Definition

A downward or upward adjustment to the sales of the previous period (CSF) may arise as a result of:

- Changes in the cost of work.

- If it is necessary to adjust the sales of the previous period towards a decrease in quantity.

- With a simultaneous change in quantity and cost.

- If a VAT evader returns the goods to the seller.

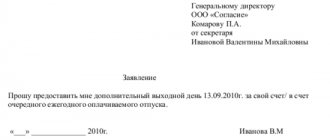

If the parties agreed to change the terms of the transaction before issuing the shipping document, then within 5 days the seller can reissue the invoice.

Document flow

Reducing the cost of products is a business transaction that needs to be documented with primary documents. If errors are identified, changes are made to them. The consignment note is used to formalize the sale of goods and materials to a third party. But it cannot serve as evidence that the buyer agrees with the change in the terms of the contract. To issue an adjustment invoice, you must provide a payment slip for the invoice, a new contract or a statement of shortage of goods at acceptance. Let's take a closer look at how this process is carried out in NU and BU.

Adjustment of sales and invoices from the seller

Situations when it is necessary to adjust the primary document up or down, carried out in previous periods, may also arise when selling goods. In such a situation, you can safely use the instructions described above.

An implementation adjustment in 1C 8.3, just like a receipt adjustment, is created on the basis of a primary document. The set of fields is quite similar. Only the movements created in the program differ.

Now you can check the result of mutual settlements by making a reconciliation report with the counterparty.

See also video instructions:

Requisites

The procedure for filling out the CSF is prescribed in Art. 169 of the Tax Code of the Russian Federation.

If there is a downward adjustment to the sales of the previous period, then the difference in monetary terms must be indicated in column 8 of line D without a negative sign. The document must be signed by an authorized person. The individual entrepreneur must additionally indicate the details of the state registration certificate.

If the downward adjustment to the sales of the previous period is incorrectly filled out, VAT will not be recalculated. The CSF should be drawn up in 2 copies within 5 days from the date of receipt of the document confirming the changes: additional agreement, statement of shortage of goods, payment order, etc.

If changes are made simultaneously to several documents in which identical goods were shipped, the seller can re-issue one invoice for all shipments.

Adjustment of sales of the previous period downward: postings

Let's take a closer look at how the CSF is reflected in the seller's accounting book:

- Reversal of DT62 KT90 – revenue is reduced by the difference.

- Reversal DT90 KT68 – deduction for the amount of the difference.

- Reversal DT20 KT60 – the client’s debt is reduced by the difference.

- Reversal DT19 KTt60 – VAT difference.

- DT19 KT68 – previously deducted VAT has been restored.

Let's look at how the CSF is reflected in the increase in the seller's book value:

- DT62 KT90 – increase in the cost of revenue.

- DT68 KT90 – tax accepted for deduction.

- DT20 KT60 – debt increased.

- DT19 KT60 – tax amount has been changed.

- DT68 KT19 – tax accepted for deduction.

When making any changes to invoices, the seller must provide an invoice, and the buyer must recover VAT. In both cases, the difference in tax amounts accrued before and after the changes is deductible. Any changes to the CSF are not grounds for filing an updated declaration.

The seller must reflect the corrected invoice in the sales book (increase in value) or purchase book (decrease in value) in the period of its preparation, and the buyer in the reporting quarter. Deductions under the CSF can be applied within 36 months after drawing up the document.

Adjustment of sales downwards in 1C 8.3 in the current period

Implementation adjustments

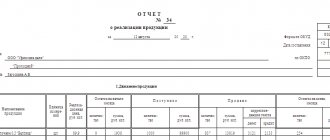

Adjust the amount of services using the Sales Adjustment document. Create it based on the Sales document (act, invoice).

Please indicate:

- Type of operation - Adjustment by agreement of the parties;

- Reflect the adjustment - In all sections of accounting, because Not only VAT is adjusted, but also the sales amount.

On the Services tab, adjust the amounts.

Postings

Postings are generated:

- Dt 62.01 Kt 90.01.1 - the amount of revenue has been adjusted;

- Dt 90.03 Kt 19.09 - accrued VAT has been adjusted.

Issuance of Adjustment Invoice to the buyer

Generate the CSF using the Write adjustment invoice button.

Acceptance of VAT for deduction when reducing the sales amount

You can accept VAT for deduction under the CSF only using the document Generating purchase ledger entries in the section Operations - Closing the period - Regular VAT operations - Create - Generating purchase ledger entries.

Sales adjustments are reflected on the Sales cost reduction tab.

Generate the Purchase Book report from the Reports – VAT – Purchase Book section.

Adjustment of sales of the previous period downward in 1C

To register shipment changes in 1C, a document of the same name is provided. If the shipment amount decreases and reporting is not submitted, then “Adjustment of sales” will reflect the amount of mutual settlements and make changes to the income tax. The document generates transactions using account 76K. The debt is taken into account from the moment of the transaction to the date of adjustment. Analytical accounting is carried out for each counterparty, agreement and settlement document.

