Legislative regulation of the issue

The concept of wages, as well as its components, is regulated by the norms of Article 135 of the Labor Code of the Russian Federation , which states that wages include several components.

In particular:

- salary or hourly rate;

- allowances or additional payments that are provided by law for certain categories of workers, for example, for those workers employed in hazardous work;

- incentive payments that involve bonuses, additional payments for various labor achievements or bonuses.

At the same time, salary and additional payments are mandatory components of wages, given that the conditions for their assignment, as well as the amount and timing of payment, are regulated by law, but incentive accruals are paid only based on the financial situation of the company and only if the condition for their accrual enshrined in local acts.

Also in Art. 22 of the Labor Code of the Russian Federation states that the company’s management is obliged to provide wages equal to the labor costs of employees, and for the duration of a full shift and within the scope of duties approved by the same job description and mutual cooperation agreement. And since the scale according to which the physical costs of workers are determined has not been developed, and due to the fact that many employers deliberately underestimate the level of wages, a minimum wage has been approved at the legislative level, which, in essence, acts as a guarantor of minimum material security in regarding ordinary workers.

So, in particular, Article 133 of the Labor Code of the Russian Federation states that the enterprise is obliged to pay wages not lower than the minimum wage approved by law to every worker who has worked the required hours in a month. That is, at the legislative level, based on the real subsistence level of the working population, a certain amount of material support is established, thanks to which the worker will be able to provide himself with everything necessary and below which the employer has no right to pay.

Moreover, if an employee performs his duties in conditions deviating from normal conditions, for example, in difficult climatic conditions, which is important for the northern regions, a regional coefficient is also added to the already guaranteed minimum wage in accordance with the norms enshrined in Article 316 of the Labor Code RF and in the amount approved by Law No. 4520-1.

And in accordance with Article 317 of the Labor Code of the Russian Federation, northern workers are also entitled to a bonus, calculated in proportion to the length of service in areas belonging to the far north or equivalent to it. That is, in fact, both the coefficient and the bonus for northern experience are calculated based on the accrued salary, which, in accordance with Article 135 of the Labor Code of the Russian Federation, should not be lower than the minimum wage.

What to do if the salary is below the minimum wage

In this regard, many employers are asking questions: what to do if the salary is below the minimum wage, and can the salary be below the minimum wage? The salary may be less than the minimum wage. After all, the salary includes not only the salary itself, but also compensation payments (for example, various allowances for working conditions), as well as incentive payments (for example, bonuses) (Article 129 of the Labor Code of the Russian Federation). Therefore, if for a month an employee receives, taking into account all allowances and incentives, an amount greater than or equal to the minimum wage, then neither the labor inspectors nor the employees should have any questions for you.

It is important to note that if, after withholding personal income tax from the income due to the employee, he receives an amount less than the minimum wage, then this does not threaten the employer. Additional payment up to the minimum wage If the employee’s salary is still less than the minimum wage, it is necessary to make an additional payment up to the minimum wage.

From January 1, 2018, the minimum wage is 9,489 rubles. (Article 3 of Federal Law No. 421-FZ dated December 28, 2017). The minimum wage established by federal legislation dated July 1, 2017 in the amount of 7,800 rubles, make an additional payment starting from July 2020 for each month worked.” Provide the relevant document to each employee against signature. Provided that this deviation may be widespread, it is possible to replace the order with a local act for each department, division or enterprise as a whole.

How do these bonuses and the minimum wage interact?

Even in the process of formation, each company develops a staffing table based on the existing volume of work and the needs for employees who will perform the agreed amount of work. At the same time, when forming the terms of reference, the employer must take into account the norms of Article 195.2 of the Labor Code of the Russian Federation , which implies professional standards and ETKS, where the approximate volume of workload for each employee in the context of all positions is developed in a standard form.

