Sample information letter on change of director, nuances of drafting

Key points to pay attention to when compiling:

- The letter is printed on the organization’s letterhead (you can read more about this in the article “Requirements for the organization’s letterhead and seal”).

- The document is assigned a serial number indicating the date.

- The text contains information about the change of director, the date of the appointment order and full biographical information of the new manager.

- A reference to the number and date of the protocol, according to which the general meeting of participants decided to make personnel changes, is also required (a copy of the protocol can also be attached).

- The document must contain the signature of the new manager and the seal of the organization (if any).

Information letters must be sent after receiving an extract from the Unified State Register of Legal Entities, which will contain new information regarding the management. Of course, formally, the procedure for changing a director begins with drawing up the minutes of the general meeting and issuing an order of appointment, but these actions are given an official subtext only by making an entry in the Unified State Register of Legal Entities.

***

When to report

The General Director has the authority to engage in business activities and make decisions on behalf of the company without a power of attorney. Therefore, information about such persons should be reflected in the general state register of legal entities - Unified State Register of Legal Entities). Such requirements are established by the legislation of the Russian Federation. Also see “Employment contract with the general director: sample 2020.”

https://youtu.be/XPPcdHnf7YM

Registration through the tax authority indicates that the director has the right to sign agreements with counterparties, and they have legal force. Therefore, when there is a change of leadership, even after local acts are drawn up, the actions of the new head are not yet significant from the point of view of the law. Also see “Order for appointment to the position of General Director: how to complete it.”

Another reason why you need to inform about the change of the main employee at the Federal Tax Service is administrative responsibility for failure to comply with this requirement. And in order to prevent all possible troubles, you need to promptly send a notification of a change in the director of the company, on the basis of which the inspectors will make the necessary adjustments to the Unified State Register of Legal Entities.

Current domestic legislation obliges firms to report a change in their management to the inspectorate at the place of registration no later than three working days from the moment the new employee began performing duties. Moreover, both the new and the previous chapter have the right to submit documentation.

If the notice period for a change of director is not observed, the following sanctions are applied to the legal entity:

- warning (if tax authorities do not consider the violation serious);

- fine 5000 rub. (with a significant deviation from the mentioned period).

We invite you to familiarize yourself with Sick leave for caring for a relative: is it necessary to open a sick leave for caring for a bedridden patient?

A similar penalty is provided for cases of submitting false information. Despite the fact that difficulties may arise if the notification is filled out incorrectly.

The general director is the person interacting with current accounts, so when there is a change in management, the banking institution must be notified about this. You will need to change your card, account access key, etc. Bankers will require a number of documents, including a copy of the Unified State Register of Legal Entities. There is no need to report changes to the pension fund, Social Insurance Fund or health insurance.

During the registration procedure, it is important to be able to correctly prepare all documents. Including notification of a change of general director. Taking into account the recommendations discussed and following our instructions, you can safely complete all formalities.

If you find an error, please highlight a piece of text and press Ctrl Enter.

What is this document and what is it for?

The company resorts to drawing up this document in the event of a change in its general director.

In this case, it practically does not matter what the reason for this was, they could be as follows:

- If the change of director occurs at his own request (he is not satisfied with the salary, or he has found a more promising place of work);

- If shareholders have lost faith in the management effectiveness of a given manager;

- In the event of the death of the director;

- When an organization declares its own bankruptcy.

Example of a newsletter

It will need to be sent to all legal entities that cooperate with the organization, as well as to the tax authorities and a number of other institutions.

Meeting of owners and decision making

The head of a legal entity is a key figure in any organization, so to replace him, all shareholders will have to be convened.

The only participant of the LLC... full name, passport and registration data, -

- Release from his position... position... full name, passport details, based on his application from... date... - from... date.

- Assign a new... position... Full name, passport details, from... date.

- Responsibilities for making changes are assigned to the legal consultant, full name and passport details.

LLC participant... full name... signature.

Letter about change of director to counterparty sample

The head of an enterprise is an official who signs all contracts concluded by this legal entity.

His surname and initials are indicated in the text of the contract.

Unified State Register of Legal Entities or a decision to refuse state registration.

Bank notification

In a situation where there is a change of chief accountant, it is impossible to do without notifying the bank, otherwise all financial activities of the organization will stop. Banks try to adhere to the general package of documents that are required when changing the chief accountant, but it is better to check the exact list with the servicing bank. A sample list would look like this:

- cover letter (two copies);

- copies of orders on the dismissal of the old accountant and the appointment of a new one;

- a new card containing sample signatures of persons authorized to manage the account and a seal of the legal entity (notarized);

- a copy of the passport of the appointed chief accountant.

All copies are certified by the manager; they must contain his full last name, first name and patronymic, signature and the phrase “the copy is correct.”

The presence of founders (participants) in the process is not required.

Types of info letters

- Letters-messages. They represent a notification (notification) about some processes. For example, about changes in prices for your goods or services, about a change in the general director or company details (including bank details), about concluding contracts, increasing the volume of supplies, etc.

