First warning

Until 2014, the situation with fines for small and micro businesses was depressing, since their size corresponded to the size of fines for large corporations. It is clear that in this way the very system of sanctions against violators among businessmen was simplified, but it was extremely difficult for a small entrepreneur to survive. After the president’s instructions, they decided to reduce the fines. This happened thanks to Nina Enshchikova, who on behalf of entrepreneurs drew the government’s attention to the problem. There was also an initiative to introduce the term “warning” into the administrative code. Since differentiation of administrative penalties will contribute to development and reduce the burden.

February 2020 was marked by the fact that the Ministry of Economic Development nevertheless submitted for public discussion amendments to the Code of Administrative Offenses, which included the introduction of a “pre-fine” warning. Now, those who broke the rules for the first time can only get off with a reprimand and not grab their heads.

As for the inspection activities themselves, new individual entrepreneurs were subjected to them only three years after opening, and the inspection plan could be viewed on the electronic resources of the prosecutor's offices. Inspections every three years were referred to as “inspection holidays” for small and medium-sized businesses.

Test holidays

“Test holidays” were organized only for respectable businessmen. Those who were found to have committed periodic violations could not count on being included in the “exempt” list. Also excluded were various companies engaged in the niches of education, medicine and social services, companies working in auditing, management companies, as well as those involved in state secrets.

But for complete understanding, tax holidays apply only to scheduled audits. And besides them, there are a bunch of different types. In addition, there is nothing to think about indifference on the part of fire supervision, industrial and environmental audits. No one will also save you from checks on depositing funds into extra-budgetary funds. So, the introduction of “vacations” actually lightens the test load, but it is by no means critical.

And they never adopted a law to reduce fines for small businesses. And rumors suggest that we can generally expect their growth. So, unfortunately, there is nothing to be happy about yet. The appearance of caring for small businesses does not mean that care exists in reality.

It is interesting that for the state, constant and ubiquitous inspections are not a free pleasure. Control and supervisory activities can spend up to 2% of a country's GDP per year. And this is quite a considerable amount. Although it turns out that it is the citizens themselves who pay for it.

But let's get back to our checks. More specifically, to the types of inspections that currently exist in the Russian Federation.

What to ask from inspectors if you receive an inspection

1. Control authorities cannot conduct an inspection without you. Compliance officials must call you or your representative to come in and begin inspecting your facility. There are exceptions to this rule. This is precisely the harm to human life, a threat to life and health, harm to animals, plants, the environment, cultural heritage sites (historical and cultural monuments) of the peoples of the Russian Federation, state security, as well as the occurrence of natural and man-made emergencies.

2. During any on-site inspection, the inspector must show you his service ID. Be sure to check that the person who came to you is the one whose name and position are indicated in the order (notification) of the inspection? If a different person comes to you, you have the right not to allow him to begin the inspection. The notification must be given to you against signature in advance; we have already indicated the deadlines.

3. Before starting the inspection, you must be shown the agreement between the inspection body and the prosecutor's office; the topic of the agreement must be clearly stated - an inspection of such and such individual entrepreneur such and such. The number and signature must be present. If the resolution is written on company letterhead, then an authority seal is not required. And if all this is on a simple sheet of paper, then you must definitely check for a seal.

4. The resolution on the inspection must indicate the goals, objectives, and grounds for conducting the inspection. The types and scope of activities that will take place during the inspection must also be specified. If this requires it, then it is necessary to indicate all expert councils, the composition of experts participating in the inspection, all organizations that will be involved in the inspection, the timing of its completion and conditions.

Video about changes in the order of appointment of on-site inspections in 2013

0

Author of the publication

offline 20 hours

adminkos

0

Comments: 2Publications: 269Registration: 12/25/2012

Types of checks

The main division is into:

- Scheduled checks

- Unscheduled inspections

One conclusion can be drawn: to the question of when to expect an inspector to visit, the answer will always be - always. In fact, the cancellation of scheduled inspections for the time being did not change the situation, because unscheduled ones continue to go on a rampage, and they are regulated by law 294-FZ (Part 2 of Article 10).

Auditing

It can be traveling, or it can be documentary.

An on-site inspection means that inspectors come to visit you personally. They come and confiscate everything that may be involved in the case (this is official, in fact, they can confiscate everything). And they check.

In the case of a documentary check , you will only get away with the fact that you will have to bring the documents on the case yourself.

Changes to the administrative code are not yet in effect. That is, until the summer of 2020 (and possibly for a longer period), you can forget about the possibility of receiving a warning rather than a fine.

