How does the CEO change his name?

The manager's passport data may change due to a change in the registered address at the place of residence or surname, as well as as a result of the replacement or loss of a passport.

The change of the surname of the director (USR) must be recorded in the Unified State Register of Legal Entities (USRLE). And despite the fact that there should be interdepartmental interaction between the bodies of the Ministry of Internal Affairs and the Federal Tax Service, in order to avoid misunderstandings, it is still better to notify the tax authority that the founder now has a new last name.

The procedure for state registration of changing the surname of the director of an LLC in 2020

Within three days after changing the passport details of the general director (last name, first name, other information), an application in form P14001 must be submitted to the registration authority. It must be drawn up and filled out in strict accordance with the specified form and the requirements of tax legislation. The document must be certified by a notary.

The state fee for registering a change in the surname of the director of an LLC is not paid.

The package of documents can be submitted to the registration authority personally by the director (EIO) or an authorized representative (in this case, a power of attorney will be required).

You can send documents in the following ways:

- through a multifunctional center;

- by post;

- through the Internet.

State registration of changes in the surname and other passport data of the director of the LLC is carried out within five working days from the date of submission of the package of documents to the registration authority.

How to change the last name or passport details of the founders and general director of an LLC in 2020

Let's look at the step-by-step procedure for changing the passport data of the participants of an LLC or the general director of the organization. The procedure for changing passport data is simple at first glance, but it will require you to devote a sufficient amount of time to carry out all stages of making changes, namely:

In addition to the application in form P14001, you will need to prepare a protocol or decision on changing passport data (depending on the number of participants in the company, in a company with one founder a decision will be required, with two or more participants a protocol will be required).

Changing the surname of the head of the organization

“The surname of the head of the organization may change due to marriage, after divorce, or at one’s own request. When a surname is changed, the registry office issues a document such as a certificate of name change. After which, within thirty days it is necessary to replace the old passport with a new one. If the head of the organization issued powers of attorney before changing the last name, then there is no need to re-issue them again. But in order to carry out work activities, it is also necessary to replace other documents. So, let’s list what other documents are changed when the name of the head of the organization changes. 1. You need to select the documents to which changes need to be made. You can make changes to personnel and other documents if you have a registry office certificate and a new passport. Often, the head of an organization is in no hurry to reissue personal documents, without which it will not be possible to replace the personnel and constituent documents of the organization. In this case, the employee can independently replace: - marriage certificate; — certificates of name change; — passports; - driver's license; — compulsory health insurance policy; — certificate of registration with the tax authority; — insurance certificate of compulsory pension insurance; - medical record; - bank card. 2. It is necessary to issue an order to change the personal data of the manager. To make changes to the organization’s documents, the manager needs to issue an order. And it is advisable to begin the procedure for making changes to personnel and constituent documents as early as possible. 3. It is necessary to make changes to the employment contract and work book. After the order is issued, it is necessary to make changes to the employment contract and the manager’s work book. The employment contract indicates the old name, surname and passport data (clauses 1, 2 of the first article 57 of the Labor Code of the Russian Federation). And new information is entered directly into the text of the employment contract (part three of article 57 of the Labor Code of the Russian Federation). It is also necessary to make changes to the work book (clauses 2, 3 of the Instructions approved by Resolution of the Ministry of Labor of Russia No. 69). 4. It is necessary to make changes to personnel records documents. Personal data of the head of the organization changes in the following personnel documents: - work book; — personal card; — personal account; — vacation schedule; — time sheet; — a book for recording the movement of work books. All changes must be made according to the rules. Carefully cross out the old surname so that it remains readable, write a new one next to it. Make a note “Believe the corrected”, put the number and date of the order for amendments and sign everything. 5. Changes need to be made to other documents. The organization also has documents that must be signed by the head of the organization. In addition, the tax authority and the bank store information about the name and passport details of the manager. Thus, you need to make changes to: 1. Power of attorney. If the manager received it from the founder. But you don’t have to issue a new power of attorney, since the old one will also be valid. There is also no need to issue new powers of attorney for employees of the organization. 2. Unified State Register of Legal Entities. Within three days after receiving a new passport, you must inform the tax authority about this in order to reflect new information about the manager in the Unified State Register of Legal Entities (subparagraph “l”, paragraph 1, article 5 of the Federal Law of August 8, 2001 No. 129 -FZ). 3. Constituent documents. If information about the manager is included in the organization’s constituent documents, then a new edition of the documents must be made. An application certified by a notary, constituent documents with amendments and a decision to make amendments are subject to registration with the tax authority (Article 17 of Law No. 129-FZ). Within five working days, all necessary changes will be made to the register (clause 4, article 5 of Law No. 129-FZ). If the personal data of the manager was not indicated in the constituent documents of the organization, then changing his last name is not a reason to amend the constituent documents (clause 5 of Article 5 of Law No. 129-FZ). 4. Signature sample card. To avoid suspension of account transactions and delays in payment of wages to employees, it is necessary to re-issue, along with bank documents, the sample signature card (clauses 7, 14 of Bank of Russia instructions dated September 14, 2006 No. 28-I, Appendix No. 1 to instructions)."