If the reporting has been submitted, then when creating the document you need to check the box “Last year’s accounting is closed” and be sure to indicate the item of income/expenses. In this case, transactions will be generated by the current date. If there is an increase in the sales amount, the program will automatically increase the tax base.

According to Art. 168 of the Tax Code, if there is a downward adjustment to the sales of the previous period after the sale, then the seller must reissue the invoice within 5 days from the date of receipt of the basis document. SCF is the basis for deducting tax. In this case, the amount of tax accrued before and after making the changes is subject to adjustment. Expenses from previous years are taken into account when calculating VAT in the month they are identified.

VAT

According to Art. 168 of the Tax Code, if there is a downward adjustment to the sales of the previous period after the sale, then the seller must reissue the invoice within 5 days from the date of receipt of the basis document. SCF is the basis for deducting tax. In this case, the amount of tax accrued before and after making the changes is subject to adjustment. Expenses from previous years are taken into account when calculating VAT in the month they are identified.

Income tax

According to Art. 54 of the Tax Code, taxpaying organizations calculate the base based on the results of each period based on accounting registers or on the basis of any data on objects. If errors from previous periods are identified, it is necessary to recalculate the tax base and the amount of the fee payable to the budget. If the period of the error cannot be identified, then the recalculation should be carried out in the current period.

Read more: Breathalyzer shows alcohol in a sober person for reasons

Revenue from the sale of goods is recognized on the date of sale. Adjustment of the sales of the previous period towards a decrease in accounting should also be carried out in NU. That is, the taxpayer must change his tax obligations. This is how downward adjustments are made to the sales of the previous period. At the same time, the organization’s profit also decreases, and an overpayment of taxes occurs.

If the change in value is explained by the discount provided, the seller can adjust the tax base during the period of re-registration of the contract. In this case, the amount by which income is reduced must be reflected as part of non-operating expenses. The resulting loss can be carried forward to future reporting periods, that is, reduced by the amount of profit of the future period. The only condition is that you cannot reduce income received from activities taxed at a 0% rate. The loss can be carried forward to future periods within 10 years.

How to reflect the implementation of the previous period

Let's look at an example.

Let’s say that the Confetprom company in March discovered unrecorded sales of communication services for December 2020.

To reflect the forgotten implementation document in 1C 8.3, we create the Implementation (acts, invoices) on the date the error was found. In our case, March, not December:

In the invoice document we indicate the date of correction (March) and the same date is indicated in Issued (transferred to the counterparty):

To reflect VAT in the previous period, you must check the Manual adjustment box and correct it in the Sales VAT register:

- Recording an additional sheet – set to Yes;

- Adjusted period – set the date of the original document. In our case, December:

Erroneously forgotten document when creating the Sales Book from the Sales page:

We recommend watching our seminar, which discusses how to correct VAT amount errors that affect the tax calculation and how to correct “technical” errors that do not affect the tax calculation:

You can study in more depth the mechanism for adjusting past periods and correcting errors of the past period in 1C 8.3, as well as the necessary actions when an error is detected, at our master class “ Correcting errors and adjustments in accounting .”

Give your rating to this article: (

3 ratings, average: 5.00 out of 5)

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

I am already registered

After registering, you will receive a link to the specified address to watch more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP 8 (free)

By submitting this form, you agree to the Privacy Policy and consent to the processing of personal data

Login to your account

Forgot your password?

Example

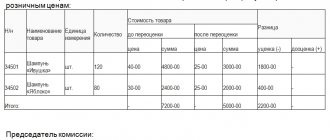

On 12/18/15, the LLC signed an act for carrying out repair work in the amount of 236 thousand rubles. The funds were transferred to the contractor on 12/20/15. In March of the following year, the LLC conducted an examination to assess the quality of work, as a result of which paid but uncompleted work was discovered (18 thousand rubles). The LLC sent a claim and an additional agreement to the contractor to reduce the cost of the work. In April 2016, the documents were re-signed, and the funds were returned to the organization’s current account. We will reflect these operations in the customer’s accounting system.

- DT20 KT60 - the costs of repairing the facility are included in the cost price (200 thousand rubles).

- DT19 KT60 - VAT reflected (36 thousand rubles).

- DT68 KT19 - VAT accepted for deduction (36 thousand rubles).

- DT60 KT51 - paid for work (236 thousand rubles).

- DT76 KT91 - income accrued (RUB 15,254 thousand).

- DT76 KT68 - tax restored (RUB 2,746 thousand).

- DT51 KT76 - funds received from the contractor (18 thousand rubles).

