Mergers of enterprises and their consequences

One of the forms aimed at consolidation and reorganization of a legal entity is the merger of enterprises.

This form is a process as a result of which several existing enterprises cease their activities, and a completely new legal entity is created on their basis.

The consequences of the merger will be the following events:

- Two (or more) enterprises will officially cease their activities and will be deregistered.

- A record of the registration of a new legal entity will appear in the Unified State Register of Legal Entities.

- All rights and obligations, as well as property and debts of liquidated enterprises will transfer to the newly created one.

In some cases, the merger requires the consent of the antimonopoly committee, since as a result of this procedure a large monopoly enterprise may be formed.

Also often, mergers of companies act as an alternative to liquidation, since with its help it is possible to quickly stop the activities of unprofitable companies.

https://youtu.be/TcUOajE6RMk

Largest mergers and acquisitions[ | ]

1990s deals[ | ]

| Place | Year | Acquirer | Acquired | Transaction value, $ billion |

| 1 | 1999 | Vodafone Airtouch[4] | Mannesmann | 183.0 |

| 2 | 1999 | Pfizer[5] | Warner-Lambert | 90.0 |

| 3 | 1998 | Exxon[6][7] | Mobile | 77.2 |

| 4 | 1999 | Citicorp | Travelers Group | 73.0 |

| 5 | 1999 | SBC Communications | Ameritech Corporation | 63.0 |

| 6 | 1999 | Vodafone Group | AirTouch Communications | 60.0 |

| 7 | 1998 | Bell Atlantic[8] | GTE | 53.4 |

| 8 | 1998 | [9] | Amoco | 53.0 |

| 9 | 1999 | Qwest Communications | US WEST | 48.0 |

| 10 | 1997 | Worldcom | MCI Communications | 42.0 |

Transactions from 2000 to the present.[ | ]

| Place | Year | Acquirer | Acquired | Transaction value, $ billion |

| 1 | 2000 | Merger: America Online Inc. (AOL)[10][11] | Time Warner | 164.747 |

| 2 | 2000 | Glaxo Wellcome | Smith Kline Beecham | 75.961 |

| 3 | 2004 | Royal Dutch Petroleum Co. | Shell Transport & Trading Co | 74.559 |

| 4 | 2006 | AT&T Inc.[12][13] | BellSouth Corporation | 72.671 |

| 5 | 2001 | Comcast Corporation | AT&T Broadband & Internet Svcs | 72.041 |

| 6 | 2004 | Sanofi-Synthelabo SA | Aventis SA | 60.243 |

| 7 | 2000 | Division: Nortel Networks Corporation | 59.974 | |

| 8 | 2002 | Pfizer | Pharmacia Corporation | 59.515 |

| 9 | 2004 | JP Morgan Chase & Co[14] | Bank One Corp | 58.761 |

Transactions 2009-2012[ | ]

- Pfizer acquired Wyeth for $64.5 billion

- Merck acquired Schering-Plough for $46 billion

- MTN acquired Bharti for $23 billion

The Pfizer and Merck deals totaled more than $100 billion as the drug market was least affected by the financial crisis and managed to maintain stable cash flows.

2013 deal[ | ]

In 2013, Microsoft acquired Nokia's mobile devices division (Devices and Services) for $7.17 billion (€5.44 billion - 3.79 billion for the company itself and 1.65 for the patent portfolio). Microsoft paid less for Nokia and its patents than it paid for Skype in 2011 ($8.5 billion)[15].

Which form should I choose?

Two similar forms of reorganization are affiliation and merger, however, despite many common features, they also have significant differences.

Therefore, the choice between them largely depends on the characteristics and characteristics of specific enterprises.

Merger is the only form of reorganization, as a result of which information about the new enterprise is not entered into the Unified State Register of Legal Entities.

On the contrary, one or more legal entities are deregistered.

In this case, all property and debts as a result of the closure of the LLC through a merger of enterprises are transferred to the legal successor, whose organizational and legal form does not change.

