Home / Labor Law / Employment / Employment contract

Back

Published: 05/09/2017

Reading time: 8 min

0

3849

An employment contract is the main document that confirms the emergence of an employment relationship between an employer and a subordinate. There are certain requirements regarding its design and content established by current labor legislation.

In particular, these include the display of wage terms in the contract. It is worth considering how these conditions are included in the document, using the example of one such as the establishment of piecework wages.

- Legislative regulation

- Concept and scope

- Indication in the employment contract and sample filling

Dear readers! To solve your problem, call hotline 8 or ask a question on the website. It's free.

Ask a Question

When is the piecework remuneration system used?

A similar system is applicable in cases where the volume of work performed can be measured, for example, in the number of hours or in units of production.

Even with this method of mutual settlements with employees, it is necessary to draw up an employment contract with each of them - piecework payment does not imply that the employee works without official registration. It is advisable to use this form of settlements with personnel in the following cases:

- the need to establish additional motivation for employees;

- the need to increase production volume without compromising the quality of the goods produced;

- the need to accurately determine the quantity of products produced.

When setting wages based on results, it is important to ensure that there is no downtime in production due to the fault of the employer.

A sample employment contract with piecework wages is being developed for enterprises with temporary or seasonal work, for the provision of personal services. Hourly payment for consulting services is a type of such mutual settlements.

Sample piecework wages in an employment contract

Mandatory indication in the agreement with the employee of the payment procedure, including additional payments and incentive payments, is established by Article 57 of the Labor Code of the Russian Federation. Therefore, when registering such labor relations, the method of calculating remuneration should be described.

The piecework worker's salary may include compensation payments for deviations from normal conditions. For example, additional payment for work on a weekend or holiday or for overtime work. It is important that piecework employees are paid additional remuneration for non-working holidays on which they were not involved in production (meaning, for example, the New Year holidays when the standard working hours are less than usual) (salary employees are not entitled to such incentives). This rule is established in Art. 112 Labor Code of the Russian Federation. The employer sets the amount of such payment independently; the law does not contain any restrictions on the amount.

With a simple “piece-work” wage is calculated based on the prices established in the organization and the number of commodity units produced.

The number of commodity units that the employee managed to produce during the paid period is determined on the basis of primary accounting documents - acceptance certificates, statements, etc. An organization can develop the forms of such documents independently, in compliance with all requirements for primary documentation.

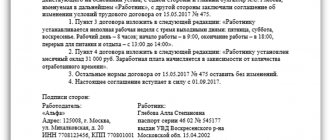

The payment procedure is specified in the contract as follows:

Or, if prices are set per unit of production, then the wording may be as follows:

The amount of remuneration can also be specified in the annex to the agreement between the employer and employee. In this case, the conditions in the contract are formulated as follows:

Legislative regulation

Chapter 11 of the Labor Code of the Russian Federation is devoted to regulating the issues of registration and conclusion of an employment contract.

In particular, it states that an essential condition of this document is the provisions on remuneration. Without indicating the size of the salary and the form for determining it, the document will not be considered valid.

In accordance with Part 2 of Art. 57 of the Labor Code of the Russian Federation, the contract must necessarily include conditions regarding remuneration, including official salary or tariff rates. Moreover, specific numbers must be indicated, and not just links to internal documents of the company (for example, to the Regulations on remuneration or staffing).

This is due to the fact that the employer can change the terms of these documents on his own (that is, without the consent of the subordinate). Changing the terms of an employment contract is possible only with the consent of both parties. If this requirement is not met, the employer will be fined under Art. 5.27 Code of Administrative Offenses of the Russian Federation for violation of labor legislation.

According to Art. 135 of the Labor Code of the Russian Federation, the manager has the right to independently choose and approve the payment system at his enterprise. For example, he can do this using:

The only requirement is compliance with current legislation and guarantees that are established for the employee. These guarantees may be established:

- Labor Code;

- federal laws;

- presidential decrees;

- Government regulations;

- local regulations, etc.

For example, they may relate to the minimum wage, the frequency of its payments, etc. Art. 131 and 132 of the Labor Code of the Russian Federation.

As for the piecework system, the Labor Code does not have separate chapters or articles that would regulate this issue.

Only in Art. 150 of the Labor Code of the Russian Federation states that employees working under such a system should be paid on the basis of prices established for work of varying complexity. Therefore, to determine the essence and features of its application, it is necessary to turn to the analysis of economic literature and other sources that are devoted to this issue.

