Duration of work of a part-time worker

If we turn to the Labor Code, it does not contain such a concept as “full-time” or “half-time”. However, they are often used to draw up staffing schedules or determine the number of employees.

An external part-time worker is understood as an employee who has entered into an employment contract with another employer to perform a regular type of work in his free time from working for the main employer. According to the Labor Code of the Russian Federation (Article 284), the duration of work of such an employee should not exceed ½ of the norm. If we consider the standard working time as 40 hours per week, then half will be 20 hours per week or 4 hours per day.

Important! On those days when the main employer’s employee is released from his work duties, he has the right to work for the employer for a full working day.

However, the total duration of work for a month cannot be more than the monthly norm established for the same category of workers. That is, full-time work is not provided for part-time workers.

Example

Example 1: Ivanov I.I. At his main place of work at LLC Continent, he works from Monday to Thursday, and has a day off on Friday. In addition, he works part-time at Vega LLC, where he has the following work schedule: Monday, Tuesday - 4 hours a day from 18.00 to 22.00, closed on Wednesday, Thursday - 4 hours from 18.00 to 22.00 , on Friday - a full 8-hour working day from 9.00 to 18.00 (with a lunch break from 13.00 to 14.00). In total, Ivanov got 20 hours of work per week.

Example 2: Petrov P.P. works part-time at Vega LLC. The employment contract provides for remuneration based on the final result of work. Petrov, during the working hours established for him, fulfills the labor standard established for key workers. In accordance with this, Petrov’s remuneration is calculated based on the work actually performed by him.

Results

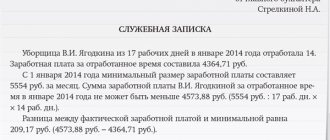

The calculation of the additional payment up to the minimum wage is made when the employee’s salary (its fixed part) is less than the established minimum. In relation to part-time workers, you should take into account what rate coefficient is assigned to such an employee. This is stipulated in the employment contract along with the duration of the working day.

In accordance with the Labor Code, an employee who has worked an 8-hour workday (or an incomplete workday, depending on the conditions of employment) must receive a salary no less than the approved minimum. The minimum wage, as a rule, is approved annually from the beginning of the year through the adoption of the relevant federal law. From 01/01/2020, the minimum wage is 12,130 rubles.

If the amount of wages accrued to the employee is less than the current minimum wage, then the employer must calculate the appropriate additional payment and pay it along with the monthly salary. In addition, employers should take into account that regions may have a different level of minimum wage.

The obligation to follow the regional minimum wage is enshrined in Art. 133.1 of the Labor Code. An exception is an official refusal to apply the local minimum wage, which the employer can submit within 30 days after the approval of the regional agreement.

Sources: Labor Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Part-time full-time job

Important! In some cases, it is possible to establish a full-time work schedule for a part-time worker.

Despite the limitation on working hours, there are exceptions to this norm of the labor code. For example, for a certain category of health workers, for whom the duration of part-time work can be set to the same as for main workers. These include health workers living and working in villages or urban settlements. Such employees can be hired full-time (Government Decree No. 813 of November 12, 2002).

In addition, for some part-time workers whose working conditions for their main job have changed, an exception also applies. A full-time job is possible for them in the following cases:

- At the main place of work, a suspension of work was established due to a delay in payment of wages, the period of which exceeded 2 weeks (142 Labor Code of the Russian Federation);

- In the event that an employee at his main job is suspended from work for medical reasons for no more than 4 months. At the same time, he refused to be transferred to another job with easier working conditions, or if the company does not have a position to offer this employee (73 Labor Code of the Russian Federation). The same exception is established for company managers, their deputies or chief accountants. An additional condition in this case is that the employment contract at the main place of work is not terminated.