Another feature of the merger is the fact that to carry it out you do not need to obtain a certificate of absence of debts from the Pension Fund.

Often, it is the absence of this document that is the basis for refusal of reorganization.

As for the merger of two companies into one, as a result of this procedure all participants are liquidated, and on their basis a new enterprise arises, with completely different registration data.

It brings together all the assets of predecessors and allows you to start a new activity more efficiently, with more opportunities.

In general, the merger procedure is easier than merging an LLC. However, the first form may violate the rights of participants, while the second provides the most equal opportunities for all reorganized enterprises.

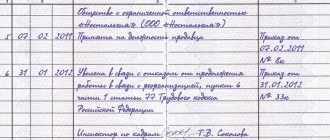

Dear Rinata Nikolaevna!

We notify you that on April 11, 2011, Municipal Educational Institution Secondary School No. 72 will be reorganized by merging with Municipal Educational Institution Secondary School No. 126.

Based on Art. 75 of the Labor Code of the Russian Federation, you can refuse to continue working in connection with the reorganization. In this case, the employment contract with you will be terminated in accordance with clause 6, part 1, art. 77 Labor Code of the Russian Federation.

If you refuse to continue working due to the reorganization, please notify the HR department by 04/08/2011.

Director Pavlova /O.E. Pavlova/

I received the notification and agree to continue working. 03/23/2011, Pakhomova

After this, the employer can proceed in two ways.

Director Pavlova /O.E. Pavlova/

Conversion by merging, step by step instructions

Since at least two business entities take part in the merger of organizations by accession, the algorithm of actions will be slightly different from all other forms:

Stage 1. At this stage, all participants in the reorganization hold general meetings of owners and, by voting, make a decision on the reorganization. The results are documented in a protocol (if there are several owners) or in the form of a decision on reorganization (if there is only one owner). Also, each company must conduct an inventory of assets, draw up a transfer deed and take care of paying off its debts.

An example of a completed decision on the reorganization of an LLC in the form of a merger.

Stage 2. Holding a joint meeting of the reorganization participants, which is attended by representatives of each company. At this stage, it is necessary to sign the final decision on the reorganization (in the form of a merger agreement), develop and approve the draft charter of the created enterprise, and also, based on the data submitted by the companies, formulate a general transfer act.

And about the transfer act during reorganization by merger, transformation of a closed joint stock company into an LLC and division, read here.

An example of a joint protocol for a company being created as a result of a merger. Stage 3. Notifying the registration authority of the decision to pursue a merger. Participants in the procedure are given three days from the moment of signing the merger agreement (agreement) to do this.

Sample agreement on the merger of companies participating in the reorganization.

Stage 4. Notification of all known creditors. These actions must be taken by all participants in the reorganization when merging a company with debts. Notification occurs in two ways:

- by sending relevant notices by mail;

- by publishing a message in the media (in the Bulletin, at least twice).

It is also necessary to take care of repaying all debts to the tax office and extra-budgetary funds, in particular to the Pension Fund. All known debts and claims must be settled before the merger is completed.

An example of a notification to creditors about the reorganization of an LLC in the form of a merger.

Stage 5. Submitting a package of necessary documents to the registration authority to begin the reorganization procedure.

Stage 6. Registration of a new enterprise in the Unified State Register of Legal Entities and receipt of documents confirming the merger procedure.

Reorganization in the form of a merger of enterprises is considered completed from the moment information about the newly created enterprise is entered into the state register.

The merger period usually ranges from 2-3 months to six months, depending on the size and specific types of reorganized enterprises.

How is reorganization carried out in the form of a merger?

One of the forms of company reorganization, which involves combining the capital, assets and debts of two or more companies into a single business (Article 52 of the Civil Code of the Russian Federation).

The merger process is described in stages in the civil legislation of the Russian Federation and provides for the implementation of a number of activities that last about 2-3 months.

A merger of companies involves the formation of a new legal entity, which becomes the legal successor of the companies participating in the merger process.

