Who should I write to about changing details?

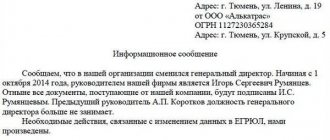

This message is used to inform partners/clients/customers/creditors, as well as interested government agencies and regulatory authorities about the changes that have occurred.

An important clarification: today there is no need to report changes in bank details to the territorial tax service in writing, because this function was transferred to banks.

FILES

As for the other counterparties of the enterprise, in relation to them the letter is not voluntary, but mandatory, since the need to notify about a change of details is always reflected in the written contractual relationship between the parties. The most important thing is to do this in a timely manner, even better in advance, so that during practical interaction no unpleasant incidents arise, such as sending important documents to the previous address or transferring funds to old accounts.

Letter of notification of change of legal address: sample writing

Have questions? Consult a lawyer (free of charge, 24 hours a day, seven days a week):

8 – Federal number

8 – Moscow and Moscow region.

8 – St. Petersburg and Len. region

Each enterprise is assigned a legal address, which is registered during company registration and entered into the state register. But in some situations there is a need to change it.

The reasons can be very diverse. In this case, you should definitely warn your business partners about this fact.

The article discusses the main features and rules for filling out a letter to counterparties about changing the legal address, and a sample of how to write it.

Reasons for writing a notice

In the process of changing the address of the organization's location, these changes must be recorded in the constituent documentation. They must be registered with government agencies. The adjustments made become legally significant only after their state registration.

The notification must be sent to the banking institution servicing the enterprise, as well as to partners with whom the company interacts. In addition, changes should be reflected in concluded contracts and work books of employees. Agreements with counterparties usually stipulate how and within what time period notification of changes that have occurred should be sent.

A sample notification of counterparties about a change of legal address can be found on the Internet at various resources.

What documents to submit to the Federal Tax Service: preparation and submission

After the organization’s management has decided on a new address, a general meeting of participants is scheduled (if there is only one participant, then his decision is recorded). As a result of the meeting, a protocol on the change of legal address is signed, where it is necessary to reflect:

- name and location of the enterprise;

- type of general meeting (regular or extraordinary);

- date and place of the meeting;

- who took part;

- the topic under discussion (the issue of changing the address and making changes to the constituent documents);

- consent of the participating persons with the change of address and approval of the new place of registration, as well as with the new edition of the charter, amendments to it and change of the company stamp.

Important: The minutes must be signed by the chairman and secretary of the meeting (meeting participants).

List of documents

After the decision is made, within 3 working days you must submit a package of documentation to the Federal Tax Service, including:

- decision of the sole participant or document following the results of the general meeting;

- application on form No. P13001, approved by Order of the Federal Tax Service of the Russian Federation dated January 25, 2012 No. MMV-7-6/25. You only need to fill out sheets A, B and M. The paper must be signed by the head of the organization and notarized. The notary should submit a recent extract from the Unified State Register of Legal Entities, a certificate of registration, the charter and a document on the appointment of the head of the enterprise. This list may vary depending on the notary office. Therefore, it should be clarified in advance;

- new constituent documents or amendments to them (in two copies);

- check for payment of state duty and payment order with a bank stamp. According to subclause 3 of clause 1 of Article 333.33 of the Tax Code of the Russian Federation, the cost of the procedure for changing the address in government agencies is 800 rubles;

- documentation confirming the new address. For example, a copy of the certificate of ownership, purchase and sale agreement and rental contact, etc.

This set of documents is submitted to the tax office directly by the applicant or his representative. You can submit them in person or by mail in the form of a valuable letter. The inspector receiving the papers draws up a receipt with a list of documents received. It confirms the fact of their submission.

After the tax authorities record the changes made in the database and issue the corresponding document, the procedure for changing the address can be considered completed. Now you should notify the company's partners about this.

Who should I send the notification to?

Such a notice is used to inform partners, clients, customers, creditors and interested government agencies about the changes that have occurred.

Important to know: Currently, written notification of changes in bank details is not sent to the tax office - this responsibility has been transferred to financial institutions.

Regarding other counterparties of the organization, the letter should be sent to them without fail, since changes in the legal address affect the execution of contracts between the interacting parties. It is important to do this on time to avoid misunderstandings (sending important documentation to an old address, transferring funds using outdated bank details).