- Application letters. They talk about what the addressee is going to do in the near or distant future. For example, increase prices, stop cooperation with the addressee, or self-destruct.

- Confirmation letters. Everything here is boring and banal - “hello, Ivan Ivanovich, I received the goods, they also sent the accompanying documents, thank you, all the best.”

- Reminder letters. They inform the addressee that he needs to do something - for example, fulfill his obligations under the contract.

- Advertising and information letters. As a rule, they are the longest and often resemble sales proposals. For anyone to read these messages, they must be at least a little interesting and not too banal.

This classification is conditional, but in general it gives an idea of the functions of information messages. If necessary, additional materials can be attached to letters. Very often, message letters (as well as advertising and informational letters) are sent at the request of partners and other interested parties.

You can find a sample information letter.

How to submit an information letter

There are no special requirements for the format of the letter, as well as for its content. It can be written either on the company’s letterhead or on a standard sheet of any convenient format. The first option is preferable, since there is no need to manually write the organization details. In addition, such a letter looks much more respectable and once again emphasizes its relationship to official correspondence.

The information letter can be printed on a computer (good if you need several copies at once) or written by hand - letters written in calligraphic handwriting using a pen look especially advantageous.

The message must be certified by the signature of its originator. If this is a printed letter, you can use a facsimile signature; if it is a “live” letter, then only the original one.

There is no strict need to stamp the message using a seal, because... from 2020, legal entities have the right to use stamp products in their work only when this norm is enshrined in the company’s internal regulations.

If necessary, before sending a message, it should be registered in the internal document log or the outgoing documentation log.

Download information letter sample

The dismissal of the chief accountant is carried out in accordance with labor law norms, and special documents are not provided for when changing the chief accountant, with the exception of some special cases. An accountant can be dismissed on the same grounds as provided for other employees.

If an accountant resigns of his own free will, he writes a corresponding statement to management, and the decision to dismiss becomes an order from the head of the legal entity.

It should be noted that in the situation of dismissal of the chief accountant and the appointment of a new one, the procedure for submitting and accepting cases is mandatory. If a new chief accountant has already been appointed to the position, the transfer is carried out to him, if not, then to the manager, or a person (persons) specially authorized by him. In this regard, it is necessary that the manager issues an appropriate order (decision) to carry out the appropriate procedure.

Documents during the procedure for transferring and receiving cases

Currently, there is no special legal document regulating the transfer of affairs from a former accountant to a new one. Any legal entity has the right to independently develop and approve the appropriate rules, which are based on the general requirements of the legislation on accounting.

In practice, when transferring and receiving cases, an Act is drawn up, which lists the transferred and accepted materials, seals, keys and documents. When changing the chief accountant, it is important to provide the entire list of documents as accurately and carefully as possible. For convenience, it is better to group them into categories. When changing the chief accountant, the act should reflect the identified shortcomings, shortcomings, errors, shortages and other negative aspects, as well as the attitude of the former accountant towards them, giving him the right to give appropriate explanations. When changing the chief accountant, the act is approved by the person who made the decision to change the chief accountant.

As a rule, when the chief accountant changes, inventories are carried out, and in large organizations audits are carried out. Documents when changing the chief accountant related to the transfer and acceptance of cases make it possible to distinguish between the responsibilities of the former and new accountant.

Notification of change of chief accountant

None of the regulations provides for the obligation of the organization to send a notification to the tax authority about the change of chief accountant . Unlike the situation with the manager, an application to change the chief accountant is also not submitted. At the same time, since the chief accountant signs the tax reporting documents, in order to avoid conflicts, the manager can report in any form about the change that has occurred. The same applies to other organizations, for example extra-budgetary funds.

talk about filing an application to change the chief accountant with a different wording only if he is a member of the organization.

Key points and sample letter writing

Information messages, regardless of their author and addressee, should relate only to the activities of the sending organization or related circumstances. At the same time, they must meet certain requirements in terms of structure and content:

- First of all, it should be noted that the information letter should always contain:

- date of its preparation,

- details of the sender and recipient,

- correct address address (for example, “Dear Petr Semenovich”, “Dear Irina Viktorovna”, “Dear colleagues”, etc.). But if the addressee is not defined, which sometimes happens, then you can limit yourself to the greeting “Good afternoon!”

- Next comes the main, informational part of the letter. Here you need to indicate the reason and purpose for writing it, as well as everything else that is related to the matter being described: news, suggestions, changes, requests, explanations, etc.

- Below in the letter you need to write a conclusion that should summarize all of the above.

If any additional papers, video and photo files and evidence are attached to the letter, this should also be noted in its content as a separate paragraph.

Sample letter about changing the legal address of an LLC

Important

To do this, the following documents are submitted to the tax office, according to the new location of the company:

- Prepared changes to the statutory documents in two copies;

- A decision made by a single participant, or minutes of a meeting of founders on approval of the changes made;

- Application of the established form in form p13001, certified by a notary;

- Payment order confirming payment of the state fee in the amount of 800 rubles for making changes to the constituent documents.