Concept and regulation

Remuneration may directly depend on the result of the work, more precisely, on the volume completed: the number of parts made, consultations provided, knitted scarves or restored paintings (Articles 129, 135, 160 of the Labor Code of the Russian Federation). This possibility is prescribed in a sample employment contract with piecework wages.

Typically, employees transferred to such a system:

- actively take initiative;

- interested in achieving maximum results;

- receive income that directly depends on the efforts invested;

- can prove their effectiveness.

The advantages are obvious, but sometimes in the pursuit of high quantitative indicators, quality suffers. Workers neglect safety precautions, violate technological processes and do not save materials. But this can be influenced by excluding defective products from payment.

How to write it in the contract

Simple piecework wages - calculation of an employee’s income according to approved company rates. At the same time, production standards are approved - the number of products produced per hour or day. That is, a minimum is established that must be met.

For greater motivation, the piecework-premium option is used. With it, in addition to the salary, a bonus is awarded provided that the employee exceeds the norm and does not allow defects.

A sample piecework wage in an employment contract may look like this.

There are also piece-progressive and chord-premium options. The first option involves an increased tariff for manufactured products above the norm. The second one encourages completing work ahead of schedule, since they are paid extra for completing a complex complex ahead of schedule.

Employer's liability if wages are not specified in the agreement

6.1. In case of failure or improper performance by the Employee of his duties specified in this employment contract and job description, violation of the labor legislation of the Russian Federation, as well as causing material damage to the Employer, he bears disciplinary, financial and other liability in accordance with the current legislation of the Russian Federation.

6.2. The Employer bears financial and other liability to the Employee in accordance with the current legislation of the Russian Federation.

| Employer [fill in as required] [position, signature, initials, surname] M.P. | Worker [fill in as required] [signature, initials, surname] |

I received a copy of the employment contract [date, month, year] [signature, surname, initials of the employee]

Differences from salary

The salary option means receiving a fixed amount for full working hours. The norm is established by law. If a person worked 193 hours in November at a similar standard of working time, then he will receive a salary. Another name is time-based. Allowances, coefficients and bonuses may be added to the salary. Bonuses are for length of service, coefficients are for work in harsh natural and climatic conditions, and the specifics of calculating bonuses are determined by the employer at his own discretion. Information on bonus conditions is reflected in:

- regulations on bonuses (separate document);

- regulations on wages and bonuses (combined local act);

- agreement with the employee.

With the piecework option, the number of hours worked does not in itself affect the final amount. As already mentioned, the result that can be calculated is important.

Employment contract: types of remuneration

Current labor legislation gives the employer the right to independently choose and establish what type of remuneration he will use when setting the employee’s salary. He has similar rights in terms of setting the amount of remuneration.

It is important to understand here that this right may be limited if the employer abuses his rights and his actions in establishing working conditions worsen the situation of his employees compared to those established by labor legislation (for example, the employee’s salary will be below the established minimum wage).

Among the main types of remuneration often used in practice are the following:

- piecework (the amount of wages depends on prices and the number of products produced per month);

- time-based (the employee is given a salary, the amount of which does not depend on the production rate and the number of days in the month);

- commission (the employee receives a set percentage (commission) for goods sold (work, services)).

Types of remuneration can be mixed among themselves, and can also be divided into subtypes depending on the specific working conditions of the employer.

The employee’s salary in accordance with one or another type of remuneration established for a specific category of workers must be specified in the employee’s employment contract, since it is an essential condition (Articles 57, 135 of the Labor Code of the Russian Federation).

Calculation

To clearly present the sample by which piecework wages are calculated under the relevant employment contract, it is necessary to determine, first of all, the calculation procedure. It is determined by taking into account the number of units produced by the contractor.

One unit has a certain cost, therefore, the final indicator will be formed depending on the volume completed.

ZP = T * NP

where T is the employee’s tariff; NP is the production rate; ZP is the contractor’s salary.

ZP = PV * S

where PV is the period of time required to complete the entire volume of work, calculated in hours; C is the cost of one hour of work, expressed in rubles.

For a more visual representation, let's look at examples.

Example 1

In one day, according to the norm, a milling machine operator must produce 120 pieces of parts on his machine. Its daily rate is 1200 rubles. In one month, a worker will produce 2,400 pieces of products.