A situation is possible when, after shipment, the quantity or price of goods, works, or services change. For example, the seller has given the buyer a bonus for achieving a certain purchase volume, and this bonus reduces the cost of previously shipped goods. Or a misgrading was identified that required an adjustment in the quantity and price of goods. It is good if such changes occur within 5 calendar days from the date of initial shipment. Then the invoice is issued taking into account the changes. Otherwise, you will need to draw up an adjustment invoice (clause 2.1 of article 154, clause 3 of article 168 of the Tax Code of the Russian Federation, Letters of the Ministry of Finance dated July 25, 2013 No. 03-07-11/29474, dated November 17, 2016 No. 03-07- 09/67407, dated 06/18/2014 No. 03-07-RZ/29089). We will tell you in our consultation how adjustments to the sales of the previous period are reflected in the direction of decrease or increase in accounting and tax accounting.

Reflecting adjustments in accounting

An increase in the price or quantity of goods shipped is generally reflected in the following accounting entries (Order of the Ministry of Finance dated October 31, 2000 No. 94n):

Debit of account 62 “Settlements with buyers and customers” - Credit of account 90 “Sales” - the cost of shipped goods, works or services has been increased (including VAT)

Debit of account 90 – Credit of account 68 “Calculations for taxes and duties”, sub-account “VAT” - additional VAT on sales is charged

Debit account 90 – Credit accounts 41 “Goods”, 43 “Finished products”, etc. – the cost of previously shipped goods has been increased (when adjusting the quantity of goods)

When the price or quantity of shipped goods, works or services decreases, postings are made with a “-” sign, i.e. REVERSE.

If the preparation of an adjustment invoice is associated with the return of part of the goods by a VAT evader, then the original seller will make the following entries:

Debit account 41 – Credit account 62 – the cost of returned goods is capitalized (excluding VAT)

Debit of account 19 “VAT on purchased values” - Credit of account 62 - accepted for accounting for VAT related to the cost of returned goods

Debit of account 68, sub-account “VAT” - Credit of account 19 - VAT on returned goods is accepted for deduction

Adjustment of sales upward for the previous period in 1C

Adjust the amount of services using the Sales Adjustment document. Create it based on the Sales document (act, invoice).

Please indicate:

- Type of operation - Adjustment by agreement of the parties;

- Reflect the adjustment - In all sections of accounting, because Not only VAT is adjusted, but also the sales amount.

On the Services tab, adjust the amounts.

When adjusting the amounts of the previous period, the postings directly depend on whether the financial statements are signed. This fact is set on the Calculations tab. Here, indicate the item of other income and expenses to account for the adjustment in the taxonomy.

The amount of adjustment for the selected item Corrective entries for transactions of previous years will be reflected on page 100 (101) of the income tax return.

Postings

If the Last year's accounting checkbox is closed for adjustment (reporting has been signed) is not checked, then in 1C the following is corrected:

- BU - the last day of the year (December 31);

- NU - date of primary documents;

- Mutual settlements - in the current period, through account 76.K.

Postings are generated:

- Dt 76.K Kt 90.01.1 - reflection of the unaccounted amount of revenue;

- Dt 90.03 Kt 68.02 - additional VAT charged.

- Dt 99.01.1 Kt 90.09 - profit adjusted;

- Dt 62.01 Kt 76.K - the buyer’s debt is reflected.

If the Last year's accounting checkbox is closed for adjustment (reporting has been signed) is checked, then in 1C the following is corrected:

- Accounting and mutual settlements - the current period, through account 76.K;

- NU - date of primary documents.

Write out the CSF using the Write adjustment invoice button.

Generate the Sales Book report from the Reports – VAT – Sales Book section.

VAT adjustment for the previous period

An adjustment invoice with VAT for additional payment as a result of an increase in the price or quantity of previously shipped goods is registered by the original seller in the sales book in the quarter in which the adjustment invoice was drawn up (Clause 10 of Article 154 of the Tax Code of the Russian Federation).

An adjustment invoice with VAT for deduction, which arose as a result of a decrease in the cost of previously shipped goods, works or services, is registered by the original seller in the purchase book no earlier than receipt of a document confirming the buyer’s consent to reduce the price or quantity of goods, but no later than 3 years from the date of drawing up the adjustment invoice (clause 13 of article 171, clause 10 of article 172 of the Tax Code of the Russian Federation).

Nuances of tax accounting

An invoice from the seller to reduce the cost of shipment, VAT for deduction is registered in the purchase book. This can be done no earlier than the buyer’s consent to the reduction has been received, and no later than 3 years from the date of registration of the adjustment invoice (Articles 171-13, 172-10 of the Tax Code of the Russian Federation).

If sales increased, the adjustment document is entered into the sales book in the same quarter in which it was drawn up (Article 154-10 of the Tax Code of the Russian Federation).

