Calculation of the amount of compensation (regulatory framework)

The first and main source of norms for regulating any labor relations is the Labor Code of the Russian Federation. It is he who is in Art. 139 and part 2 of Art. 394 determines the procedure for calculating the amount of compensation for absenteeism due to the fault of the employer, and the grounds for such payment.

The amount of payments due to forced absence is calculated taking into account average earnings. The features of its calculation to determine the amount of compensation are discussed in the resolutions of the Government of the Russian Federation “On the peculiarities of the procedure for calculating ...” dated December 24, 2007 No. 922 and the Plenum of the Supreme Court of the Russian Federation dated March 17, 2004 No. 2.

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

A collective agreement may also contain conditions regarding the calculation of average earnings when determining the amount of compensation. However, this is permissible only if they do not worsen the legal status of employees in comparison with the Labor Code of the Russian Federation and do not contradict its provisions.

Payment procedure

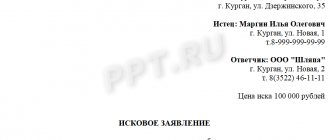

An employer may voluntarily pay an employee for forced absence. If he does not recognize the fact of its existence, then the employee has the right to file a claim in court no later than three months based on the fact of violation of his rights (Article 391 of the Labor Code of the Russian Federation). The period of trial will also be counted as forced absenteeism.

If the employer does not pay compensation within the deadlines set by the court, then the victim has the right to receive a penalty in the amount of 1/300 of the Central Bank rate for each day of delay.

When is compensation due for forced absence due to illegal dismissal?

As the name of the payment suggests, compensation of this kind is awarded to the employee in the event of forced absence. Not a single normative act provides a definition of the concept of “forced absenteeism”, so its meaning is derived based on an analysis of the articles of the Labor Code of the Russian Federation and the above-mentioned resolutions. Taking this into account, we can say that forced absenteeism is a period during which the employee was unlawfully deprived by the employer of the opportunity to work and, as a result, receive earnings.

Illegal dismissal is one of the cases when we can talk about forced absenteeism. The decision on payments related to illegal dismissal is made by the court, and it also indicates their amount directly in the text of its decision. When filing a claim, the plaintiff can either independently calculate the amount of compensation with the attachment of documents confirming the amount of the average salary, or limit himself to the requirement to pay for forced absence for a certain period of time.

The court may decide to pay compensation not only in case of illegal dismissal, but also in other cases:

- If an employee is deprived of the opportunity to work as a result of suspension from work, transfer to another, or delay in issuing a work book (Article 234 of the Labor Code of the Russian Federation).

- If the employer refuses to conclude an employment contract with an employee invited in writing on the terms of transfer from another organization (Article 64 of the Labor Code of the Russian Federation). In this case, we are talking about a violation of the employee’s right to work. He has the right through the court to demand employment and compensation for forced absence for the period from the date of refusal to hire him until the date of the court decision.

Labor Code of the Russian Federation on asserting rights by employees

Unlawful termination of an employment agreement for absenteeism carries with it the employer's liability under several articles of the Labor Code of the Russian Federation. According to Article 234, the employer is obliged to fully compensate for material damage based on the proven fact of unlawful downtime of an employee’s work. In this case, the amount of compensation is calculated based on the employee’s average earnings, which is regulated by Article 394 of the Labor Code of the Russian Federation. At the same time, Article 395 obliges the employer to make the awarded payments in full.

Read also: How to apply for a foreign passport through State Services?

Depending on the wishes of the wrongfully dismissed citizen, the courts may consider changing the previously recorded entry in the work book. It may sound like terminating an employment agreement at your own request. Article 394 of the Labor Code of the Russian Federation allows you to do this.

After a court makes a ruling in favor of a wrongfully dismissed citizen, the employer is obliged to immediately comply with the court's ruling. This is due to Article 396 of the Labor Code of the Russian Federation. In this case, the court decision is considered executed upon the fact that the employee is reinstated in his position, as well as appropriate changes are made to the work book.

