Violation of the sick leave regime

Ignoring doctor's orders is more expensive for yourself. Find out what the employee risks by violating the requirements of the attending physician during illness, what the employer must do and how to draw up documents determining the amount of benefits. Download useful documents: Sample from an expert Sample from an expert Sample from an expert A visit to the doctor and registration of sick leave is the first thing a sick employee should do.

To increase the effectiveness of treatment and reduce the risk of complications, during the illness the doctor will prescribe the patient not only pills or injections, but also a special regimen, adherence to which will help a speedy recovery. These are rules and regulations that should not be ignored. At a minimum, because a note about violation of the regime on the sick leave may affect the amount of payment for temporary disability (Federal Law No. 255-FZ of December 29, 2006).

Violation of sick leave is a failure to comply with medical requirements, including:

- unauthorized departure from the inpatient department of a hospital or dispensary;

- premature return to work;

- missing one or more doctor's appointments;

- refusal to perform rehabilitation activities or take medications.

- refusal to conduct a medical examination;

★ A correctly executed sick leave certificate is a documentary basis for the assignment of temporary disability benefits. The Sistema Personnel expert will tell you which institutions have the right to issue it, and whether the form can be checked

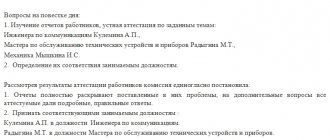

How to draw up a sick leave protocol?

If an organization has created a social insurance commission, then it considers issues of assigning and paying benefits only in controversial situations.

last name, first name, patronymic of the User; 3.2.2. User's contact phone number; 3.2.3. email address (e-mail)3.2.4.

Its meetings and conclusions are recorded. But the decisions made by the commission are advisory in nature, since the responsibility for the correct expenditure of compulsory social insurance funds rests with the administration of the policyholder represented by the head and chief accountant MINUTES No. 1 of the meeting of the social insurance commission of LLC "Pz,kbr" ...... ... February 5, 2000

PRESENT: Members of the social insurance commission: Chairman Secretary Members of the commission: INVITED: customer service manager position full name AGENDA: payment of temporary disability benefits position full name HEARD: statement full name of the chairman on the payment of temporary disability benefits to an employee of Mir Tovarov LLC Kulakova Irina Alekseevna.

ESTABLISHED: Customer Service Manager Full name works in LLC…. under an employment contract and is subject to state social insurance.

On February 2, 2000, the full name presented for payment a certificate of incapacity for work, series 15855207 No. 222222222, issued on January 00, 2009, drawn up in accordance with the requirements established by the legislation of the Russian Federation.

Type of disability – maternity leave lasting 140 calendar days. Period of temporary incapacity for work: from…. By …. inclusive. The insurance period is …………… The monthly salary of the employee is 5,000 rubles.

The period for temporary disability subject to payment is calculated from ...... to...... inclusive.

The billing period for calculating average daily earnings is set from …… to …… inclusive. The average daily earnings of a female worker is 240 rubles 96 kopecks.

DECIDED: Guided by the legislation on social security of the Russian Federation and this protocol: 1. The HR department will issue maternity leave based on the application of the employee, full name.

2. The accounting department will accept the certificate of incapacity for payment. 3. Pay no later than 10 days to Irina Alekseevna Kulakova temporary disability benefits in the amount of 100% of earnings in the amount of 23,373 rubles 12 kopecks at the expense of …………. Chairman of the commission __________________ Secretary of the commission __________________ Resolution of October 26, 2006 No. 193 “On approval of the standard form of minutes of the meeting of the commission (authorized) for social insurance of an enterprise, institution, organization” In accordance with Federal Law dated December 29, 2004 No. 202-FZ

“On the budget of the Social Insurance Fund of the Russian Federation for 2005”

Is incapacity for work due to a domestic injury paid from the first day on the basis of a sick leave certificate?

jan explanatory note from the employee who submitted a certificate of incapacity for work in connection with a domestic injury is not required.

If there is a controversial situation, an act can be drawn up in any form.

Sick leave with violation: consequences and calculation of benefits in 1C

Accounting, taxation, reporting, IFRS, analysis of accounting information, 1C: Accounting

03/18/2014 subscribe to our channel

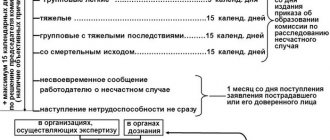

The amount of sick leave benefits may be reduced if the employee violates the regime prescribed by the doctor without good reason or does not appear on time for a medical examination or medical and social examination.