For income tax, when the sales volume changes, and therefore the tax base, an adjustment declaration is submitted. The information must be reflected in the period of initial recording of the business transaction. This is stated in a number of letters from the Ministry of Finance (for example, No. 03-03-06/1/44103 dated 12/07/17).

As implementation increases, this rule always works. If an adjustment has occurred downwards, it is possible to reflect this in the adjustment period, with one condition: in the period of initial shipment, income tax is calculated for payment. During the period of initial shipment there was a loss (or zero income) - which means an adjustment declaration is submitted (Article 54-1 of the Tax Code of the Russian Federation).

Adjustment of income tax for the previous period

In general, adjustments to the tax base for income tax as a result of changes in the price or quantity of previously shipped goods are made in the reporting period in which such shipment was originally reflected (Letters of the Ministry of Finance dated July 12, 2017 No. 03-03-06/1/44103, dated February 14, 2017 No. 03-07-09/8251). That is, if, say, for the February shipment the cost of goods, works or services sold increased, then you will need to submit an updated income tax return for the 1st quarter.

Read more: Is it possible to return an inheritance that was abandoned?

But if the cost of goods has decreased, then it will be possible to reflect the decrease in revenue and direct expenses in the form of the cost of previously shipped goods in the period when sales are adjusted. But only if during the period of initial shipment income tax was calculated for payment. Therefore, if, for example, the cost of shipped goods decreased for the March shipment, but according to the results of the 1st quarter, income tax was calculated for payment, then the sales adjustment reflected in May can be shown in the profit declaration for the 1st half of the year. But if at the end of the 1st quarter there was a loss or the seller broke even, then the decrease in sales for such a quarter will need to be reflected only by submitting an amendment (Article 54 of the Tax Code of the Russian Federation).

Situations when, after the shipment of goods, there is a change in the quantity of goods or their value, occur quite often . This happens when the seller provides the buyer with a premium that reduces the cost of previously shipped product items, or when a misgrading occurs that requires an adjustment in volume and cost.

If such errors were identified within 5 calendar days , an invoice is issued taking these changes into account. If this happens later, an adjustment invoice will be required.

Adjustments to sales and receipts from previous periods

Our clients are often faced with situations where, in the current tax period, they have to adjust or reflect the facts of economic life relating to previous periods. At the same time, they often contact us with the question of why the movements of the documents “Adjustment of receipts” and “Adjustment of sales” are formed not by the date of the adjustment document, but by the date of the document being adjusted, that is, the date of last year. This article is devoted to how to correctly reflect the adjustment of income and expenses of the previous period, not even from the point of view of 1C programs, but from the point of view of accounting and tax accounting methodology.

Accounting

According to Order of the Ministry of Finance of the Russian Federation dated July 22, 2003 N 67n “On the forms of financial statements of organizations”:

- In cases where incorrect reflection of business transactions of the current period is detected before the end of the reporting year, corrections are made by entries in the corresponding accounting accounts in the month of the reporting period when the distortions are identified.

- If an incorrect reflection of business transactions is detected in the reporting year after its completion, but for which the annual financial statements have not been approved in the prescribed manner, corrections are made by entries in December of the year for which the annual financial statements are prepared for approval and submission to the appropriate addresses.

- In cases where an organization reveals in the current reporting period that business transactions were incorrectly reflected in the accounting accounts last year, corrections are not made to the accounting records and financial statements for the previous reporting year (after the annual financial statements have been approved in the prescribed manner). Clause 11 of the Order of the Ministry of Finance of the Russian Federation dated July 22, 2003 N 67n.

In the documents “Adjustment of receipts” and “Adjustment of sales” the above legislative requirements are supported optionally. For this purpose, in the documents “Adjustment of receipts” and “Adjustment of sales” on the “Additional” tab there is the sign “Last year’s accounting is closed for adjustment (reporting signed).” When posting a document “Adjustment of sales” without this attribute, accounting entries are formed using accounts 90 and 99, for example, in the case of an upward adjustment of sales revenue:

Dt 76.K Kt 90.01.1 - for the amount of increase in cost

Dt 90.03 Kt 68.02 - for the amount of the VAT increase

Dt 62.01 Kt 76.K - for the amount of increase in cost

Dt 90.09 Kt 99.01.1 - financial result of adjustment

In this case, all postings are formed not by the date of the adjustment document, but by the date of the adjusted sales document, that is, last year.

When posting a document “Adjustment of sales” with the attribute set “Accounting for the previous year is closed for adjustment (reporting has been signed),” entries in accounting are generated through 91 accounts, for example, when adjusting sales in the direction of increasing income:

Dt 62.01 Kt 91.01 - for the amount of increase in cost

Dt 91.02.1 Kt 68.02 - for the amount of the VAT increase

Postings are generated by the date of the sales adjustment document. Analytics of account 91, that is, the item of other income and expenses, is indicated in the document on the “Additional” tab next to the sign “Last year’s accounting is closed for adjustment (reporting signed).”