Unfortunately, the practice of lawyers who defend audited organizations shows that there are outrageous cases. For example, during an unscheduled inspection (where a number of violations were discovered), one organization was closed for 3 months! This is precisely the period needed to eliminate all violations. It’s scary to say what losses the entrepreneur suffered.

And the fines themselves make some businessmen go gray before their time. So for individual entrepreneurs, fines usually start at 40 thousand rubles. And for legal entities we are talking about millions of rubles.

Tax audit concept

The Federal Tax Service's control over the correct and timely calculation and payment of taxes is called a tax audit. In this case, the Federal Tax Service takes as a basis the tax returns provided by payers during a certain period (for which the audit is carried out). The audit is based on the Tax Code and legislation of the Russian Federation.

Tax audit is one of the methods of tax control (Article 82 of the Tax Code of the Russian Federation) along with:

- with receipt of explanations;

- checking accounting and reporting data;

- inspection of premises and territories used for profit;

- other control procedures provided for by the Tax Code of the Russian Federation.

Whether tax monitoring helps you avoid tax audits, find out from the publications:

- “Tax control in the Russian Federation: forms, methods and types”;

- “Is tax monitoring possible not for all, but only for individual taxes?”

There are several types of tax audits.

Officially, the term “counter audit” has not been used since 2007, but in practice accountants still use it now.

If you have access to ConsultantPlus, find out how an on-site inspection differs from a desk inspection . If you don't have access, get trial of online legal access.

What are the grounds for unscheduled inspections?

- If the period specified in the previously issued resolution expires after violations are identified. Violations may be in relation to orders and requirements under legal acts, as well as municipal ones. In general, if you have not corrected the errors that were previously pointed out to you.

- Also, the basis may be an order from a state control agency, if required, for example, by a prosecutor, based on the materials available to him.

- If they complain about you. Here we are talking about statements from citizens - from other entrepreneurs, from legal entities, the media, even government bodies. But statements must be at least about the following facts:

- threat to the life or health of citizens

- threat of harm to animals or plants, the environment, or cultural sites

- threat to state security

- causing harm to all of the above

- violation of consumer law

Grounds for inspections

IP inspections can be either planned, determined in advance, or unscheduled, for one of the possible reasons:

- Expiration of the period assigned for correcting violations after the previous inspection.

- Receipt of evidence or complaints to regulatory authorities about violations by the entrepreneur of the rights of consumers, employees and other norms.

- Request of the prosecutor and order of the head of the supervisory authority.

But even about an unscheduled inspection, the entrepreneur must be notified no later than 24 hours in advance. The exception is emergency situations and cases where the individual entrepreneur is suspected of causing harm to the health of people, animals or the environment.

What checks can find

To avoid any negative consequences of audits at all, your business activities must fully comply with the letter of the law.

And in order to be prepared for what violations may be attributed to you, read at your leisure the 14th chapter of the Code of Administrative Offenses. There you can find 61 reasons to be more careful in your business. For each of these reasons, an administrative fine may be issued. And if you violate the criminal code (and tax evasion is a violation of the Criminal Code of the Russian Federation), you will generally face up to 6 years in prison.

How to avoid a fine

Of course, the surest way to avoid a fine after checking is not to break the law. It is quite difficult, but still possible, to run a business in compliance with all legal regulations.

The first step is to study the laws. The most common fines imposed on entrepreneurs based on the results of state inspections are collected in Chapter 14 of the Administrative Code of the Russian Federation.

The Criminal Code should also not be overlooked. For example, under Article 199 you can get up to 6 years in prison for tax evasion.

What should an entrepreneur do during an inspection?

It’s good if the enterprise has a strict access control regime - this way inspectors will not be able to start an on-site inspection without the presence of the manager. In other situations you should be careful.

By law, an on-site inspection must be carried out in the presence of the entrepreneur or his deputy, but in practice it happens that the inspection encounters violations as soon as it enters the organization’s territory. Even conversations between employees on the porch can be used against the person being tested.

In this regard, the entrepreneur must:

- Organize a security system in advance;

- Instruct employees on the rules of communication with inspectors - only in the presence of the manager.

An on-site inspection in the absence of a responsible person is possible only in emergency situations, in cases of harm to the health of citizens or animals.

Before the inspection begins an on-site inspection, the entrepreneur needs to check the following:

- Familiarize yourself with the certificates of the inspectors (the data can be rewritten just in case).

- Accept against signature and study a copy of the inspection order. It must indicate the purposes of the inspection, types of control measures, the composition of the inspection commission, the date of the inspection and other conditions.

