The act of revaluation of goods is drawn up in connection with the revaluation or markdown of existing commodity items. The basis for drawing up the act may be an order from the head of the company or an order from government bodies.

FILES

Paper will be needed if prices for goods increase or decrease for some items and increase for others. In order to document only the markdown (discount, price drop), there is a special markdown act in the MX-15 form. It is quite convenient to use.

Preparation for registration of the act of revaluation of goods

In order for the act to acquire legal force, it is first necessary to form a separate commission (through a separate order) and select the chairman of this commission. Also, the act must be based on something, refer to something. To do this, the manager issues a special order to revaluate the goods.

The last paper should describe the reasons why the organization resorts to revaluation of goods. Motives can be very diverse. A number of legally acceptable ones include, for example:

- A change in demand or supply for any product sold by an organization. For example, there is a seasonal demand for a product, increasing at the beginning and decreasing towards the end. Along with the level of demand, the price of a product may also change.

- If the supplier produced and delivered a product of lower quality than expected.

- Expiration of the shelf life and sale of goods in the warehouse.

- Changes in the VAT rate or other parameters related to legislative adjustments.

- Moral obsolescence of unsold goods in the warehouse.

- Inflation. Increases in the prices of goods can be directly related to the annual inflation of the currency in which they are sold.

- Screening of individual units as samples on the sales floor.

Revaluation of goods when accounting at purchase prices

When the accounting policy of an organization provides for the use of valuation of goods at purchase prices, these markdowns are not recorded in accounting if it does not exceed the amount of the trade margin.

When goods are marked down at purchase prices by an amount exceeding the trade margin, the accounting value of the goods is reduced. The accounting accounts reflect the difference between the amount of markdown of goods and the size of the trade margin on them. In addition, the amount of restored VAT, which previously reduced the budget debt for it, is fixed.

Example 1 . A trading organization that sells goods at retail and accounts for them at purchase prices has marked down product “A” due to a decrease in demand. The purchase price of the balance of goods “A” was 5,000 rubles. The percentage of trade margin on product “A” is 30%, the amount is 1,500 rubles. (5000 x 30%). According to the order of the manager, the amount of markdown of goods “A” is determined in the amount of 3100 rubles.

The difference between the amounts of markdown of product “A” and the markup will be 1,600 rubles. (3100 - 1500). It will be reflected in the accounting accounts with the following entry:

Dt sch. 91 “Other income and expenses”, subaccount. "Losses on discounted goods"

K-t sch. 41 “Goods”, subaccount. 2 “Products in retail trade”

1600 rub.

The amount of restored VAT is 1000 rubles. (5000 x 20%), having previously reduced the budget debt for this tax, will be recorded as follows:

Dt sch. 68 “Calculations for taxes and fees”, subaccount. "VAT calculations"

K-t sch. 19 “VAT on acquired values”, subaccount. 3 “VAT on purchased inventories”

———-¬ ¦1000 rub.¦ L———-

The restored amount of VAT is written off - 1000 rubles. due to financial results:

Dt sch. 91 “Other income and expenses”, subaccount. "Losses on discounted goods"

K-t sch. 19 “VAT on acquired values”, subaccount. 3 “VAT on purchased inventories”

1000 rub.

VAT in the amount of 1000 rubles. transferred to the budget:

Dt sch. 68 “Calculations for taxes and fees”, subaccount. "VAT calculations"

K-t sch. 51 “Current accounts”

1000 rub.

According to clause 15 of the Regulations on the composition of costs for the production and sale of products (works, services), included in the cost of products (works, services), and on the procedure for the formation of financial results taken into account when taxing profits (Resolution of the Government of the Russian Federation dated 05.08.1992 N 552 , as amended on May 31, 2001) losses from markdowns of goods do not reduce taxable profit. Therefore, when drawing up a Certificate on the procedure for determining the data reflected on page 1 “Calculation (tax return) of tax on actual profit”, in accordance with the Instruction of the Ministry of Taxes of the Russian Federation “On the procedure for calculating and paying to the budget the income tax of enterprises and organizations” dated 15.06. 2000 N 62 (hereinafter referred to as the Certificate), taxable profit increases by the amount of losses from the markdown of goods (page 4.3).