You need to determine a piece rate. To do this, you need to divide the daily tariff by the standard quantitative indicator.

Price = 1200 / 120 = 10 rubles per piece

Earnings = 10 * 2400 = 24,000 rubles

Example 2

If the price is set not per piece, but per time indicator, the calculation will have a slightly different form.

The milling operator should spend no more than ½ hour on one operation. The tariff rate per hour is 130 rubles. In 1 month, the employee performed 600 transactions.

Price = 130 * 30 / 60 = 65 rubles per operation

Salary = 65 * 600 = 39,000 rubles

An employment contract for piecework wages can take a number of forms, since the actual payment for the “transaction” itself may differ.

Despite a number of nuances, payment for work performed based on results is a fairly profitable option for both parties to the employment contract.

We invite you to familiarize yourself with: Report on roof leakage of a rented property sample

The main thing is to correctly formulate the employee’s work attitude. A man must:

- have a certain incentive to perform a sufficient amount of work;

- produce labor based not only on quantitative, but also on qualitative indicators.

However, it is possible to work on a deal only when the volume of work can actually be measured in a number of ways, for example, counting the number of parts manufactured by a machine operator or measuring the volume of work performed by builders, for example, masonry laid by masons. Where this is physically impossible, an employment contract should be concluded on a time-based basis.

State legislation allows you to vary the methods of remuneration for work and in every possible way encourage workers to produce high-quality work and exceed established standards.

ZP = Kp * Sed, where

- ZP – salary before taxes;

- Кп – number of released (manufactured) units of product;

- Sed – prices for 1 unit of finished product.

ZP = Kp * Sed P, where

- P is a bonus based on the results of work, which is often fixed, but may also depend on the number of products produced in excess of the norm.

ZP = Kp * Sed Kpp * Sedp, where

- KPP – quantity of products in excess of the established fee;

- Sedp is the increased cost of products established after fulfilling the established norm in a certain time period.

If a local act provides for more than one progressive increase in the cost of production, then there will be even more terms in the formula.

The specific calculation formula depends on the specifics of calculating piecework wages established by the relevant Regulations at the level of a particular organization.

Employment contract with piecework wages

When developing a sample employment contract with piecework wages, you need to pay attention to the following points:

- setting unit prices.

In practice, prices are approved by the employer by an order establishing prices at the enterprise for a manufactured unit of product (another operation or work, service) or in another local act;

- specifics of remuneration on holidays, including payment of additional remuneration to the employee.

The employer has such an obligation if there are non-working holidays in the billing month. The parties fix the procedure and amount of additional payment either directly in the employment contract, or the employer approves a local act, which the employee must be familiarized with in writing when hired. Additional remuneration is part of the salary. These provisions are established in Part 3 of Article 112 of the Labor Code of the Russian Federation.

If an employer provides a shift work schedule for piecework workers, including night shifts, then the employer is not obliged to pay additional remuneration for the employee’s work on holidays. In this case, the employer becomes obligated to pay for work at night and on holidays.

employment contract with piecework wages

What needs to be reflected in the salary section

When formalizing a relationship with an employee, employers often have the question of how to stipulate piecework wages in an employment contract. The head of the enterprise should take a responsible approach to the section regarding remuneration. In order to reduce the risk of disputes regarding payroll calculations during the cooperation process, all the nuances should be described in detail.

The document must indicate the type of salary calculation scheme used. If it provides for the payment of a bonus, then it should be indicated for what achievements.

The monetary value can be calculated based on the amount of work performed by a team or an employee individually. The agreement usually specifies the cost of the product or service provided, expressed in a single measurement.

Tariff parameters must be reflected in digital measurements. References to internal administrative documentation are not allowed. All information should be discussed in the contract, which also recommends regulating the timing of payment of wages.

Interesting on the topic:

GPC agreement with an individual for the provision of services - sample 2019

The employer has the right to hire any individual to perform work, having formed a contractual relationship with him. This can be done under an employment or civil law agreement. We will consider the features of a civil law contract with a citizen below.

What is a civil contract?

A GPC agreement is a transaction where, based on the agreement of the parties, their obligations and rights in relation to each other are established, changed or terminated in accordance with Articles 153, 154 and paragraph 1 of Art. 420 GK.

This type of agreement between a legal entity and an individual determines their relationship related to the result of the work. In this case, the parties do not enter into an employment relationship; in relation to each other, they are the customer and the contractor.