Also, in accordance with Article 133 of the Labor Code of the Russian Federation, the company’s management is obliged to provide for wages not lower than the minimum wage established in Russia as a whole, as well as in most constituent entities of the Russian Federation. That is, in fact, the law provides for each worker the opportunity to receive a monthly allowance not lower than the minimum for the working population for performing duties within the limits of physical resources.

In turn, the regional coefficient has a different purpose. Thus, Article 3 of Law No. 4520-1 states that the northern coefficient applies to all types of income of citizens living in the northern regions due to the fact that the cost of living in special climatic conditions is many times more expensive in comparison with the southern regions of the Russian Federation, and Due to the northern surcharge, the ability of citizens to provide the required minimum is equalized.

For example, the range of duties of a cleaner or economist in any region of the Russian Federation will be approximately the same, as will the level of wages, but at the same time northern workers will perform their duties with a greater load due to special climatic conditions, which will lead to discrimination. That is why, for the same cleaner, a standard is provided that allows her labor costs and financial capabilities to be equalized through the application of a regional coefficient.

Approximately the same meaning is given by law to the northern bonus in accordance with Article 137 of the Labor Code of the Russian Federation, which, in essence, is financial gratitude at the state level for work experience in the northern regions. After all, working for 15 years in low temperatures with excessive physical exertion is not so easy, which is why the agreed bonus is paid to northerners.

That is, following the direct interpretation of the law, wages are remuneration for a certain amount of work performed within the standard hours per month, while the coefficient and bonus are compensation for living in special climatic conditions, implying excessive expenditure of physical strength, and material resources. And since the agreed payments have different purposes, both the bonus and the coefficient are not included in the minimum wage and are added to the already calculated wages.

Minimum wage in the Kemerovo region from July 1, 2019 - subsistence level

The minimum wage is a fairly important indicator, on which a number of factors depend, including not only the amount of citizens’ earnings, but also various payments.

In this regard, any adjustment to this indicator never goes unnoticed by citizens, for whom it is truly important, since government bodies regularly change it.

In particular, residents are interested in what the minimum wage has been set in the Kemerovo region since July 1, 2020.

Concepts and definitions

The minimum wage is the minimum amount of monetary remuneration that must be established by the employer in favor of his employee if he was employed full-time and worked fully for the allotted time.

The amount of the minimum wage is determined by the Government and cannot be less than the subsistence level, since this rule is provided for in Article 133 of the Labor Code.

This measure is quite logical for the reason that, without receiving the required amount of the subsistence minimum established by the government, a person, in principle, cannot exist normally. This minimum is also determined by the relevant decision of the government after it receives reports on the standard of living of citizens from the state statistics agency.

In accordance with current legislation, an employee can receive an amount less than the minimum wage, since a tax for individuals is collected from the income he receives, the amount of which is 13%. In case of violation of the established amount of remuneration, the employer may subsequently be brought to criminal or administrative liability.

The amount of the minimum wage in the Kemerovo region is slightly different from the minimum wage and corresponds to the regional subsistence level, which is calculated by the territorial division of the statistical authority and sent to the governor.

After the new cost of living indicator was approved, the tripartite commission began to consider the issue of increasing minimum wages in various areas. The work of the commission is carried out in accordance with Law No. 7-OZ, published on February 21, 2003.

How changes happen

In accordance with the procedure approved in accordance with the latest amendments to current legislation introduced on May 1, 2020. After this date, the amount of the minimum wage will correspond to the subsistence level of the working-age population in Russia for the second quarter of last year.

If the subsistence minimum does not reach the subsistence level established for the second quarter of the year preceding the previous one, the minimum wage will correspond to the minimum in force from January 1 of the previous year.

In accordance with the standards specified in Article 3 of Federal Law No. 82, adopted on June 19, 2000, the minimum wage is used to make calculations:

- wages (every employee working in certain organizations on the territory of Russia has the right to receive wages from his employer, the amount of which will be more than the minimum wage accepted at the federal or regional level, if he fully works out his allotted working hours);

- all kinds of maternity benefits, as well as temporary disability of a citizen;

- other options for social insurance of citizens.