Article 40 of Part One of the Tax Code of the Russian Federation for tax purposes provides for the price of goods specified by the parties to the transaction. Until proven otherwise, this price is assumed to be in line with market prices. Consequently, the taxable profit of the organization increases by the difference between the amounts of markdown of goods and the trade margin (in example 1 it is 1,600 rubles).

The restored amount of VAT written off to financial results (in example 1 - 1000 rubles) increases taxable profit and is shown on page 4.2 of the Certificate.

The use of goods for the design of shop windows, exhibitions, exhibitions - sales, rooms of product samples leads to the loss in whole or in part of their consumer qualities and sale at lower prices. The cost of values that have completely lost their consumer qualities in accordance with clause 2.11 of the Methodological Recommendations for Accounting of Costs Included in Distribution and Production Costs, and Financial Results at Trade and Public Catering Enterprises, approved by the RF Committee on Trade in agreement with the Ministry of Finance of Russia dated April 20, 1995 N 1 -550/32-2, included in advertising costs. When including such expenses included in distribution costs, the following is recorded:

Dt sch. 44 “Sales expenses”, subaccount. "Advertising expenses"

K-t sch. 41 “Goods”, subaccount. 2 “Goods in retail trade.”

If the consumer qualities of the product are partially lost, then the accounting accounts will reflect only the difference between the amounts of the product markdown and the trade margin, which increases advertising costs.

If the value of the markdown of goods does not exceed the trade margin in accounting for goods at purchase prices, no entries are made in the accounting accounts.

One of the reasons leading to the discounting of goods is the loss of their consumer properties as a result of an emergency (natural disaster, fire, accident, etc.) caused by extreme conditions. The fact of the occurrence of such a situation must be documented by a written conclusion of the services involved in its elimination: the Ministry of Emergency Situations of the Russian Federation, the State Fire Service, the Ministry of Internal Affairs of the Russian Federation, etc.

The loss of consumer properties of goods recorded at purchase prices is reflected in accounts when they are marked down by an amount greater than the markup, i.e. when the book value of goods decreases.

Example 2 . Product “B”, recorded at purchase prices, partially lost its consumer qualities due to the flood. The amount of reduction in the book value of goods “B” amounted to 4,000 rubles. Let's write down this amount:

Dt sch. 99 “Profits and losses”, subaccount. "Extraordinary Expenses"

K-t sch. 41 “Goods”, subaccount. 2 “Products in retail trade”

4000 rub.

Example 3 . Product “B” completely lost its consumer qualities due to the fire. The purchase price of product “B” is 15,000 rubles. The goods will be written off on the following accounts:

Dt sch. 99 “Profits and losses”, subaccount. "Extraordinary Expenses"

K-t sch. 41 “Goods”, subaccount. 2 “Products in retail trade”

15,000 rub.

In accordance with clause 15 of the Regulation on the composition of costs, non-operating expenses that reduce taxable profit include uncompensated losses from natural disasters, including damage and destruction of inventories. When drawing up the Certificate, profit for tax purposes according to accounting data should be calculated minus extraordinary expenses, including the amount of VAT reimbursed from the budget. To do this, VAT on destroyed values is restored using a reversal entry:

Dt sch. 68 “Calculations for taxes and fees”, subaccount. "VAT calculations"

K-t sch. 19 “VAT on acquired assets.”

This amount is then included in financial results:

Dt sch. 99 “Profits and losses”, subaccount. "Extraordinary Expenses"

K-t sch. 19 “VAT on acquired assets.”

When revaluing goods accounted for at purchase prices, the organization, based on the order of the manager, draws up new price lists and issues new price tags. In the accounting of goods at purchase prices, revaluation is not reflected, since the price at which goods are listed in current accounting does not change.