Payment amount calculation

When making a decision regarding compensation for forced absence, the court applies the provisions of Art. 139 Labor Code of the Russian Federation. For the calculation, all types of payments used by the employer in the remuneration system for the employee are accepted. This means that the popular pay system of minimum wage and large bonuses, which is often used to reduce tax deductions, will not help reduce the amount of payments in question. They are compensated within the limits of average earnings for the entire time during which the employee could not work due to the fault of the employer.

The issues of determining average earnings are covered in detail in Decree of the Government of the Russian Federation No. 922. Based on its provisions, as well as the norms of the Labor Code, the basic rules for calculating payment for forced absence can be formulated:

- The calculation is made for the last 12 months before the moment of illegal dismissal or for a shorter period if the employee worked for less than a year.

- The actual hours worked and wages paid are taken into account for the calculation. The operating mode does not matter.

- The month is counted calendar - from the 1st to the 30th or 31st, with the exception of February, which has 28 or 29 days.

Additionally, it is necessary to take into account the norms of paragraph 17 of Resolution No. 922, which establishes that such payments should be increased if tariff rates and salaries were increased during absenteeism. The increasing coefficient is calculated by dividing the employee’s wages during the period of actual start of work after his reinstatement by the tariff rate in effect during the forced absence.

Subscribe to our newsletter

Read us on Yandex.Zen Read us on Telegram

Payments taken into account when calculating average earnings

Attention

Legal advice on how to correctly calculate average earnings Important For example, when calling an employee liable for military service for training or conscription for military service, the calculation period is two months (calendar), which precede the month of the training. That is, if an employee leaves for training camp in November 2014, then the calculation takes into account income for the period from 09/01/14 to 10/31/2014. In 2014, to calculate benefits for temporary disability, as well as maternity and child care benefits, information for 2 calendar years is taken into account.

Thus, depending on whether or not a leap year falls within the calculation period, the number of days taken into account may be 730 or 731.

Formula S*P / 300*K,

https://www.youtube.com/watch{q}v=540BYYeWnmQ

where C is the amount of debt, P is the refinancing rate K is the number of days of salary delay

For example, you are not paid a monthly salary (30 days) in the amount of 30,000 rubles.

30,000*8.25%/300*30 = 248 rubles

A break (downtime) in work can happen for reasons: - due to the fault of the organization; - for reasons beyond the control of the organization and the employee; - due to the fault of the employee.

Downtime caused by the employee is not paid at all.

Downtime caused by the employer is paid based on average earnings. In this case, at least 2/3 of the average earnings accrued during forced rest are paid. To do this, the beginning and end of the downtime must be recorded. The manager must issue an order on the duration of the downtime and its payment.

If the downtime is prolonged, there is no need to recalculate the amount of average earnings every month.

Payments to employees should be made within the deadlines established by the organization for issuing wages.

Using this online service, you can keep accounting for OSNO (VAT and income tax), simplified tax system and UTII, generate payments, personal income tax, 4-FSS, SZV-M, Unified Account 2020, and submit any reports via the Internet, etc.( from 350 RUR/month). 30 days free (now 3 months free for new users). With your first payment (via this link) three months free.

Billing period

As a general rule, the calculation is based on the employee’s average earnings over the last 12 calendar months. Let’s say the downtime began in April 2020. This means that the billing period is from April 1, 2019 to March 31, 2020.

A dismissed employee has every right to disagree with the employer's decision to fire the employee. And submit a corresponding application to the court, the labor dispute commission (if there is one) or the state labor inspectorate, art. 382 and 352 of the Labor Code of the Russian Federation). And if in the end the organization’s decision is declared illegal, it will be obliged to reinstate the dismissed person at his previous job and pay him the average salary for the period of forced absence. And if the employee demands, then compensation for moral damage caused (Article 394 of the Labor Code of the Russian Federation).