The minimum wage is adopted simultaneously throughout the entire territory of Russia and cannot have an amount that is lower than the subsistence level adopted for able-bodied citizens in accordance with the provisions of Article 133 of the Labor Code.

The procedure and timing according to which the current minimum wage indicator should be gradually increased must be regulated by current federal legislation, as specified in Article 421 of the Labor Code.

Article 133 of the Labor Code of the Russian Federation. Establishing a minimum wage

Article 421 of the Labor Code of the Russian Federation. The procedure and timing for introducing the minimum wage

The living wage, which is used as a starting point in the process of determining the minimum acceptable wage for citizens, is the total cost of products included in the conditional consumer basket.

In particular, this includes the minimum necessary set of food products for a person, as well as non-food services and goods that are necessary to ensure normal human life.

In addition, this indicator includes all kinds of mandatory payments and fees that are included in the state budget.

The cost of living is determined based on the results of each quarter. In order to accurately determine this indicator, a huge amount of statistical data is used, including the recorded inflation rate.

The Russian government sets this indicator exclusively at the federal level, while regional authorities always have the right to change it for their territory.

Minimum wage in the Kemerovo region

In the Kemerovo region, starting from January 1, 2020, a tripartite agreement has been in force, which was concluded between the regional association of trade unions, the Board of Administration and employers.

For commercial companies, this figure in the region is one and a half times higher than the established cost of living for the working population. The only exception to this rule are companies that operate in the field of regulated pricing.

At the moment, a completely different algorithm has already been proposed, according to which adjustments will be made to the minimum allowable wage. Thus, starting from January 1, 2019, the amount of the minimum wage will be revised once annually.

Installed by

As mentioned above, the minimum wage in the Kemerovo region is established on the basis of a decision made by a tripartite commission operating in accordance with the norms of Law No. 7-OZ, adopted on February 21, 2003. Seven people from each party are present during the commission meeting, who can be hired employees, authorized representatives of executive authorities and employers.

The decision is made only after all three parties come to a single agreement, after which it must be published in the regional newspaper Kuzbass, as well as in the bulletin of deputies of this region.

In the territory of this region, employers must conduct their activities in accordance with the Kuzbass Regional Agreement, which was drawn up between the Kemerovo Regional Association of Trade Union Organizations, employers, and the Board of Administration of this region. This agreement was concluded on January 25, 2020 and published in the public domain.

Regional coefficient

Do not forget that in the territory of the specified region there is a coefficient of 1.3 and is established in accordance with Resolution of the Council of Ministers of the USSR No. 601, published on August 1, 1989.

Thus, the salary of company employees must be multiplied by this value, but at the same time the amount is compared with the minimum wage, which does not take into account all kinds of allowances and coefficients, since in accordance with current legislation they must be superimposed on top.

At the same time, all kinds of remunerations and bonuses, which according to the rules relate to the remuneration system, are taken into account in the process of calculating the minimum amount.

Is it possible to refuse in favor of the federal

Both commercial private companies and budgetary authorities or private entrepreneurs who operate and hire employees in the Kemerovo region must comply with legislative norms regarding the minimum wage.

Since companies operating on a budgetary basis pay their employees salaries in accordance with the federal level, they cannot reduce this figure regardless of the circumstances, nor can they ignore the accepted coefficient.

At the same time, commercial companies and private entrepreneurs are given the opportunity to abandon the minimum wage adopted in the region and replace it with the federal one in the following situations:

- if they are start-up entrepreneurs or newly formed organizations;

- if the company has recently suffered from all kinds of fires or any natural phenomena;

- the company is bankrupt.

In order to receive a wage benefit, an application is drawn up in free form, which is subsequently sent to the local committee involved in ensuring labor and employment.