A civil law contract is concluded according to the rules of the Civil Code and its main difference from an employment contract is the ability to prescribe any conditions that do not contradict the law and suit both parties. This rule is prescribed in Art. 421 Civil Code.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, call

8 Moscow and Mos. region

8 St. Petersburg and Len. region

8 Regions of Russia

It's fast and free !

Final provisions

7.1. Disputes between the Parties arising during the execution of this employment contract are considered in the manner established by the Labor Code of the Russian Federation and other federal laws.

7.2. In all other respects that are not provided for in this employment contract, the Parties are guided by the legislation of the Russian Federation governing labor relations.

7.3. The employment contract is concluded in writing, drawn up in two copies, each of which has equal legal force.

7.4. All changes and additions to this employment contract are formalized by a bilateral written agreement.

7.5. This employment contract may be terminated on the grounds provided for by current labor legislation.

Types of GPA

A GPC agreement can be concluded with an individual:

- Contract. The parties are the customer and the contractor. The customer gives the contractor a task, the result of which he undertakes to accept and pay for at the cost established in the agreement. The contractor guarantees the completion and delivery of the task within the framework of the contract within a certain period. At the same time, it is permissible to involve other persons (subcontractors), the only important thing is compliance with deadlines and the quality of the work performed.

The result of acceptance of the work is an act signed by both parties. The amount and procedure for payment must be strictly specified in the GPA.

- For the provision of services . Parties to the contract are the customer and the contractor. The contractor is obliged to provide services in accordance with the terms of the agreement, and the customer is obliged to pay for them. All general provisions that are valid for a contract are applicable to such an agreement.

- Author's order. The author, on the one hand, and the customer, on the other, enter into an agreement that the author agrees to create a work of art, literature, science, etc. and transfer it to the ownership of the customer. The customer is obliged to accept it and pay. The agreement stipulates the deadline for delivery, the amount and procedure for payment.

In each case, the contract is of a compensatory nature, i.e. an individual receives remuneration for work or services. The difference from other types of contractual relationships is that the contractor receives a result that is separate from the work itself.

Employer's liability if wages are not specified in the agreement

The absence of provisions on remuneration is a significant violation, for which fines and other sanctions may be imposed, provided for when checking regulatory documentation by the State Labor Inspectorate. For such a violation, the operation of a commercial enterprise may be suspended.

If the issue of a violation is raised before the prosecutor’s office, then, on the basis of a prosecutor’s inspection, administrative liability may be imposed under Article 5.27 of the Code of Administrative Offenses of the Russian Federation. In this case, liability can entail serious legal consequences and be accompanied by large fines.

— conclusion, amendment and termination of an employment contract in the manner and under the conditions established by the Labor Code of the Russian Federation and other federal laws;

- providing him with work stipulated by the employment contract;

— a workplace that meets state regulatory requirements for labor protection and the conditions provided for by the collective agreement [if any];

— timely and full payment of wages in accordance with their qualifications, complexity of work, quantity and quality of work performed;

— rest provided by the establishment of normal working hours, reduced working hours for certain professions and categories of workers, the provision of weekly days off, non-working holidays, paid annual leave;

— complete reliable information about working conditions and labor protection requirements in the workplace;

— training and additional professional education in the manner established by the Labor Code of the Russian Federation and other federal laws;

We invite you to read the Complaint to neighbors who flooded their apartment - sample

— association, including the right to create trade unions and join them to protect their labor rights, freedoms and legitimate interests;

— participation in the management of the organization in the forms provided for by the Labor Code of the Russian Federation, other federal laws, if any, and by the collective agreement;

— conducting collective negotiations and concluding collective agreements and agreements through their representatives, as well as information on the implementation of the collective agreement and agreements;

— protection of one’s labor rights, freedoms and legitimate interests by all means not prohibited by law;

— resolution of individual and collective labor disputes, including the right to strike, in the manner established by the Labor Code of the Russian Federation and other federal laws;

- compensation for harm caused to him in connection with the performance of his job duties, and compensation for moral damage in the manner established by the Labor Code of the Russian Federation and other federal laws;

— compulsory social insurance in cases provided for by federal laws;

— [other rights provided for by the current labor legislation and other regulatory legal acts containing labor law norms, collective agreement, local regulations].

