Catering: information site

Pantry requirement.

Form OP-3 is a document that is intended to accompany the procedure for releasing certain products from the pantry of a particular enterprise to the appropriate persons. The document has a specialized form approved by Russian legislation. This form must display the name of the structural unit of the enterprise from which the products are issued (storeroom), as well as the unit to which these products are transferred. In this case, the surnames and initials of persons directly involved in the process of dispensing and receiving a certain amount of products are indicated. It is also mandatory to indicate the serial number of the document of form OP-3 and the date of its preparation.

The document itself consists of a table indicating the products released from the pantry according to their name. In this case, you should indicate the units of measurement of products and their quantity. The document is signed by the production manager and the head of the enterprise.

The requirement for the pantry is drawn up in a single copy for the upcoming day of preparing a particular dish in the kitchen of an enterprise, organization or other institution. It is on the basis of this document that an invoice for the release of the required goods is issued.

+

The document request to the pantry (form OP-3) is used to determine the release of the required amount of products from the pantry.

It is compiled in one copy, taking into account the need for raw materials (products) for the coming day and the balance of raw materials in the production (kitchen) at the beginning of the day.

Based on the request, an invoice is issued for the release of goods.

Cost calculation of ready-made dishes in the restaurant business (Autosaved)

Cost calculation of ready meals in the restaurant business

In order for managers of enterprises providing services in the field of public catering to be able to objectively analyze the situation and make optimal management decisions in the field of pricing, reliable information is needed on the costs of material resources for production.

Strict monitoring of correct pricing helps prevent unprofitable work and the ruin of the enterprise.

Accurate data and operational accounting allow you to optimize production processes and, accordingly, ensure consistently high profits for the enterprise. That is why cost calculation

acts as one of the main tasks of financial and management accounting of a restaurant.

Product cost

- this is the monetary expression of the costs necessary to carry out production and commercial activities related to the production and sale of products, performance of work and provision of services

Product cost

– this is the totality of costs (expenses) incurred by an enterprise for the production and sale (sale) of products or services

Sales prices are calculated separately for each dish

The choice of method for calculating product costs should be based on the characteristics of technological production and manufactured products. Only an experienced accountant can accurately calculate and document everything properly.

, specializing in restaurant accounting.

Drawing up a calculation involves a number of preparatory works. The calculation procedure is performed in a certain order.

Calculation is successfully carried out for:

*Pricing

* Analyze the economic component of dishes and identify ways to reduce costs and plan enterprise costs.

(in order for the calculation to reflect objective reality and bring practical benefit to the enterprise, it must be based on real numbers and carried out taking into account all accounting nuances)

*. Timely implementation of control over the movement of basic positions of inventory of the enterprise and max. rational use of warehouse stocks, avoiding misuse of products.

To calculate selling prices for finished products of the enterprise, special calculation cards of form OP-1 are used separately for each type of product.

The completed costing card must be signed by the production manager, the specialist responsible for carrying out the costing, as well as the head of the organization.

Calculation of the cost of ready-made restaurant dishes

Let's look at the procedure for creating calculations manually.

Calculation of selling prices for ready-made meals of catering enterprises is carried out on the basis of special calculation cards of form OP-1

for each type of product.

Calculations are based on one or one hundred dishes

In order to most accurately determine selling prices, it is recommended to calculate for one hundred dishes.

P

The calculation procedure is carried out in the following order:

- A list of dishes for which calculations are made is determined.

- Based on a collection of recipes and technological maps, standards for the inclusion of all ingredients in the finished dish are established.

- Purchasing prices for raw materials and ingredients are determined.

- The cost of the raw material set of dishes is calculated by multiplying the amount of raw materials by the selling price and summing over all items in the range of ingredients.

- The raw material cost of one dish is obtained by dividing the total by 100.

- The selling price of a finished dish is calculated by increasing the cost of raw materials by the amount of the trade margin (in %) established by order of the head of the catering enterprise.

Selling price of the dish = Total cost of raw materials + Markup

Calculation of prices for side dishes and sauces

is also done using this method. At the same time, the price of semi-finished and finished culinary products is taken into account at purchase prices. Purchased goods are sold at the purchase price, taking into account the markup.

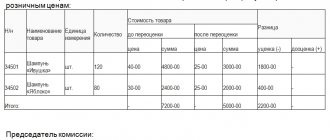

Let's look at calculation using an example

preparation of “Berlin cake” by the enterprise “Public Service”. Calculation is carried out based on 50 units of the product.

To prepare the dish, the technological maps require: ground cinnamon - 20 g; butter—0.1 kg; wheat flour - 0.250 kg; zest—50 g; sugar - 0.1 kg and egg - 6 pcs.

The calculation card is filled out in the following order: a list of food ingredients of the dish and the corresponding units of measurement (kg, g, pcs) are entered in the appropriate columns (Products); in the Price column the sales price per unit of measurement of the product is indicated; in the Gross and Net columns the quantity of products for 50 products is recorded; accordingly, in the Amount column the cost of individual types of products required to prepare 50 units of a dish is calculated.

The total cost of the raw material set is formed by summation and is equal to 391.6 rubles. Next, the raw material cost of one portion and the selling price taking into account the trade margin (1177%) are calculated.

Calculation card OP-1. Calculation example “Berlin cake”

The most optimal option for organizing a costing system is the introduction of an automated financial accounting system

tying together all the material and financial flows of the institution.

For example, such systems include 1С Public catering for organizing, first of all, accounting for a cafe, restaurant, as well as 1С Restaurant Management, which allows you to automate the management accounting of a single establishment or a chain of restaurants.

Further in the article we will describe the mechanism for generating calculations based on the 1C public catering system

.

This system was developed on the basis of the 1C Accounting solution, taking into account the specifics of the restaurant business - it is possible to carry out cutting and disassembly operations, entering recipes and calculating food calculations, preparing dishes, etc.

The main document on the basis of which the food calculation operation is carried out is the Recipe document

.The type of document may vary depending on the nature of the operation: preparation, cutting, disassembly.

Recipe - document for creating calculations in 1C Public catering

Source: https://StudFiles.net/preview/5999270/

Pantry requirement. unified form n op-3 (filling sample)

Golubev, M.P. Mogilny, T.V. Shlenskaya. – M: DeLi print, 2006. – 590 p. 27. Dementieva, E.P. Restaurant business: secrets of success.

–

Important

Rostov n/d: Phoenix, 2008. – 253 p. 28. Zolin, V.P. Technological equipment for public catering establishments. – M.: Academy, 2009. – 256 p. 29. Kucher, L.S. Organization of service at public catering enterprises / L.S.

Kucher, L.M. Shkuratov. – M.: Publishing House “Business Literature”, 2010. – 544 p. 30. Nikulenkova, T.T. Design of public catering enterprises / T.T. Nikulenkova, G.M. Yasina. – M.: KolosS, 2010. – 247 p. 31. Radchenko, L.A. Organization of production at public catering establishments. –

Info

Rostov n/a: Phoenix, 2010. – 352 p. 32. Usov, V.V. Organization of production and service at public catering establishments: Textbook - M.: Academy, 2010. - 432 p. Best sayings: For students, there are even, odd and test weeks.