Thus, in accounting we can independently regulate in what period and through which account we reflect the adjustment of income and expenses of the previous period.

Tax accounting

The procedure for adjusting income and expenses for the previous year in tax accounting is regulated by Article 54 of the Tax Code of the Russian Federation:

Taxpayer organizations calculate the tax base at the end of each tax period on the basis of data from accounting registers and (or) on the basis of other documented data on objects subject to taxation or related to taxation.

If errors (distortions) are detected in the calculation of the tax base relating to previous tax (reporting) periods in the current tax (reporting) period, the tax base and tax amount are recalculated for the period in which these errors (distortions) were made.

(as amended by Federal Law dated July 27, 2006 N 137-FZ)

If it is impossible to determine the period of errors (distortions), the tax base and tax amount are recalculated for the tax (reporting) period in which the errors (distortions) were identified. The taxpayer has the right to recalculate the tax base and the amount of tax for the tax (reporting) period in which errors (distortions) relating to previous tax (reporting) periods were identified, also in cases where the errors (distortions) led to excessive payment of tax .

(paragraph introduced by Federal Law dated July 27, 2006 N 137-FZ, as amended by Federal Law dated November 26, 2008 N 224-FZ)

Thus, failure to reflect business transactions in the past period is an error that led to distortion of data for past periods. Therefore, upon receipt of supporting documents (clause 1 of Article 252 of the Tax Code of the Russian Federation) and in accordance with Art. 54, 272 of the Tax Code of the Russian Federation, by resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 09.09.2008 No. 4894/08:

- if the amount of income relating to the previous period increases, an updated tax return is submitted for the period to which the adjustment relates (paragraph 2, paragraph 1, article 54 of the Tax Code of the Russian Federation).

- when the amount of expenses related to the previous period increases, the taxpayer has the right to choose (paragraph 3, paragraph 1, article 54, paragraph 2, paragraph 1, article 81, subparagraph 3, paragraph 7, article 272 of the Tax Code of the Russian Federation, resolutions of the FAS North -Western District dated 06/05/2012 No. A44-3816/2011, dated 01/31/2011 No. A56-10165/2010, North Caucasus District dated 02/22/2012 No. A53-11894/2011, Moscow District dated 03/15/2013 No. A40-54227 /12-90-293, dated 08/14/2013 No. A40-110013/12-20-566, Ninth Arbitration Court of Appeal dated 03/26/2013 No. 09AP-6639/2013, letter of the Ministry of Finance of Russia dated 01/23/2012 No. 03-03-06 /1/24, dated 08/25/2011 No. 03-03-10/82, Federal Tax Service of Russia dated 03/11/2011 No. KE-4-3/3807): - submit an updated tax return for the period to which the primary accounting document relates; — or adjust the tax base in the current tax period (year).

At the same time, the taxpayer has the right to adjust the tax base of the current period only if, according to tax accounting data, the taxpayer has a profit in the period to which the error relates. If, according to tax accounting data, a loss is received, then there is no fact of excessive tax payment, therefore, an updated tax return is submitted (letters of the Ministry of Finance of Russia dated January 30, 2012 No. 03-03-06/1/40, dated October 5, 2010 No. 03-03- 06/1/627, dated 08/11/2011 No. 03-03-06/1/476, dated 03/15/2010 No. 03-02-07/1-105).

When carrying out the document “Adjustment of sales” (adjustment towards an increase in value) with an unspecified sign “Accounting for the previous year is closed for adjustment (reporting has been signed)”, postings to the NU are generated through account 90 by the date of the document being adjusted, that is, the date of the previous period:

Dt Kt 90.01.1 (NU) - by the amount of increase in cost

Dt 90.09 Kt 99.01 (NU) - financial result of adjustment

When posting the document “Adjustment of sales” (adjustment towards an increase in value) with the established sign “Last year’s accounting is closed for adjustment (reporting signed)”, the following entries are generated in NU:

Date of the document being adjusted:

Dt Kt 90.01.1 (NU) - by the amount of increase in cost

Dt 90.09 Kt 99.01 (NU) - financial result of adjustment

The date of the current period, that is, the date of the adjustment document:

Dt Kt 91.01.7 (PR) - by the amount of increase in cost

Thus, the developers of 1C are guided by the principle that accounting adjustments for previous periods in tax accounting should not affect (change) the tax base for the income tax of the current period. In cases provided for by law, documents can form accounting and tax accounting movements in the period in which the document being adjusted is drawn up.

Reasons for change

In practice, there are a large number of situations in which adjustments are required within the current period. There are several reasons why this phenomenon occurs:

- Cost reduction in the course of identification by the customer of low-quality products, uncompleted work, payment for which was made in the previous period.

- Changes to sales documentation in the current period due to the fault of persons responsible for sales.