Note! In some cases, the tax office may refuse to register a new legal address. On-site inspections: which organizations will be included in the “inspection” plan When drawing up a plan for on-site inspections, tax authorities use a risk-based approach

On-site inspections: which organizations will be included in the “inspection” plan When drawing up a plan for on-site inspections, tax authorities use a risk-based approach.

Social Insurance pilot project is expanding From 07/01/2018, the number of regions in which the Social Insurance pilot project for direct payments is being implemented will increase from 33 to 39.

A sample of this document cannot be found in any reference book.

It is compiled randomly and contains the following mandatory information:

- name of company;

- date and place of changes;

- FULL NAME.

new director; - a document on the basis of which the manager is vested with certain powers.

What would such a letter regarding the change of CEO look like? The sample may include only one phrase, which will detail the required information.

In addition, it is advisable to attach to such a letter a copy of the main document confirming the appointment and powers of the new manager.

Signature authority Sometimes when drafting such a notice, a question arises regarding who should sign the letter regarding the change of CEO? The sample document in this case will be no different from other business papers. The general director of the enterprise is the sole executive body who acts on behalf of the company and in its interests. Is it necessary to notify counterparties about a change of director, who generally needs to be notified when changing the head of the company and within what time frame, we will tell you in this article. Information about the current manager is not reflected in the statutory documents, but is published in the Unified State Register of Legal Entities, and when concluding transactions, counterparties can check the authority of a particular person. Who and how long will hold the position of head of a legal entity is determined solely by the decision of the company’s founders or the employee himself. Company representatives must send notifications about the change of general director to government agencies and contractors as soon as possible, regardless of the reason for the dismissal of the employee and the article of the Labor Code.

The date from which the previous details lost their meaning is also entered here.

- Then, you should indicate all the requests the sender has regarding past and future documents regarding the changed data.

- At the end, the letter must be signed, with a transcript of the signature and an indication of the position of the signatory.

- How to send a letter Since details are the most important part of official documentation, it is advisable to send letters about all changes associated with them in “natural” form.

This makes it possible to reliably bring information about new details to the attention of counterparties, especially if you send these messages by registered mail with return receipt requested. As a last resort, you can combine different sending options: for example, combine an email or fax message with sending via Russian Post.

They can be replaced with a stamp, if the enterprise has one.

- In the upper right corner, information about the recipient is indicated.

- A little lower in the center is a heading that contains the main topic of this letter.

- Further, the main content reflects the information that the company wants to convey to the addressee.

- Such a letter must have an attachment in which the counterparty is provided with copies of supporting documents.

- In conclusion, the new manager puts his personal signature and certifies it with the round seal of the company.

- The sending of such letters is usually carried out by the secretary, registering them as registered mail. Changing the last name of the manager In the case where the manager remains the same, but his passport details have changed, it is necessary to proceed in the same way.

Holding a general meeting to change the director

To resolve the issue of changing the executive body of a legal entity, a general meeting of its founders is held. If the meeting is unscheduled, then the participants should be aware of the date, time and place of its holding a month or more in advance. At that time, participants are notified of the meeting agenda. If changes occur in the issues put to vote, participants must be notified in writing at least 10 days in advance. Only in this case will the meeting to decide on changing the director be legitimate. However, this issue can be put to a vote without first being included in the agenda if all the founders of the LLC or representatives by proxy of all the founders of the LLC take part in the meeting.

Before the start of the meeting, all participants are registered, their passport details or powers of proxies are checked - this is especially true for companies with a large number of participants. If there are several of them, it is not necessary to draw up a separate registration sheet; it is enough to list in the minutes of the decision to change the general director of the LLC all those present with links to their documents and the amount of contribution to the authorized capital.

The minutes of the general meeting , which decides the issue of changing the director of the LLC, is a summary that allows you to establish and verify the legitimacy of the decisions made. It includes:

- information about the chairman and secretary of the meeting;

- agenda;

- participants' proposals on each issue;

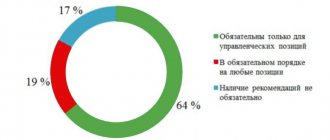

- voting results in percentage terms (for summing up results) and in fact (in the future this may affect the limits of subsidiary liability of the founders);

- signatures of all meeting participants, including representatives of the founders and invited persons (they may be the current general director, candidates for this position, the chief accountant - to assess the economic consequences of the director’s actions, the company’s lawyer - to monitor compliance with the law).

Voting can be carried out on the basis of “one participant - one vote” or the weight of votes can be proportional to the size of shares (including the right to vote for several candidates for the post of General Director).

In accordance with the minutes of the general meeting of founders, a decision is made to change the general director of the LLC. The decision indicates which manager replaces which one. The dates of termination of the powers of one and the beginning of the powers of the other must be indicated; their duration may be indicated. The same decision may give instructions :

- one of the founders must sign an employment contract with the new director;

- HR employee - complete all documents;

- make changes to the Charter and register them with the Federal Tax Service.

powers of attorney can also be resolved . They do not cease to be valid, since they are considered issued on behalf of a limited liability company. Another possible question is about the transfer of files and documents between directors.