Sanitary rules. Conditions and periods of storage of especially perishable products" 12. SanPiN 2.4.5. 2409-08 “Hygienic requirements for the safety and nutritional value of food products” 13. SanPiN 2.2.4. 548-96 “Hygienic requirements for the microclimate of industrial premises” 14. Collection of technological standards, published 1994-1997. Publishing house "Khlebprodinform". 15. Collection of recipes for dishes and culinary products for catering establishments. – M.: Khlebprodinform, 2003. 16. Collection of recipes for dishes and culinary products for catering establishments. Part 1 - M.: Khlebprodinform, 1996. 17. Collection of recipes for dishes and culinary products for catering establishments. Part 2 - M.: Khlebprodinform, 1997. 18. Collection of recipes for cakes, pastries, muffins, rolls, cookies, gingerbreads, gingerbreads and bakery products. Part 3 – M.: Khlebprodinform, 2000. 19.

https://youtu.be/_CZjI21i5-M

Inventory of daily fence sheets (invoices) (Form N OP-7)

Culture card. – (Form No. OP-1) Used to determine the selling price separately for each dish (product) using calculation.

The calculation is based on one or one hundred dishes. In order to most accurately determine selling prices, it is recommended to calculate for one hundred dishes. It is quite difficult to calculate the cost of one serving, since for one dish the ingredients can be taken in a minimum quantity, the specific gravity of which will tend to zero.

The Code of Civil Procedure of the Russian Federation, that a repeated appeal to the court in a dispute between the same parties, about the same subject and on the same grounds is not allowed, the court accepted the refusal of the claim declared by the representative of the plaintiff.

Prices for side dishes and sauces are also calculated on a separate card, and prices for semi-finished products and culinary products are calculated using the calculation method, based on the cost of the raw material set of products at sales prices.

Code of Civil Procedure of the Russian Federation, it was explained and clear to him, which he personally indicated in the application to terminate the proceedings in the case, which is also reflected in the protocol of the court session.

The main part of the primary accounting document OP-3 is a table to reflect information about the raw materials sold.

Form OP-3 (Pantry Requirement): what this document is and what it is intended for

The main area of application of the unified form OP-3 is public catering. It is successfully used in companies such as cafes, restaurants, canteens and other organizations that need to release goods from warehouses to production sites. Thus, document OP-3 is used in catering establishments when the release of materials from the pantry is necessary for the manufacture of food products.

Important! The significance of this document cannot be underestimated. Despite the fact that it is not the most significant, other documents of the warehouse accounting system are generated on the basis of the OP-3 form.

The preparation of a document requiring a storage room is preceded by:

- The range of manufactured products is planned;

- Calculation of raw materials for production is carried out;

- Information about the necessary materials is transmitted to the production manager and the head of the company, who confirm their consent to the release of materials with their signatures.

The unified form OP-3 consists of a title part and a tabular part. The header of the document should contain information about the organization, such as:

- its name;

- OKPO and OKDP codes;

- the name of the structural unit that issues raw materials, as well as its recipient unit.

Important! Due to the fact that the financially responsible person is responsible for the safety of raw materials in the company, only an authorized employee can issue valuables from the storeroom.

The main part of the primary accounting document OP-3 is a table to reflect information about the raw materials sold.

The following information must be reflected in the tabular section:

- Serial number;

- Name and code of consumable raw materials;

- Unit of measurement of raw materials and code from the OKEI classifier;

- Quantity;

- Comments and notes to be reflected as necessary.

Participation in the preparation of requirements for the warehouse of the invoice for the release of goods

The act is drawn up in two copies by the commission.

One copy is transferred to the accounting department, the other remains with the financially responsible person. Product reserves are necessary for the uninterrupted operation of catering and incoming raw materials and products, until they are used in the process of preparing dishes, are stored in specially equipped pantries. When dispensing the required volumes of semi-finished products, raw materials and products as calculated by the technologist or manager. production standards, a document is drawn up - a requirement for the storeroom.

The request specifies the following required information:

- number and date of document preparation;

- name of the department (warehouse);

- name of the workshop or production unit to which raw materials and products will be supplied;

- information about the financially responsible persons dispensing/receiving the goods;

- a detailed list and name of each type of product (indicating the code);

- designation of the unit of measurement and quantity of product or raw materials supplied;

- special marks or notes on the product.

Procurement act (form N OP-5)

It should not be allowed that analytical accounting of finished products is carried out only in quantitative terms, without valuation (paragraphs 201 and 203 of Guidelines 2). When moving products internally from one materially responsible person to another, it is necessary to indicate the cost of the product in the invoice request No. M-11.

The storekeeper periodically lets her go. Some of the products are outsourced to customers, the other part is transferred to the company's branches as a semi-finished product for the production of other products.

Order - the selection sheet is drawn up in one copy. This document confirms the fact of selection of goods for sale to the buyer in accordance with the terms of the supply or purchase and sale agreement.

An invoice for the release of goods in the OP-4 form (OKUD code 0330504) is issued at enterprises operating in the catering industry. It is used in various kinds of cafes, canteens, restaurants and other retail establishments when releasing raw materials from the warehouse to production sites.

The requirement is usually drawn up in one copy, unless otherwise provided by the internal rules of the enterprise. The requirement is drawn up taking into account the estimated demand of the production workshop for certain products and raw materials, as well as taking into account the balance at the beginning of the reporting day.

One of them remains with the receiving employee, while the second is transferred to the financially responsible person. He, in turn, submits them to the accounting department along with a report on the movement of materials and balances.

I. Instructions on the procedure for accepting production and technical products and consumer goods by quantity.

Basis for drawing up the document

The document is a reporting document, so you need to be very careful in its preparation and execution.

You should strive to avoid mistakes, but if any are made, you must carefully correct them by crossing out incorrect information and entering correct information.

Next to the correction, you must put the signatures of the persons responsible for drawing up the invoice with the inscription “Believe the corrected one.”

This document has three objectives. Firstly, it is proof that receiving is not a whim, but is a production necessity (no theft).

Secondly, it removes responsibility for the issued products from the person in charge. Almost every enterprise has a storage room with various equipment or a warehouse.

The employee responsible for his position is responsible for the safety of stored property. As a rule, this is a storekeeper.

During the work of an organization, it is often necessary to use these values within the enterprise.

Requirement for the pantry (form N OP-3)

The second copy is transferred to a third party and is the basis for the recording of these valuables.

When transferring inventory items for storage, the quantity and value of the transferred inventory items are indicated (for the purpose of assessing the transferred property).

The act is signed by members of the commission, the cashier and checked by an accountant, approved by the head of the organization.

https://youtu.be/YTN0iVr8gFM

The LLC is located at OSNO in Perm, a storage agreement has been concluded with the individual entrepreneur in Uva. Question: 1. We transfer the goods to the individual entrepreneur (does it need to indicate the amount or is only the quantity sufficient)?2. According to the document (director’s order), the individual entrepreneur ships the goods to the client3. The document (invoice) is issued from the storage warehouse to the client in quantitative and total accounting, i.e. in sales prices.

The act is signed by members of the commission, the cashier and checked by an accountant, approved by the head of the organization.

The cafe's cold shop is designed for preparing, portioning and decorating cold dishes and snacks, sweet dishes and cold soups.

Act on cutting raw meat into semi-finished products (form N OP-23)

Indeed, Article 3 of Federal Law No. 14-FZ “On Limited Liability Companies” says that...

This act also indicates the net weight of the product, obtained by subtracting the tare weight from the gross weight.