When filling out the application, you must provide the following information:

- sending the document to: the head of the Public Relations Committee;

- indication of the checkpoint and tax identification number, as well as the address of the institution;

- an indication that the applicant refuses to join the regional agreement on determining the minimum wage, specifying the date of filling out the document;

- an indication that, using its own right granted in accordance with the provisions of Article 133.1 of the Labor Code, due to the lack of a sufficient amount of funds, the company refuses to join the agreement in accordance with which the regional minimum wage is determined;

- list of documents that are attached to the submitted application;

- the company's proposals regarding when it will be able to join the agreement;

- signatures of the general director and chief accountant of the organization.

It is imperative that you justify your requirements in this document, and as soon as the new minimum wage is approved, each company is given no more than 30 calendar days to completely abandon the regional level. For beginners, this period will be counted from the moment of registration.

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

Accrual procedure

Considering that the northern part of Russia is quite vast and includes many areas with different climatic conditions, the size of the coefficients has been approved at the legislative level to balance the costs of the population.

So, in particular, on average, the surcharge for special climatic conditions is a maximum of 2, which is relevant for Yakutia, the Sakhalin region and the Chukotka District, and a minimum of 1.15 in relation to such areas as Karelia.

Moreover, according to the law, the coefficient does not apply to all accruals, but only to those that are mandatory or included in the company’s remuneration system on the basis of local regulations.

In particular, the surcharge applies to the following charges:

- salary;

- compensation payments for night or overtime work;

- bonuses or bonus system.

For other accruals that imply one-time financial assistance, as well as all cases of calculating payment at an average rate, the coefficient is not applied, due to the fact that when calculating the average wage, all payments for the year with an already accrued coefficient are taken into account.

For example, an employee has a salary of 20,000 and lives in Yakutia, while he is given a bonus of 25% and 10% for hazardous working conditions. Also, in connection with family problems, the worker was given assistance in the amount of 3,000 rubles.

Then the calculation will look like this:

- 20000 * 2 = 40000;

- 20000 / 25 = 5000;

- 20000 / 10 = 2000.

Thus, the employee’s salary for the month will be: 40,000 + 5000 + 2000 + 3000 = 50,000 rubles .

Minimum wage and insurance premiums for individual entrepreneurs in 2020

In 2020, individual entrepreneurs pay 40,874 rubles in fixed insurance premiums + 1% of income over 300 thousand rubles - this amount does not depend on the minimum wage.

Since 2020, insurance premiums do not depend on the minimum wage. In 2020 and earlier, the fixed part was calculated using the formula:

Contributions for the year = minimum wage x 12 x 31.1%

For the calculation, we used the federal minimum wage, which was in effect at the beginning of the year. On January 1, 2020, the minimum wage was 7,500 rubles, so for 2020, individual entrepreneurs paid 27,990 rubles + 1% of income over 300 thousand.

Sick leave payment

In accordance with Article 183 of the Labor Code of the Russian Federation, during the period of incapacity, the employee retains not only his job, but also his average salary in proportion to the length of service worked.

That is, if you have a total employment history of more than 8 years, sick leave will be paid in the amount of 100% of earnings, less than 8 years in 80% and up to 5 years in the amount of 60% of the average wage for each day of illness (Article 7 of Federal Law No. 255) .

In this case, the calculation of the average salary is carried out in accordance with Article 139 of the Labor Code of the Russian Federation, which states that all accruals for the year are taken into account, except for financial assistance, which implies the summation of salary, allowances, and the accrued coefficient. That is, in fact, when calculating the average wage, the coefficient is already taken into account initially, and for the entire past year, that is why the regional coefficient is not applied when calculating days of incapacity.

Regional minimum wage

In addition to the federal minimum wage, which is valid throughout Russia, some regions determine their own minimum wage or regional minimum wage. If the authorities of your region have established their own minimum wage, be guided by it when issuing wages. It doesn't affect anything anymore.

If the regional minimum wage is less than the federal one, use the federal amount.