Structure of the information letter 5 mandatory sections

An information letter is one of the most common types of business letters. Its main task is to convey specific information to a specific person:

- subordinates;

- colleagues;

- partners;

- clients;

- potential clients.

In practice, it is customary to comply with certain requirements for the structure and text of the document. It is compiled only in an official business style, characterized by a small volume (most often 1 page), the absence of emotionally charged phrases and colloquial expressions. Usually the text is compiled according to this plan:

- In the upper right corner, indicate the position and full name of the person to whom the message is addressed. Usually this is the chief director of the enterprise, who in the future must familiarize all employees or some colleagues with the text of the letter.

- In the upper left corner indicate the number and date, which is written in the outgoing correspondence log.

- Then comes the text itself - this is the main content of the document. It usually begins with the phrase: “We hereby notify you that...”. Next, the essence of the notification is stated in one or more sentences (a numbered list is often used).

- If necessary, appendices are written after the text - a list of documents that are attached to the message.

- Next, the author-sender indicates his position, the name of the company, puts a stamp and signature, and a transcript of the signature (last name, initials).

Expert opinion Svetlana Chadova Leading HR specialist, lawyer, labor law consultant, site expert In addition to this material, we recommend that you familiarize yourself with a sample of drafting cover letters for documents.

Notification of change of general director

Take, for example, a situation where, for one reason or another, the director was forced to change his last name.

Attention

In order for the documents confirming his authority to have legal force, it is necessary to make certain changes to them. Info

You can do this:

- personally;

- through a proxy by issuing a power of attorney for him;

- by mail, sending information by registered mail with notification.

The appeal in this case will be a letter about changing the surname of the general director, the sample of which depends on who exactly it is sent to.

Thus, information is transferred to the branch of the servicing bank to replace the card with a sample signature.

Other interested parties must also be notified of the new name of the manager.

How to get

https://youtu.be/BzoRTv-5B_8

The procedure for issuing a notice of a change of general director depends on how you submitted the documentation (see table).

| Way | Bottom line |

| In person or by mail to the tax authority | The applicant receives a sheet of the Unified State Register of Legal Entities in the manner indicated in the application |

| Appeal to multifunctional) | It is necessary for the director or representative of the company to come to this organization |

| Notarial office | To get an answer, you need to contact a specialist who took part in the registration process. |

| Electronic portal | The result is sent to the applicant's email. If desired, you can request the document in writing. |

Document to the tax office

It is worth noting that the preparation of this document must begin when the general director has already been relieved of his duties, and the new one has already begun to fulfill them and has been entered into the unified state register of legal entities.

This happens because until these operations are carried out by the law, dismissal cannot carry with it any legal force and, accordingly, writing an information letter will not have any meaning.

After the letter has been written, it must be sent to the tax authorities as quickly as possible. This fact is required by law. In addition, the letter must be drawn up according to a special form P14001. There is no need to attach any additional documents to this letter.

In this case, filling out the information letter in accordance with the established form will take place according to the following procedure:

- The title page must reflect the full name of the organization, as well as its taxpayer identification number and main state registration number;

- Sheet “K” must be made in two copies. The first will display information about the old CEO, and the second about the new one. In this case, you also need to fill out the third section on the second sheet;

- Sheet “P” must contain data about the individual who will send the data to the tax authorities. This can be either the new general director or his deputy. A special authorized representative can also act, but he must have a power of attorney certified by a notary.

It is important to note that this information letter is sent to the tax authorities only after it has been certified by a notary. Therefore, the new manager will need to contact a notary office so that it, in turn, officially verifies his signature

Sample notification of change of general director for counterparties

That is, the 3-day period must be counted from the day following the day: (or) on which the meeting minutes or decision are dated; (or) which is designated as the day the new manager takes office.

If the manager does not submit an application in form N P14001 to the tax office within 3 days from the date of taking office, he may be fined 5,000 rubles. (Part 3 of Article 14.25 of the Code of Administrative Offenses of the Russian Federation). Although the tax authorities may simply issue a warning the first time. True, there will be no punishment if more than 2 months have passed since the expiration of the allotted 3-day period (Part 1 of Article 4.5 of the Code of Administrative Offenses of the Russian Federation).

The Federal Tax Service must register the changes and make a corresponding entry in the Unified State Register of Legal Entities within 5 working days from the date of receipt of the documents (Clause 1 of Article 8, paragraph 3 of Article 18 of Law No. 129-FZ).

True, the bank may ignore your request. Moreover, if the bank executes the payment orders of the previous director and the company loses its money, you will not be able to make any claims to the bank. After all, he acted according to his instructions.

How to fill out

A director is a person responsible for the safety of the organization’s documents and part of the property assigned to him.

Upon dismissal, the director must hand over his files, but no specific procedure is established by law. The procedure for changing the general director in an LLC can be enshrined in a local act of the company. In any case, the LLC participants do not have the right to delay the dismissal of the director under the pretext that he did not transfer any documents or property, but they can claim them as part of legal proceedings.

https://www.youtube.com/watch?v=ytdev

If a change of director occurs with a conflict between the parties, and the new director or participants for some reason do not accept the documents, then the previous director can deposit them with an archival organization or a notary.