The release of products from the warehouse to production and goods to bars (buffets, shops) is issued with an invoice for the release of goods in accordance with paragraphs. 4.3 clause 4 Methods for accounting for raw materials, goods and production in mass catering enterprises of various forms of ownership, approved by Roskomtorg of August 12, 1994 N 1-1098/32-2.

The invoice for the release of goods (Form No. OP-4) is drawn up in two copies, one of which remains with the financially responsible person who received the goods, the second, together with the goods report, is submitted by the storekeeper to the accounting department. The invoice is signed by the production manager and approved by the head of the organization. This document will be the delivery note. Its form must be approved by the manager by order to the accounting policy.

Invoice for goods release form OP-4 is a document that is used to account for the release of goods or products, as well as containers from the enterprise’s pantry to the production kitchen, small retail chain, buffets, as well as to account for one-time release of finished products from the kitchen to buffets, branches , a small retail network, separated from the main production by a dispenser. Code of the invoice form according to OKUD form 0330504.

Naturally, it is not enough to contact the financially responsible person with a verbal request. Therefore, in the company’s records management there is a document on the basis of which releases from the warehouse (storeroom) are made.

The “Total” line summarizes the information entered above. Filling out the back side of the OP-4 form. On the back side of the document there is a continuation of the table.

The preparation of this form is preceded by the filling out of the warehouse request by the accounting department, thanks to which the company exercises control over the transfer of materials by management. 2 The invoice must be drawn up in two copies.

The financially responsible person releases goods on the basis of the “Order - selection sheet” or other document provided for by the document flow schedule of the trade organization.

Fence sheets are written out in two copies by an accountant. The production manager or a person authorized to do so, when releasing products (products) from the kitchen, fills out the appropriate columns of the first copy of the collection sheet as a carbon copy, indicating the time of release of each batch of products.

Form OP-3. Pantry requirement

If you nevertheless draw up a delivery note, it must be identical to the UPD, including signatories and a seal. At the same time, a seal is not required to be affixed to the UPD. In any case, the above documents are stamped by the seller - LLC.

It is on the basis of this document that an invoice for the release of the required goods is issued. The document request to the pantry (form OP-3) is used to determine the release of the required amount of products from the pantry.

A log of products and invoices accepted for expedition from warehouses and sent to customers. If the second option leaves extra lines, it is advisable to cross them out to avoid misunderstandings and fraud. What documents are generated on its basis? The data contained in the warehouse request will be useful when filling out an invoice for the release of goods.

Statement of movement of dishes and cutlery (Form N OP-9)

The menu plan indicates the names (column 2) and numbers of dishes (column 4) according to the Collection of Recipes or according to TTK, STP, and technical specifications.

However, most companies still prefer to use old forms to record goods, since they are convenient and contain all the necessary information.

Storekeeper Alexander Ivanovich Zaikin released the requested amount of products from the warehouse through the cook Alexander Sergeevich Sergeev.

It is drawn up by warehouse employees and issued on the basis of settlement and other accompanying shipping documents from suppliers.

Is it necessary to strictly adhere to the column form? Not all columns of the main table are required to be filled out. For example, Notes will rarely contain any information.

However, all columns are important and are provided for by State Statistics Committee Resolution No. 132. However, in 2013, part of this resolution became invalid. Civil Code of the Russian Federation “Storage Agreement”.

The party accepting the goods and materials for storage is called the custodian, and the party transferring the goods and materials for storage is called the bailor.

Source: https://ds8-vasilek.ru/razvody/5380-uchastie-v-sostavlenii-trebovaniya-v-kladavuyu-nakladnoy-na-otpusk-tovara.html

Features of drawing up a unified document OP-3

Features that you should pay attention to when drawing up the OP-3 form can be presented in table form:

| p/p | Features of document preparation |

| 1 | It is necessary to draw up a requirement for the pantry in one copy, since its main purpose is to determine the required amount of raw materials stored in the pantry, which will be used for the manufacture of products. If the company has a need, the number of copies can be increased. |

| 2 | When filling out, it is necessary to focus on the actual need of the structural unit for raw materials. |

| 3 | The document will not be valid if the release of materials is not confirmed by the signature of the production manager and the head of the organization, since only these persons have the right to regulate the consumption of raw materials. |

| 4 | Filling out a request for a warehouse is the basis for drawing up another equally important document in the company’s warehouse accounting system - an invoice for the release of goods. |

| 5 | The document is drawn up on the basis of the product cost estimate and the calculation of the amount of required materials. |

Blanker.ru

But they must be specified in the accounting policy (written, with certified seals and the signature of the manager) and contain all the information that is entered in the standard form. Thus, the best option is to use the forms presented above, since they have already been time-tested, recognizable and have space for entering the necessary data. The requirement can be filled out either electronically or in paper form. If the second option leaves extra lines, it is advisable to cross them out to avoid misunderstandings and fraud. What documents are generated on its basis? The data contained in the warehouse request will be useful when filling out an invoice for the release of goods. The latter paper is presented at the warehouse, entered into warehouse registers and serves as the basis for issuing food to a separate unit for public catering needs.

Errors when filling out form OP-3

When filling out any accounting document by those responsible for drawing up the primary document, errors may be made. What should you do if a violation is discovered?

The law allows corrections to be made to most primary documents.

| p/p | Typical mistakes when filling out form OP-3 | |

| Violation | Elimination methods | |

| 1 | The responsible person committed a violation in the calculations and in the OP-3 form indicated the amount of material exceeding the actual balance in the warehouse | It is necessary to make corrections to the document in accordance with accounting requirements: carefully cross out incorrect indicators, make a correct entry, and also certify with the signature of an authorized person. |

| 2 | There are no signatures of the manager or production manager on the document | The document structure requires two signatures. Accordingly, their absence casts doubt on the approval of the organization’s management for the release of raw materials into production. |

| 3 | The primary document OP-3 does not indicate the department that receives raw materials from the pantry | The requirement for the storeroom is a unified document in which the State Statistics Committee has determined all the mandatory details of this document. Accordingly, filling out the structural unit is necessary for the correct formation of OP-3. |

Unified form No. op-5 – procurement act – State Collection of Info

If a company or individual entrepreneur purchases any goods from an individual, a purchase and sale agreement is drawn up, as well as a purchase act. A sample of this document, a ready-made version of filling it out and rules for its preparation - all this is discussed in detail in the article.

Blank procurement act form (word)

Sample of filling out a purchase act from an individual (word)

Main purpose

Each company (and individual entrepreneur) has the right to purchase goods not only from legal entities (or other individual entrepreneurs), but also from private citizens. These products can be used in the future for any purpose:

- resale for the purpose of profiting from the difference in price;

- storage for a certain period for the purpose of further sale;

- direct use in production as raw materials (for example, the purchase of food products for the manufacture of other products).

In any case, citizens can purchase goods from:

- commercial enterprises (LLC, PJSC and others);

- individual entrepreneurs;

- non-profit companies for their own needs (for example, charitable, educational organizations, religious and public associations and others).

At the same time, they must be of proper quality, which is confirmed by relevant documents (for example, a veterinary certificate for meat).

The purchase is a normal sales transaction, so a corresponding agreement is drawn up. The parties can carry out a transaction one-time or periodically over a certain period of time. A so-called procurement act must be drawn up for the purchase and sale agreement, which confirms several facts at once:

- The fact of concluding a purchase and sale transaction with a detailed description of the product - name, quantity, amount for each item and the total amount of the transaction.

