In 2020, individual entrepreneurs and organizations registered in the territory of the Republic of Crimea will face a fairly significant increase in tax rates for the main special regimes: simplified tax system, PSN and unified agricultural tax. The simplified tax rate will rise from 3% to 4 for the object “income” and from 7% to 10% for “income reduced by the amount of expenses.” The agricultural tax rate will rise by 8 times, and the patent rate by 4 times.

Entrepreneurs and organizations registered on the territory of the Crimean Peninsula are provided with a number of fairly significant tax benefits by the current tax legislation. And despite the fact that from 2020 the rates for payments on simplified taxation, patent and agricultural tax are increasing significantly, taxation in Crimea is one of the most profitable in Russia as a whole. Let us briefly consider the main tax systems that can be used in this region.

BASIC

The main tax regime involves the payment of three payments:

- VAT;

- Income tax (organizations) or personal income tax (individual entrepreneurs);

- Property tax.

We will not dwell on this regime separately; we will only note that the use of this system will be beneficial in case of obtaining the status of a participant in the SEZ (free economic zone).

FEZ participants receive the right:

- Do not pay import duties and VAT on imported equipment;

- Pay income tax at a reduced rate: 0% to the federal budget and 2% to the republican budget (for the period established by regional legislation);

- Do not pay property and land taxes (within 3 years from the date of registration of the property);

Application procedure

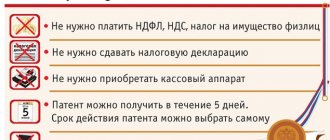

The key difference between the PNS is the fixed fee for a patent permit. Thus, the general provisions on the patent tax system set the tax rate at 6%. However, for some regions it may be reduced. For example, for Crimea and Sevastopol the value is set at 4%.

There are also tax holidays. For example, when registering an individual entrepreneur for the first time, the PTS rate may be 0%. Moreover, the benefit is provided for 2 years, that is, until 2020.

The tax base for a patent 2020 is the expected income that an entrepreneur can receive during the reporting period. The indicator is set at the regional level. That is, the authorities of the constituent entities of the Russian Federation approve fixed values separately for each OKVED.

The tax period for tax calculation (patent taxation system) is the calendar year or the number of calendar months for which the permit was purchased.

Simplified taxation system in Crimea

Table No. 1. Comparison of the simplified tax system of Crimea and other regions of the Russian Federation in 2016-2017.

| Condition | 2016 | 2017 | ||||

| simplified tax system of other regions of the Russian Federation | SSNO Crimea | simplified tax system of other regions of the Russian Federation | SSNO Crimea | |||

| Marginal income for switching to the regime (million rubles* without taking into account the deflator coefficient) | 60 | 120 | ||||

| Income limit for being on the regime (million rubles * excluding the deflator coefficient) | 45 | 90 | ||||

| Maximum cost of fixed assets (million rubles) | 100 | 150 | ||||

| The number of employees | No more than 100 people | |||||

| Share of participation in other companies | No more than 25% | |||||

| Bid | At the object "income" | The rate does not change | According to the income simplified tax system – 4% For income and expenses – 10% | |||

| 6%; | 3% | |||||

| At the object “income minus expenses” | ||||||

| 15% | 7% | |||||

| Reporting | Declaration (submitted once a year) and Book of Income and Expenses - KUDIR (maintained, but not submitted to the tax authority) | |||||

| Payments | 3 advance payments during the year and tax at the end of the year | |||||

| Other reporting | Depends on the availability of employees | |||||

Source: Consultant +

Changes for 2020 ↑

Since the beginning of 2020, a number of changes have been made to the laws on the simplified tax system. And this applies not only to profits, but also to methods of writing off products, declarations, etc. What innovations should you be prepared for?

By income

In 2020, the deflator coefficient on which it is necessary to index the profit limit of the simplified tax system is 1.147 (in accordance with the order of the Ministry of Finance of the Russian Federation dated October 29, 2014 No. 685).