Legal Defense Services

Since 1997, we have been helping our clients in the field of labor protection and personnel records management. We provide services throughout Russia. Remotely, in a short time, our specialists will help resolve any issue.

Below you can select the service you are interested in.

The director of an LLC has the right to act on behalf of the organization without a power of attorney, and signs agreements with counterparties and financial documents. Like all employees, the director has the right to change his last name due to marriage or other reasons.

What is the procedure for changing the surname of the general director of an LLC, what documents should be changed, is it necessary to notify extra-budgetary funds and the tax authority?

Legal regulation of changing the director's surname

Due to the requirements of the Law on State Registration of Legal Entities No. 129-FZ, information about changes in the surname of the manager must be registered in the Unified State Register of Legal Entities (clause l.ch. 1, art. 5).

This law establishes the obligation of the organization to submit an application for changing information to the Unified State Register of Legal Entities (Part 5, Article 5 of Law No. 129-FZ) within 3 days after changing the name of the director.

Important! In the event of a change in the manager's passport data, the obligation to notify the tax authority does not arise!

An application for changing information in the Unified State Register of Legal Entities in the event of a change in the director’s passport data must be submitted if the director is a foreign citizen.

The last name, within the meaning of paragraph “l” of Part 1 of Article 5 of Law No. 129-FZ, does not apply to passport data, and a legal entity is obliged to notify the tax authority of its change.

What documents should I change when changing the last name of the LLC director?

| Document | Notes |

| Passport | Within 30 days after the fact |

| Employment history | A new surname is entered, the old one is crossed out |

| Personal card T-2 | |

| Vacation schedule | Amendments are being made to the document |

| Labor record book | |

| Employment contract | An additional agreement to the contract is drawn up |

| Extract from the Unified State Register of Legal Entities | An entry is made in the Unified State Register of Legal Entities and a new extract is issued |

| Constituent documents | Documents are changed if they contain information about the full name of the director, or the director is a founder |

| Accounting documents | |

| Bank documents | To receive payment documents and issue powers of attorney. To confirm new passport data and signature, you must personally appear at the bank |

Who to notify about the change of director's name

| Who to notify | Note |

| Tax authority | To make an entry about a change in the personal data of a person authorized to act without a power of attorney in the Unified State Register of Legal Entities |

| Pension Fund | The employer's obligation to notify a change in the personal data of the insured person |

| Banks | To carry out banking transactions on a current account, receive payment documents, wages, etc. |

| Counterparties | To avoid misunderstandings, notify counterparties by letter of the change in the director’s surname |

Tax authority

The Unified State Register of Legal Entities contains information about a citizen - an individual who has the right to act on behalf of an organization without a power of attorney. Since in an LLC such a person is the director, his personal data, including his new surname, is entered into the register.

An entry on changes in information about a legal entity in the Unified State Register of Legal Entities is made by the Federal Tax Service on the basis of the submitted application form P14001. The application form can be downloaded from the Federal Tax Service website.

If the director is also the founder of the company, then it is also necessary to make changes to the constituent documents and submit to the Federal Tax Service an application form P13001 for amendments to the constituent documents; the director’s signature in the application is certified by a notary. A state fee of 800 rubles is subject to payment.

Within 5 working days, the inspection makes an entry in the Unified State Register of Legal Entities about the change in information, and issues an extract with the new data.