In this case, on the certificate of incapacity for work, the doctor will put a violation code in the line “Note about violation of the regime.” In the article we will talk about the consequences that arise in the event of such violations and how to calculate benefits in the 1C: Salary and Personnel Management 8 program.

The grounds for reducing the amount of benefits for temporary disability are listed in “On compulsory social insurance in case of temporary disability and in connection with maternity” (hereinafter -), as well as in the specifics of the procedure for calculating benefits for temporary disability, pregnancy and childbirth for citizens subject to compulsory social insurance, approved. Decree of the Government of the Russian Federation (hereinafter -). These include: 1) violation during illness of the regimen prescribed by the attending physician, without good reason (from the day on which it was committed); 2) failure to appear on time for a medical examination or for a medical and social examination without good reason (from the date of this violation).

What is labor, insurance and non-insurance experience?

Many people have come across the concepts of work experience and insurance experience, but not everyone understands what their differences are.

Work experience is the entire period of a person’s work, including the performance of work under contract agreements. In addition, it can also be attributed to pension terminology, since length of service is used when calculating the pension of citizens who worked before January 2002, that is, before the start of the pension reform.

Insurance experience (SS) is those periods of a citizen’s work during which the employer paid insurance contributions to the Pension Fund of the Russian Federation and the Social Insurance Fund for him.

However, there are days when a person does not work, but the work experience still goes on:

- Upon the occurrence of incapacity for work, including maternity leave (Maternity leave), caring for a child under 1.5 years old, a disabled family member or an elderly relative (80 years and older).

- During military service upon conscription.

Find out the specifics of calculating length of service during military service in the material “Is military service included in length of service (nuances).”

- When performing state or civil service, etc. (everything that is listed in the law of February 12, 1993 No. 4468-I).

All of the above cases relate to non-insurance period, that is, to periods when insurance premiums were not paid for a citizen.

How to pay for sick leave in 2020 with a violation of the regime

See what to do if an employee brings sick leave in violation of the rules, and how to pay for it in 2020. We explained the consequences of non-compliance with the hospital regime and gave an example of calculating disability benefits.

You will be able to download samples of all documents required to pay for sick leave in violation of the regime. Violation of the hospital regime entails a reduction in the amount of disability benefits, but not in all cases.

Two circumstances are taken into account:

- Type of violation

- Having a good reason.

Information about the file Article on the topic: Let's figure out in order what an accountant should do if an employee brings a certificate of incapacity for work with a note of violation. Information about the file Information about the file The procedure for calculating benefits is regulated in two regulations:

- Government Decree of June 15, 2007 No. 375.

- Federal Law of December 29, 2006 No. 255-FZ “On compulsory social insurance in case of disability and in connection with maternity”,

Read on the topic: Sick leave with violation of the regime is paid in full, reduced amount or not paid at all. First of all, it depends on the code specified by the doctor: Violation code Type of violation Examples, comments

- Refusal to comply with the doctor’s requirements, leaving the medical institution, moving to another area. The patient does not comply with the prescribed daily regimen or refuses to take prescribed medications.

The amount of sick leave depending on the length of service when caring for a sick family member

If an employee was on sick leave due to the fact that he was caring for a sick member of his family, then payment for sick leave will depend not only on the length of service, but also on who was cared for (Parts 3, 4, Article 7 of the Law of 29.12 .2006 N 255-FZ).

| Which family member needed care? | What percentage of sick leave accrual depending on length of service is used in calculating benefits? |

| For a child during his treatment on an outpatient basis | The first 10 calendar days are paid based on the “percentage” of sick leave, determined by the employee’s length of service (indicated in the table above). The remaining days are based on 50% of average earnings. |

| For a child during his treatment in a hospital setting | Sick leave percentages are determined depending on length of service according to the general rule (60%, 80% or 100%) |

| To another family member (for outpatient treatment) |

The insurance period for sick leave includes the periods (Part 1, 1.1 of Article 16 of the Law of December 29, 2006 N 255-FZ):

- work under an employment contract;

- state civil or municipal, military and other services (fire fighting, service in the penal system, etc.);

- other activities when a person was subject to compulsory social insurance for temporary disability and in connection with maternity. For example, when an entrepreneur voluntarily pays contributions to the Social Insurance Fund.

The data for calculating the length of service for sick leave is taken from the employee’s documents: work record book, written employment contracts, certificates issued at the previous place of work, other documents (clauses 8, 9 of the Rules, approved by Order of the Ministry of Health and Social Development dated 02/06/2007 N 91). The length of military service can be confirmed by the employee's military ID.