- Reduction in cost due to discounts and other bonuses.

- Mutual agreement of the parties reached in order to achieve other business and commercial purposes.

When changes in historical sales occur

Cases where it is currently necessary to correct the sales amounts of a closed period, as we noted, are quite common. They can arise, for example, due to:

- price reduction as a result of the buyer identifying products that do not meet accepted quality standards, misgrading, or uncompleted work, payment for which was made in the previous period;

- corrections in sales documents in the reporting period that arose through the fault of responsible persons;

- reduction in the cost of goods after a discount is provided. Often, the seller provides the buyer with a bonus for a certain volume of purchases, which reduces the cost of previously supplied goods;

- agreements between the parties concluded to stimulate further business cooperation.

A change in sales amounts will undoubtedly affect VAT and will require adjusting the accounting records that reflected the sales transactions. Adjustment of sales of past periods is formalized by the mandatory preparation of an adjustment invoice.

The procedure for adjusting sales and basic postings

Adjustments to the sales of the previous period can be made in both directions – both increasing and decreasing.

Downward

To understand the principle of designing implementation adjustments, it is worth studying examples from practice.

Limited Liability Company "Mir" signed the act on December 18, 2020. The amount of the agreement was 236,000 rubles. It includes a value added tax of 20%, it amounted to 36,000 rubles. The transfer of funds took place entirely from the organization’s current account; this happened on December 20, 2020.

In March of the following year (2018), an independent examination was initiated in order to assess the quality of the work that was performed. Based on its results, a set of works was identified that were not completed, but payment for them was received. The amount of such events amounted to 18,000 rubles. VAT amount – 2746 rubles.

Subsequently, she sent a written complaint and supporting agreement to the contractor SK Pari LLC. She did this in order to reduce the cost of work performed and return financial resources. A few weeks later, Pari signed a document and issued a refund for work that was never completed.

In this case, the following accounting entries are prepared (December 2020):

- Dt 20 Kt 60 - reflection of expenses associated with ongoing repairs of the facility, which relate to the cost of finished product units (amount - 200,000 rubles);

- Dt 19 Kt 60 – reflection of value added tax, the amount of which is 36,000 rubles;

- Dt 68 Kt 19 – acceptance of value added tax to the corresponding deduction, the amount of the accounting transaction is the same;

- Dt 60 Kt 51 – payment for work performed in an amount equal to 236,000 rubles.

For April 2020:

- Dt 76 Kt 91.1 – accrual of other income in the amount of 15,254 rubles;

- Dt 76 Kt 68 – restoration of the VAT amount for work that was not performed, in the amount of 2746 rubles;

- Dt 51 Kt 76 – receipt of financial resources from (18,000 rubles).

As for the accounting entries on the contractor's side, they are as follows (December 2020):

- Dt 62 Kt 90.1 – reflection of revenue received for repair work (RUB 236,000);

- Dt 90.3 Kt 68 – reflection of value added tax on work, the implementation of which occurred (RUB 36,000);

- Dt 51 Kt 62 – receipt of payment from the organization Mir LLC (RUB 236,000).

The entries for April 2020 are as follows:

- Dt 91.2 Kt 62 - a reflection of the decrease in sales (in particular, loss) in 2020, which was discovered in April of the following year (RUB 15,254);

- Dt 68 Kt 62 – reflection of value added tax by reduction (2746 rubles);

- Dt 62 Kt 51 – transfer of funds to the organization (RUB 18,000).

In practice, a large number of other accounting records are compiled, depending on the transactions performed.

Increasingly

Accounting specialists often apply a reverse upward adjustment. To consider the procedure for carrying it out in practice, it is worth using data from the previous example, supplementing its basic conditions.

Read more: Categories of goods that are not subject to exchange or return

In this case, the contractor’s accounting entries for May 2020 are as follows:

- Dt 62 Kt 91.1 – additional accrual of revenue in the amount of 50% of the original value (9,000 rubles);

- Dt 51 Kt 62 – receipt of monetary assets from Mir LLC (9,000 rubles).

If there is an increase in revenue, the contractor needs to pay additional value added tax. This operation is reflected by the following transactions:

- Dt 90.3 Kt 68 – additional charge of VAT, the amount of which is 1,500 rubles;

- Dt 68 Kt 51 – transfer of value added tax to budget funds.

These are just some of the entries made in the process of changing certain data. There is no complete list of them, since they depend on the specific circumstances.

Adjustments to sales and receipts from previous periods

Sales Book sheet?

Re: How to properly reverse Sales of services from a previous period?

