A cooperative is an economic association of people or organizations created to achieve common goals and protect their interests. The cooperative movement represents the 3rd economic sector of the national economy and acts as an alternative to individual and state production. The fundamental feature of this education is the combination of social and commercial aspects in its status. At the legislative level, cooperative activities are regulated by the Civil Code of the Russian Federation, Federal Law No. 190, Federal Law No. 193, Federal Law No. 215, Law No. 3085-1 and other legal acts. Consumer cooperatives are the most widespread in Russia.

Creation and registration of a cooperative

Before we begin to analyze the question of how to register a cooperative, it should be noted that there are many varieties of such formation, but all of them can be divided into 2 groups: production and consumer. The main difference between the latter is the lack of a commercial basis inherent in the former. In this case, members are not subject to the requirement for mandatory labor participation in the activities of the organization, while in a production association the main goal is to extract maximum profit, and to achieve it, the personal contribution of each participant is necessary. Taking into account the differences in the nature of activities, the procedure for registering them also has its own characteristics.

The main question that the founders have difficulty resolving is which body the cooperative is registered with. Logic says that production ones should be under the jurisdiction of the Federal Tax Service, and consumer ones should be under the jurisdiction of the Ministry of Justice. However, the non-profit basis of consumer entities is only significant in practice. The legislator defines a cooperative as an economic association, and therefore, granting it the official status of a legal entity is in any case within the competence of the tax authorities. Taking into account Part 3 of Art. 1 Federal Law “On Non-Commercial Organizations”, both production and consumer cooperatives are registered with the territorial bodies of the Federal Tax Service.

Step-by-step instructions for registering a production cooperative include 3 stages : collecting a package of documents, submitting it to the Federal Tax Service, obtaining certificates. The list of documents for the Federal Tax Service includes:

- cooperative charter (original and archival copy);

- protocol, which contains comprehensive information about the organization: goals, size and form of authorized capital, information about the founders, governing body, etc.);

- application in form P11001;

- application in form 26.2-1 (if a transition to simplified taxation is planned);

- receipt of payment of state duty;

- certificate of legal address (if the premises are owned - a copy of the certificate, if rented - a letter of guarantee from the owner).

It should be noted here that before registering a cooperative, members must make at least 10% of contributions to the mutual fund. The rest can be paid within a year from the date of official registration.

The documents required for registering a consumer cooperative are similar . If there are no objective reasons for refusal, the Federal Tax Service Inspectorate registers the new entity, after which it is entered into the Unified State Register of Legal Entities. As for how to create a consumer credit cooperative, in this case the scheme is identical.

After the organization receives official status, the founders receive a certificate of registration and OGRN, IIN, an archival copy of the Charter, an extract from the Unified State Register of Legal Entities, notifications from the Pension Fund of the Russian Federation and the Social Insurance Fund. Codes for making a seal are obtained from Rosstat.

In the question of how to register a production cooperative, the main problem lies in the choice of taxation system. If an organization wants to use a simplified scheme, it must provide documentary reasons for this. In general, with a competent approach and provision of a package of documents according to established templates, no difficulties arise. Moreover, the state, in turn, tries to encourage the creation of such organizations and makes the procedure for their registration as simplified as possible.

The process of creating a production cooperative does not have detailed regulation.

The legal basis for the establishment of a production cooperative and its activities is set out in Art. 106.1 – 106.6 Civil Code. They are specified in the law “On Production Cooperatives”.

According to these documents, a production cooperative should be understood as an organization representing a voluntary association of citizens who have joined it by way of membership, created for the purpose of conducting joint economic activities with personal labor participation, with the pooling of share contributions made by each member.

Each of these characteristics of such an organization determines the features of regulation of their activities.

Advantages and disadvantages

A production cooperative has the following advantages:

- Distribution of profits between participants depending on their contribution to the association. In a similar way, assets are distributed after the liquidation of an artel. This approach motivates participants to improve and increase their labor contribution.

- Any number of participants can join an artel. There are no restrictions.

- Participants are given equal rights. Each party has equal authority to manage the association.

- Each participant has the right to sell his share. That is, your share can be easily converted into cash.

- Quickly achieve your goals by combining the resources of all participants.

Artel is characterized by the following disadvantages:

- If the cooperative incurs a large debt, all participants bear responsibility for it.

- A person is responsible for debts with personal property. The liability of a participant is limited to the size of his share.

- Activities are carried out jointly. All participants will have to bear responsibility for the wrong decisions made by others.

All the advantages and disadvantages of a production cooperative are relative. That is, with proper organization of activities, the artel will not suffer from characteristic disadvantages. If the production cooperative operates illiterately, you can forget about the characteristic advantages. Significant shortcomings of the artel appear only when a large debt has accumulated.

General conditions for the formation of a production cooperative

The establishment of the PC is provided for in Chapter 2 of the law. Art. 4 defines the requirements related to the composition of the founders. According to this norm, the number of initially joined members cannot be less than 5.

Who can become a member of the cooperative?

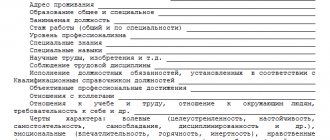

Pointing out that only citizens can be members of the organization, the legislator is not referring to holders of a Russian passport, but to individuals as such, regardless of the presence or absence of a political and legal connection with a particular country. At the time of joining the cooperative, such a person must be at least 16 years old.

