKTMO in payment orders for the payment of personal income tax. Currently, an error in this detail does not result in a fine being imposed on the taxpayer. The tax authorities resolve this situation on their own by redirecting funds to the required budget. The explanatory note to the bill notes that situations where tax is actually paid outside the place where the company operates are quite common. In this regard, local budgets suffer constant losses, for example, in personal income tax, which is a budget-forming region for many. Therefore, in order to reduce the number of errors in payment orders, it is possible in the future to establish the real responsibility of the taxpayer.

When the bill is adopted, the Tax Code will provide an additional basis for recognizing the obligation to pay tax as unfulfilled in the event of an error in OKTMO. It is proposed to introduce a fine of 20% of the amount of unpaid tax.