Why you shouldn't give up your vacation

Have you ever thought that by taking compensation for unused vacation in the hope of earning more, you thereby lost money? Tatyana Pavlova, financial consultant, will tell you with examples where exactly you made (or may make) mistakes.

No money? - Go on vacation!

The issue of personal finance accounting is more relevant today than ever. Some limit themselves to approximate cost calculations, while others use special programs for planning a personal or family budget. But one thing can be said for sure about everyone - every year society becomes more literate and the desire to keep abreast of lost profits, so as not to regret lost profits, increases exponentially.

We constantly calculate how much we earn and how much we spend. How much we save and how much we lose in certain situations. But few people know that you can “earn” and “lose” even on such a banal thing as a vacation. How is this possible? For example, instead of going on vacation, you decided to take monetary compensation for not using it. You can motivate this in any way you like - high employment, lack of funds, an all-consuming desire to save money.

But in fact, if you really went for it, you made two serious mistakes at once. The first is obvious, and you yourself are well aware of it - by refusing to rest, you deprived your body of the opportunity to regain strength and, as a result, significantly reduced your efficiency for the next year. The second mistake is not so obvious, but no less serious. It turns out that by refusing your legally entitled vacation, you lost another 2.33 days of freedom!

The fact is that, according to Article 121 of the Labor Code of the Russian Federation, the length of service giving the right to annual paid leave includes not only the time of actual work, but also the time when the employee did not actually work, but retained his place of work, including, This is the time of annual paid leave. What does this mean in practice?

Per year, an employee is entitled to 28 calendar days of annual paid leave, respectively, this is 28 / 12 = 2.33 days of paid leave every month, regardless of whether you are actually working or on vacation. Then, after working for 11 months and earning 2.33 x 11 = 25.63 days, you can go on vacation. During your vacation, you will earn an additional 2.33 days of paid vacation time. And, as a result, at the end of the year you will have a year’s experience in your piggy bank, giving you the right to a vacation of 25.63 + 2.33 = 28 days. So, in fact, after working only 11 months, you receive the vacation due for 12 months of work.

Now the second situation is when you do not take vacation, but are limited to monetary compensation, and work for 12 months. According to the same article 121 of the Labor Code of the Russian Federation, you are entitled to 28 days of vacation (no more!), and 2.33 days of them, unlike rested colleagues, you receive not during rest, but during work.

In other words, every time you refuse to go on vacation - reschedule it or take compensation - you steal 2.33 days of vacation from yourself annually. But the losses are not only moral. For example, if you work as a manager in a company for 3 years (36 months) with a salary of 60,000 rubles, for 3 years of work without vacation, you will lose... 15,000 rubles. Let's see how this figure turns out and check it in two ways.

Vacation pay calculation

When leaving work, a subordinate has the right to use his paid leave. Some take days off in lieu of the required work. This is permitted by law, so there should be no problems with registration. But it should be remembered that replacing work with weekends is possible only with the permission of the employer.

If the employee does use vacation, the employer is obliged to pay vacation pay. This amount is provided to employees as incentives. The question of what is more profitable, vacation pay or compensation, worries many. Therefore, it is important to know how the required payments are calculated.

To do this, the employer must also calculate the person’s average daily earnings, and then multiply the resulting amount by the number of days off. That is, there is no difference in the calculations. And if you take an employee with a salary of 340 thousand rubles per year, then both vacation pay and compensation for him will be the same.

In order for a manager to provide an employee who decides to quit with vacation or money, his request must be formulated correctly. To do this, you need to draw up a letter of resignation, indicating how the days off should be spent. The employer does not have the right to decide this issue instead of the employee.

Help: if a subordinate has requested vacation pay, that is, he is going to use his legal days off, then the application must be submitted no less than 14 days before going on vacation. Then the employer will be able to carry out all the calculations. Payment is made 3 days before departure to the employee’s bank card or in cash at the cash desk.

Compensation for unused vacation or vacation pay - which is greater? The answer to this question is very simple - employers use the same formula for calculation, so there is no difference. And the choice must be made by the employee, going on vacation or demanding legal payments.

