Who must submit Form 4-NDFL

Many people who are just starting their business do not know 4-NDFL, what it is and who submits it.

However, along with the 3-NDFL declaration, this is one of the main reports that an individual entrepreneur must regularly submit to the tax office under the general taxation system. 4-NDFL for individual entrepreneurs on OSNO is a special form with which an entrepreneur declares his planned income for the coming year. This is necessary so that the inspector can correctly calculate advance tax payments for him.

After the report is received by the Federal Tax Service, the tax officer determines and sends the entrepreneur a receipt for payment of future taxes. It is allowed to reduce the amount of income that the individual entrepreneur plans to receive in the specified period by the amount of expenses incurred.

An entrepreneur does not always have an obligation to provide this form.

The Tax Code states that the obligation to submit the form arises when an individual entrepreneur has just registered to conduct business, or in the current year there has been a sharp increase or decrease (50% or more) in income from business activities than was planned.

Also, the report must be submitted by the individual entrepreneur in the case when he makes the transition to the general system from other tax systems.

Attention! Another mandatory case for submitting this form is the provision of services by individuals who are not registered as entrepreneurs. These include, for example, lawyers and notaries.

Sanctions and fines

Violations of tax laws may be subject to both administrative and criminal penalties. An entrepreneur who violates the requirements of the Tax Code of the Russian Federation regarding the declaration of taxes faces:

- A fine of 1,000 rubles or 5% of the tax amount - if the reporting tax calculation is submitted late (or is absent). Sanctions will be assessed for each month of delay, the maximum fine for this violation is 30% of the calculated tax amount (in addition to declarations, this also includes the 6-NDFL report).

- After 10 days of delay when submitting reports, the Federal Tax Service has the right to block the current accounts of individual entrepreneurs. This is the most common regulatory sanction today.

- For submitting the declaration incorrectly (or in the wrong form) - a fine of 200 rubles.

More serious sanctions await individual entrepreneurs who attempt to evade taxes and provide fictitious information when declaring taxable items, accounting for income and expenses:

- 10 thousand rubles - for gross errors in calculations, if this is discovered during 1 tax period;

- 30 thousand rubles - if the Federal Tax Service detects fraud for 2 or more reporting periods;

- 40 thousand rubles or 20% of the tax - if it is proven that the entrepreneur has underestimated the tax base on a large scale;

- an entrepreneur who has a staff of employees, as a tax agent, for failing to withhold or transfer personal income tax, will be charged a fine of 20% of the tax amount.

If a private entrepreneur does not provide the tax regulator with the requested documents or does not provide explanations for the calculations, he may be fined under Article No. 126 of the Tax Code of the Russian Federation:

- 200 rubles for each document not submitted on time (including 2-NDFL and 4-NDFL);

- from 2020, a new requirement has been introduced for tax agents - for submitting documents with false information, as well as for refusal to provide, a fine of 500 rubles is imposed for each report on 2-NDFL or 6-NDFL;

- for 10,000 rubles - for falsifying tax documents, or for refusing to submit the requested papers.

One example from judicial practice

Failure to pay tax at the request of the Federal Tax Service led the entrepreneur to blocking the account and litigation, which did not bring a positive result. The entrepreneur did not agree with the conclusions of the desk audit and the amount of tax charged to him, refusing to comply with the requirements of the tax regulator and pay tax on the specified amount.

After the tax office sent the individual entrepreneur a request to pay the tax fee, penalties and fines for late payment of personal income tax, he submitted an updated declaration in order to reduce the amount. But at the same time, the businessman deliberately did not pay the tax presented to him. The inspectorate blocked the individual entrepreneur's current account. The entrepreneur filed a lawsuit.

After the trial, the court sided with the Federal Tax Service, saying that the businessman must first of all comply with the Federal Tax Service's requirement by paying the tax and all established fines and penalties, and only after that justify and insist on the correctness of the calculations he made. The Arbitration Court of the Far Eastern Federal District, in its decision dated July 23, 2015 No. F03–2916/2015 in case No. A04–7042/2014, supported the opinion of the lower courts.

Personal income tax is one of the most controlled taxes on the list of government regulators. When submitting reports, an entrepreneur needs to be especially attentive to the figures and data on personal income tax, be aware of the new editions of the Tax Code of the Russian Federation, and constantly become familiar with the innovations of the tax service on the issue of taxation. In 2018, there are no changes to the registration and payment of personal income tax for individual entrepreneurs, but in the next year they may well appear.

https://youtu.be/X8PDXBDM8o8

Deadlines for submitting the 4-NDFL declaration in 2018

The law establishes that an entrepreneur must submit Form 4-NDFL for the first time within 5 days of receiving his first income. This means that if he has just registered and has not yet started doing business, then he does not have the obligation to submit the form.

However, as soon as he has his first income, the obligation to submit the form also arises.

For example, Galina Aleksandrovna Petrova registered as an entrepreneur on January 16, 2020. The first income in the form of funds received into the current account occurred on February 6, 2020. This means that, according to the Tax Code, she has an obligation to prepare and submit a 4-NDFL declaration with the expected amount of income by February 11, 2020.

Moreover, if such a day falls on a holiday or a day off, then it can be moved forward to the next working day. In our example, February 11 is a day off, so the deadline for submission is moved to the 12th.