Pension Fund

The organization is not obliged to notify the department of the Pension Fund of the Russian Federation about the change of the director’s surname, since this is reported by the inspectorate at the location of the company within 5 working days from the date of making the corresponding entry in the Unified State Register of Legal Entities.

Meanwhile, due to the requirements of Law No. 27-FZ, policyholders are required to report changes in the personal data of insured persons, and this requirement applies to all employees.

To receive a SNILS with a new last name, the director fills out an application form ADV-2. Within 14 calendar days, the organization submits an application to the territorial body of the Pension Fund of the Russian Federation to receive a new insurance certificate.

Banks

The bank must be notified of the change of name of the manager in order to avoid suspension of transactions on current accounts and delays in the payment of wages, settlements with partners and extra-budgetary funds.

To do this, the manager should contact the banking institution where the organization’s current accounts are opened, present a passport with a new name and certify a sample of the new signature.

The bank card with sample signatures and seal imprint will be replaced. The obligation for an organization to provide a new card in connection with a change in the surname of the person indicated on the card is established by Bank of Russia Instruction No. 28-i. You can apply for a new card directly at the bank by presenting your passport with your new name.

The legislation does not establish a period for notifying the bank about a change in name; however, the agreement with the bank may contain a clause obliging the client to notify about such changes.

Counterparties

Agreements concluded with counterparties usually include a clause on notifying the other party to the agreement about changes in details.

To avoid possible misunderstandings, you should notify your counterparties of the change in the manager's name in an official letter, sending it by mail, fax or e-mail.

Decision to change passport data: sample

Characteristics of the director of a cultural institution for awarding

Poses jewelry is not exchanged and returned

List of documents for compensation for utilities

Pegasus reduced the tour by 1 day when the money will be returned

How much can you sell a land share in Ukraine for?

Is it possible to fly with a temporary ID card?

Changing the passport of the general director, as well as the founder, entails making changes to the Unified State Register of Legal Entities. The Federal Tax Service must be notified of the receipt of a new passport no later than 5 working days from the date of its receipt.

If this fact is not registered, then work with the bank, INFS and extra-budgetary funds will be stopped, since the data of the new identity card will not correspond to the information already entered into the databases of the above structures. Initially, to change passport data, a decision (protocol) is prepared stating that it is necessary to make changes in the Unified State Register of Legal Entities, for the reason that the passport data of the manager is now different.

Important! Making changes takes 5 working days, after which a Unified State Register of Legal Entities (USRLE) entry sheet is issued, which must be carefully checked to ensure the correctness of the completed data. The document received from the tax authority is provided to the servicing bank, which must reflect the changes in its accounting documents. If the change of the general director’s passport is due to a change in the first name, last name or patronymic, then a card with samples of the legal entity’s seal and signatures must be replaced.

Depending on the organization of the process of interaction between departments in a particular region, it is necessary to inform extra-budgetary funds (PFR, FSS, TOMS) about changes in passport data of management by submitting an application accompanied by a copy of the updated passport, drawn up in free form.

You can clarify this issue upon receipt of the Unified State Register of Legal Entities entry sheet. DECISION No. __ of the Sole Participant of the Limited Liability Company “____________”

_________ “__” _________ _____ I, citizen _________________________________________________ DECIDED:

- In connection with the change in the passport data of the participant and the general director, ______________________ make changes to the Unified State Register of Legal Entities.

- Assign the responsibility for registering changes to the General Director ______________________

Procedure for registering a last name change

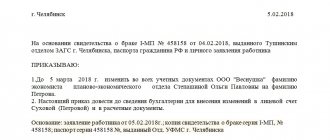

After registering a marriage with the civil registry office or receiving a certificate of change of name, the company’s participants hold an extraordinary meeting at which the issue of re-appointing a director to his position, indicating a new surname, is decided. The results of the meeting are documented in minutes.

If the company has a single participant and founder, the meeting is not held. The founder makes a decision to appoint a director to a position with a new name, and issues an order to change the personal data of the head of the company.

Changing the director of an LLC: step-by-step instructions in 2020

Since the change of director is a direct responsibility of the meeting of participants (clause 4, paragraph 2, article 33 of the Federal Law “On LLC”), this action will need to be formalized in the form of minutes of the meeting of participants, or in the form of a decision of the sole participant, depending on their number.