— conscientiously fulfill his labor duties assigned to him by the employment contract;

— comply with internal labor regulations;

— maintain labor discipline;

— comply with established labor standards;

— comply with labor protection and occupational safety requirements;

— take care of the property of the Employer (including the property of third parties held by the Employer, if the Employer is responsible for the safety of this property) and other employees;

— immediately inform the Employer or immediate supervisor about the occurrence of a situation that poses a threat to the life and health of people, the safety of the Employer’s property (including the property of third parties held by the Employer, if the Employer is responsible for the safety of this property);

— [other responsibilities provided for by the current labor legislation and other regulatory legal acts containing labor law norms, collective agreement, local regulations].

— conclude, amend and terminate an employment contract with the Employee in the manner and under the conditions established by the Labor Code of the Russian Federation and other federal laws;

— conduct collective negotiations and conclude collective agreements;

— encourage the Employee for conscientious, effective work;

— require the Employee to fulfill his job duties and take care of the property of the Employer (including the property of third parties owned by the Employer, if the Employer is responsible for the safety of this property) and other employees, and compliance with internal labor regulations;

— bring the Employee to disciplinary and financial liability in the manner established by the Labor Code of the Russian Federation and other federal laws;

— adopt local regulations;

- create associations of employers for the purpose of representing and protecting their interests and join them;

— create a works council;

— comply with labor legislation and other regulatory legal acts containing labor law norms, local regulations, terms of the employment contract, agreements, collective agreement [if any];

— provide the Employee with work stipulated by the employment contract;

— ensure safety and working conditions that comply with state regulatory requirements for labor protection;

— provide the Employee with equipment, tools, technical documentation and other means necessary to perform his job duties;

— provide the Employee with equal pay for work of equal value;

— pay the full amount of wages due to the Employee within the terms established in accordance with the Labor Code of the Russian Federation, the collective agreement [if any], internal labor regulations, and the employment contract;

— conduct collective negotiations, as well as conclude a collective agreement in the manner established by the Labor Code of the Russian Federation;

— provide employee representatives with complete and reliable information necessary for concluding a collective agreement, agreement and monitoring their implementation;

— familiarize the Employee, against signature, with the adopted local regulations directly related to his work activity;

— timely comply with the instructions of the federal executive body authorized to exercise federal state supervision over compliance with labor legislation and other regulatory legal acts containing labor law norms, other federal executive bodies exercising state control (supervision) in the established field of activity, pay fines, imposed for violations of labor legislation and other regulatory legal acts containing labor law norms;

— consider the submissions of the relevant trade union bodies, other representatives elected by employees about identified violations of labor legislation and other acts containing labor law norms, take measures to eliminate the identified violations and report on the measures taken to the specified bodies and representatives;

We invite you to familiarize yourself with the enterprise's property

— create conditions that ensure the Employee’s participation in the management of the organization in the forms provided for by the Labor Code of the Russian Federation, other federal laws and the collective agreement [if any].

— provide for the Employee’s everyday needs related to the performance of his job duties;

— carry out compulsory social insurance of the Employee in the manner established by federal laws;

— to compensate for damage caused to the Employee in connection with the performance of his labor duties, as well as to compensate for moral damage in the manner and under the conditions established by the Labor Code of the Russian Federation, other federal laws and other regulatory legal acts of the Russian Federation;

Differences between a GPC agreement and an employment contract

GPA has significant differences from an employment agreement, since the subject of the agreement in the first case is precisely the result of the labor of an individual, and not the labor function itself. The contractor under the GPC agreement is obliged to do the work and transfer its result to the customer, while he runs the risk of producing it in sufficient quality and within the specified time frame.

Whereas an employee under an employment contract:

- included in the regular staff;

- is obliged to comply with the work regime specified in the contract;

- accepts responsibilities to perform work in accordance with the job function;

- submits to and is controlled by the management of the employing organization;

- receives wages based on a time sheet.

Labor Code in Art. 15 does not allow the replacement of an employment contract with a civil contract if, in fact, an individual and an employer have an employment relationship. At the same time, the employer must not only determine a specific list of work for the position in accordance with the staffing table, establish the amount of wages, and the working day schedule, but also provide the employee with working conditions that meet labor law standards and other regulations (Article 15 of the Labor Code).

The content of the employment contract must comply with the requirements of Art. 57 of the Labor Code, the drafting of a GPC agreement is regulated by the Civil Code.