When crossing any of the specified periods, only one of them is counted towards the length of service (Part 2 of Article 16 of the Law of December 29, 2006 N 255-FZ).

Answering the question of how to calculate the length of service for sick leave, let's start with the fact that it is determined on the date preceding the date of onset of temporary disability (Part 3 of Article 16 of the Law of December 29, 2006 N 255-FZ, clause 7 of the Rules, approved. Order of the Ministry of Health and Social Development dated 02/06/2007 N 91).

We suggest you read: How to take sick leave on the weekend

By the way, is sick leave itself included in the length of service? Yes, if in the future your employee gets sick again, the current period of temporary disability will need to be taken into account when calculating the length of service to pay for the next sick leave (Part 1, 1.1 of Article 16 of the Law of December 29, 2006 N 255-FZ).

The calculation of length of service for sick leave is based on full years and full months (clause 21 of the Rules, approved by Order of the Ministry of Health and Social Development of the Russian Federation dated 02/06/2007 N 91). That is, first, the employee’s full years and months of work are counted toward the length of sick leave. A full year is not a calendar year, but 12 months from the date of employment (the start day of the period included in the length of service). A full month is not a calendar month, but 30 days. And then the procedure is like this:

- count the total number of days not included in full months and years;

- Convert this number of days into months according to the rule: 30 days are equal to 1 month. That is, divide the number of days by 30 and for further calculations take only the whole part of the value obtained by division. It will correspond to the number of whole months;

- if the resulting sum of whole months turns out to be more than 12, then the months will need to be converted to whole years according to the rule: 12 months are equal to 1 year. Months that are not included in whole years remain whole months for counting.

The calculated values of whole months and years must be added to the whole months and years initially taken into account when calculating the length of service for sick leave in 2019/2020 (in the very first step of the calculation).

The length of service obtained must be indicated on the employee’s sick leave certificate, also in whole years and months.

The insurance period calculator available on our website will help you calculate your insurance period.

The amount of temporary disability benefits depends on the employee’s insurance coverage:

- if the employee’s insurance period is from 6 months to 5 years, then he should be paid 60% of average earnings;

- from 5 to 8 years - 80%;

- more than 8 years - 100%.

Electronic work books

Express course at Kontur.School

More details

The insurance period includes:

- periods of work under an employment contract;

- periods of state civil or municipal service;

- periods of other activities during which a citizen was subject to compulsory social insurance in case of temporary disability and in connection with maternity.

Periods of work (service, activity) are counted in calendar order based on full months (30 days) and a full year (12 months). Every 30 days of these periods are converted into full months, and every 12 months of these periods are converted into full years (clause 2, section III of the Rules for calculating and confirming the insurance period).

Let's calculate the insurance period for employee Igor Plyushkin to calculate temporary disability benefits. The employee brought sick leave for the period from August 10 to August 15, 2020. Work book details:

- from January 1, 2012 to July 20, 2012, Plyushkin worked at Progress LLC;

- from July 22, 2012 to August 25, 2014 - at Vector LLC;

- from August 26, 2014 to August 29, 2014 - at Horizont LLC;

- from September 1, 2014 to the present time he works at Prima LLC.

Training

Remotely at Kontur.School. For accountants and personnel officers. Training document.

Select program

Please note that the length of service should be calculated on the day preceding the day the illness occurred, that is, in our example, on August 9, 2020:

- from 01/01/2012 to 07/20/2012 - 0 year 6 months. 20 days;

- from 07/22/2012 to 08/25/2014 - 2 years 1 month. 4 days;

- from 08/26/2014 to 08/29/2014 - 0 year 0 month. 4 days;

- from 09/01/2014 to 08/09/2017 - 2 years 11 months. 9 days

- Total: 5 years 7 months. 7 days Igor Plyushkin’s insurance experience is 5 years 7 months 7 days; accordingly, when calculating benefits, the average daily earnings must be multiplied by 80%.

It is very important to correctly calculate the length of service to calculate disability benefits, since an error even on one day will give the Social Insurance Fund inspectors reason to recalculate the entire amount of sick leave.

We invite you to familiarize yourself with the Loan at Rosgosstrakh Bank: conditions, reviews and how to apply

For sick leave, the SS is taken into account, including all non-insurance periods. SS calculation is carried out in calendar order. All partial work periods are converted to full months and years in the following order: 30 days are counted as a full month, and 12 months are converted to a full year.

See also “How to calculate the insurance period in partial months.”