Drawing up an act of acceptance and transfer of affairs when changing the general director is, first of all, in the interests of the former manager himself. The transfer and acceptance certificate can be signed either by two directors among themselves, or with the participation of the owners of the organization.

Is it necessary to notify the bank that the company’s manager has changed? What is it for?

From the bank's point of view, the manager is the main person in the organization who can manage funds in the account and give instructions for money transfers. The bank will not miss a single payment document unless it is signed by the director of the company.

Accordingly, if the bank receives a document with a signature that differs from the sample previously provided to the bank by the director, then such a document will be rejected. That is why it is mandatory to notify the bank that the manager has changed.

You also need to notify the bank if, when submitting documents, the director’s term of office was indicated, and it ended, but an agreement was concluded with the director to extend the employment relationship.

If the company has the electronic signature of the old director, and it will be used after the termination of his powers, in the future, when this is discovered, the company may be subject to administrative liability.

When changing the head of an organization to a bank, as a rule, you need to provide:

- The document according to which a decision was made to extend the powers of the head of the company. This may be the minutes of the constituent meeting, a decision of a higher body, an order of appointment and an employment contract, or several of the listed documents at once. Most often, the bank requests a decision from the owners on conferring powers on the manager and an order on his assumption of office.

- An extract from the Unified State Register of Legal Entities, issued no later than 30 days before the date of submission of documents to the bank.

- In addition to these documents, the bank will need to fill out a special card that contains sample signatures of the director.

The manager must appear at the bank in person. He needs to have a passport with him.

Usually the bank requires original documents or a notarized copy.

You need to notify the bank that the powers of the old manager have been extended or transferred to a new one as soon as possible. Many banks automatically stop servicing companies if the documents for the manager indicate the expiration date of his powers.

Documents must be provided to the bank when changing the director. The necessary list first of all includes a document according to which the manager receives his powers; its type will depend on the organizational and legal form of the employer.

The document in question contains a request to make changes about the new director to the register. The notification form has number P14001. It was established by Federal Tax Service order No. ММВ-7-6-25 and is designed to read information by machine. Therefore, it is important to know some nuances:

- The form must be filled out by hand in block letters;

- black ink is used to write data;

- no errors or corrections are allowed;

- spaces are needed between words;

- if a word needs to be transferred, no signs are placed;

- when a word begins on a new line, and the previous one completely fits into the previous one, leave an empty cell (the computer will mistake it for a space).

Now let’s talk about how to fill out the sections of the notice of dismissal of a director (a sample can be found below).

- Title page. Enter the full name of the company, legal form, INN and OGRN. Addresses are indicated in full compliance with KLADR. In the “Application submitted” cell, enter the number 1 – due to changes in information about the legal entity.

- Sheet K - contains information about a person who has the right to act on behalf of the enterprise without a power of attorney. The page is filled out for the new and previous manager. In the section “Reason for changing information” you need to put the numbers 2 or 1, respectively – termination of authority/assignment of responsibilities.

- Sheet P - reflects information about the person who presented the notification. Information about it is carefully entered into sheets P2 and P3. The option to receive confirmation from the tax authority is also marked.

The notice must be certified by a notary to confirm authenticity and give legal significance.

Please note: Blank pages will not be sent. And it is advisable to attach the minutes of the general meeting or the decision of the participants to speed up the registration process.

The rules of the tax service regulations state that an application to change the general director can be submitted to the Federal Tax Service in different ways:

- personally to the tax office (can be done by the former or new manager (you will need to issue a power of attorney), as well as a notary);

- through a multifunctional center;

- by Russian post (it is advisable to declare the value and make an inventory of the investment);

- in electronic form through the website of the Federal Tax Service, using a special service, or using a single portal of public services;

- through a notary who certified the signature on the notification (for the procedure for submitting documents, see Article 86.3 of the Fundamentals of Legislation on Notaries).

After submitting the documentation, the applicant is given a receipt containing a list of submitted materials and the date of the response. Within five working days, the inspection makes the necessary corrections, and at the end of the procedure, issues a Unified State Register of Legal Entities entry sheet. It officially confirms the registration of the new manager.

Usually it is the head of the company who has the right of first signature on. Therefore, when changing the manager, you will have to contact your servicing bank to replace the card with sample signatures (Clause 7.14 of the Bank of Russia Instruction dated September 14, 2006 N 28-I).

The period within which an organization must inform the bank about a change of manager (for the purpose of issuing a new card) is not established by law. Often, banks require, in addition to the protocol (decision) and passport of the new director, to provide them with an extract from the Unified State Register of Legal Entities in which he appears.

Attention! You do not have to notify extra-budgetary funds (PFR, FSS RF, TFOMS) and statistical authorities about the change of director. This will be done by your inspection (Clause 19 of the Rules, approved by Decree of the Government of the Russian Federation of June 19, 2002 N 438).