Re: How to properly reverse Sales of services from a previous period?

| (1) Thank you, I made you happy. Quote (UII @ Apr 12 2006, 07:51) “I wrote to the support service regarding this issue, they answered me: Currently, adjustments in the standard configuration are reflected manually. The developers have written down a wish to add reversal documents, but the implementation timeframe has not yet been determined. I made a document about the sale of goods and services, the amount with a minus. True, we had to make a few small changes in the configurator. Otherwise 1. There are no movements in the “Mutual settlements with counterparties” register 2. There is no reversing entry in account 68.02 3. There is no reversing entry in the “Sales Book” - The date of the discussion is especially encouraging. Haven’t they really come up with anything since then other than to edit the configuration to solve a seemingly typical situation like document reversal? |

Re: How to properly reverse Sales of services from a previous period?

| The arrangement, of course, is quite typical. Who can argue? Only now it is automated with the same success as its euphonious synonym, chaos. |

Re: How to properly reverse Sales of services from a previous period?

| (3) Valera, I’m not laughing. We need to close it for a year. But the problem has not yet been solved. Better tell me how to get out of the situation |

Re: How to properly reverse Sales of services from a previous period?

| ...I noticed that they have a hard time with MINUS... |

Re: How to properly reverse Sales of services from a previous period?

| Here I found methodological instructions from 1C (almost my version): Filling out additional sheets of the purchase book and sales book in 1C: Accounting 7.7 programs. And 8.0 06/30/2006 Example 1: In March 2006. sold to individual entrepreneur D.N. Taganov. services in the amount of 2000 rubles, incl. VAT 18% - 305.08 rub. The certificate of services performed and invoice number 2 were dated March 1, 2006. In June of this year, it turned out that the amount indicated in the invoice was incorrect. issued a duplicate invoice dated March 1, 2006, where she indicated the correct cost of services - 2,500 rubles, incl. VAT 18% - RUB 381.36. It is necessary to reflect the changes made in the sales book. ... |

Re: How to properly reverse Sales of services from a previous period?

| + Adjustment of the sales book in the 1C: Accounting 8.0 program. Shipment of services to the buyer on March 1, 2006. for the amount of 2000 rubles. were entered into the 1C: Accounting 8.0 program using the document “Sales of goods and services”, and VAT on sales is reflected in the sales book for March using the document “Formation of a sales book”. In June 2006, after making adjustments to the issued invoice, the user can reflect the correction of the error in an additional sheet of the purchase ledger in one of three ways. Option 1: Using the document “Adjusting entries in accumulation registers” Option 2: Using the introduction of reversing documents Option 3: Using manually filling out the document “Creating sales book entries”... |

Re: How to properly reverse Sales of services from a previous period?

| We missed another document “Registration of payment from buyers for VAT” |

Re: How to properly reverse Sales of services from a previous period?

| Option 2: By entering reversing documents You can also enter information into an additional sheet of the sales book by duplicating documents. To do this, it is necessary to issue two additional documents “Sales of goods and services” on March 1, 2006. In the first document, you must indicate incorrect amounts with a minus sign (in our example, this will be the amount - 2000 rubles, including VAT - 305.08 rubles). And in the second document, reflect the corrected amount (in our example, this is 2,500 rubles, including VAT of 381.36 rubles). Invoices for these two new documents should not be entered. The information we entered will be reflected in the regulatory document “Creating Purchase Ledger Entries” on the “VAT on Sales” tab. To do this, simply fill out the document automatically using the “Fill” button (Fig. 3-1, 3-2). In this case, the reversing document will be automatically reflected as an entry in an additional sheet of the sales book (with a tick in the appropriate field and filling in information about the period being adjusted). And in the second line, where the corrected amount is displayed, these details will need to be filled in manually. Next, in the “Invoice invoice” field in both lines, you should select the corrected invoice from the document journal “Sales of goods and services”. |

In the “Event” field, the “Sales” attribute is indicated for the reversing entry, and “VAT adjusted” for the correcting entry.

Re: How to properly reverse Sales of services from a previous period?

| Question: Why is it necessary to create a reversal document “Sales of goods and services” in the CLOSED period (March 01, 2006)? Reversing entries must be created in the month the error was DETECTED, i.e. in June. |

Re: How to properly reverse Sales of services from a previous period?

| What is “Adjusting accumulation register entries”? |

Re: How to properly reverse Sales of services from a previous period?

| As a note: Wiring D62.01 - K90.01.1 with a minus may turn out to be incorrect. Namely, if the sale was carried out in one tax period (for profit), and the error was corrected in another |

Re: How to properly reverse Sales of services from a previous period?

| (19) This is exactly what happens. Implementation in one tax period, and corrected in the next quarter. |

Re: How to properly reverse Sales of services from a previous period?

| Gentlemen, has anyone encountered a similar problem? How did you get out? What they were doing? |

Re: How to properly reverse Sales of services from a previous period?

| (20) from (0) “in 4 sq. reversing entries." The tax period for profits is one year. (21) once. Accounting certificate + Adjustment. I don’t remember what and how I did now. |

Re: How to properly reverse Sales of services from a previous period?