Moreover, if a person worked in different organizations at the same time, then one of the periods of the employee’s choice is taken into account. This choice must be supported by a statement from the employee.

NOTE! When calculating length of service for sick leave, all insurance periods are taken into account, regardless of work interruptions.

To correctly calculate an employee’s insurance period for calculating sick leave, you can use free software by downloading it from the Internet.

Let's consider the algorithm for calculating the CC using an example.

Example 1

Efimova A. Yu. On 02/20/2020 she submitted to the accounting department of Versailles LLC a sick leave certificate for 14 days of incapacity for work (from 02/06/2020 to 02/19/2020). The period of work in this company is from 06/01/2018, that is, 1 year 8 months. and 5 days (calculation from 06/01/2018 to 05/31/2019 - 1 year, from 06/01/2019 to 02/05/2020 - 8 months and 5 days).

07/17/2017 to 03/31/2018 - Garant LLC;

01/15/2016 to 07/16/2017 - Azimuth LLC.

Let's calculate the total SS.

The insurance experience at Azimut LLC was 1 year 6 months. (from 01/15/2016 to 01/15/2017 - 1 year and from 01/16/2017 to 07/16/2017 - 6 months).

At Garant LLC, the insurance period was 8 months 15 days (from 07/17/2016 to 03/17/2017 - 8 months and from 03/18/2017 to 03/31/2017 - 14 days).

The 2 months when A.Yu. Efimova was unemployed are not included in the insurance period (period from 04/01/2018 to 05/31/2018).

Now we add up the obtained indicators: 1 year 6 months. 8 months 14 days 1 year 8 months. 5 days = 2 years 22 months. 19 days.

22 months convert to full years, that is, it is 1 year 10 months.

2 years 19 days 1 year 10 months. = 3 years 10 months 19 days.

19 days are less than 30 and are not counted as a full month, so the SS is not included in the calculation.

Thus, the SS is equal to 3 years 10 months.

| Cause of disability | % of payment of average daily earnings depending on length of service | ||

| Up to 5 years | 5–8 years | More than 8 years | |

| Illness of an employee, caring for a sick relative (outpatient), caring for a sick child (inpatient) | 60% | 80% | 100% |

| Injury sustained during production | 100% | 100% | 100% |

| Caring for a sick child on an outpatient basis | 60% for the first 10 days of illness and 50% for the next | 80% - 10 days and 50% after | 100% - 10 days and 50% - all subsequent days of illness |

| B&R manual | 100% | 100% | 100% |

| Child care up to 1.5 years old | 40% | 40% | 40% |

| Within 30 days after dismissal | 60% | 60% | 60% |

If the insurance period for paying sick leave is less than 6 months, then the calculation is based on the minimum wage.

How to determine the maximum and minimum amount of sick leave, see the article “Maximum amount of sick leave in 2020 - 2020”.

Let's look at complex cases of calculating SS in questions and answers.

Question 1

Artemov A.Yu. provided 2 certificates of incapacity for work to the accounting department: the primary one and its continuation. At the time of the onset of the disease, the SS was 4 years 11 months, which corresponds to 60% of the payment from the average daily earnings. When the employee provided the 2nd sick leave, the SS increased to 5 years and 1 month, that is, 80%. How to calculate sick leave and SS in this case?

Answer. Since all bulletins relate to one insured event, the SS is determined on the date of its occurrence and is not subject to recalculation (FSS letter dated 08/18/2004 No. 02-18/11-5676). That is, in this situation, the length of service of 4 years 11 months is taken into account, and sick leave payment will be 60% of the average daily earnings.

We invite you to read Consent to financing bankruptcy proceedings by the debtor himself

Question 2

The employee's 3 children fell ill in turn. Treatment was carried out on an outpatient basis. She was given 1 sick leave for a period of 35 days. The employee's experience exceeds 8 years. How is the benefit calculated?

How is sick leave with a note about violation of the regime paid in 2020?

Author: Maria Novikova Contents Payment for the period of temporary disability for officially employed citizens is guaranteed by the Labor Code (LC) of the Russian Federation.

Article 183 of the Labor Code of the Russian Federation: “In case of temporary disability, the employer pays the employee temporary disability benefits in accordance with federal laws”

It happens that, accidentally or deliberately, a citizen violates the regime prescribed by the attending doctor. How sick leave is paid in such a case and whether it is possible to receive sickness compensation in full is discussed in this review. If an employed citizen becomes ill or injured, if he is unable to perform his job duties, he must go to a clinic or other medical institution.

It doesn’t matter whether it’s free honey. assistance with compulsory health insurance (CHI) or receipt of paid medical services.