Document elements

If the number of items of goods is impressive, then the act turns into an inventory. It can be called that - an inventory-act of revaluation of goods. But if we are talking about several positions, one page is enough to draw up the act.

The act begins with the manager’s visa. He must certify the list of goods and the conversion of their prices. The position, full name and signature of the head of the organization should be located at the top of the act.

Without it, the act will not have legal force. If possible, a stamp will be affixed. This is not a mandatory point, since since 2014 the use of printing has become much easier. Also at the top of the paper there should be information about:

- Date of signing.

- Document number.

- Full name and position of the chairman and members of the commission for revaluation of goods.

- The number and date of the order on the basis of which the revaluation is made. Sometimes the basis for the act will not be an order, then a link to the relevant document is given.

Below in the attached form is a table. It greatly simplifies the process of describing goods that need revaluation. Each name is allocated a separate line. It is unacceptable to place several different products into one. The columns of the tabular part of the act are filled in gradually and have the following names:

- Nomenclature number. If it is absent, simply indicate the serial number.

- Name of the product (according to the accompanying documentation for each).

- Unit of measurement. If possible, it is necessary to indicate the OKEI code of this unit of measurement.

- Quantity of goods of each item.

- Cost before revaluation.

- Cost after revaluation. Moreover, for each of the two cost parameters, both the price of an individual unit of the product being described and the total amount of all goods are indicated.

- Difference. This column is divided into two parts: revaluation and devaluation. Naturally, one column for each product is filled in each line. The price of the same realized commodity-material value cannot fall and rise at the same time. For greater clarity, the parameters have “+” and “-” signs.

- Notes. This column may contain links to the conclusions of the inventory commission, explanations of the storekeeper, and the main nuances that relate to changes in prices for each product.

Completing the revaluation table can take quite some time. The optimal solution would be to generate a document using computer programs. The main thing is to be able to print and certify the document at any time (during various checks).

At the end of the paper, all members of the commission, including the chairman, as well as the financially responsible person, sign. The “autograph” of the head of the organization is not required, since it must be at the very beginning.

Revaluation of goods in retail trade

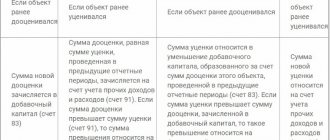

Based on the results of the revaluation, an inventory list-act was compiled, a fragment of which is presented in Table. 4.9.

Table 4.9 Inventory list-act

| Item number | Name of product | Unit | Quantity | Cost of goods | Difference | ||||

| before revaluation | after revaluation | Markdown (-) | Revaluation (+) | ||||||

| Price | Sum | Price | Sum | ||||||

| Washing machine "Vyatka" | PC. | 4 000 | 80 000 | 4 300 | 86 000 | 6 000 | |||

| Washing machine “Malyutka” | PC. | 2 000 | 90 000 | 2 500 | 112 500 | 22 500 | |||

| Total: | 28 500 | ||||||||

If a store keeps records of goods at purchase prices, then the fact of revaluation of goods is not reflected in accounting entries.

If goods are accounted for at sales prices, then, based on the inventory report, the accountant will make an entry for the amount of the increase in the trade markup for overvalued goods:

Debit 41-2

Credit 42 – 28,500 rub.

Corrections

Revaluation is often carried out using the 1C program. There is a similar table there. Some fields are filled in automatically. If you have to fill out the document manually, then the remaining empty lines can be crossed out. If errors occur, their correction must be formalized accordingly. Cross out the erroneous value with one line, and then write the correct one on top or on the side. In this case, all members of the commission and the head, as well as (if any) the financially responsible person present when drawing up the act, must sign next to the correction.

Change of price tags

In large organizations, there is a well-thought-out algorithm for changing prices for individual items. Its main principle is the replacement of old prices with new ones on a priority basis.

Upward prices change earlier than downward prices. Moreover, it is prohibited to cross out the old value and write a new one on them. It is better to print new information on adhesive paper and, with one movement of the hand, replace irrelevant information on the sales floor (or in another place where buyers receive information about the cost of goods).