Normative base

Piecework wages, like any other labor relations, are regulated by a certain regulatory framework that both employees and their employers must follow.

Based on paragraph 1 of Art. 135 of the Labor Code, wages are set for an employee upon concluding an employment contract with him on the basis of the payment system that is established in the organization or enterprise.

Art. 8 of the Labor Code provides for the right and obligation of organizations to issue local acts that extend to labor relations within the organization. However, they must not contradict the current Labor Code and go beyond the competence of the company.

Regulation of piecework (as well as time-based) payment is also carried out by other norms of the Labor Code contained in Chapter 21, general principles and principles of labor law and other norms regulating the issue under consideration in general.

A more detailed source of legal regulation is the local act of the organization, which establishes the rules for piecework and payment for it. This is the Regulation on piecework wages, on the basis of which the employee’s salary is set, calculated and issued.

Other local documents of the organization may establish rules for establishing payment for work performed, tariffs, labor standards and other issues in this area.

The execution of an employment contract must comply with Chapter 11 of the Labor Code of Russia.

Direct forms of remuneration are prescribed in Articles 131 and 132 of the Labor Code of the Russian Federation.

Russian legislation states that each employee must enter into a document that will regulate his relationship with the employer and provide for:

- work and rest schedule;

- remuneration and its form;

- working conditions of the employee.

The employer, without violating the norms and rules of the current legislation, has the right to independently:

- determine the form of remuneration and its type;

- assign specific working conditions, for example, shift schedule and so on.

All conditions must be fully specified in the contract or employment agreement drawn up between the employer and the employee.

In case of significant changes in working conditions, an additional agreement must be drawn up.

Advantages and disadvantages

For an individual, concluding an agreement has the following positive aspects:

- there is no subordination, the agreement rather regulates partnership relations;

- the contractor has the right to complete the work at a time convenient for him without the need to comply with the internal labor regime;

- the result must be paid in accordance with the terms of the contract or the customer will be held liable.

But not everything is so simple, so we will list the negative aspects:

- lack of social support;

- the workplace must be equipped independently;

- you will have to take into account the costs of tools and materials that will be required to obtain the final product under the contract.

Filling out a civil contract for the provision of services

The form of such an agreement between the customer and an individual can only be written in order to avoid situations where one of the parties in the process refuses to complete the task, and the customer refuses to accept or pay for it.

The contract should not contain language related to labor relations - “employer”, “salary”, “employee”. Otherwise, he may be reclassified as a labor worker, and this threatens the organization with a fine.

Any use of materials is permitted only with a hyperlink.

The document form is not regulated by law and is drawn up in a simple form. But it must contain:

- details of the parties indicating the name of the customer organization, its manager or other official who has the right to sign contracts, as well as information about the individual performing the work or services;

- the subject of the contract with the wording of the specific task, address of execution and properties of the final result;

- conditions of execution, including qualitative characteristics of the final result, scope of work or services, deadlines, conditions for monitoring the stages of execution, as well as issues of provision of materials and equipment;

- the procedure for delivery and acceptance of work or services performed;

- order cost and payment procedure;

- liability of both parties with the establishment of parameters for the application of a penalty in case of failure to fulfill their obligations for both parties;

- establishing the validity period of the contract and the procedure for making changes to it;

- full details of the parties to the contractual relationship.

All changes to the terms of the GPC agreement that could occur during its execution must be documented in an additional agreement. This document is an integral part of the main agreement, so it must indicate the number and date of the original agreement. All changes are written down point by point and certified by the signatures of both parties.

The document is drawn up in one copy for each party and certified by their signatures. The organization affixes the signature of the head with a seal.

Attention! A multi-page GPC agreement is certified by the signatures of the parties on each sheet.

Duration of the GPC agreement

The specific validity period of the agreement is fixed in its corresponding paragraph, while the maximum term of the GPC agreement with an individual is not limited by law (Part 1 of Article 708, Part 1 of Article 781 of the Civil Code). Additionally, intermediate deadlines may be provided.

In practice, the customer and the contractor are interested in completing the work (providing the service) as quickly as possible and generating income. Therefore, although according to the law the period can be calculated in decades, it has reasonable limits. The duration is determined based on the actual ability to fulfill the terms of the contract.

Storage of contracts is determined by the provisions of Art. 23 of the Tax Code and Federal Law of December 6, 2011 No. 402-FZ and is 5 years.