When the legal address changes, the Federal Tax Service division servicing the company may also change. You can clarify this fact on the government services website.

Who issues the notice?

As a rule, the preparation of such notices is entrusted to a legal consultant or secretary of the organization. Also, this responsibility can be assigned to managers and employees of departments who directly interact with partners.

Recommendation: Regardless of who writes the letter, the main thing is that the employee understands the procedure for composing business correspondence.

A sample notification of a change of legal address is given below.

Writing order

The notification letter does not have a strict unified form that must be used without fail. The notice can be written in any form in accordance with the needs and goals of the sender. But you still need to follow some rules and regulations, which are listed below.

Source: https://YuridicheskijAdres.ru/yuridicheskoe-soprovozhdenie/pismo-uvedomlenie-o-smene-uridiceskogo-adresa-obrazec-napisania.html

Compilation rules

The letter does not have a strict, mandatory, unified template, so it can be written in free form, taking into account the needs and objectives of the sender. However, you still need to adhere to some norms and standards.

- At the beginning of the letter, it is necessary to indicate the sender and addressee, and if we are talking about the addressee, you should enter not only the name of the company, but also the position of a specific employee.

- Next comes the informational part of the message. Here you need to convey to the recipient a message about the change in details, indicate new ones, and also state requests related to the changes made.

The tone of the letter should be polite, not too dry, but in no case cheeky. It is necessary to follow a business style and carefully monitor compliance with the rules of the Russian language, especially in terms of vocabulary, grammar and punctuation.

A letter about changing details can be written either by hand or printed on a computer, but in any case, it must contain a “living” signature of the head of the sending organization or another authorized person. It is not necessary to put a stamp on the document, because from 2020, legal entities have the right not to put stamps on paper documentation.

You can write a letter

- on a regular standard A4 sheet of paper

- or on the organization’s letterhead.

The last option is preferable, because it gives the document solidity and indicates the official nature of the message.

The letter may have as many copies as required to notify all interested parties. Each sent message must be recorded in the outgoing registration log, so that in case of disagreements with the counterparty, the sender has information about the date the message was sent.

How to properly notify counterparties about a change of legal address and checkpoint

> Family law

13.10.2019

The legal address of a business entity is its main characteristic, which is recorded by authorized bodies and counterparties. When changing it, it is necessary to notify the persons interested in cooperation and regulatory authorities about the event. How correctly and in what time frame should the procedure be implemented?

general information

The legal address determines the location of the business entity.

It is one of its main details, which are recorded in a single database.

When changing it, it is important to promptly notify the Tax Service, whose representatives, in turn, inform other government bodies.

The head of the business entity notifies business partners if there are personal interests, understanding of the situation or obligations reflected in the contract about such actions.

The set of documents attached to the notification letter is formed depending on whether the innovation requires changes to the statutory documentation or not. When changing the legal address, the actual location of the subject may not change.

When is it necessary to submit a notice of a change of location of a company?

Changing the legal address is relevant in situations where the company previously rented premises to ensure the functioning of the company, and has now acquired commercial real estate, as a result of which the need for rent has disappeared.

The situation may become relevant if the actual and legal addresses coincide and management makes a decision to change premises or offices in order to ensure more efficient activities.

A change of legal address is also initiated by management if it is impossible to renew the lease agreement for a property whose address was previously used as the legal address.

Deadlines

The provisions of legal acts stipulate that notification of a change of legal address by a business entity to the Tax Service must be carried out no later than the third day after the decision made by the founders of the company.

If such requirements are violated, a fine of 5,000 rubles is imposed on the official.

Informing other government bodies and partners about the event is carried out only after receiving new registration documents indicating changes have been made to the Unified State Register of Legal Entities database.

Who needs to be notified

A business entity is first of all obliged to inform the Tax Service about changes, whose representatives are responsible for notifying extra-budgetary funds and statistical bodies within five days after updating the information in the state register. The head of the company is not obliged to independently notify Statistics and Funds about the event, however, if necessary, to speed up the procedure, he has the right to submit the appropriate set of documents.

