Legislative regulations for 2020 on reorganization

The reorganization is regulated by the state. In case of violation of laws, such a procedure may be declared invalid. The main regulatory documents are the following laws:

- Civil Code of the Russian Federation (main articles - 57, 58, 60, 92, 104 and some others). Contains basic information about the reorganization procedure.

- Federal Law of the Russian Federation No. 14 (main articles - from 51 to 58). Includes some clarifications and amendments.

- Resolution of the Plenum of the Russian Federation No. 19 for 2020 (the main point is number 20). Also makes some other clarifications and amendments.

Why is reorganization in the form of merger necessary?

Reorganization is the complete or partial replacement of owners with or without a change in organizational and legal norms. In some cases, there is also a replacement or transfer of property from one enterprise to another. There are several types of reorganization, and it can be carried out by both a legal entity and an individual entrepreneur.

In the case of reorganization in the form of a merger, one or more companies are merged with another (in this case, the owners of the companies usually do not change, although some of their rights and obligations may change). Most often, reorganization in the form of affiliation is done to optimize the conduct of business, namely:

- business expansion through mergers;

- increasing the material support of each company;

- tax optimization.

Typically, reorganization in the form of affiliation is used by small players to protect themselves from more serious players. In some cases, it is also carried out by more serious companies, which, after the merger, plan to modernize their production facilities. From an economic point of view, a merger can be fully justified in the following cases:

- the emergence of new players in the market who may in the future take a leading position, displacing competitors;

- a sharp change in the structure of supply and demand;

- increase in prices for purchasing materials and raw materials;

- modernization of enterprises with subsequent improvement of the quality of products.

Main difficulties you may encounter

- Let's start with the fact that all the rules and principles are found in various legislative acts. This causes significant difficulties, since even within one stage you need to have a large amount of information. You cannot look at the action plan in one document and be guided by it. Everything is collected piece by piece in various Codes, Instructions, etc.

- Misunderstanding of the content of specific documents can significantly slow down the execution of the LLC reorganization through merger. The fact is that not all papers are drawn up in a certain form. In some cases, the legislator gives the initiative to the legal entities themselves, but this does not mean that the absence of some important point will be ignored by the registration authority, banks, tax inspectorate, etc. You can only include all the necessary points if you have good experience in this field.

- Failure to understand hidden issues can jeopardize the entire process. For example, if you do not budget for the possible costs of paying severance pay to employees who do not want to continue working, you will already be faced with a shortage of financial resources at the initial stage of the new enterprise’s existence.

- It is important to strictly follow all the nuances. Let’s say that in the process of reorganizing an organization in the form of a merger, you do not personally notify creditors, but simply make a publication in the media. This approach will make the entire procedure illegal.

- Superficial attitude to the operation. You should secure your enterprise as much as possible from the legal standpoint. This is done by including specific points in the documents being prepared. For example, minutes of a general meeting. It is important not only to outline the circle of participants, but also to analyze within its framework all the points that may complicate joining.

- Laws are constantly changing. This especially applies to the Civil Code. At the stage of reorganization, significant changes may be made to legislation, which will certainly affect the specific content of each stage of this operation.

- You should not only prepare the papers, but also submit them to the relevant authorities on time. There are many other nuances that only a qualified lawyer can deal with.

Only those difficulties in the reorganization of an enterprise (merger) that are textbook in nature are given. There are always implementation features related to a specific project. Even if you have a lawyer on your staff, it is quite difficult to cope with such a volume of work alone, and it is unlikely that your employee will have much experience in performing such operations. If there is no lawyer, then independent reorganization is generally undesirable. An unprepared person will take too long to understand all the vicissitudes of Belarusian legal acts.

The optimal solution is to contact specialists. Our company would be an excellent option. To make sure of this, we suggest considering the benefits of cooperation with us.

Step-by-step instructions for reorganization in the form of affiliation

Only the owners of the company can carry out a reorganization in the form of a merger at a special meeting, and the opinions of certain employees are taken into account only if they are co-owners (for example, in the case of a cooperative enterprise). The accession procedure is quite strictly regulated by law. In 2018, the algorithm looks like this:

- Hold a meeting of owners at which you raise the issue of reorganization in the form of affiliation. The decision to join is made based on voting, and to win you need to get a majority of votes.

- Draw up an agreement on behalf of all owners and sign it with representatives of another company that also wants to merge. The agreement must specify the rights and obligations of the parties, the grounds for the merger, the tax regime, and so on.

- Draw up and agree on a new charter with your partners.