Keep one more thing in mind. Until you have submitted a new card to the bank along with documents confirming the powers of the new director, the bank must execute payment documents drawn up in accordance with the current card (Clause 1 of Article 847 of the Civil Code of the Russian Federation; clauses 4.1, 7.

14 Instructions of the Bank of Russia dated September 14, 2006 N 28-I). Therefore, if you have suspicions that during the period of issuing a new card, the former director of the payments signed by him is able to withdraw or transfer money somewhere from your company’s account, take action.

Immediately write an official letter addressed to the head of the bank with a convincing request not to carry out transactions using payment documents signed by the former director. This letter must be signed by the new director; attach a copy of the protocol (decision) on his appointment to the letter.

True, the bank may ignore your request. Moreover, if the bank executes the payment orders of the previous director and the company loses its money, you will not be able to make any claims to the bank. After all, he acted according to his instructions.

The period within which an organization must inform the bank about a change of manager (for the purpose of issuing a new card) is not established by law. Often, banks require, in addition to the protocol (decision) and passport of the new director, to provide them with an extract from the Unified State Register of Legal Entities in which he appears. And here, whether you want it or not, you will have to get an extract.

Go How to deal with employee complaints

The annoying thing is that until a new card is issued, you will not be able to make any payments through the bank.

Application for amendments to information about a legal entity contained in the Unified State Register of Legal Entities, certified by a notary (P14001);

2. Decision (minutes) on the appointment of a new general director of the LLC (optional).

1. Extract from the Unified State Register of Legal Entities (fresh);

2. Charter of the company;

3. OGRN certificate;

4. TIN certificate;

5. Decision (minutes) on changing the director.

Attention!

— As a rule, the originals of the above documents are more than enough. You can clarify the list of documents required to change the director of an LLC directly from your notary.

— Before going to the notary, be sure to order an extract from the Unified State Register of Legal Entities. How to order an extract from the Unified State Register of Legal Entities yourself, read the article Obtaining an extract from the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs.

1. We prepare a protocol on the change of director of the LLC. If there is only one participant, then a decision on changing the director of the LLC is prepared accordingly.

— Protocol on change of director sample

— Decision to change the director sample

Attention!

The law does not provide for the mandatory provision of a protocol or decision on changing the head of an organization during state registration of these changes. Usually, a notarized statement in form P14001 is sufficient.

In particular, the Moscow Tax Service does not require a protocol or decision when changing the director of an LLC, inspections in other regions should not request them either, but this often happens, so it is recommended to have the original of this document with you.

Application on form P14001 in 2019

An application in form P14001 must be submitted by legal entities in order to notify the tax office of changes made to the Unified State Register of Legal Entities that are not related to the constituent documents (charter).

Basic rules for filling out application P14001

- when filling out on a computer, use capital letters, height 18, Courier New font;

- The application is filled out manually in capital block letters and in black ink;

- the application consists of 51 pages, we use only those to which changes are made (there is no need to submit blank pages);

- Several changes can be provided for in one application, but simultaneous changes and corrections of errors are not allowed (two applications will be required);

- Double-sided printing of the application is prohibited;

- page 001 and sheet P are always filled out, regardless of the type of changes;

- Section 6 of sheet P is filled out by a notary.

In this case, the application will consist of page 001, sheets K and R.

https://youtu.be/9ubnvEkUXwo

A separate sheet K is filled out for the old and new director.

In section 1 of sheet K for the old director, enter the value 2 and fill out section 2.

In section 1 of sheet K for the new director, enter the value 1 and fill out section 3.

The applicant will be the new director, his details are indicated in sheet R.

There may be 2 options here:

- If during the month the share of a retired participant is distributed, fill out page 001, the corresponding sheet (B, D, E or F), Z and R. In this case, for the retired participant we use only the first page, for the rest we enter updated information. In sheet 3 we fill in information about the transfer of the share to the company and its distribution among the participants.

- If the share is not distributed, you will need to submit an application twice, in the first case, the withdrawal of the participant is reported, fill out page 001, the corresponding sheet B, D, E, E, in sheet 3 we indicate the transfer of the share to the company. Then we fill out an application for distribution.

We use page 001, sheet B (D, D, E) and sheet R.

In the corresponding sheet B (D, D, E) we enter information about the founder terminating participation - in section 1 we set the value 2, fill out section 2.

Then we add information about the new participant to sheet B (D, D, E) - in section 1, select value 1 and fill out sections 3, 4.

Please note, from January 1, 2020. a share purchase and sale agreement, regardless of who it is concluded with (with a participant, company, third party), is subject to mandatory notarization

The notary certifies the agreement, application P14001 and submits documents for registration to the Federal Tax Service.

To fill out, use page 001, sheets D and R.

When filling out sheet D for the testator, in section 1 we enter the value 2, then we fill out section 2.

When filling out sheet D for the heir, in section 1, select value 1, then fill out sections 3 and 4.

Note

: in order to have the right to participate in the affairs of the company, it is necessary to obtain a certificate of the right to inheritance from a notary. The inheritance can be accepted within six months from the date of opening.