Goskomstat

To notify statistical authorities, you do not need to visit the organization in person. All issues can be resolved without leaving the office through the official website of the State Statistics Committee. Copies of documents received from the Tax Service and the corresponding decision of the founders can be uploaded to the portal server or sent by mail as a valuable letter.

Funds

The law adopted in 2014 abolished the obligation of taxpayers to notify the Pension Fund and the Social Insurance Fund about changes made to the unified database.

This procedure is carried out by the Tax Service, however, the head of a business entity that has undergone changes in parameters should make sure that the supervisory authority has submitted the relevant information.

If this does not happen, then the company must initiate an event from the Tax Service or independently.

A business entity is obliged to notify the banking institution in which its current accounts are opened about all changes in the parameters of the organization. The terms of notification are specified in the service agreement. A sample information letter about changing the legal address of an organization is developed independently by each bank.

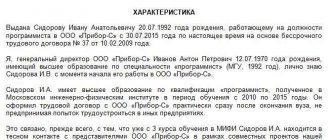

An example of writing a letter about changing the details of an organization

Filling out the header of the letter

- At the top of the message, the sender is first indicated, that is, it is entered

- full name of the organization (in accordance with registration papers),

- address and telephone number for contact.

- Then enter information about the recipient:

- its name

- and a specific person to whom the address is directly made (position, surname, first name and patronymic).

- After this, the date of drawing up the letter and its number according to internal document flow are indicated.

- Below in the middle of the line is written the name of the document.

Filling out the body of the letter about changing details

The following is an information section.

- First, the recipient is informed of the fact that the details have changed and it is indicated which data has been changed. The date from which the previous details lost their meaning is also entered here.

- Then, you should indicate all the requests the sender has regarding past and future documents regarding the changed data.

- At the end, the letter must be signed, with a transcript of the signature and an indication of the position of the signatory.

Notification of change of legal address

After making a decision to change the legal address, the founders of the organization will have to carry out a number of legal and registration actions. Having registered a new location with the Federal Tax Service, it is necessary to notify creditors and counterparties, and in some cases, government agencies, by sending them a notification about the change of legal address.

In what cases is it necessary to draw up a notice of change of legal address?

A letter about changing the legal address of an organization is sent to government departments and business partners. The decision to change the address is usually made in the following cases:

- if it is impossible to renew the lease agreement for premises that were previously registered as a legal address;

- if the company has acquired its own premises for carrying out activities and moves into it;

- if the management of the organization decided to change the office in order to carry out activities more efficiently;

- if there are other objective reasons for changing the legal address.

When must an organization notify the tax authorities?

In accordance with the provisions of paragraph 5 of Art. 5 of the Law on State Registration No. 129-FZ of 08.08.

2001, organizations are required, within three working days after approval of the decision to change the legal address, to send to the Federal Tax Service the corresponding application and package of documents in order to register the changes.

For failure to comply with this deadline, a company official will have to pay a fine of 5,000 rubles. (Clause 3, Article 14.25 of the Code of Administrative Offenses of the Russian Federation).

An information letter about a change of legal address should be sent to government agencies and business partners after making the appropriate changes to the Unified State Register of Legal Entities and receiving new documents from the registration authority.

To whom should written notice be sent?

Decree of the Government of the Russian Federation dated December 22, 2011 No. 1092 states that the registering Federal Tax Service is obliged to notify extra-budgetary funds and statistical authorities about changes in information about a legal entity within 5 working days after they are entered into the state register. The organization should not report changes of address to funds and statistics, but can do it independently if it is necessary to speed up this procedure.

To notify Goskomstat, it is not necessary to come there in person. This can be done on the official web portal of the statistics authority. The user must send to Statistics a copy of the decision to change the legal address and a copy of the entry sheet from the State Register received from the Federal Tax Service.

Since 2014, taxpayers are not required to notify the Pension Fund and the Social Insurance Fund of all changes made to the Unified State Register of Legal Entities. This responsibility is assigned to the Federal Tax Service, but it is better to make sure whether the fund has received the necessary information. If the fund does not have such information, the company can report this itself.