- Notify the tax authorities, the Pension Fund of the Russian Federation, the Social Insurance Fund and the Compulsory Medical Insurance Fund about the reorganization. If you have a large debt, you also need to notify the credit institution. Remember that government authorities must be notified within 3 days after the decision to join is made.

- Publish an announcement about the reorganization in the State Registration Bulletin. You need to publish advertisements 2 times; 1 month must pass between publications.

- Conduct a complete inventory of the property and draw up a transfer deed. This document regulates issues of debts and property.

- Collect all the necessary documents and submit them to the Unified State Register of Legal Entities (the list of documents is presented in the table below). If everything goes well with the documents, then you will receive an extract - a copy of it must be given to your partners, as well as to Rosreestr and the tax authorities.

Accounting during the reorganization of enterprises

- Dt. account 60 “Settlements with suppliers and contractors” - Set account 50 “Cash desk” - 6,720 rubles. (2,000 + 4,720) funds transferred to a law firm;

— Dt. 26 “General business expenses” — Kt. 60 “Settlements with suppliers and contractors” - 4,000 rubles. reflects the cost of services provided by the law firm;

- D-t 90, sub-account “Revenue” - K-t 90, sub-account “Profit/loss from sales” - for the amount of revenue received from sales of products (works, services) since the beginning of the year;

- D-t 91 - K-t 70 - 50 thousand rubles. - the amount of compensation to dismissed employees (except for the manager and chief accountant).

- Dt 91, subaccount “Balance of other income and expenses” - Dt 91, subaccount “Other expenses” - 80 thousand rubles. - the amount of non-operating expenses;

- Dt 91, subaccount “Balance of other income and expenses”, Kt 91, subaccount “Other expenses” - 125 thousand rubles. - the amount of non-operating expenses;

In the accounting of the successor, before drawing up the opening balance sheet, the profit and loss accounts must be closed.

— numerical indicators reflecting mutual receivables and payables between reorganized organizations, including calculations of dividends;

— financial investments of some reorganized organizations in the authorized capital of other reorganized organizations;

— other assets and liabilities characterizing mutual settlements of reorganized organizations, including profits and losses as a result of mutual transactions.

The most common examples of mutual obligations that should not be taken into account are presented in Table 2.

The reorganized organization does not separate the numerical indicators of the profit and loss statement.

- D-t 71 “Settlements with accountable persons” - D-t 50 - for the amount of cash issued from the cash desk to pay for the costs of re-registration of documents.

- D-t 84- K-t 99 - for the amount of the organization’s net loss attributed to the decrease in net profit of previous periods;

Documents for submission to the Unified State Register of Legal Entities

At the final stage, you should submit documents to the Unified State Register of Legal Entities to register the enterprise. Documents must be submitted on behalf of two persons - on behalf of the organization and on behalf of the owners. You also need to take into account that the owners can be both individuals and legal entities, and the list of documents for them will be slightly different:

| On behalf of the founder, if he is an individual | Passport and TIN |

| On behalf of the founder, if he is a legal entity | Appointment order, passport and TIN |

| On behalf of the company | Constituent documents, minutes of the meeting, agreement on accession, paper in form P12003, deed of transfer, photocopy of the “Bulletin”, as well as notices from the Federal Tax Service, Pension Fund of the Russian Federation, Social Insurance Fund and the Compulsory Medical Insurance Fund. |

Notification about the reorganization of the Federal Tax Service and other interested government agencies

At the second stage of joining, it is important for its participants to know several points:

- in addition to the tax inspectorate, the Pension Fund and the Social Insurance Fund must be notified about the reorganization;

- the notification period is limited - it begins to flow from the moment the decision is made by the last member of the association and expires three working days from that moment;

- the division of the Federal Tax Service that serves the legal entity that remains active after the merger should be notified of the reorganization;

- the notification form is special, it was approved by order of the Federal Tax Service of Russia in 2011 (form S-09–4);

- upon acceptance of the notification, the inspector makes a record in the Unified State Register of Legal Entities indicating that all companies participating in the process are in the reorganization procedure;

- After notification of the reorganization, the tax inspectorate has the right to schedule an on-site inspection of the accuracy of tax reporting in relation to the liquidated (merged) company.

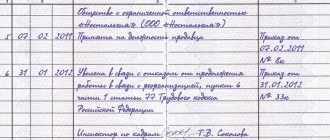

Workers and their rights

Upon joining, the new owner is obliged to retain all employees in their positions, and unilateral dismissal of old employees is prohibited. If after the reorganization there is no longer a need for any employee, then the employer must offer such a person a new job that matches his qualifications and experience. If the employee refuses the transfer, the owner of the company can fire him. Also, an employee can resign at any time on his own, and in his resignation letter he should indicate that his dismissal is due to his unwillingness to work at the new enterprise after the reorganization.