The new business assumes all property and non-property rights, as well as all debts and obligations to third parties.

In connection with this, the last stage of the merger process is the submission to the Federal Tax Service of a notice of merger and an application for registration of a new business.

The merger procedure can only be carried out at the level of commercial or non-profit organizations operating as legal entities.

The government body regulating competition in the market must be sure that there are no precedents for market monopolization.

The documentary basis for the reorganization may be decisions made by the founders or judicial authorities.

When reorganizing state institutions or budgetary organizations, the decision is made by the Government of the Russian Federation.

A deed of transfer is a document on the basis of which the property and obligations of reorganized companies are transferred to their legal successors (Article 20 of Federal Law No. 208).

As noted above, the legal basis for a merger of companies is civil law.

The basis for the reorganization is a package of papers that is submitted to the Federal Tax Service by all participants in the merger process.

The above documents are submitted to the Federal Tax Service in person by an authorized representative of the company created during the reorganization.

In addition, they can be sent to the tax service by registered mail with an inventory compiled at the post office attached.

In the presence of the above conditions that “complicate” the reorganization procedure, it may take about 5-6 months to complete it completely.

In addition, it is important in the document to indicate the procedure for transferring assets, liabilities, rights and obligations to the newly created organization

Once all the steps listed above have been completed, the final stage of the company merger process begins.

The procedure for merging companies is a legally complex process that may involve emergency situations.

Educational institutions are also structures financed from the budget, which means that the decision on their merger will be made by the Government of the Russian Federation.

As a result of a merger of companies, which may be aimed at consolidating a business or avoiding liquidation of a business, a new legal entity is formed.

Required documents

The list of documents required for reorganization by merging can be divided into two groups:

- Documents that enterprises prepare before reorganization. These include: Application form P12001, which must be certified by a notary. This document indicates the form of reorganization, the number of participants in the procedure, as well as the number of enterprises that will be formed after completion of the procedure (in this case, one).

- The charter of the new enterprise, which must be developed and approved at the stage of the meeting of owners. are submitted to the registration authority , one of which is then returned. There are general requirements for the registration of the charter: it must be stitched and numbered.

- The transfer act is a mandatory document during a merger, and all enterprises participating in the reorganization must draw it up. The act must contain information about the amounts of accounts payable and receivable, as well as the amount of property that is transferred from each company to the new company. There is no established form for this document; it can be drawn up in the form of a regular balance sheet or by simply listing all assets.

- Permission from the Antimonopoly Committee. This document is required only if the total assets of the enterprises or proceeds from sales exceed the legally established limit.

- Documents confirming notification of creditors. These may be receipts for payment of letters sent to them, as well as copies of the pages of the Bulletin.

- The merger agreement signed by the participants at the general meeting. This document defines the conditions and rules for the reorganization, as well as the procedure for exchanging shares of old enterprises for new ones.

- Minutes of the joint meeting of enterprise owners.

- A certificate from the Pension Fund of Russia confirming the absence of debts, which must be received by each participating enterprise.

- Receipt of payment of the state duty (its amount is 4,000 rubles).

- Documents that must be obtained as a result of the reorganization. These papers are issued by the tax office: charter of LLC merger;

- documents on deregistration of enterprises;

- state registration certificate;

- documents on tax registration of a new company;

- extract from the Unified State Register of Legal Entities.

These papers must be issued within five days after submitting the first package of documents.

After this, the new enterprise can begin its work in accordance with the chosen type of activity and available capabilities. Read more about changing the types of LLC activities here.

Main details of liquidation by merger

The procedure for carrying out this procedure is determined by law and leads to the removal of an entry from the Unified State Register of Legal Entities of the company being reorganized as a result of the merger.

- Consists of providing the tax authority for state registration with the entire package of documents on the liquidation of the Company through a merger. Documents are submitted after the second publication of the notice of reorganization in the Bulletin. This can be done by a representative of the executive body or the director of the newly created company.