- The fact of transfer of a product from the seller (individual) to the buyer (legal entity or individual entrepreneur).

- The fact that there are no complaints about the quality and quantity (package) of the buyer’s products in relation to the seller.

Instructions for filling out the document

It’s quite easy to draw up a document yourself or fill out a ready-made form. It is important to carefully enter all the data with a blue or black pen (a printed version is also allowed). The act in form No. OP-5 contains the following information:

- Short name of the company (for example, Smartcon LLC).

- Codes for OKUD and OKPO.

- The name of the structural unit (for example, warehouse or sales department), if there is one.

- TIN of the company and its type of activity in accordance with the OKDP system.

- “I approve” visa, which is registered by the general director (or another authorized person - for example, his deputy): date, signature, signature transcript (last name, initials).

- Number and date. Numbering can be used consecutively, by calendar year. It is also possible to use another system at the discretion of the company management.

- Next, the place of purchase is indicated - the address is written down to the exact name of the locality. Common abbreviations are used: d. - village, g. - city, etc.: for example, Omsk region, Omsk district, Putintsevo village.

- The following is the full name and contact information of the parties:

- purchasing manager (for example, supply department manager) – full last name, first name, patronymic;

- Full name of the seller - a private individual (also in full).

- Next, the names of the agricultural products that were purchased are written down in tabular form:

- titles;

- codes;

- name of the unit of measurement and its code in accordance with OKEI;

- the quantity of each product and its price accurate to the nearest kopeck (in the case of integers, “00” kopecks is indicated);

- total amount;

- the total cost of all products.

- The total amount is indicated on a separate line in words, kopecks are written in numbers - for example, “00” kopecks.

- Next, indicate all the details of the passport of the citizen from whom the products were purchased: series, number and others. The registered address is also written down.

- Then indicate the details of the individual entrepreneur registration certificate. If purchases are made by a legal entity, these lines remain blank.

- In the final part, it is necessary to indicate information about the certificate, which confirms that the seller has a personal subsidiary plot (by whom, when it was issued, in whose name).

- Income tax amount (13% of the total purchase price).

- At the very end there are marks:

- about receipt of money by the seller (signature, decryption of signature);

- on receipt of products by the buyer (signature and transcript of the signature of the responsible person).

Form and sample act 2019

Each company or individual entrepreneur has the right to independently decide which form is more convenient to use:

- There is a unified form No. OP-5, which until recently was used everywhere as a single option.

- You can also develop a sample yourself, taking into account the specific features of the procurement process.

The following is a blank form of a single form - it can be used as a sample when drawing up your own version of the procurement act.

And here is the finished sample:

As for your own form, when developing it you should take into account that the document should contain at least the following information:

- purchase amount;

- signature, transcript of the signature of the head of the enterprise;

- Date of preparation;

- who is responsible for the transaction (last name, first name, patronymic in full and job title);

- information about the seller (full name, passport details, registration address, TIN);

- what goods (products) were purchased - in tabular form (name, quantity, amount for each item and total transaction cost);

- total amount in words;

- the seller’s signature stating that the money was received in full;

- the buyer’s signature indicating that the products of proper quality were received in full.

You can use the following form as a basis:

And here is a finished sample, which can also be used as one of your own options.

Purchase procedure from individuals

The buyer should also understand the general procedure for transactions. The calculation occurs immediately at the time of transfer, and two options are possible:

- Cash payment - money is transferred from the company's cash desk, or an employee buys goods at his own expense and draws up an advance report, for which he then receives compensation in full. At the same time, it is extremely important to indicate in it that the payment was made in full and the seller has no complaints.

- In the case of non-cash payment, the sample document does not change, but a note is made about which account and within what time frame the funds should be transferred.

At the same time, the company must convey to the seller that he himself is obliged to pay personal income tax, i.e. declare your income to the local tax office, since the company purchasing the goods does not bear any responsibility for this transaction.

Source:

Procurement act op 5 in 2020 form free download

- The reverse side contains the details of the seller, a receipt for receipt of payment, as well as a place for signatures by the parties.

The header section displays the following data:

- Details of the buyer's company - name of the legal entity, address, OKPO, INN, division, type of activity and transaction code;

- Number and date of the procurement act - the date must coincide with the day of the transaction, the number is set independently, and there should not be repetitions within the same reporting period;

- Position and full name of the person representing the buyer’s organization;

- Full name of the individual seller (the remaining details of this person are filled out on the reverse side of the procurement act).

filling out the procurement act (form OP-5) The table is filled out as follows: Column number Information to be filled in 1 Name of the purchased product.

Unified form No. op-5 - procurement act

An organization purchasing products from the population must understand that you can only buy the quantity that an individual is able to collect or grow on their own.

For example, purchasing tons of nuts from an individual is not possible; a person is not able to collect tons of nuts.

The tax office monitors this moment and may refuse to accept the procurement act and expenses for it if the volumes of goods purchased seem suspicious. Rate the quality of the article.

Most asked questions

Question No. 1 Does an organization have the right not to fill out a request for a pantry in the OP-3 form?

Answer: The company must draw up this document for the purpose of confirming the consumption of raw materials for the manufacture of products, since the tax position is as follows: expenses can be recognized only by confirming them with documents.

Question No. 2 Can a company include additional details in the form approved by Goskomstat?

Answer: Maybe, since the album of unified forms of primary documents contains a form indicating the required details. If the company deems it necessary to provide additional useful information, it has every right to do so. However, if management decides to change the established form, this must be reflected in the company’s accounting policies, otherwise the use of the document will be unlawful.

Question No. 3 Should the head of the organization appoint someone responsible for drawing up a document in the OP-3 form?

Answer: There is no mandatory requirement to appoint a company employee responsible for filling out the OP-3 form in the regulatory framework. However, it would be rational for an organization to assign the preparation of a document to a specific employee (for example, to the one who performs the calculation) in order to control the quality of filling out the document.

A collection of recipes for dishes and culinary products from the cuisines of the peoples of Russia. – M.: Khlebprodinform, 1992. 20. Collection of recipes for dietary dishes. – M.: Khlebprodinform, 2002. 21. Regulatory and technological documentation for the implementation of the diploma project: Manual – N.: NKI, 2003. 22. Directory of the head of a public catering enterprise. M.: Ministry of Trade of the Russian Federation, 2000. 23. Agranovsky, E.D. and others. Organization of production in public catering. – M.: Economics, 2008. – 254 p. 24. Agranovsky, E.D. Fundamentals of design and interior of public catering enterprises / E.D. Agranovsky, B.V. Dmitriev. – M.: Masterstvo, 2006. – 216 p. 25.Glavcheva, S.I. Organization of production and service at public catering enterprises / S. I. Glavcheva, E.I. Kovalenko. – Novosibirsk: NSTU Publishing House, 2011.- 404 p. 26. Golubev, V.N. Handbook of catering workers / V.N.

Info

Requirement for the pantry form OP-3 is a document intended for use in public catering establishments. It is needed to generate an accurate list of products that will be needed for the normal operation of one of the departments over the next day.

FILESDownload a blank request form for the storeroom, form OP-3 .xlsrequirements for the storeroom, form OP-3 .xls Do not underestimate the importance of this paper. In addition to its main functionality, it allows the management of a restaurant, canteen or cafe to be aware of the list of goods that are used to prepare certain dishes. If a document exists, you can confirm or refute the current recipe, track possible shortages, etc.