| I discovered a way to create corrective entries and entries in registers. It turned out to be simple. No Negative Realizations or Accounting Certificates are needed. You can reverse the “Sales of services” dock using the “Adjustment of accumulation register entries” dock. — We create the “Adjustment of accumulation register entries” dock during the error detection period. — on the Filling in movements tab, check the box “Use filling in movements” — Action — Reversal of document movements — Document — indicate the document to be reversed (“Sales of services” for the previous period) — Click Fill in movement In this case, everything under this document is reversed (accounting, accounting, Registers). |

Re: How to properly reverse Sales of services from a previous period?

| But that is not all. It is necessary to make changes to the Sales Book. To do this, you need to reverse the entries in the registers created by the “Creating sales book entries” dock. This seems to also be done using the “Adjusting accumulation register entries” dock. Similar to (23) with the only difference that after the automatic generation of records using the Fill in Movement button, you must manually delete records in registers that are not related to our service. |

Re: How to properly reverse Sales of services from a previous period?

| + to (24): In the “VAT Sales” register, you need to manually check the boxes in the Record additional sheet column and put the end date of the previous period in the Adjusted period column. Now you can see additional sheets in the Sales Book and fill out the Adjustment VAT return for the previous period. — Maybe someone has comments on the methodology? |

Filling out a correction invoice

The need to use an adjustment invoice arises when the cost of shipped commodity items or services provided changes. This is stated in clause 5.2 of Art. 169 of the Tax Code of the Russian Federation. If the company has carried out work to adjust the cost and change the number of shipped commodity items, it is impossible to do without using an adjustment invoice.

In practice, basic requirements for this documentation have been developed. They contain detailed information about filling out data related to the parties to the transaction. Correction paper implies compliance with the following conditions:

- the preceding factor (prerequisite) should be the fact of the buyer’s consent to make certain changes to the volume or quantity of goods (clause 10 of Article 172 of the Tax Code of the Russian Federation);

- the document must be drawn up no later than 5 days from the date of execution of the agreement (clause 3 of article 168 of the Tax Code of the Russian Federation).

A special form is provided for the document containing a detailed template for its preparation. The form is presented in Appendix No. 2 to the Decree of the Government of the Russian Federation No. 1137 of December 26, 2011.

Reflection in accounting

If during the shipment process there was an increase in cost or an increase in the number of commodity items, the following accounting entries are drawn up (regulation - Order of the Ministry of Finance of the Russian Federation No. 94n dated October 31, 2000):

- Dt 62 Kt 90 – increase in the cost of shipped commodity units, as well as works, services, including value added tax;

- Dt 90 Kt 68 – additional VAT charge upon sale;

- Dt 90 Kt 41 (43) - increasing the cost of goods that were shipped earlier.

If there is not an increase, but a decrease in the cost or volume of shipped goods, postings are created with a “-” sign, i.e. REVERSE. If a VAT evader returns part of the goods, the seller makes the following entries:

- Dt 41 Kt 62 – the cost of commodity items that were returned was capitalized;

- Dt 19 Kt 62 – acceptance of tax for accounting;

- Dt 68 Kt 19 – acceptance of tax for deduction.

How to simplify the registration procedure

Modern and advanced tools facilitate the rapid search for the necessary information, including information on filling out an adjustment invoice. But you should prepare for the fact that the computer system will provide a large number of answers, which are usually difficult to navigate. In order not to waste a lot of time searching for relevant information, you should use the following algorithm of actions :

- study the text of the main standard regarding adjustment documents (it is prescribed within the framework of Russian Government Decree No. 1137);

- , which is current;

- Pay attention to the example of filling out the document;

- create your own document based on existing templates.

Value added tax adjustment

The corrective VAT invoice is subject to registration by the seller in the text of the sales ledger in the quarter in which it is drawn up. This is stated in paragraph 10 of Art. 154 of the Tax Code of the Russian Federation.

An adjustment invoice for deduction, resulting from a reduction in value, is recorded in the document recording the purchase. This occurs no earlier than the time of receipt of a document confirming the buyer’s consent to reduce the cost or volume of commodity items. But you need to meet it within 3 years from the date of drawing up the invoice (clause 13 of article 171, clause 10 of article 172 of the Tax Code of the Russian Federation).

Correction in primary documents

To register corrected primary supplier documents, you must select the operation Correction in primary documents in the Operation menu.

On the Products, Services, Agency Services tabs, information about correcting errors in the primary document is indicated.

The data on the tabs can be filled in automatically if the document Sales (act, invoice), Provision of production services, Sales report of the commission agent (principal) is specified Base

If the invoice was issued on the basis of other documents, the tabular part must be filled out manually.

When posting a document, movements on the original primary document are canceled in the tax period in which it was registered, and movements on the corrected invoice are generated. In this case, an entry in the sales book is generated automatically.