An enterprise whose profit was no more than 68,820,000 rubles (60 million * 1,147) can remain in the simplified regime.

A company that wishes to switch to a simplified regime in 2020 must ensure that profit for 9 months of the current year does not exceed 51,615,000 rubles (45 million * 1.147).

For what BCC under the simplified tax system “Income minus expenses”, see the article: BCC of the simplified tax system. Read all about accounting for excise taxes in accounting here.

The Tax Code of the Russian Federation states that the maximum amount of 45 million must be indexed no later than December 31, 2015 by the coefficient.

The State Duma is considering amendments to Ch. 26.2 NC. In accordance with the new document, it is planned to make changes to the simplified tax system in 2020 “income minus expenses” and by income.

The authorities are going to set the following maximum income amounts:

- when calculating the amount for 9 months, income limit

- – 150 million rubles. (currently it is 45 million);

- when calculating the amount for the year - 200 million rubles. (now it is 60 million).

The maximum residual value is 300 million rubles.

LIFO method

Enterprises using the simplified tax system cannot write off products using the LIFO method when calculating tax amounts. The authorities canceled it in order to bring accounting and tax accounting closer together.

Enterprises that carried out assessments using this method back in 2020 must choose one of the 3 proposed options (subclause 2, clause 2 of Article 346.17 of the Tax Code as amended by Law No. 81-FZ of April 20, 2014):

- at the price of the first in terms of purchase (FIFO);

- at an average price;

- at unit price.

By compensation

On the simplified tax system, the costs of paying for work can include the same payments that are used when determining income taxes (subparagraph 6, paragraph 1, paragraph 2 of Article 346.16 of the Tax Code).

Since the beginning of 2020, the list of labor costs includes a mention of the severance pay that an employee of the company will receive if the employment contract is terminated with the consent of the parties (clause 9 of Article 255 of the Tax Code).

Payments can be taken into account on a simplified basis. To do this, the following condition must be met - they must be stated in employment contracts with employees, in local regulations, for example, in the regulations on remuneration for work.

The Ministry of Finance previously allowed the inclusion of compensation in the costs of paying for work, which is provided for by additional agreements to employment contracts (in accordance with letter dated July 16, 2014 No. 03-03-06/1/34828).

But representatives of the tax authority believed that such payments should be taken into account if they are of a production nature and related to the working conditions of a company employee.

VAT declaration

From the beginning of 2020, enterprises using the simplified tax system that issue invoices with value added tax must indicate information for each of them in their VAT reporting (clause 5.1 of article 174 of the Tax Code).

The twelfth section of the declaration is specially designated. You will need to submit documentation of this type (electronically) after submitting the report for the first quarter of 2020 by April 27.

If the report is submitted later than the deadline or forms are submitted that are handwritten, the inspector has the right to block the accounts (clause 11 of Article 76 of the Tax Code).

Tax authorities can easily verify that a company issues an invoice with value added tax using the simplified tax system, but does not submit a declaration to the Inspectorate.

The report reflects invoices, which means the tax authority representative will be able to see the VAT claimed for deductions from buyers.

The declaration form was changed back in 2020 (in accordance with the order of the Federal Tax Service of the Russian Federation dated July 4, 2014 No. ММВ-7-3/ [email protected] ).

It consists of the following sections: if the taxpayer chose the “income” object, he will have to fill out sections 1.1, 1.2, if the company chose the “income reduced by expenses” object - 1.1, 2.2.

Invoice journal

The intermediary, who is in a special regime (in this case, on the simplified tax system), undertakes to transfer the invoice journal in electronic form to the tax authority (clause 5.2 of article 174 of the Tax Code).

Maintaining a sales book was mandatory in the past. Now you need to submit it to the Federal Tax Service by the 20th day of the month following the tax period (quarter).