In sheet B we enter information about the new address (location) of the permanent executive body (another body or person acting by proxy on behalf of the LLC).

To indicate streets, highways, avenues, etc., it is necessary to use abbreviations, a list of which is available in the above official instructions in Appendix No. 2.

In sheet H we use the following pages:

- new OKVED codes are added - sheet H page 1 is filled out;

- exclusion of current OKVED codes - fill out sheet H page 2;

- change of the main type of activity - we enter the new code in sheet N on page 1, the old code is entered in sheet N on page 2. At the same time, the old OKVED can be left as an additional one, indicating it in sheet N on page 1.

Note

: there can only be one main activity code.

To correct errors, use page 001, sheet P and the corresponding sheet (depending on what needs to be corrected).

On page 001 in section 2, select value 2; in the field below, indicate the OGRN number, which was assigned on the basis of a registration application containing errors.

Select a sheet to correct incorrect information:

- “Sheet A” is a mistake in the name.

- “Sheet B” – an error in the address;

- “Sheet B (D, D, E)” – an error in the information about the participants.

- “Sheet K” – an error in the information about the director.

- “Sheet P” – error in the amount of authorized capital.

Having decided on the sheet, we add relevant information to it.

In sheet D we enter only the information that changes.

Please note that it is not necessary to notify the Federal Tax Service about changes in the passport information of a citizen of the Russian Federation, since the FMS independently sends new information to the tax office for inclusion in the Unified State Register of Legal Entities

If the CEO changes at the same time as the founder

How to do it right

For example, within a week from the appointment of a new director.

How to fill out form P14001 when changing the director? The application form was approved by Order of the Federal Tax Service dated January 25, 2012 No. ММВ-7-6/ [email protected] , the document consists of 51 sheets. For different cases of changes in LLC registration information, different sheets are filled out.

Which sheets of form P14001 should I fill out when changing directors? Total 8 pages:

- title page, where information about the organization is indicated;

- sheet K - page 1 (for the former director);

- sheet K - pages 1 and 2 (for the new director);

- sheet P – all 4 pages (information about the applicant).

Since the application is sequentially numbered, the first page will be the title page, page 1 of sheet K with the data of the former director is assigned the number 002, etc. Blank pages of form P14001 are not submitted to the tax office.

Who applies for a change of director - the old or new director? On the one hand, information about the new director has not yet been entered into the Unified State Register of Legal Entities, on the other hand, the previous director has already been deprived of his powers. About 10 years ago, there was a practice of signing an application by the old director as a person whose information was included in the state register (letter from the Federal Tax Service dated October 26.

Moreover, the courts have repeatedly emphasized that the powers of the former leader terminate from the moment the corresponding decision of the participants is made (for example, the decision of the Supreme Arbitration Court of the Russian Federation dated September 23, 2013 No. VAS-12966/13). Based on this, the application in form P14001 can only be signed by a new director; the previous director no longer has any relation to the LLC.

We suggest you read: Interrogation of the director at the tax office

An example of filling out form P14001 when changing the director can be found in our sample documents.

A director is a person responsible for the safety of the organization’s documents and part of the property assigned to him. Upon dismissal, the director must hand over his files, but no specific procedure is established by law. The procedure for changing the general director in an LLC can be enshrined in a local act of the company. In any case, the LLC participants do not have the right to delay the dismissal of the director under the pretext that he did not transfer any documents or property, but they can claim them as part of legal proceedings.

Drawing up an act of acceptance and transfer of affairs when changing the general director is, first of all, in the interests of the former manager himself. The transfer and acceptance certificate can be signed either by two directors among themselves, or with the participation of the owners of the organization. You can familiarize yourself with our document acceptance certificate template and change it to suit your situation.

How to change the director in an LLC if there is only one founder? The only difference between changing the director in an LLC with a single founder and a company with several participants is that instead of the minutes of the general meeting, the founder makes a sole decision on changing the general director.

If the director is not the founder, but an employee, then the usual dismissal procedure is carried out. In the case where the sole founder is a director under an employment contract, he does not have the right to compensation upon dismissal, because Chapter 43 of the Labor Code of the Russian Federation does not apply to such a case. For more information about whether a sole founder can enter into an employment contract, read this article.

We have prepared a sample decision of the sole founder to change the director, in which the founder and the director are different persons.

If there are several participants in an LLC, then the sale of a share or the withdrawal of a participant is possible (the condition for the possibility of leaving the LLC must be provided for in the charter). Read more about this in the article “Withdrawal of a participant from an LLC: step-by-step instructions 2020.” If there is only one founder, then he cannot leave the company until a new participant joins it.

We do not recommend registering the change of the sole founder of the LLC on your own, because To do this, it is necessary to formalize the entry of a new participant with a change in the charter and an increase in the authorized capital in the form P13001 and the subsequent withdrawal of the participant or the sale of a share. This is quite complicated, so it is worth contacting specialist registrars.