Features of providing an additional payment up to the minimum wage when combining in a budgetary institution

Nuances on incentive payments Can a part-time worker receive a salary at the full rate? If payment is made on a time basis, then definitely not. In this case, it turns out that the employee works full time, which means that he is, in fact, the main employee, which requires documentation. However, the salary of a part-time worker can be increased due to incentive payments.

In addition to the bonus for qualifications, these may include additional payments for the amount of work actually done, if it exceeds the norm. Also, the employee can be encouraged for high performance indicators and so on. In this case, the assignment of additional payments is entirely at the discretion of the employer. The upper salary threshold for a part-time worker is not limited by law.

But speaking of incentive payments, we cannot ignore the fact that the salary of a part-time worker is less than the norm established by law.

- bonuses based on the results of work performed;

- district coefficient;

- northern allowances;

- other payments.

If the employment contract provides for any individual bonuses, they must also be taken into account when paying external part-time workers. Minimum amount of incentives According to the law, the employer has the right to reward particularly distinguished employees. However, this is not an obligation, but only a right. Therefore, employees may or may not receive incentives.

The list of incentives existing in the organization is defined in the collective contract. Part-time employees receive incentive payments in the same manner as main employees.

This decision of the boss is influenced by the level of quality and volume of fulfilled obligations of subordinates. It should be borne in mind that the amount of payments provided must comply with legal standards. Minimum wage for part-time jobs In part-time jobs, the minimum wage should not be lower than the minimum wage. The employer must calculate earnings based on hours worked.

In a combined part-time position, the subordinate will legally receive half the earnings of the main position. Since 2020, the minimum wage is 7,500 rubles. According to the current law, when calculating the salary of a part-time employee, the manager must start from this amount.

A part-time employment contract with an hourly wage provides for the provision of funds for each hour worked.

Employment contract

- The concept of minimum wage is primarily necessary in order to correctly determine the total amount of taxes, fines and other fees.

- As for the definition of the minimum wage itself, it means the minimum established by the legislation of the Russian Federation, which each employer is obliged to pay to its employees for the month worked.

- Each employee must know the amount of his salary, since this is a kind of guarantee that he will not receive less than this amount for the month he worked.

- According to current legislation, each employer does not have the right to pay its employees wages below the established minimum.

- If the employer pays less than the minimum wage, he faces both administrative and criminal penalties.

We suggest you familiarize yourself with whether the actions of bailiffs are legal. They withhold 50 from transfers to the card.

The minimum wage in the Russian Federation is necessary for such basic tasks as:

- control and regulation of wage levels;

- determining the amount of social benefits;

- to assess the rights of those categories of citizens who are insured for pensions.

In addition, entrepreneurs who carry out their work activities make certain insurance payments based on the minimum wage. This means only one thing: if the minimum cost of living in a country increases, not only does the level of wages increase, but the amount of deductions also increases, which leads to higher prices.

It is worth noting that the amount of fines or taxes directly depends on the amount of the minimum wage.

In addition, the minimum wage is used in such Codes as:

- Tax;

- Administrative;

- Civil.

In all Codes it is applied at the initial level, in relation to which all monetary sanctions are determined.

- The minimum wage in the Russian Federation is the minimum wage that unskilled employees are entitled to receive for their full working day.

- It is important to note that the entire working day must be in proper conditions.

- Article 129 of the Labor Code clearly defines the components of the minimum wage:

- when setting wages, the qualifications of the employee, as well as the amount of work and working conditions are taken into account;

- additional payment for irregular working hours or for difficult working conditions;

- various bonuses, allowances and so on.

It is important to take into account that there is a premium for additional work.

At the same time, additional work, or carrying out labor activities at 1.5 times the rate, does not give reason to believe that the total income should be equal to the minimum wage.

The purpose and rules for applying for a subsidy for utility bills are discussed here. The procedure for applying for a standard tax deduction for a child is set out in this article.

Read about what a social tax deduction for treatment is in this material.

The question of what exactly the minimum wage will be in a certain period of time in any territory of the state is decided at the federal level.