- At the end of five days after receiving the entire package, the registration authority must issue certificates of registration of the new company and liquidation of the reorganized ones, after which the liquidation procedure by merger can be considered completed.

Liquidation of a company by merging it with another enterprise is regulated by Art. 57, 58 of the Civil Code of the Russian Federation, as well as Federal Law No. 129-FZ of August 8, 2001.

Reorganization through merger has found its wide application due to a number of advantages over other forms of liquidation.

What should you pay attention to when choosing a service for urgent liquidation of companies? Comments from experts are given here.

Personnel component

With any form of reorganization, the changes that have occurred in the company will affect such an element of the enterprise as personnel. A merger is no exception; some personnel changes will occur in this case as well.

What will happen to employees when organizations merge by joining?

It is worth highlighting several rules for reorganization that directly affect employees:

- None of the forms of enterprise reorganization provide for the dismissal of employees. Therefore, such an event cannot be a basis for termination of the employment contract with them (by the employer).

- Before the reorganization or after completion of the procedure, employees have the right to resign, indicating as a reason such a reason as a change in the owner of the enterprise or its legal form.

- Before the merger, employers are not required to notify staff of upcoming changes, however, after the procedure is completed, it is better to do this (in writing).

- In an organization that is formed as a result of the reorganization of a legal entity by merger, a new staffing table must be adopted. Duplication of responsibilities is also inevitable, so some employees may be transferred to new positions or dismissed due to staff reductions.

- In case of changes in working conditions, additional annexes to the employment contract must be accepted and signed and appropriate entries must be made in the employees’ work books.

Obviously, in most cases, layoffs are inevitable anyway. According to the labor code, it is impossible to dismiss employees due to the reorganization of structural divisions through a merger, however, after completion of the procedure, the management of the new enterprise will be able to legally reduce staff.

General steps for processing and registering changes in passport data

We suggest you read about how to formalize and register a change in the passport data of a director or founder, about the procedure for changing the founder of an enterprise or the name of an LLC, as well as about making changes to the OKVED IP, to the constituent documents. The site also contains materials about the reorganization of a closed joint stock company into an LLC and the division of an LLC into two LLCs.

Dismissal of a manager during reorganization

Reorganization in itself is not a reason to dismiss the head of an enterprise. You can resolve the issue in another way by offering him another position. There is always only one manager at an enterprise, but you can expand the staffing table and introduce a new position, for example, executive director.

We invite you to read: Grounds for an unscheduled inspection by the labor inspectorate based on an employee’s complaint (2019)

During reorganization, the owner of the enterprise's property changes, and this is the basis for the dismissal of the entire management team. The new owner can independently decide what positions he needs and what employees will occupy these positions.

A complete replacement of the director and chief accountant, as well as their deputies, can be made in the event of a complete replacement of the owner of the property. That is, if there were 2 owners, but only 1 was replaced, then this is not a reason for dismissing managers.

The process of dismissing the manager and chief accountant, as well as their deputies, follows exactly the same pattern as the dismissal of an ordinary employee. But there are several nuances:

- it is possible to dismiss the management team, precisely on the basis of “change of ownership of property”, only within three months after the changes have occurred;

- the amount of severance pay for the top management is slightly higher than for ordinary workers;

- all affairs of the former manager, chief accountant and their deputies must be transferred to new employees. This is done by signing the transfer deed. This document is signed by both the employee who transfers the cases and the employee who receives them. To avoid any “surprises,” the act must indicate all the documentation accepted by the new manager or chief accountant.

The new owner of the enterprise's property must pay the dismissed manager and his deputies a severance pay in the amount of average monthly earnings for the next 3 months.

The maximum amount of such a benefit is not limited by any regulations, so the amount can be impressive. But it is not included in the income tax base.