In 2020, the following rules apply for changing a founder in an LLC. The following must be certified by a notary:

- participant’s statement about leaving the LLC;

- decision of the general meeting of participants to increase the authorized capital;

- an offer by the remaining participants to buy out the share;

- demand of a participant to buy out his share.

The company has two participants, one of them was accepted to the position of general director under an employment contract. The director decides to resign as director and leave the LLC. The charter provides for the right to withdraw from the LLC; one participant remains in the company, so this option is permitted by law.

- Approval of a new format of constituent and other documents.

- Making changes to the composition of the founders.

You must approach the filling out of these forms with all responsibility.

Form P14001 is found in two versions. One is new, the other is outdated. Everyone keeps it up-to-date, so anyone can fill it out. The field with the Address deserves special attention - only information that corresponds to the KLADR classification is entered there.

It is not advisable to have empty fields in the form. It is better to put dashes in those cells that have nothing to fill in. They will point out that there is simply no data.

After filling out the form, take it to a notary for certification. He must fasten the sheets of form. You cannot do this on your own.

Types of information letters 5 ready-made samples

There are quite a few types of newsletters. Their main purpose is to inform the interlocutor, which may involve performing a variety of tasks - notification, statement, confirmation of intentions, advertising message (commercial offer) and much more.

Notice (notice)

The main task is to notify the client, partner, colleagues, employees of branches, and other departments about the most important company events expected in the near future:

- change of director, chief accountant and other employees;

- change of details;

- change of legal or actual address;

- preparation for inventory;

- changing the work week, reducing hours, etc.

The sender can also report on any informal events - preparation for a corporate party, celebration of the company’s anniversary, exhibition, etc.

Confirmation of intent

This letter can serve as an informational occasion to “remind” yourself or simply confirm intentions in response to a request. For example, a company is negotiating a deal, but at various times for some reason it periodically interrupts them. Subsequently, management came to the conclusion that the deal would indeed be profitable, so a letter of confirmation of intentions could be sent to the partner.

Explanation

Such a letter usually comes from government bodies and departments - the Federal Tax Service, the Federal Antimonopoly Service, the Ministry of Emergency Situations, Rostrud and many others. A company can also draw up its own letter based on these documents. The main purpose of the text is to explain in detail your position when disagreements arise (or to prevent them).

Reminder

In such a letter, the partner seeks to warn the other partner about the end of the deadline for transferring the advance or final payment under the supply agreement, provision of services, etc. Often, the preparation of this document becomes the last resort, after which the company is forced to go to court - a corresponding warning can also be included in the text.

Advertising letter (commercial offer)

When drawing up commercial proposals, a more informal style of text and message design is allowed and even encouraged

The main task of the document is to attract the attention of the interlocutor and make him want to learn more about the product or service, i.e. interest and encourage contact

It is a mistake to think that a commercial offer can immediately “sell” a product. In fact, his main task is to “sell” the meeting or phone call.

>Notification of the change of general director for counterparties

Litvinova

Decor

The structure and details of the information letter are standard, as are the rules for drafting. In the “design” sense, information messages must comply with all the norms of business correspondence. The algorithm for writing them is quite simple.

- In the upper left corner of the form, the details of your company are indicated - name, legal address, contact information, etc. You can fill out this information manually, print it in advance in a sample file, or simply put a company stamp if you have one. The stamp contains all the necessary details, and in addition you will only have to indicate the date the letter was written and its outgoing number. If you are writing a response letter, indicate next to the date and number of the incoming document.

- In the upper right corner you need to indicate information about the recipient. Usually here you can get by with the position and full name of the recipient’s manager, but ideally you should also include the name of the company itself, along with its address (including zip code).

- In the center, write a heading that reflects the topic and content of the letter (for example, “About difficulties that arose during the delivery process,” “About the results of the meeting”).

- In the content part, state the information you want to convey to the recipient. Start the text with the phrases “we inform you about...”, “we inform you that...”, “we inform you about...”. Try to avoid verbosity, write concisely and orderly, without jumping “from fifth to tenth.” Don’t forget: if the essence can be stated in five sentences, there is no need to fill up a whole sheet of paper. This also applies, by the way, to advertising texts (even a commercial proposal should not take more than one sheet). An information letter about a change of director, written according to a standard template, for example, takes literally 4–5 lines.

- If you are attaching any documents or other additional materials to the message, list all attachments at the end of the content. Provide brief explanations for them if necessary. Please indicate the number of sheets in the attached papers.

- End the letter with the wording “Sincerely...” (or any similar ones). At the very end, you need to indicate the sender’s position and his last name with initials. The sender can be the manager, his deputy or the clerk. If you are personally involved in writing and sending business correspondence, put your signature. If one of your employees is authorized to conduct correspondence, you can indicate him as the sender. And sometimes information letters are sent to tens or hundreds of people at once (for example, to all clients of the company). Signing on each of them is not the most pleasant task. In such cases, you can do without it.

An important point: along with the information letter, you can send documents of any type - contracts, constituent acts, receipts, advertising materials, price lists, etc. And quite often in information messages you have to use excerpts from regulatory documents and legal acts, so if necessary, involve specialists in drafting letters.