Attention

The primary document OP-3 does not indicate the department that receives raw materials from the pantry. The requirement for the pantry is a unified document in which Goskomstat has determined all the mandatory details of this document. Accordingly, filling out the structural unit is necessary for the correct formation of OP-3.

Important

Responsibility for identified violations in filling out OP-3 Such documents for public catering organizations, which confirm the consumption of raw materials for the manufacture of products, will always be under the close attention of tax authorities.

Calculation card (Sample filling)

Calculation card No. 121 dated February 20, 2012

Product name ____Meat platter with vegetables____

Recipe number according to the Collection (technical sheet number) __________

Calculation for the number of units - ____100 servings____

————————————————————————— ¦ ¦ Norm ¦Retail¦ ¦ ¦ Name of raw materials ¦ investments ¦ price, ¦Amount (calculation), rub.¦ ¦ ¦ (gross/ ¦ rub./ ¦ ¦ ¦ ¦net), kg ¦ kg ¦ ¦ +——————————+————+———+———————+ ¦ Homemade Polendvitsa ¦3.06 ¦74 249 ¦227 202 ¦ +——————————+————+———+———————+ ¦European style sirloin pork k/v¦3.09 ¦84 263 ¦260 373 ¦ +——————————+————+———+——————+ ¦Balyk Minsk k/v ¦3.06 ¦81 535 ¦249 497 ¦ +——————————+————+———+———————+ ¦Pickled gherkins ¦2.5 ¦35 111 ¦87 778 ¦ +——————————+————+———+———————+ ¦Fresh red pepper ¦3,325 ¦35 600 ¦118 370 ¦ +——— ———————+————+———+———————+ ¦Olives ¦1.5 ¦23,000 ¦34,500 ¦ +——————————+ ————+———+———————+ ¦Olives ¦1.0 ¦26,330 ¦26,330 ¦ +——————————+————+——— +———————+ ¦Fresh parsley ¦0.405 ¦104 000 ¦42 120 ¦ +——————————+————+———+———————+ ¦Cauliflower ¦1.49 ¦32 360 ¦48 216 ¦ +——————————+————+———+——————+ ¦Cost of a set of raw materials in ¦ ¦ ¦1,094,386 ¦ ¦retail prices for 100 servings,¦ ¦ ¦(227,202 + 260,373 +¦ ¦rub. ¦ ¦ ¦+ 249,497 + 87,778 +¦ ¦ ¦ ¦ ¦+ 118,370 + 34,500 + ¦ ¦ ¦ ¦ ¦+ 26 330 + 42 120 + ¦ ¦ ¦ ¦ ¦+ 48 216) ¦ +——————————+————+———+———————+ ¦ Cost of a set of raw materials in ¦ ¦ ¦10,943.86 ¦ ¦retail prices for one portion, ¦ ¦ ¦(1,094,386 / 100) ¦ ¦rub. ¦ ¦ ¦ ¦ +——————————+————+———+———————+ ¦Markup, % ¦ ¦ ¦128.44 ¦ ¦ ¦ ¦ ¦(14 056.14 / ¦ ¦ ¦ ¦ ¦/ 10,943.86 x 100) ¦ +——————————+————+———+———————+ ¦Extra charge in amount, rub. ¦ ¦ ¦14,056.14 ¦ ¦ ¦ ¦ ¦(25,000 - 10,943.86)¦ +——————————+————+———+——————— + ¦Cost of a set of raw materials with ¦ ¦ ¦25,000 ¦ ¦surcharge, rub. ¦ ¦ ¦ ¦ +——————————+————+———+———————+ ¦Selling price for 1 portion, ¦ ¦ ¦25,000 ¦ ¦rub. ¦ ¦ ¦ ¦ +——————————+————+———+———————+ ¦The yield of the finished portion is 100 / 90 / 10 / 3 ¦ —— ———————————————————————

FORMATION OF PRICES FOR PUBLIC FOOD PRODUCTS SOLD IN EDUCATIONAL INSTITUTIONS OF THE CITY OF MINSK (EXAMPLES)

Example 1. A school canteen, when organizing meals for students at the expense of the budget and without attracting budget funds, forms retail prices for its own products as follows: Calculation card N 566 dated March 28, 2012. Name of the dish (product) “Tasty” salad ———— ———————- Recipe number according to the Collection (technical card number) 69B/B/02 —————— Calculation for the number of units - 100 servings ——————————— ————— ———————————————————— ¦ Name of raw materials ¦ Norm ¦ Retail ¦ Amount, ¦ ¦ ¦ investments, ¦ price, ¦ rub. ¦ ¦ ¦ kg ¦ rub./kg ¦ ¦ +—————————————+————+————+———-+ ¦ 1 ¦ 2 ¦ 3 ¦ 4 ¦ +—————————————+————+————+———-+ ¦Canned green peas ¦ 0.770 ¦ 11936 ¦ 9190.72 ¦ +—————— ———————+————+————+———-+ ¦ Potatoes ¦ 2,940 ¦ 1610 ¦ 4733.4 ¦ +—————————————+— ———+————+———-+ ¦ Boiled sausage ¦ 1,550 ¦ 31130 ¦ 48251.5 ¦ +—————————————+————+———— +———-+ ¦Onion ¦ 0.600 ¦ 3632.0 ¦ 2179.2 ¦ +—————————————+————+————+———-+ ¦Mayonnaise ¦ 2,000 ¦ 15423 ¦ 30846 ¦ +—————————————+————+————+———-+ ¦Melange ¦ 1,000 ¦ 18593 ¦ 18593 ¦ +— ————————————+————+————+———-+ ¦ Carrot ¦ 0.756 ¦ 1910 ¦ 1443.96 ¦ +—————————— ———+————+————+———-+ ¦ Pickled cucumber ¦ 2,220 ¦ 9861.0 ¦ 21891.42 ¦ +—————————————+—— ——+————+———-+ ¦Cost of a set of raw materials in retail ¦ ¦ ¦ 137129.2 ¦ ¦ prices, rub. ¦ ¦ ¦ ¦ +—————————————+————+————+———-+ ¦Markup of public catering, % (for ¦ ¦ ¦ 40 ¦ ¦ catering at the expense of funds ¦ ¦ ¦ ¦ ¦ the budget of the city of Minsk) ¦ ¦ ¦ ¦ +—————————————+————+————+———-+ ¦Markup of public catering , rub. ¦ ¦ ¦ 54851.68 ¦ ¦(137129.2 x 40 / 100) ¦ ¦ ¦ ¦ +—————————————+————+————+———- + ¦Cost of a set of raw materials in retail ¦ ¦ ¦ 191980.88¦ ¦ taking into account the markup, rub. ¦ ¦ ¦ ¦ ¦(137129.2 + 54851.68) ¦ ¦ ¦ ¦ +—————————————+————+————+———-+ ¦Retail price of 1 serving, rub. ¦ ¦ ¦ 1919.8 ¦ ¦(191980.88 / 100 servings) ¦ ¦ ¦ ¦ +—————————————+————+————+———-+ ¦Retail price of 1 serving, taking into account ¦ ¦ ¦ 1920 ¦ ¦ rounding, rub. ¦ ¦ ¦ ¦ +—————————————+————+————+———-+ ¦Yield of finished dish ¦ 80/20 ¦ ¦ ¦ +—— ———————————+————+————+———-+ ¦Markup of public catering, % (with ¦ ¦ ¦ 50 ¦ ¦ catering without involvement ¦ ¦ ¦ ¦ ¦ budget funds) ¦ ¦ ¦ ¦ +—————————————+————+————+———-+ ¦Markup of public catering, rub. ¦ ¦ ¦ 68564.6 ¦ ¦(137129.2 x 50 / 100) ¦ ¦ ¦ ¦ +—————————————+————+————+———- + ¦Cost of a set of raw materials in retail ¦ ¦ ¦ 205693.8 ¦ ¦ taking into account the markup, rub. ¦ ¦ ¦ ¦ ¦(137129.2 + 68564.6) ¦ ¦ ¦ ¦ +—————————————+————+————+———-+ ¦Retail price of 1 serving, rub. ¦ ¦ ¦ 2056.9 ¦ ¦(205693.8 / 100 servings) ¦ ¦ ¦ ¦ +—————————————+————+————+———-+ ¦Retail price of 1 serving including ¦ ¦ ¦ 2060 ¦ ¦ rounding, rub. ¦ ¦ ¦ ¦ +—————————————+————+————+———-+ ¦Yield of finished dish ¦ 80/20 ¦ ¦ ¦ ——— ——————————+————+————+————