If all the documents are correct, you should not interfere with the verification, as this may result in an additional fine.

If the inspection is carried out as part of a criminal case, the person being inspected has the right not to answer questions until his lawyer arrives and not to sign documents (even the inspection report).

The person being inspected is obliged to provide inspectors with access to all documents and premises related to the subject of the inspection.

An audit log is created at the enterprise at the request of the manager. Its presence will help control the frequency of checks and many other factors.

Checking act

The result of the inspection is an act that records all the activities carried out and the violations detected. The entrepreneur’s signature on the act means his agreement with everything that is described there.

The individual entrepreneur has the right to add his objections to the inspection report.

Including justified objections to the act increases the entrepreneur’s chances of appealing the results of the inspection. Therefore, before signing the deed, you must study it carefully.

The presence of a lawyer during the inspection provides an additional guarantee that all rights of the individual entrepreneur are observed.

Bottom line

We said terrible things. But that was the topic of the article. The overall situation is actually not so dire. Don’t let you get the feeling that everyone who opens an individual entrepreneur will definitely be subject to monthly, if not daily, inspections and will definitely be fined. No. Many work calmly and successfully. The main thing is to be careful.

Not even every detected violation will result in a mandatory fine. In fact, even inspectors fail; the human factor cannot be canceled anywhere. Therefore, just study additional material on how to behave during inspections.

Well, and finally. Even a simple desire to put into effect the amendments about a “warning” before a fine gives something. Let's hope that things will only get easier in the future, and the verification burden on our entrepreneurs will gradually decrease. There are prerequisites for this.

On-site inspection

When carrying out this type of inspection, the Federal Tax Service monitors how the payer fulfills the obligations reflected in the contracts, as well as the availability and compliance with protocols, orders and other internal documents. Cash discipline, accrual of personal income tax from wages, accounting of income, expenses and economic feasibility of business transactions are subject to verification, that is, almost all activities of the payer for a certain period.

The main distinctive features of an on-site tax audit (Article 89 of the Tax Code of the Russian Federation):

- place of conduct - the territory of the taxpayer or the tax authority (if the person being inspected cannot provide the inspectors with premises);

- verification period – no more than 2 months. (but can be extended up to 4 months, and in exceptional cases - up to 6 months);

- inspection period - no more than 3 years preceding the year the decision to conduct the inspection was made (unless otherwise provided by the Tax Code of the Russian Federation).

On-site inspections may include several subtypes:

| Subtypes of on-site tax audits | Purpose |

| Comprehensive | Produced in the area of economic and financial activities of an organization for a certain period of time |

| Thematic | Aimed at monitoring the correctness of calculation and payment of a specific tax - profit, VAT, etc. It is carried out if tax authorities discover violations regarding the calculation and payment of taxes. |

| Target | Analysis of specific mutual settlements between buyers and sellers, verification of import and export transactions, legality of the application of benefits. This type of verification is issued as a separate application. |

| Control | It is carried out only if the initial check was carried out poorly. It can only be carried out by a higher-level Federal Tax Service. If such an audit reveals violations, sanctions will be imposed on the taxpayer. And the Federal Tax Service, which initially inspects the organization, may be held liable |

Basic provisions of Law No. 294-FZ

The most important provision of the adopted law is the limitation on the frequency of inspections. If before 2008 the tax inspectorate or Rospotrebnadzor could literally “live” in the office of an individual entrepreneur, now this is impossible. The frequency of inspections of individual entrepreneurs is limited - no more than once every 3 years . Moreover, you can check the same area of activity of an individual entrepreneur only once a year.

Also, Law 294-FZ established the division of inspections into unscheduled and scheduled, as well as documentary and on-site. The deadlines for conducting inspections of individual entrepreneurs for each of the controlling organizations were also determined, as well as the conditions under which it is possible to extend the deadlines specified in the law. The bodies of the Prosecutor General's Office were entrusted with the function of unified monitoring of inspections and implementation of planning.

IP inspection schedule

Scheduled inspections of individual entrepreneurs (as well as legal entities) must, firstly, be planned in advance, and secondly, included in the schedule of inspections of individual entrepreneurs and legal entities. This schedule is published on the website of the Prosecutor General's Office at ]]>https://plan.genproc.gov.ru/plan2018/]]>. (- this is for 2018, for 2020 you need to change the address accordingly from 2020 to 2019, etc.)