The main condition is that the medical institution has a certificate to issue certificates of incapacity for work. The doctor, having carried out the necessary diagnostic procedures, must prescribe appropriate treatment and issue a sick leave certificate, on the basis of which the citizen will receive benefits.

One of the main conditions of payment is the patient’s compliance with certain rules and regulations, which together determine the sick leave regime.

Violation of the sick leave regime is a good reason for changing the payment amount downward.

We recommend reading: The owner signs a relative out of his apartment, what is the procedure?

Regulations on the commission at the enterprise

The social insurance commission in the institution operates on the basis of internal regulations. It is drawn up in accordance with the rules of law set out in clause 11 of the regulations “On the Social Insurance Fund of the Russian Federation”, which is designed to ensure timely control of the payment of benefits and the issuance of vouchers.

The full procedure for creating a commission at an enterprise is thoroughly discussed in regulation 556a of the Russian Social Insurance Fund. In particular, it states that the main task of the commission is the expenditure of funds for recreation and sanatorium-resort treatment, financed from the fund.

Violation of hospital regulations: how to pay in 2020

The amount of temporary disability benefits depends, among other things, on how carefully the patient adhered to the treatment rules recommended by the doctor and whether he showed up for his next appointment on time. We tell you what violations of the hospital regime can lead to a reduction in the amount of payments.

The doctor prescribes treatment for the patient and issues a sick leave note, which indicates the date of the next visit. If the patient does not comply with the hospital regime and does not come to the appointment on the appointed day, the doctor enters information about this on the temporary disability certificate in the form of an appropriate code.

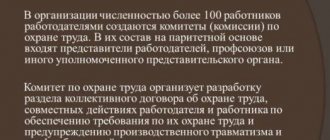

What types of organizations are required to ensure the work of the commission?

Depending on the number of insured workers, as well as the form of operation of the institution, the mandatory nature of the organization of this group, its composition and tasks are determined.

Regardless of the form of ownership (state or private), if an organization uses hired labor, then it is obliged to ensure the existence of the commission .

Also, those enterprises that operate under the single tax payment system must organize the work of this social insurance service.

If the number of employees with insurance is less than fifteen, then a working group for monitoring social security can be created by an individual decision, as has already been mentioned. But initially, at the general meeting, an authorized person is appointed to perform this type of function, and the rest of the composition will include a representative determined by the hirer. Or the employer may wish to independently monitor the activities of the delegate.

In cases of large-scale production, in which the number exceeds a thousand, a single central commission is first organized. To help her, additional working groups are created for each individual unit.

When an enterprise has more than fifteen employees with public insurance, the commission is created from applicants selected by management, as well as from a representative of insured citizen employees. Usually its role is performed by a trade union.

Features of paying sick leave in case of violation of the regime in 2020

Sick leave must be paid by the employer of the officially registered employee in any case, but there are situations in which the employee violates the sick leave regime.

institution for passing ITU. 28 Other violations. For any violation of the hospital regime, the consequence may be a reduction in the amount of temporary disability benefits or a complete refusal to pay - this is stated in Law No. 255-FZ of December 29, 2006.

This happens when a person fails to show up for an appointment with a doctor or a meeting of the medical commission, as indicated on the sick leave certificate.

Specialists who calculate the amount of temporary disability benefits must understand the situation and understand what are the features of paying sick leave in case of violation of the regime in 2020. When filling out a sick leave certificate, the doctor informs the patient what actions are required of him and at what time he must appear for a second examination.

For many reasons, the patient may not show up at the appointed time, or may violate the treatment regimen, so a special code 24 is entered in the medical document.

It means that the regime was violated, and the benefit must be calculated based on this fact; there is no need to prove to the doctor that the reason is valid, and documents about this are sent directly to the employer.

When calculating compensation, the specialist uses not only the average daily salary and number of days, but also takes into account the person’s length of service and additional factors. Management must figure out what the reason was for the violation of the regime, and how the person can confirm these arguments. Depending on the situation, a document may be requested confirming the reason for the absence, and a special commission that examines the case takes into account all the nuances.

The concepts that are used in the field of payment of temporary disability benefits must be analyzed in order to be able to operate with legislation and carry out calculations.

Responsibility of the management of the enterprise for the absence of a social insurance commission on it

The functions and structure of this collegial body have become clear from the above information. But what about those employees whose manager did not organize the process of forming a commission?