As soon as the manager changes, it is necessary to notify interested parties of the accomplished fact. These include:

- counterparties. The new director will now sign contracts and other papers, so each partner must be notified. Any form of notification, but written;

- Federal Tax Service - this must be done within three days after the appointment of a new head. Notification is made by application. Information about the new management will be entered into the register;

- bank - the right to sign is usually vested in the manager and chief accountant. If there are several banks, then each one needs to be notified. You just need to bring a newly filled out card containing the data and sample signature. The period for notifying the bank about a change in management is not established by law, but this must be done as quickly as possible, since not a single payment will be made.

Dismiss under Art. 75 of the Labor Code of the Russian Federation, that is, when changing the owner of the property of an enterprise, only the management team is allowed. This circumstance does not apply to other employees and is not a basis for termination of employment relations.

Reorganizing an enterprise is a rather complicated procedure! But if there is a reduction or dismissal, all personnel nuances must be observed.

The reorganization does not imply the mandatory dismissal of the director. He is usually offered other positions. Some organizations are expanding staff and introducing a new position, for example, director of public relations or executive director.

The procedure for dismissing or laying off a manager is carried out according to the usual rules: he must be notified in advance and offered available vacancies. When there is a change of owner, the management team may be dismissed under Article 75 of the Labor Code of the Russian Federation. This article cannot affect other employees.

Features of dismissal of managers:

- The dismissal of executive employees on the grounds of “change of ownership” is carried out within three months.

- The amount of compensation and payments is higher than that of ordinary employees, severance pay is usually in the amount of his average earnings for 3 months. The upper payout limit is unlimited.

- Before dismissal, management employees are required to transfer affairs to a new team; a transfer act is signed with the signatures of the former and new manager, with a complete list of documentation transferred from hand to hand.

Typically, during a reorganization, an enterprise is transferred to a new owner, who himself decides which positions can be removed or added. Complete elimination of the positions of manager and chief accountant occurs only with a complete change of ownership.

After a change of management, certain persons who are interested in this should be notified in writing:

- Counterparties who conduct business and sign an agreement with the head of the enterprise.

- Federal Tax Service. Within three days after the change of management, an application is submitted, on the basis of which the data of the new director is entered into the register.

- Bank or all banks with which business is conducted. The right to sign passes to the new director and chief accountant. They need to send completed cards with data and sample signatures.

Debts of participants and final reporting

Before carrying out the procedure, each reorganized company must prepare final financial statements, the date of which will be the day before the merger is recorded in the Unified State Register of Legal Entities. This includes the balance sheet, as well as statements of profit and loss, cash flows and changes in equity.

This reporting should reflect all transactions that have occurred in the company since the date of drawing up the transfer deed.

The “Profit and Loss” account must also be closed, funds from which are distributed according to the decision of the owners.

After the reorganization, all debts of the old companies are completely transferred to the legal successor.

If one of the predecessor enterprises had debts to the tax authorities or funds, they will be transferred to the account of the new organization.

It is advisable to submit tax returns to reorganized companies, but this can also be done by their legal successor after the procedure is completed.

An important point is the fact that reorganization is not a basis for changing the periods for paying taxes or submitting reports.

The new company is obliged to submit all documents within the period established by law.

Possible risks during accession (merger)

Being an alternative method, liquidation by merger is associated with certain risks:

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 110-43-85 (Moscow)

+7 (812) 317-60-09 (Saint Petersburg)

8 (800) 222-69-48 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

- Subsidiary liability. Debts incurred by the organization under the leadership of the former founders will most likely fall on them. Despite the fact that initially they will “pass” to the legal successor organization. Therefore, liquidation by merger is suitable for companies without debt obligations.

- You should not start the reorganization process after the initiation of an audit by the tax authorities - such actions may be regarded as an attempt to evade taxes and fees.

- If a company has a large tax debt, the tax authorities usually order an audit immediately after receiving an application to begin the reorganization process.

- When joining (merging), the risks of being brought to property, administrative and tax liability increase, since the successor company may already include affiliated organizations with existing debts and obligations. There is a possibility that among such problematic companies there may be a company under surveillance by law enforcement agencies. In this case, the liquidated company will be carefully checked along with other companies merged earlier.