The head of an LLC is a key figure in the management of the company. If we draw an analogy with the branches of government, the meeting of participants is the legislative body, the director is the executive. The trial will be judicial. And therefore, the issue of changing the director in an LLC must be taken extremely seriously. Otherwise, at one point the company may be left without leadership.

Procedure for changing personal data

To make changes, the director must contact the personnel service of the enterprise with an application to make changes to the documents and present a passport with a new last name, as well as a document on the basis of which the change in personal data occurred.

| Action | Note |

| Step 1 – issuing an order | Based on a certificate of marriage (divorce), change of name or other document, an order is issued to make changes to his personal data |

| Step 2 – making changes to personnel records | Corresponding changes are made by crossing out the previous name and entering a new one in the work book and other documents |

| Step 3 – making changes to accounting documents | In connection with automated accounting, when changing your last name, the data in the personal account, the card for recording the income of individuals and payment of personal income tax, and the card for recording the amounts of insurance contributions to the Pension Fund of the Russian Federation will automatically change. |

| Step 4 – notification to the tax authority | Within 3 working days, the organization is obliged to notify the Federal Tax Service of the change in the name of the director |

| Step 5 – making changes to the Unified State Register of Legal Entities | An application to amend the Unified State Register of Legal Entities is submitted to the tax authority. Within 5 working days, a corresponding entry is made in the Unified State Register of Legal Entities and an extract from the Unified State Register of Legal Entities is issued with new data |

| Step 6 – notification of the Pension Fund of the Russian Federation | To register the insured person, it is necessary to report a change in his personal data to the Pension Fund of the Russian Federation |

| Step 7 – re-registration of bank documents | To prepare new documents and certify the signature, the manager must personally submit an application to the bank with the necessary documents attached. |

| Step 8 – notification of counterparties | To avoid misunderstandings, inform counterparties about changes in the director’s personal data |

Important! When entering a new surname, an entry is made on the inside cover of the work book or insert indicating the document on the basis of which the surname was changed, certified by the seal of the organization.

The director changed his last name

According to Order of the Ministry of Finance of Russia dated December 25, 2008 N 145n and Appendix 5 to Order of the Ministry of Finance of Russia dated November 24, 2004 N 106n, the state duty for state registration of amendments to the constituent documents is in the amount of 400 rubles. listed using the following details.

We recommend reading: Discount Travel Card for St. Petersburg 2019

Based on the manager’s application, it is necessary to prepare and note in the registration journal an order to make changes to the documents containing his personal data. The order should be familiarized with the signature of the director himself, as well as responsible employees of the personnel service and accounting department.

General steps for processing and registering changes in passport data

It should be remembered that in 2011, changes were made to the Federal Law “On State Registration of Legal Entities and Individual Entrepreneurs”.

Now changes relating to the first name, patronymic, last name and other passport data of both the founders (participants) and the management of organizations must be made by the registration authorities (FTS) independently based on data received from the FMS.

Previously, the law provided for the obligation to notify the Federal Tax Service in the prescribed form within three days.

However, you should remember: despite the passage of time and the deadlines established by the new regulations, the data is updated very slowly. Even after several months, the information may not have changed.

That is why, if there is a change in the passport data of the general director, there is still a need to notify the Federal Tax Service and make changes to the Unified State Register of Legal Entities to the management of the organizations themselves. This need is due to the fact that if an extract from the Unified State Register of Legal Entities is urgently required (for court or other purposes), it may contain old data.

Therefore, it is always better to play it safe and apply for changes yourself, without waiting for the reaction of the migration service.

Change of passport data of the founder and director of the LLC

Do you have doubts during the documentation of a particular procedure related to the activities of the organization? On our forum you can clarify any points. Here, for example, they will help you figure out when and how the Founder’s Decision needs to be updated.

IMPORTANT! The law provides for the entry of changed passport data into the unified state register only for citizens of the Russian Federation. Citizens of other states are required to submit an application in form P14001 with a notarized signature to the Federal Tax Service, as before.

In what cases are changes made to documents?

According to the law, passport data may change in the following cases:

- A new document was issued after the old one was lost or rendered unusable.