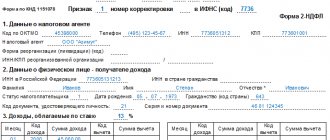

Here, any entrepreneur or head of an organization can find out whether an audit will be carried out in the coming year. To do this, you must indicate the OGRN, INN, name (full name of individual entrepreneur) and the expected month of inspection. As a result of searching according to the schedule of inspections of individual entrepreneurs and legal entities, information about:

- details of the individual entrepreneur being checked;

- what kind of regulatory organization will carry it out (fire inspection, Federal Tax Service, Rospotrebnadzor, and so on);

- the number of days allocated for inspection, as well as the number of hours allocated daily;

- verification form (documentary, on-site).

Also, the individual entrepreneur’s inspection schedule will indicate the month of the planned inspection, and the entrepreneur will be informed of the specific period in a written notification sent no later than 3 days before the start date of control actions.

The individual entrepreneur inspection plan is posted not only on the website of the prosecutor’s office, but also directly on the websites of regulatory organizations - Rospotrebnadzor, Federal Tax Service, Rostechnadzor, and so on. A moratorium on scheduled inspections of small businesses has been declared for the period 01/01/2016 – 12/31/2018. This ban has its exceptions - it does not apply to some individual entrepreneurs who work in particularly important areas, for example: healthcare, education, social sphere, electric power industry and others. In these organizations, scheduled inspections are allowed to be carried out two and three times every three years. The types of activities and the permissible frequency of inspections are determined by the Decree of the Government of the Russian Federation. More often than once every three years, it is allowed to inspect those individual entrepreneurs who, over the previous three years, committed gross violations of the law and were subject to administrative penalties. In addition, this law provides for the liability of inspection organizations for violation of legal requirements. Thus, an inspection carried out in gross violation of the law on state control is considered invalid and its results are annulled. It is also unacceptable for several regulatory organizations to impose the same mandatory requirements and requirements established by municipal legal acts in relation to one individual entrepreneur.

What tax audits is a new individual entrepreneur exempt from?

The Ministry of Emergency Situations checks both the physical presence of fire-fighting devices (fire extinguishers, fire hoses, taps, etc.) and documentary support

Since January 2020, “supervisory holidays” have been introduced, which last 3 years and will end in December 2020. This exemption applies only to individual entrepreneurs, which include enterprises with annual revenue of less than 800 thousand rubles. and a staff of less than 100 people.

This moratorium does not apply to those employed in the fields of healthcare, auditing, energy and electricity supply, and social services.

Inspections of various government agencies, including tax authorities, are carried out as planned (once every 3 years) or based on a complaint received. At the end of the inspection, a document is drawn up, according to which the individual entrepreneur must eliminate all identified deficiencies and violations, as well as pay accrued fines.

Who checks individual entrepreneurs

The number of supervisory organizations that have the right to exercise control over the activities of individual entrepreneurs is not so large, but more than one:

Individual entrepreneur tax audit

It is almost impossible to avoid an inspection by the tax inspectorate - after all, every individual entrepreneur is by default a tax payer, and accordingly falls under the control of the Federal Tax Service. Regarding scheduled tax audits of entrepreneurs, the rule “no more than once every 3 years” also applies. But unscheduled inspections are also possible in case of malicious violations of tax laws, failure to comply with inspectors’ orders, or receipt of complaints from local or state authorities.

The duration of an on-site tax audit (when an inspector carries out control directly at an enterprise or in an entrepreneur’s office premises) cannot exceed 2 months. But in special cases, inspectors may stay longer - for up to 6 months.

You can read in detail about the features of individual entrepreneur audits by tax authorities in the article “Tax audit of individual entrepreneurs”.

Inspection of individual entrepreneurs by Rospotrebnadzor

Visits from Rospotrebnadzor or officially, the Service for Supervision of Consumer Rights Protection and Human Welfare, are not that rare. This body is designed to protect clients from unlawful actions of individual entrepreneurs who violate the law, as well as to carry out sanitary and epidemiological control. Entrepreneurs dealing with food products – owners of grocery stores, cafes, restaurants and bars – meet Rospotrebnadzor inspectors more often than others. Such an inspection can be initiated not only by the federal service itself, but also by clients dissatisfied with the products or actions of individual entrepreneurs’ employees by filing a corresponding complaint with Rospotrebnadzor (you can leave a complaint remotely on the official website of this federal service).

Read about the possible reasons, procedure and rules for conducting inspections of individual entrepreneurs by Rospotrebnadzor in the article “Inspections of individual entrepreneurs by Rospotrebnadzor”.