- The absence of notifications to the creditors of the reorganized company may become a reason for refusal to register the termination of the company's activities, or serve as a reason for declaring the reorganization invalid. In this case, the property, tax, and administrative responsibility of the company again falls on its former founders (managers). Particular care must be taken when notifying creditors when merging several companies, since failure to notify at least one creditor may lead to unpleasant consequences.

- A common case is the liquidation of an organization by joining (merging) with a company located in another region. At the same time, it is planned to further liquidate the successor company voluntarily or through bankruptcy with the repayment of all existing outstanding obligations. Such a process can drag on for quite a long time, since usually they try to pin as many companies with debts on the new organization as possible. A liquidator in another region does not always have a sufficient number of connections to complete the liquidation process without leaving a trace. In addition, the founder (manager) of the reorganized organization may lose control over the situation due to the remoteness of the region of the successor company.

Read what the register of creditors during liquidation is, and what are the requirements of creditors for monetary obligations. Interested in learning everything about the voluntary liquidation of a closed joint stock company? Follow this link.

Company

Features of liquidation of an enterprise by merger:

- the successor is liable for all outstanding obligations of the acquired company. This means that possible lawsuits and demands will be brought against the main organization. However, this does not prevent the founders of the legal successor from going to court and collecting obligations through subrogation of claims;

- liquidation by merger is often carried out in the presence of large accounts payable. However, in this case, it is more expedient to liquidate the enterprise by selling it to one of the founders or another person. But if there is no possibility of sale, then it is worth using an accession;

- all persons in one way or another connected with the liquidated organization must be notified. Otherwise, a number of problems will arise at the final stage, up to and including the registration authority’s refusal to properly formalize the liquidation of the closed joint-stock company by merging with the LLC. Therefore, responsible persons should carefully consider the procedure so that each creditor knows about the accession and can send all the necessary demands and claims on time;

- the accession must serve some purpose. This may be a business reorganization, a desire to increase profits, or other reasons. If there is no clear purpose, the procedure may be considered illegal under current law;

- The planned period of liquidation by merger is four calendar months. The procedure itself for concluding an agreement with the legal successor, submitting documentation to the registration authority and holding meetings does not take much time. Most of the time is taken up by the need to wait for a two-month period during which creditors can present their claims. Otherwise the process is quite fast;

- the complex of measures must be carried out in accordance with the norms and rules of the current legislation. Otherwise, it is possible to bring officials to the appropriate types of liability. Compliance with the law is beneficial - the parties to the process receive a unique opportunity to complete the liquidation within the planned time frame, while spending a minimum of effort;

- during liquidation there may be risks that can be avoided if certain rules are followed;

- The successor organization must carefully consider the procedure. The acquired company should have a minimum of problems, since the main company will have to solve them. Therefore, when signing a contract, you should think several times, compare the pros and cons, and assess the risks. With an analytical approach, the probability of success of the operation increases several times.

Stages of LLC liquidation by merger

The procedure under consideration is divided into several stages.

Preliminary preparation of documents

At the initial stage, the founders of all organizations participating in the procedure gather. At the meeting, a verdict is passed on liquidation through merger, and an agreement on merger is approved. This document determines the main stages of the entire process, the size of the authorized capital of the new company, the amount of expenses of participants during the procedure, as well as the party managing the process itself.

An enterprise can be liquidated only by decision of the general meeting of owners

Each of the communities taking part in the procedure makes a decision reflecting the fact of transfer of powers to the governing community. They relate to notification of tax authorities about accession and publication of information about this fact in the printed publication “Bulletin of State Registration”.

Then an application for future accession is prepared: it must be notarized. A message is created about the initiation of the procedure under consideration in form C-09–4 to notify the tax authorities at the place of registration of legal entities.