This rule applies to:

- agent and commission agent who acts on his own behalf;

- developer;

- forwarder, which includes only intermediary types of remuneration in profit.

Property tax

There are changes in 2020 for individual entrepreneurs on the simplified tax system and for property tax. A simplified enterprise must pay taxes on real estate from the beginning of the year, the tax base of which is expressed by cadastral value (clause 2 of Article 346.11 of the Tax Code).

The obligation to transfer this type of tax arises for the company if several conditions are met:

- The enterprise has an administrative business or shopping center (as well as an area in it).

- In the territorial district, regulations are valid on the transfer of taxes on property objects from the cadastral value of real estate.

- The real estate of the enterprise is indicated in the list that was approved by the territorial government (Article 378.2 of the Tax Code).

For the first time, it is worth submitting reports for this type of tax to organizations that work on the simplified tax system before April 30, 2020.

KBK

The budget classification code for simplifiers in 2020 remains the same (Order of the Ministry of Finance of the Russian Federation dated July 1, 2013 No. 65n).

“Income” and “income reduced by expenses” have different BCCs. There is also a separate code for the minimum tax. The code table is contained in a special reference book.

Patent taxation in Crimea

Table No. 2. Comparison of PSN of the Crimean Peninsula and other regions of the Russian Federation in 2016-2017.

| Condition | 2016 | 2017 | ||

| PSN of other regions of the Russian Federation | PSN Crimea | PSN of other regions of the Russian Federation | PSN Crimea | |

| Income limit for being on the regime (million rubles * excluding the deflator coefficient) | 60 | |||

| The number of employees | No more than 15 people | |||

| Period for which a patent can be purchased | From 1 to 12 months throughout the year | |||

| Bid | 6% | 1% | The rate does not change | 4% |

| Reporting | The declaration is not submitted, KUDIR (maintained, but not submitted to the tax authority) | |||

| Patent payment | If a patent is purchased for a period of more than 6 months, payment occurs in two stages: 1 part (at least 30% of the cost) is paid within 90 days from the date of commencement of application of the PSN, and the remaining part until the expiration of the patent. | |||

| Other reporting | Depends on the availability of employees | |||

Source: Consultant +

The legislative framework

The procedure for applying the patent taxation system (PTS) in the territory of the Republic of Crimea is regulated by the following legislative acts:

| No. | Regulatory document PSN in Crimea | What regulates |

| 1 | Law of the Republic of Crimea No. 19-ZRK/2014 dated May 28, 2014 | The law introduced a taxation system in the form of payment of PSN on the territory of Crimea. The law also establishes the values of the basic profitability of activities used when calculating tax |

| 2 | Law of the Republic of Crimea No. 62-ZRK/2014 dated December 29, 2014 | The law establishes preferential tax rates used when calculating the value of a patent |

Let us remind you that in accordance with paragraph 1 of Art. 346.43 of the Tax Code of the Russian Federation, PSN is put into effect on the territory of municipal administration in the presence of an appropriate decision made by the local authorities of the region.

Unified agricultural tax on the Crimean peninsula

Table No. 3. Comparison of the Unified Agricultural Tax of the Crimean Peninsula and other regions of the Russian Federation in 2016-2017.

| Condition | 2016 | 2017 | ||||

| Unified agricultural tax of other regions of the Russian Federation | Unified agricultural tax of the Crimean peninsula | Unified agricultural tax of other regions of the Russian Federation | Unified agricultural tax of the Crimean peninsula | |||

| Who can apply | Individual entrepreneurs and organizations whose total income from agricultural activities is at least 70% of total income | |||||

| Bid | 6% | 0,5% | The rate does not change | 4% | ||

| Reporting | The declaration is submitted once a year, KUDIR (maintained, but not submitted to the tax authority) | |||||

| Tax payment | During the year, payers must pay an advance at the end of the half-year and tax at the end of the year. | |||||

| Other reporting | Depends on the availability of employees | |||||

Source: Consultant +