Clause 5 of the Instruction on the procedure for setting prices for public catering products sold in educational institutions of the city of Minsk, approved by the decision of the Minsk City Executive Committee dated 09/08/2011 N 2674 (hereinafter referred to as Instruction N 2674), provides for the procedure for setting retail prices for bakery, bakery and flour confectionery products of its own production. Retail prices for the specified products of own production are formed using maximum markups to retail prices for raw materials used for the preparation of products of own production, in the following amounts:

for bakery and bakery products - 60%;

for flour confectionery products - 70%.

Example 2. In the confectionery shop of a college cafeteria, bakery products are produced. The retail price for bakery products is formed as follows: Calculation card N 96 dated March 30, 2012 Name of the dish (product) bun “Sun” ———————————- Recipe number according to the Collection (technical card number) N 25 from 11/18/2011 —————— Calculation for the number of units - 100 servings ——————————— —————————————————————— ——— ¦ Name of raw materials ¦ Norm ¦ Retail ¦ Amount, ¦ ¦ ¦ investments, ¦ price, rub./l¦ rub. ¦ ¦ ¦ l (or kg) ¦ (or kg) ¦ ¦ +————————————+————+————+———-+ ¦ 1 ¦ 2 ¦ 3 ¦ 4 ¦ +———————————+————+————+———-+ ¦Premium grade wheat flour ¦ 5.3 ¦ 3450 ¦ 18285 ¦ +——— —————————+————+————+———-+ ¦Margarine ¦ 0.64 ¦ 18390 ¦ 11769 ¦ +————————————+ ————+————+———-+ ¦ Pressed yeast ¦ 0.15 ¦ 23940 ¦ 3591 ¦ +————————————+————+———— +———-+ ¦Whole milk ¦ 2.7 ¦ 3960 ¦ 10692 ¦ +————————————+————+————+———-+ ¦Salt ¦ 0.072 ¦ 700 ¦ 50.4 ¦ +————————————+————+————+———-+ ¦Granulated sugar ¦ 0.86 ¦ 6400 ¦ 5504 ¦ +————————————+————+————+———-+ ¦ Melange ¦ 0.3 ¦ 13430 ¦ 4029 ¦ +————————— ———+————+————+———-+ ¦Vegetable oil ¦ 0.05 ¦ 17060 ¦ 853 ¦ +————————————+————+ ————+———-+ ¦Vegetable oil for lubricating sheets¦ 0.019 ¦ 17060 ¦ 324 ¦ +————————————+————+————+——— -+ ¦Cost of a set of raw materials in retail ¦ ¦ ¦ 55097.4 ¦ ¦ prices, rub. ¦ ¦ ¦ ¦ +————————————+————+————+———-+ ¦Catering markup, % ¦ ¦ ¦ 60 ¦ +————— ———————+————+————+———-+ ¦Markup for public catering, rub. ¦ ¦ ¦ 33058.4 ¦ ¦(55097.4 x 60 / 100) ¦ ¦ ¦ ¦ +————————————+————+————+———-+ ¦The cost of a set of raw materials in retail ¦ ¦ ¦ 88155.8 ¦ ¦ taking into account the markup, rub. ¦ ¦ ¦ ¦ ¦(55097.4 + 33058.4) ¦ ¦ ¦ ¦ +————————————+————+————+———-+ ¦Retail price 1 dish, rub. ¦ ¦ ¦ 881.6 ¦ ¦(88155.8 / 100 servings) ¦ ¦ ¦ ¦ +————————————+————+————+———-+ ¦ Retail price of 1 dish including ¦ ¦ ¦ 880 ¦ ¦ rounding, rub. ¦ ¦ ¦ ¦ +————————————+————+————+———-+ ¦Yield of finished portion ¦ 1/75 g ¦ ¦ ¦ ——— —————————-+————+————+————

Paragraph 6 of Instruction No. 2674 establishes the procedure for the formation of retail prices when sizing fruits and (or) sweets. Thus, the retail price for 1 unit of goods when sizing fruits and (or) candies is determined based on the retail price for fruits and (or) candies per 1 kilogram and a maximum markup of 20 percent in terms of the number of pieces per kilogram.

Calibration of fruits and (or) sweets is documented in a calibration report in accordance with Appendix 2 to Instruction No. 2674.

Let's consider the procedure for forming retail prices when sizing apples.