Example 1 (first way to calculate the difference)

So, option one - you have never gone on vacation:

- For 36 months worked, you received 60,000.00 x 36 = 2,160,000.00 rubles.

- Then, upon dismissal, you will receive compensation for 28 x 3 = 84 days. 60,000 / 28(*) x 84 = 180,000.00

- Total earnings for 36 months will be 2,160,000.00 + 180,000.00 = 2,340,000.00

Total average monthly earnings will be 2,340,000.00 / 36 = 65,000.00

Option two – you went on vacation every year:

Over the course of 3 years, you went on paid leave three times, each time for 28 calendar days (let’s take it as a month. Accordingly, we subtract these days from the total number of months worked, since on these days you rested.

- 36-3 = 33

- For 33 months worked, you received 60,000.00 x 33 = 1,980,000.00 rubles.

- For 3 months of vacation you received 60,000.00 x 3(*) = 180,000.00 rubles.

- Total earnings for 33 months will be 1,980,000.00 + 180,000.00 = 2,160,000.00

Total average monthly earnings will be 2,160,000.00 / 33 = 65,454.55. The difference between these two examples over 3 years will be:

- (65,454.55-65,000.00) = 454.55 x 11 x 3 = 15,000.00

Let's check our calculations in one more way.

What is more profitable for the employee?

Employees often wonder what is more: vacation pay or compensation for unused vacation. The main indicator for calculating both payments is the average daily earnings for the last 12 months of work. Therefore, the amount of vacation pay will be equal to compensation for unused vacation.

When leaving a job, many people wonder which option is more profitable:

- work for two weeks and receive payment for unused vacation;

- go on paid leave and leave without working.

In the first case, the employee will be able to count on an amount exceeding the allotted amount; in the second, he will have more rest. When calculating the number of unused days, work experience is rounded to the nearest month. If less than half a month is worked, it is not taken into account. Thus, having worked 7.5 months, a citizen will receive payment for 8 months of work.

Some employers pay part of the salary unofficially. In such a situation, it is worth remembering that all payments and compensation will be calculated based on “white” income.

Trying to find a more profitable option when leaving, employees choose between paid rest and compensation for unpaid vacation. But these payments are calculated in one way - based on average daily earnings.

Dear readers, the information in the article may be out of date, take advantage of a free consultation by calling: Moscow +7

, St. Petersburg

+7 (812) 317-70-86

or via the feedback form below.

Have you ever thought that by taking compensation for unused vacation in the hope of earning more, you thereby lost money? Tatyana Pavlova, financial consultant, will tell you with examples where exactly you made (or may make) mistakes.

Example 2 (second way to calculate the difference)

If you have never gone on vacation.

- For 12 months of work, you have earned insurance experience, giving you the right to annual paid leave of 28 calendar days.

- Total for 36 months – 84 calendar days.

- You went on vacation every year.

- For 11 months worked, you have earned an insurance period (giving you the right to annual paid leave) of 25.67 = 28 / 12 x 11 calendar days.

Total for 33 months 77 = 28 / 12 x 33 calendar days. For 1 month of vacation, you have earned insurance experience (giving you the right to annual paid leave) 2.33 = 28 / 12 x 1 calendar days. Total for 3 months 7 = 28 / 12 x 3 calendar days. Your income is 60,000.00 / 28(*) x 7 = 15,000.00. This is where your lost income lies!

As a particular example of this situation, we can cite the current rules on regular and additional leaves No. 169 of April 30, 1930: “If you work in the company for only 11 months and decide to quit, the employer is obliged to pay you compensation for the full year worked.”

Who can receive monetary compensation?

An employee can receive compensation for vacation in two cases:

All payments to the employee must be made on the day of dismissal. But sometimes it happens that, in agreement with management, an employee, after 6 months of work, takes a 28-day rest. Accordingly, if he decides to quit in the near future, part of the vacation will be spent in advance.