The average salary is calculated based on payments accrued to the employee for the 12 calendar months preceding the moment of dismissal (Article 139 of the Labor Code of the Russian Federation, paragraph 62 of the resolution of the Supreme Court of the Russian Federation of March 17, 2004 No. 2). Workdays (hours) falling within the period from the moment of dismissal until the moment of reinstatement are subject to payment.

Please note: the salary that an illegally dismissed employee received in another organization does not reduce the amount of payment for forced absence (clause 62 of the resolution of the Supreme Court of the Russian Federation of March 17, 2004 No. 2). Therefore, when calculating the average salary, amounts paid to an employee at a new place of work are not taken into account.

The calculation is based on the employee’s average earnings over the last 12 calendar months. Let's say a person was fired in April 2020. This means that the billing period is from April 1, 2020 to March 31, 2020.

A different billing period may be established in the following cases.

If the employee has not yet worked for the organization for 12 months. In this situation, the billing period will be the period during which the person is registered in the organization. For example, an employee joined the company on July 8, 2020, and was fired on February 2. The billing period is from July 8, 2020 to January 31, 2020.

If a person got a job and was fired in the same month. Then the calculation period is the actual time worked. Let’s assume that an employee joined the company on January 12, 2020, and was fired on January 20. If the court decides that this was done illegally and obliges the company to pay for the time of forced absence, the billing period will begin on January 12 and end on January 19.

If it is more convenient for an organization to set its own billing period other than 12 months. However, in such a situation, the average earnings will have to be calculated twice (for 12 months and for the established billing period) and compared the results. The fact is that average earnings in any case cannot be less than the amount calculated on the basis of annual earnings.

If a reorganization has occurred and the employee is transferred to a new company. A person can move to a new company in different ways. He can be fired from the old organization and immediately hired into a new one, or simply transferred by drawing up an additional agreement to the employment contract. When a person quits, when calculating average earnings after this event, only those payments that were accrued to him in the newly created organization are taken into account. If the employee is transferred, payments for the last 12 months are taken into account, including those accrued before the reorganization.

| Average earnings | = | The amount of accruals for the billing period taken into account | : | Number of days (hours) worked in the billing period | × | Number of working days (hours) to be paid |

Example. Sidorov V.S. was fired on January 25, 2020, and reinstated by court decision on May 12 of the same year. He returned to work on May 13.

The organization has a regular five-day work week. The period of forced absence from January 26 to May 12, 2020 inclusive accounted for 73 working days.

Sidorov's salary is set at 20,000 rubles.

The billing period is 2020. It accounts for 249 working days. Information about the periods excluded from it is given in the table.

Periods that are excluded from the calculation period when determining average earnings

| Base | Period | Length of period in working days | Accrued for time worked in partial months |

| Business trip | From 20 to 30 April 2020 | 9 days | RUB 11,818.18 |

| Annual leave | From August 3 to August 30, 2020 | 20 days | RUB 952.38 |

| Temporary disability | From 9 to 20 February 2020 | 10 days | 9473.68 rub. |

(RUB 20,000 × 9 months RUB 11,818.18 RUB 952.38 RUB 9,473.68) : 210 days. = 963.07 rub.

RUB 963.07 × 73 days = 70,304.11 rub.

In all institutions of the budgetary and extra-budgetary sphere, employment contracts are concluded with employees, which in turn regulate relations in the labor sphere and arise between the employer and the employee. The contract is concluded in writing, in two copies. Signed by the subordinate and the boss.

However, in many companies such documents are drawn up in an inappropriate manner: either the terms and conditions of work are not specified, or there is no agreement with the worker. This can further lead to such a phenomenon as forced absenteeism.

Concept

There is no clear definition of the term forced absenteeism in labor law documents. It is determined by the courts after considering the request of the dismissed person, which lists the circumstances of the dismissal.

The court decides whether the occurrence of absenteeism was due to the fault of the manager or not.