Read more: What does a Sberbank mortgage loan agreement look like?

Legal entities, as an exception, may participate in the activities of the cooperative. This is only possible if there is a representative individual appointed by the organization. His powers arise on the basis of a power of attorney.

Such a procedure must be provided for by the charter.

It is also possible to have members who do not have an employment relationship with the organization. However, their number cannot be more than a quarter.

About the mutual fund and share contributions

The cooperative has a mutual fund. Its size and the size of the share contribution are determined by the founders in the charter. The share contribution can be money, securities, other property, including property rights and other objects of civil rights. Estimation of share contribution up to 25 thousand rubles. carried out upon the formation of a cooperative by mutual agreement of the founders. Above 25 thousand rubles. - an independent appraiser.

A nuance: following the letter of the law, it can be assumed that all members of the cooperative can have the same share size; at most, in a mutual fund they can own several shares, multiples of the value established in the charter. In practice, everything is much more flexible, and the size of contributions to a mutual fund for specific founders can be set differently. How the founders will agree. Any contributions to a mutual fund are exempt from taxes from the receiving party (that is, the cooperative itself) on the basis of the benefits of pp. 3 p. 1 art. 251 Tax Code of the Russian Federation.

Another nuance: regardless of the size of the share owned, the shareholder has one vote at the general meeting of members. This is a fundamental difference from an LLC, where votes are proportional to shares in the authorized capital.

When might this come in handy? For example, to ensure ownership control. Regardless of the size of the contributions of the “investors” (let’s assume there are two), the initiators of a certain project (let’s say there are three of them) will each have one vote, that is, a majority. At the same time, the size of shares in the mutual fund of investors is proportional to their contribution. Everything is fair both financially and managerially.

Injustice and risk manifest themselves when trusted persons participate in the PC. Even the smallest share gives 1 vote. And if there are several such additional shareholders, significant management risks arise, which are quite difficult to minimize. In a cooperative, shareholders cannot enter into a corporate agreement capable of ensuring ownership control, as in an LLC, requiring uniform voting.

Procedure for establishing a cooperative

The process of creating a production cooperative does not have detailed regulation. It is valid only in cases of the establishment of agricultural production cooperatives, provided for by the law of the same name, which can be taken as a model if the goals of the organization are not related to agricultural production.

It involves a number of stages.

The purpose of this stage is to ensure the competence of the general meeting of members and to prepare a high-quality charter, the registration of which will not cause problems in the future. Given the complexity of the issues being resolved, each member of the organizing committee must have the necessary knowledge in the economics of the relevant industry, or qualifications in the legal field. The latter is necessary to develop the charter, since the sample or form used may not correspond to the law or the purpose of creating a cooperative.

Voting at the general organizational meeting

The voting results are entered into the protocol. That is why registration of all citizens who came to the meeting and wrote statements is necessary.

A presiding officer and a secretary must be selected from among the participants. If the first one leads the meeting and puts the agenda items to vote, then the second one records all the actions taken and the results of the expression of the opinions of the members of the cooperative.

Within the framework of this procedure, issues of approval of the charter, the admission of each member to the organization, as well as the election of governing bodies are resolved.

If a sample protocol is used to document the results of the general organizational meeting, it must be adapted to the characteristics of the cooperative.

The procedure for liquidating a cooperative

Let's consider the stages of liquidation of an artel:

- Collection of liquidation documents. Organization of an extraordinary meeting of participants at which the decision on liquidation is announced. At the same meeting, an action plan is formed and members of the liquidation commission are selected.

- Sending a notice to the tax authorities. After this, adjustments are made to the Unified State Register.

- Local media publishes information about the liquidation. At the same time, the address of the liquidation commission is indicated so that those interested can ask questions.

- If creditors have not made any claims, an interim liquidation balance sheet must be created, which is approved at the meeting.

- An inventory act for the association's property is drawn up.

- If the association is unable to cover its debts to creditors, the artel’s property is sold at auction.

- After all debts have been repaid, a final balance sheet is formed, which must be approved at the meeting.

- An entry about liquidation is made in the Unified State Register of Legal Entities.

The existence of an association can be terminated through reorganization.

What must the charter contain?

The requirements for the charter are contained in Art. 106.2 of the Civil Code and in Art. 5 laws.

According to these documents, the following provisions are required:

- About the company name, taking into account the requirements established by law.

- About the location. It means a populated area.

- About all issues related to share contributions, including the composition of the contribution and its procedure, as well as penalties in cases where a member violates such obligations.

- On the basics of personal labor participation in the work of a cooperative and the responsibility of members for violations in this area.

- About the rules by which the profits and losses of the cooperative are distributed.

- On establishing the rules for the occurrence and amount of subsidiary obligations that each member bears for the organization’s debts.

- On the structure of governing bodies, as well as their powers and the procedure for making certain decisions.

- On the rules by which payments to members who have left the cooperative are determined and made.

- About the procedure for accepting new members.

- On the rules governing withdrawal and expulsion from the organization.

- On the procedure determining the formation of the property of a cooperative.

- Data on branches and representative offices.

- Rules by which reorganization and liquidation are carried out.

If the charter of the production cooperative does not meet these requirements, the registration of the cooperative may end in refusal.