The legislation provides for such a situation. If in an enterprise that has existed for more than one month, a social insurance commission has not been created, its functions are automatically assigned to the employer. And in this case, he is obliged to take care of the timeliness of making insurance contributions, receiving insurance payments, and also fulfill other duties of this body. In most cases, this prospect prompts management to organize a committee selection process.

However, if the manager did not take care of this, but does not fulfill such duties himself, then the enterprise team has the right to take on the organization of this body, which controls all aspects of social insurance. In some cases, it is allowed to create alternative organizations that perform similar functions on the initiative of the enterprise’s employees in the event of inaction by its management.

In this case, the manager himself bears administrative responsibility, which may be accompanied by a monetary penalty. Responsibility for the absence of a social insurance commission occurs after the social insurance fund submits orders indicating violations addressed to the manager. The social insurance commissioner usually acts on behalf of the fund.

The manager is not responsible if a large enterprise with a staff of over 1 thousand people has one general commission, and at the same time it copes with the responsibility assigned to it. The creation of several separately functioning bodies at such large enterprises is not a mandatory requirement - they are formed exclusively on a voluntary basis on the initiative of the manager himself or the collective of workers.

The manager is also not responsible in cases where the commission was not created in an enterprise with a staff of less than 15 people.

In all other situations, the management of the enterprise is directly responsible for the absence of commissions on social insurance issues.

An example of calculating payment for sick leave with violation of the regime

> > > May 08, 2020 Sick leave with violation of the regime - we will consider an example of payment in 2020 in the material below - paid in the minimum amount.

How to pay for sick leave if it contains a note about violation of the regime? What codes display this or that violation of the regime and does the amount of benefits depend on these designations? We will consider the answers to these and other questions in the material below.

If we consider the provisions of Art.

8 of the Law “On Compulsory Social Insurance” dated December 29, 2006 No. 255-FZ in correspondence with the order of the Ministry of Health and Social Development of Russia dated April 26, 2011 No. 347n, then the following options for violation of the treatment regimen by an employee on sick leave can be determined: 1. Non-compliance with the treatment regimen ( This violation corresponds to code 23, recorded on the certificate of incapacity for work).

2. Failure to show up for a scheduled examination with a doctor (code 24).

3. Failure to appear for a planned medical and social examination (code 27). 4. Refusal from ITU (code 26). 5. An employee goes to work with unpaid sick leave (code 25).

In addition, sick leave may indicate illness due to intoxication (code 021). Violations in paragraphs 1–5 are recorded in the “Notes of violation” column, code 021 - in the “Additional notes” column. All of these violation options can be combined with each other in any way.

But only 1 of them is enough for the legal consequences of their commission to occur. Let's explore what they can be.

You can learn more about the codes recorded on certificates of incapacity for work in the article.

Protocol of the Social Insurance Commission on recognition of a valid reason for violating the hospital regime

Contents Presenting such a bulletin at work means there is a high probability of a significant reduction in the amount of monetary compensation assigned for the period of forced disability.

The first and main authority that can indicate an employee’s non-compliance with sick leave rules is his attending physician.

Then there are 2 options: either the employer personally determines the degree of guilt of his employee, or a special commission is created that determines this collectively.

As a rule, such a temporary or permanent commission on social issues. insurance is created from representatives of the organization's management and trade union members by elections at a general meeting of the labor collective.

The commission has the right to legally determine whether the reason for non-compliance with the regime by a particular citizen is valid or not. They are obliged to note all violations of the sick leave committed by the patient:

- visiting another clinic without the doctor’s permission.

- non-compliance with the rehabilitation regime;

- refusal to refer for a medical examination;

- leaving the hospital without permission;

- visiting a place of work without a doctor’s permission;

- failure to show up for an appointment with a specialist;

Reasons A note about violation of the regime is a reason to reduce the sick leave benefit. To find out the reasons, a social insurance commission is called, consisting of representatives of the administration and the organization.

An employee who was under medical supervision is required to provide written explanations. The degree of their validity influences the employer’s further decision.

Rules for creating a social insurance commission

An organization of any form of ownership must have a social insurance commission at the enterprise if the company is registered with the Social Insurance Fund. Members of the body are elected on a voluntary basis. The meeting is held in a conference format with the presence of all personnel.

The Commission has the following powers and functions:

- determining the direction of spending contributions

- distribution of vouchers according to the established procedure

- issuance of vouchers to insured persons

- taking into account the need for spa treatment

- control of the procedure for financing treatment and rehabilitation

- checking the basis for the right to receive a discounted voucher

- handling complaints from insured employees

- preparation of reporting documents for the fund

IMPORTANT: members of the commission are elected for 1-3 years, meetings must be held once a month or more often, all decisions must be documented in minutes.