Upon completion of the merger, all employees must sign a new employment contract, and the employees' employment status must improve or remain the same. An employer can unilaterally change only some working conditions:

- the address where the new workplace will be located;

- methods of calculating salaries and various bonuses;

- working hours;

- some other working conditions based on the Labor Code of the Russian Federation.

Legislative regulation

The general rules for the reorganization of a legal entity are enshrined in the norms of the Civil Code of the Russian Federation.

They apply to all types of commercial and non-commercial entities. In addition, special rules apply for certain organizational and legal forms of enterprises. For example, when merging an LLC, you must comply with the provisions of Law No. 14-FZ. When filling out documents that will be checked by the Federal Tax Service, you need to take into account the requirements of by-laws. For example, to fill out and submit an application to close an affiliated company, the Federal Tax Service Order No. ММВ-7-7/ [email protected] . To regulate labor relations with personnel, the norms of the Labor Code of the Russian Federation must be used.

Nuances of the procedure in 2020

You also need to remember some important nuances that apply in 2020:

- If the companies are not cooperative and are subject to antimonopoly regulation, then in order to join, it is necessary to obtain permission from the FAS. Permission can be obtained only if the accession does not lead to a violation of antitrust laws. Usually, a license is given to small and medium-sized companies without any problems. Problems with obtaining a license may arise for companies with total assets of more than 7 billion rubles. Also, certain difficulties may arise for companies that are involved in the production of alcohol or tobacco products;

- Special rules apply to non-profit organizations, which are listed in the Law “On Non-Profit Organizations” No. 7-FZ. If the organization is budgetary, then the decision to join it is made not by the head, but by the relevant government body. For example, the decision to reorganize a municipal organization is made by the municipality.

Major violations

When carrying out reorganization, the founders often commit violations, which sometimes result in criminal cases. Main violations:

- the founder will not include some joint-stock communities in the list of organizations subject to merger. Because of this, such communities lost the opportunity to participate in the accession;

- the head of the organization distorted or hid reporting from his partners or the state (most often this problem arises in the case of budgetary organizations);

- the founder forgot to notify government agencies or creditors about the reorganization.

Obtaining approvals to increase assets

Obtaining approvals is an optional stage of the reorganization procedure. Approvals are not necessary in every case of accession, but only in the following situations:

- if the total value of the assets of the enlarged enterprise exceeds 6 billion rubles, before reorganization it will be necessary to obtain permission from the antimonopoly service. It considers such requests within 30 days;

- if the merged organizations (or one of them) are financial, then permission from the Bank of Russia will be required;

- when state-owned enterprises financed from the budget merge, it is impossible to do without government permission.

Common problems

Also, when carrying out a reorganization, managers often face the following problems:

- the owner notified government authorities late. Remember that after making a decision on reorganization, you must notify the tax authorities and state funds within 3 days, and failure to comply with these deadlines is an administrative offense;

- inventory errors. If the inventory of property was made with errors, then after the merger, property disputes may arise, due to which the functioning of the organization may deteriorate;

- problems associated with the transfer of workers to new places. If the new employment contract was drawn up incorrectly, employees can challenge it in court. This will also impair the functioning of the enterprise until the trial is completed.

Accounting and taxation

Let's start by considering the procedure for preparing financial statements (in the example under consideration, for 2009).

The methodological recommendations do not establish special provisions for the submission of final financial statements to the tax authority.

Other norms of the Tax Code of the Russian Federation also do not provide for the obligation to submit final financial statements of the merging organization.

Now let's say a few words about what features need to be taken into account by reorganized organizations when preparing reports.

When filling out the indicators in Section III “Capital and Reserves” of the successor’s balance sheet, no entries are made in the accounting records.

Thus, the obligation to pay taxes (income tax and property tax) falls on the legal successor.

The obligation to pay tax must be fulfilled within the period established by the legislation on taxes and fees (paragraph 2, paragraph 1, article 45 of the Tax Code of the Russian Federation).

Tax legislation does not provide for special rules for submitting a tax return during reorganization.

If primary documents and invoices after the completion of the reorganization are issued to the legal predecessor...

The above expenses must meet the general requirements established in paragraph 1 of Art. 252 of the Tax Code of the Russian Federation (economically justified and documented).

In this case, tax inspectors will most likely refuse to recognize expenses based on the following.

Purchasing a share in an organization and its subsequent acquisition. Accounting for the difference between the value of the organization's share and its net assets.