A letter about changing the legal address of an organization, a sample of which will be presented below, must be sent to the following entities:

- To the bank. The organization must notify the credit institutions where the company's accounts are opened that its legal address has changed. The notification period for changes in details is usually specified in the agreement with the bank. It may be necessary to reissue the card with samples of seals and signatures of persons entitled to carry out financial transactions. The form of the letter about changing the legal address of an LLC should be clarified with the banking institution. As a rule, the bank develops its own document forms to fill out.

- To contractors. The legislation does not oblige organizations to notify all partners - they have the right to decide on their own who exactly to inform about changes that have occurred. The exception is situations when the agreement between organizations stipulates the requirement for mandatory notification within a certain period of time about changes in details. A letter to counterparties about a change of legal address, a sample of which you will find below, can be sent by mail or delivered in person.

How to create a notification?

A letter about changing the legal address of an LLC, a sample of which can be taken as a basis when drawing up a similar document, refers to official business correspondence and is actively used in document flow. The letter can be written on a regular A4 sheet or on company letterhead. The document must be signed by the head and certified by the seal of the organization.

A sample letter about a change of legal address is not established by law, so it is drawn up in free form. When drafting the document, the following points must be taken into account:

- The document header is located in the upper right part. Here you must indicate the full name of the organization or department to which the notification will be sent, as well as your full name. and the position of the person who is the direct recipient.

- You can specify “Information letter” or “Letter about change of details” as the title of the document.

- The text of the letter should be located immediately after the header. The text style is business.

- It is recommended to start the letter with the phrase “We inform you that ....” or “We inform you about ....”. Next, you can indicate the reasons for changing the legal address, the old and new address.

- After the main text, indicate the date of preparation and certify the document with the signature of the manager and the seal of the company.

Sample information letter about change of legal address

Source: https://spmag.ru/articles/uvedomlenie-o-smene-yuridicheskogo-adresa

How to send a letter

Since details are the most important part of official documentation, it is advisable to send letters about all changes associated with them in “natural” form. This makes it possible to reliably bring information about new details to the attention of counterparties, especially if you send these messages by registered mail with return receipt requested.

As a last resort, you can combine different sending options: for example, combine an email or fax message with sending via Russian Post. On the one hand, this will allow partners to be notified of changes as quickly as possible, and on the other hand, it will provide the sender with evidence that the corresponding letter was sent to them in a timely manner and received by the addressee.

BUSINESS LETTERS

LETTER OF REQUEST

A request letter is perhaps the most common form of business correspondence. The number of situations that necessitate making a request on behalf of a legal or natural person cannot be counted. This is obtaining information, product samples, coordinating actions, inducing some action, etc.

The composition and structure of a request letter is not much different from the standard ones (see Business letters. Formatting rules. Letter structure). As a rule, the text of a request letter consists of two parts:

1. Introductory part, where the essence of the matter is stated in a narrative form, the motives and reasons for making the request are explained. The following standard expressions are often used here:

- the reason for petition

- Due to non-receipt...

- Considering the social significance...

- Taking into account (our long-term cooperation)…

- Considering (the long-term and fruitful nature of our business ties)…

- Due to the discrepancy between your actions and previously accepted agreements...

- Due to the delay in receiving the cargo...

- Based on the results of negotiations on the issue of... etc.

- Goal of request

- In order to comply with the order...

- In order to resolve the issue as quickly as possible...

- To coordinate issues...

- In order to ensure the safety of cargo passage...

- To avoid conflict situations... etc.

- links to grounds for appeal

- In accordance with the previously reached agreement...

- In connection with the appeal to us...

- Based on a verbal agreement...

- Based on our telephone conversation...

- According to government decree...

- According to the protocol on mutual supplies... etc.

All of the above expressions must be used taking into account the context and speech situation.

Almost all standard expressions begin with a derived preposition or prepositional phrase. You should pay attention to the correct use of these prepositions with nouns, which are mainly in the genitive and dative cases.

2. Actually a request. Here the key phrase of the letter includes words formed from the verb to ask

. Its use is explained by etiquette requirements for business texts and the psychological laws of business communication - a person more willingly agrees to perform an action expressed in the form of a request than in the form of a demand.

In some cases, the request itself, expressed descriptively, may not contain this verb, for example: We hope that you will find it possible to consider our proposal within the specified period.