Read more Novorossiysk lawyer in administrative law

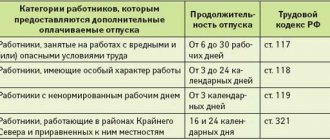

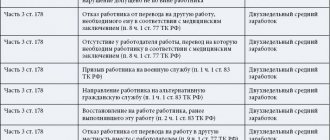

Therefore, the employer has the right to withhold compensation for extra days. By law, this amount should not exceed 20% of the salary paid to the employee upon dismissal. The second case is related to the fact that, according to the Labor Code of the Russian Federation, certain categories of workers have the right to extended leave.

However, under no circumstances is it allowed to replace vacation with money:

It should be noted that study leave also cannot be replaced with payment.

Did you know about such nuances of the labor code?

* The problem assumes that during your vacation your monthly salary is retained, and the average salary is not calculated according to accounting rules. By improving your financial literacy, you can increase your personal budget.

The relevance of this topic is undeniable. After all, the issue of financial literacy is often thought about not by those who have problems with money, but by people who have plenty of it. So, being savvy and flexible to modern conditions will give you self-confidence and make you more successful. Feel free to attend courses and seminars, and get information from financial media reviews.

© Tatyana Pavlova, BBF.RU

Comparison of the amount of compensation payments for unused vacation and vacation pay: which is greater

Every officially employed citizen has the right to paid leave. To obtain it you must work for 11 months. It is also allowed to take half of the vacation six months after employment. The standard duration of leave is 28 days, but additional days off may be provided.

A subordinate may not use all of his vacation in a year. By law, when dividing this period, the duration of one of the parts must be at least 14 days. And upon dismissal, the employer is obliged to compensate the subordinate for unused days off. Payment is made on the employee's last working day.

Calculation of compensation payments

Persons who are officially employed are required to receive paid leave. To apply for it, an 11-month work period is required, but an employee can apply for half of the required rest after six months of work. According to standards, vacation is provided in the amount of 28 days, but some enterprises provide their employees with additional days for harmful working conditions and other stress. But what is more profitable - vacation or compensation upon dismissal - is up to the employee to decide.

We invite you to read: How to change your last name in your passport in 2020: documents, procedure

The subordinate does not have to take out a whole vacation. The legislation provides for partial division of vacation days. Moreover, each part of the vacation should not be less than 14 days. In case of dismissal, the employer must pay the employee compensation for unused rest days. Payment must be made no later than the employee’s last working day at the enterprise.

The compensation payment is calculated based on the average daily earnings of the subordinate.

The billing period is calculated based on the calendar year. All earned monetary resources received by the employee must be divided by 12. The amount received is divided by a coefficient of 29.4, which means the average number of days in a calendar month.

When calculating the amount of compensation payment, not all of the employee’s income is taken into account. The following types of profit received are not taken into account:

- sick leave payments;

- downtime due to the fault of management;

- travel allowances.

Some periods are also not included in the compensation payment. The following are not taken into account:

- time off taken at your own expense;

- absenteeism without good reason;

- going on maternity leave.

After determining the daily wage, this amount is multiplied by the number of days that the employee did not use for rest.

For example, if a worker’s annual income is 340,000 rubles, the calculation is carried out according to the formula: 340,000 / 12 (months per year) / 29.4 (coefficient). The total is 963 rubles. This means average daily income. If an employee has 12 calendar vacation days left, then 963 is multiplied by 12, which totals 11,556 rubles.

Compensation can be made by the employer not only in case of dismissal of the employee. This is not always justified, but there are some exceptions:

- Payment can only be accrued for additional vacation days. For example, if an employee has 28 days of basic leave and 6 additional days for harmful working conditions, then the organization has the right to issue compensation for only 6 days, and the employee will have to take the rest of the days off.

- Pregnant women and minor citizens lose the right to compensation for additional days. In this case, reimbursement of funds is possible only in the event of dismissal of the employee.

Estimated payments are calculated in the same way as compensation payments for unused vacation days. Before receiving this money, the employee must write a letter of resignation. Funds are credited to the employee’s account during the period the company makes wage payments.