Example 3. The canteen of a school catering plant received foreign-made apples at a selling price of 8,589 rubles. for 1 kg in the amount of 100 kg. Let's form a retail price for 1 kg of apples. The procedure for determining the retail price of 1 kg of apples will be as follows: —————————————————————————— Selling price of the manufacturer or supplier excluding VAT, rub. 8589 ¦ + ———————————————————+—————+ ¦Trade markup, % ¦ 25 ¦ +——————————————— ————+—————+ ¦Trade markup, rub. ¦ 2147.25 ¦ ¦ (8589 x 25 / 100) ¦ ¦ +———————————————————+—————+ ¦The cost of apples taking into account the trade markup, rub. ¦ 10736.25 ¦ ¦ (8589 + 2147.25) ¦ ¦ +———————————————————+—————+ ¦VAT, % ¦ 20 ¦ + ———————————————————+—————+ ¦VAT, rub. ¦ 2147.25 ¦ ¦ ((8589 + 2147.25) x 20 / 100) ¦ ¦ +———————————————————+—————+ ¦Retail price including trade markup and VAT, rub. ¦ 12883.5 ¦ ¦ (8589 + 2147.25 + 2147.25) ¦ ¦ ———————————————————-+—————- The next stage is necessary calculate the retail price of 1 kg of apples with a catering markup. Calculation card N 102 dated March 28, 2012 Name of dish (product) apples ———————————- Recipe number according to the Collection (technical card number) __________________ Calculation for the number of units - 100 kg —————— ————— ————————————————————————— ¦ Name of raw materials ¦ Norm ¦ Retail¦ Amount, ¦ ¦ ¦ investments, ¦ price, ¦ rub . ¦ ¦ ¦ kg ¦ rub./kg ¦ ¦ +——————————————-+———+———+———+ ¦ 1 ¦ 2 ¦ 3 ¦ 4 ¦ + ——————————————-+———+———+———+ ¦Apples ¦ 100 ¦ 12883.5 ¦ 1288350 ¦ +—————————— ————-+———+———+———+ ¦Cost of a set of raw materials at retail prices, ¦ ¦ ¦ 1288350 ¦ ¦rub. ¦ ¦ ¦ ¦ +——————————————-+———+———+———+ ¦Catering markup, % ¦ ¦ ¦ 20 ¦ +————— —————————-+———+———+———+ ¦Markup for public catering, rub. ¦ ¦ ¦ 257670 ¦ ¦(1288350 x 20 / 100) ¦ ¦ ¦ ¦ +——————————————-+———+———+———+ ¦Cost of a set of raw materials at retail prices ¦ ¦ ¦ 1546020 ¦ ¦ taking into account the markup, rub. ¦ ¦ ¦ ¦ ¦(1288350 + 257670) ¦ ¦ ¦ ¦ +——————————————-+———+———+———+ ¦Retail price 1 kg including markups, rub. ¦ ¦ ¦ 15460 ¦ ¦(1546020 / 100 kg) ¦ ¦ ¦ ¦ ———————————————+———+———+———- School feeding plant in Minsk Calibration report N 12 dated March 28, 2012 —————————————————————————————————— ¦ N ¦ Number ¦Name¦ Net weight, ¦ Retail ¦ Limit ¦ Quantity ¦ Retail ¦ Note ¦ ¦ p/p ¦ commodity- ¦ goods ¦ kilograms¦ price per ¦ margin, ¦ pieces per 1 ¦ price for 1¦ ¦ ¦ transport¦ ¦ ¦ goods per 1 ¦ percent¦kilogram¦ unit ¦ ¦ ¦ ¦ invoice ¦ ¦ ¦kilogram,¦ ¦ ¦ goods with ¦ ¦ ¦ ¦ ¦ ¦ ¦ rubles ¦ ¦ ¦ taking into account ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦maximum ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ markups, ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ rubles ¦ ¦ +—+————-+————+————+———-+———-+—— —-+———-+———-+ ¦ 1 ¦ 2 ¦ 3 ¦ 4 ¦ 5 ¦ 6 ¦ 7 ¦ 8 ¦ 9 ¦ +—+————-+————+———— +———-+———-+———-+———-+———-+ ¦ 1 ¦TTN N 3789123¦Apples ¦ 100 ¦ 15460 ¦ 20 ¦ 6 ¦ 2580 ¦ ¦ ¦ from 28.03 .2012¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ —-+————-+————+————+———-+———-+———-+———-+— ——— Goods in the amount of six pieces in 1 kilogram ———————————— (in words) in the amount of one million five hundred forty-six thousand rubles. ———————————————————- (in words) Chairman of the Commission L.I. Levchenko ——————- ——————————- (signature ) (initials, surname) Members of the commission: O.D. Sergeeva ————————- ——————————- (signature) (initials, surname) S.Yu. Kulikova ——— —————- ——————————- (signature) (initials, surname)

According to clause 10 of Instruction No. 2674, when setting retail prices for soft drinks, juices, mineral and drinking bottled water sold on tap, as well as when using soft drinks, juices, mineral water for preparing drinks, dishes, culinary products, a maximum markup of at the rate of 20 percent.

When using drinking bottled water for preparing drinks, markups and trade allowances are not applied.

Example 4. Minsk-4 mineral water and Coca-Cola soft drink are sold in the buffet of a higher educational institution. Retail prices should be formed as follows: ————————————————————————— ¦ Name of indicators ¦ Calculation ¦ +—————————— ————————-+——————+ ¦ Mineral water “Minsk-4” ¦ +——————————————————————— —-+ ¦Sale price for 2 liters, rub. ¦ 2892 ¦ +——————————————————-+——————+ ¦Trade markup (30%), rub. ¦ 867.6 ¦ ¦ (2892 x 30 / 100) ¦ ¦ +———————————————————-+——————+ ¦VAT (20%), rub. ¦ 751.92 ¦ ¦ ((2892 + 867.6) x 20 / 100) ¦ ¦ +——————————————————-+——————+ ¦ Retail price without rounding, rub. ¦ 4511.5 ¦ ¦ (2892 + 867.6 + 751.92) ¦ ¦ +——————————————————-+——————+ ¦Markup, % ¦ 20 ¦ +———————————————————-+——————+ ¦Markup, rub. ¦ 902.3 ¦ ¦ (4511.5 x 20 / 100) ¦ ¦ +——————————————————-+——————+ ¦Retail price with extra charge , rub. ¦ 5413.8 ¦ ¦(4511.5 + 902.3) ¦ ¦ +———————————————————-+——————+ ¦Retail price of one serving yield 1/200 g, rub. ¦ 541.38 ¦ ¦(5413.8 / 10) ¦ ¦ +———————————————————-+——————+ ¦Retail price of one serving, yield 1 /200 g taking into account ¦ 540 ¦ rounding, rub. ¦ ¦ +——————————————————-+——————+ ¦ Soft drink “Coca-Cola” ¦ +—————————— ——————————————-+ ¦Sale price for 2 liters, rub. ¦ 5695 ¦ +——————————————————-+——————+ ¦Trade markup (30%), rub. ¦ 1708.5 ¦ ¦ (5695 x 30 / 100) ¦ ¦ +———————————————————-+——————+ ¦VAT (20%), rub. ¦ 1480.7 ¦ ¦ ((5695 + 1708.5) x 20 / 100) ¦ ¦ +——————————————————-+——————+ ¦ Retail price without rounding, rub. ¦ 8884.2 ¦ ¦ (5695 + 1708.5 + 1480.7) ¦ ¦ +———————————————————-+——————+ ¦Markup, % ¦ 20 ¦ +———————————————————-+——————+ ¦Markup, rub. ¦ 1776.84 ¦ ¦ (8884.2 x 20 / 100) ¦ ¦ +——————————————————-+——————+ ¦Retail price with extra charge , rub. ¦ 10661.04 ¦ ¦ (8884.2 + 1776.84) ¦ ¦ +——————————————————-+——————+ ¦Retail price of one serving yield 1/200 g, rub. ¦ 1066.1 ¦ ¦(10661.04 / 10) ¦ ¦ +——————————————————-+——————+ ¦Retail price of one serving, yield 1 /200 g taking into account ¦ 1070 ¦ rounding, rub. ¦ ¦ ———————————————————+——————

Example 5. Orange juice is sold by the glass in the school cafeteria. The manufacturer's selling price for 1 liter orange juice is 5,800 rubles. without VAT. Manufacturer VAT 10%.

The juice is poured into disposable cups with a capacity of 0.2 liters. In the invoice for cups, the supplier's selling price without VAT is 400 rubles, VAT (20%) is 80 rubles.

We will form a retail price for a serving of 1/200 orange juice, at which the school canteen buffet will sell the specified drink, taking into account disposable tableware.

We determine the selling price per serving of juice with a yield of 1/200.

In the price register we form the retail price of 1 liter of orange juice. The trade markup for orange juice should not be higher than 15% in accordance with paragraph 3 of Instruction No. 2674, since juices are not included in the List of socially significant goods (works, services), prices (tariffs) for which are regulated by the Ministry of Economy, and the List of socially significant goods (works, services), prices (tariffs) for which are regulated by the regional executive committees and the Minsk City Executive Committee, approved by Resolution No. 495, and are sold in public catering organizations of institutions providing general secondary education.