You might be interested in:

TZV-MP new reporting for small businesses

Entrepreneurs who have been operating for a long time are required to submit this form simultaneously with the 3-NDFL declaration.

If an entrepreneur records an increase or decrease in income by more than 50%, there is no special filing deadline. The Tax Code only establishes the obligation of the individual entrepreneur to fill out this form.

Attention! It is very beneficial for an individual entrepreneur to prepare and submit a declaration on time when income decreases, since this will reduce the tax burden by reducing advance payments.

If an individual entrepreneur does not send a declaration within the period specified by law, then a fine of 200 rubles will be imposed on him. There are no sanctions for failure to submit information in the event of a significant change in income, because there is no mandatory deadline for sending such data.

What is it and who rents it?

A declaration in form 4-NDFL must be submitted by individual entrepreneurs on the general taxation system after receiving the first income of the year (from the moment the application of the OSN begins or the transition to it).

In 4-NDFL, the entrepreneur indicates the estimated income for the year that he plans to receive (minus expenses). Based on this information, the Federal Tax Service calculates and sends payment slips to individual entrepreneurs for the payment of quarterly advance payments for personal income tax.

You need to resubmit 4-NDFL if the income received during the year differs significantly (by more than 50%) from what was indicated in the previously submitted declaration. This is necessary for accurate calculation (adjustment) of advances payable.

In addition to 4-NDFL, entrepreneurs on OSNO must submit a 3-NDFL declaration at the end of the year.

Where are the reports submitted?

The declaration must be sent to the tax authority, which is located at the place of registration of the entrepreneur.

If an individual entrepreneur has difficulties determining the correct code of the Federal Tax Service, to which he should send the completed form, then a special service from the tax service portal will come to his aid. There you need to indicate your registration address, after which the required code will be displayed.

If an individual entrepreneur operates in a region other than his registered registration, then he must still submit the form to the inspectorate where he was registered.

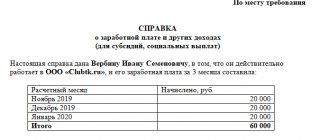

Competently prepared certificate

Despite the simplicity of the process of filling out the document, you should familiarize yourself with a sample of filling out the new 4-NDFL declaration form. Form 4-NDFL consists of one sheet, so filling it out is not difficult.

It consists of several stages:

- First of all, you need a free tax return 4-NDFL using this link and save it in your computer;

- the individual taxpayer number (TIN) is entered in the top line of the form;

- in the line "page" it is written “001” because the page is the first and only;

- in the line “Adjustment number”, “0” is written if the reporting is submitted for the first time, “1” if it is submitted for the second time, etc.;

- in the line “Tax period” the year in which the estimated amount of profit will be received is indicated. This is usually the current year;

- in the line “Submitted to the tax authority (code)” enter the code of the tax authority to which the declaration will be submitted;

- in the line “Taxpayer Category Code”, fill in “720”, since this is the code of individual entrepreneurs;

- in the line “Code according to OKTMO” the code of the territory of registration of the individual entrepreneur is filled in;

- Next, fill in the last name, first name and patronymic, and indicate the contact phone number. If the form is filled out manually, then all data should be written in block letters;

- the amount of estimated income is filled in as a whole number, without indicating kopecks;

- in the lower left part of the form, fill out the section “I confirm the accuracy and completeness of the actions specified in this declaration.” In case of personal submission of the certificate, the taxpayer enters the number “1”. If submitted by a proxy, enter the number “2” and fill in the data of the representative, as well as the data of the power of attorney;

- At the end there is a date and signature.

There is no need to provide documents confirming the amount indicated in the reporting. According to the projected income, the tax office will assess advance payments, of which the entrepreneur will be notified in writing.

https://youtu.be/h0bAgXHbeRE

Delivery methods

The current legislation provides for the following methods of submitting this report to the tax authority:

- Directly to the inspector at the Federal Tax Service by submitting a report on paper in two copies. The report can be submitted by the entrepreneur himself, or by the person for whom he has issued a power of attorney. One report is returned to the submitter with an acceptance mark and is proof that the form was accepted.

- By means of a valuable letter sent through the post office. A prerequisite for using this method is to fill out an inventory of the investment. One inventory must be present in the envelope with the letter, the second remains in the hands of the sender. The post office also provides the entrepreneur with a receipt, and the date indicated on it will be considered the date of departure.

- Using electronic document management through a special communications operator or through the tax website. This method will require an electronic digital signature.

It must be remembered that in order for a proxy to send the report, he needs to issue a power of attorney at a notary office. If this document is not executed in the appropriate manner, the declaration will be refused.

Depending on the region, the tax authority may request to provide along with the report:

- Electronic version of the submitted report.

- The presence of a special barcode on the paper version of the report.

Attention! It must be remembered that this is not enshrined in legislation as a performance obligation, and the inspector does not have the right to refuse admission due to the absence of these points. If you receive a refusal, you can go to court.

4-NDFL

Download form 4-NDFL in Pdf format. You might be interested in:

Declaration under the simplified tax system 2020: deadlines, methods of submission, sample filling

Download the form 4-NDFL for free in Word format.

Download a sample of filling out form 4-NDFL in Pdf format.