Sending materials to state registration authorities

All organizations participating in the liquidation of an LLC are required to notify the tax authorities at the place of registration within three days from the date of the verdict on the procedure. During this period, it is required to send an application to initiate the merger procedure to the tax authorities at the place of registration of the parent company. At the end of the specified period, the Federal Tax Service is obliged to issue an official document about the start of the accession process. At the same time, the established entry is made in the Unified State Register of Legal Entities.

Ensure that the tax office is properly notified of upcoming accession procedures

Notification of creditors

Within five days from the date of execution of the document on the beginning of the merger, each of the organizations participating in the process is obliged to notify all its creditors about this in writing. It is better to send such a message by mail with a delivery notification and a description of the attachment.

Notify creditors about the liquidation of the company by merger - this will help maintain good business relations with them and restructure existing debt

Publication in the media

The notice of liquidation must be published in the publication “Bulletin of State Registration”. As a rule, such publication is made by the parent company, the one to which the merger takes place. Submission of information must be completed twice. The second one is done 30 days after the first one is released.

Publishing an announcement in the State Registration Bulletin will help avoid demands from creditors to extend the liquidation period of the company

Obtaining permission from the antimonopoly authority

Consent to join is required if the total assets of the communities subject to liquidation exceed 3 billion rubles. Permission must be obtained no later than a month from the date of submission of documents; the time frame may change by agreement of the parties.

Drawing up a transfer act and inventory of property

The parties involved in the liquidation carry out an inventory of valuables and intangible assets and distribute responsibilities. In accordance with the information obtained from the inventory results, a property transfer act is drawn up.

A meeting of community members participating in the procedure is held, the agenda of which includes the following issues:

- changes are stipulated in the constituent documents of the parent organization in connection with the expansion of the authorized capital and the addition of new members;

- elections of the leadership of the parent organization are held.

The results of the meeting are recorded in the compiled minutes.

Property inventory will help you preserve important assets and get rid of unnecessary junk

Carrying out state registration of amendments

After an additional message is published in the State Registration Bulletin, information about the liquidation of the affiliated community and changes in the statutory documents of the parent organization are submitted to the state registration authorities. After 5 days, information about the liquidation of the affiliated LLC is entered into the Unified State Register of Legal Entities, after which the registration authority issues the required documents. This completes the process of liquidating an LLC by merger.

General requirements for company reorganization

Since 2014, it has become possible to simultaneously apply several forms of reorganization. It is also allowed to be carried out in relation to companies of different legal forms, with the exception of non-profit organizations. The reorganization includes several interrelated stages.

- Legal formalities, registration.

- Transfer of property, rights and obligations.

- Transfer of employees to another organization.

Since the last two do not differ in specific features, when considering each method, only the first stage is described separately.

Important! In June 2020, by Resolution of the Supreme Court. RF (clause 26) it is clarified that merger and liquidation provide for legal succession. Therefore, the act of transfer in this case is recognized as a non-binding document.

Features of the procedure

The merger of an LLC is similar to the merger of legal organizations, however, it does not provide for the formation of a company on the basis of legal entities that have ceased to operate. This does not have a significant impact on the results of liquidation, but it is necessary to carefully select the company to which the merger will take place. Such an organization will become the legal successor and will continue to operate for a certain time after the completion of the accession process.

The following types of LLC can take part in the liquidation procedure by merger:

- Having no debts or having settled their debt obligations through reorganization. At the same time, the opinion of creditors should not become an obstacle to completing the liquidation and registering the fact of merger with the tax authorities.

- They set the goal of a relatively quick (up to four months) end of the company’s activities with less financial losses than during a merger.

- Unable to take the risks associated with the introduction of quick methods of alternative liquidation (sale of the enterprise, replacement of founders, etc.).

Liquidation of an LLC through merger often becomes the best option for ending operations for a company having financial problems. In this case, management responsibilities are officially transferred to another legal entity, and in order to reduce risks it is necessary to incur large losses. A competent approach to solving the issue helps to achieve the goal.

Before liquidating a business by merging with another company, consider all the pros and cons of such a step.