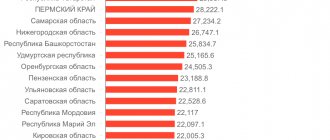

We found the minimum wage for some regions. If yours is not on the list, write in the comments, we will try to help.

To make sure that the minimum wage is up to date, follow the link in the table.

| Region | Minimum wage size |

| Moscow | 20,195 ₽ — from October 1, 2020 |

| Saint Petersburg | 19,000 ₽ - from January 1, 2020 |

| Sevastopol | 12,130 ₽ — from January 1, 2020 |

| Altai region | 13,000 ₽ + regional coefficient - from January 1, 2020 |

| Bashkortostan | 12,130 ₽ + regional coefficient - from January 1, 2020 |

| Volgograd region | 14,032 ₽ — from January 1, 2020 |

| Irkutsk region | 12,130 ₽ + regional coefficient - from January 1, 2020 |

| Kabardino-Balkaria | 12,834 ₽ — from August 30, 2019 |

| Karelia, Republic | 12,130 ₽ + regional coefficient - from January 1, 2020 |

| Kemerovo region | 16,516.50 ₽ + regional coefficient - from January 1, 2020 |

| Krasnodar region | 12,130 ₽ — from January 1, 2020 |

| Crimea, Republic | 12,130 ₽ — from January 1, 2020 |

| Kursk region | 12,130 ₽ — from January 1, 2020 |

| Leningrad region | 12,800 ₽ — from January 1, 2020 |

| Moscow region | 15,000 ₽ - from November 1, 2019 |

| Nizhny Novgorod Region | 12,130 ₽ — from January 1, 2020 |

| Novgorod region | 12,130 ₽ — from July 1, 2019 |

| Novosibirsk region | 12,130 ₽ + regional coefficient - from January 1, 2020 |

| Perm region | 12,130 ₽ + regional coefficient - from January 1, 2020 |

| Pskov region | 12,276 ₽ — for small business employees |

| Rostov region | 14,556 ₽ + regional coefficient - from January 1, 2020 |

| Sverdlovsk region | 12,130 ₽ + regional coefficient - from January 1, 2020 |

| Stavropol region | 12,130 ₽ + regional coefficient - from January 1, 2020 |

| Tomsk region | 12,130 ₽+ regional coefficient - from January 1, 2020 |

| Tula region | 14,100 ₽ — from October 1, 2019 |

| Tyumen region | 12,200 ₽ + regional coefficient - from January 1, 2020 |

| Khabarovsk region | 12,130 ₽ + regional coefficient - from January 1, 2020 |

| Khanty-Mansi Autonomous Okrug | 12,130 ₽ + regional coefficient |

| Chelyabinsk region | 12,130 ₽ — from January 1, 2020 |

| Yamalo-Nenets Autonomous Okrug | 12,130 ₽ — from January 1, 2020 |

In what cases is the regional coefficient for sick leave calculated?

As we already know, the regional coefficient is an indicator by which the salary of an employee working in a region for which the corresponding coefficient is determined by law is multiplied. When calculating sick leave, such multiplication is generally not carried out: this is due to the fact that disability benefits are calculated based on actual earnings (which have already been calculated and paid taking into account the established coefficients).

You can learn more about the features of calculating sick leave based on average earnings in the article “Average daily earnings for calculating sick leave.”

However, the regional coefficient when calculating sick leave can still be applied if:

1. The employee has an insurance period that does not exceed 6 months.

2. The employee’s average monthly earnings for the 2 years preceding the year in which the sick leave is issued is less than the minimum wage.

3. The employee did not work under the Labor Code of the Russian Federation for 2 years preceding the year in which the sick leave was issued (and, accordingly, did not have a salary).

4. The employee violated the treatment regimen.

5. The employee’s incapacity for work was due to intoxication.

Let us consider in more detail the procedure for calculating sick leave in these cases in practice.