Free legal consultation: ON LABOR ISSUES

Example: I took out loans from a microfinance organization to renovate an apartment and treat an illness. I realized late that these were unaffordable loans for me. They call and threaten with various methods of influence.

We recommend reading: Cost of commission when applying for a job in Belgorod

What should I do? Moscow St. Petersburg By clicking the SEND button, you accept the terms and conditions Send Send

Moscow Government

Ministry of Justice of the Russian Federation

Rospotrebnadzor Latest questions Full comprehensive service From the moment you contact us until the issue is completely resolved, we are ready to accompany our clients, providing them with the necessary services and advice.

Free detailed analysis of the situation Our specialists will study your situation in detail, review all available documents, and draw up a clear picture of the problem. Working for results We are interested in the success of your business! Your victories are our victories. We are exclusively results-oriented.

Drawing up documents If necessary, the lawyers of our company will take upon themselves the preparation of all the necessary documents for a positive resolution of the case. Free study of options Only after a detailed analysis of the available documents and immersion in the current situation will we be able to work out solutions and the feasibility of their use. Submitting documents We take care of everything.

Compilation. Collection of the necessary package of documents.

Appeal against verdicts

Quite often, in cases of a negative decision or regarding the amount of subventions, there are appeals against the commission’s decisions. This process also requires compliance with a certain set of rules and is strictly logged.

The application is submitted directly to the federal social insurance service of the corresponding territorial unit. In addition, it is quite acceptable to appeal the commission’s verdict to a judicial authority.

In accordance with the innovations in the legislative resolution on the work of this commission, the deadline for filing an appeal is limited to five working days from the moment the letter with the decision was received.

The insured person cannot file a dispute after their expiration.

Violation of the sick leave regime in 2020: how code 24 is paid

In a situation where an employee violates the sick leave regime, the accountant must calculate the benefit by changing its amount for the period of this violation.

Code 24 on a sick leave certificate is a signal to pay attention to the violation.

It is permissible, for good reason, not to reduce disability benefits. Sometimes an employee, while on sick leave, for some reason does not come for a follow-up appointment with the doctor at the appointed time. The HR department learns about this from the line “Notes on violation of the regime” of the sick leave brought by this employee after recovery.

There is code 24, and in the “Date” line is the date of the violation. In the article you will learn how to calculate this type of sick leave and get acquainted with an example. Order of the Ministry of Health and Social Development of Russia dated June 29, 2011 No. 624n “On approval of the Procedure for issuing certificates of incapacity for work” provides for a note about violation of the regime on the sick leave, which is filled in with a two-digit code depending on the type of violation:

- 25 - going to work without being discharged;

- 27 - late appearance at the medical and social examination institution;

- 23 - failure to comply with the prescribed regimen, unauthorized leaving the hospital, traveling for treatment to another administrative region without the permission of the attending physician;

- 26 - refusal to refer to a medical and social examination institution;

- 28 - other violations.

- 24 – late attendance at a doctor’s appointment;

Further in the article we will consider this type of violation as being late for a second appointment with the attending doctor, which comes under code 24.

How to calculate the insurance period for sick leave

Example 1

The length of service for sick leave is calculated according to the employee’s work book. If a document is missing or contains incorrect information, the following are taken into account:

- labor agreements formalized by law;

- certificates issued by the employer;

- personal accounts;

- extracts from orders.

All documents must contain:

- number and date of issue;

- Full name of the employee;

- employee's date of birth;

- place of work;

- job title;

- work period.

The papers are transferred to the accounting department at the insured person’s place of work.

If an insured event occurs and the employee cannot provide the necessary documents to calculate the insurance period, then information about the employee’s salary and length of service should be requested from the Pension Fund of the Russian Federation.

Question 1

Question 2

Since the employee’s three children fell ill, the first ten days of sick leave with pay based on length of service applies to each individual. In this case, 30 days are paid based on 100% (since the length of service exceeds 8 years) and 5 days based on 50%.

Act on violation of hospital regulations

0 Employees of the organization who are insured persons have the right to receive benefits in a timely manner and in full in case of temporary disability and in connection with maternity ().

For their part, the insured persons are obliged, among other things, to comply with the treatment regimen determined for the period of temporary disability (). Violation of the hospital regime may be grounds for reducing the amount of temporary disability benefits. In the current form of sick leave, in the line “Notes on violation of the regime”, depending on the type of violation, the attending physician indicates the following two-digit code (, approved.