The request can be made in the first person singular (“I ask...”), in the first person plural (“We ask...”), in the third person singular (in this case, nouns with a collective meaning are used: “The management asks...”, “Administration asks...", "The Work Collective Council asks...", etc.), from the third person plural, if several nouns with a collective meaning are used (The Administration and the Work Collective Council ask...).

If the request letter is multidimensional, then the composition of the second part of such a letter may look like this (parts of the composition must correspond to the paragraph division of the text):

I ask... (We ask...) ... At the same time I ask... (We also ask...) ... And I also ask... (And we also ask...) ... etc.

When drafting a letter of request, you should consider the following recommendations:

1. When making a request, emphasize your or your organization's interest in fulfilling it. 2. Under no circumstances begin a letter with the word “Please...” - it is more tactful to first explain the reasons for your request (even if all the details have already been agreed upon with the addressee). 3. Don’t rush to thank the recipient in advance. By doing this you put both yourself and the recipient in an awkward position. Try to say thank you when you find out that your request has been granted.

How to notify the customer about changes

After the contractor becomes aware of the start date of the new information, he draws up the above-mentioned paper.

You can hand it over to the customer in person or use postal services. In order to promptly notify the buyer, you can additionally send him a copy in electronic form. However, the form of the document that is defined in the government contract (for example, written) will be considered valid.

It is important to note that the contractor must ensure that the buyer accepts this document. This can be done by asking the addressee for the incoming number and date or a receipt.

When can you do without a letter about changing details?

Even at the stage of submitting an application to participate in public procurement, a potential supplier is required to provide general and banking information. This is necessary for drawing up a contract after the tender. Accordingly, if an organization, during the preparation of a tender proposal, is in the process of changing any of the above data, then it should indicate new data in its application. Moreover, such information will become available to the customer only after opening the envelopes (opening access to electronic documents), when it will no longer be possible to make changes. It should be remembered that before the deadline for submitting competitive and auction applications, the participant can withdraw the proposal, make adjustments and resubmit it.

In the case when the application has already been submitted, the participant has won the tender and the need to change the details arose at the stage of concluding the contract, instead of a notification, a protocol of disagreements is drawn up.

- Registration of a new legal address with the tax office

- Who else needs to be informed about the change of legal address?

Changing the address of a legal entity is not just moving to another office. This is a change in information registered in the state register, the “registration” of an organization to a specific municipality, and, accordingly, to the territorial body of the Federal Tax Service. The new location of the company must be recorded in the Unified State Register of Legal Entities and communicated to all interested authorities, and this procedure has a strictly limited time frame. How and to whom should an organization notify about a change of legal address?

Changing the contact email address in the registration data

Changing the contact email address in the registration data

You can change your contact email address in your control panel in the “Registration Information” section.

If you have lost your access details to the control panel, you can use the special form and click on the “Forgot your password” link. Then follow the instructions.

If the access details (login and/or password) to the agreement with Domain Registrar LLC are lost, and you are not able to restore them using the form located on the Registrar’s web server, then you can change the contact e-mail based on an official statement , sending it to Domain Registrar LLC.

Letter form:

Requirements for writing a letter:

Requirements for a letter submitted on behalf of an organization:

- The information provided in the letter must match that available in the Domain Registrar LLC database;

- The letter must be on the letterhead of the organization, with the seal of this organization;

- If the letter is signed by a person who is not the head of the organization (Director, General Director, Rector, Chairman of the Board), then the position, surname, first name, patronymic of this authorized person should be indicated, and a link to the document confirming his authority (for example: “based on power of attorney No- ______ dated _______”, or “based on order No- ______ dated _______”). In this case, the signature of the authorized representative must appear at the end of the letter. A copy of the power of attorney or order must be attached to the letter.

- A mandatory attachment to the application is a copy of the certificate of registration with the tax authority of the legal entity (TIN/KPP document).

Requirements for a letter submitted on behalf of an individual or individual entrepreneur:

An individual entrepreneur is also required to have a Certificate of entry into the Unified State Register of Individual Entrepreneurs.

The letter can be:

- bring it to our office;

- send by Russian post;

- a copy of the letter can be sent by fax, (495) 956-97-23;

- a copy of the letter can be sent electronically (for example, scanned) to the address

After receiving copies of letters, changes will be made to the Domain Registrar LLC database within 24 hours.