The regional government has every reason to independently decide on increasing the amount of the minimum wage. At the same time, it is worth keeping in mind that authorities in the regions cannot set a lower minimum wage at the government level.

The established amount of the minimum wage can be changed in the process of increasing or decreasing the level of inflation. The ideal minimum wage is one that is higher than the minimum subsistence level in a given region.

The Labor Code of the Russian Federation, in particular Article 133, clearly defines the sources that finance the minimum wage. According to the law, the main source of the minimum wage is the employer. As for budgetary enterprises, in their case, the source of the minimum wage is usually considered to be the federal balance.

Forms of international labor law

- As for the Federal Minimum Wage, it is initially adopted by the Federal Assembly of the Russian Federation, after which it is sent to the President for signature, and only after that it becomes a Federal Law.

- In the constituent entities, the minimum wage level is established by signing a tripartite agreement.

- This document is handled by:

- power or administration of a certain region;

- representative of the workers' union;

- Commissioner of the Union of Industrialists and Entrepreneurs on behalf of workers.

- After such a decision was published in the local media, within the first month, employers in the region have every right to express their dissatisfaction.

- Any dissatisfaction must be accompanied by a corresponding statement to the district administration.

- If the employer ignored his grievances for a month, this only means that he fully supports the established level of the minimum wage.

The minimum wage is applied in many areas, among them:

- Regulation of wages in the country. According to the Labor Code of the Russian Federation, the salary of an employee of any organization, including individual entrepreneurs, regardless of his work experience and qualifications, cannot be below the legal limit. Here we are talking about accrued wages, taking into account the fact that the employee conscientiously performed his duties throughout the entire working month.

The amount of money an employee receives in person, after withholding taxes and necessary contributions, may be less than the established minimum wage; this is quite acceptable by law. Part-time workers and citizens working at a part-time rate can also receive wages below the established threshold.

- Where is the minimum wage applicable? Determination of the amount of social benefits. In this case, the minimum wage will determine the amount of payments for temporarily unemployed persons and for citizens whose average earnings over the last two years did not reach the minimum wage.

- Calculation of the amount of fines, taxes, fees and contributions calculated in accordance with the law on the basis of the minimum wage. The minimum wage is used in the Administrative, Tax and Civil Codes as an entry level. On its basis, the amounts of the above payments are established.

Workers' rights

Nuances on incentive payments Can a part-time worker receive a salary at the full rate? If payment is made on a time basis, then definitely not.

In this case, it turns out that the employee works full time, which means that he is, in fact, the main employee, which requires documentation. However, the salary of a part-time worker can be increased due to incentive payments.

In addition to the bonus for qualifications, these may include additional payments for the amount of work actually done, if it exceeds the norm. Also, the employee can be encouraged for high performance indicators and so on.

In this case, the assignment of additional payments is entirely at the discretion of the employer. The upper salary threshold for a part-time worker is not limited by law. But speaking of incentive payments, we cannot ignore the fact that the salary of a part-time worker is less than the norm established by law.

Applying for a part-time full-time job

If the employee at his main place of work has certain circumstances specified above, then in order to transfer him to full-time work, the part-time employer must make certain changes in working conditions. This must be done in order to avoid violations of labor laws.

In this case, you will need to complete a certain package of documents. First of all, the employee must provide evidence that circumstances have arisen at his main place of work that allow him to work part-time full-time. Such documents can be submitted:

- Medical report or medical certificate confirming the health status of the part-time worker;

- An order from the main place of work confirming that the employee has been suspended from performing work duties;

- A copy of a document confirming the suspension of work with the main employer due to a delay in payment of wages (a copy of the notice or a copy of the order).

Supporting documents are attached to the application drawn up by the employee, in which he indicates a request to increase his working hours to the full rate.

After this, the manager issues an order indicating the period for which the changes will be in effect, as well as the amount of the salary. The employee's statement is indicated as the basis.