- The passport was replaced based on age. Citizens of the Russian Federation are required to change their passports twice - at 20 and at 45 years old. It is unlikely that a person will become a director before he turns twenty, but many managers under forty-five are a reality.

- There has been a change in the last name, first name or patronymic.

A change in the surname of the founder of an LLC and the director of an LLC usually occurs with marriage and most often among women. However, firstly, there are already quite a lot of women directors, and many of them get married during the period when they occupy a leadership position. Secondly, family law allows a husband to change his last name (or adopt a double one). As for the remaining parts of the full name (that is, the actual name and patronymic), they can also be changed at the request of the citizen by registering changes in the registry office. - The gender has changed.

This situation looks exotic, but is quite probable. Sometimes surgical gender reassignment is the only option for a transsexual person. Operations of this type are not carried out too often, but regularly. In law? after a gender change has occurred, the citizen is obliged to change his documents. Accordingly, he will receive a new passport with a new gender indication, and usually also a new name. - Errors or inaccuracies were discovered in the passport. Unfortunately, mistakes made by passport officers are quite common, and as a result, citizen Kazakov may be recorded as Kozakov in his passport.

Often, errors of this kind are revealed only in controversial situations (for example, related to inheriting property or establishing kinship), and then the citizen may need to clarify the passport data.Since legal norms do not allow corrections or erasures of the passport, a person must receive a new document - which, accordingly, will have a new number and series (each passport form is unique).

So, the surname of the general director of the LLC has changed, the procedure will be as follows.

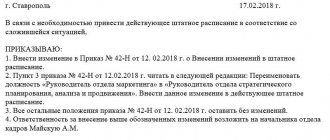

Minutes of the meeting of participants

After a change has occurred in the passport data of the founder of the LLC, it is necessary to begin the procedure for making changes to the Unified State Register of Legal Entities.

The first step will be the adoption of a decision by the sole participant (founder) or the general meeting.

The general meeting is held according to the same rules as in the case of a change of general director.

Since the change in passport data is unlikely to coincide with the next meeting, the decision will have to be made out of turn.

It can be collected either by one of the participants owning at least 10% of the authorized capital, or by the director himself.

The meeting considers the issue and makes a decision by voting or absentee poll. In the latter case, participants exchange documents by mail, using telephone messages or electronic correspondence - in any way permitted by the charter and other internal documents of the organization.

The main requirement here is that the communication method reliably identifies the source from which the document originates.

The decision of the meeting (in person or in absentia) is formalized by drawing up minutes, which contain the following information:

- date, time and place of the meeting;

- composition of participants authorized to make decisions;

- question put to vote;

- the results of voting on the issue and the essence of the decision made;

- signatures of participants.

Protocol on changing the surname of the founder, sample

Changing the passport details of the LLC founder in 2020

If, after the expiration of the period established by law, the tax office has not made all the necessary changes to the Unified State Register of Legal Entities, the LLC can write a letter to the Federal Tax Service demanding that the procedure for making changes be carried out in the proper manner.

If the change of identity document was made by the founder of the LLC and the passport details of the named person did not appear in the constituent documentation of the LLC, the legal entity in this case can limit itself to monitoring the timeliness and accuracy of entering current data into the Unified State Register of Legal Entities (see the first block of this article).

Sole founder's decision

If the company has a single founder and participant, the meeting is not held.

In this case, he himself makes a decision and formalizes it in writing, certifying it with his signature.

What specific questions should be asked before the meeting?

It should be noted that from the moment the current director’s passport details have changed, from the point of view of the law he should be considered as a new entity.

In this case, the general meeting or the sole participant must decide on the reappointment of the existing general director again to the same position.

Accordingly, the question will be posed exactly like this: “To appoint Ivan Ivanovich Ivanov, passport series... number..., as the general director of the company...”.

Decision to change the surname of the director of an LLC or founder of an LLC, sample

What to do if you have changed:

- director's surname; Although the Federal Law “On State Registration of Legal Entities and Individual Entrepreneurs” in paragraph 5 of Art. 5 does not require notifying the registration authority within three days; in practice, it is better to notify the tax office that the director’s passport has changed. Otherwise, problems may arise with the preparation of documentation at the Federal Tax Service, as well as in relations with counterparties.