In fact, forced absenteeism is a period of time when an employee was illegally removed from his job due to the fault of his boss.

There are a number of reasons for this:

- termination of labor relations between a worker and his boss in an illegal manner;

- execution of a contract that does not comply with the standards governing labor relations;

- illegal movement of a person between various positions in the enterprise that do not correspond to the employee’s qualifications;

- issuing a work book at an inappropriate time;

- Incorrect or non-statutory dismissal record.

We invite you to familiarize yourself with: Sample employment contract with an obstetrician-gynecologist

After the employee is familiarized with the dismissal order, he is given a work book. If this dismissal occurred illegally, then the dismissed employee can contact the prosecutor with a statement of violation of his labor rights within a month.

The duration of absenteeism in different situations is determined individually.

This period of time begins from the moment when the person left his workplace because of his boss, and lasts until the court makes an appropriate decision on compensation for the amount of forced absence and his reinstatement at work.

The time for an illegally dismissed person to go to court ranges from 1 day to 3 months from the moment his rights were violated when he was removed from his position.

After the court has made its decision, the person must return to his previous position.

Documentation

When reinstating an employee, the employer must:

- issue an order for reinstatement indicating the date of reinstatement;

- make an appropriate entry in the work book, noting that the previous entry is not valid.

https://www.youtube.com/watch{q}v=6zdmoY0sQ58

After completing these documents, the accountant must calculate and pay for forced absenteeism.

The calculation is made based on the employee’s average earnings.

For this purpose, wages actually accrued for the 12 months immediately before his removal are taken.

This includes all payments provided for by legal regulations that regulate the calculation of wages in a given company for days actually worked, excluding amounts paid for sick leave and vacation pay.

Calculation example

As an example, let’s consider calculating compensation for forced absence for an illegally dismissed employee who has worked in the organization for more than a year. Let's say Ivanov I.I. was fired from his job on January 1, 2020, after which he went to court and was reinstated on April 1, 2020.

Ivanov I.I.’s salary was 30,000 rubles. for each month of the previous year. There were a total of 247 working days in 2020. There were 57 working days between January 1 and April 1, 2020.

Thus, the calculation will be made in the following order:

- 30,000 × 12 = 360,000 (rub.) - the employee’s earnings for the previous year;

- 360,000 / 247 = 1,457.48 (rub.) - average daily earnings for the past year;

- 1457.48 × 57 = 83,076.38 (rub.) - amount of compensation.

Is it possible to reduce the amount of compensation?

When dismissing an employee, the employer can make the necessary payments, in particular severance pay and compensation for unused vacation. In accordance with paragraph 62 of the resolution of the Plenum of the Supreme Court No. 2, funds paid as severance pay are subject to offset when determining the amount of compensation for absenteeism. Thus, the amount of payment for forced absence will decrease.

The following payments are not subject to offset:

- wages paid to an employee by another employer, regardless of the time of employment and work schedule;

- benefits for temporarily disabled persons, including disability benefits;

- unemployment benefits.

Neither the Labor Code of the Russian Federation nor other acts contain instructions on how to deal with money paid as compensation for unused vacation, and therefore do not provide the opportunity to reduce compensation for forced absence by these amounts. All that remains is to refer to the clarifications in the letter of Rostrud “On the provision of annual paid leave...” dated June 14, 2012 No. 853-6-1, according to which the reinstated employee acquires all the rights that he had before the illegal dismissal. The continuous course of work experience and, consequently, the right to annual paid leave are restored.

Thus, the employee has 2 options:

- After being reinstated at work, write a statement and return an amount equal to compensation for the vacation to the organization’s cash desk (when the vacation period begins, he will be able to receive all vacation pay in full). The employer must be careful in this matter and accept money only if there is a written statement from the employee explaining what amounts he returns to the cashier and what their purpose is.

- No refund. In this case, this amount will be deducted from his vacation pay and he will receive only the part that is formed taking into account the illegal dismissal.