By Order of the Ministry of Health and Social Development dated June 29, 2011 No. 624n):

- 25 - going to work without being discharged;

- 24 – late attendance at a doctor’s appointment;

- 26 - refusal to refer to a medical and social examination institution;

- 23 - failure to comply with the prescribed regimen, unauthorized leaving the hospital, traveling for treatment to another administrative region without the permission of the attending physician;

- 27 - late appearance at the medical and social examination institution;

- 28 - other violations.

Having received from the employee a sick leave with the completed line “Notes on violation of the regime”, the employer has the right to reduce the amount of temporary disability benefits in the following cases ():

- violation by the insured person without good reason during the period of temporary disability of the regime prescribed by the attending physician;

- failure of the insured person to appear without a valid excuse

Why do we need a commission (authorized) for social insurance?

All issues related to the work of the commission (commissioner) for social insurance are now regulated by Regulation No. 13

*.

This document came into force on July 27, 2018.

* Let us recall that previously the Regulations on the commission (authorized) for social insurance of an enterprise, institution, or organization, approved by the Resolution of the Board of the Social Insurance Fund for VTP dated June 23, 2008 No. 25, were in force.

The main function of the commission (authorized person) is to make decisions on the assignment or refusal to assign benefits from the Social Insurance Fund (sick leave, maternity leave, funeral benefits). In addition, the commission (authorized) is obliged, in particular:

— check the correctness of the issuance and completion of documents that are the basis for the provision of benefits;

— consider employee complaints about their decisions;

— take measures to eliminate violations in the provision of benefits from the Social Insurance Fund (for example, if the payment of benefits to an employee is delayed);

— participate in FSS inspections at the enterprise, etc.

The full list of functions of this body is given in clauses 2.1, 2.2, 3.1 of Regulation No. 13

.

Attention! The following functions have been removed from the functions of the social insurance commission (commissioner) since July 27, 2018: issuing vouchers to sanatoriums and (or) sanatoriums for insured persons and members of their families; allocation of vouchers to children's health institutions; provision of social services for out-of-school care for children of insured persons; allocation of New Year's gifts. This is not know-how. ☺ Simply Regulation No. 13

, unlike its predecessor, complies with

Law No. 1105

.

Now let's deal with organizational issues.

Violation of the hospital regime - payment of sick leave in case of violation of the regime in 2020

Every employee has the right to issue a certificate of incapacity for work due to illness.

In this case, the prescribed treatment by the doctor must be strictly followed by the patient. Only in this case is the sick leave paid by the employer. What to do if there is a violation of the hospital regime, whether payment will be made for the period of incapacity for work and what consequences await the employee, you can find out based on the provisions of the Labor Code of the Russian Federation (including the question).

To the question: how to calculate the payment of benefits yourself, even if violations are found, you can get the answer in the material.

Violations in filling out sick leave notes are a common occurrence at work.

Payment of sick leave in violation of the procedure is done:

- After non-compliance with the rules - taking into account the minimum wage.

- Until the violation is recorded according to the generally accepted formula.

The calculation depends on the degree of the offense: accidental and special.

In order for the benefit to be paid by the employer, a special commission is invited, which considers the case of violation and makes a conclusion in the form of non-compliance with the rules, for a good or bad reason. The list of marks that cause the payment of the minimum amount of benefits includes the following factors:

- Failure to comply with the instructions of a medical specialist means failure to show up for an appointment.

- Transfer to another hospital.

- Failure to return to work on time without a doctor's permission.

- Failure to comply with and refusal to take tests and conduct examinations.

Features of creation

The commission includes employees working in the organization. To elect members, a general meeting must be scheduled. Members of the commission are appointed on the basis of their voluntary consent. As a rule, the commission includes representatives of the company administration and leaders of the local trade union. It makes sense to appoint them specifically, since these employees have a common understanding of working in a social direction. Their work will be more efficient.

If the company has fewer than 1,000 employees, a general commission is sufficient. If the number of employees exceeds this limit, commissions must be created for each division. The management body is formed on the basis of the order of the head. It includes this information:

- Company name.

- Order number.

- Publication date.

- Reference to the law on the basis of which the commission is created (clause 11 of Regulation No. 101).

- Full name and position of all commission members.

- Functioning life of the organ.

- Manager's signature.

The work team must be familiarized with the document. The leader can determine the rights and obligations of the participants and give them various guarantees.

After the commission is appointed, its chairman is elected. A majority of votes is required to elect him. The main function of the chairman is to organize the activities of the commission and coordinate all its participants.