- address; The General Director can change not only his first name, patronymic or last name, but also his registered address. Is it necessary to make changes to the Unified State Register of Legal Entities if the address of the founder of the LLC has changed?

No. In this case, no action is required from the company’s management, because:the passport remains the same, and only a new stamp on registration at the place of residence is affixed to it; All data on a citizen’s residence is registered with the Federal Migration Service of the Russian Federation. This organization itself must contact the tax service and, if necessary, provide information.

However, if a change in any other information is later registered, the director’s new place of residence will also need to be indicated in form P14001.

Form 14001

An application for amendments to the Unified State Register of Legal Entities is submitted using one of the standard forms established by the Government of the Russian Federation.

Typically, changes in the surname of the director and founder are reflected in form P14001.

Although this form was introduced back in 2002, the tax authorities themselves recommend using those samples, the forms of which are either issued by the Federal Tax Service itself, or which can be downloaded from the official tax website.

Both Form 14001 and 13001 must be notarized. To do this, before contacting the Federal Tax Service, you first need to contact him.

You will need to have the same package of documents with you (with the exception of a receipt for payment of the fee - the notary does not need it). The certification must be paid for.

The cost depends on the notary’s tariff, but as of 2020, you should expect at least 1,500 rubles.

Form P14001

As you can see, although since 2012 it is no longer necessary to notify the Federal Tax Service of the organization itself, it is still better to do so. The procedure itself is not too complicated or expensive, but it allows you to avoid many difficulties in the future.

If you find an error, please select a piece of text and press Ctrl+Enter.

>Decision to change the surname of the LLC founder

Which authorities need to be notified?

The entire package of documents is submitted to the registration authority at the location of the organization. This body can be either a regular Federal Tax Service Inspectorate or a specialized one that deals only with the registration of legal entities. The latter option is now practiced in many constituent entities of the Russian Federation in order to relieve the burden on district tax inspectorates.

Previously, it was required to notify the Pension Fund and the Social Insurance Fund. However, now all the data there comes from the tax service, so notification is no longer required.

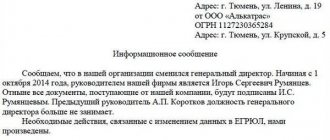

However, we recommend notifying counterparties under contracts concluded by the company about changes regarding the name. This will avoid misunderstandings and questions about why new documents will be signed by a different person than before.

Sample information letter about changing the director's surname

What documents should I submit?

To register changes you will need the following package of documents:

- Application in the prescribed form. If information about the director is included in the charter (for example, he is also a member of the company), then you will need form P13001. If the charter does not contain passport data, then form P14001.

- If changes are made to the charter - a document confirming payment of the fee. If the director is not a participant and is not mentioned in any way in the charter, no fee is required.

- The decision of a single participant or minutes of the meeting.

- The decision to create a company.

- Order on the appointment of a director.

Form P13001

Order on the appointment of a director

All these documents are submitted to the Federal Tax Service, where the company was registered. The documents must be submitted by the director himself or a person acting on his behalf on the basis of a power of attorney.

We have also prepared the following materials on our website:

- Reorganization by merger, transformation of a closed joint stock company into an LLC and division.

- How to make changes to the OKVED of an individual entrepreneur or change the main type of activity?

- In what cases is it necessary to make changes to the constituent documents?

- Everything you need to know to successfully carry out the reorganization of legal entities in the form of an LLC merger or through the merger of organizations.

- How does the reorganization of a closed joint stock company into an LLC take place?

- The division of an LLC into two LLCs, as well as a change in the types of activities of the LLC, the procedure for changing the founder, and amendments to the Charter.

- Reorganization in the form of merger.

Changing the director in an LLC: step-by-step instructions for 2020

An important point is that when changing a director, “dual power” should not be allowed, that is, a period of time when the previous director has not yet been fired, but an employment contract has already been concluded with the new one. A situation of “anarchy” is also unacceptable - the director is fired, and no one is appointed to his position.

How to fill out form P14001 when changing the director? The application form was approved by Order of the Federal Tax Service dated January 25, 2012 No. ММВ-7-6/ [email protected] , the document consists of 51 sheets. For different cases of changes in LLC registration information, different sheets are filled out.