Thus, the retail price of 1 liter orange juice will be:

REGISTER of retail prices N 142 dated March 10, 2012 for orange juice with a capacity of 1 liter buffet in the canteen of school N 46 in Minsk ————————————————————————— ——— ¦ N ¦ N ТТН¦Name¦Article,¦ Volume¦Vacation pay¦VAT,¦ Wholesale¦Trading¦Retail¦ ¦p/p¦ ¦product ¦type, ¦batch¦ price per ¦% ¦surcharge¦surcharge¦ price ¦ ¦ ¦ ¦ ¦ brand ¦ ¦ unit ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦measurements¦ ¦ ¦ ¦ ¦ +—+——+————+———+——+———+—- +———+———+———+ ¦ 1 ¦ 2 ¦ 3 ¦ 4 ¦ 5 ¦ 6 ¦ ¦ 7 ¦ 8 ¦ 9 ¦ +—+——+————+———+—— +———+—-+———+———+———+ ¦ 1 ¦578965¦Juice ¦ ¦ 20 l ¦ 5800 ¦ 10 ¦ — ¦ 15 ¦ 7337 ¦ ¦ ¦ ¦orange¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ —-+——+————+———+——+———+—-+———+———+———- The procedure for setting the retail price for orange juice will be as follows: ————————————————————————— ¦Selling price of the manufacturer or supplier without VAT, rub.¦ 5800 ¦ +—————————— —————————+—————+ ¦Trade markup, % ¦ 15 ¦ +———————————————————+————— + ¦Trade markup, rub. ¦ 870 ¦ ¦(5800 x 15 / 100) ¦ ¦ +———————————————————+—————+ ¦Cost of juice including trade markup, rub. ¦ 6670 ¦ ¦(5800 + 870) ¦ ¦ +———————————————————+—————+ ¦VAT, % ¦ 10 ¦ +———— ———————————————+—————+ ¦VAT, rub. ¦ 667 ¦ ¦(6670 x 10 / 100) ¦ ¦ +————————————————————+—————+ ¦Retail price including trade markup and VAT, rub. ¦ 7337 ¦ ¦(5800 + 870 + 667) ¦ ¦ ————————————————————-+—————-

Let's calculate the selling price of a 1/200 serving of orange juice in the calculation card. For public catering organizations of educational institutions in accordance with paragraph 10 of Instruction N 2674 when selling bottled soft drinks, juices, mineral and drinking bottled water, as well as when using soft drinks, juices, mineral water for preparing drinks, dishes, culinary products for retail The price of these goods is subject to a maximum catering surcharge of 20%.

Calculation card N 212 dated March 10, 2012 Name of dish (product) orange juice ———————————- Recipe number according to the Collection (technical card number) __________________ Calculation for the number of units - 100 servings ————— —————— ————————————————————————— ¦ Name of raw materials ¦ Norm ¦ Retail ¦ Amount, ¦ ¦ ¦ investments, l ¦ price, rub./l¦ rub. ¦ +————————————+————-+————+———-+ ¦ 1 ¦ 2 ¦ 3 ¦ 4 ¦ +————————— ———+————-+————+———-+ ¦Orange juice ¦ 20 ¦ 7337 ¦ 146740 ¦ ¦ (100 servings x 0.2 l) ¦ ¦ ¦ ¦ +————— ———————+————-+————+———-+ ¦Cost of a set of raw materials in retail ¦ ¦ ¦ 146740 ¦ ¦prices, rub. ¦ ¦ ¦ ¦ +————————————+————-+————+———-+ ¦Catering markup, % ¦ ¦ ¦ 20 ¦ +———— ————————+————-+————+———-+ ¦Markup for public catering, rub.¦ ¦ ¦ 29348 ¦ ¦ (146740 x 20 / 100) ¦ ¦ ¦ ¦ + ————————————+————-+————+———-+ ¦The cost of a set of raw materials in retail ¦ ¦ ¦ ¦ 176088 ¦ ¦ taking into account the markup, rub. ¦ ¦ ¦ ¦ ¦(146740 + 29348) ¦ ¦ ¦ ¦ +————————————+————-+————+———-+ ¦Selling price for 1 portion, rub. ¦ ¦ ¦ 1760.88 ¦ ¦(176088 / 100 servings) ¦ ¦ ¦ ¦ +————————————+————-+————+———-+ ¦Sales price of 1 serving including ¦ ¦ ¦ 1760 ¦ ¦ rounding, rub. ¦ ¦ ¦ ¦ +———————————+————-+————+———-+ ¦Yield of finished dish ¦ 1/200 ¦ ¦ ¦ ——— —————————+————-+————+————

According to Instruction No. 2674, when selling public catering products in disposable tableware and packaging materials, the cost of these utensils and materials may be charged in addition to the retail price for public catering products at purchase prices.

We determine the retail price for a serving of orange juice with a yield of 1/200 in a disposable cup with a capacity of 0.2 l:

An example of filling out a request for a pantry

- home

- Documentation

The legal framework does not establish an obligation to use a warehouse accounting system in the company. However, if the management of the organization is interested in setting up a high-quality control system over the use of products, reducing the number of questions from tax authorities, and most importantly, the correspondence between the resources expended and the output of the finished product, a document flow system should be created in the company that can resolve all such difficulties. This article will discuss why and together with what documents Form OP-3 (Demand for storage) is used, as well as responsibility for identified violations.

Requirement for the pantry form OP-3 is a document intended for use in public catering establishments. It is needed to generate an accurate list of products that will be needed for the normal operation of one of the departments over the next day.

FILES

Don't underestimate the importance of this paper. In addition to its main functionality, it allows the management of a restaurant, canteen or cafe to be aware of the list of goods that are used to prepare certain dishes. If a document exists, you can confirm or refute the current recipe, track possible shortages, etc.

For whom the use of the OP-1 form is mandatory

Form OP-1 was introduced by Decree of the State Statistics Committee of the Russian Federation No. 132, issued on December 25, 1998. Until January 1, 2013, the use of forms provided for by the relevant source of law was mandatory for all legal entities (clause 2 of Resolution No. 132).

However, in connection with the entry into force of the new law on accounting in 2013 (law dated December 6, 2011 No. 402-FZ), the Ministry of Finance of the Russian Federation in information No. PZ-10/2012 expressed the opinion that organizations received the right to use in their activities not only unified primary forms, which include the OP-1 form, but also those that they developed independently.

The Ministry of Finance of the Russian Federation has established an exception for organizations in respect of which the use of unified forms is directly prescribed by separate legislative acts. At the moment, no similar sources of law that would oblige organizations to use the OP-1 form have been published in the Russian Federation. At the same time, many Russian catering enterprises continue to use the appropriate form due to the convenience of its structure and established business customs.

Read about the specifics of doing business in the catering industry when using UTII in the article “Peculiarities of using UTII for cafes and restaurants.”

Control calculation of spice and salt consumption (form N OP-13)

At the very end of the requirement there is a place for the signatures of the production manager and the head of the organization (and more often, his authorized person). In the latter case, the position must be prescribed.

When changing the components in the raw material set of a dish and the price of raw materials and products, the new price of the dish is determined in the subsequent free columns of the calculation card, indicating the date of the changes made in the header.

The financially responsible person is usually indicated immediately below the name. In particular, his position and full name. This column is called “Through whom”. It is this employee who is responsible for the speed and quality of delivery, verifies its volume, quality and weight upon receipt and carries out other organizational functions.